Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Sounds interesting - Thanks

https://themarketonline.ca/voyageur-pharmaceuticals-is-going-global-why-its-time-to-buy-the-stock-2025-01-23/

https://ceo.ca/vm

PLAYED THAT MANY MOONS AGO...ONE OF MY MONSTER TIN PLAYS....REALLY LIKE VM.V...AN ABSOLUTE BEAUTY DAILY WEEKLY...MONTHLY////LOADED UP THIS MORNING!!

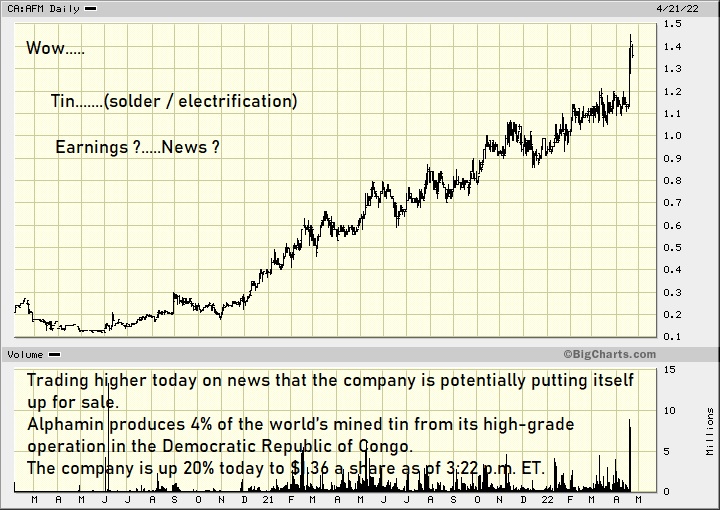

Holey !......Look at that.......What a . . . . yeesh

https://amp.cnn.com/cnn/2025/01/26/africa/congo-severs-ties-rwanda-rebels-goma-intl

Same Monday Nvidia did ITS' thang

Day #7 of Trump

.

The "competition".....

https://www.youtube.com/watch?v=aYAw26nSzBA

https://www.coreconsultantsgroup.com/alphamins-super-grades-overshoot-global-norms/

August 19th

Sept 30th

Thing's PROBABLY? quite a ":bargain" but.......its' chart is (quite ugly) like all others.

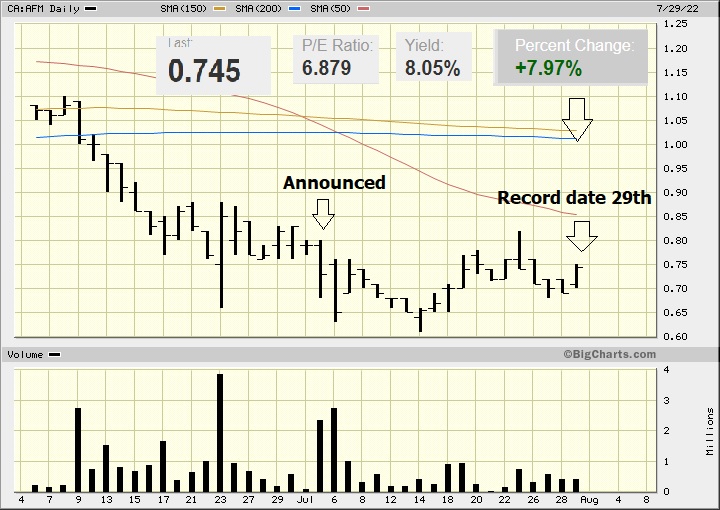

July 29th

.

Strategic Review Update - July 5 2022 https://alphaminresources.com/2022/07/05/alphamin-announces-record-quarterly-tin-production-q2-2022-ebitda-guidance-of-us66-5m-dividend-declared/

On 9 November 2021, the Company announced the initiation of a strategic review to explore alternatives such as fast-tracking the Company’s expansion and life-of-mine extension potential, balance sheet restructuring including revenue prepayments and streaming, shareholder distributions or a corporate merger or sale transaction.

The Company wishes to update shareholders and other market participants on this initiative:

Exploration drilling doubled from Q4 2021 to a quarterly average of over 12,000 metres and delivered an additional 124,700t contained tin in inferred Resource and 21,400t contained tin in indicated Resource at Mpama South. In addition, multiple high-grade tin intercepts were reported from drilling at depth at Mpama North.

Mine development of the adjacent Mpama South deposit commenced, which is expected to increase annual contained tin production from the current 12,000tpa to ~20,000tpa, approximating 6.6% of the world’s mined tin, effective FY2024.

Dividend distributions commenced in February 2022 (Final FY2021 dividend) and net cash increased from US$1m to US$138m during the 9 months ended June 2022. A strong balance sheet to support growth initiatives whilst achieving high dividend returns to shareholders is considered a robust value proposition.

The Company is of the opinion that global tin supply is likely to remain constrained for at least the next five years while demand for tin is expected to increase. In addition to the development of Mpama South, the Company’s vision is to discover more tin deposits on its license areas with a view to deliver additional mine developments and incrementally increase tin supply into an expected widening market deficit.

At this point in time, the Company believes that an outright sale transaction would not deliver the future value it intends to unlock through ongoing resource development and production growth.

x

x

x

x

JULY 26

Interim FY2022 Dividend Declared

On 5 July 2022, the Board resolved to declare an interim FY2022 cash dividend of CAD$0.03 per share on the common shares (approximately US$30m in the aggregate) (the “Dividend”). The Dividend will be payable on 5 August 2022 to shareholders of record as of the close of business on 29 July 2022.

Dividend distributions will be considered semi-annually based on excess free cash after taking account of capital funding requirements, including for the new Mpama South expansion project.

.

https://www.kitco.com/news/2022-04-19/Alphamin-jumps-on-news-of-potential-sale.html

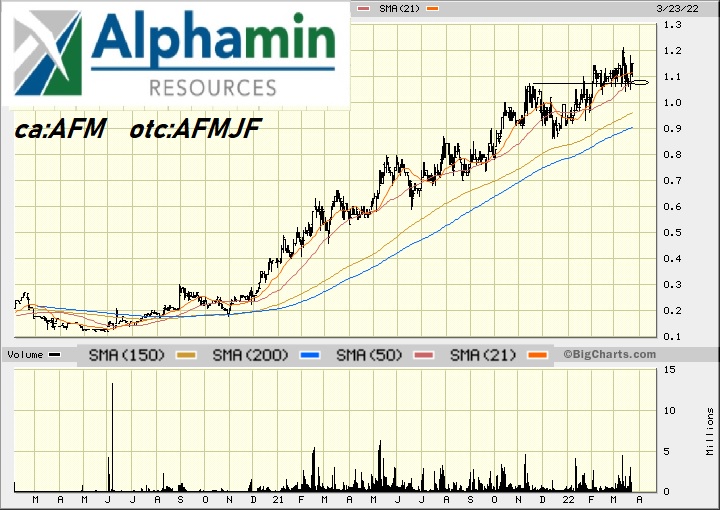

3+ weeks ago - Oval = intended bid.......(1.08 never would've gotten hit)

https://ceo.ca/afm

No mention of a sale proposal on their website however https://alphaminresources.com/

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Stock&symb=ca%3Aafm&x=0&y=0&time=100&startdate=2%2F4%2F2000&enddate=5%2F21%2F2022&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=2&style=320&size=3&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

With the electrification of everything, the demand for tin should remain strong.

The greater the tin concentration, the greater the solder’s tensile and shear strength.

https://en.wikipedia.org/wiki/Solder

The first tin alloy used on a large scale was bronze, made of 1/8 tin and 7/8 copper,

https://en.wikipedia.org/wiki/Tin

Tin is unique among mineral commodities because of the complex agreements between producer countries and consumer countries dating back to 1921. Earlier agreements tended to be somewhat informal and led to the "First International Tin Agreement" in 1956, the first of a series that effectively collapsed in 1985. Through these agreements, the International Tin Council (ITC) had a considerable effect on tin prices. ITC supported the price of tin during periods of low prices by buying tin for its buffer stockpile and was able to restrain the price during periods of high prices by selling from the stockpile. This was an anti-free-market approach, designed to assure a sufficient flow of tin to consumer countries and a profit for producer countries. However, the buffer stockpile was not sufficiently large, and during most of those 29 years tin prices rose, sometimes sharply, especially from 1973 through 1980 when rampant inflation plagued many world economies

In 2018, just under half of all tin produced was used in solder.

March 7th

DID my homework months ago.

Liked what I saw but waren't eager to chase it.

Must you be so snotty ?

should have did your homework on TIN, and how rare good TIN stocks are...long and strong!!

It's sure been an outstanding play (I must say) !

Wishing I'd gotten in months ago....

TIN blowing up...AFM.V ready to fly soon!!

TIN continues to climb...37800.00 and ready for 40,0000 a tonne

AFM...dolla land will be back as TIN soars above 37000 a tonne....omg 40 0000 a tonne is coming

AFM>V the monster TIN play continues to rage...dolla is here!!

AFM.V what a monster set up. A chartist wet dream.

TIN the most explosive metal in the market...TIN soaring to new highs at 36 000 a ton

This one goes no where but down. 90% drop from here.

TIN ready for 36,000.00 a ton....the trend is your friend!!

TIN is the only metal trending in the market....not even lithium, which is suppose to save the planet is trending!!!

TIN exploding...here comes 35,000.00 a ton!!!! The hottest meatal out there and no-one is talking about it

GFTX is real and AH will shine like the North Star soon. So much in the pipeline and fully reporting status is coming in September my beloved infidels.

One thing is for certain. GFTX will not end up like YOUR ATVK TrendTrade.

NO bid til recently with a scam CEO that you recommended aggressively.

Shut down by OTC Markets and a current bid of .002 down from .50c

TIN breaking 34,000.000 a ton....AFM is getting close to rumble in the jungle!!

TIN breaking 33,000.... the best metal play out there....watch what happens next here

watch what happens next

Hey aszh0l3. I C you still cant pick a winner and still have lost all of your followers. Good showing!! You will break the 600 barrier soon. Joke of a stock picker.

AFM.V we are about to bow up...huge TIN discovery news out!!!

Follow you..Just Saw Your Post on BB Board..Really?!..Holy>Shit!

TIN here comes 30, 000.00 ...epic TIN rally and short squeeze

TIN here comes 29 000 a ton and then we soar to 32 000 a ton!!

Why TIN is the next monster metal play////////

https://moneyweek.com/investments/commodities/industrial-metals/602903/the-next-big-bull-market-in-metals-look-no-further

AFM>V the next TIN monster has broke out of its cage....TIN prices blowing up!!!

sell company dumping

the metal TIN broke out to all time highs this week, trading at 30 000 a ton!!

AFM>V the next monster TIN play...TIN is the metal with the most demand in the world.

|

Followers

|

4

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

58

|

|

Created

|

03/13/21

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |