Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

CSPGF FINRA Deleted Symbol

http://otce.finra.org/DLDeletions

"Westwater has acquired, through its wholly-owned subsidiary 114, all of the outstanding common shares of the Company in exchange for an aggregate of 11,625,210 shares of common stock of Westwater. Matching TSX"

Elcora is an interesting company. The mine lump graphite from Sri Lanka which is fundamentally different from flake graphite everywhere else. It has far fewer impurities because how it forms and occurs in very large flakes. The only downside is that the mines are very small and it is hard to scale up production on that type of deposit.

I've heard where they also have some properties in Canada but don't know anything about them. More than likely they are flake graphite deposits which are similar to all the other North American deposits. The only exception to that is Zenyatta's Albany graphite deposit. Zenyatta was a market darling a few years ago when it got hyped beyond any reasonable price. While the graphite they have is different from other deposits, they were putting a dollar value on it that was delusionally optimistic.

The fact that Elcora is working with Coulormetrics is a plus. Those guys are doing some interesting things regarding graphite technology. I'm less impressed with the graphene angle. There is a lot of research into low-cost graphene production and it's just a matter of time before somebody figures it out (you are just breaking Van Der Waal bonds). A very small amount of graphite can produce a huge amount of graphene. The big emerging growth for graphite is still in batteries and maybe desalinization.

Searchlight1, any input on Elcola ECORF. Took a position and from what i read the mmoney will be in who can purify the graphite to its highest perentage with low cost and make it perfect for batteries.

Alabama Graphite is in the process of being acquired by Westwater Resources. The decision is supposed to take place tomorrow so it is possible that Alabama Graphite will cease to exist shortly after that.

Eagle Graphite is a funny company. They mine at very small scale high up in the Canadian Rockies. Their resource is poorly explored and pretty low-grade. They would have a difficult time ramping up production with their current mill. I've never really understood what they want to accomplish. I've talked to management a couple times and didn't come away any smarter for it.

Graphite Energy Corp is an interesting player. Their stock has certainly been performing. Their asset is the Lac Aux Bouleaux deposit in Quebec. Here's the thing - if you look at their NI 43-101 Technical Report dated May 23, 2017, they don't list any resources. Factor in drilling, defining those resources, scoping studies, permits, dealing with First Nations and buildout, you are talking 5 to 10 years out. And that assumes the size and geometry of the deposit warrants production. Or that they could raise the money to put in into production which is the toughest hurdle.

I'm not sure why the market is giving them so much love. Do they have a 'proprietary' technique for turning flake graphite into graphene or coated spherical graphite? It seems everybody in the natural graphite sector either has a proprietary process or has 'magic' graphite that nobody else has. A few years ago Alabama Graphite announced that they found naturally-occurring graphene on their property in Alabama. Funny how they never mentioned that ever again.

One last caveat - it isn't entirely clear that you can use natural flake graphite for lithium ion batteries. I've talked to people in the battery business and they claim the limits on impurities are too strict for that to work. Individual batches will meet spec and others won't. Flake graphite is tough to get to 99.999 purity and the metals are the hardest impurity to remove. You definitely can't use flake graphite in nuclear reactors. Right now synthetic graphite is what people are using. Flake graphite is still what is used in electrodes, crucibles, refractory bricks, pencils, lubricants but the sales price for that is a fraction of what battery-grade graphite sells for. Trying to get the economics to work on a natural graphite deposit without producing battery-grade material is pretty tough.

Hi guys, been reading most of youre previous post, educational and informative. Just recently started trading and this is one of the sectors that i am looking into. Thinking of getting in on Alabama, Eagle and GRXXF.Graphine Energy Courp has been climing every day since it listed. So i am here asking some input on GRXXF, any input would be appreciated.

Context of link, hit post to soon. This video was emailed to those signed up for their newsletter yesterday.

I can respect that. Wastewater has done nothing but go down since the deal was announced. It is trading 20% below where it was. That just means that Alabama Graphite's shareholders get even less for their shares.

Too late for me

Even I really dislike the pompous wannabe at helm now.

Made that decision based on bankruptcy vs this Hail Mary deal

I don't know about any of the rest of you, but I've been getting a lot of contact from Computershare to vote my shares. Other times this has happened was when management thought the vote was going to be close and they needed all the 'friends' they could find to swing the outcome.

If that's the case, they clearly put me in the wrong column. I'm voting against and urge others to do so as well.

If they want an election, then let's vote out the current BoD and put up a dissident slate of candidates. One that will represent the shareholder's interests rather than management.

Westwater is NOT the only option! Vote AGAINST.

Don Baxter brought so much baggage with him that he needed a moving van. He never left a graphite company without hard feelings and/or threats of legal action. One of the guys I knew at Alabama Graphite says bringing Don aboard was the dumbest thing they ever did. They must have paid him by the press release.

They bullshitted their way with Ty’s storytelling skills.

Don has no charisma he’s not a deal closer. He should be confined to desk work in the basement

Let me begin by saying that I haven't torn apart their financial filings to see how bad a shape they are in. More than likely I'd get no farther how much Don Baxter was paying himself and Ty and Jean and the rest of the board. At that point I'd start hitting the Tequila.

However, I'm still of the opinion that there were other options - particularly after they got rid of the current group of ne'er do wells and brought in competent management. This company was doing okay until Don. Not great, mind you - Ron Roda brought nothing to the table. But Don rubs people the wrong way - not a trait you want in a CEO that has to make deals.

One option would be to do a reverse split and get the share structure back under control. This is still the only graphite deposit in the continental US. How is it that Graphite One in Alaska can get the state to kick in money to get that project moving forward? This is a strategic resource for the US, and Alabama should be enthusiastically pushing to help this along.

Who would I bring in to manage it? How about Tom Burkett of Ontario Graphite. He is a straight shooter and is interested in seeing his company be successful rather than prancing around like some narcissistic rooster. If Tom doesn't want it, than Ellerton Castor, his #2 at Ontario. For that matter, merge the two companies.

Right now I'm not convinced that Westwater is going to do anything good with the Coosa deposit. On the bright side, they have lithium which is currently hot. But what started out with so much promise in Alabama is facing an inglorious end.

The other choice would be bankruptcy by mr big shot wannabe ty his muse and Donnie that can’t hold a job and ever deliver

Got my proxy to approve this abortion of a deal. I seriously hope it falls through. This deal really sucks.

Seeing how Ty is now running the show, I would suspect so. He seems to have taken his Investor Relations training at Trump University where if you don't like what somebody is saying, threaten to sue them. I've gotten some choice little nasty-grams from him over the years.

Seeing as how Don and Ty and Jean were doing nothing but bleeding the treasury dry, maybe new management is the best of all worlds.

Thankfully my other investments are doing well because Alabama Graphite has been a complete turkey.

More bans and post deletions on stockhouse’s board!

Unreal they are running Alabama like a mom and pop shop.

Let’s see where that lawsuit against Ann-Marie will bring.

Ty if you are behind this, you are a low life degenerate.

When Don Baxter took over as CEO in December 2015 the stock was trading at C$0.16. Today it is trading at C$0.08.

My question is what exactly did Don Baxter do to justify all the money and stock he paid himself over the last two years? Or Ty Dinwoodie, Don's pet ferret? Or Jean Depatie or Daniel Goffaux who are supposed to be the graphite experts on the board but did nothing except rubber stamp Don and Ty's compensation packages.

It's been over 20 years since the Bre-X debacle. Yes, the reporting is better (although the Alabama Graphite PEA is full of ludicrous assumptions). But the people who run so many of the Canadian exploration juniors are as ethically challenged as ever.

Just tell me one thing - Did Don and his band of pranksters have clauses in their contracts where they get a windfall if the company gets bought out? If so, I hope it wasn't more than 30 pieces of silver. That seems to be the going rate.

Which is why I don't have anything to do with Stockhouse. There are a number of us who felt that Alabama Graphite had their in-house trolls shouting down anybody who questioned just how wonderful they are. Same thing on their Facebook page where any negative comments were taken down in a flash.

There needs to be a venue where people can question the "official version of reality" coming down from the C-suite. I only post on boards where I have a knowledge of either the industry or the company. And what I see over and over are companies who subscribe to the "mushroom theory of investor relations" - feed them manure and keep them in the dark.

There are some really good companies in the junior resource sector, but it is getting harder and harder to differentiate them from those who treat their investors like marks to be played.

Ouch if you posted this on stockhouse you would of got banned for 7 days. It’s such a disgrace that they mute everyone on there. So pitiful.

Don and the boys were always big at putting things out there that were divorced from reality.

The mining flow sheet shows the same thing. "Mining (no drilling or blasting required)". Nonsense. I've seen that rock and you aren't going to be able to rip it without doing some blasting. "Mechanical Separation (no crushing or grinding)". How do you separate the graphite flakes from even small chunks of rock without at least crushing it? When Alabama was producing graphite during WW2 they used roller mills to crush the rock.

Yes, the Bond Work Hardness Index is low for the weathered rock, but you still need to mechanically separate the flakes.

This is similar to their news release that they found naturally-occurring graphene. That would be the equivalent for finding the Higgs Boson, yet the geologic world ignored it because of how preposterous it was at face value.

There was a period where Alabama Graphite could've moved this project forward, but crappy management only interested in their own economic well-being got their claws into them. The whole "proprietary process" was just a smokescreen so Don and Tyler could collect their paychecks until there was no more money in the bank.

purification

Anybody remember PEA proprietary process for CSPG and Northern controversy?

Check out: https://view.publitas.com/the-assay/the-assay-battery-materials/page/34-35?dm_t=0,0,0,0,0&dm_i=4LP9,542N,21JLYR,JZRS,1

Alabama now say they use thermal purification so proprietary process does not work. I guess they forgot to tell shareholder. Nobody else use thermal, too expensive. What good FS with bad numbers?

Read more at http://www.stockhouse.com/companies/bullboard?symbol=v.cspg&postid=27220410#TvAV7E3H7mstBeuK.99

Based on the way the Westwater's shares are dropping, the market doesn't think much of the merger. And since the acquisition is strictly a share exchange, the more Westwater drops the less Alabama Graphite's shareholders receive in value.

On the positive side, Westwater Resources' team look to be a lot more professional than anybody with Alabama Graphite. All of Alabama Graphite's technical expertise resided in it's outside consultants. The only thing Don Baxter seems to be an expert in is self-promotion. Same thing for their board.

Sorry situation, for sure.

First time I've ever seen a merger where the acquisition candidate DROPS 25% in value as soon as the deal is announced. That whole Canadian Board of Directors for Alabama Graphite is a joke.

Time will tell......

Maybe. Maybe a white knight will rush in with a better offer (unlikely). Maybe Westwater Resources will be the better company to own (lithium looks to be a better bet than graphite right now). I'm just disgusted with the whole mess. Wish I had loaded my shares ages ago. Better yet, I wish I'd never bought any.

Maybe we can salvage so good from this?

The only silver lining to this dark cloud is that Don Baxter is out. Every former Alabama Graphite employee I know says hiring Don was the dumbest thing they ever did. A raving narcissist who seemed more interested in lining his pockets than doing something for the shareholders. Sad ending to what started out so well.

As are we. Best of luck to us all in 2018.

From everything I can see the shareholders are being totally screwed over. The deal was done at a discount to the current stock price. The only likely winners will be the management who will likely use the take-over clause in their contract to get one more payday after milking this for all its worth.

Let's hope so. Cautiously optimistic at this point.

Thank you for your response. We shall become more educated about this in the coming weeks. Maybe it is a good offer when debt and development potential is considered?

Every 12.5 shares of Alabama you get 1 share of Westwater. I think

I have no idea. Haven't really looked into them yet. They're listed on Nasdaq for what it's worth. It still needs approval on many levels for the next couple months. The nr also said Alabama is still open to receive offers from any other interested party. Hold or sell....what to do....

Is this a good offer? I am not making out on it very well. Is WWR a good stock to be in?

Stock was halted today. Anybody know why?

Anybody here know who the group was that did the hostile takeover offer a couple months ago? I heard to vague rumblings that it might have been a group out of Denver but I can't find any confirmation on any of the other Alabama Graphite Boards.

Thanks

Press Release: June 19, 2017 10:29 ET

Alabama Graphite Appoints Auburn University Professor Emeritus Dr. Robert Cook, P.G. as Strategic Advisor

The Energy Graphite™ Company

Sourced and Manufactured in the United States of America

TORONTO, ONTARIO--(Marketwired - June 19, 2017) - Alabama Graphite Corp. ("AGC" or the "Company") (TSX VENTURE:CSPG)(OTCQB:CSPGF)(FRANKFURT:1AG) is pleased to announce Dr. Robert. B. Cook, P.G., Ph.D., M.S., E.M., has been appointed as Strategic Advisor to the Company. Dr. Cook is one of America's most accomplished professional geologists, with more than 40 years of experience in both the state of Alabama and surrounding region. Dr. Cook is a Professor Emeritus in the Department of Geology at Auburn University in Auburn, Alabama and headed the University's Department of Geology for more than two decades. Dr. Cook's professional specialties are mineral exploration, environmental geology, and mining.

Dr. Cook holds a Doctorate degree and Master of Science graduate degree in Geology from the University of Georgia, in addition to a degree in Mining Engineering from the Colorado School of Mines. Dr. Cook has consulted for the United States Department of Defense ("DoD"), the National Aeronautics and Space Administration ("NASA"), the United States Department of Justice ("DOJ"), and the United Nations ("UN"). Dr. Cook has been a member of American Institute of Mining and Metallurgical Engineers, Alabama Academy of Science, Geological Society of America, Alabama Geological Society, Georgia Geological Society, and the Society of Exploration Geochemists, among several other professional organizations.

Honored with the Robert B. Cook Endowed Chair in Geology, established at Auburn University in 2009, Dr. Cook's publication record includes over 200 papers and articles, as well as two state mineralogies (Alabama and Georgia), a U.S. Geological Survey Professional Paper, and a variety of Alabama state geological survey bulletins. An Executive Editor of Rocks and Minerals magazine for more than 25 years, Dr. Cook is a Fellow of the Society of Economic Geologists, Inc. ("SEG"), and a registered Professional Geologist (P.G.) in Alabama, Georgia and Florida. The uranium mineral bobcookite was named in his honor by a group of American and Russian scientists.

President and Chief Executive Officer Donald Baxter, stated, "We are honored to have an Alabama-based expert geologist advising the Company and further validating our world-class Coosa Graphite Project, the only graphite project in the contiguous United States. Dr. Cook's profound understanding of the geology of Alabama and the region will be invaluable with assisting with the supervision of the ongoing development and permitting process for Coosa, in addition to continued mineral exploration for new battery-materials-related targets, as well as advising on mine planning and further resource development."

On behalf of the Board of Directors of ALABAMA GRAPHITE CORP.

Donald K. D. Baxter, P.Eng., President, Chief Executive Officer and Executive Director

QUALIFIED PERSON

Jesse R. Edmondson, P.G., a registered Professional Geologist in the State of Alabama and Project Geologist of Alabama Graphite Corp., is a Qualified Person as defined by National Instrument 43-101 ("N.I. 43-101") guidelines, and has reviewed and approved the content of this news release.

ABOUT ALABAMA GRAPHITE CORP. (AGC)

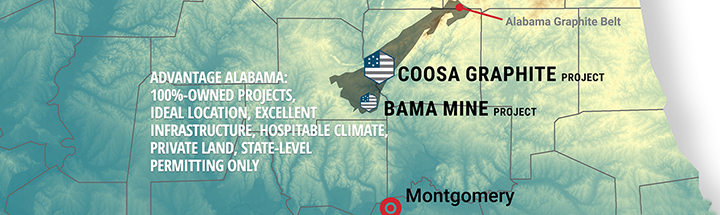

Alabama Graphite Corp. is a Canadian-based flake graphite exploration and development company as well as an aspiring battery materials production and technology company. The Company operates through its wholly owned subsidiary, Alabama Graphite Company Inc. (a company registered in the state of Alabama). With an advancing flake graphite project in the United States of America, Alabama Graphite Corp intends to become a reliable, long-term U.S. supplier of specialty high-purity graphite products. A highly-experienced team leads the Company with more than 100 years of combined graphite mining, graphite processing, specialty graphite products and applications, and graphite sales experience. Alabama Graphite Corp. is focused on the exploration and development of its flagship Coosa Graphite Project in Coosa County, Alabama, and its Bama Mine Project in Chilton County, Alabama as well the research and development of its proprietary manufacturing and technological processing process of battery materials.

Alabama Graphite Corp. holds a 100% interest in the mineral rights for these two U.S.-based graphite projects, which are both located on private land. The two projects encompass more than 43,000 acres and are located in a geopolitically stable, mining-friendly jurisdiction with significant historical production of crystalline flake graphite in the flake graphite belt of central Alabama, also known as the Alabama Graphite Belt (source: U.S. Bureau of Mines). A significant portion of the Alabama deposits are characterized by graphite-bearing material that is oxidized and has been weathered into extremely soft rock. Both projects have infrastructure in place, are within close proximity to major highways, rail, power and water, and are approximately three hours (by truck or train) to the Port of Mobile, the Alabama Port Authority's deep-seawater port and the ninth largest port by tonnage in the United States (source: U.S. Army Corps of Engineers/USACE). The state of Alabama's hospitable climate allows for year-round mining operations and the world's largest marble quarry (which operates 24 hours a day, 365 days a year in Sylacauga, Alabama), is located within a 30-minute drive of the Coosa Graphite Project.

On November 30, 2015, Alabama Graphite Corp. announced the results of PEA for the Coosa Graphite Project, indicating a potentially low-cost project with potential positive economics. Please refer to the Company's technical report titled "Alabama Graphite Corp. Preliminary Economic Assessment (PEA) on the Coosa graphite Project, Alabama, USA" dated November 27, 2015, prepared by independent engineering firms AGP Mining Consultants Inc. and Metal Mining Consultants Inc., and filed on SEDAR at www.sedar.com.

* Note: A Preliminary Economic Assessment ("PEA") is preliminary in nature. A PEA includes Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves and there is no certainty that the Preliminary Economic Assessment will be realized. Inferred Mineral Resources represent material that is considered too speculative to be included in economic evaluations. Additional trenching and/or drilling will be required to convert Inferred Mineral Resources to Measured or Indicated Mineral Resources. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no guarantee that all or any part of the Mineral Resource will be converted into a Mineral Reserve.

Alabama Graphite Corp. is a proud member of the National Association of Advanced Technology Batteries International ("NAATBatt International"), a U.S.-based, not-for-profit trade association commercializing advanced electrochemical energy-storage technology for emerging, high-tech applications.

Press Release:

Alabama Graphite Appoints Auburn University Professor Emeritus Dr. Robert Cook, P.G. as Strategic Advisor

http://www.marketwired.com/press-release/-2222535.htm

A lot of information here! If I interpret this correctly, I think they are starting production. Below is the most recent shareholder eBlast I received:

Alabama Graphite Corp. Commences Production of >150 Kilogram Stockpile of Sourced-and-Manufactured-in-USA Specialty Battery-Ready Graphite for End User Qualification

The Energy GraphiteTM Company

Sourced and Manufactured in the United States of America

TORONTO — (May 1, 2017) — Alabama Graphite Corp. (“AGC” or the “Company”) (TSX-V:CSPG) (OTCQB:CSPGF) (FRANKFURT:1AG) is pleased to announce that it has commenced production of more than 120 kilograms (“kg”) of the Company’s 100% sourced-and-manufactured-in-the-contiguous-USA Coated Spherical Purified Graphite (“CSPG”) and, concurrently, more than 35 kg of its Purified Micronized Graphite (“PMG”) for potential end-user evaluation and qualification.

Note: a Preliminary Economic Assessment is preliminary in nature, it includes Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves and there is no certainty that the Preliminary Economic Assessment will be realized. Inferred Mineral Resources represent material that is considered too speculative to be included in economic evaluations. Additional trenching and/or drilling will be required to convert Inferred Mineral Resources to Measured or Indicated Mineral Resources. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no guarantee that all or any part of the Mineral Resource will be converted into a Mineral Reserve.

As indicated in the Company’s November 30, 2015 announcement, ‘Alabama Graphite Corp. Announces Positive Preliminary Economic Assessment for Coosa Graphite Project in Coosa County, Alabama, USA; Files Completed PEA NI 43-101 Technical Report’, AGC’s business model is predicated on the eventual downstream production of CSPG. CSPG is a high-value secondary-processed, ultra-high-purity, natural battery-ready graphite engineered for use in secondary/rechargeable lithium-ion (“Li-ion”) battery anodes. There is significantly more CSPG than there is lithium in a Li-ion battery. For further information about the Company’s CSPG production and testing, please refer to the Company’s January 19, 2016 announcement entitled, ‘Independent Test Results: Alabama Graphite Corp. Succeeds in Producing High-Performance Coated Spherical Graphite (CSPG) for Lithium-ion Batteries’

PMG is a primary (non-rechargeable) lithium-battery and alkaline-battery conductivity enhancement. PMG also serves as the Company’s feedstock to produce its ultra-high-purity, natural high-conductivity enhanced graphite battery-ready product, Delaminated Expanded Graphite (“DEXDG”) for Li-ion battery cathode applications. For further information about the Company’s DEXDG production and testing, please refer to the Company’s March 28, 2017 announcement entitled, ‘Independent Test Results: Alabama Graphite Corp. Succeeds in Producing High-Performance Conductivity-Enhancement Graphite for Lithium-ion Batteries’

When AGC produces its core CSPG product, the resultant byproduct is ultra-high-purity PMG. The DEXDG product is ultimately produced from the PMG byproduct material; however, both products are high-value battery-conductivity-enhancement materials. Management believes that AGC holds the potential for 100% of its run-of-mine (“ROM”) graphite material to be effectively converted into high-performance, value-added battery-ready materials.

AGC’s current battery-ready graphite production campaign consists of the following stockpiles:

More than 60 kg of a large-specification CSPG, specifically a D50 of 22 microns (“µm”);

More than 60 kg of a medium-specification CSPG, specifically a D50 of 16 µm; and

More than 35 kg of PMG, specifically sub-10 µm material. PMG is a byproduct of CSPG manufacturing. AGC achieves an approximate 75% yield in CSPG manufacture, meaning the remaining 25% of material is PMG (3:1 ratio CSPG to PMG).

AGC Lab

© Copyright 2017 Alabama Graphite Corp.

FIGURE 1: An image of AGC’s American-sourced ultra-high-purity graphite being spheronized via a Japanese spheronization system in the United States. Spheronization represents a critical step in CSPG production in which flat graphite flakes are converted into spheroidal particles or spheroids.

The Company will independently characterize, analyze and electrochemically test the CSPG stockpiles in representative samples to validate the high electrochemical performance of both size specifications of CSPG and, as importantly, consistency in electrochemical performance. Additionally, AGC will demonstrate its ability to produce CSPG in multi-kilogram quantities. Further, the Company will utilize these stockpiles to conduct long-term cycling efficiency testing — up to 400 cycles.

With the only graphite project in the contiguous United States, all of AGC’s graphite is sourced from the Company’s flagship, 100%-owned Coosa Graphite Project — located in Coosa County, Alabama, USA. All requisite downstream secondary processing to manufacture AGC's CSPG is being conducted in the United States of America. Although AGC’s proprietary, environmentally sustainable process to purify and produce battery-ready graphite is source agnostic, the Company’s process flowsheet has been optimized for Coosa Graphite Project material.

President and Chief Executive Officer

r commented, “We are pleased to have commenced with the production of our CSPG and PMG stockpiles. AGC has successfully progressed from gram-scale, to kilogram-scale to now multi-kilogram production of our CSPG. Having such a significant amount of fully characterized and tested battery material on hand will demonstrate our in-house technical capabilities and the efficiency of our technologies. Additionally, the stockpile will provide AGC with enough material to satisfy the numerous requests for larger samples of battery-ready graphite from existing and new potential end users in the United States and around the world, with a focus on the U.S. Department of Defense (“DoD”) and U.S. Department of Energy (“DOE”) battery manufacturers and laboratories. We look forward to updating the market regarding electrochemical testing and long-term cycling data, demonstrating the high performance of AGC’s American-sourced-and-manufactured battery-ready graphite products.”

AGC’s COMMITMENT TO ENVIRONMENTAL SUSTAINABILITY

AGC’s graphite is purified via the Company’s propriety, low-temperature thermal purification process. AGC’s environmentally responsible and sustainable graphite purification process does not utilize caustic chemicals or harsh acids that are commonly regarded as dangerous and environmentally harmful (e.g. hydrofluoric acid — as is commonly used in Chinese graphite production — hydrochloric acid, sulfuric acid, nitric acids, or alkali roasting, caustic-soda roasting, etc.), nor does the process require copious amounts of clean water or costly, energy-intensive high-temperature thermal upgrading. Please refer to the Company’s February 17, 2017 announcement, ‘Alabama Graphite Corp. Achieves 99.99997% Graphite Purity via Proprietary, Environmentally Responsible and Sustainable Purification Process; Exceeds Nuclear Graphite Purity Requirements.’

For more information about AGC’s specialty, secondary processing to produce its CSPG please refer to the June 2016 comprehensive independent report, ‘Alabama Graphite’s Coated Spherical Purified Graphite for the Lithium-ion Battery Industry,’ written, researched and prepared by Dr. Gareth P. Hatch, CEng, FIMMM, FIET, prior to his joining the AGC Board of Directors. Dr. Hatch is also President of Innovation Metals Corp., Founding Principal of Technology Metals Research, LLC, and Independent Director of the Company,

Readers are cautioned that AGC is not yet in production and there is no guarantee that the Company will advance to full-scale production. If, following the completion of a Feasibility Study — which has not yet been commenced — AGC is able to advance the Coosa Graphite Project into production, the resulting battery-ready graphite products would be sourced from within the contiguous United States and the Company may have a potential competitive advantage over other producers of value-added graphite materials sourced from other countries, regardless of whether said materials were processed and/or manufactured in the United States of America.

On behalf of the Board of Directors of

ALABAMA GRAPHITE CORP.

Donald K. D. Baxter, P.Eng.

President, Chief Executive Officer and Executive Director

Thanks. I will watch this for a while. Interesting company.

Not that I know of yet

I am new here. Is there any discussion when the company may actually begin to generate revenue?

Response received from company:

Alabama Graphite Corp. is a pre-revenue junior graphite development and technology company. As such, like our peers in the space, there are no sales or earnings reports for Alabama Graphite Corp.

All of Alabama Graphite Corp’s disclosures can be found on the Company’s website at: http://alabamagraphite.com/news-releases-2017/

With regards to the Company’s Issued & Outstanding and/or Fully-Diluted shares, Alabama Graphite Corp. raises capital via equity private placements. Although current management assumed leadership at the end of 2015, all information pertaining to the Company’s private placements (and resultant share issuance) can be found in its disclosures.

I'll reach out to the woman in investor relations listed on their investors page and see if I can get any recent information. Leaving for a family vacation today, I'll get back to you as soon as I can (return Tuesday), but I'll be checking my emails periodically.

Where can i find some sales and earnings figures? Couldn't find anything in their homepage.

How about the increase in Shared o/s from 40+ mio. in 2013 to 170+ mIo. now?

|

Followers

|

3

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

100

|

|

Created

|

08/27/13

|

Type

|

Free

|

| Moderators | |||

Management:

Share Price $0.145

Market Capitalization $21 million

90-Day Volume (average) 371,000

52-Week Range (low—high) $0.105 — $0.22

Shares (issued & outstanding) 145,315,187

Options 13,491,000

Warrants 32,884,025

Total Shares (fully diluted) 191,690,212

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |