Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Sure. But I also know they are working and moving forward the business right now. That give me hope.

I think we should hear something soon.

Before April 1st.

We ain't gonna hear J.S! Hopium for the last decade and counting.

Buddy, do you think we will hear good news this month ?

Let's see if anything positive comes from the meeting for the new edition of 3PowerEnergyGroup

results.

Actually everything is very simple. They are expected to provide PSPW with over $500 million.

With a good workforce of at least 300 professionals and in one or two years there will be a profitable company and of course also for the shareholders.

Projects capitalization and foresight. All strong traits exhibited by the management of this endeavor

Our day is close is close for a Peace of mind after all these years. best to all the longs!

During the "head-to-head" meeting with the president of the United Emirates, the topic of discussion is revealed

WRITTEN BY SOT.COM.AL

14 FEB 2024

The head of the government, Edi Rama met with the president of the United Emirates, Muhammed Bin Zayed Al Nayan in Abu Dhabi.

The Prime Minister stated that during the meeting the progress of strategic projects in the field of energy, tourism, infrastructure and security was discussed.

As he revealed that the free trade agreement will be signed soon.

"Honored by the friendship and hospitality at the home of the President of the United Emirates, Muhammed Bin Zayed Al Nayan, with whom we talked about the progress of major strategic projects in the fields of energy, tourism, infrastructure, security, as well as the trade agreement free that we will sign soon", writes Rama.

https://sot.com.al/english/politike/rama-takim-koke-me-koke-me-me-presidentit-e-emirateve-te-bashkuara-zbar-i643175

Without investments in energy for 3 years, Balluku from Pogradeci: The pandemic and the war in Ukraine damaged us economically

From OraNews

Last update 14 February 2024,

The government had to stop some investments in infrastructure and energy for 3 years due to the pandemic or the war in Ukraine.

In an inspection at the Pogradec electrical substation, Deputy Prime Minister Belinda Balluku emphasized that the year 2024 has come with a new spirit and promising projects for the country.

The pandemic, the aggression in Ukraine as well as other external factors that have affected the economy, have forced the government to curb investments in infrastructure and energy.

Deputy Prime Minister Belinda Balluku during the inspection of the electrical substation works in Pogradec emphasized that the last 3 years have been extremely difficult.

"After 2020, with the start of the pandemic, we had to stop the investments that were then followed by the post-pandemic, and then with the energy crisis as a result of the Russian aggression in Ukraine," said Balluku.

According to Balluk, 2024 has come with a good investment plan.

"This is the first year that we have a good investment plan," said Balluku.

The cities with the highest number of tourists have priority in terms of new energy projects.

As for the electrical substation in Pogradec, the works according to number two of the government will be completed in December of this year.

https://www.oranews.tv/ekonomi/pa-investime-ne-energji-per-3-vite-balluku-nga-pogradeci-pandemia-dhe-lu-i1139381

Just came across an interesting stock ( AMRRY ) on OTCQX, it ran up to $16 from $0.01 in just two days with only 60k volume. Hope to see PSPW run in a similar way with several million volume very very soon. Let's rock and roll , Mr. Falak. Go, PSPW !!!!!!!!

Over that time frame have made some decent coin

But if I was more disciplined, could have made a lot lot more

Bad, maybe it will finally help to invest millions in PSPW. Climate developments do not stop at the UAE either.

https://www.n-tv.de/mediathek/videos/panorama/Hagel-und-Wassermassen-ueberraschen-Oasenstadt-article24732806.html

Sincerely wish we loyal longs will get our big deserved reward this month. Mr. Falak show us the money. Go, PSPW ! ! ! 👍️

2024 has got to be the year PSPW gets going. It’s do or die imo. After so many years of share price stagnation it’s become easy to expect more of the same. When this launches it may take a while to trust that gains will hold. At what point will any of us sell shares? I look forward to having the opportunity to take a few gains!

I hope my xrp doesn’t mimic pspw… if so I will be going through a divorce…

Sounds like my story.. however my account at the time was like 250…

Two sec. lawyers called me for deposion twice on Brook. Not sure what happened to him but he seems to be off the radar around here!!

Lol, It was my introduction to the pennies, from WindTamer and Brock to PSPW

A very expensive lesson, my account was north of $400k at the peak of that 2 day run. Sold Nothing!

And still a hard lesson for me to apply when your stock is flying to new highs daily

I have had to relearn that lesson more than once

Looking back we should have listened to choi.

YEP, IT PAINS ME TO EVEN THINK ABOUT IT!!!

Glad to see a lot of our loyal longs are still here. We will be greatly rewarded very very soon. Go, PSPW ! ! !

My first post here was 3/10/11.

It certainly was an exciting ride back then and all I wanted was to make enough money to get a riding mower.

And the daring toby

Nice to see some old faces! We’re all either the smartest ones or…

My first post 2/6/11... still have shares

Ahhh, The days of Seawind and our intrepid insider, the Mighty Zoedog!!!!

Only mistake from that time is I sold enough to have free shares then bought back on that Monday. Should have done what I planned then and learned a lesson.

I remember ed3 and I think future from those days. Yeah that 2010 run was wild. I missed out on selling everything and ending up holding some. Turned out to be a bad idea lol never got that bounce back. Before I knew it, there was no point in selling the shares and completely forgot I still had them till 2 nights ago. I mean, I’ll most likely never get my money back but it brought back some memories from my younger years

I've been here since March 2011. I am keeping my fingers crossed.

Me and walk? Guess you are known for the company you keep!!!

Have been here for all highs and lows. The fake high with our installed CEO a builder and a plan. To the cancelled contracts and my personal panic when I actually had 200+ k shares and hope . Through it all have stayed here with our band of inglorious bastards with the hope that something good might finally show up. As future you and David have stuck it out I have stuck with you. Maybe some day is our mantra and hope

Right here, feb./2011 and loaded heavy with shares. If this lottery ticket hits , a major life changer.

Wish the patience of us the loyal longs will be paid off big time this month. Go, go, go, PSPW ! ! !

Still hangin around. Long ways from the windmill days!!

My first post here was 1/31/2011. The only name still here from back then is Wakl! He was 1/27/2011. Anybody else from January 2011 still lurking here? PSPW

Its crazy how long everyone held!! I dont think we will repeat this in stock history unless its another billionaire run!!!!!!??????

Dispute me still being here

Hey welcome to the board!! I missed that run. I started loading at 2 cents in 2013 and look its still only worth 1/2 cent!!!

Trading will resume once the filings are filed. 6 years worth imo and hopefully there is done solid news.

This is a billionaires owned company. Anything is possible!!!

Hopefully we meet all criteria soon with updated Filings and uplift as they stated years ago.

How Does a Stock Move From OTC to a Major Exchange?

https://www.investopedia.com/ask/answers/08/otc-nyse-nasdaq.asp

By KEN CLARK Updated December 04, 2021

Reviewed by CHIP STAPLETON

Fact checked by MARCUS REEVES

Over-the-counter markets can be used to trade stocks, bonds, currencies, and commodities. This is a decentralized market that has, unlike a standard exchange, no physical location. That's why it's also referred to as off-exchange trading. There are many reasons why a company may trade OTC, but it's not an option that provides much exposure or even a lot of liquidity. Trading on an exchange, though, does. But is there a way for companies to move from one to the other?

Read on to find out more about the difference between these two markets, and how companies can move from being traded over-the-counter to a standard exchange.

KEY TAKEAWAYS

Over-the-counter securities are not listed on an exchange, but trade through a broker-dealer network.

Companies can jump from the OTC market to a standard exchange as long as they meet listing and regulatory requirements, which vary by exchange.

Exchanges must approve a company's application to list, which should be accompanied by financial statements.

Some companies choose to move to get the visibility and liquidity provided by a stock exchange.

OTC vs. Major Exchange: An Overview

Over-the-counter (OTC) securities are those that are not listed on an exchange like the New York Stock Exchange (NYSE) or Nasdaq. Instead of trading on a centralized network, these stocks trade through a broker-dealer network. Securities trade OTC is because they don't meet the financial or listing requirements to list on a market exchange. They are also low-priced and are thinly traded.

OTC securities trading takes place in a few different ways. Traders can place buy and sell orders through the Over-the-Counter Bulletin Board (OTCBB), an electronic service offered by the Financial Industry Regulatory Authority (FINRA).

1

There is also the OTC Markets Group—the largest operator of over-the-counter trading—which has eclipsed the OTCBB. Pink Sheets is another listing service for OTC penny stocks that normally trade below $5 per share.

Securities listed on major stock exchanges, on the other hand, are highly traded and priced higher than those that trade OTC. Being able to list and trade on an exchange gives companies exposure and visibility in the market. In order to list, they must meet financial and listing requirements, which vary by exchange. For instance, many exchanges require companies to have a minimum number of publicly-held shares held at a specific value. They also require companies to file financial disclosures and other paperwork before they can begin listing.

Mechanics of Moving

It isn't impossible for a company that trades OTC to make the leap to a major exchange. But, as noted above, there are several steps it must take before they can list.

Companies looking to move from the over-the-counter market to a standard exchange must meet certain financial and regulatory requirements.

The company and its stock must meet listing requirements for its price per share, total value, corporate profits, daily or monthly trading volume, revenues, and SEC reporting requirements. For example, the NYSE requires newly listed companies to have 1.1 million publicly held shares held by a minimum of 2,200 shareholders with a collective market value of at least $100 million.

2

Companies that want to list on the Nasdaq, on the other hand, are required to have 1.25 million public shares held by at least 550 shareholders with a collective market value of $45 million.

3

Second, it must be approved for listing by an organized exchange by filling out an application and providing various financial statements verifying that it meets its standards. If accepted, the organization typically has to provide written notice to its previous exchange indicating its intention to voluntarily delist. The exchange may require the company to issue a press release notifying shareholders about this decision.

While a lot of fanfare may occur when a stock is newly listed on an exchange—especially on the NYSE—there isn't a new initial public offering (IPO). Instead, the stock simply goes from being traded through the OTC market to being traded on the exchange.

Depending on the circumstances, the stock symbol may change. A stock that moves from the OTC to Nasdaq often keeps its symbol—both allowing up to five letters. A stock that moves to the NYSE often must change its symbol, due to NYSE regulations that limit stock symbols to three letters.

Why Switch Stock Exchanges?

There are a variety of reasons why a company may want to transfer to a bigger, official exchange. Given its size, companies that meet the requirements of the NYSE occasionally move their stock there for increased visibility and liquidity. A company listed on several exchanges around the world may choose to delist from one or more in order to curb costs and focus on its biggest investors. In some cases, firms have to involuntarily move to a different exchange when they no longer meet the financial or regulatory requirements of their current exchange.

A Dow-Inspired Departure

Although the NYSE may seem like the pinnacle for a publicly-traded company, it may make sense for a company to switch exchanges. For example, Kraft Foods, once one of the 30 companies in the Dow Jones Industrial Average, voluntarily left the NYSE for the Nasdaq, becoming the first DJIA company ever to do so. At the time of the move, Kraft was planning to separate into two companies. That decision, coupled with the Nasdaq's significantly lower fees, prompted the switch.

For most companies, however, the marriage to an exchange tends to be a lifetime relationship. Relatively few companies voluntarily jump from one exchange to another. Charles Schwab is an example of a company moving back and forth between the NYSE and the Nasdaq.

4

Delisting

Delisting occurs when a listed security is removed from a standard exchange. This process can be both voluntary or involuntary. A company may decide its financial goals aren't being met and may delist on its own. Companies that cross-list may also choose to delist their stock from one exchange while remaining on another.

Involuntary delistings are generally due to a company's failing financial condition. But there are other reasons why a stock may be forced to delist. If a company shuts down, goes through bankruptcy, merges or is acquired by another company, goes private, or fails to meet regulatory requirements, it may be required to delist involuntarily. Exchanges will normally send a warning to the company before any action is taken to delist.

Seems our big winning day is very close. Drop that bomb please, Mr. Falak. Go, go, go, PSPW ! ! !

I have zero idea why pspw popped into my head today after 14 years. I also have no idea what drew me back to this website after all those years (under new account) but here I am. Maybe nostalgic purposes. I feel like I still notice a couple names from those times as well. I logged into my trading account after all these years just to see where I had purchased at. $.34. Wild no? That run in I believe 2010 was a fun time. 21 years old. No clue what I was doing. Just “fuck it, let’s ride it out”. Good times

Just wait until PSPW is moving $1/day or multiple $$ in a day! Talk about a mind blowing experience that’ll be! For most of us.

With disappearing ink. Lol

Finally i got some spending cash on paper!!!

The Company is not required to file Current and Periodic Reports with the U.S. Securities and Exchange Commission and the Company’s status as a voluntary filer may have consequences for investors’ ability to access relevant and timely information about the Company.

The Company is a “voluntary filer” with the U.S. Securities and Exchange Commission. This means that the Company is not required to file Current and Periodic Reports with the U.S. Securities and Exchange Commission. The Company is not a fully reporting company that is subject to review under Section 408 of the Sarbanes-Oxley Act of 2002. Furthermore, the Company is not subject to the going private rules and certain tender offer regulations, and the beneficial holders of the Company’s securities do not need to report on acquisitions or depositions of the Company’s securities or their plans regarding their influence and control over the Company. Therefore the Company’s status a voluntary filer reduces investors’ rights to access significant information regarding the Company and its controlling shareholders.

https://last10k.com/sec-filings/pspw/0001144204-12-039689.htm

"We believe in the success of 3Power and we will continue our support to the company," said Mohammed Falaknaz, chairman of 3Power and vice president of Falak Holding

This is a vote of trust in our company future and business plan.

New Interview with Mr.Falaknaz (view 36 minutes into)

https://www.youtube.com/watch?v=m3tVFks20kQ

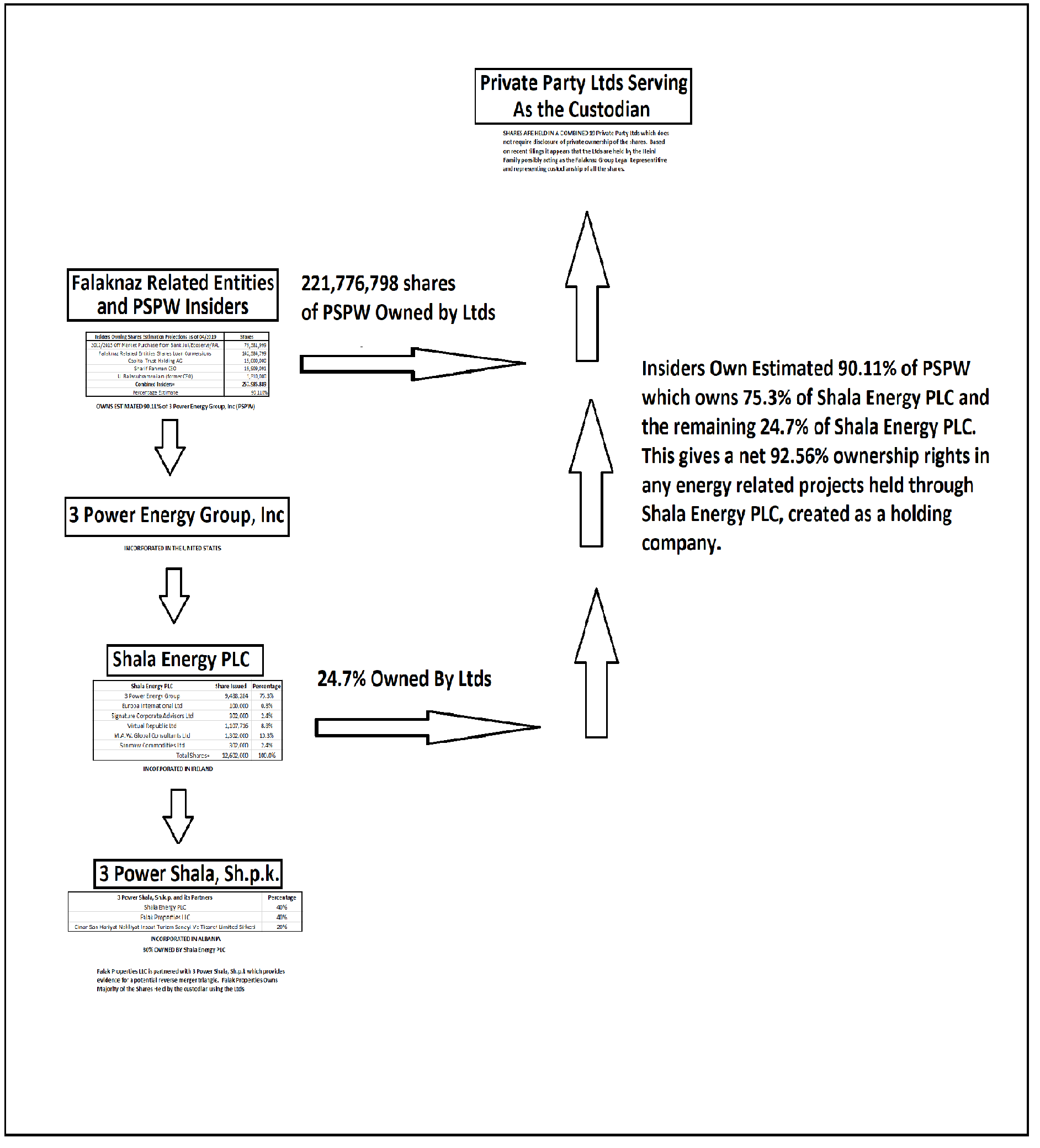

3Power Energy Group Subsiduaries

Shala Energy PLC (Majority owned 75.3% by PSPW as of 11.6.2017 per Ireland Filing 2/5/2018)

3 Power Shala Sh.p.k (Majority owned 80% by Shala Energy PLC)

3Power Energy Group Subsiduaries Flow Chart

| Shares Outstanding | 286,301,430 | a/o June 1, 2018 |

| Authorized Shares | 300,000,000 | a/o June 1, 2018 |

| Public Float Estimate | 21-28 million shares |

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001221554&type=&dateb=&owner=include&count=100

Nevada SOS Entity Details (Actively Registered)

http://nvsos.gov/sosentitysearch/CorpDetails.aspx?lx8nvq=edQVDEOyd14Pu94MlD0CQA%253d%253d&nt7=0

http://www.otcmarkets.com/stock/pspw/

Disclaimer - the moderators of this board are not registered financial advisors and are not recommending the securities of this company to purchase or to sell, and may hold positions bought in the open market, which we may liquidate without notice from time to time. Please do your own due diligence, and make your own investment decisions. These are opinions based on data collected from publically available sources throughout the world. We are not responsible for losses or gains and recommend getting professional advice if needed.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |