Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

A few press releases about identity of early or late stage customers would help, I think

There does not appear to be too much correlation between how the overall market(or the Russell 2000 for that matter) trades or that of our beloved little Avid. Right now, especially today, there does not appear to be too much conviction either way on the stock based on the anemic volume, and whether the share price is up $.25 or down $.25 does not really matter.

What does matter is for this management team to get back on track, get the financials restated and then start working on building confidence with investors on this stock as currently there is very little promotional activity taking place that I am aware of!!!

At the same time, we are really just one or two announcements away for this stock to really start heading higher again....maybe not to the heights we were at a couple of years ago, but I think we have a shot at $15 or $16 in a year or two if things start falling into place(which I still believe they will)!

So c'mon Nick, lets get this show moving again!!!

We will be looking at the Russell rebalancing soon...r

Reported that JNJ is in talks to acquire SWAV; current share price of SWAV is ~ $320/share, CDMO is ~ $6.80/share.

I might add that there are other weight loss drugs out there and they are all in high demand. Lilly recently, actually, ran an ad asking people who are not diabetics to please not try to get the drug. I've never heard a company ask the world NOT to buy so much of their drug. They can't make enough of it. The point is, CDMO could be a target for the same reason CTLT was, and maybe for a similar price/multiple.

CTLT was providing the manufacturing component for Novo Nordisk on the injectible portion of their weight loss drug... CTLT just so happened to have the proverbial bucket at the foot of their bed when they hitched their wagon to Novo... Smart move by Novo now controlling the production and eliminating the potential problem of farming it out to a third party when you have a blockbuster drug like they do...imao...r

Maybe we will be bought like Catalent was. They had some screw ups with their quality control. EPS last quarter were -7.18 which comes to 1.4 billion loss. They had lost over 700M two or three quarters earlier. Haven't looked at their other quarters but it would be hard to imagine that they were profitable. How did Catalent end up being bought for 16.5 billions? It appears that a CDMO is worth a lot more to an acquiring big pharma than to any and all investors or another bigger CDMO.

We ended up with a new loan that has a higher interest rate and will cost us tens of millions more over the life of the loan. The 50 or so more millions in interest should lower the buying price by the same amount and not by 500M or a Billion.

I find it interesting that the headline for many days of lawyers looking for customers on Schwab Streetsmart edge has disappeared.

I take it as a good sign but then just my personal opinion.

4 day trading week........................GLTA....

Gosh, I'm happy to wait if they do it RIGHT this time. Speedily correcting big flubs doesn't usually work well...some thoughtfulness, legal/financial advice from top sources, etc.....work better! I think the damage is done, so a client ($) is all that will get us going again. IMHO. GLTA.

Repeat of yesterday—some time same place. Drop in share price to $6.62.

Legally there is no issue, but I do not understand why the company is taking this much time to restate their financials. This is not complicated unless there is something we do not know and they are somehow checking out some legal avenues??? According to what management has offered to date, there does not appear to be any legal malfeance and just something the company(legal/financial) missed on their convertible terms and so therefore had to negotiate a new financing agreement and of course have a legal obligation to restate the financials.

They have also indicated that once the financials are restated they will have the conference call but not sure if there will be questions allowed or if it will be more of a statement of what happened without going into detail???

As an optimist, I am hoping that this delay in filing the restated financials is to wait as long as possible and perhaps secure some additional contracts based on FDA approval of one or more of their clients drug candidates. So they start with the bad(mess up and $10 mil in additional financing costs) and then end with announcement of new contracts that should allow them to start manufacturing some of their backlog in contracts and perhaps allow them to increase their revenue projections going forward. This would be a good thing...yes???

Now I could be way off here, but like I said...trying to be optimistic!!!

If CDMO has the same attorney from Coley who handled the previous class action matter, they are in outstanding hands. Koji Fukumra (sp?)

I would rate him 5 stars of out 5.

Just IMO

I Agree, But At Least Am Confident That...

Any Buyout Price Would Be up, Up, UP from Here!

On The Other hand, Investors Need To Keep In Mind That

When You Consider The Previous Stock Splits And Years We Have Invested,

It Belittles The Potential Buyout By One Of Our Customers?!?!?!

All Older StockHOLDERS Should Have Gained More From Their Investments!

But, For New Investors, This Stock Could Represent A Quick Double Or Triple

From Current PPS!

Since Avid Is No Longer A Bio Pharmaceutical With Those Investment Risks,

But MerelyA Bio Manufacturer, Not To Mention, Bavi, Beta Bodies, Etc........

Seem To Have Disappeared With Oncologie/OncXerna Therapeutics,

StockHOLDERS Should No Longer Hold Their Breathes

For Astronomic PPS Buyout prices.

On The Other Hand, Since It Appear Oncologie/OncXerna Therapeutics,

May Have Gone Out Of Business, AND, I Think There Was A Footnote In The

Lease/Sale(?) Of Bavituximab. et al, That May Come In To Play

"IF" Oncologie/OncXerna Therapeutics Has Actually Go out Of Business...

Either Way, Avid's State Of The Art BioManufacturing Facility Capabilities

Is Worth MUCH, MUCH MORE Than The Currently Shorted PPS.

And Those Shorters Were Probably Mainly The Original Senior Note Investors!

ANY Potential BuyOut Would Be MUCH Higher Than Today's PPS!

Yet, If The Contract With Oncologie/OncXerna Therapeutics Had A Footnote

That Allowed For The Return Of The Rights To Bavi, Beta Bodies, Etc,. Etc.

Under Circumstances That Oncologie/OncXerna Therapeutics Failed To Do Certain Things...,

Well, Going Out Of Business Should Return All Those Assets To Avid.

IF ALL that Were True, There Could Feasibly Still Be A Chance For A Greatly Substantially

BuyOut Price Then Currently Seems Feasible.

Hard To Say What May Be Going On Behind Closed Doors!

I For One Am Still Not Selling!!!

Glta Bulls, Watchers, & StockHOLDERS!!!

I also believe that may be the direction we are headed. I only thing that can stop it is a PR saying we signed a major contract with a large Pharma company.

I think wenn Joseph Carleone CoB bought shares at a little under $10 he was putting a floor in for anyone considering. I think if it comes it will be at a 25-40% premium. Look how much our top guys get in a "change of control" situation. It on the last proxy

Have a hard time understanding how with Nicks solid reputation over the years that such a mess as this happened.

Have to believe that all this is happening to force a sale at a rediculous low price.

These attorneys are just ambulance chasers looking for their next slip and fall IMO

If you called them a said you slipped on the sidewalk in Tustin they would be your best friend

The real question is how much will our stellar manufacturing and regulatory compliance reputation be tarnished by our inept financial and legal follies?

If I was going to place a drug with Avid for development or late stage manufacturing I would want to be assured that the ineptness has been purged from the system. All the way to the top!

Started falling at 2:27 pm right after this lawyer Hagen Berman put out their release really making Avid look bad.

Really trying to look out for Avid investors.

A shame CDMO couldn’t hold its $7+ position in light of record close of the major indices today

I still wonder whether Eastern Capital/Ken Dart had anything to with what you describe. Money has meant a lot to him, historically.

Well it seems that the stock market is shrugging off the Avid convertible screw up as the stock has significantly strengthened since the March 6th fall from $8.78 back down into the $5's before holding in the low $6 range. Now since then, we are back over $7 and the stock is trading amazingly well🤞....much better than I thought.

Although one wonders where the stock would be trading at had this screw up not happened...would we be pushing $10 plus??? Even higher??? Well pure speculation, so will leave it at that.

As for how things are going in Tustin, it seems like business as usual...there were several congratulatory comments from senior Avid staff(including Mark Z and Nick G) towards one of their engineers who completed the LA marathon over the week-end....surely if things were dire, top management would not be spending time on Linked in!?

However in the end, at the very least, the new convertible will cost Avid in the range of $10 mil in additional financing costs over the life of the old convertible financing which would have matured in 2026. One can again only speculate what position Avid would have been in at that point and where the share price would have been when the older convertible financing matured. Would the share price be high enough to cause some of the debt to be converted to shares? I think not, but you never know...perhaps by 2026 Avid will be running at full capacity??? Again pure speculation. But if they were, the loan could have easily been paid off or renegotiated at much better terms.

So bottom line is that this new convertible will cost us at least $10 mil, and then the question is, will the shares go up enough in price to cause the debt to be converted to shares, or will we(Avid) be stuck with higher interest rates for the entire term of the new financing??? Your guess is as good as mine here.

Finally apparently Nick will be having a CC once the financials have been restated and I for one will be very curious as to exactly how much he will share about this debacle on the convertible and then having the loan called. Something does not make sense here....I cannot believe that this term was missed by our legal team(inside and outside)....I am pretty certain that we were set up by the lenders of the original financing and they were set to win either way.

If the stock went up high enough...they convert and win big....if things were taking longer to fill capacity resulting in slow share price growth, well they had the opportunity to short the hell out of the stock and force the price down(which did happen) and then call the loan when the time was ripe or right based on this term which everyone seemed to have missed...that is everyone from Avid's team anyway.

So the originators of the initial financing won big....made big profits on shorting the stock(again only what I surmise to make sense) and then were able to call the loan and get their principle and interest back knowing it would put Avid in a precarious situation!

And that kids, is how small companies get screwed by savvy financiers!!! Of course this is all in my opinion only.

So Nick....how will you explain this away or what kind of spin will your Finance dept put on this whole mess up???? Inquiring shareholders want to know!!!

All I have left to say, is that I still believe the company will succeed, but the road got a little longer and the share price will never get to where it once was. Hopefully when capacity starts being filled, we will eventually again hit the low teens?????

4 shares traded at 8:55 a.m., after you posted. Ask price is $7.40, bid is $7.07.

first time in a long time, no pre-market trades so far. Doesn't bode well for the PPS today.

With better than 100% institutional ownership, non-compliance

with NASDAQ is existentially inconceivable....I hope the May 20th

clock is of no consequence to Nick and team however crummy the

report..............GLTA........

Interesting that the reason for restatement does not include a different interest rate, unless that is somehow included/implied by the classification as a long-term liabilities issue. I would be willing to bet the holder(s) of the 2026 notes were short CDMO.

FFTT

JBAIN

This company can’t do anything right? Cant file required documents, Geez.

The company previously reported in its Form 12b-25 filed with the SEC on March 12, 2024 that the company was unable to file the Form 10-Q within the prescribed time period due to the need to restate and file certain prior period financial statements as a result of the continued classification of the company’s 1.250% Exchangeable Senior Notes due 2026 as long-term liabilities following an event of default, as more fully described in the company’s Current Report on Form 8-K filed with the SEC on March 12, 2024.

