Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Brutal my friend.

From $12.50 less than 2 months ago to $4.50.

Unreal. Horrible. Wes is so incompetent it is really sad.

Been transferring some profits to Tilray…Apld will recover-well..too

Back to $4 this week or rebound to $6?

Wes seems shady. I don’t trust him at all.

I just don’t see them finalizing this lease anytime soon.

Hyperscalers now in the driving seat. They can wait and get a much better deal.

APLD might be in trouble.

JMO.

Brutal week for this scam stock.

No lease. No financing, no updates.

I really they have something real because the stock price is getting decimated daily.

Good luck here. That 1 yard line Wes talked about last year is more like 1 galaxy away.

Data centers are out of favor for whatever reason.

Wow.

Wow. Worse than I thought.

Now it might move to under $6.

Most people think Wes is a scammer and drunk.

Whom am I to argue.

What a cluster F this stock has become.

Long term RKLB for me.

Just like that… $8 then dump down to low $7’s.

Here comes $6’s again.

Without news or updates this stock just sucks.

Wes horrible CEO. He is in way over his head here.

Goodbye. I’m gone.

I like RKLB long term. No manipulation there like APLD.

Huge dump today on some Chinese guy talking about DC.

I just don’t trust what these Chinese people are saying.

However, most DC stocks are down big today.

Just another reason for shorts and others to dump this stock.

Wes are you going to announce the tenant during earnings call?

Do you have a signed lease?

Give us a bone here. Any positive news and the stock could run back to $8.

Tick toc.

Nice dump EOD.

Huge short interest.

Lots selling. No news. No updates.

No buying power.

Truly crap stock IMO.

Any more weakness in market next week then this stock will move back to $6.50 or lower.

Wes seems so incompetent.

Stock can never hold its gains.

Unless you are a day trader, this stock really sucks.

Management has dropped the ball here.

I think it closes under $7.00.

Drops from $7.29 to $7.10 in 15 minutes.

Shorts are making a killing here.

Huge resistance at $7.50.

Stock swings $0.40 everyday.

Traders dream stock.

No news = manipulated stock.

Every morning always down.

Needs to break $7.50 and preferably $7.80 to show some reversal.

However, looks like Wes will never get lease signed.

Stock will be stagnant for quite awhile.

So much potential but management seems incompetent.

JMO.

APLD has tour today with Governor Armstrong.

Maybe we finally get an update today.

https://www.governor.nd.gov/events/armstrong-visit-ellendale-tour-and-updates-applied-digital-data-center-housing-project

Interesting news today. What does it mean for APLD?

https://www.streetinsider.com/Corporate+News/BlackRock+%28BLK%29%2C+Global+Infrastructure+Partners%2C+Microsoft%2C+and+MGX+Welcome+NVIDIA+and+xAI+to+the+AI+Infrastructure+Partnership+to+Drive+Investment+in+Data+Centers+and+Enabling+Infrastructure/24519950.html

Holding my July calls waiting for Wes to sign the lease.

Once a lease is signed, then it’s easy sailing from there.

The toughest hit in baseball is that first hit.

I would have sent Wes down to the minors by now because he is 0 for 10.

I feel like news is coming soon. Just hope it’s something big.

Come on Wes release some news or update. This is the week to do it.

We need some juice to get us back to that critical $8 level.

Crossing our fingers and hoping just ain’t going to cut it anymore.

We need some significant news. It’s been quiet for way too long.

Let’s go!

Wow. APLD hit $7. Will it hold and close at $7 today?

It would take some serious buying to offset the typical selling in this stock.

I am hopeful but you never know on a Friday.

Ok. So not looking like back to $6. I will admit I was wrong.

Let’s see if this has the buying power to get back to $7.

Just need the Q’s and SPY to cooperate today.

An update here would be nice.

Looks like it wants under $6 today. How low will they drop this before it recovers?

Looks really weak. No one expecting that lease to be signed anytime soon.

Wes seems really incompetent.

JMO.

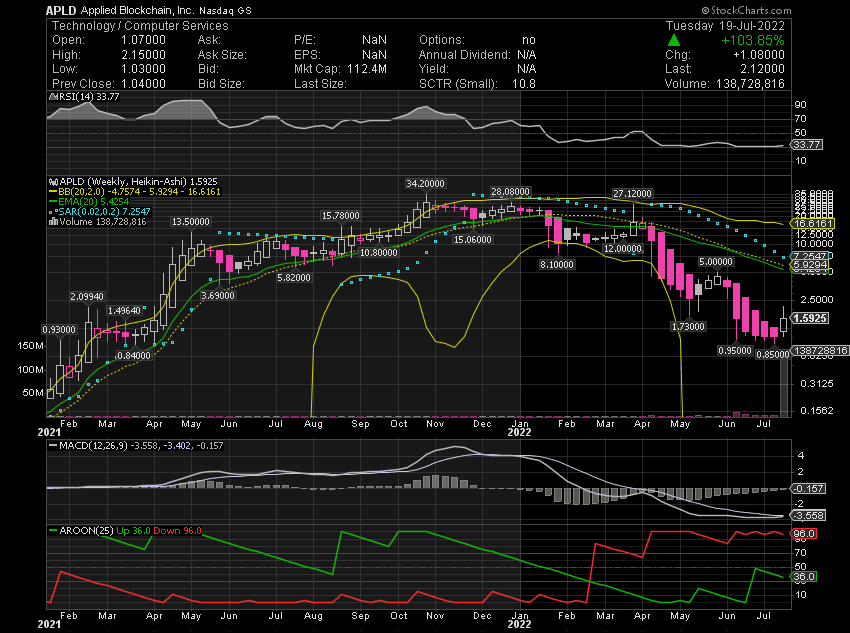

Chart… trend is still negative.

Will need to move to $9 to reverse trend.

Ain’t going to happen.

Way more likely back to $5 than $9.

Moving back down right now. Might even close red again. Gap at $6.47.

Something is wrong here. Wes has no clue how to get this lease final.

JMO,

Will let the truth guide the full story

Most tech stocks are rocking today.

APLD huge resistance in $6.70’s. Lots of selling.

Lack of news. Lack of credibility. Too risky for most.

Sign the lease. Finalize the financing and stock moves back to $10.

Otherwise just smoke and mirrors.

I was the first to call yall out..yall got nowhere to hide but keep utilizing this as the preferred platform for yalls securities fraud.

Fake narrative to support the false-narrative analysts…everyone sees it.

Not bragging about complete collapse of stock market in less than 3 weeks.

Stocks will recover but APLD will lag in that recovery without substantial news.

Investors will not want to risk capital here without some news about financing and lease.

lol..I’m surprised you’re-not bragging about $5.98 for-a minute yesterday, up over 20% since September..come capital gains time..how much higher?

Talking about OTC market.

APLD might be moving to the OTC sometime this year.

Looks like they cannot get a lease signed.

If they ever do get one signed, the deal likely will not be great for APLD.

Back to $5’s and likely lower.

OtcMarkets the-only-alternative to-giving controlling-stake to-VC’s in growth-stage…legit CEO’s own controling-stake to deter hostile takeovers…legit companies are exiting OTC by buyout/uplisting. You are intentionally malinforming the public and officially have implicated yourself, good job.

Red to green today?

Is there any hope left here?

Any updates or news?

Hello?

Hahaha. OTC market is nothing but scam stocks and horrible promoters. Lots of toxic notes and just non stop dilution.

Good luck in OTC dump land. It will never ever recover. People who invest in OTC market are destined to become broke.

I’m invested in myself so I offer my time.

Frank gets paid..so he chooses how he manages his-time.

This is-the preferred-platform for OTC-trader-group-fraud..holding this truth to-be self-evident.

OTC Markets is legit..however..OTC-trader-group-fraud has infested the OTC.

For legit money..OTC investment is for buyout/uplisting prospects…will see who’s scamming who and why you choose this platform for yours over others.

This coming from someone who is invested in the biggest OTC scam TPTW. Hahahahaha.

How’s Frank doing? That POS scamming loser.

Please, give me your worldly advice here.

LMFAO.

You don’t know how to invest..keep getting paid other-ways.

Did I really sell my call options just prior to this breakout with news expected imminently? Oh boy.

Good riddance. This stock has no power to move higher.

What’s going on with MAM financing?

Hyperscaler?

Wes???? Any updates?

Someone?

You’re outta commission, you’ve got nothing doing here.

Ok Wes. Did you get that financing finalized? Where’s the news?

Do you have a hyperscaler?

Enough with the silence. Give us some frikkin updates.

Maybe today is capitulation for the stock.

That is your only hope.

Buying calls again my friend.

Looking for sharp reversal.

That’s why everyone’s holding/institutions buying..new all time highs just-as-quick.

Down $7 from 1 week ago.

Ouch.

Still well in-the green from last September’s $5 shares.

Worst trading AI stock.

Company has concerns.

Looks like they couldn’t close that financing with MAM.

Lack news or updates are telling negative future.

Stock dumping hard yet again.

Answer = NOPE.

All holding $5/share aren’t-selling anytime under $15/holding majority-for $30+

These investors(myself included) expecting $100-$200/share within 2years

$4B nearterm revenue expected(currently under 300m-OS)..Capital gains coming

|

Followers

|

74

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

2707

|

|

Created

|

05/19/14

|

Type

|

Free

|

| Moderators | |||

| Volume: | 33,316,120 |

| Day Range: | 4.5801 - 5.5253 |

| Last Trade Time: | 7:59:41 PM EDT |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |