Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Alibaba $BABA is down more than 57% over the last 5 years! That hurts

By: Barchart | July 1, 2024

• Alibaba $BABA is down more than 57% over the last 5 years! That hurts.

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba Returns to the Scene of the Crime

By: Arthur Hill | June 8, 2024

• Big breakouts are bullish, but sometimes traders miss the breakout.

• A throwback is a decline back to the breakout zone, which turns support.

• Throwbacks offer traders a second chance to partake in breakouts.

Chinese stocks wet on a tear from mid April to mid May with the China Large-Cap ETF (FXI) gaining some 40% and breaking its 200-day SMA. FXI then fell back over the last few weeks. This surge and pullback created a potential opportunity because some stocks returned to their breakout zones. These so-called throwbacks offer traders a second chance to partake in the breakouts. Today's example will show Alibaba (BABA), which was featured on ChartTrader this past week.

The chart below shows Alibaba with the 200-day SMA (red line) and the Trend Composite in the indicator window. On the price chart, BABA found support twice in the 67-68 area and broke resistance with a surge in May. The two lows in this area formed a Double Bottom and the breakout reversed the downtrend. Also notice that BABA broke the 200-day SMA.

Traders who did not catch the breakout have a second chance because BABA returned to the breakout zone in early June. This is a classic "throwback" to broken resistance, which turns into support. The stock also returned to the 200-day SMA and the decline retraced around 61.8% of the prior surge. This retracement is normal for a pullback within a bigger uptrend. Overall, I see a Support-Reversal Zone in the upper 70s and I am watching short-term resistance at 80. A breakout here would reverse the short-term downswing and argue for a resumption of the bigger uptrend.

Read Full Story »»»

DiscoverGold

DiscoverGold

Correct, for a total of $1.66

I believe it will July 12

Thanks

Yes, Alibaba (BABA) has declared a one-time extraordinary cash dividend of $0.66/ADS as a distribution of proceeds from the disposition of certain financial investments. This special dividend was announced along with the annual dividend of $1.00/ADS, which is in line with previous dividends.

Will BABA do a SPECIAL DIVI in the 3 qt????

When is the DATE of the SHARE BUY BACK?

Did BABA Post it yet?

Bear Of The Day: Alibaba (BABA)

By: Zacks Investment Research | May 24, 2024

Alibaba (BABA) is a Zacks Rank #5 (Strong Sell) as earnings estimates have tracked lower after a recent earnings beat. The company s. This article will look at why this stock is a Zacks Rank #5 (Strong Sell) as it is the Bear of the Day.

Description

Alibaba Group Holding is one of the leading e-commerce giants in China. Over the last few years, the company has transformed itself from being a traditional e-commerce company to a conglomerate that has businesses ranging from logistics and food delivery to cloud computing.

Earnings History

When I look at a stock, the first thing I do is look to see if the company is beating the number. This tells me right away where the market’s expectations have been for the company and how management has communicated to the market. A stock that consistently beats has management communicating expectations to Wall Street that can be achieved. That is what you want to see.

In the case of Alibaba, I see three beats and one miss of the Zacks Consensus Estimate. The most recent quarter was a beat with the company posting $1.40 when $1.24 was expected. This alone does not make the stock a Zacks Rank #1 (Strong Buy) and it doesn’t make it a Zacks Rank #5 (Strong Sell) either.

The Zacks Rank does care about the earnings history, but it is much more heavily influenced by the movement of earnings estimates.

Earnings Estimates

The Zacks Rank tells us which stocks are seeing earnings estimates move higher or in this case lower. For BABA I see annual estimates moving lower of late.

The current year (2024) consensus number moved lower from $8.99 to $8.26 over the last 60 days.

The next year has moved from $10.10 to $9.17 over the last 60 days.

Negative movement in earnings estimates like that is why this stock is a Zacks Rank #5 (Strong Sell).

It should be noted that a lot of stocks in the Zacks universe are seeing negative earnings estimate revisions. That means that the stocks that are seeing small but negative earnings estimate revisions are falling to a Zacks Rank #5 (Strong Sell).

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba is heading for its best month since July 2023 following last week's earnings report

By: TrendSpider | May 19, 2024

• Alibaba is heading for its best month since July 2023 following last week's earnings report. $BABA

We aren't even back to IPO levels yet.

Early innings.

Read Full Story »»»

DiscoverGold

DiscoverGold

David Tepper's Appaloosa reported BABA as its largest position (12% of the portfolio)

By: Macro Charts | May 16, 2024

• David Tepper's Appaloosa reported BABA as its largest position (12% of the portfolio).

He was loading up in Q1.

In total, nearly 25% of Tepper’s $6.7B disclosed positions are now in Chinese Stocks / ETFs:

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba $BABA weekly chart is looking the best it has quite some time

By: TrendSpider | May 16, 2024

• Alibaba weekly chart is looking the best it has quite some time. $BABA

Will the bull's patience finally be rewarded?

Read Full Story »»»

DiscoverGold

DiscoverGold

Bulls Blast Alibaba (BABA) Stock Despite Earnings Miss

By: Schaeffer's Investment Research | May 14, 2024

• Alibaba's profits for the fiscal fourth quarter fell 86%

• Revenue still came in above analysts' estimates, though

Alibaba Group Holding Ltd (NYSE:BABA) stock is down 5.9% at $79.60 at last check, after the e-commerce company's profit for the fiscal fourth quarter plunged 86%, missing analysts' estimates amid cautious consumer spending in China. Revenue still impressed, however, thanks to a focus on low-cost goods.

Today's pullback found support at the $78 region, after the equity yesterday hit its highest level since November. The 20-day moving average also lingers below as a potential floor, as BABA clings to a slim 2.9% year-to-date lead.

Options volume is already running at four times the intraday average, with 161,000 calls and 60,000 puts traded so far. The most active contract is the May 85 call, followed by the June 95 call.

This penchant for bullish bets is far from being the norm. Alibaba stock sports a Schaeffer's put/call open interest ratio (SOIR) that ranks in the 87th percentile of readings from the last 12 months. This means short-term options trades have been much more bearish than usual.

Read Full Story »»»

DiscoverGold

DiscoverGold

$BABA bulls with a statement ahead of tomorrow's quarterly earnings report...

By: TrendSpider | May 13, 2024

• $BABA bulls with a statement ahead of tomorrow's quarterly earnings report...

If results are solid, this setup has serious explosive potential.

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba holds the weekly triangle breakout ahead of Tuesday's quarterly earnings report

By: TrendSpider | May 10, 2024

• Alibaba holds the weekly triangle breakout ahead of Tuesday's quarterly earnings report. $BABA.

Read Full Story »»»

DiscoverGold

DiscoverGold

Chart evaluation on BABA made today (Saturday 5/4)

BABA made a new 6-month intraweek and weekly closing high and closed on the high of the week, suggesting further upside above last week’s high at 81.42 will be seen this week. The stock generated a failure signal against the bears, having closed above the previous weekly close support at 79.62, meaning that the breakdown that occurred in November has now been negated. More importantly, the downtrend that started in October 2020 (from a high of 304.69) and that ended in October 2022, now shows 2 successful retests of it and that suggests that a short-term uptrend could begin shortly. To do that, the bulls need to generate a weekly close above 85.31. If that occurs and is confirmed, a rally up to the $95-$98 level would likely be seen over the following 2-4 months. This breakout is not likely to occur this week or the next but could occur before the end of the month. As a matter of information, the stock could get up to the $113 level over the next 6 months and if that level is broken on a monthly closing basis, A longer term uptrend will begin and have as an objective, a rally back up to the $200 level (which could be seen over the next couple of years). As for as this week, the bulls must now stay above (on a daily and weekly closing basis) the $80 demilitarized zone (79.70-80.30). The 200-day MA is currently at 80.00 and there is short-term pivotal daily close support at 79.84 and pivotal at 78.23. If a weekly close now occurs below 77.51, all of this accomplishment by the bulls will be erased.

