Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Goldman - >>> Investors should 'go for gold' as Fed rate cut looms, Goldman says

Yahoo Finance

by Ines Ferré

Sep 3, 2024

https://finance.yahoo.com/news/investors-should-go-for-gold-as-fed-rate-cut-looms-goldman-says-155551358.html

Investors should "go for gold" as the precious metal's stellar run isn't over, Goldman Sachs analysts said in a research note.

On Tuesday, gold futures hovered above $2,515 per ounce. The precious metal is off its all-time high touched last month but still up nearly 22% year to date, making it the world's second-best-performing asset behind crypto.

"Our preferred near-term long is gold. It remains our preferred hedge against geopolitical and financial risks, with added support from imminent Fed rate cuts and ongoing EM central bank buying," wrote Goldman Sachs analysts on Sunday.

The firm maintains a 2025 target of $2,700 per ounce and issued a "long gold" recommendation.

Purchases by central banks, which hit a record in the first quarter of 2024, have been one of the biggest drivers of the precious metal's rise this year. BofA analysts estimate gold has now surpassed the euro to become the world's largest reserve asset, second only to the US dollar.

Geopolitical risks such the Israel-Hamas war and Russia-Ukraine conflict, as well as signals from the Federal Reserve of a September rate cut amid signs of a slowing labor market, have also buoyed prices.

"We're seeing gold being used as an uncertainty hedge," said Tom Bruni, head of market research at Stocktwits, in a recent episode of Stocks in Translation.

Global physically backed gold ETFs have now seen inflows three months in a row as Western investors pile into gold, with North American activity outpacing Europe and Asia in July, according to the latest World Gold Council data.

In the near term, traders may be wondering if gold will succumb to a historically negative trend for assets this month. The yellow metal has declined every September since 2017, according to Bloomberg data.

Analysts expect the commodity's next catalyst will come when the Federal Reserve meets this month following a week of fresh labor data and a crucial monthly jobs report on Friday.

"Gold prices continue to hover at around $2,500/oz with focus primarily on the size of the expected upcoming Fed rate cut later this month," wrote JPMorgan analysts in a note on Tuesday.

As of early Tuesday, traders were pricing in a 31% probability of a 50 basis point cut instead of 25 basis points, per the CME FedWatch Tool.

<<<

---

>>> Why gold is outperforming nearly everything so far this year

Yahoo Finance

by Jared Blikre

Aug 28, 2024

https://finance.yahoo.com/news/why-gold-is-outperforming-nearly-everything-so-far-this-year-100022695.html

Gold futures have been surfing record highs, with Monday's prices hitting $2,555.2 per ounce, sending the value of a 400 troy ounce gold bar to $1,022,080.

The yellow metal has forged meteoric gains this year, emerging as the world's second-best-performing asset next to crypto. Its 23% year-to-date gain edges out the megacap-loaded Nasdaq Composite — itself up a healthy 18%. (A proxy for the crypto market writ large, the Bitwise 10 Crypto Index Fund (BITW), is up 47% this year.)

According to BofA Global Research, gold funds just absorbed the largest inflows in four weeks, attracting $1.1 billion. Yet, the broader trend has actually seen $2.5 billion in outflows year to date, suggesting that underlying strength is coming from outside traditional fund flows.

Central banks — especially those of developing countries — have been buying the barbarous relic at a record clip. According to the World Gold Council, central banks have purchased 290 tonnes in the first quarter alone, beating out the prior Q1 record from 2023 and setting CBs on a path to record gold purchases in 2024 that are estimated to easily eclipse 1,000 tonnes.

"Not only is the long-standing trend in central bank gold buying firmly intact, it also continues to be dominated by banks from emerging markets," wrote the Gold Council.

In that regard, Turkey tops the buy list this year with 30 tonnes purchased in the first quarter — lifting its gold reserves to 570 tonnes. China bought 27 tonnes in Q1, making it the 17th consecutive quarter of purchases and also bringing its holdings to 2,262 tonnes. Other notable purchasers include India, Kazakhstan, the Czech Republic, Oman, and Singapore.

The central bank buying spree has solidified gold's status as a reserve asset. According to BofA, gold has now surpassed the euro to become the world's largest reserve asset second only to the US dollar, representing 16% of the reserve pool.

The precious metal’s performance can be attributed to its unique position as a real asset with one of the lowest correlations to stocks across asset classes, making it a safe haven from market swings and inflation.

According to Tom Bruni, head of market research at StockTwits, in a recent episode of Stocks in Translation, "We're seeing gold being used as an uncertainty hedge."

Bruni also emphasized gold's appeal to traders due to its price action. "With gold breaking out above its 2011 highs, it's drawing significant attention from trend followers and technical analysts alike."

Investors looking for deep, liquid gold markets have a robust choice of futures markets, ETFs, and gold miner stocks and ETFs, which tend to be even more volatile than the underlying metal.

"The volatility in gold prices has made it a prime trading vehicle, whether through gold ETFs or mining stocks," said Bruni.

BofA separately highlighted how this latest gold rally isn't like the other advances this century, offering a tantalizing glimpse of future bullish potential.

The bank noted this is the third major gold advance in two decades, yet "households have missed this rally." The first two rallies — from 2004 to 2011, and from 2015 to 2020 — attracted big fund flows into gold ETFs. But over the last year, gold bullion and gold miner ETFs have shed $6.4 billion in assets, according to Bloomberg data and Yahoo Finance calculations.

But if last week's large gold inflows were to gain momentum, that trend could signal a perfect storm of retail, institutional, and central bank gold buying is brewing. Why?

Bruni said it best: “Gold is kind of one of these things that operates on vibes."

<<<

---

>>> Trump is starting to move markets

Yahoo Finance

by Rick Newman

Jul 17, 2024

https://finance.yahoo.com/news/trump-is-starting-to-move-markets-203051423.html

Donald Trump has had a surprisingly solid summer, raising the odds, for now, that he’ll win a second presidential term.

That's why financial markets are reawakening to the “Trump trade,” with varying implications for stocks, bonds, cryptocurrencies, interest rates, and inflation.

Trump’s upturn began with the June 27 presidential debate in which President Joe Biden’s bumbling raised more questions than ever about the incumbent’s age and stamina. Ever since, a swelling chorus of Democrats has been calling for Biden to withdraw and let Vice President Kamala Harris or another younger Democrat take on Trump.

Trump survived a July 13 assassination attempt and appointed the first millennial to a national ticket by choosing J.D. Vance as his vice presidential running mate. Former Trump challengers lined up behind the former president at the Republican convention, an uncharacteristic show of unity in an otherwise fractious party.

Trump himself seems to be steering to the center, perhaps in a bid to win swing voters and mainstream business backers. In an interview with Bloomberg Businessweek, he sought to assuage Wall Street fears of chaos in a second term. He said he’d probably keep Fed Chair Jerome Powell in the job through the end of his term in 2026, “especially if I thought he was doing the right thing.” That means lowering interest rates, but only during a Trump presidency—not in the fall, when it might help Biden.

Trump tried to assure investors there would be no unusual inflation caused by new tariffs without explaining how he’d work that magic. He even suggested he’d consider JPMorgan Chase CEO Jamie Dimon for Treasury Secretary, which would put a Wall Street eminence in the job, should Dimon accept.

Election scenarios are now nudging earnings and inflation off the radar screen as top investor concerns. “‘Animal spirits’ have taken on a whole new head of steam because of this growing feeling that Donald Trump is going to emerge victorious,” economist David Rosenberg of Rosenberg Research wrote to clients on July 17. “No wonder investors are foaming at the mouth.”

Betting markets — which can be spurious — now give Trump 66% odds of winning, according to the RealClearPolitics average. That suggests rising odds of not just a Trump win, but of a Republican sweep in which the GOP wins both houses of Congress too, giving it unified control of the government.

That would open the door to more corporate tax cuts, which Democrats would likely block if they controlled at least one chamber of Congress. Rosenberg views the GOP sweep scenario as a contributor to the recent investor rotation out of tech stocks into smaller companies deemed value stocks on the theory that more tax cuts would help smaller shares catch up in value to the so-called Magnificent Seven.

Cryptocurrencies have been another beneficiary of Trump’s rising fortunes. Trump, once a crypto skeptic, now pledges to end government efforts to regulate crypto in a bid to capture younger voters smitten with the trend. The value of bitcoin jumped by $1,000 during the first hour after Trump survived the July 13 shooting as buyers bet the failed assassination would boost Trump’s election odds. During the next four days, bitcoin rose by another $4,500. Most other cryptos followed bitcoin higher.

But the outlook for a second Trump presidency isn’t entirely bullish.

For instance, Trump’s plans to boost import tariffs and roust undocumented immigrants out of the country are both inflationary, since they would raise the prices of imported goods on their face and probably also boost labor costs by making workers in some industries more scarce.

That could undo the considerable progress of the last two years, with inflation falling sharply from its 2022 peak, prompting hope that the Federal Reserve could start cutting interest rates as soon as September. Any sign of resurgent inflation — including possible Trump policies — could interfere with that and keep interest rates elevated. Some analysts think interest rates are already higher than they would otherwise be because investors are beginning to price in the effect of inflationary Trump policies.

Investors are also sniffing around for specific sectors or companies that could benefit or suffer under a second Trump term. During the Bloomberg interview, for instance, Trump suggested he wouldn’t aid Taiwan if China attacked, even though Taiwan is a key source of the world’s most advanced semiconductors, which are fundamental to the US economy and to the artificial intelligence boom. Or, he said, Taiwan should pay the United States for its protection.

Tech stocks promptly sold off, leading to a 2.5% one-day drop in the Nasdaq stock index on July 17. “Some of the pressure on big tech stocks today seems to be tied to [Trump] remarks that Taiwan should pay for US defense,” Capital Economics explained on July 17, the day Bloomberg published the Trump interview. Shares of TSMC, Taiwan’s semiconductor giant, fell by 7% on the news.

Though he’s having a good run, Trump is not a shoo-in.

For all of Biden’s woes, he’s less than three points behind Trump in the Cook Political Report polling average.

And an already unpredictable race could get woolier still. Biden could still withdraw, with a less familiar Democrat taking his place. Trump is also due to be sentenced on 34 felony convictions in the New York City fraud trial on Sept. 18, just six weeks before the election. And both candidates are elderly and frail in their way, elevating the odds of a health emergency in the home stretch of the election.

Whatever markets price in today they could price out tomorrow.

<<<

---

>>> The Economic Slowdown Is Finally Here. Welcome It.

The Wall Street Journal

by Aaron Back

5-4-24

https://www.msn.com/en-us/money/markets/the-economic-slowdown-is-finally-here-welcome-it/ar-AA1o8acL?cvid=3bfc0e278d8b4951a298718a752e86b8&ei=71

Evidence is stacking up that the U.S. economy has slowed, led by the formerly red-hot services sector.

Yet overall activity levels remain healthy, and some cooling is welcome news to investors because it opens the door back up to possible rate cuts by the Federal Reserve.

The most obvious indicator was Friday’s employment report, which showed the economy added 175,000 jobs in April, down significantly from 315,000 in March. Particularly notable was the shift to just 5,000 jobs being added in the leisure and hospitality sector compared with 53,000 in March.

This is consistent with earnings reports over the past week from food-services providers including Starbucks and McDonald’s, which both cited growing caution among consumers. Even Kraft Heinz said out-of-home venues such as restaurants are buying less from it.

“The consumer is certainly being very discriminating in how they spend their dollar. And the inflation that has occurred over the last couple of years in the U.S., I think, has certainly created that environment,” McDonald’s Chief Executive Christopher Kempczinski told analysts on a conference call on Tuesday. Starbucks, for its part, reported a 3% decline in North American comparable-store sales in the first quarter which, along with weakness in China, prompted a 15.9% plunge in its stock price.

Also on Friday, a monthly survey by the Institute for Supply Management showed services-sector activity dipping into contractionary territory in April for the first time in 15 months. “The composition of the report was weak, as the employment, new orders, and business activity components all declined,” Goldman Sachs economists said in a note.

Why many Americans still feel bad about the economy despite strong data

Of course, it wasn’t all doom and gloom. True, the unemployment rate ticked up to 3.9% in April from 3.8% the prior month. But, as the Bureau of Labor Statistics noted, this indicator has been in a narrow range of between 3.7% and 3.9% since August of last year. Economists at Bank of America said they see evidence that the great “catch up” in services-sector employment following the pandemic is finally ending. “In our view, this is not an outright negative sign for the economy,” they added.

One very welcome sign from the Fed’s point of view is the continued slowdown in wage growth, with average hourly earnings rising just 3.9% from a year earlier in April, compared with 4.1% in March and 4.3% in February. This suggests pricing pressures could keep subsiding, despite the stubbornly high inflation reports of recent months.

Indeed, Friday’s soft jobs data was enough to get investors thinking about rate cuts again. Stocks rose and bond yields fell on the data, with the S&P 500 gaining 1.3% and yields on benchmark 10-year Treasurys declining by 0.07 percentage point. A move at the Fed’s next meeting in June still seems to be off the table. But the likelihood of a cut by September as implied by the Fed Funds futures market rose to 67.1% late Friday from 61.6% a day earlier, according to CME Group.

If the economic data cooperates between now and then, the possibility of a sneaky July cut could keep creeping higher. Right now, markets put that at just a 36.6% chance, but it is Goldman Sachs’s base case.

A little summer slowdown could be just what this economy needs.

<<<

---

>>> Equal-Weight RSP Boxing Out SPY, Mag 7

ETF.com

by Jeff Benjamin

March 20, 2024

https://finance.yahoo.com/news/equal-weight-rsp-boxing-spy-160000389.html

While riding a handful of stocks that have been driving market indexes can be exhilarating, there is also a time for tapping the brakes, whether to reduce risk or diversify a portfolio.

That’s the premise behind ETFs like the Invesco S&P 500 Equal Weight ETF (RSP), which has risen more than 3% over the past month.

The fact that RSP has been running evenly with the market-capitalization-weighted SPDR S&P 500 ETF Trust (SPY) over the past 30 days has drawn the attention of both savvy market watchers and trigger-happy traders as a sign that the influence of the Magnificent Seven stocks is waning slightly.

“The broadening of market breadth may make financial advisors feel a bit more at ease,” said Nicholas Codola, senior portfolio manager at Omaha, Neb.-based Orion.

“Generally, it’s a sign of a stronger, more resilient market when the majority of the stock market returns are not explained by seven-to-10 names,” he added. “We’ve all heard the old adage that diversification is the only free lunch.”

RSP's Implications for Long-Term Investors

Indexes weighted to the largest and fastest growing companies have historically had a huge upside, as has been evident recently.

Last year, SPY’s 26.2% gain was nearly double the 13.7% gain by RSP. And so far this year that trend has continued with SPY up 8.2% and RSP up 4.5%.

But longer term, where most retail class investors live, RSP has been a powerful force.

Since its inception, 21 years ago, RSP has produced a cumulative return of 542%, which compares to a 458% cumulative return over the same period for SPY, according to Morningstar.

On an annualized basis, according to Invesco, RSP's index, the S&P 500 Equal Weight Index, has generated an 11.5% gain since inception, which compares to a 10.8% annualized return for the S&P 500 Index over the same period.

“Advisors can tell clients that if and when the rest of the 490-plus companies in the index begin to catch up, investors will be more exposed to those gains with an equal weight approach,” said Jeff Schwartz, president of Markov Processes International in Summit, N.J.

“Additionally, equal-weighted indices have an important quirk where the average or mean return of the portfolio is slightly above the median,” he added. “This means that the investor should expect to have a return that is slightly better than half the companies in the portfolio.”

Paul Schatz, president of Heritage Capital in Woodbridge, Conn., sees equal-weight indexes as the start of a longer-term story.

“The Mag Seven has struggled lately and at the same time the New York Stock Exchange advance-decline line has been chugging higher, which is expressed in RSP finally trying to hold its own against SPY,” he said.

Chuck Etzweiler, senior vice president of research at the advisory firm Nepsis in Minneapolis, said equal-weighted and factor-based indexes are part of the nuance that can make indexed investing “quite confusing to even the most intuitive investor.”

“Equally weighted indexes not only provide a greater level of diversification as they lower concentration risk, (but) their methodology allows for a greater number of companies down the market-cap stream to be included, such as mid and small cap companies,” he said. “And anytime an equal-weight process begins to outperform it usually shows a broadening out of companies achieving higher price appreciation and suggests a near term healthy economic environment."

<<<

---

You are the second person in a week to mention DHR to me. Perhaps the Universe is giving me a stock tip.

Of those listed, WTS appealed to me the most.

Key Competitors

ELECTRONIC EQUIPMENT: CONTROL AND FILTER

Name Consolidated Market Cap

- Current (MM) Sales

- Last Twelve Months (MM) EBITDA

Margin - Last Twelve Months Enterprise Value/EBITDA

- FY1

Pentair Plc 12,094.92 4,123 20.1 15.1

Xylem Inc 27,106.78 6,752 15.1 21.5

Mueller Water Products, Inc. 2,140.57 1,276 14.9 12.9

Idex Corp 15,994.8 3,296 29.8 18.8

A O Smith Corp 11,559.34 3,801 10.7 14.3

Zurn Elkay Water Solutions Corp 5,123.83 1,514 17.7 16.2

Flowserve Corporation 5,239.16 4,194 8.3 12.4

Watts Water Technologies, Inc. 6,598.92 2,011 19.1 16.3

Derf, >> PHO <<

For the water sector, I've had PHO and FIW in the past, though currently only have a group of water related stocks -- BMI, ROP, TTEK, WTS, and Danaher (DHR) also has some exposure to water. See link to Water Sector below.

The expense ratios are fairly high with FIW and PHO, but they do provide the diversification aspect. Fwiw, I've been leery of the water utility and electric utility stocks in general for a few years. On the water side, their aging infrastructure is going to need major improvements going forward, which will be expensive. On the electric utility side, they are facing lots of issues going forward. After the big PG&E lawsuits, I figure it's best to use an ETF, though I'm not currently in the sector.

Water Sector -

https://investorshub.advfn.com/Water-Investment-Ideas-31293

---

Instead of gold, look to $PHO. Moving up at about the same pace, and which commodity is more important?

I don't know who this guy is, but can't disagree with his points. Although one day not far in the future, I can see Treasuries being downgraded.

>>> Rickards’ Five 2024 Forecasts

BY JAMES RICKARDS

DECEMBER 12, 2023

https://dailyreckoning.com/rickards-five-2024-forecasts/

Rickards’ Five 2024 Forecasts

I have five forecasts for 2024 to help keep you ahead of the curve in positioning your investment portfolio.

My overall forecast is that 2024 will be more tumultuous and shocking than 2023. That may seem hard to credit.

With two major wars going on, an indicted former president and a demented current president, how can 2024 be more challenging than 2023?

Rest assured; it will be. I explain why below.

An Election of Dire Consequences

It’s a cliche to write that the next presidential election will be the “most important in our lifetimes.” Yet in 2024 that cliche will actually be true.

The divide between the two parties is probably greater than at any time in U.S. political history since the Civil War. The choice could not be more stark and the stakes could not be higher.

That’s why this election is so important.

First off, I don’t think that Joe Biden will be the Democratic nominee for president.

Biden’s problem is not just his age, but the fact that he actually is mentally and physically impaired. He’s simply not fit to be president, and everyone knows it even if Democratic operatives and media sycophants don’t want to mention it. But who will replace Biden?

The most likely replacements are Gavin Newsom, J.B. Pritzker, Gretchen Whitmer and Jennifer Granholm. All four were or are state governors. They’re all about the same ideologically; take your pick. Forget Kamala Harris; she’s simply too much of a liability.

The Republican Side

On the Republican side, there’s not a lot to say. Trump will be the nominee; no one can recall a non-incumbent with such a large lead in the polls.

He’s leading the pack by 55 points or more and is now even running ahead of Joe Biden in recent polls.

Meanwhile, Trump’s facing over 90 felony charges in four separate indictments in two state courts and two federal courts. Criminal indictments only increase Trump’s popularity because they are clearly motivated by politics.

A criminal conviction (likely in my view) will further solidify Trump’s base because of the blatant jury shopping, targeted prosecutions and absence of due process that Trump has had to endure.

The biggest curveball is that Trump may actually be behind bars on Election Day. That’s OK, there is no legal or other prohibition on electing an incarcerated convicted felon as president. Third-world, yes. Illegal, no.

This brings us to the third-party situation. There are many third-party candidates who will likely divide the Democrats. These include RFK Jr., Cornel West and Jill Stein. I wouldn’t rule out Sen. Joe Manchin from West Virginia, who’s announced he won’t seek reelection. If he runs for president, he’s likely to go on the No Labels party line.

I believe these third-party candidates will divide the Democratic vote, which I also believe will favor Trump. So that’s my first forecast — Trump will win back the presidency in 2024.

U.S., China and a Global Recession

Chinese economic growth is now in the low single digits (about 4% per year). That’s down from the double-digit growth of the 1994–2008 period.

China has had two failed “reopenings” (one after COVID in 2022, and one as the result of “stimulus” in 2023) and seems headed for a third. China gets a small boost from loose fiscal and monetary policy that rapidly fades because there is no real stimulus possible when a country is as heavily indebted as China.

The U.S. faces its own economic headwinds. The Federal Reserve has raised interest rates to 5.50% from zero in 20 months and reduced its balance sheet by over $1 trillion in the same period, an even tighter monetary policy than the one engineered by Paul Volcker from 1979–1981.

Fiscal policy is also tightening since the COVID handouts and student loan grace periods are over. Fiscal policy will get even tighter now that Republican deficit hawks have the upper hand in the House of Representatives.

The data showing the U.S. is heading to a recession is abundant. In fact, the U.S. may already be in recession. The indicators include inverted yield curves, rising commercial real estate defaults, declining industrial production, declining job creation and falling bank loans.

That leads me to my next forecast: China, the U.S. and Japan will all fall into recession in the coming months. The EU is already in recession. A rare global recession will be the result in 2024.

Ukraine

Russia is winning the war decisively. The West and Ukraine have shown no willingness to negotiate and there’s no reason for the Russians to negotiate because they’re winning.

With that in mind, it seems likely that Joe Biden will double-down on his losing bet.

The Russians don’t expect the war to be over until 2025. That gives Biden time to deliver F-16 fighter jets and more money and to help Ukraine with its flying drones and sea-drones that can attack Russian vessels and the Kerch Bridge.

Russia will certainly match that kind of escalation by shooting down the F-16s, increasing its cruise missile attacks on Ukrainian cities and destroying Ukraine’s energy infrastructure so that the country will lack electricity and heat this winter.

My forecast is that Russia will not de-escalate because they’re winning. Biden will not de-escalate because he’s senile, is surrounded by warmongers and has no reverse gear.

I do not expect escalation to the point of nuclear weapons, but the probability of that outcome is uncomfortably high and should not be dismissed.

Next is part two of this forecast…

Israel and Gaza

The Israeli-Hamas War has its own risks of escalation. As of now, fighting is mostly limited to northern Gaza adjacent to the Israeli border. Yet Israel faces an enemy 10 times more powerful than Hamas in the form of Hezbollah, which is located in Lebanon on Israel’s northern border, and which is heavily subsidized by Iran in terms of money, weapons and intelligence.

Hezbollah has launched some missile attacks from Lebanon on Israel’s northern border, but those have not been extensive. In addition to Hezbollah, the Houthi rebels in Yemen are firing missiles into Israel.

The Houthis are a direct Iranian proxy intended to threaten Saudi Arabia, but are equally capable of threatening Israel. If Hezbollah and Houthi attacks on Israel escalate, Israel will not limit their response to those two groups. They are likely to launch attacks on Iran itself, going to the root of the problem. At that point, Iran may fire missiles at Israel and close the Straits of Hormuz.

For now, the tensions have been reduced slightly. But if the escalation scenarios play out even in part, expect oil prices to go to $150 per barrel or higher. That will put the U.S. and Western Europe in a recession worse than 2008 and the earlier oil shock of 1974.

Don’t rule it out.

Banking Crisis Stage 2

In less than two months from early March to early May 2023, we saw the failures of Silvergate Bank, Silicon Valley Bank, Signature Bank, Credit Suisse and First Republic.

In response, the FDIC stepped in with the mother of all bailouts. Going forward, the issue is: Once you’ve guaranteed every deposit and agreed to finance every bond at par value, what’s left in your bag of tricks? What can you do in the next crisis that you haven’t already done — except nationalize the banks?

Investors are relaxed because they believe the banking crisis is over. That’s a huge mistake. History shows that major financial crises unfold in stages and have a quiet period between the initial stage and the critical stage.

My next forecast is that a bigger and more acute Stage 2 of the banking crisis is coming after the quiet period that has prevailed since June. This new crisis will be focused on about 20 banks with $200–900 billion in assets — the so-called midsized regional banks that are not too big to fail.

Crises of this sort can feed on themselves and cause losses that go far beyond the particular banks that may be most vulnerable. A new global financial crisis could be the result.

Markets

All of the above predictions involve turmoil either in domestic U.S. politics, international macroeconomics, ongoing wars or a potential financial meltdown starting in the banking system. With that as background, my market predictions are fairly straightforward:

2024 will be a difficult year for stocks. The market could decline at least 30% on a recession alone, and as much as 50% if either the Ukraine or Israeli war escalates, or a global financial crisis emerges.

The major sectors that will outperform even in a falling market are energy, defense, agriculture and mining.

2024 should be an excellent year for U.S. government securities. All maturities will produce decent yields and capital gains as interest rates decline going into a recession.

Basic commodities such as copper, iron ore, coal, non-precious metals and agricultural produce will generally decline as the recession unfolds. Gold and silver should perform well based on declining interest rates and a flight to quality.

Energy will be volatile. It will tend to go down based on economic weakness, but occasionally rally on geopolitical fears.

The investment choices are clear. It will be a bad year for stocks, a good year for Treasury securities and a down year for commodities, except for energy and gold. The winners will be Treasuries, gold, oil and King Dollar.

Put on your crash helmets for a wild ride in the coming year.

<<<

---

>>> Goldman says ‘shine is returning' for gold as investors ramp up bets on rate cuts

by Jenni Reid

CNBC

November 27, 2023

https://www.nbcchicago.com/news/business/money-report/goldman-says-shine-is-returning-for-gold-as-investors-ramp-up-bets-on-rate-cuts/3287739/

...Analysts at Goldman Sachs said in a note Sunday on the metals outlook for 2024 that gold's "shine is returning."

"The potential upside in gold prices will be closely tied to U.S. real rates and dollar moves, but we also expect persistent strong consumer demand from China and India, alongside central bank buying to offset downward pressures from upside growth surprises and rate cut repricing," they said.

Bank of America analysts, meanwhile, said in a Sunday note that the commodities team's base case was for gold to appreciate from the second quarter of 2024 as "real rates are pushed lower by the Fed cutting."

<<<

---

>>> Signs the S&P 500 rally is broadening beyond megacaps feed investor hopes

Reuters

by Lewis Krauskopf

November 24, 2023

https://finance.yahoo.com/news/broadening-u-stock-rally-feeds-110424040.html

NEW YORK (Reuters) — Signs the U.S. stock market rally is broadening from the so-called Magnificent Seven of mega-cap growth and technology companies is bolstering investor hopes for a rally through year-end.

Equities have risen sharply, with the S&P 500 up over 8% in November, on the cusp of a new high for 2023, fueled by falling Treasury yields and cooling inflation readings that could signal the end of Federal Reserve rate hikes. Yields fall when Treasury prices rise, and the lower returns on guaranteed fixed-income investments make stocks more appealing.

While some big investors are skeptical the rally amounts to more than just a year-end rebound, recent signs of market strength include gains in areas that have lagged this year.

In one encouraging sign, about 55% of the S&P 500 were trading above their 200-day moving averages as of Monday. That level breached 50% last week for the first time in nearly two months, according to LPL Financial.

Breadth is finally starting to broaden out to levels more commensurate with bull markets," said Adam Turnquist, chief technical strategist at LPL Financial. "This has been one of the keys to calling this recovery sustainable."

Equal weight

Among other signs, the equal-weight S&P 500 — a proxy for the average stock in the index — rose 3.24% last week. That was substantially more than the 2.24% rise for the market-cap weighted S&P 500, the biggest percentage point outperformance for the equal-weight index in nearly five months.

Even so, the S&P 500 equal-weight index has gained just 3% in 2023, against an 18% rise for the overall S&P 500 — on pace for the biggest such annual percentage-point gap in 25 years.

Much of that underperformance is due to the outsized gain in the Magnificent Seven stocks, which collectively hold a 28% weight in the S&P 500 index: Apple, Microsoft, Alphabet, Amazon, Nvdia, Meta Plaforms and Tesla. Overall, the group of stocks makes up nearly 50% of the weighting of the Nasdaq 100, which is up nearly 47% for the year to date.

Struggling small-cap and bank stocks have perked up, especially after last week's U.S. consumer price data for October was unchanged from the prior month.

The small-cap Russell 2000 is up 5.5% since the CPI data with the S&P 500 banks index up 6.5%, versus a 3% rise for the S&P 500. Year-to-date, the Russell 2000 is up 2%, while the S&P 500 banks index has fallen over 6%.

Mona Mahajan, senior investment strategist at Edward Jones, said an environment that could be conducive for a broadening of the rally "is starting to take shape."

“This environment where rates are cooling, inflation is moderating and the Fed is on the sidelines, that is typically a good backdrop for risk assets,” Mahajan said.

“Typically when rates start to move lower, you get valuation expansion and the areas that we could see some more meaningful valuation expansion is outside of large-cap tech,” she said.

The equal-weight S&P 500 is trading at a 5% discount to its 10-year average forward price-to-earnings ratio, according to Edward Jones.

Case against

Still, there are reasons to think that the market rally is not on the verge of a sustained broadening.

Investors will get further readings of consumer confidence and inflation next week. Stronger than expected data could spur a selloff in Treasuries, sending yields higher.

At the same time, the sharp rally in stocks for the week ended Nov. 17 was accompanied by high demand for upside call options, particularly in parts of the market that have underperformed this year, such as the small-caps focused iShares Russell 2000 ETF.

Some of that has already started to unwind. "We saw a huge pickup in expectations for IWM, but now those seem to have stabilized," said Steve Sosnick, chief strategist at Interactive Brokers.

The recent surge, which has pushed the broad S&P 500 up approximately 10% over the last three weeks, may not last as investors prepare to close their books for the year, said Jason Draho, head of asset allocation Americas at UBS Global Wealth Management.

"A lot of good news is already priced in and investors may be reluctant to chase the rally," he said.

<<<

---

>>> Prime Time for Bonds

In our 2024 outlook, bonds emerge as a standout asset class, offering strong prospects, resilience, diversification, and attractive valuations compared with equities.

Asset Allocation Outlook

BY ERIN BROWNE, GERALDINE SUNDSTROM, EMMANUEL S. SHAREF

NOVEMBER 14, 2023

https://www.pimco.com/en-us/insights/economic-and-market-commentary/global-markets/asset-allocation-outlook/prime-time-for-bonds/

The global economic outlook along with market valuations and asset class fundamentals all lead us to favor fixed income. Relative to equities, we believe bonds have rarely been as attractive as they appear today. After a turbulent couple of years of high inflation and rising rates that challenged portfolios, investors may see a return to more conventional behavior in both stock and bond markets in 2024 – even as growth is hindered in many regions.

In this environment, bonds appear poised to perform well, while equities could see lower (though still positive) risk-adjusted returns in a generally overvalued market. Risks still surround the macro and geopolitical outlook, so portfolio flexibility remains key.

Macro outlook suggests a return of the inverse stock/bond relationship

In PIMCO’s recent Cyclical Outlook, “Post Peak,” we shared our baseline outlook for a slowdown in developed markets (DM) growth and, in some regions, the potential for contraction next year as fiscal support ends and monetary policy takes effect (after its typical lag). Our business cycle model indicates a 77% probability that the U.S. is currently in the “late cycle” phase and signals around a 50% probability of a U.S. recession within one year.

Growth has likely peaked, but so has inflation, in our view. As price levels get closer to central bank targets in 2024, bonds and equities should resume their more typical inverse relationship (i.e., negative correlation) – meaning bonds tend to do well when equities struggle, and vice versa. The macro forecast favors bonds in this trade-off: U.S. Treasuries historically have tended to provide attractive risk-adjusted returns in such a "post-peak" environment, while equities have been more challenged.

Valuations and current levels may strongly favor fixed income

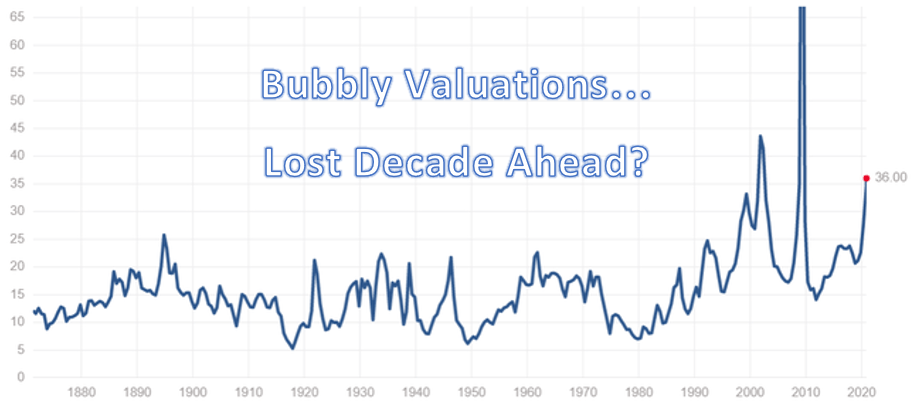

Although not always a perfect indicator, the starting levels of bond yields or equity multiples historically have tended to signal future returns. Figure 1 shows that today’s yield levels in high-quality bonds on average have been followed by long-term outperformance (typically an attractive 5%–7.5% over the subsequent five years), while today’s level of the cyclically adjusted price/earnings (CAPE) ratio has tended to be associated with long-term equity underperformance. Additionally, bonds have historically provided these return levels more consistently than equities – see the tighter (more “normal”) distribution of the return outcomes. It’s a compelling statement for fixed income.

Delving deeper into historical data, we find that in the past century there have been only a handful of instances when U.S. equities have been more expensive relative to bonds – such as during the Great Depression and the dot-com crash. One common way to measure relative valuation for bonds versus equities is the equity risk premium or "ERP" (there are several ways to calculate an ERP, but here we use the inverse of the price/earnings ratio of the S&P 500 minus the 10-year U.S. Treasury yield). The ERP is currently at just over 1%, a low not seen since 2007 (see Figure 2). History suggests equities likely won’t stay this expensive relative to bonds; we believe now may be an optimal time to consider overweighting fixed income in asset allocation portfolios.

Price/earnings (P/E) ratios, are another way that equities, especially in the U.S., are screening rich, in our view – not only relative to bonds, but also in absolute.

Over the past 20 years, S&P 500 valuations have averaged 15.4x NTM (next-twelve-month) P/E. Today, that valuation multiple is significantly higher, at 18.1x NTM P/E. This valuation takes into account an estimated increase of 12% in earnings per share (EPS) over the coming year, an estimate we find unusually high in an economy facing a potential slowdown. If we assume, hypothetically, a more normal level of 7% EPS growth in 2024, then the S&P today would be trading even richer at 18.6x NTM P/E, while if we are more conservative and assume 0% EPS growth in 2024, then today’s valuation would rise to 19.2x NTM P/E. Such an extreme level, in our view, would likely drive multiple contraction (when share prices fall even when earnings are flat) if flat EPS came to pass.

We note, however, a crucial differentiation within the equity market: If we exclude the seven largest technology companies from this calculation, then the remainder of the S&P trades close to the long-term average at 15.6x NTM P/E. This differentiation could present compelling opportunities for alpha generation through active management.

Overall, we feel that robust forward earnings expectations might face disappointment in a slowing economy, which, coupled with elevated valuations in substantial parts of the markets, warrants a cautious neutral stance on equities, favoring quality and relative value opportunities.

Equity fundamentals support cautious stance

Our models suggest equity investors appear more optimistic on the economy than corporate credit investors. We use ERP, EPS, and CDX (Credit Default Swap Index) spreads to estimate recession probability implied by different asset classes, calculated by comparing today’s levels with typical recessionary environments. The S&P 500 (via ERP and EPS spreads) is currently reflecting a 14% chance of a recession, which is significantly lower than the estimates implied by high yield credit at 42% (via CDX).

Such optimism is underscored by consensus earnings and sales estimates for the S&P 500, which anticipate a reacceleration rather than a slowdown (see Figure 3). We’re concerned about a potential disconnect between our macro outlook and these equity earnings estimates and valuations. It reinforces our caution on the asset class.

Managing risks to the macro baseline

We recognize risks to our outlook for slowing growth and inflation. Perhaps the resilient U.S. economy will stave off recession, but also drive overheating growth and accelerating inflation that prompts into much more restrictive monetary policy. There’s also potential for a hard landing, where growth and inflation fall quickly.

In light of these risk scenarios, we believe it’s prudent to include hedges and to build optionality – and managing volatility, especially in equities, is attractively inexpensive (see Figure 4). For example, one strategy we favor is a “reverse seagull” – a put spread financed by selling a call option.

Investment themes amid elevated uncertainty

Within multi-asset portfolios, we believe the case for fixed income is compelling, but we look across a wide range of investment opportunities. We are positioned for a range of macroeconomic and market outcomes, and we emphasize diversification, quality, and flexibility.

Duration: high quality opportunities

At today’s starting yields we would favor fixed income on a standalone basis; the comparison with equity valuations simply strengthens our view. Fixed income offers potential for attractive returns and can help cushion portfolios in a downturn. Given macro uncertainties, we actively manage and diversify our duration positions with an eye toward high quality and resilient yields.

Medium-term U.S. duration is particularly appealing. We also see attractive opportunities in Australia, Canada, the U.K., and Europe. The first two tend to be more rate-sensitive as a large portion of homeowners have a floating mortgage rate, while the latter two could be closer to recession than the U.S. given recent macro data. Central bank policies in these regions could diverge, and we will monitor the bond holdings on their balance sheets for potential impact on rates and related positions.

In emerging markets, we hold a duration overweight in countries with high credit quality, high real rates, and attractive valuations and return potential. Brazil and Mexico, where the disinflation process is further along and real rates are distinctly high, stand out to us.

By contrast, we are underweight duration in Japan, where monetary policy may tighten notably as inflation heats up.

While we recognize cash rates today are more attractive than they’ve been in a long time, we favor moving out along the maturity spectrum in an effort to lock in yields and anchor portfolios over the medium term. If history is a guide, duration has significant potential to outperform cash especially at this stage of the monetary policy cycle.

Equities: relative value is key

Although the S&P 500 appears expensive in aggregate, we see potential for differentiation and opportunities for thematic trades. From a macro perspective, there’s also the potential for economic resilience (such as a strong U.S. consumer) to support equity markets more than we currently forecast. Accordingly, we are neutral in equities within multi-asset portfolios. An active approach can help target potential winners.

In uncertain times, we prefer to invest in quality stocks. Historically, the quality factor has offered an attractive option for the late phase of a business cycle (see Figure 5). Within our overall neutral position, we are overweight U.S. equities (S&P 500), which present more quality characteristics than those in other regions, especially emerging markets. Also, European growth could be more challenged than in the U.S., so we are underweight the local equity market despite its more attractive valuation.

We also favor subsectors supported by fiscal measures that may benefit from long-cycle projects and strong secular tailwinds. The U.S. Inflation Reduction Act, for example, supports many clean energy sectors (hydrogen, solar, wind) with meaningful tax credits.

On the short side of an equity allocation, we focus on rate-sensitive industries, particularly consumer cyclical sectors such as homebuilders. Autos could also suffer from higher-for-longer interest rates; as supply normalizes, we think demand will struggle to keep up.

Credit and securitized assets

In the credit space we favor resilience, with an emphasis on relative value opportunities. We remain cautious on corporate credit, though an active focus on individual sectors can help mitigate risks in a downturn. We are underweight lower-quality, floating-rate corporate credit, such as bank loans and certain private assets, which remain the most susceptible to high rates and are already showing signs of strain.

In contrast to corporate credit, attractive spreads can be found in mortgages and securitized bonds. We have a high allocation to U.S. agency mortgage-backed securities (MBS), which are high quality, liquid, and trading at very attractive valuations – see Figure 6. We also see value in senior positions of certain securitized assets such as collateralized loan obligations (CLOs) and collateralized mortgage obligations (CMOs).

Key takeaway

Looking across asset classes, we believe bonds stand out for their strong prospects in the baseline macro outlook as well as for their resilience, diversification, and especially valuation. Given the risks to an expensive equity market, the case for an allocation to high quality fixed income is compelling.

<<<

---

Here's how the energy sector fared in the 2008 and 2020 crashes, vrs the S+P 500, gold, silver, and the miners (approx figures) -

2008 -

XLE - (60%)

CXV - (47%)

SPY - (52%)

GLD - (32%)

GDX - (73%)

SLV - (60%)

2020 -

XLE - (63%)

CVX - (57%)

SPY - (35%)

GLD - (14%)

GDX - (50%)

SLV - (39%)

SIL - (53%)

---

>>> How to Invest in FAANG 2.0

Money

3-17-23

https://www.bottomlineinc.com/money/investing/how-to-invest-in-faang-2-0

Low-cost exchange-traded funds (ETFs) are the best way to gain broad exposure to the market niches poised to outperform in the coming years…

Fuel/Oil & Gas:

Vanguard Energy ETF (VDE) holds stocks of about 110 companies involved in the exploration and production of energy products such as oil, natural gas and coal. The fund, which had a recent 3% yield, is dominated by giant global oil-and-gas companies such as Chevron and Exxon Mobil. Cost: 0.10%. Year-to-date performance: 3.15%.* Important: ETFs that track oil prices directly can be very volatile and are suitable only for traders.

Agriculture:

iShares MSCI Global Agriculture Producers ETF (VEGI). With about 155 stocks, this portfolio provides exposure to companies that produce fertilizers and agricultural chemicals, farm machinery, and packaged foods and meats. Top holdings: Deere & Co…fertilizer producer Nutrien. Cost: 0.39%. Performance: 1.63%.

Aerospace/Defense:

SPDR S&P Aerospace & Defense ETF (XAR) spreads its assets across about 30 aerospace and defense manufacturers. While it includes giants Boeing and Lockheed Martin, 75% of the portfolio is in mid- and small-cap names such as National Presto Industries, which manufactures ammunition for the US government. Cost: 0.35%. Performance: 7.12%.

Nuclear/Renewables:

VanEck Uranium+Nuclear Energy ETF (NLR) tracks foreign and domestic stocks and offers a 1.9% recent yield. The fund’s 25 companies include nuclear plants, engineering firms that build and maintain nuclear power facilities and uranium-mining companies. Top holdings: Dominion Energy…CEZ, which operates nuclear power plants in the Czech Republic. Cost: 0.60%. Performance: 4.44%.

Gold/Metals:

SPDR Gold Mini-Shares Trust (GLDM) is best for investors who want direct exposure to the price of gold, which typically is used as a hedge against high inflation and geopolitical uncertainty. The actual gold backing the shares is kept in vaults in London and audited regularly. Cost: 0.10%. Performance: 2.6%.

SPDR S&P Metals & Mining ETF (XME) is best for aggressive investors who want broad exposure to companies that mine major minerals and metals. The equal-weighted portfolio holds about 35 US-based gold, steel, copper and aluminum producers including Royal Gold and Reliance Steel & Aluminum Co. Cost: 0.35%. Performance: 10.88%.

<<<

---

Summarizing Jim Rickards' recommendations -

Gold - 10%

Inflation hedges and for wealth preservation -

Cash

Land

Energy

Agriculture

US Treasury Notes

Real Estate

Gold Mining Sector

Defense Sector

Avoid -

Stocks

Corporate Bonds

Commercial Real Estate

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172668844

---

VanEck Inflation Allocation ETF (RAAX) -

RAAX Holdings

Top 9 Holdings (67.64% of Total Assets)

PIT

VanEck Commodity Strategy ETF

21.14%

IGF

iShares Global Infrastructure ETF

12.91%

GDX

VanEck Gold Miners ETF

6.69%

EINC

VanEck Energy Income ETF

5.52%

XLE

Energy Select Sector SPDR Fund

5.43%

VNQ

Vanguard Real Estate Index Fund

4.82%

XOP

SPDR S&P Oil & Gas Exploration & Production ETF

4.35%

MOO

VanEck Agribusiness ETF

3.42%

NURE

Nuveen Short-Term REIT ETF

3.38%

<<<

---

>>> Peter Lynch’s 6 Categories Tool» To Find The Best Stocks To Buy

With instructions on when to sell them too

https://medium.datadriveninvestor.com/peter-lynchs-6-categories-tool-to-find-the-best-stocks-to-buy-abb5e0466db4

Peter Lynch is one of the greatest value investors out there, and thanks to his Magellan Fund he has beaten the market for over 20 years. Not only that, but he also wrote an amazing investing book called “One Up On Wall Street”.

In this amazing book, he talks about investing and the stock market, focusing in particular on how to find investment ideas and good stocks to buy. Because, as he puts it,

“Investing without research is like playing stud poker and never looking at the cards”

One of the main points of the novel is that according to him, the best way to approach stocks is to categorize them into six predefined categories — a breakdown should give an investor a clear indication of whether something is a buy, sell, hold, or stay-away-stock. So, here are the different categories and how to use them.

Slow Growers: Just Avoid Them

Starting off with a bold claim, Peter Lynch believes that companies with very slow revenue growth are straight-up stocks to avoid.

Not only that, but he says everyone should also avoid those stocks that might end up in this category soon (even if they’re currently not). This is because it never looks nice for investors when this happens, just like Netflix and IBM show.

Here are a few things that slow growers tend to have in common:

Generous and regular dividends, plus buybacks. Most slow-growth stocks usually have a relatively high payout ratio, meaning they pay out most of the profits since they don’t have any growth to reinvest for.

Flat earnings, and sometimes a flat stock chart too. Slow-growth stocks tend to have flat earnings over the long term, and sometimes even a stock chart. Not always though, since stocks can still move with multiple expansions and contractions (the P/E might go from 10 to 20 and vice versa).

Strangely high payout ratio and mid-to-high debt: if the company has a high payout ratio with growing dividends and flat profits, the risk is that they might pay out in dividends more than they can afford. Just look at McDonald’s, using debt to sustain the dividend.

Finally, keep in mind that all of this is not to say that slow growers can’t move or make their investors money. They can indeed, but it’s so rare that Lynch believes you should avoid them altogether.

Stalwart Stocks: Good Recession Protection

The second category is that of stalwarts stocks. These are businesses that grow nicely, but not enough to be considered a growth stock essentially (8-12% stable earnings growth is what defines them for Lynch). And the second necessary condition is that these companies are not in a sector that completely melts down during a recession. Think pharmaceuticals, for example.

With these stocks, to make good profits you need to time your purchase well over the cycle. In fact, Lynch says that if a stalwart goes up 50–100% in two or three years after you buy it, you might want to take profits before it’s too late.

Great examples are Bristol Myers Squibb and 3M. They have been growing their revenue at roughly 8% a year over the decade, and their investors have made decent returns. But these people also didn’t make life-changing money, they just made normal returns. These stocks have only managed to double over a decade, which might seem great but is actually just 7% per year. This is why Lynch tells his readers to buy these companies only when the risk of a recession starts to become real. Because perhaps the most important thing is that over the great recession, these stocks were flat. They remained stable during the years in which everything fell by more than 50%.

This is why they are great for recession protection — because they don’t do wonders in regular times, but they usually pull through better than others during recessions. The key is to find a few well-priced ones that have done well in past recessions.

There are two things to look out for though. These are envy, and mergers and acquisitions: Lynch warns investors to be careful about the management of big stable companies essentially. He says that sometimes CEOs tend to be jealous of fast-growing companies, so they do something stupid and this usually ends up hurting investors (like AT&T with Warner Media).

His Favorite Stocks: The Fast Growers

Next up is Lynch’s favorite category: those companies that grow at 20% or more per year. The author here is referring to the land of the 10-to-40-baggers essentially, the Amazons and Apples of the future. Those stocks that you buy and never even think of selling because they are true long-term compounders.

These stocks do not have to belong to a fast-growing industry, all they have to do is have the room to expand in a slow industry. Starbucks for example was a fast grower in the 1990s and 2000s that has now turned into a stalwart: those that invested in the 1990s ended up with a 20-bagger, whereas those that invested later did still good, but not as good.

I don’t really think there’s much more to say about growth stocks, if not about their price. Lynch says that to make a good return on your money, you should always buy them with a P/E Ratio below the growth rate. A 30% growth allows for a P/E of 30 for example, but nothing more if you want to make real money.

Here’s what else you can expect from fast growers:

If growth slows down, the market doesn’t like it and you end up with a Stalwart or Slow Grower — which is a whole different story.

Look for good balance sheets making substantial profits from the start, not unprofitable ventures.

Figure out when they’ll stop growing and how much to pay for growth. Because at some point, they will for sure stop growing and turn into something else.

Check how much more room for growth there is. 20 to 25 percent is the best growth rate, whereas businesses with 50% growth will probably attract many competitors or not last forever.

Look for companies with proven and profitable expansion in more than one city or country. Possibly those that few have heard of in general.

The Cyclicals

Cyclical stocks are those that follow the economy and/or their respective sector. Automotive, airlines, steel, chemical, travel etc. are all cyclical companies. Ford is the perfect example, as it goes down with every recession and up with every boom (it’s currently down again on the expectation that there will be a recession soon).

As you can see, these stocks are not a bad buy if you do it at the right time. Those who bought in 1989 have had a 10x over a decade, and the same goes for 2009. But those who bought at the wrong time essentially lost their money going into a recession. Timing is really the key here:

These stocks flourish when the economy turns good again, but suffer when there is no economic growth. They usually decline when peak earnings are reached and investors expect the next recession (like today).

50 or 75% drops are normal if you buy at the wrong part of the cycle. And you might have to wait years before seeing another upswing, just like Ford which is down ever since 2013.

Timing is everything — watch for inventories, economic growth, interest rates and also for new market entrants in the sector.

Know your Cyclical and figure out the cycles for each sector you are buying these stocks in. Within the car industry, 3 to 4 bad years are usually followed by 3 to 4 good years, but that’s not a universal thing.

The worse the slump, the better the recovery. But it’s also much easier to predict an upturn than a downturn in the industry.

Turnarounds: Buy Only With Maximum Certainty

Turnaround stocks are companies that are deemed as “doomed” by the market, but that might not actually be as bad as everyone thinks. Therefore, the investment thesis with these ones is that the market is being overly pessimistic.

About these stocks, Lynch essentially says you should watch carefully for the moment in which bankruptcy fears ease and the stock explodes as investors re-evaluate earnings and potential (in other words, to look for a catalyst). The problem with these stocks is that you have to be certain that bankruptcy won’t happen, or else you lose your money.

You also need to understand whether the issues are as big as perceived by the market or not, and also remember what Warren Buffett says about these companies: “turnarounds almost never turn around”.

The Asset Plays

Finally, an asset play is a company sitting on something valuable that the market is overlooking. Or even one with a good asset that hasn’t yet started to print cash, which is therefore not baked into the price of the stock.

This asset can be cash, real estate, inventory, even accounting losses, the number of users, etc. For example, during the 2020 crash, there were REITs trading for cents on the dollar when you looked at the value of the assets.

But of course, it’s not as easy as it may seem:

You must know the asset well

You must have the patience to wait until the value unlocks

You must always look at the debt, just like you look for hidden assets.

Finally, check if the management is making or destroying value for the shareholders. If they’re doing well, the value will probably be recognized soon, if not you might have to wait a while.

How To Use The Above Categories

About using this list, in the book, Lynch says that every investor should always categorize each company and find out what kind of stock it is, then closely follow it and only after a while making investment decisions. Or at least, this is what he did to beat the market for two decades.

Of course, if you’d like to know more about these categories, you should definitely go read the amazing book “One Up On Wall Street”. It’s probably the most undervalued investing book out there.

<<<

---

>>> What Is Asset Allocation and Why Is It Important?

Investopedia

By JAMES CHEN

March 01, 2022

https://www.investopedia.com/terms/a/assetallocation.asp

What Is Asset Allocation?

Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals, risk tolerance, and investment horizon. The three main asset classes—equities, fixed-income, and cash and equivalents—have different levels of risk and return, so each will behave differently over time.

KEY TAKEAWAYS

Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals, risk tolerance, and investment horizon.

The three main asset classes—equities, fixed-income, and cash and equivalents—have different levels of risk and return, so each will behave differently over time.

There is no simple formula that can find the right asset allocation for every individual.

Why Asset Allocation Is Important

There is no simple formula that can find the right asset allocation for every individual. However, the consensus among most financial professionals is that asset allocation is one of the most important decisions that investors make. In other words, the selection of individual securities is secondary to the way that assets are allocated in stocks, bonds, and cash and equivalents, which will be the principal determinants of your investment results.

Strategic Asset Allocation to Rebalance Portfolios

Investors may use different asset allocations for different objectives. Someone who is saving for a new car in the next year, for example, might invest their car savings fund in a very conservative mix of cash, certificates of deposit (CDs), and short-term bonds. An individual who is saving for retirement that may be decades away typically invests the majority of their individual retirement account (IRA) in stocks, since they have a lot of time to ride out the market's short-term fluctuations. Risk tolerance plays a key factor as well. Someone who is uncomfortable investing in stocks may put their money in a more conservative allocation despite a long-term investment horizon.

Age-Based Asset Allocation

In general, stocks are recommended for holding periods of five years or longer. Cash and money market accounts are appropriate for objectives less than a year away. Bonds fall somewhere in between. In the past, financial advisors have recommended subtracting an investor's age from 100 to determine what percentage should be invested in stocks. For example, a 40-year-old would be 60% invested in stocks. Variations of the rule recommend subtracting age from 110 or 120, given that the average life expectancy continues to grow. As individuals approach retirement age, portfolios should generally move to a more conservative asset allocation to help protect assets.

Achieving Asset Allocation Through Life-Cycle Funds

Asset-allocation mutual funds, also known as life-cycle, or target-date, funds, are an attempt to provide investors with portfolio structures that address an investor's age, risk appetite, and investment objectives with an appropriate apportionment of asset classes. However, critics of this approach point out that arriving at a standardized solution for allocating portfolio assets is problematic because individual investors require individual solutions.

The Vanguard Target Retirement 2030 Fund would be an example of a target-date fund.

These funds gradually reduce the risk in their portfolios as they near the target date, cutting riskier stocks and adding safer bonds in order to preserve the nest egg. The Vanguard 2030 fund, set up for people expecting to retire between 2028 and 2032, had a 65% stock/35% bond allocation as of Jan. 31, 2022. As 2030 approaches, the fund will gradually shift to a more conservative mix, reflecting the individual's need for more capital preservation and less risk.

In a Nutshell, What Is Asset Allocation?

Asset allocation is the process of deciding where to put money to work in the market. It aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals, risk tolerance, and investment horizon. The three main asset classes—equities, fixed-income, and cash and equivalents—have different levels of risk and return, so each will behave differently over time.

Why Is Asset Allocation Important?

Asset allocation is a very important part of creating and balancing your investment portfolio. After all, it is one of the main factors that leads to your overall returns—even more than choosing individual stocks. Establishing an appropriate asset mix of stocks, bonds, cash, and real estate in your portfolio is a dynamic process. As such, the asset mix should reflect your goals at any point in time.

What Is an Asset Allocation Fund?

An asset allocation fund is a fund that provides investors with a diversified portfolio of investments across various asset classes. The asset allocation of the fund can be fixed or variable among a mix of asset classes, meaning that it may be held to fixed percentages of asset classes or allowed to go overweight on some depending on market conditions.

Bottom Line

Most financial professionals will tell you that asset allocation is one of the most important decisions that investors make. In other words, the selection of individual securities is secondary to the way that assets are allocated in stocks, bonds, and cash and equivalents, which will be the principal determinants of your investment results.

<<<

---

>>> The housing market is in free fall with 'no floor in sight,' and prices could crash 20% in the next year, analyst says

Market Insider

by Brian Evans

October 20, 2022

https://finance.yahoo.com/news/housing-market-free-fall-no-175430725.html

US home prices have soared over the last decade, but could soon be on their way down.

The housing market will continue to plummet as there's "no floor in sight," according to Pantheon Macroeconomics.

Chief economist Ian Shepherdson wrote in a note Thursday that home prices could fall as much as 20%.

His warning came after existing home sales dropped for an eighth consecutive month, the longest slump since 2007.

The housing market crash has yet to find a bottom, setting up home prices for a steep dive in the year ahead, according to Pantheon Macroeconomics.

"Eight straight declines in sales and no floor in sight," Pantheon chief economist Ian Shepherdson wrote in a note on Thursday.

He added that the cumulative fall in sales from the peak in January is now 27%, "but this is not the floor." Shepherdson also noted that because mortgage rates have climbed to nearly 7%, which has dampened borrowing demand, the result will be a continued decline in home sales until early 2023.

"By that point, sales will have fallen to the incompressible minimum level, where the only people moving home are those with no choice due to job or family circumstances," he predicted. "Discretionary buyers are disappearing rapidly in the face of the near-400bp increase in rates over the past year."

Meanwhile, prices for existing homes have fallen on a sequential basis for three straight months, sending the median price to $384,800 — the lowest since March.

But with mortgage rates rising, even prospective buyers who are looking to downgrade to a cheaper home would face bigger monthly payments, Shepherdson said, providing more incentive to stay put and constraining supply further.

"But prices have to fall substantially in order to restore equilibrium; the supply curve for housing is not flat, so the plunge in demand will drive prices down," he said. "We expect a drop of 15-to-20% over the next year, in order to restore the pre-Covid price-to-income ratio."

The grim outlook follows similarly stark comments from Wharton professor Jeremy Siegel, who said last week that he expected home prices to see the second-worst decline since World War II amid aggressive Fed rate hikes.

<<<

---

>>> "The Big Secret Wall Street Will Never Tell You About Investing"

Motley Fool

By Mark Blank

Jul 5, 2022

https://www.fool.com/investing/2022/07/05/the-big-secret-wall-street-will-never-tell-you/

'KEY POINTS

* Fund-manager underperformance has more to do with compensation structure than it does with investing skill.

* Institutions are incentivized to pursue short-term gains, which leads to higher taxes.

* Retail investors can beat the market if they stay focused on owning great companies for many years."

"There have been numerous studies that suggest it is impossible to beat the market as an individual investor. Beating the market is described as so difficult, only the best and the brightest minds on Wall Street achieve it.

So, if that's the case, who are individual investors to think they can pull off the miraculous feat of outperforming the larger market? Ludicrous, right?

Perhaps. But before you write off investing in individual stocks, there are a few flaws in that argument you should consider that Wall Street doesn't want you to know.

"Professional incentives

Using professionals as a benchmark for individuals is problematic because institutions have unique incentives that drive their trading behavior. The two main motivators are investor retention and performance-based bonuses.

In other words, fund managers need to generate high returns every year because if they don't, they will likely lose investors and make significantly less money from their year-end bonus.

These are powerful motivators to pursue short-term gains. Meanwhile, individual investors have no pressure to produce immediate results.

High turnover among funds

Ironically, the conclusion investors should arrive at after hearing that over 90% of fund managers underperform the market is that chasing short-term gains is disastrous for long-term performance.

The main reason for this is high turnover. Turnover is the change in positions within a portfolio. At The Motley Fool, we advocate for low turnover, so your companies can compound on themselves over the long run.

In 2019, Morningstar found the average domestic stock fund had a turnover rate of 63%. Put another way, from the beginning of the year to the end, the average fund's holdings were 63% different.

Consequences of high turnover

As fund managers chase near-term results, there are very real long-term consequences for their performance. The two main costs are a lack of compound interest and higher taxes due to short-term capital gains.

Compound earnings is the byproduct of great investing, and it should be the goal of every individual investor. Compounding occurs when you start earning interest on your interest. If you earn a 10% return on a $1,000 investment, you'll earn more dollars each year as the overall portfolio increases. Compounding is hard to notice in the early years, but the results are dramatic after a few decades.

Very few fund managers ever get to enjoy this benefit because of the constant pressure to chase hot stocks. Therein lies a very real advantage for you as a retail investor: you're accountable to no one but yourself, and you face no outside pressure to chase hot stocks for near-term results.

Additionally, high turnover results in short-term capital gains taxes. These are the highest taxes you can pay on the sale of stocks. Unfortunately for fund managers, as they chase short-term results, they are frequently forced to sell stocks , resulting in higher taxes. These taxes eat into the fund's real returns, which is yet another advantage for long-term investors.

"Outperformance lies in patience

When you extrapolate why institutional investors underperform, what you learn is that overtrading is terrible for long-term performance.

Instead of throwing in the towel because the pros can't beat the market, you should conclude that you have a massive advantage by not having clients and year-end bonuses to impact your portfolio decisions.

And finally, whether it's the short-term nature of Wall Street's investing outlook or a general lack of optimism for new and disruptive companies, the financial media's track record of missed winners should only add to your conviction in your ability to...beat the market."

<<<

---

>>> The Bogleheads' Guide to The Three-Fund Portfolio

https://www.bogleheads.org/forum/viewtopic.php?t=88005

After a lifetime of investing since 1950 trying to "beat the market," I am convinced that a simple 3-fund (or ETF) portfolio of Total Stock Market, Total International, and Total Bond Market, properly allocated, is an ideal portfolio for most investors. The advantages are many :

* Avoids wasted time and the possibility of mistakes trying to pick the best of thousands of mutual funds and ETFs.

* No individual stock risk.

* Highest return with lowest risk. Efficient.

* Very diversified with over 20,000 worldwide securities (lower risk).

* Very low expense ratios.

* Very low (hidden) turnover costs.

* Very tax-efficient.

* The many Advantages of Simplicity.

* No adviser risk.

* No fund manager risk.

* No style drift.

* No asset bloat.

* No tracking error to cause abandonment of the strategy.

* No fund overlap.

* No front-running that reduces sub-index returns.

* Automatic rebalancing within each fund.

* Less worry. Never under-performs the market.

* Easy to maintain for the owner, spouse, caregivers and heirs.

* More free time.

* Mathematically certain to outperform most investors.

<<<

---

>>> Stocks could drop 50%, Nouriel Roubini argues. Things will get much worse before they get better.

MarketWatch

by Nouriel Roubini

June 30, 2022

https://www.marketwatch.com/story/stocks-could-drop-50-nouriel-roubini-argues-things-will-get-much-worse-before-they-get-better-11656611983?siteid=bigcharts&dist=bigcharts

The global economy may get the worst of the 1970s and the Great Recession: A stagflationary debt crisis that would confound central banks and fiscal authorities

It’s dangerously naive to believe that the recession will be shallow, brief or benign.

NEW YORK (Project Syndicate)—The global financial and economic outlook for the year ahead has soured rapidly in recent months, with policy makers, investors, and households now asking how much they should revise their expectations, and for how long.

That depends on the answers to six questions.

Six questions

First, will the rise in inflation in most advanced economies be temporary or more persistent? This debate has raged for the past year, but now it is largely settled: “Team Persistent” won, and “Team Transitory”—which previously included most central banks and fiscal authorities—must admit to having been mistaken.

Regardless of whether the recession is mild or severe, history suggests that the equity market has much more room to fall before it bottoms out.

The second question is whether the increase in inflation was driven more by excessive aggregate demand (loose monetary, credit, and fiscal policies) or by stagflationary negative aggregate supply shocks (including the initial COVID-19 lockdowns, supply-chain bottlenecks, a reduced labor supply, the impact of Russia’s war in Ukraine on commodity prices, and China’s “zero-COVID” policy).

While both demand and supply factors were in the mix, it is now widely recognized that supply factors have played an increasingly decisive role. This matters because supply-driven inflation is stagflationary and thus raises the risk of a hard landing (increased unemployment and potentially a recession) when monetary policy is tightened.

Hard or soft landing?