Under Nasdaq rules, the company has 60 calendar days from the receipt of the Notice, or until May 20, 2024, to submit a plan to regain compliance with the Rule.

Looks like one MM is not at work today!

Even with the cluster of ineptitude the stock is moving up.

Somewhere in this pile of dung they are seeing diamonds.

I still contend the 7 or so late stage drugs in the pipeline we have reason for optimism.

This company can’t do anything right? Cant file required documents, Geez.

"Pre-market stock trading in the United States commonly...

runs between 4:00 a.m. and 9:30 a.m. EST and after-hours trading occurs from 4:00 p.m. to 8:00 p.m. EST."

link:

https://www.investopedia.com/terms/e/extended_trading.asp

Sorry, I didn’t find it. There was a 242K trade around 5 pm yesterday.

Can you, 4OurR or Gwen confirm a trade of ~ 130,000 CDMO shares that appeared on my TD Ameritrade screen around 3:00 a.m. Eastern Time this morning? I don’t recall the share price.

Can $CDMO Touch $7 Before Close? Glta, eom.

Enhanze might be part of the play, but it doesn't look like any of their pipeline is part of our near-term backlog since nothing seems to filed. Nick was pretty clear filings have taken place.

Stockrafter post #8410, and read all posts from that date to today for other links and discussion. A few may be worthless, like cubflyer here.

Take a look at HALO’s pipeline. There are some slides, including a slide from the gov’t, that appeared on the IHub HALO board yesterday, I think. Enhanze at work among clients.

Relatively low volume with several large trades indicates MM accumulating for someone and transferring the shares in the large trades. Goes back to earlier this year when the PPS stopped for quite a while in this area. Solid base being formed.

FFTT

JBAIN

There you have it, from someone who flies broken planes for a living![]()

Jewel? More like Cubic Zirconia!

Just curios if we get some news and clarification this week on what the hell is happening in our "jewel"

That was quite a big sell Friday PM.

Well one of the reasons for todays volume was that it was triple witching day....always get plenty of volume!

And while I am at it and still holding my breath...apparently once the financials are revised/restated to reflect the increased interest charges, the company will still have a CC....which I think is a real positive!

Should not be too long!

FOR ONCE, it looks like the buyers were back today....I bought a few thousand shares

at this closing price back in mid November......we wouldn't be here if not for the "screwup"

over the agreement !! GLTA...hoping for some follow-through Monday.........

The last regular trade was over 1.3 mil shares.

Date/Time Price Shares Exch/Mkt

03/15/2024 16:01:33 EDT P 6.29 791 NDD

03/15/2024 16:01:25 EDT P 6.29 5020 NDD

03/15/2024 16:01:17 EDT P 6.29 368 NDD

03/15/2024 16:00:36 EDT I 6.29 5 NDD

03/15/2024 16:00:36 EDT P 6.29 936 NDD

03/15/2024 16:00:36 EDT P 6.29 4357 NDD

03/15/2024 16:00:36 EDT P 6.29 2752 NDD

03/15/2024 16:00:36 EDT P 6.29 18887 NDD

03/15/2024 16:00:36 EDT P 6.29 4330 NDD

03/15/2024 16:00:36 EDT P 6.29 11323 NDD

03/15/2024 16:00:36 EDT I 6.29 6 NDD

03/15/2024 16:00:11 EDT I 6.29 2 NDD

03/15/2024 16:00:10 EDT I 6.29 2 NDD

03/15/2024 16:00:07 EDT W 6.29 2035 NDD

03/15/2024 16:00:07 EDT W 6.29 3520 NDD

03/15/2024 16:00:01 EDT T 6.29 533 NDD

03/15/2024 16:00:00 EDT I 6.29 1 NDD

03/15/2024 16:00:00 EDT X 6.29 1331702

We’ve traded around 26 million shares in the last 7 trading sessions and no 13g filed?

Over 40% of the outstanding shares?

And I thought the vet bills and subsequent urgent care bills for imaging our cat with a cat hospital stay of 3 days and nights were high. She was morose and ate nothing for quite a few days. Some surgery and appetite stimulating cream applied to her ears did wonders. Our cat is back home now happily eating/snacking and sleeping away. The vets at those 2 locations know what they’re doing.

Got the hospital charge submitted for my wife’s biopsy for her lung mass(pet scan was indeterminate)…altogether $50k..wow…r

I don't think they are looking that hard for new business. I think they have there eggs in the basket of several late stage drugs they have in the pipeline.

I believe the insider buys were not to just show a good faith with shareholders.

|

Followers

|

837

|

Posters

|

|

|

Posts (Today)

|

33

|

Posts (Total)

|

346619

|

|

Created

|

11/07/03

|

Type

|

Free

|

| Moderators Preciouslife1 4OurRetirement | |||

Avid Bioservices, Inc. (Nasdaq “CDMO”), Tustin CA. http://www.avidbio.com

President/CEO: Nicholas Green (eff. 7-30-20 https://tinyurl.com/yczapcc7 )

Four Avid Fact Sheets a/o 2-2020: https://avidbio.com/resources/fact-sheets/

Avid Bioservices is a CDMO committed to improving the lives of patients by manufacturing products derived from mammalian cell culture for the biotechnology & biopharmaceutical industries. Services include cGMP clinical & commercial product manufacturing, purification, bulk packaging, stability testing & regulatory strategy, submission, and support. The company also provides a variety of process development activities, including cell line development & optimization, cell culture & feed optimization, analytical methods development, and product characterization.

12-2019/Video: Tour of Myford Facility (2mins.): https://vimeo.com/380135562

7-2020: AVID’s Push Towards cv19 (I don’t capitalize things I hate) contracts: https://tinyurl.com/y8wzgneh

UPCOMING EVENTS: https://avidbio.com/events/

Sep1(Tue): Q1/FY21 (qe 7-31-20) Financials & Conf. Call - Transcript: https://tinyurl.com/y329llow

Sep17/Fireside Chat w/Nick Green: 18th Annual Morgan Stanley Global Healthcare Conf.: https://tinyurl.com/y4cbjjrc

Sep21-24/Virtual: Biotech Week Conf., Boston

Sep21-24/Virtual: BioProcess Intl. US Wes Conf., Santa Clara CA

...Time TBD: Presentation by Haiou Yang, PhD "Facility-Fit Driven Dev. for a mAb Production Process"

Oct20 10amPT/VIRTUAL: Annual Shareholders Mtg. https://tinyurl.com/y28blkjn 14A Proxy: https://tinyurl.com/y46ga9el

...ASM Replay (9:45): https://www.virtualshareholdermeeting.com/CDMO2020 (Control# not needed)

Apr20-22 2021/Booth#1159: INTERPHEX, NYC

Dec2(Wed) after mkt: Q2/FY21 (qe 10-31-20) Financials & Conf. Call - Transcript: https://tinyurl.com/y66xk888

Dec14-17: Antibody Engineering & Therapeutics Conf., San Diego

Quotes: Yahoo: Yahoo.com/CDMO Nasdaq: http://www.nasdaq.com/symbol/cdmo RT: http://www.nasdaq.com/symbol/cdmo/real-time

• IR: Stephanie Diaz (Investors) Vida Strategic Partners 415-675-7401 sdiaz@vidasp.com, Tim Brons (Media) 415-675-7402 tbrons@vidasp.com

SEC:

Latest 10Q 10-31-20 iss. 12-2-20 https://tinyurl.com/y3ournzr (Cash 10-31-20=$35.7mm)

Latest 10K 4-30-20 iss. 6-30-20 https://tinyurl.com/yak25nco (Cash 4-30-20=$36.3mm)

Latest DEF14A/Proxy iss. 8-27-20 (re: 10-20-20 ASM): https://tinyurl.com/y46ga9el

ALL SEC filings for CDMO: https://tinyurl.com/yc4zjyzv

CDMO's Corp. Bylaws (a/o 11-14-14): http://tinyurl.com/y8hsppea

Poison Pill adopted 3-16-06 for 10yrs: http://tinyurl.com/yvypvh 44-pg SEC filing: http://tinyurl.com/5m57ut BUNGLER explains in plain language: http://tinyurl.com/mft4nd6

...3-17-16 Poison Pill extended until 3-16-2021 https://tinyurl.com/y74glo2n (Form8A Amendment #1)

...Poison Pill TERMINATED eff. 9-23-2019 https://tinyurl.com/y2mzx3xo

SHARES:

Shares O/S as of 11-23-20=56,726,334 - history since 4-2006: https://tinyurl.com/y66xk888 (at bottom)

...A/O 10-31-20: 3,451,000 stock options outstanding at a wgt.avg. exercise price of $6.41 (pg.16 10Q).

...MarketWatch.com for CDMO (shows Float): https://www.marketwatch.com/investing/stock/cdmo

1-12-18: S-3 Shelf Registration filed for up to $125mm https://tinyurl.com/y9qtewpw

...12-14-20: Avid raises ~$34M gross, selling 3,833,335@9.00/sh. (underwriter: RBC Capital) https://tinyurl.com/y92yr9g4

...2-20-18: Avid Raises ~$21.8M net, selling 10,294,445@$2.25 (underwriter: Wells Fargo) 8-K: https://tinyurl.com/ya3nenth 424B5: https://tinyurl.com/ycpshgxl

Total INST.+LARGE Holdings now 41,617,965 73.5% a/o 9-30-20 https://tinyurl.com/y652nxpr

13 LARGEST SHAREHOLDERS a/o 9-30-20:

1. Eastern Capital (Kenneth Dart): 4,300,992 7.6% (a/o 8-21-19 14A/Proxy: https://tinyurl.com/y9c972fa – orig. 13G filed 11-2015)

2. Tappan Street (Prasad Phatak): 4,285,000 7.6% (a/o 12-31-19 13G: https://tinyurl.com/wlcwnnv )

3. Blackrock Inc. (Larry Fink): 3,834,816 6.8% (-111,172 a/o 9-30-20 Nasdaq Inst.)

4. IsZo Capital Mgt. (Brian Sheehy): 3,459,888 6.1% (-88,144 a/o 9-30-20 Nasdaq Inst.)

5. Millennium Mgt. 2,678,984 4.7% (+633,918 a/o 9-30-20 Nasdaq Inst.)

6. Vanguard Group 2,659,738 4.7% (-19,553 q/e 9-30-20 Nasdaq Inst.)

7. Snyder Capital 2,302,621 4.1% (-2,258 a/o 9-30-20 Nasdaq Inst.)

8. Altravue Capital 1,973,349 3.5% (+39,534 a/o 9-30-20 Nasdaq Inst.)

9. Wellington Mgt. 1,503,162 2.7% (+236,947 a/o 9-30-20 Nasdaq Inst.)

10. Sargent Invest. Grp. 1,052,099 1.9% (-11,000 a/o 9-30-20 Nasdaq Inst.)

11. State Street 992,280 1.8% (-65,922 a/o 9-30-20 Nasdaq Inst.)

12. Portolan Capital 963,374 1.7% (+528,662 a/o 9-30-20 Nasdaq Inst.)

13. Silvercrest Asset Mgt. 878,805 1.6% (-16,746 a/o 9-30-20 Nasdaq Inst.)

Inst. Holdings (Nasdaq) - updated 45-days after each qtr-end: http://www.nasdaq.com/symbol/cdmo/institutional-holdings

INSIDER-Trans: https://tinyurl.com/ycpw4j9z (formerly PPHM thru 2017: http://tinyurl.com/ypkow8 )

Short Interest, updated twice a month: https://www.nasdaq.com/symbol/cdmo/short-interest

A-T-M (At-The-Market) Sales 3/2009 - 7/14/17 ($272,500,000gr./34,869,747sh=$7.81/sh): http://tinyurl.com/yagmu2on

PPHM shares were 1:7 Reverse Split eff. 7-10-17 (315mm/$.606=>45mm/$4.24) http://tinyurl.com/yymtzcm9

PPHM shares were 1:5 Reverse Split eff. 10-19-09 (~237mm/$.64=>~47.4mm/$3.20) http://tinyurl.com/ykuw588

Potential Value: 9-19-2017: Catalent acquires CDMO Cook Pharmica for $950M ($179Msales x 5.3; EV/EBITDA=17.3) http://tinyurl.com/yd46m8py

AVID TEAM: https://avidbio.com/leadership/ - Open Jobs: https://avidbio.applicantpro.com/jobs

7-30-20: Nicholas Green (ex-Therapure Biopharma) becomes President/CEO of Avid - 6-25-20 PR: https://tinyurl.com/yczapcc7

4-13-20: Avid Hires 2 Senior Directors of Bus. Dev: Jason C. Brady & Sylvia Hinds https://tinyurl.com/sq2679g

1-8-20: Avid Appoints Timothy Compton as Chief Commercial Officer (repl. Tracy Kinjerski) https://tinyurl.com/ydww58sn

7-26-19: Catherine Mackey, PhD (ex Pfizer VP) joins Avid's BOD, replacing Joel McComb https://tinyurl.com/y3xhqmvm

5-8-19: Richard (Rick) B. Hancock named Interim President/CEO; Roger Lias resigns https://tinyurl.com/y4pqdwyc

7-16-18: Daniel Hart (ex-ENO Holdings) joins Avid as CFO https://tinyurl.com/ychz45p2

7-16-18: Michael Faughnan (ex-Lonza/WuXi Biologics) joins Avid as Sr.Dir./BusDev/WestC https://tinyurl.com/yaozdggz (Left 5-2019)

5-29-18: Sandra C. Carbonneau (ex-Lonza) joins Avid as Dir./BusDev./EastCoast https://tinyurl.com/ybvrwn2l (left 12-2019)

5-8-18: Magnus Schroeder (ex-AGC Biologics) joins Avid as VP/Process Sciences https://tinyurl.com/y7tpswaw

2-23-18: CFO Paul Lytle voluntarily resigns eff. 5-24-18 (2-23-18 +90days), "CFO search underway" https://tinyurl.com/ybnjzbv6

9-11-17: Roger J. Lias (ex-Allergan) to become Avid’s CEO and join PPHM’s BOD eff. 9-25-17 https://tinyurl.com/yddufw4s (left 5-8-19)

11-29-17: Tracy L. Kinjerski joins Avid as VP/Bus.Operations https://tinyurl.com/yc4zenkc (Left 1-8-2020)

Profiles of all 7 BOD members: http://ir.avidbio.com/corporate-governance/board-of-directors

...Joseph Carleone/Chair, Nicholas Green(CEO), Richard Hancock, Gregory Sargen, Mark Bamforth, Patrick Walsh, Catherine Mackey

10-24-17: Peregrine Adds Patrick D. Walsh to BOD, "An Industry Veteran with 30+yrs Experience Leading Successful CDMO Org’s” http://tinyurl.com/y3jo2rv7

10-19-17: Peregrine Adds Mark R. Bamforth to BOD, "10yrs/Genzyme; 30yrs of biologics leadership experience, incl. founding 2 CDMOs" http://tinyurl.com/y6ydcaof

ANALYST COVERAGE: http://ir.avidbio.com/analyst-coverage

Also see: https://www.marketbeat.com/stocks/NASDAQ/CDMO/price-target

Janney Montgomery Scott - Paul Knight PT=$10

H.C. Wainwright & Co. - Joseph Pantginis PT=$9

Craig-Hallum Capital Group - Matt G. Hewitt PT=$10

First Analysis Securities - Joseph Munda PT=$7.50

Stephens Inc. - Jacob Johnson PT=11 (10=>11 9-2-20)

FINANCIALS & BUSINESS DEV.:

2-3-21: Avid to Mfg. CV19 Therapeutic Lenzilumab for Humanigen https://tinyurl.com/1hzzksxa

8-26-20: Mapp Biopharmaceutical signs w/Avid for ClinDev of Antiviral Antibody (MBP091) https://tinyurl.com/yxwvr949 BARDA #HHSO100201900018C($16.5M+Opt/$30M), see: https://tinyurl.com/yye8t5nx

8-20-20: Oragenics signs Dev/Mfg Agreement with Avid for COVID-19 Vaccine “TerraCoV2” https://tinyurl.com/yxqg3w4v

8-6-20: Iovance Biotherapeutics signs w/Avid(+Aragen) to Dev+Mfg. IOV-3001 (IL-2 Analog) https://tinyurl.com/y2lgzh6x

7-28-20: Avid Teams with Argonaut to add “Parenteral Fill-Finish Services” https://tinyurl.com/y2lgzh6x

5-6-20: Avid Teams with Aragen to speed up drug dev./delivery timelines https://tinyurl.com/ycuu2m5r

4-23-20: Avid receives $4.4M PPP/CV19 Loan (can apply for forgiveness) 8K: https://tinyurl.com/yaltupxa

...5-12-20: Avid Pays Back $4.4M PPP/CV19 Loan (“New SBA Guidance/abundance of caution”) 8K: https://tinyurl.com/y993tkk6

3-10-20: CDMO's Revs & Burns By Qtr Table, FY07/Q1 thru FY20/Q3 (q/e 1-31-20): https://tinyurl.com/s9cmzmf

......Avid FY20 (fye 4-30-20) revenues guidance: $55-59M; committed backlog=$58mm at 1-31-2020.

7-8-19: Avid Signs New Top10 Global Pharma and Expands Existing Cust. Relationship https://tinyurl.com/yyq8zgb9

6-27-19: "The 5 new clients signed in late FY2018 contributed significantly to revenue diversification in FY2019." SEE CUST SPLITS for FY19: http://tinyurl.com/y5j4dlsv

4-24-18: ”In recent weeks, Avid has signed new agreements with 3 addl. undisclosed intl. drug dev. companies (that’s 4 thus far in CY2018)” https://tinyurl.com/y89whc8d

3-1-18: Acumen Pharm. selects Avid for Process Dev. & Mfg. of ACU193 (Alzheimer’s) https://tinyurl.com/y8jvwleq http://www.acumenpharm.com

2-21-18: Enzyvant selects Avid to commercially mfg. RVT-801 (Farber disease) https://tinyurl.com/yd5xhcx8 http://www.enzyvant.com

2-12-18: Peregrine’s Legacy PS-Targeting IP Sold to ONCOLOGIE INC. (Boston, CEO: Laura E. Benjamin) for $8M/upfront, $95M/milestones https://tinyurl.com/yam8gb3h

...NOTE: 2-13-18: Oncologie Licenses Mologen’s immunotherapeutic ‘lefitolimod’ (TLR9 agonist) https://tinyurl.com/y9z54f4x “ONCOLOGIE is backed by top-tier intl. investors and has the objective to dev. novel personalized medicines in the field of immuno-oncology."

2-28-17: Avid & Cook (acq. by Catalent 12-2017 for $950M; $179Msales x 5.3; EV/EBITDA=17.3) remain Halozyme's 2 CMO's (“working to scale-up/validate/qualify Avid II/Myford for Roche collab.”): http://tinyurl.com/h75teta

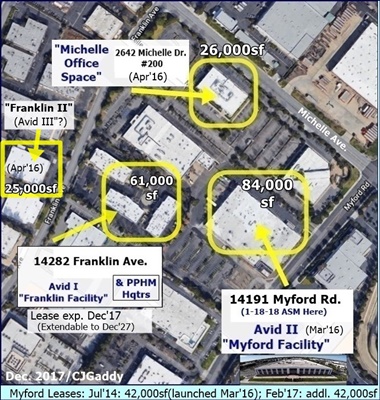

FACILITIES: https://avidbio.com/facilities/

10-8-19: Avid Announces Completion of Expansion of Process Dev. Capabilities & Labs https://tinyurl.com/y3hfwst9

...will “significantly accelerate Avid’s ability to drive efficient & rapid on-boarding of new cust. pgms progressing to mfg.”

4-24-18: Avid adding Process Dev. Labs, upgrading capabilities (in phases; total will be >6000sq; 1st one ready Q3CY18/Jul-Sep'18) https://tinyurl.com/y89whc8d

5-2017: Avid II (Myford) adds 2 MilliporeSigma Mobius 2,000L single-use bioreactors; total mfg. capacity now ">11,000L". http://tinyurl.com/ky7bmu4

5-10-17: Halozyme comments on Avid II(Myford) expansion in their 3-31-17/10Q pub. 5-9-17: http://tinyurl.com/mrl34uk

..."validation of the new facility is scheduled to end in Q2/2017… Once this new facility is approved, it will become the primary source for Roche of bulk rHuPH20.”

6-2-16: Corp.Update – Avid Expansion & Drug Development - http://tinyurl.com/zvmhqmr

3-7-16/Avid II: Formal Commissioning of Avid's New 40,000sq "Myford" Facility, “single-use/fully disposable” (potentially $40M addl revs) http://tinyurl.com/y5jmfpo3

12-10-15/Avid II: Avid Expansion into MYFORD Facility now GMP-run ready (potential +$40mm sales) - contemplating further expansion http://tinyurl.com/y539yut4

12-10-14: Avid to Double Mfg. Capacity(“Myford Expansion”) http://tinyurl.com/y2sqoy2u & http://tinyurl.com/kmdgq8t

PRESENTATIONS & ARTICLES: https://avidbio.com/events/

Sep17/Fireside Chat w/Nick Green: 18th Annual Morgan Stanley Global Healthcare Conf.: https://tinyurl.com/y4cbjjrc

5-18-20: Avid Listed In Top CMO Awards Article https://tinyurl.com/yb5cnh6m

...”Avid received 5 CMO Leadership Awards categories, incl. 2 Champion designations: Expertise & Service.”

10-25-18/BioPharma: Roger Lias Interview, “Avid expansion to Triple Process Dev. Capacity” https://tinyurl.com/ybtuk29m

Sept2018/BioTechWEEK: Tracy Kinjerski (VP/BusOP) interview: Avid’s differentiators (6mins.) https://www.youtube.com/watch?v=x3tzo4pZivk

1-29-18: NobleCon14 - 14th Annual Inv. Conf., Ft.Laud. => Roger Lias' webcast/slideshow https://tinyurl.com/yanwk9yo

11-15-17/Outsourcing-Pharma: “How This R&D Company (Peregrine) is Transitioning to a Pure-Play CDMO: ‘Opportunities Are Almost Endless’" - Recap of interviews with Steve King & Avid Pres. Roger Lias http://tinyurl.com/y7dv9faz

CONFERENCE CALLS & ASM's:

12-2-20: Qtly. Conf. Call (Green/Hart/Compton) PR & Transcript https://tinyurl.com/y66xk888

10-20-20 Annual Shareholders Meeting - Replay (9:45): https://www.virtualshareholdermeeting.com/CDMO2020 (Control# not needed)

9-1-20: Qtly. Conf. Call (Green/Hart/Compton) PR & Transcript https://tinyurl.com/y329llow

...CEO N.Green: ”My first few weeks have done nothing but confirm my view that I believe Avid to be a strong and state-of-the-art company with significant opportunity for growth."

6-30-20: Qtly. Conf. Call (Hancock/Hart/Compton) PR & Transcript https://tinyurl.com/y9zbgmos

...RickH: "Based on our customers' growing demand and our expanding business development activity, we believe that we will significantly increase capacity utilization in 2021 and beyond. Accordingly, we have entered into a new phase of planning for the expansion that will support our growing business in the years to come.”

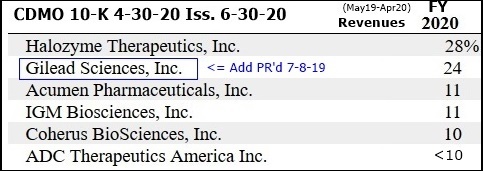

...”Top10 Pharma customer added 7-2019 named in 10-K: GILEAD SCIENCES.”

3-10-20: Qtly. Conf. Call (Hancock/Hart/Compton) PR & Transcript https://tinyurl.com/s9cmzmf

12-9-19: Qtly. Conf. Call (Hancock/Hart/Kinjerski) PR & Transcript https://tinyurl.com/tfewuzc

9-5-19: Qtly. Conf. Call (Hancock/Hart/Kinjerski) PR & Transcript https://tinyurl.com/y6t8zfur

6-27-19: Qtly. Conf. Call (Hancock/Hart/Kinjerski) PR & Transcript https://tinyurl.com/y6zdjyu2

...Rick Hancock, "Most importantly, during Q4, the Company achieved positive income, generating cash from dev. & mfg. operations for the 1st time since the beginning of the CDMO transition (Jan'18)."

3-11-19: Qtly. Conf. Call (Lias/Hart) PR & Transcript http://tinyurl.com/yy6dvjvc

12-3-18: Qtly. Conf. Call (Lias/Hart//Kinjerski) PR & Transcript https://tinyurl.com/y9n374kp

10-4-18: ASM/2018 (@Myford Facility) - Roger Lias’ Slideshow & Attendee Report https://tinyurl.com/yctfzhlb

9-10-18: Qtly. Conf. Call (Lias/Hart) PR & Transcript https://tinyurl.com/y8oc6hx8

...Roger Lias, "During the qtr, we advanced the projects of our existing active clients and continue to engage with numerous potential new customers."

7-16-18: Qtly. Conf. Call (Lias/Kinjerski) PR & Transcript https://tinyurl.com/yaozdggz

...Roger Lias, “In a short period, we’ve established a targeted business dev. operation that is actively providing visibility for Avid Bioservices within our fast growing but competitive marketplace.”

3-12-18: Qtly. Conf. Call (Lias/Kinjerski/Lytle) PR & Transcript https://tinyurl.com/yakdl4wj

...Roger Lias, ”I'm pleased to be able to report that in a very short period of time we've generated significant interest from both emerging & growth biopharmaceutical players and from pharmaceutical multinationals. I'm confident that the plan we're executing will drive a considerable increase in backlog and the opportunity to further enhance capacity utilization in the future.”

......From the 3-12-18 PR: “At present, we are in late-stage negotiations with several potential new customers and expect to announce the executed agreements before the end of the FY[4-30-18].”

1-18-18: ASM/2017 (@Myford Facility) - Roger Lias’ Slideshow & Attendee Reports https://tinyurl.com/yca6enbr 12-7-17 PROXY/14A: https://tinyurl.com/y7qprpg9

12-11-17: Qtly. Conf. Call (Lias/Lytle) Transcript https://tinyurl.com/ybycb2s6

...Roger Lias, "the company is undergoing a broad-scale transformation, the goals of which are to shift complete focus to the Avid Bioservices CDMO business and the complete divestiture of all of Peregrine's legacy R&D assets, which include bavituximab."

9-11-17: Qtly. Conf. Call (King/Lias/Lytle) Transcript http://tinyurl.com/y9y8qdac

...Steve King: “For this reason, we have concluded that in order to best position Peregrine’s R&D assets for successful development, they should be advanced by a partner with the appropriate expertise and ample resources to invest in the necessary clinical trials. To that end, we have been working diligently towards the transformation of the overall business to becoming a pure-play CDMO, while assessing the best strategic options for the R&D assets that would allow stockholders to directly see the future value from their continued developments. By partnering & eliminating future R&D expenditures, we believe we are best positioning Avid for future growth. Through reinvestment & expansion, we believe we will attract new customers and extend current contracts that will help position Avid as a leading U.S. CDMO. We are moving forward expeditiously with strategic discussions as we recognize the need to move quickly both from the R&D & CDMO standpoints. We hope to bring this process to completion over the coming months and will update you on our progress.”

7-14-17: Qtly. Conf. Call (King/Shan/Lytle) Transcript http://tinyurl.com/yb4wulvu

...Steve King: “We are seriously considering the possibility of separating our 2 distinct businesses, Avid and R&D/PS-Targeting.”

3-13-17: Qtly. Conf. Call (King/Shan/Worsley/Lytle) Transcript http://tinyurl.com/grhwjvy

...Steve King: “We believe the recent improvement of stock price is a growing recognition of the value of Avid, and having the full value of the Avid business reflected in our stock price is a top priority.”

12-12-16: Qtly. Conf. Call (King/Shan/Hutchins/Lytle) Transcript http://tinyurl.com/hhn4gga

...Steve King: “Our goal is to bring the overall company to profitability within the next 18mos. We believe just the value of Avid Bioservices is far greater than our current market cap and is only growing in value."

10-13-16 ASM/2016: ATTENDEE Reports & Link to CEO Steve King's 35min/45slide webcast: http://tinyurl.com/jx7ouay

Feb. 2018: Peregrine Pharmaceuticals completed its Mid’17-Early’18 Transition to a Pure-Play CDMO

(Contract Development & Manufacturing Organization), Avid Bioservices, Inc. - CEO: Roger Lias.

**FULL PPHM=>CDMO Transition History (Ronin/SWIM): https://tinyurl.com/ybqvzwhg

1-8-17: Peregrine chgs. name to “Avid Bioservices, Inc.”; new ticker: “CDMO” (+CDMOP) https://tinyurl.com/y8vhjow4

2-12-18: Peregrine’s Legacy PS-Targeting IP Sold to ONCOLOGIE INC. (Boston, CEO: Laura E. Benjamin) for $8M/upfront, $95M/milestones https://tinyurl.com/yam8gb3h

...12-13-18/8-K: Overview of Oncologie sale: https://tinyurl.com/yab9c6cr

NOTE: “PS-targeting Exosome tech. not included; back to UTSW", see: https://tinyurl.com/yakdl4wj

Click here for an ARCHIVE of the History of Peregrine’s Anti-PS/Bavituximab Platform - MOA, Trials, and Activity over the years, from early 2000’s thru 2017, prior to being Sold to ONCOLOGIE:

https://tinyurl.com/y8pq4rhc

Of Interest (post Oncologie Sale):

Oncologie's website: https://oncologie.com/true-home-v2/ NEWS: https://oncologie.com/newsroom/

4-20-18/AACR’18: MSKCC(LudwigCC) Tweets about 2 WolchokLAB/”PPHM” Anti-PS Posters https://tinyurl.com/ycgjhvqa

4-26-18: New Bavi+Keytruda/LIVER Ph2 IST Trial, Sponsor=UTSW, Collab=MERCK https://tinyurl.com/y7fd9vdb

6-7-18: Oncologie Obtains $16.5M Seed Funding Led by Pivotal bioVenture Partners China Fund https://tinyurl.com/ybrrbgg7

6-7-18/BioCentury: Laura Benjamin states, “Oncologie plans to begin a trial mid-summer '18 evaluating Bavi to treat HCC and a P-O-C trial in Gastric cancer in 1Q19/2Q19.” https://tinyurl.com/ycb8r7sm

12-3-18: During q/e 10-31-18, Avid sold remaining legacy R&D asset, r84(anti-VEGF), to Oncologie for $1.0M upfront. Avid is eligible to receive up to an addl. $21M in dev/reg./comm. milestones, and low to mid-single digit royalties on net sales upon commercialization of products utilizing r84 https://tinyurl.com/y9n374kp

11-4-19/PharmaBoardroom: Interview with Oncologie CEO Laura Benjamin discussing the 2 ongoing Bavi Trials w/Keytruda (USA UK Taiwan S.Korea) https://tinyurl.com/ydf6zhsv

...Dr. Benjamin, "We have high expectations of bavituximab and have obtained the global rights for this compound."

...Ongoing Trial #1 (N=80): Open Label, Bavi+Keytruda Adv. Gastric/GEJ Cancer https://clinicaltrials.gov/ct2/show/NCT04099641

......1-17-2020 ASCO/GI Poster: https://oncologie.com/wp-content/uploads/2020/01/2020-01-17-ASGO-GI-poster-final-draft.pdf

...Ongoing Trial #2 (N=34 UTSW): Open Label, Bavi+Keytruda Adv. Hepatocellular Carcinoma https://clinicaltrials.gov/ct2/show/NCT03519997

6-11-20/Fiercebiotech: Oncologie Reels In $80M To Push Clinical Pgms/Build Pipeline https://tinyurl.com/yany8f34 & https://tinyurl.com/y8p9artk

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |