Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Here we go again: Deja VU.

What is next? the begging extension

then what is next? the Reverse Split,

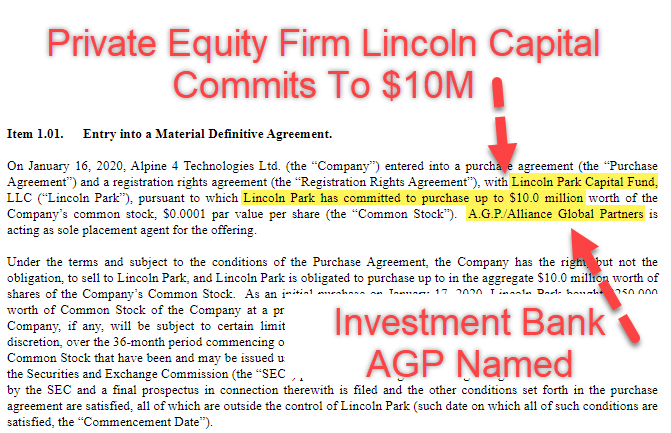

then what is next? Wilson screaming " IT IS NOT MY FAULT "

INSANE and DISRESPECTFUL

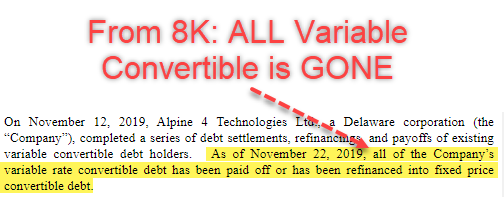

8K out

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On December 27, 2023, Alpine 4 Holdings, Inc., a Delaware corporation (the “Company”), received a notice (the “December Notice”) from The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that, for the preceding 30 consecutive business days, the closing bid price for the Company's Class A Common Stock (the "Common Stock") was below the minimum $1.00 per share requirement for continued inclusion on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”).

The Notice has no immediate impact on the listing of the Company’s Common Stock, which will continue to be listed and traded on The Nasdaq Capital Market under the symbol “ALPP,” subject to the Company’s compliance with the other continued listing requirements of The Nasdaq Capital Market.

In accordance with Nasdaq rules, the Company has been provided an initial period of 180 calendar days, or until June 24, 2024 (the “Compliance Date”), to regain compliance with the Bid Price Requirement. If, at any time before the Compliance Date, the closing bid price for the Company’s Common Stock is at least $1.00 for a minimum of 10 consecutive business days, the Staff will provide the Company written confirmation of compliance with the Bid Price Requirement and will then consider the matter closed.

If the Company does not regain compliance with the Bid Price Requirement by the Compliance Date, the Company may be eligible for an additional 180 calendar day compliance period, provided that, on such date, the Company meets the continued listing requirement for market value of publicly held shares and all other applicable initial listing requirements for the Nasdaq Capital Market (other than the minimum closing bid price requirement) and the Company provides written notice to Nasdaq of its intention to and plans for curing the deficiency during the second compliance period.

The Company will monitor the closing bid price of its Common Stock through June 24, 2024, and intends to take all reasonable measures available to regain compliance with the Bid Price Requirement under the Nasdaq Listing Rules and to maintain the listing of its Common Stock on the Nasdaq Capital Market.

Item 7.01 Regulation FD Disclosure

A press release, dated January 3, 2024, disclosing the Company’s receipt of the Notice referenced above is attached hereto as Exhibit 99.1.

The information furnished in this Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1 attached hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

My sympathies to you and your family, Anvil

So sorry for your loss Z-Rock. I know this may sound cliche but time does heal all wounds. Staying busy seems to work for me when bad things happen. Stay well and God Bless you and your family.

HYPOCRISY Again, get to your point and name me.

Don't you get it? I am NOT afraid and I was so damn right about Alpine. Anyone with even half brain could see it coming.

I STARTED to EXPOSE that SHITTY ALPINE SCAM 18 months ago, and HOPEFULLY many people saved money by NOT investing in some form of DEMENTIA that Wilson seems to be infected. NOTHING makes any sense with this company. NOTHING.

BIG Shame to use Zrock tragedy to get a cheap shot on me.

Very sorry for you and family. Nothing is as important as concern for your children. Almost missed your post trying to brush past all the grousing and venting (rolling eyes) of a particular contributor.

Very sorry for your loss. My wife and I lost our oldest son 4 years ago today...1/3/2020.

Ohh man sorry for your loss . My condolences.

So sorry to hear that Z. My condolences.

good morning pick'em and all. I certainly hope so!

2023 was a horrific year for me. I lost my youngest son on December 21st..

7.5 cents pre split. COMPLETELY INSANE.

Is the IDIOT CEO REALLY understand how BADLY HE SCREWED UP this company, this stock, the shareholders, the employees?

A COMPLETE MORON.

Impossible NOT to be upset by the current situation of this company.

How is it possible for a CEO to be so F bad, REALLY BAD?

STUPID is the only answer I have, not only for the decisions made, but for the full team, the board of directors.

WHY???????????????

NOT tired, YET, to support that SCAM.????

Look around. the manure is well above the knees, it is around the neck.

Alpine was, is , and will be always a team of IDIOTS.

Yes sir lookin forward to it!

Better Outcome??? REALLY, with the same IDIOTS.

Back to OTC, with a bankruptcy on their rear.

Alpine is OVER.

Happy New Years Pick!! A toast to a new year and better out comes!!! Let’s rock 2024!!

$$$$$$ALPP$$$$$$

Happy new year! looking forward to a better year !

Why is it any different than you posting

I don’t comment much, but this squarely on Wilson. He F up big time.

where the pumpers like Danno at??? lol

Real mess easy avoidable if the CEO had even only half brain functioning.

Complete idiots running that company, but so good at making LIES and diluting shareholders value.

Wilson should not be surprised at all. He created the mess.

If at least we could see a solid plan for the future.

Complete fiasco. Waiting MINUS 99% to admit it. POOR Wilson.

It sounds like Alpine is a real mess and it’s going to take time to fix. Meanwhile we will see the results of the current garage sale, Morris et al.

How dare you to even post a single word?

Similar to the " adding " posts.

The hypocrisy is WELL beyond control.

Really sound like a college student flunking his finals.

Alpine is at least a 2 years failure in the making.

STOP being STUPID should be the first step to tackle next year.

Happy New Year, LOSERS.

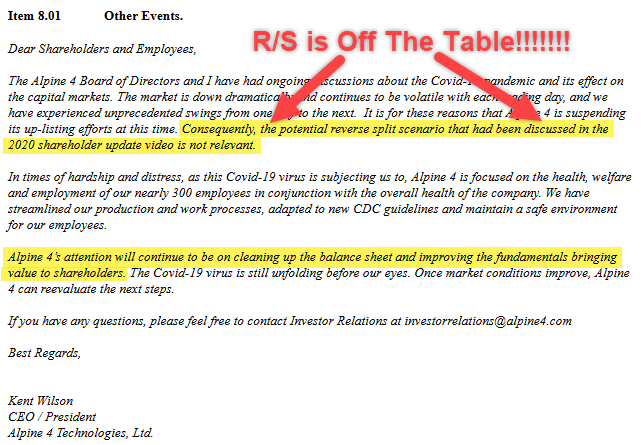

Letter to Shareholders

On December 29, 2023, Kent Wilson, the Chief Executive Officer of Alpine 4 Holdings, Inc., a Delaware corporation ("Corporate"), issued a letter to shareholders and the public. The text of the letter follows.

Dear Valued Shareholders,

This year has posed formidable challenges. Our performance has fallen well short of expectations for Corporate, our Subsidiaries, and for our Shareholders. A shortcoming that has distanced us from our full potential. To be candid, the Company grapples with unparalleled challenges, and it is imperative to acknowledge the intricate and obstacle-laden path ahead. Some of the challenges we face are the result of internal decision-making, most notably financial restatements and an auditor switch that resulted in delayed filings. Despite our aspirations, this change, intended to propel Alpine 4 to greater heights, has had the opposite effect. In Q2 2023, when we filed our 10-Q ahead of schedule, it appeared that our "new era" was moving into full swing. That came to a grinding halt as the Q3 2023 10-Q went late. It's important to note that when the Company is in an untimely filing status, it hinders the Company's ability to raise money. It also prohibits the Company from putting human capital resources into areas of the business that desperately need attention and various other causational issues that disrupt business operations. The Board, Audit Committee, our CFO, and I are extremely concerned with the delinquency of these filings, and we are addressing all external and internal aspects that have contributed to this.

Additionally, there are concerning external factors rising all around us. Significant shifts in capital markets, tighter banking restrictions, rising interest rates, and record bankruptcies impact not only us but our customers as well. That said, despite these challenges, there are many positive opportunities still ahead of us, and as we move past the challenges outlined above, the Company will again be able to progress towards seizing these opportunities.

Workforce and Compensation:

In Q2 2023, the Company mandated a comprehensive effort to limit raises and/or bonuses to Corporate or Subsidiary executives unless that specific job was below the market rate. Further, in Q3 & Q4 2023, the Alpine 4 executive team and myself took additional compensation cuts. We are also optimizing subsidiary management and directing resources toward personnel capable of driving sales. Moreover, the recruitment of new, more seasoned accounting staff aims to end the cycle of delayed financial reporting. The Company and its subsidiaries have and will continue to explore ways to cut fixed expenses and restructure debts favorably and shall continue to do so well into 2024.

Financial Initiatives:

In August, we initiated an S-1 filing to secure additional capital, culminating in a disclosed $32 million three-year equity line of credit deal with Ionic Ventures. This transaction facilitates continued investment in subsidiaries with high potential and offers flexibility in utilizing equity. It's important to note that investments in important and growing products such as drones, batteries, and other emerging products will be dependent on our ability to access fresh capital, hence why this transaction is important.

Realignment of Subsidiaries:

Over the next year, our capital-raising efforts will be coupled with targeted cost reductions. This includes the sale or winding down of subsidiaries that do not align with our future strategic goals and mission of the Company. With that said, I am pleased to announce the execution of a binding Letter of Intent to sell the Morris Sheet Metal group of companies in an asset purchase sale to Bright Sheet Metal of Indianapolis, Indiana. I am grateful to see the employees of MSM and the legacy of that Company continue. Simultaneously, we have initiated a strategic review of Excel Construction Services of Twin Falls, Idaho, which may include the closing of the subsidiary. Finally, the Company has received interest from external parties for its Alternative Laboratories subsidiary and is currently in ongoing discussions with these external parties.

Strategic Direction:

It has become apparent that our shareholder base is predominantly comprised of investors interested in our technologies, and for this reason, our resources and efforts will now be more focused on our Driver and Technology-based subsidiaries.

Vayu: Since the departure of Vayu's former President, the Company has undergone strategic reassessment. Our COO, Jeff Hail, and I have embedded ourselves in the business of Vayu and its team. After a careful review of our resources and inventory previously dedicated to fulfilling the All-American Contracting Supply Agreement, we feel that the best path forward for the current built inventory is to make these airframes available for additional opportunities, whether it be sales or supplying test airframes to Global Autonomous Corporation. To date, Alpine has not received any funds towards our Supply Agreement with All American Contracting, and they have indicated that they will not be able to continue with the $5 million P.O. as their end customer has not been able to procure the funds needed to purchase these drones. However, the Supply Agreement with All American Contracting is still in effect, and when they are ready, we are open to helping fulfill their needs.

In May coupled with our trip to Dubai, UAE, I initiated a strategic effort within Vayu to actively pursue new opportunities in geographic areas conducive to Beyond Visual Line of Sight (BVLOS) flights. Our focus has been on exploring prospects in the Persian Gulf region, with a particular emphasis on Dubai. Over the past 60 days, a significant milestone has been achieved for both Vayu and Global Autonomous conducting the VTC (Validation Test Campaign) flight testing in November. This testing was conducted as the first phase of certifying the G1 Airframe for BVLOS flying in Dubai and neighboring regions.

The completion of this VTC flight testing represents a crucial step forward, and we anticipate that the certification obtained will unlock opportunities with various clients in the Gulf region and beyond. We are confident that this achievement positions us favorably in the global market. Currently, our team is awaiting the results of the Dubai Civil Aviation Authority's thorough review of our flight testing.

We understand that many shareholders have eagerly inquired about the status of this certification process. It is important to note that such reviews can be a time-consuming endeavor, often taking several weeks or longer to complete. Rest assured that once the Dubai Civil Aviation Authority concludes its assessment, we will promptly communicate the results to our shareholders.

Elecjet: Elecjet extends its best wishes to Sam Gong as he departs from our Company. Since its inception, Elecjet has maintained a small US-based staff to ensure operational efficiency and concentrate on continuous product development. Presently, Elecjet is actively engaged in recruiting new battery engineers for our upcoming facility in San Jose, California. Our small-volume prototype line and laboratory will be housed within the new QCA (Quality Circuit Assembly) facility, with the move currently underway. The procurement of laboratory equipment will follow as financial circumstances permit.

Elecjet is currently collaborating with various Original Equipment Manufacturers (OEMs) in the Energy Storage Systems (ESS), Electric Vehicle (EV), and other diverse industries. While shareholders eagerly await updates on these partnerships, it is essential to acknowledge that it will take some time before the full functionality of the AX class of solid-state cells within their specific products is fully realized. This includes integration with battery management systems (BMS) and the utilization of our specific pouch cell design.

Beyond our Material Transfer Agreements (MTAs), Elecjet continues to provide quotes for AX Class cells to end users in sectors such as the Micro Power Grid and Marine industries. We are enthusiastic about sharing more details about the outcomes of these opportunities in 2024 as they progress and develop.

We have received numerous inquiries regarding the restocking of the Apollo ESS system. The Company successfully sold out its Apollo inventory in 2023 and is currently evaluating the manufacturing of additional units for sale. It's crucial to recognize that the Apollo was originally designed as a demonstrator product showcasing Elecjet's graphene technology for potential integration into other products. While it is indeed an outstanding product, the Company is actively exploring more cost-effective approaches to further production as resources permit.

As for the Powertote and other related products in collaboration with RCA, we have been working with our contract manufacturer responsible for assembling these products. We are diligently addressing new enhancements and requirements needed to have a competitive product and are working closely with our manufacturer to implement these changes, ensuring that the product meets market-ready standards. We appreciate your patience and understanding as we work towards delivering high-quality and reliable products to our valued customers.

RCA Commercial: RCA Commercial will be actively participating in the upcoming Consumer Electronics Show (CES) scheduled to take place in Las Vegas in January 2024. CES is renowned as a premier global event that showcases the latest innovations and technological advancements in the consumer electronics industry. It provides an excellent platform for industry leaders, innovators, and enthusiasts to come together, exchange ideas, and explore emerging trends.

It is important to show our customers the significance of staying at the forefront of technological developments. Our attendance at CES aligns with our commitment towards innovation and excellence. We are eager to leverage this opportunity to showcase our latest products, engage with industry professionals, and to foster meaningful connections with partners and stakeholders.

Our team will be available at the RCA booth during the event, and we cordially invite you to visit our booth and witness firsthand the cutting-edge technologies that RCA Commercial is bringing to the market.

As we conclude 2023 and approach 2024, we want to thank the shareholders who have stood by us through the highs and lows over the past two years. Anticipating the opportunities that the New Year holds, we eagerly welcome all the possibilities it brings and are excited to embrace the fresh prospects ahead.

Best regards,

Kent Wilson

CEO / President / Co-Founder

About Alpine 4 Holdings: Alpine 4 Holdings, Inc. is a Nasdaq traded Holding Company (trading symbol: ALPP) that acquires business, wholly, that fit under one of several portfolios: Aerospace, Defense Services, Technology, Manufacturing or Construction Services as either a Driver, Stabilizer or Facilitator from Alpine 4's disruptive DSF business model. Alpine 4 works to vertically integrate the various subsidiaries with one another even if from different industries. Alpine 4 understands the nature of how technology and innovation can accentuate a business, focusing on how the adaptation of new technologies, even in brick-and-mortar businesses, can drive innovation. Alpine 4 also believes that its holdings should benefit synergistically from each other, have the ability to collaborate across varying industries, spawn new ideas, and create fertile ground for competitive advantages.

Four principles at the core of our business are Synergy. Innovation. Drive. Excellence. At Alpine 4, we believe synergistic innovation drives excellence. By anchoring these words to our combined experience and capabilities, we can aggressively pursue opportunities within and across vertical markets. We deliver solutions that not only drive industry standards, but also increase value for our shareholders.

Contact: Investor Relations

investorrelations@alpine4.com

www.alpine4.com

Forward-Looking Statements

This Report and the exhibit(s) attached hereto, including the disclosures set forth herein, contains certain forward-looking statements that involve substantial risks and uncertainties. When used herein, the terms “intends,” “anticipates,” “expects,” “estimates,” “believes” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements.

Forward-looking statements in this Report or hereafter, including in other publicly available documents filed with the Commission, reports to the stockholders of the Company and other publicly available statements issued or released by the Company involve known and unknown risks, uncertainties and other factors which could cause the Company’s actual results, performance (financial or operating) or achievements to differ from the future results, performance (financial or operating) or achievements expressed or implied by such forward-looking statements. Such future results are based upon management’s best estimates based upon current conditions and the most recent results of operations. These risks include, but are not limited to, the risks set forth herein and in such other documents filed with the Commission, each of which could adversely affect the Company’s business and the accuracy of the forward-looking statements contained herein. The Company’s actual results, performance or achievements may differ materially from those expressed or implied by such forward-looking statements. The Company expressly disclaims any obligation or intention to update these forward-looking statements contained in this Report.

The Alpine / Wilson story is quite amazing.

Many, many people lost a lot of money, and they have the right to ask WHY all this collapse.

WHY, indeed?

SCAM or STUPID???

Crazy time, crazy people all around.

Tic tic tic tic tic Bankruptcy

50 cents after hours.

Quite a New Year SHITTY party coming up for Wilson.

Nice End of the Year 8-k by Wilson.

WOW.

Filed today

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

_____________________________________________

TO OUR STOCKHOLDERS:

The purpose of this information statement (the “Information Statement”) is to inform you that, on December 20, 2023 (the “Voting Record Date”), holders of the voting capital, including any shares for which such holders have been designated by another stockholder of Alpine 4 Holdings, Inc., a Delaware corporation (the “Company,” “us,” “we,” or “our”) as such stockholder’s proxy and attorney-in-fact, representing in the aggregate approximately 72.41% of the outstanding voting power of the Company on the Voting Record Date (the “Written Consent Stockholders”), approved the following corporate actions by written consent in lieu of a special meeting of stockholders:

–For purposes of Nasdaq Rule 5635(d), the potential issuance of shares of Class A common stock to Ionic Ventures, LLC (“Ionic Ventures”), pursuant to the Purchase Agreement, dated as of November 17, 2023, (the “Ionic Ventures Purchase Agreement”), between the Company and Ionic Ventures; and the issuance and potential issuance of shares of Class A common stock to Mast Hill Fund, L.P. (“Mast Hill”) pursuant to a securities purchase agreement with Mast Hill dated as of June 29, 2023 (the “Mast Hill SPA”), pursuant to which the Company issued and sold to Mast Hill a senior convertible promissory note in the aggregate principal amount of $1,670,000 dated as of June 29, 2023 (the “Senior Note”), convertible into shares (the “Conversion Shares”) of the Company’s Class A common stock, as well as the issuance issue to Mast Hill of (i) shares of our Class A common stock underlying a common stock purchase warrant (the “Mast Hill Warrant”) to purchase 200,000 shares of Common Stock dated as of June 29, 2023 (the “MH Warrant Shares”), (ii) 67,400 shares of Common Stock (the “MH First Commitment Shares”), and 1,200,000 shares of Common Stock (the “MH Second Commitment Shares”), collectively representing more than 19.99% of the Company’s outstanding Class A common stock on the date the Company entered into the Ionic Ventures Purchase Agreement (the “Written Consent Approval”).

The foregoing Written Consent Approval is required because under the terms of the Ionic Ventures Purchase Agreement as well as Mast Hill SPA, Senior Note, and Mast Hill Warrant, we may have to issue more than 19.99% of the Company's outstanding Class A common stock as of the date the Company entered into the Ionic Ventures Purchase Agreement.

Under Nasdaq Rule 5635(d), we cannot issue shares of Class A common stock (or securities convertible into or exercisable for Class A common stock) in transactions other than public offerings without stockholder approval if the aggregate number of shares issued would be equal to or greater than 20% of the Company’s outstanding voting power before the applicable issuance and the price per share of Class A common stock issued is less than the lower if (i): the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the applicable binding agreement and (ii) the average Nasdaq Official Closing Price of the Class A common stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of the applicable binding agreement (the “Minimum Price”).

As a result of the Written Consent Approval, on the date which is 20 calendar days after this Information Statement is first distributed and made available to stockholders, we will comply with Nasdaq Rule 5635(d), as the Written Consent Approvals constitute stockholder approval for the Company to issue shares of Class A common stock pursuant to the Ionic Ventures Purchase Agreement in an amount more than 19.99% of the outstanding voting power on the date of the Ionic Ventures Purchase Agreement even if the price per share of Class A common stock issued in connection with any particular issuance is less than the applicable Minimum Price for such transaction.

Accordingly, we are not soliciting proxies for the action by written consent by the Written Consent Stockholders, but are providing this Information Statement to our stockholders in accordance with Rule 14c-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

You will find important information about the Written Consent Approvals in the accompanying Notice of Action by Written Consent and Information Statement.

This Information Statement is first being distributed and made available to stockholders of record as of December ___, 2023, on or about December ___, 2023. Pursuant to Rule 14c-2 under the Exchange Act, the written consent of the Written Consent Stockholders will not become effective until at least 20 calendar days after this Information Statement is first distributed and made available to stockholders.

Very truly yours,

/s/ Kent B. Wilson

MINUS 85% from X- mas 2022 to 2023.

What a SCAM.

Here fishy fishy!!

https://ih.advfn.com/stock-market/NASDAQ/alpine-4-ALPP/trades

Merry Christmas to all and to all a prosperous 2024!!

$$$$$$ALPP$$$$$$$

Still needs to get under 5 cents pre-split to complete the 100% retracement of the fraud-driven move. So about another 50% haircut from here. Once all the fraud has been squeezed out, lets take a look and see what is left. Probably nothing.

75 cents after split, 9.4 cents before split.

WOW, what a successful year for Wilson, and for the 3 Amigos.

Curious: What will be considered that Alpine Crap to be a FAILURE for you guys?

OTC, Pinks, subpenny???

# 28th trading days subdollar. No worries.

We have tick - tock and a great team of demented people running that company.

it is almost OVER. TOO MANY LIES.

Shorts are skittish imo🤔 - Dare I say we end green!!

https://fintel.io/ss/us/alpp

Shorts just returned 300K - Should be interesting this afternoon, finish green?

https://fintel.io/ss/us/alpp

Manipulated Exhaustion

https://ih.advfn.com/stock-market/NASDAQ/alpine-4-ALPP/trades

Twas the week before Christmas as he stepped to the easel,

No Q this year, said Kent the weasel.

"Its not our fault! I must contest!

"it was the accts and controllers that started the unrest".

"The stock price is down and i just dont get it"

"It must be the bots, MM's and those damned guys on Reddit"

"its not our fautl!" his arms raised like a ref.

"This whole NASDAQ thing, i just dont give an "F"

"But there is hope in drone delivery in Dubai"

"One last thing and i really dont lie"

"They really believe me" he says with a chuckle.

"So button your jackets and tighten your buckle.

"There will be a new company and we will call it GAC"

"New shares to all! Who have not turned their Back!"

Already 25 trading days closing under 1 buck.

Today might be # 26, and still NO Q.

Delisting is very well on the table and bankruptcy as ice on the cake, or SHIT pie.

That CEO has some serious issues. SO DISRESPECTFUL.

What a SCAM that Alpine CRAP Holding.

Hello Wilson, where is the Q?

Anybody home?

BTW, where are the drones, the batteries, and where is all the money stolen from shareholders?

And WHERE IS THE RESPECT?

100% correct. The fraud and stupidity that keeps bubbling up from those clowns astounds me.

And your point is what??????

Why using your time and brain for that free personal attack?

So easy behind a key board to look like a strong person.

Lol, amazing what lives under mulch and toadstools

Ever get tired of being a loser?

Alpine is no doubt the best 2023 failure of the year.

Blind CEO not able to see all the middle fingers.

Deaf CEO not able to hear the voices screaming STUPID.

People do not care about the BULLSHIT DSF model.

Any idea if your boss plan to be LEGIT before the end of the year.

Any idea if he is even still in the country?

Wonder if he has any idea how STUPID Alpine became in 2023 with all the BULLSHIT that was getting of his mouth.

IDIOT, absolute stubborn idiot.

Tic Toc, Tic Toc!!! 🤑🤑

$$$$$ALPP$$$$$

My guess is someone was trying rest the 30 days .

This thing moves fast on low volume once something happens for the good and big volume comes in this thing is gonna fly !!!

All we need is patience !!

Hmmm, ALPP popped up to .93 AH. SMH

|

Followers

|

451

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

73091

|

|

Created

|

12/21/16

|

Type

|

Free

|

| Moderators | |||

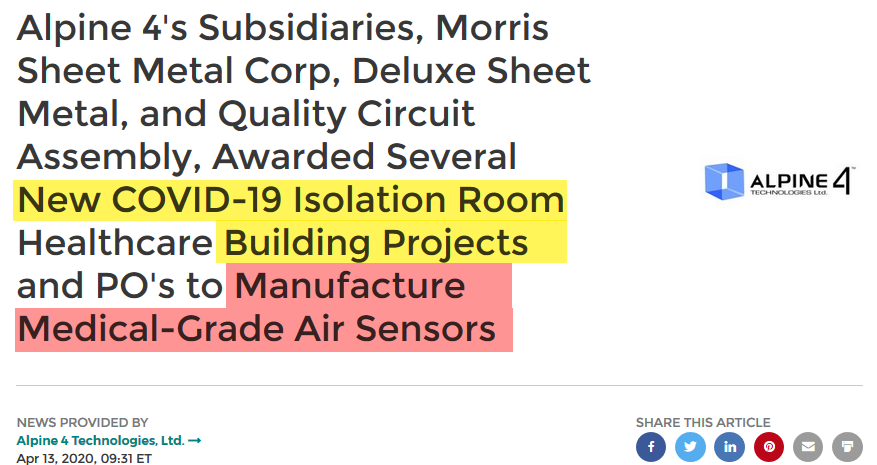

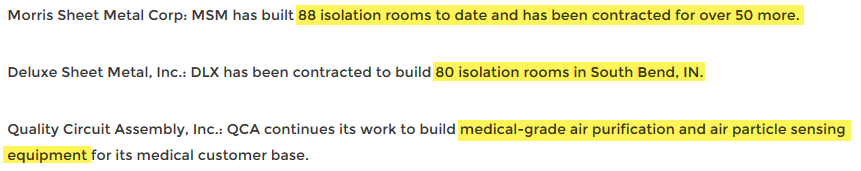

About Deluxe Sheet Metal: Deluxe is a company that has been in business for over 45 years, specializing in all aspects of Commercial and Industrial Sheet Metal installations. Servicing top research institutions like the University of Norte Dame and large companies like GE, Deluxe is the go-to company for complex thermal and HVAC design in their region.

Completed in 2004, Deluxe's facility is home to a 59,000-square-foot building purposefully tucked away into a hillside on South Bend's northwest side. Within their building is a 35,000 square foot fabrication shop filled with skilled Union craftsmen and some of the latest in modern equipment and advanced technologies giving Deluxe the abilities to meet some of the most arduous demands of today's complex construction projects. The facility is one of the most modern operations in the area.

Kent B. Wilson, CEO of Alpine 4, had this to say: "We're excited about adding Deluxe to the Alpine 4 family. The addition of Deluxe will have an immediate impact on Q4 revenue. Deluxe is expected to play a significant role as a Stabilizer in the Alpine 4 umbrella of companies. Also, the Deluxe transaction has some very compelling strategic and financial benefits:

- First, even though our subsidiaries are separate functioning entities, they can share in the benefits of being a part of the Alpine 4 family. The combined ownership of Deluxe and Morris Sheet Metal expands our geographic reach and overall scale as a company. The addition of Deluxe's service footprint in key geographies of; Northwest Indiana, Chicago, IL and Southwest Michigan combined with MORRIS's presence in Fort Wayne, IN and its geographical footprint Ohio, enhances Alpine 4's existing offering platform and market density. This acquisition will better insulate both MORRIS and DELUXE against hostile competition and allow both companies to thrive even more with a bundling of their competitive advantages.

- Second, this Enhances their combined Customer Base and Product Offerings. Deluxe has a unique and well-defined customer base including the University of Norte Dame, and is considered a leader in the development of high-tech construction services. The combined portfolio of proprietary brands broadens Alpine 4's offering.

- Last, Significant Synergistic Opportunities are realized. Alpine 4 expects to achieve approximately $1.4 million in annual run-rate cost synergies. Cost synergies have been identified primarily in the procurement of materials (especially with spiral ductwork), operations and logistics."

Click Here for YouTube Video by CEO Kent Wilson on Deluxe Acquisition

Current ALPP Customers & Partners List:

- AMAZON

- APPLE

- BERTOLLI PASTA

- HYUNDAI

- CHEVROLET

- CHRYSLER JEEP

- COOK NUCLEAR POWER PLANT

- ETHANOL PLANTS

- FACEBOOK

- IDAHO POWER

- KRAFT

- MAJOR AIRLINES

- MAJOR HOSPITALS

- MEDICAL DEVICE MANUFACTURERS

- NOTRE DAME UNIVERSITY

- MCCORMICK SPICES

- MOVIE THEATERS

- RESTAURANTS

- SARGENTO FOODS

- ST MARY’S COLLEGE

- CITY OF SOUTH BEND

- CITY OF MISHAWAKA

- COBALT ROBOTICS

- ALTER G ANTI GRAVITY

- LEBRON JAMES

Here is Lebron working out on Alter G Anti Gravity (Remember ALPP is in partnership with Alter G and makes all the "insides" of that machine)

- NATIONAL ELDER CARE FACILITIES

- LEADERS IN 3D PRINTING

- AND MANY MORE

ALPP is a TOP 1% REVENUE PRODUCING COMPANY ON THE OTC

ALPP is now a $50M EXISTING REVENUE company.

ALPP brings in more business than half of NASDAQ plays.

ALPP Corporate Office Images:

ALPP is a Full Reporting Company which is AUDITED by Malone Bailey (link to Malone Bailey website)

Malone Bailey is an audit firm REGISTERED with the Public Company Accounting Oversight Board (PCAOB). At this link to the PCAOB, you can see that Malone Bailey, LLP is listed as the ALPP auditor for the past 3 years.

ALPP is Transfer Agent Verified & Penny Stock Exempt as can be seen on the Company's profile with OTC markets here.

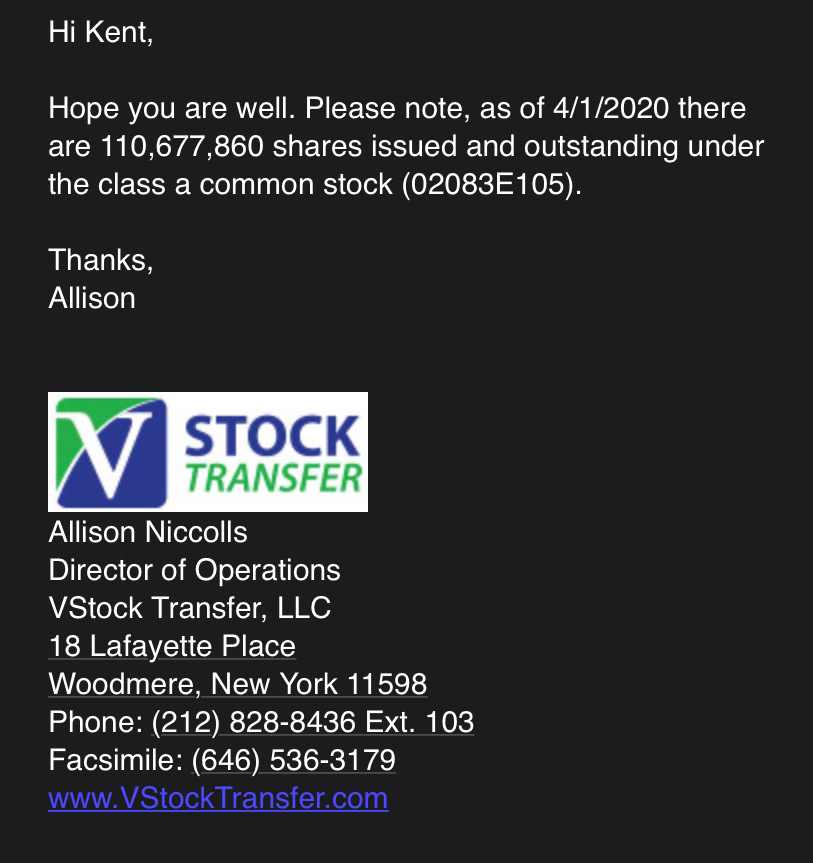

Transfer Agent Verified means that ALPPs outstanding share information is confirmed by the TA regularly. ALPP's Transfer Agent is V-Stock Transfer. You can contact the TA at (212) 828-8436 to verify this information.

Recent ALPP Dividend was APPROVED by FINRA. You can verify this information on the FINRA Daily List using the following search parameters:

- Issue: ALPP

- Start & End Date Range: 8/28/2019 (start) - Present date (end)

Company Headquarters & Contact Information:

2525 E. Arizona Biltmore Circle, Suite C237, Phoenix, AZ 85016

Google Map Search To Validate Address

UPDATED PHONE NUMBER --> (480)-702-2431 (The Company is very responsive to investor / prospective investor questions. If you reach out with any questions, you WILL get a response).investorrelations@alpine4.comwww.alpine4.com

2019 Shareholder Annual Meeting --> Saturday, November 23, 2019 from 1:00 - 3:00pm at ASU SkySong Innovation Center at 1475 N Scottsdale Rd, Scottsdale, AZ, 85257 (Contact: investorrelations@alpine4.com for any questions).

Q2 Shareholder's Letter From CEO Kent Wilson at SEC.gov https://www.sec.gov/Archives/edgar/data/1606698/000109690619000308/exh99.htm

Recent Video Overview of ALPP by CEO Kent Wilson: https://www.youtube.com/watch?v=YKYmQbcWEeo

UPDATED DUE DILIGENCE 9/22/2019 ----------------------------------------------------

Alpine 4 Subsidiary Information:

The Company has 5 Operating Subsidiaries & 150+ Employees. In addition, ALPP is developing a Blockchain Enabled Enterprise Business

Operating System called SpectrumEBOS. This system is intended to rival Oracle & SAP in the microcap to midcap space.

Below are links to the subsidiary websites, further subsidiary information and recent press releases.

- Quality Circuit Assembly: https://www.qcamfg.com/

- American Precision Fabricators: https://www.apfab.net/

- Morris Sheet Metal: https://www.morrissheetmetal.com/

- JTD Spiral: http://www.jtdspiral.com/

Altia is a automotive technology company with products in the Connected Car and Vehicle Safety markets. Altia’s 6th Sense Auto connected car solution is a combination of our unique, cutting-edge telematics hardware solution tethered to our robust and intuitive SAAS platform, giving our customers a meaningful and purposeful connected car experience. Altia’s BrakeActive product is a rear-end collision avoidance system. According to NHTSA Study, 90% of all rear-end Collisions could be avoided with just one more second of warning. It is with this motivation that we created BrakeActive and it’s our mission to help reduce accidents and protect families!

Founded in 1988, Quality Circuit Assembly, Inc. produces printed circuit board assembly services to original equipment manufacturers. QCA provides electronic contract manufacturing solutions for customers via strategic business partnerships. From the initial prototypes creation to turnkey low-volume production, QCA offers a wide range of services that truly make it a one-stop shop for companies and their specific requirements.

SPECTRUMebos is an Enterprise Business Operating System that combines key technology software components to help accomplish your organization’s objectives. Spectrum tethers each to management reporting & collaborative toolsets so that goal completion & progress is easy to follow. Security is not an issue because Spectrum imbeds itself into a robust BlockChain ledger system. Authenticity for all transactions will remain static.

Since 1996, American Precision Fabricators has been supplying American-built parts to businesses around the world. When it comes to restoring, rebuilding or restructuring, APF of Fort Smith, Arkansas does it all and strives to provide excellent customer service. In such a demanding industry, it is imperative that the correct parts show up on time, the first time and APF always delivers.

KENT WILSON CEO/PRESIDENT

Before being named CEO/President in June 2014, Mr. Wilson was the Chief Financial Officer of United Petroleum, Inc and was responsible for all of the company’s financial and reporting operations, including end-to-end management of company’s supply chain, and financial support systems. In prior years he also served as the Chief Executive Officer of Crystal Technologies, Ltd a technology company serving both the automotive industry and the insurance industry. Kent played a key and critical role in the development and deployment of a strategic web-based insurance platform for automobile dealerships.?

Mr. Wilson earned his MBA from Northcentral University and considers himself a “University of Arizona Wildcat”. He also spent 4 years studying at the University of Arizona before earning his undergraduate degree in Management from the University of Phoenix.?

Mr. Wilson also serves on the Board of Directors for Restoration Ministries dba Crossroads Youth a faith based organization dedicated to helping at risk children of the working poor in downtown Phoenix.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

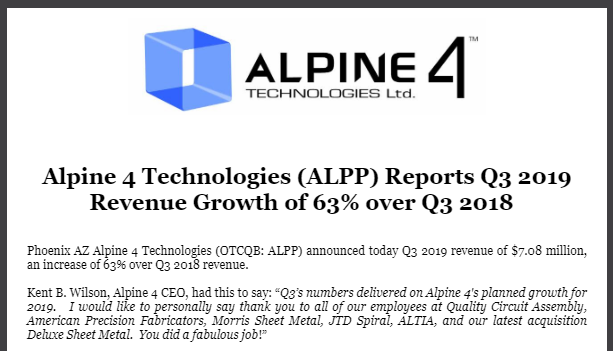

| Last Trade Time: |