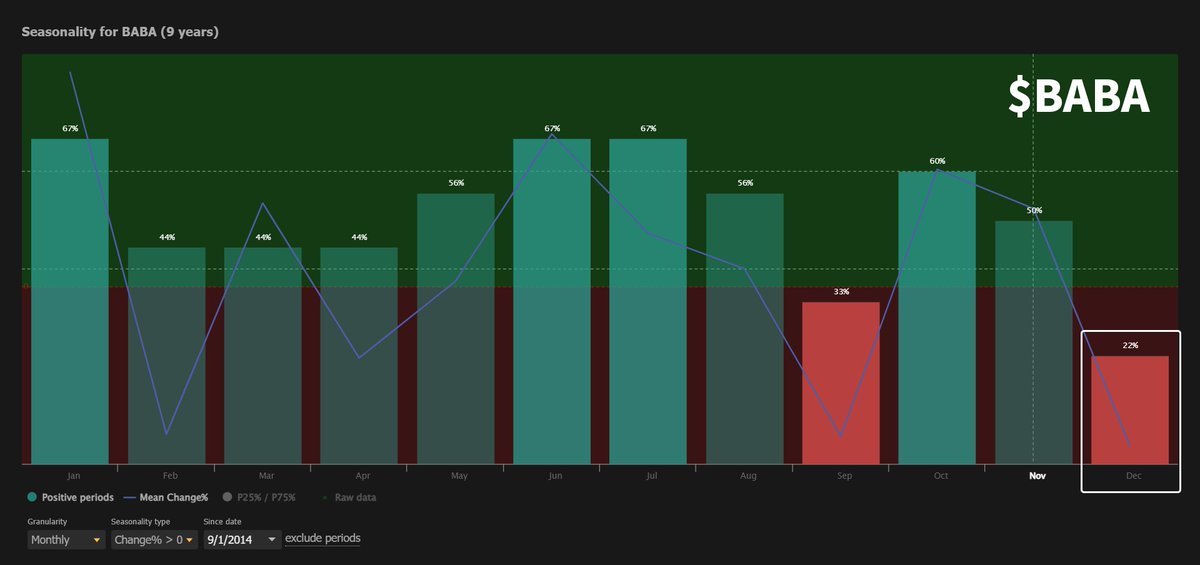

These next three months have historically been positive for Alibaba since the company went public in 2014

By: TrendSpider | May 2, 2024

• These next three months have historically been positive for Alibaba since the company went public in 2014.

The stock has a 67% win rate in June with a mean return of +4.95% $BABA

Read Full Story »»»

DiscoverGold

DiscoverGold

Is Alibaba FINALLY about to make its move?

By: TrendSpider | April 25, 2024

• Is Alibaba FINALLY about to make its move?

Read Full Story »»»

DiscoverGold

DiscoverGold

Are shares of Alibaba under accumulation down here?

By: TrendSpider | April 11, 2024

• Are shares of Alibaba under accumulation down here? $BABA

Price has been coiling up at the lows since mid November 2023.

Read Full Story »»»

DiscoverGold

DiscoverGold

Bearish Trendline Threatening Alibaba Group Holding (BABA) Stock

By: Schaeffer's Investment Research | April 2, 2024

• Alibaba stock just brushed its historically bearish 100-day moving average

• The equity is already down substantially over the last 12 months

U.S.-listed shares of China-based e-tailer Alibaba Group Holding Ltd (NYSE:BABA) are 0.8% lower at $72.80 at last glance, following news that the company bought back shares worth $4.8 billion -- its second largest repurchase ever. BABA is underperforming in 2024, down 6.1% year to date, and a historically bearish signal is flashing that could keep headwinds blowing.

Specifically, Alibaba stock just pulled back within one standard deviation of its 100-day moving average after mostly trading above the trendline since August. According to a study from Schaeffer's Senior Quantitative Analyst Rocky White, eight other similar instances occurred in the last three years. After 75% of these occurrences, the equity suffered a drop one month later, averaging a 9.8% loss.

A similar move from its current perch would put BABA near the $65.70 level, surpassing its year-to-date lows and moving to its lowest mark since November 2022. What's more, it would extend the stock's already steep 26% year-over-year deficit.

Sentiment surrounding Alibaba stock is already quite bullish. Of the 15 covering analysts, 12 rate the shares a "strong buy." Plus, short interest dropped 7.4% in the last reporting period.

Now might be the perfect time to speculate on BABA's next move with options. The stock's Schaeffer's Volatility Index (SVI) of 29% sits in the low 8th percentile of its annual range. In other words, options players are pricing in lower-than-usual volatility expectations at the moment.

Read Full Story »»»

DiscoverGold

DiscoverGold

$BABA 1.50 million share #darkpool print at $72.48 ~ 10% of 30D Avg Vol

By: Flowrensics | March 28, 2024

• $BABA 1.50 million share #darkpool print at $72.48 ~ 10% of 30D Avg Vol.

Read Full Story »»»

DiscoverGold

DiscoverGold

$BABA Nearly 100% buy consensus on Alibaba, zero sell ratings down here... Is the bottom close?

By: TrendSpider | March 9, 2024

• $BABA Nearly 100% buy consensus on Alibaba, zero sell ratings down here...

Is the bottom close?

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba has cut its cloud computing prices in half! Attempting to undercut the rest of the industry to gain market share. https://eastern.finance/2024/03/03/alibaba-cuts-prices-of-core-cloud-products-by-55/

Big bid acquisition baba $100s incoming

China bans institutions from dumping stocks at open, and close of the market.... Insane.

https://www.bloomberg.com/news/articles/2024-02-21/china-tightens-grip-on-stocks-with-net-sale-ban-at-open-close

China is so authoritarian communist and narcissistic, it actually thinks this is a good idea... Putting your foot on the neck of institutional money, is insane. Nobody is going to want even a dime invested in china, if they don't control it in an open market. China is shooting itself square in the head.

You don't think those BUYING BACK SHARES are trying to drop the PPS?

NAH!

$BABA Alibaba beats top & bottom line estimates, announces $25B increase to buyback program

By: TrendSpider | February 7, 2024

• $BABA Alibaba beats top & bottom line estimates, announces $25B increase to buyback program.

~EPS: $2.67 vs $2.64 est

~SALES: $36.67B vs $36.40B est

Read Full Story »»»

DiscoverGold

DiscoverGold

That was a nice DIVIDEND BABA paid out in Last month.....$1.00 annual..........

A Word and A Chart About and On Alibaba

By: Mish Schneider | January 29, 2024

Alibaba.com is one of the world's largest wholesale marketplaces.

To be honest, I had never gone to their website until today, even though we bought shares in BABA 2 weeks ago. So, in case you are like me and have not checked them out, they sell a lot of consumer items in bulk.

And they also sell pretty much everything. For instance, if you want a 1000w off-grid wind power Free Energy System for your home or business, you can get one and find an online description of the supplier, including their annual revenue. Plus, if you want them in bulk, you can order 1000 sets at a reduced price.

BABA has proven controversial a lot, most recently with a lawsuit settlement on monopolistic practices. However, the impact on their revenues is nominal and, in fact, could be a plus, as the company's stock price trades at just 8x net profits.

Anyway, China overall, has had no shortage of bad press. Yet, before we learned Jack Ma and others bought up to $200 million of BABA stock, the stock looked and still looks appealing to us. If one is looking to be a contrarian to all the bad press, then BABA is a company with solid fundamentals...

Read Full Story »»»

DiscoverGold

DiscoverGold

Midday movers: Alibaba surges, 3M sinks, and more

By: Investing | January 23, 2024

Main U.S. indexes edged lower Tuesday, consolidating after recent gains as the earnings season kicks into full gear.

Here are some of the biggest U.S. stock movers today:?

Alibaba (NYSE:BABA) shares climbed 7% following a report from the New York Times that suggested co-founders Jack Ma and Joe Tsai believe the business is undervalued and have been buying shares.

Read Full Story »»»

DiscoverGold

DiscoverGold

$BABA ~ 2014 vs 2023

By: TrendSpider | January 2, 2024

• $BABA ~ 2014

Revenue: $10.1B

Stock Price: $92

$BABA ~ 2023

Revenue: $133.59B

Stock Price: $78

Read Full Story »»»

DiscoverGold

DiscoverGold

Is this the year for BABA?

$BABA January is the best performing month for Alibaba since the company IPO'd back in 2014

By: TrendSpider | December 22, 2023

• $BABA January is the best performing month for Alibaba since the company IPO'd back in 2014.

67% win rate and average return of +6.94%

Read Full Story »»»

DiscoverGold

DiscoverGold

Moody’s cuts China credit outlook to negative

https://apnews.com/article/moodys-china-rating-cut-negative-4d9105eb5c711a4bc7fc1f7db1f66c35

China's economy was built on real estate, in which they proceeded to build worthless ghost cities. It was pure insanity, and the repercussions are here. The economy is mid collapse, and will be worse for China, than any other misstep in history. It could end China as it's known.

China Investment Bank Bans Bearish Research, Wealth Displays

CICC asks analysts to avoid negative macro, market commentary

https://www.bloomberg.com/news/articles/2023-11-30/china-investment-bank-bans-bearish-research-displays-of-wealth#xj4y7vzkg

This is the nail in the coffin, and absolute proof China's economy is an absolute communist fantasyland. It's on the brink of total collapse, so they simply ban talking about it... Nothing to see here... everything is great!! What a joke...lol

Capital International Investors Has $148.76 Million Stock Position in Alibaba Group Holding Limited (BABA)

By: MarketBeat | November 25, 2023

• Capital International Investors increased its position in Alibaba Group Holding Limited (NYSE:BABA) by 174.0% in the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,784,713 shares of the specialty retailer's stock after purchasing an additional 1,133,419 shares during the quarter. Capital International Investors owned approximately 0.07% of Alibaba Group worth $148,758,000 as of its most recent SEC filing...

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba (BABA) share price decline post-results overdone, Goldman Sachs sees favorable risk/reward

By: Investing | November 24, 2023

Goldman Sachs maintained a Buy rating and $134 per share price target on Alibaba (NYSE:BABA) in a note to clients Friday.

Analysts told investors that they see upside ahead for the stock based on a favorable risk/reward.

"With [the] current market cap (US$209bn) implying 8.7X this year's earnings or 6.4X ex-cash compared with double-digit EPS growth potential ahead, we believe the share price decline post-results has been overdone and see favorable risk-reward given limited downside on our bull/base/bear valuation of US$191/$134/$74," the analysts wrote.

"We continue to view valuation as attractive as current market cap suggests a value for the underlying Taobao+Tmall business of c.6.5X NOPAT after adjusting for net cash on hand (over US$60bn end-2QFY24E), without valuing any of its ex-domestic eCommerce/cloud businesses, with double-digit EPS growth potential on the back of mid-single digit CMR growth, mid-single digit share count reduction yoy and further loss reductions at other businesses," they added.

Along with PDD and Kuaishou, Alibaba continues to be the investment bank's top Buy ideas in eCommerce.

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba Group $BABA Ugly report, not spinning of cloud now... near 52W low

By: Options Mike | November 19, 2023

• $BABA Everyone keeps waiting for this one to wakeup.. I'm still saying China is a avoid or quick trade only for me.

Ugly report, not spinning of cloud now... near 52W low.

Read Full Story »»»

DiscoverGold

DiscoverGold

Since IPO in 2014, Alibaba $BABA has been green in December just twice, with an average return of -5.12%

By: TrendSpider | November 16, 2023

• Looking to buy the $BABA dip? Check this out first...

Since IPO in 2014, Alibaba has been green in December just twice, with an average return of -5.12%.

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba Group $BABA Barclays reiterates Overweight rating with $138 PT

By: FLOWrensics | November 17, 2023

• $BABA Barclays reiterates Overweight rating with $138 PT.

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba (BABA) reports Q2 revenue growth, announces dividend amid trading slump

By: Investing | November 16, 2023

NEW YORK - Alibaba (NYSE:BABA) Group Holding Limited (NYSE:BABA), a leading Chinese e-commerce giant, reported a 9% year-over-year increase in its second-quarter revenues today, reaching $30.8 billion. The figure was slightly below the anticipated $30.9 billion. Earnings for the quarter rose by 21% year-over-year to $2.14 per American Depositary Share (ADS), which was just above the expected $2.11.

Despite the positive earnings report, Alibaba's shares experienced a downturn in pre-market trading on Thursday. The company decided against proceeding with a full spin-off of its Cloud Intelligence unit, citing concerns over U.S.-imposed restrictions on semiconductors and computing chips that could negatively impact the unit's performance.

In a move to reward shareholders amidst market challenges, Alibaba's board has approved an annual cash dividend for the fiscal year 2023. Shareholders are set to receive $0.125 per ordinary share or $1.00 per ADS, with payments made in U.S. dollars.

Analysts remain optimistic about Alibaba's stock prospects, maintaining a Strong Buy consensus despite today's pre-market trading slump. This confidence is likely buoyed by Alibaba's solid quarterly performance and strategic decisions to navigate regulatory challenges while providing shareholder value through dividends.

Read Full Story »»»

DiscoverGold

DiscoverGold

$BABA near YTD lows...

By: Mike Zaccardi | November 16, 2023

• $BABA near YTD lows...

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba $BABA Reported Earnings:

By: Evan | November 16, 2023

• ALIBABA $BABA JUST REPORTED EARNINGS

EPADS of $2.14 beating expectations of $2.09

Revenue of $30.8B missing expectations of $31B

Alibaba has decided to not proceed with a full spin-off of its Cloud Intelligence Group

Read Full Story »»»

DiscoverGold

DiscoverGold

China's Alibaba to scrap cloud unit spinoff in response to US chip curbs

By: Investing | November 16, 2023

(Reuters) -China's Alibaba (NYSE:BABA) Group Holding said on Thursday it will scrap the spin off of its cloud unit in response to export curbs by the United States on chips used in artificial intelligence applications.

Its U.S.-listed shares fell about 5% in premarket trading after it also reported second-quarter revenue in line with market expectations.

"The recent expansion of U.S. restrictions on export of advanced computing chips has created uncertainties for the prospects of Cloud Intelligence Group," Alibaba said.

The e-commerce giant posted revenue of 224.79 billion yuan ($31.01 billion) in the quarter, compared with analysts' average estimate of 224.32 billion yuan, according to LSEG data.

China's economic recovery has been uneven. While the industrial and the retail sectors performed better than expected, the crisis-hit property sector still weighed on consumer confidence.Alibaba resorted to pressuring merchants to price aggressively during its Singles Day festival as it looks to take on competitors such as Douyin and PDD Holdings' Pinduoduo (NASDAQ:PDD) who have been selling lower-cost products year-round.

This is the first quarterly results for CEO Eddie Wu, one of Alibaba Group's co-founders and long-time lieutenant of former chief Jack Ma, who took over from former group chief executive Daniel Zhang in September.

($1 = 7.2481 Chinese yuan renminbi)

Read Full Story »»»

DiscoverGold

DiscoverGold

The numbers coming out of China, are extremely hard to take seriously, and believe. The last couple years have been extremely bad, yet it's always reported that things are good, and getting better... Which is simply not reality.

I've noticed with communism, the "truth" is what they say, and demand the people believe, not what actually is.... I guess they can force feed their "truth" to their people, but outside investors, aren't buying the BS. That's why money is fleeing at a massive pace.

The BABA bots are out in full force on twits. Desperate to lure in some money, from anywhere. Unfortunately, it's well known fact, China is now in a downfall. Real estate was a massive chunk, and the ghost cities crumbling are now on display to the world.

Unemployment will turn the vice onto society and squeeze millions into poverty.

Money is fleeing China in an incredibly massive way.

Anyone watch the Interview with David Hill from Deloitte on Bloomberg tonight...?

Pretty much puked through the whole thing...

Pure shit.

Alibaba Group $BABA Gaps all over, 50D next target to the upside

By: Options Mike | November 5, 2023

• $BABA Gaps all over, 50D next target to the upside.

Read Full Story »»»

DiscoverGold

DiscoverGold

|

Followers

|

274

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

8269

|

|

Created

|

03/22/08

|

Type

|

Free

|

| Moderators DiscoverGold | |||

We operate leading online and mobile marketplaces in retail and wholesale trade, as well as cloud computing and other services. We provide technology and services to enable consumers, merchants, and other participants to conduct commerce in our ecosystem.

We aim to build the future infrastructure of commerce. We envision that our customers will meet, work and live at Alibaba, and that we will be a company that lasts at least 102 years.

We empower our customers with the fundamental infrastructure for commerce and data technology, so that they can build businesses and create value that can be shared among our ecosystem participants.

We strive to expand our products and services to become central to the everyday lives of our customers.

For a company that was founded in 1999, lasting at least 102 years means we will have spanned three centuries, an achievement that few companies can claim. Our culture, business models and systems are built to last, so that we can achieve sustainability in the long run.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |