Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

They are pretty elusive, I'll say that for them.

Evil naked short sellers from Mars.

What is ENSSFM? And I haven't heard of a Jerry Williams siting in over 11/12 years.

Hey, have to ask: have there been any Jerry Williams sightings in the last five years?

Hey, have to ask: have there been any Jerry Williams sightings in the last five years?

Did you ever find the ENSSFM here?

Did you ever find the ENSSFM here?

$EIGH 07/27/2023 20233376245 Annual List

Well, I guess we'll see if this security is really a dog or not. And as long as it takes could be a long long time? I wouldn't hold my breath.

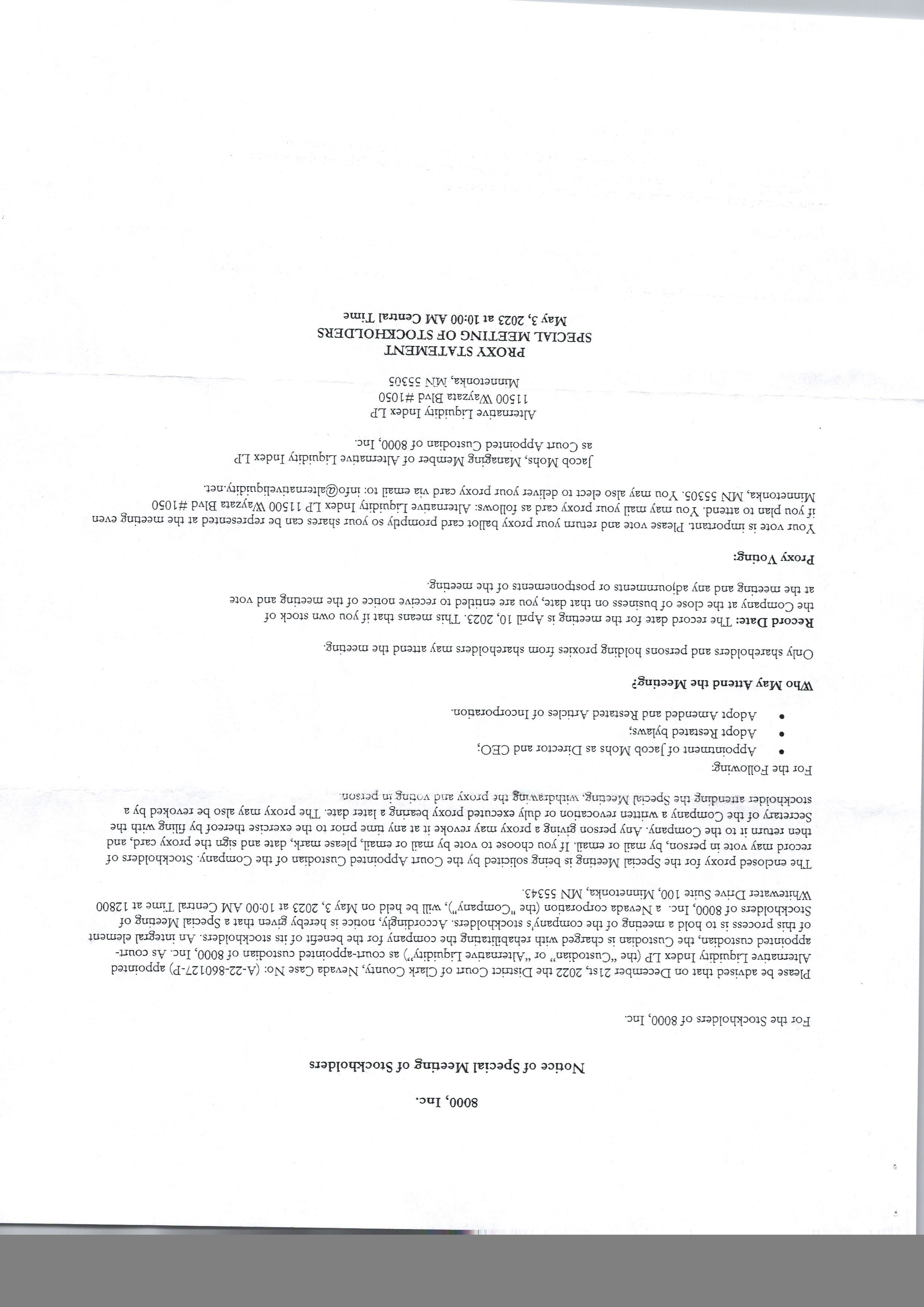

You're wondering how the meeting went? I think its clear how it went. 70% controlling interest.

And this security is not a dog. Its a security going thru a process for as long as it takes!

Wonder how the meeting went? No way this dog can be resurrected from the dead. And if it was there's no way it will bring value to any existing shareholders... IMHO!

Yeah, that pesky comma keeps coming up huh

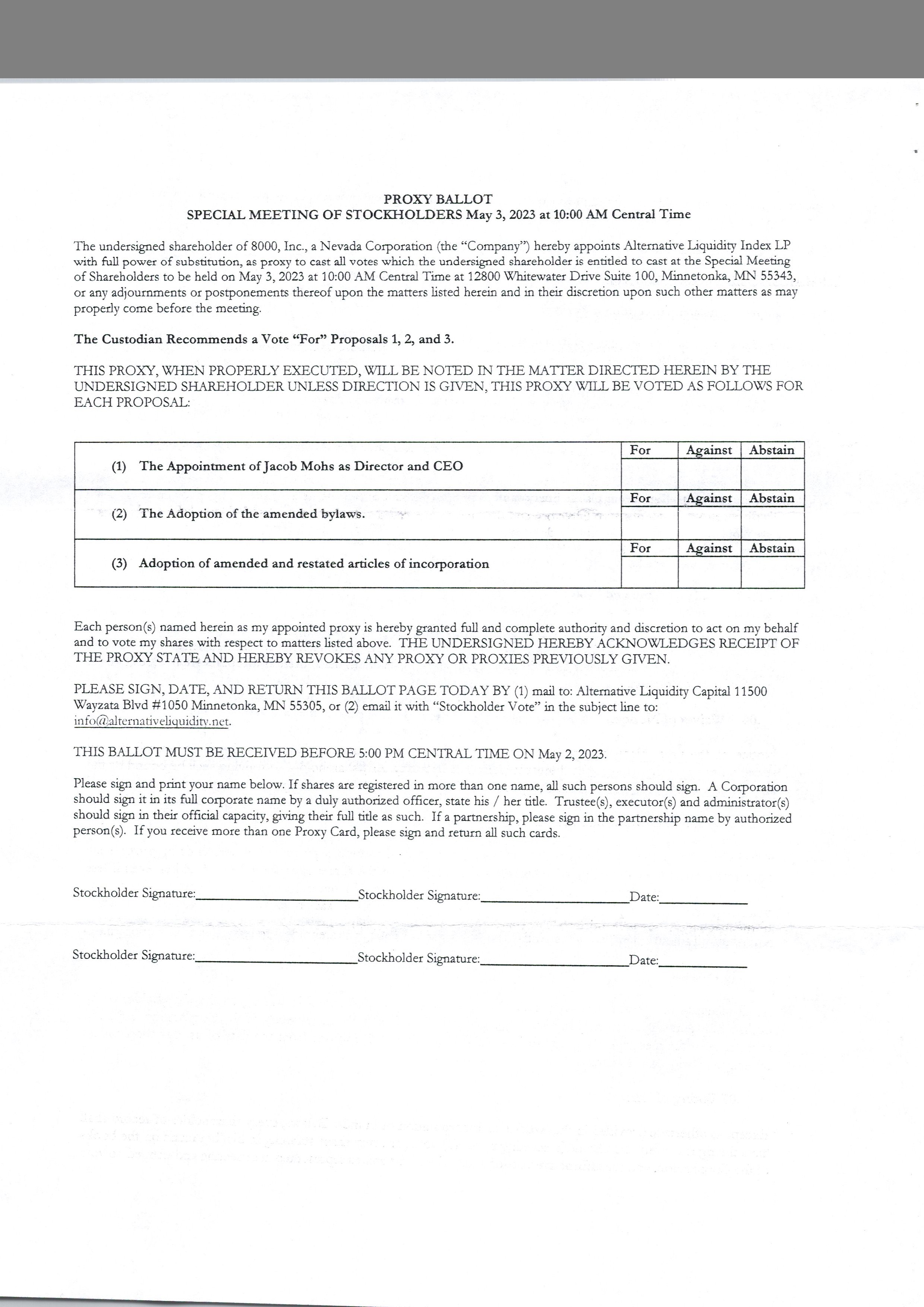

Looks like there was a proxy vote yesterday for 8000, inc. How is this possible given the history of this security?

Historical References:

8000 inc Stock Certificate (Real Proof)

.png)

Etrade (Morgan Stanley) Broker Correspondence on EIGH naked short position

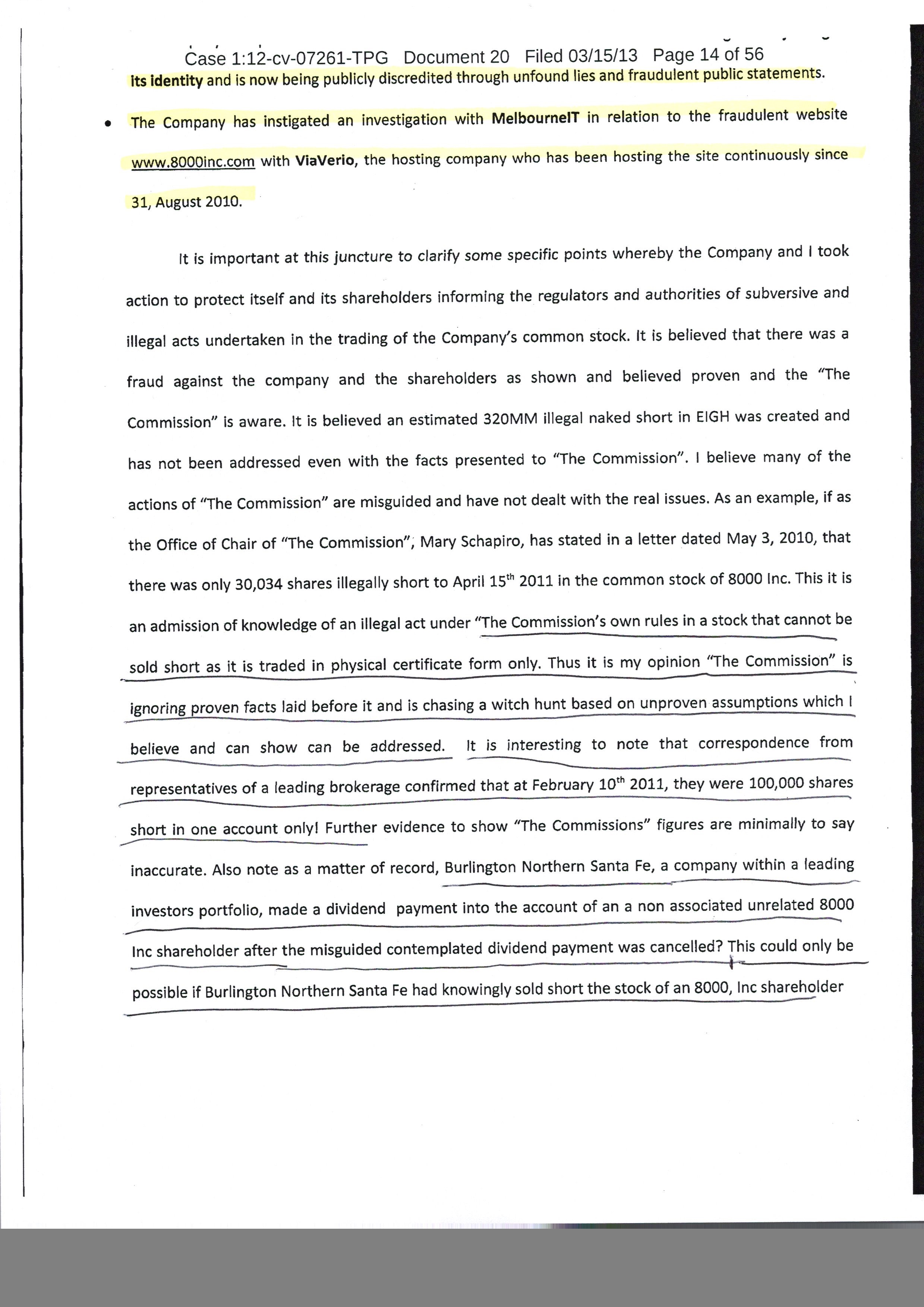

Bryant Response to SEC

Did you notice the "Jury Trial Demanded"?

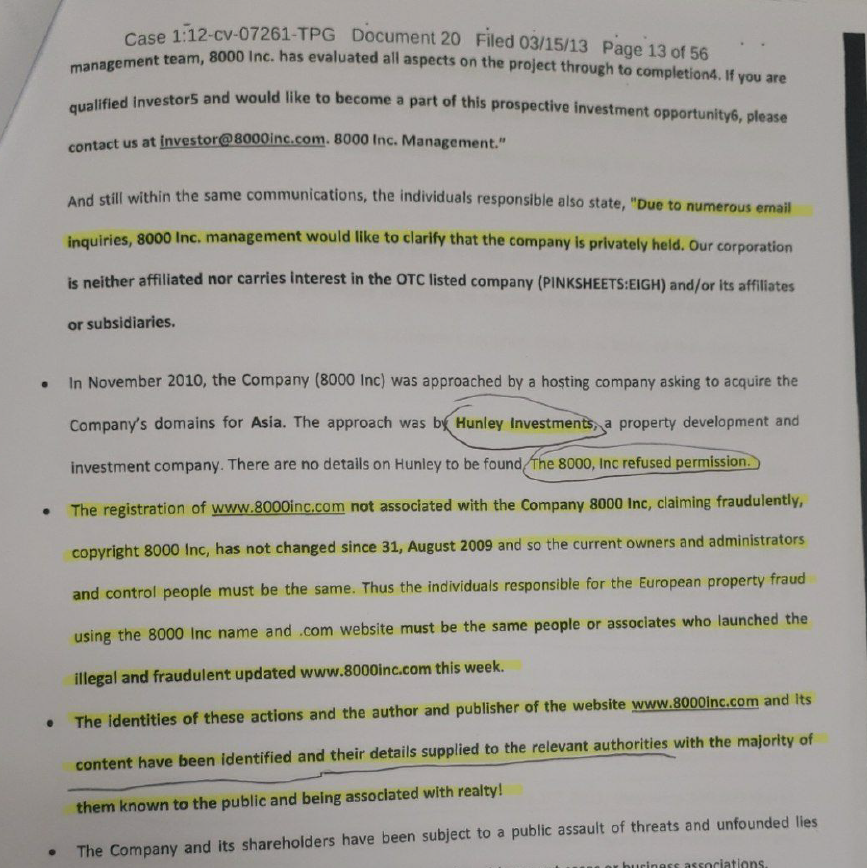

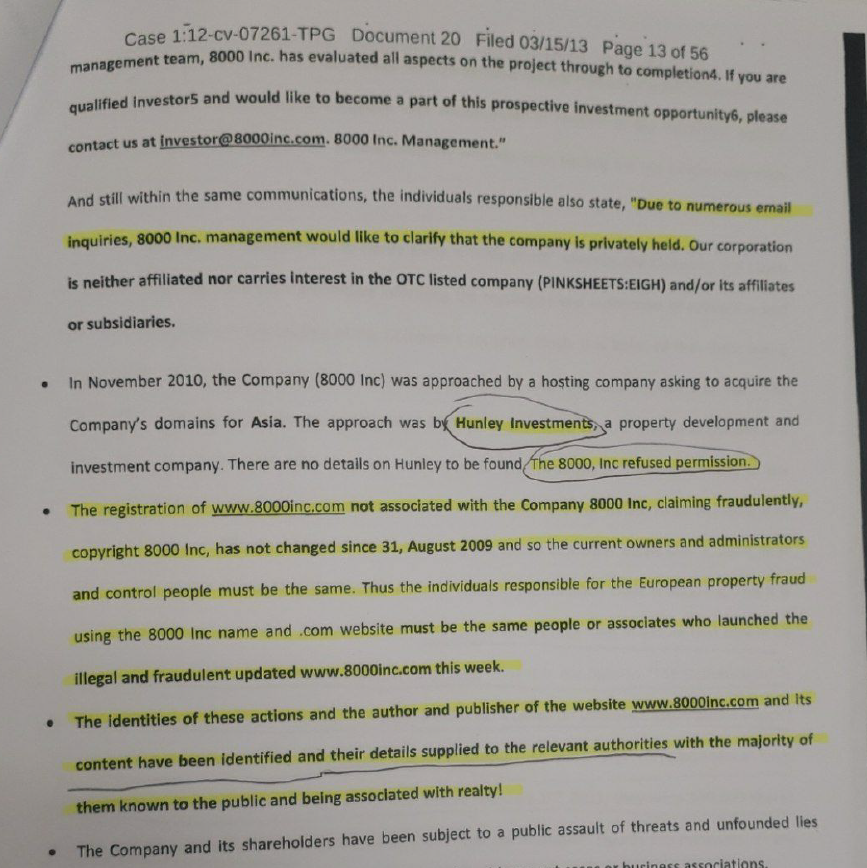

8000 inc is a private entity

Official notice via the SEC court (later found the SEC acted in an unconstitutional manner)

320 million illegal naked short identified

sca

sca

Letter to SEC identifying there is a naked short position asking for SEC/Finra remedy

https://www.otcmarkets.com/otcapi/company/financial-report/55378/content

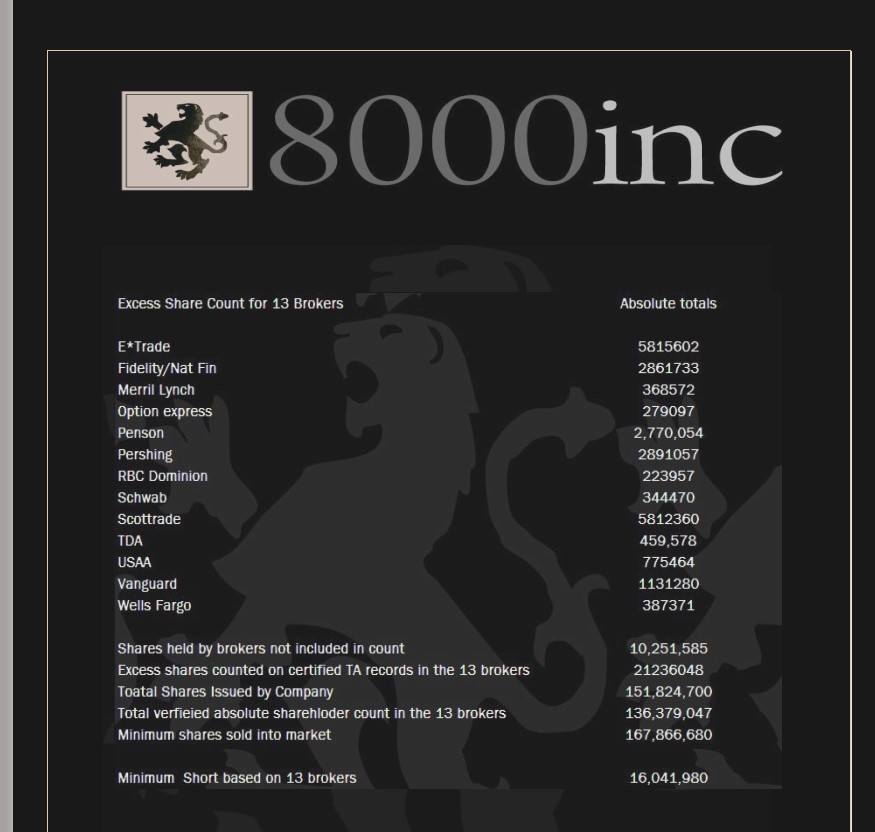

13 Broker identified with an excess/imbalance of shares

DTCC

Subject: Re: 8000inc ticker EIGH

From: sletzler@dtcc.com

Date: Mon, 26 Sep 2011 15:43:11 -0400

Dear XXXXXXX,

Your email to XXXXXXXXX was forwarded to me for response.

Since 8000Inc is not and has never been eligible for full services at DTC, DTCC is unaware of any restrictions that may be placed on this security by brokers. But in any case, no action that DTCC or DTC would take would have any impact on trading activities, but would only impact the electronic clearing and settlement of securities held at DTC. My suggestion is that you speak directly to your broker to answer any further questions you may have about 8000Inc.

Steve Letzler

Director, Corporate Communications

DTCC

SEC in-house judges violate right to jury trial, appeals court rules

https://www.reuters.com/legal/government/sec-in-house-judges-violate-right-jury-trial-appeals-court-rules-2022-05-18/

Agency powers under threat in U.S. Supreme Court FTC and SEC cases

https://www.reuters.com/legal/agency-powers-under-threat-us-supreme-court-ftc-sec-cases-2022-11-03/

U.S. Supreme Court rules federal courts have jurisdiction to hear challenges of FTC, SEC

https://bankingjournal.aba.com/2023/04/u-s-supreme-court-rules-federal-courts-have-jurisdiction-to-hear-challenges-of-ftc-sec/

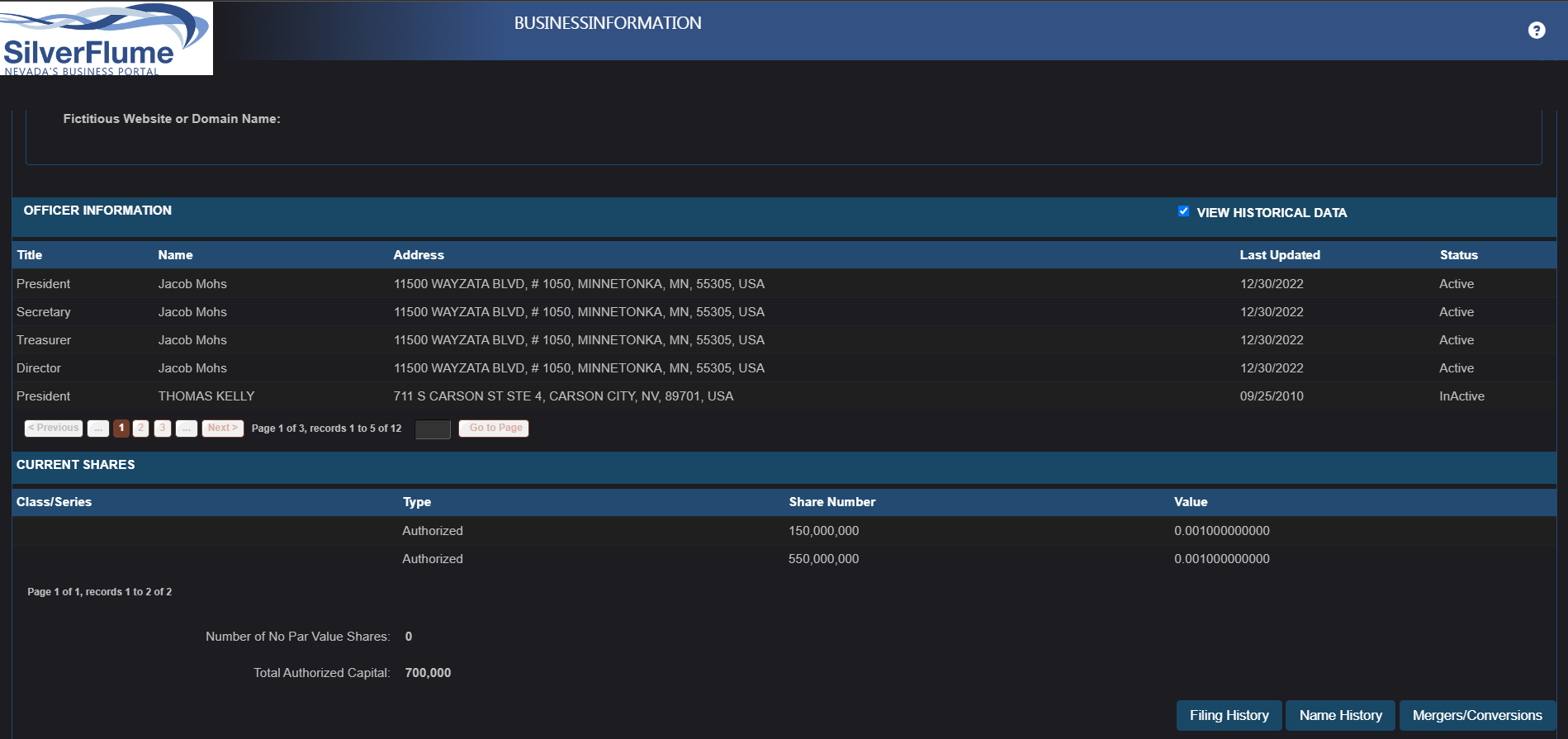

Does anybody want to show Jacob Mohs that he has custody of a security that should not be trading???

Rule 144 violation*

$13

$EIGH

How did “commagate” work out?

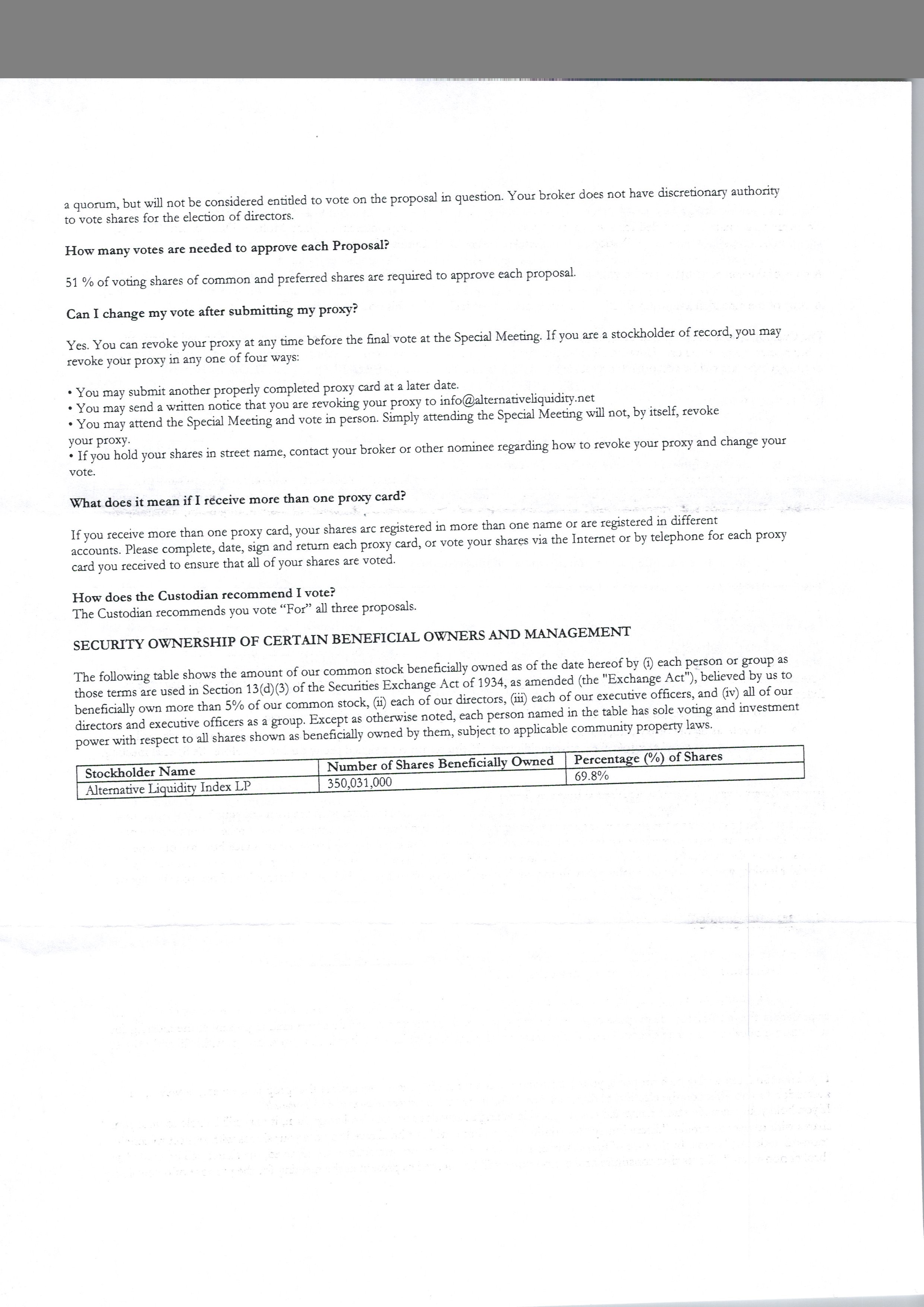

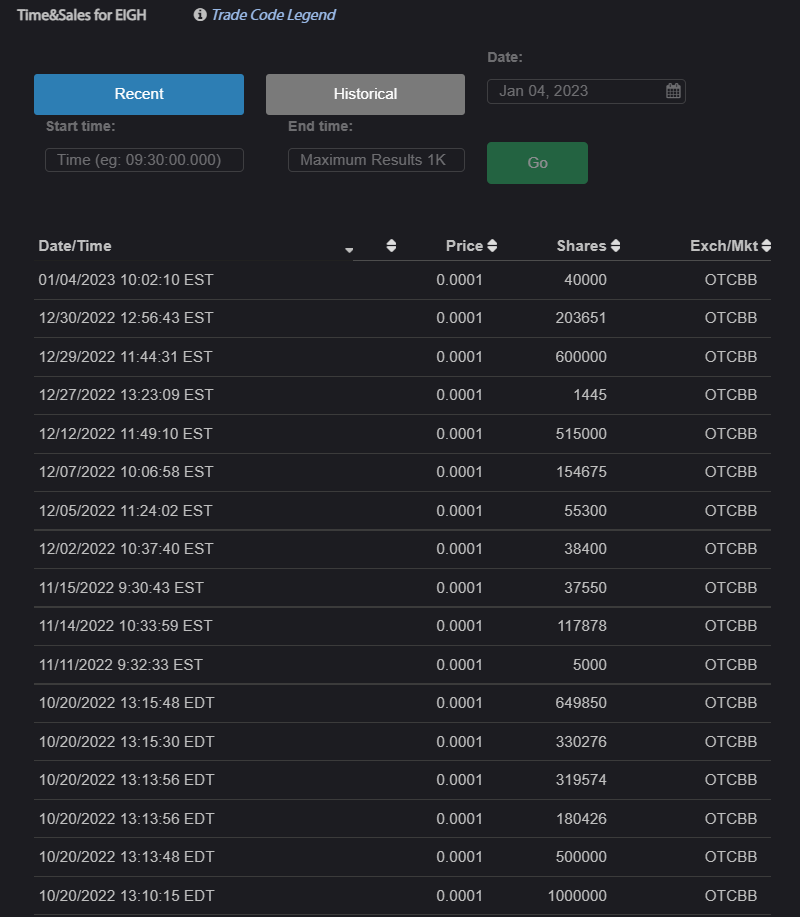

$EIGH OS Increased by 350m

?? EIGH

?? 0,000001000

??Outstanding Shares Updated:

??Old: 151.824.000 (2021-10-23)

??New: 501.824.000 (2023-03-30)

Difference: +230.5301% (+350.000.000)

That's good news. Thanks for the update.

Just called Signature Stock Transfer (SST), who is the Transfer Agent for 8000 Inc. SST confirmed the stock certificates are free trading in certificate form only! Signature Stock Transfer is also aware that 8000, inc was activated in the State of Nevada on December 30th 2022.

He would need the stock certificates to be in the majority. Any electronic volume does not reflect this behavior. Real certs can not trade electronically. Non DTC eligible!!!

$EIGH 3.98m vol on 10/20/22, what if Jacob Mohs has been accumulating the shares past few years and also bought the shares from Jonathan, Monk, etc.? By now he might be holding the controlling shares, the reason he wants to hijack this shell through custodianship.

SPAMming this board now to get the Naive to sign up/subscribe. Sad....

How Do Hedge Funds Manipulate the Stock Market?

https://franknez.com/how-do-hedge-funds-manipulate-the-stock-market/

So..did a hedge fund get custodianship of this?

To be honest, the EIGH corporate action never went thru in the past. The SEC was notified and did nothing to enforce the settlement rules and regulations of an identified naked short position. Correspondence between brokers even identified fails to deliver in the 8000 Inc disclosure statements. Also, If you remember, there were a few solutions to resolve this private security trading illegally on the OTC. One of them was to cancel all common and transfer to preferred with a new cusip. That cusip was created successfully. So it really boils down to how does a hedge fund take over the custodianship of a private entity that should not be trading electronically in the first place?

Well if the financing is there to support any reporting and handing fees with OTCM and the TA, Signature Stock Transfer, then I guess we shall see how it plays out.

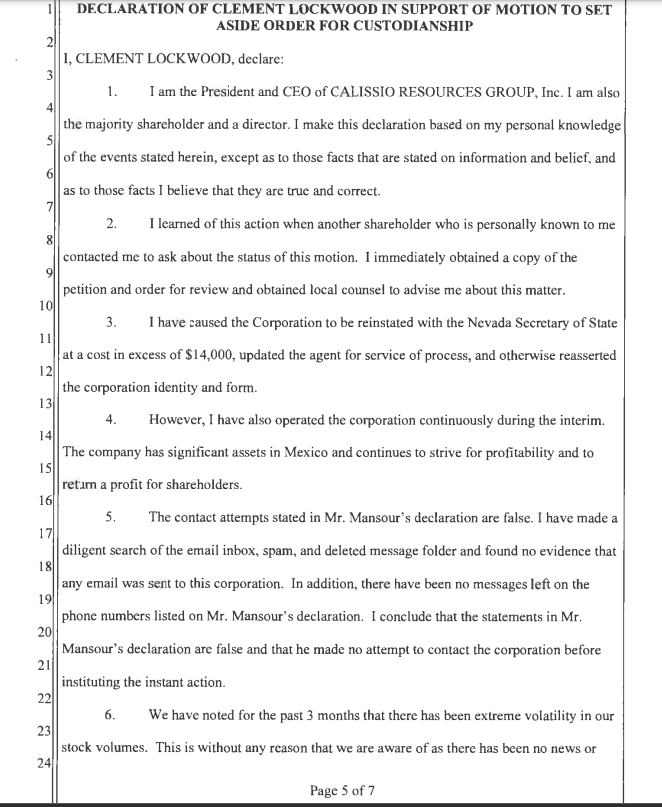

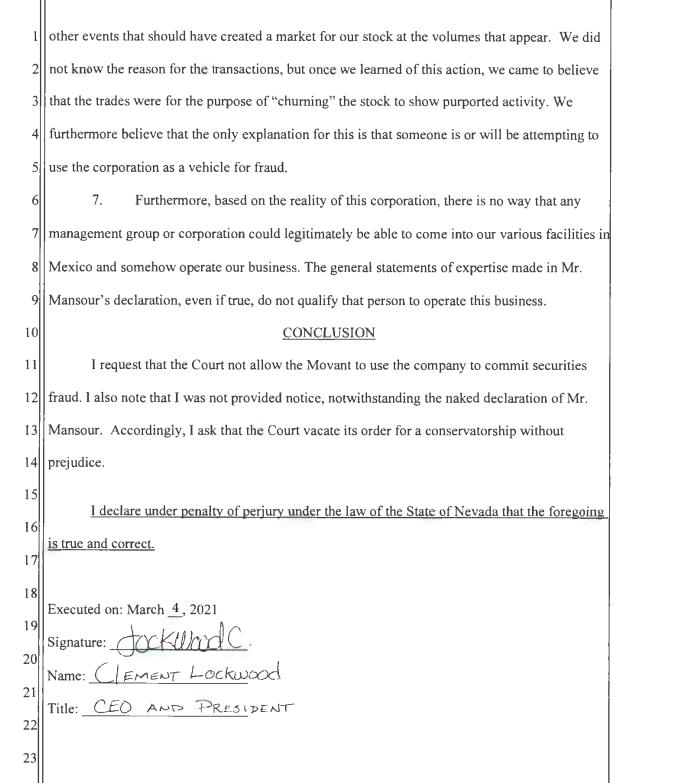

The problem is with the OTCM IDQS system. After all fillings are up to date and fees paid that need to be reviewed and processed, there is no guarantee any enforcement will be made. The 15c211 quotation process is broken. In my opinion, it is no different than CRGP (formerly their TA was Signature Stock Transfer) going private corporate action is stuck in right now. The attempted hijacking over custodianship certainly made things interesting (somehow quotation was granted and it traded for a year, I would assume illegally). All of that didn't change the fact that an imbalance of shares was identified in Nebraska court and was never resolved.

EIGH would be in the same situation where all of its securities trading on the OTC, which essentially are obligations (debt) that is illegal, would be required to be settled.

So is this another attempted hijacking or is this an entity protecting the shareholder's rights to what was perceived as real property when it was sold to them by their brokers?

Another example is the $MMTLP matter. Its was created via a special dividend as a private preffered security that was allowed to illegally trade. There is a pending corporate action in progress. Shareholders are stuck because of a FINRA U3 halt for "extraordinary events"

Seem like all 3 tickers CRGP, MMTLP, and EIGH are private securities by way of slight differences that should not be trading while the SEC, OTCM and FINRA do not know what to do because they got caught in their failures of governance in the financial system.

$EIGH

$CRGP

$MMTLP

Will this new custodianship move benefit the old shareholders of $EIGH who still own the shares?

Interesting facts on Jacob Mohs the new custodian of EIGH....

https://www.linkedin.com/in/jacobmohs/

https://alternativeliquidity.net/

Some Deals

https://www.marketscreener.com/quote/stock/LOOKSMART-GROUP-INC-120796116/news/Alternative-Liquidity-Index-LP-managed-by-Alternative-Liquidity-Capital-announced-an-offer-to-acqui-41294503/

https://www.marketscreener.com/quote/stock/SYNERGY-CHC-CORP-120795410/news/Alternative-Liquidity-Index-Announces-Offer-to-Purchase-Shares-in-Synergy-CHC-Corp-37726064/

https://www.sfexaminer.com/ap/national/alternative-liquidity-capital-announces-offer-to-purchase-jade-power-trust-cvrs/article_a3c078d2-82e6-5147-bb67-0fbe158672fc.html

https://www.sec.gov/Archives/edgar/data/1091596/000187041222000006/nuo_sc_to_cover_sheet.htm

https://www.benzinga.com/secfilings/22/12/29974560/strategic-realty-trust-inc-formsc-to-t-amended

Look at the address on his purchase and sale agreement

https://alternativeliquidity.net/wp-content/uploads/2022/12/Purchase-and-Sale-Agreement-Fillable.pdf

Why did he choose this space?

Conveniently next to Fidelity

https://www.officespace.com/mn/minnetonka/2145098-11500-wayzata-blvd

https://www.formds.com/issuers/alternative-liquidity-index-lp

Hedge Fund

https://www.sec.gov/Archives/edgar/data/1870412/000187041222000015/xslFormDX01/primary_doc.xml

https://www.sec.gov/Archives/edgar/data/1870412/000187041221000001/xslFormDX01/primary_doc.xml

https://www.prweb.com/releases/alternative_liquidity_index_lp_extends_tender_offer_for_grandview_missouri_tax_increment_revenue_bonds/prweb18288793.htm

As mentioned in the above link

https://westcoaststocktransfer.com/

The PAUSE Program lists entities that falsely claim to be registered, licensed, and/or located in the United States in their solicitation of investors. The PAUSE Program also lists entities that impersonate genuine U.S. registered securities firms as well as fictitious regulators, governmental agencies, or international organizations.

https://www.sec.gov/enforce/public-alerts/impersonators-genuine-firms/west-coast-stock-transfer-inc

Yes, he popped up during the time when SSM Monopoly tried to hijack the custodianship of CRGP. Sagar Raich showed proof to the Nevada State court that it was defrauded and the custodianship ruling was overturned to Clement Lockwood. An affidavit was filed with the court.

Jacob Mohs was attempting to buy private placements after CRGP was heavily shorted from .02. to trips...Just odd timing in my opinion. Not sure if this guy is the real deal or not.

Also during the SEC vs Johnathan Bryant litigation, JB answer to the complaint showed EIGH listed as a private company under 8000 inc, not 8000, inc.

The SEC identified 8000 inc as non-DRS eligible. So what is Jacob Mohs trying to do by taking custodianship over this entity?

$EIGH

#SEC

#OTCM

#FINRA

#Naked

#Short

#Fraud

#finrafraud

$MMAT

$MMTLP

$CRGP

$AMC

$GME

Jacob M - the new filer's name comes in Cascadia Investments.

He is a member of Alternative Liquidity Capital, google this company, interesting...

https://esos.nv.gov/EntitySearch/BusinessFilingHistoryOnline

$EIGH

12/30/2022 12/30/2022 20222844779 Certificate of Amendment by Custodian

12/30/2022 12/30/2022 20222844777 Certificate of Revival

12/30/2022 12/30/2022 20222844777 Annual List

Can someone with access validate this filing?

Recent filings for 8000, INC.

30 Dec 2022 CERTIFICATE OF AMENDMENT BY CUSTODIAN

30 Dec 2022 CERTIFICATE OF REVIVAL

https://opencorporates.com/companies/us_nv/E0538142007-6

#FINRA

#Naked

#Short

#Fraud

#finrafraud

$MMAT

$MMTLP

$EIGH

$CRGP

$AMC

$GME

Good to see you still around too onehundredmph.

Wow that is some good reading. Would love to see justice finally prevail.

[img]Thanks for pointing all that out. I'll keep an eye out for news regarding these matters.

[/img]

Also this happened recently

https://www.thinkadvisor.com/2023/01/24/finra-enforcement-head-to-step-down/

This person is responsible for the governance/review of the 15c211 and regsho data in the financial system for 18 years. Conflict of interest?

$EIGH

#NakedShortWar

Hi LoneGrey,

Its been forever, glad to see you around.

Are you following the mmtlp situation? I believe the illegal naked short practices that we have fought against in the past will finally be resolved.

Both securities are private which traded illegally on the OTC and had the same market makers involved. Both securities involved an issued a special dividend to expose a naked short. Even if EIGH had its dividend frozen, it still exposed it. The disclosure statements are a record reflecting the alleged crimes made against the company and requested the SEC and FINRA to enforce its settlement of transaction rules and regulations in order to protect investors, which it still has not done yet. The request for resolution is still open today.

Nothing happened with EIGH before 2016 because there was nothing to force the issue. All the naked short matters were hiding behind the immunity in the corporate veil of securities laws in the stock borrowing program at the DTCC/NSCC/Obligation Wharehouse.

Well all that changed after the Supreme Court decision allowed/opened the door for jurisdiction and liability to be used against all participants including the DTCC and FINRA.

https://www.crowell.com/NewsEvents/AlertsNewsletters/all/Supreme-Court-Allows-Securities-Related-Claims-to-Proceed-in-State-Court

This law opened the opportunity for all investors to defend their property in a court of law.

The margin requirements have also changed because of the realization of securitized debt obligations is plentiful and unmanageable in the financial system.

Many CEO's are joining efforts for the first time ever to defend their companies against these illegal practices.

CEObloc.com

Fyi in 2022 prior EIGH litigation can be considered unconstitutional by the Supreme Court.

https://www.heritage.org/the-constitution/commentary/secs-house-enforcement-action-ruled-be-unconstitutional

EIGH is still trading illegally with volume until this day.

I believe we have reached new territory here where a final resolution is upon us.

They're many court cases challenging FINRA right now via the mmtlp situation. The matter of naked shorting cannot be ignored anymore.

I believe Congress will have to get involved to force the regulatory agencies to do their functioning purpose in protecting the economy of the United States against the nefarious actions that threaten its stability.

The legal framework is all set for this to be resolved soon in my opinion.

All it takes is one company to expose it legally via "Discovery" and the pin to the grenade in the Obligation Wharehouse blows up and forces a massive settlement of failures to deliver in the system. Thats how I see it.

$EIGH

#NakedShort

I think she's done. Never to see the light of day again.

$EIGH Time and Sales 1/4/2023

$EIGH

$MMAT

$MMTLP

$CRGP

#FINRAFRAUD

#FINRACORRUPTION

#FINCEN

#SEC

#FBI

#NakedShort

#AMC

#GME

#CPayne

#SCOTUS

#DTC

#BIS

#Debt

#Money

#Supply

#Counterfeit

#Stolen

#Crime

#Wallstreet

#Senate

#Obligation

#Warehouse

#Wallstreetbets

#Duress

#Damages

#Locate

#News

#Media

#Stock

#Borrow

#Economy

#Market

#OTC

#Loan

#Margin

#Lending

#Interest

#Account

#Cash

#Crypto

#Offshore

#FX

#Trust

#Congress

#Treasury

#Currency

#Constitution

#Law

#Cusip

#Transfer

#Agent

#Broker

#Exclearing

#FailtoDeliver

This is one of the best legal discussions that describe in great detail the level of Naked Short Selling I have seen in the last 13 years of my trading and investor experience in the US market.

Excellent source of understanding on how significant the threat that exists against the economy of the United States and the theft of private property of its citizens/participants.

Every single EIGH shareholder should understand and share

Legal Advocate for Financial Reform

$MMAT

$MMTLP

$CRGP

$EIGH

$CDIV

#FINRAFRAUD

#FINRACORRUPTION

#FINCEN

#NakedShort

#AMC

#GME

#CPayne

#SCOTUS

#DTC

#BIS

#Debt

#Money

#Supply

#Counterfeit

#Stolen

#Crime

#Wallstreet

#Senate

#Obligation

#Warehouse

#Wallstreetbets

#Duress

#Damages

#Locate

#News

#Media

#Stock

#Borrow

#Economy

#Market

#OTC

#Loan

#Margin

#Lending

#Interest

#Account

#Cash

#Crypto

#Offshore

#FX

#Trust

#Congress

#Treasury

#Currency

#Constitution

#Law

#Cusip

#Transfer

#Agent

#Broker

#Exclearing

"We ask the SEC to take action as this information suggests (and, in our opinion prove). We believe the SEC and the public have been misled, probably defrauded and your rules (and those of FINRA) have been ignored. And for those reasons plead that the SEC and/or FINRA require a buy-in and/or take other preemptive regulatory action that will reverse this fraud upon both EIGH specifically and, more generally, public markets. "

https://www.otcmarkets.com/otcapi/company/financial-report/55376/content

Common:

SECURITY: E008256

8000 INC

CUSIP: 28251Q109

Preferred:

CUSIP NUMBER: 28251Q 208

ISIN NUMBER: US28251Q2084

ISSUE DESCRIPTION: PFD

https://www.otcmarkets.com/otcapi/company/financial-report/55379/content

$EIGH

#FINRAFRAUD

Very interesting video where a CEO reports FINRA tells him Naked Short positions in OTC Nasdaq companies moved offshore to avoid reporting the "Failure to Delivers"

Dec 13, 2022 - $MMTLP

— Copy&Paste©️ (@wdmorgan2) December 13, 2022

Interview with John Brda regarding MMTLP / META and FINRAs Corrupt practices https://t.co/CmxnVtFoq3

Squeeze, or a Jerry Williams (aka Mr. Monk) scam? Geeze, fun days tho!

Looks like you didn't make it to Easter. Butthay, you gott Christmas and the Superbowl in. Now you've been REVOKED.

Anybody hitting this ?

I know of a stock I think should run It’s a better option for me and lithium is to hot to pass up right now

Another trip to leave bagholders.

Damn shame

You are correct.

yeahh i couldnt find a shred of information regarding it

Looks like a pump and dump

whats going on here?

So it’s going to pop off here or what lol

Too bad this didn’t happen when EIGH & CDIV were still in the game, woulda been one heck of a squeeze.

|

Followers

|

462

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

111214

|

|

Created

|

08/14/07

|

Type

|

Free

|

| Moderators | |||

EIGH Share structure

http://www.otcmarkets.com/stock/EIGH/company-info

| Market Value | $1,438,240 | a/o Dec 31, 2010 |

| Shares Outstanding | 143,824,000 | a/o Sep 30, 2010 |

| Float | 72,391,750 | a/o Sep 30, 2010 |

| Authorized Shares | 700,000,000 | a/o Jun 30, 2010 |

| Par Value | 0.0001 |

8000 Inc (EIGH.PK) Statement to Shareholders –February 15, 2011

As previously announced, 8000 Inc. (EIGH.pk) is volunteering information to the SEC relating to (i) the

proposed merger with a non-shell trading Bulletin Board company as well as (ii) its demonstrable

evidence regarding its concern about a suspected manipulation including a naked short position, in its

common stock (estimated by the Company to be an amount greater than twice the reported float).

Today, the Company volunteered additional information to the SEC Staff collated from the transfer

agents transaction and certificate reports for the periods August 22, 2010 to September 30, 2010 and

October 1, 2010 to December 31, 2010.

The Company has publicly stated that, due to the many issues raised, the contemplated merger (and

associated share exchange) will be undertaken only through the recall and retirement of EIGH.pk

certificates. This position is further reinforced by the following facts identified in the transactional

statements.

? Shares were exchanged, traded or transferred by several brokerage houses during the period

of the Company’s trading suspension, November 4, 2010 to November 17, 2010.

? Several brokerage firms transacted internally, same day, the sale and purchase of large

numbers of shares not recorded in the trading day volume. The events so far recorded

equate to over 30% of the trading days.

? Over defined periods, the number of shares purchased and recorded as such by brokerage

firms was greater than the recorded trading volume

? Trading volume recorded for defined period was seen to be significantly less than the

transactional volume in over 60% of the trading days.

These events are not the only identified examples raising issues of improper trading of EIGH.pk They

do, however, lead the Company to the conclusion that the matters need to be investigated and the

decision to recall certificates in relation to the contemplated merger, being correct. The Company has

submitted all data and further findings to the SEC Staff and requested assistance with this matter to

the degree provable, highlighting all questionable events. The Company is further supported by the

now known issue of non-delivery of requested certificates to Shareholders, equally exampled and

relayed with the SEC Staff.

EIGH will continue to keep its shareholders apprised as events unfold. Also keep updated on 8000 Inc.

developments on Facebook or Twitter.

www.brand8000.com

www.8000incgroup.com

www.8000inc.net

1 0 4 3 2 B a l l s F o r d R o a d S u i t e 3 0 0 M a n a s s a s V i r g i n i a 2 0 1 0 9

-ENDS

8000 Inc (EIGH.PK) Statement to Shareholders –February 8, 2011

As previously announced 8000 Inc. (EIGH.pk) is providing information to the SEC relating to (i) the

proposed merger with a non-shell trading bulletin Board Company as well as (ii) its demonstrable

evidence regarding its concern about a suspected naked short position in its common stock

(estimated by the Company to be an amount greater than twice the reported float). Per requests

from the Staff, supplemental evidence from the shareholder, certificate and stock transaction lists is

being forwarded today. The Company has been copied as supporting factual representations by

Company shareholders directly to the SEC.

EIGH has advised the SEC Staff that it will issue a public statement about the proposed merger as soon

as it has concluded its due diligence. Meanwhile, the Staff has indicated that, consistent with their

policies in the area, it is aware of the Company’s and shareholder concern and proposed resultant

corporate actions. In that context, we understand the SEC Staff can’t provide legal advice or otherwise

express any views on the proposed corporate actions.

? As to the Company’s proposed merger as outlined; or

? To the Company’s intent to request shareholders return their common stock certificates for

recall (i.e., cancellation) as part of the transaction.

Because of the concerns expressed above, the Company will not release the name of the target entity

until after its due diligence review is concluded and upon the effective date of the share exchange.

The contemplated merger and associated share exchange between the two companies will be

undertaken solely through the receipt of 8000 Inc. stock certificates with the pro rata stock in the new

entity being issued electronically and directly to the shareholder account pursuant to an independent

opinion of counsel. Absent a surprise, the Company expects to issue direct instructions to its Transfer

Agent near term, most likely in the next two weeks. Shareholders are asked, in the interim, to

request physical delivery of their 8000 Inc. stock certificates from their brokerage firms in preparation

for the contemplated merger and exchange. Full details of the process will be issued at the end of the

due diligence review period as stated. The certificates will be verified against the Transfer Agent’s

records. No exchange of stock in the new, combined Company will be undertaken without the

provision of a physical certificate. Through this process, the Company hopes to address the

shareholder concerns and in so doing progress to a higher quotation and accountability.

EIGH will continue to keep its shareholders apprised as events unfold. Also keep updated on 8000 Inc.

developments on Facebook or Twitter.

www.brand8000.com

www.8000incgroup.com

www.8000inc.net

-ENDS

8000 Inc (EIGH.PK) Statement to Shareholder –February 3, 2011

8000 Inc. (EIGH.pk) announces that it has provided the SEC today additional details of EIGH’s

proposed merger with an OTCBB company per a February 2, 2011 SEC subpoena on the topic.

EIGH has confirmed with the SEC that it intends to issue a public statement about the status of the

current inquiry and has requested the following of the SEC Staff:

It has no objection to the Company’s proposed merger in the interim; and

It has no objection to EIGH’s request for its common stock certificates in the merger be

recalled [returned for cancellation] as part of the transaction.

Those discussions are expected to ensue shortly.

Legal Counsel, through a second submission, will be:

~ Providing documents identifying the individuals EIGH believes is responsible for the public

posting of fraudulent and false allegations made against the Company on internet investor forums

and blog sites.

~ Supporting evidence to prove clear association between ALL these matters, and the

individuals responsible, is also being given.

~ Submitting further information relating to the fraudulent use of the Company name and

marks (including factual documents identifying the recorded publisher of the illegal content on

www.8000inc.com (a former EIGH website that has been hijacked) and the associated parties.

Shareholders and the public should also be aware that due to the apparent refusal of at least one

brokerage firm to provide a physical certificate to one of its clients, an independent EIGH shareholder,

a complaint has been filed with the SEC and a case number now formally allocated.

EIGH will continue to keep its shareholders apprised as events unfold. Also keep updated on 8000inc

developments on Facebook or Twitter

www.brand8000.com

www.8000incgroup.com

www.8000inc.net

-ENDS

This news release contains forward-looking statements that are subject to certain risks and

uncertainties that may cause actual results to differ materially from those projected on the basis of

such forward-looking statements. The words "estimate," "project," "intends," "expects," "believes,"

and similar expressions are intended to identify forward-looking statements. Such forward-looking

statements are made based on management's beliefs, as well as assumptions made by, and

information currently available to, management pursuant to the "safe harbor" provisions of the

Private Securities Litigation Reform Act of 1995. For a more complete description of these and other

risk factors that may affect the future performance of 8000 Inc., see published disclosure documents

at www.OTCMarkets.com. Readers are cautioned not to place undue reliance on these forward looking

statements, which speak only as of the date made and the Company undertakes no obligation

to disclose any revision to these forward-looking statements to reflect events or circumstances after

the date made or to reflect the occurrence of unanticipated events.

8000 Inc. (EIGH.pk) Announces Proposed Merger (January 31, 2011)

8000 Inc., a Nevada Corporation currently traded on the OTCMarkets Pink Sheets (EIGH.pk), today announced that they have conditionally signed an agreement in connection with the pending merger and acquisition of a currently trading, non-shell Bulletin Board Company, current in its filings. The Board of 8000 Inc. has approved this merger under Nevada state law whereby there will be no change to the rights, ownership or conditions for all shareholders after the merger is completed.

Due to the current public shareholder concerns and speculation relating to the common stock of 8000 Inc., the transaction and will remain under the current signed Non-Disclosure Agreement (“NDA”) until concluded. The agreement has placed a 14 day time frame, commencing today, January 31, 2011 for completion as dictated by the NDA and agreed respective due diligence over the period. The Company, because of the existing inquiry, voluntarily informs the SEC of all its substantive corporate actions.

The acquisition, if consummated as expected, is being structured as an exempt share exchange transaction between the shareholders of the two companies with 8000 Inc. stock being exchanged for stock in the Bulletin Board Company pursuant to an opinion of third party independant counsel being provided accordingly. Due to the fact that 8000 Inc. (EIGH.pk) is non-DTC eligible, 8000 Inc. shareholders will be asked to request delivery of their shares in paper certificate form from their brokerage accounts. All existing shareholders will then be asked to send their certificates, and DTC delivery instructions for their brokerage accounts, to the Company’s Transfer Agent, Signature Stock Transfer Inc. On receipt of the paper certificate, the Transfer Agent will verify and confirm ownership, and 8000 Inc. certificates will be exchanged with shares in the new combined [or merged] Company via DTC. No exchange of shares will be undertaken until the TA has received the paper certificate and verified ownership by the shareholder. Detailed instructions will be made available to all shareholders within 5 days of the due diligence period outlined above.

For more information please visit: www.brand8000.com www.8000incgroup.com www.8000inc.net

Or contact:

investors@8000inc.net

Also keep updated on 8000 Inc developments on Facebook or Twitter

-ENDS-

This news release contains forward-looking statements that are subject to certain risks and uncertainties that may cause actual results to differ materially from those projected on the basis of such forward-looking statements. The words "estimate," "project," "intends," "expects," "believes," and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are made based on management's beliefs, as well as assumptions made by, and information currently available to, management pursuant to the "safe-harbour" provisions of the Private Securities Litigation Reform Act of 1995. For a more complete description of these and other risk factors that may affect the future performance of 8000 Inc. see published disclosure documents at OTCMarkets. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made and the Company undertakes no obligation to disclose any revision to these forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events.

November 22, 2010 9:15 AM ET

MANASSAS, VA, Nov. 22 /PRNewswire/ - On November 8, 2010, the Company became the subject of a trading suspension and an SEC Subpoena "In the Matter of Monks Den."

The trading suspension, which related principally to questions about the accuracy of certain press releases, was lifted at 11:59PMNovember 17, 2010.

The Subpoena required the submission of documents and testimony of certain persons associated with the Company relating principally to its relationship with Monks Den. Through its legal counsel and advisors, the Company and such Subpoenaed persons are cooperating fully with all requests from the SEC, have submitted the documents required under the Subpoena and the first of at least two SEC depositions to be given in this matter is scheduled for Monday November 22, 2010.

Preliminarily, the Company wants to state publicly:

In fact, the Company would like to clarify and make public the following:

While the Company regrets the trading suspension and investigation, it is more troubled with the scurrilous comments and false statements about the Company.

The Company will continue to inform and update its investors accordingly.

This news release contains forward-looking statements that are subject to certain risks and uncertainties that may cause actual results to differ materially from those projected on the basis of such forward-looking statements. The words "estimate," "project," "intends," "expects," "believes," and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are made based on management's beliefs, as well as assumptions made by, and information currently available to, management pursuant to the "safe-harbour" provisions of the Private Securities Litigation Reform Act of 1995. For a more complete description of these and other risk factors that may affect the future performance of 8000inc. see "Risk Factors" in the Company's Annual Report on Form 10-KSB and its other filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made and the Company undertakes no obligation to disclose any revision to these forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events.

SOURCE 8000inc

http://articles.moneycentral.msn.com/news/article.aspx?feed=PR&Date=20101122&ID=12440045

8000inc Web Site

Click Image to visit

10432 Balls Ford Road

Suite 300

Manassas, VA 20109

Phone: 1-703-881-7834

Fax: 1-703-881-7601

E-mail: enquiries@8000inc.net

2632 Coachlight Ct.

Plano, TX, 75093

972-612-4120

SignatureStock@aol.com

Note to shareholders: There are no liabilities or debts carried forward for 8000 Inc. or its shareholders from the previous activities of the subsidiary Cannonball 8000.

Chart:

The Breitinger Agency was acquired for 22M restricted shares of 8000 inc. common stock. The acquisition was completed on the 19th November 2009 with The Breitinger Agency becoming a wholly owned subsidiary of 8000 Inc.

The principle motivation for the acquisition was a significant branding opportunity. The Breitinger Agency has good foundations within a competitive status market and needed financial stability and opportunity to maximise its presence. 8000 inc. was able to provide this stability and financing and is so doing expanded its brand reach into a new market, new country and position itself within a high profile brand-reliant market.

8000inc (EIGH.pk) has teamed up with an exclusive London Fashion House to design, develop and produce the first two 8000inc clothing lines.

Negotiations are underway with a worldwide distributor, with stores bidding for exclusive rights to sell this exciting new collection of aspirational clothing, sportswear and accessories from the 8000inc brand.

Below: Brand8000 had huge presence at the games in Barbados on 03/17/10

Brand8000 promotion in limegrove.com

Look at and compare other brands in the list with Brand8000. It's HUGE. Where this one is heading?

Sponsorship

8000 inc. has also agreed to sponsor a potential 2012 Olympic track and field star. The sponsorship will provide funding for training costs and expenses to ensure a full focus on the 2012 games is maintained. Currently, designers are putting together ideas and swatches for company branding on training and promotional kit. Full details will be announced during December 2009 and a full biography will be released.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |