| Followers | 71 |

| Posts | 1651 |

| Boards Moderated | 0 |

| Alias Born | 02/18/2010 |

Thursday, November 04, 2010 12:41:09 PM

MOUNT PEARL, Newfoundland--(BUSINESS WIRE)--Kat Exploration (OTC-Pink Sheets: KATX) is happy to report that its exploration program carried out this summer on its 100% wholly owned “Lucky” Property has been a real success.

Copper mineralization is quite visible in an old pit near a gravel road and impressive malachite staining along with chalcocite is strata bound within the more sandy beds of the sediments. The horizon that contains the mineralization has been traced for approximately 8 miles with copper mineralization at a thickness of 300ft in places. Assay results of 2.5% Cu [COPPER]were discovered in the most exposed areas within this horizon. The most recent work uncovered several large areas of semi-massive to well disseminated chalcopyrite approximately 4 miles on strike from the open pit which reveals the highest copper grades to date.

This type of environment has the potential to produce low grade, large tonnage copper deposits similar to those of the Zambia copper belt.

To secure an area of interest the company recently staked 1225 acres of new land mass where some recent grab samples produced copper results of .5% along with anomalous gold.

More ground work is planned for the Northern portion of the property where the most recent copper occurrences were discovered.

In its future endeavors the company would hope to ensure non-dilutive options where the merits of the projects will fund the operations. As one of the co-founders of Cornerstone Resources Inc., who had done joint ventures with major mining companies such as Noranda, Phelps Dodge, and other major companies, Mr. Stead is quite familiar with world class mining companies and is confident in bringing their interest to Kat’s projects as they move forward. Future press releases will provide more updates to confirm more guidance on the direction of the company.

http://ca.news.finance.yahoo.com/s/23112009/34/biz-f-business-wire-kat-exploration-report-recent-discoveries-its-lucky-property.html

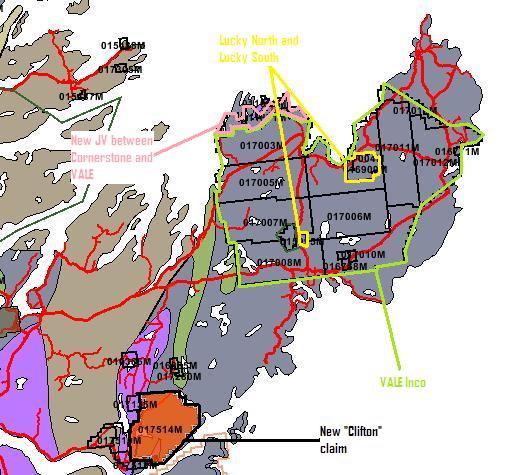

KAT Exploration Signs Three-Year Option Agreement Contract With Vale

MOUNT PEARL, NL--(Marketwire - June 11, 2010) - KAT Exploration Inc. (PINKSHEETS: KATX) ("KAT") is pleased to announce that it has signed an option agreement with Vale Exploration Canada Inc. ("VEC"), a wholly-owned subsidiary of Vale S.A. ("VALE"), on its North and South Lucky copper properties on the Bonavista peninsula in eastern Newfoundland. Under the terms of the agreement, VEC has committed to an initial C$20,000 cash payment on signing and may elect to make further cash payments totaling C$75,000 over the three-year option period, and may elect to incur a minimum of C$750,000 in exploration expenditures within the option period to earn an 80% interest in the Lucky properties.

Upon VEC's exercise of the option, a joint venture will be formed to further develop the properties, with each party contributing to further approved exploration programs as per their interest. VEC will be the operator of the exploration programs during the option period.

The Lucky properties are in a geological setting with the potential for sediment-hosted stratiform copper (SSC) deposits. The Lucky properties have the potential to produce low-grade, large tonnage copper deposits similar to those of the Zambia copper belt.

Ken Stead, President/CEO of KAT, states, "The very fact that a company of Vale's caliber has enough interest in the area and sees enough potential in the Lucky properties to warrant an option with KAT, leaves us very excited. We are very pleased to be exploring these copper properties with Vale and look forward to bringing them to their full potential."

The Lucky properties are located on the Bonavista Peninsula in eastern Newfoundland, and are accessible by well-maintained roads, allowing for exploration programs to be carried out fairly quickly and comfortably.

Copper mineralization is quite visible in an old pit near a gravel road with impressive malachite staining along with chalcocite strata bound within the more sandy beds of the sediments with assay results of 2.5% Cu in the more concentrated areas. The most recent discovery was on our North Lucky property where well-disseminated chalcopyrite was found in exposed outcrop approximately 10km north of the South Lucky property.

About KAT Exploration Inc.

KAT Exploration's principal objective is to locate, stake, prove up and sell mineral properties to major mining companies. It is the Company's objective to take advantage of increased activity to generate numerous joint venture clients, and sales of our existing and yet to be acquired properties.

About VEC

VEC is a wholly-owned subsidiary of Vale, the world's second largest mining company by market capitalization, with its headquarters in Brazil. Vale is committed to the pursuit of sustainable growth by operating with respect for the natural environment and being an ethically and socially responsible company.

Jack Zwicker

KAT Exploration Inc.

Investor Relations

Ph 902-497-3188

jzwicker@katexploration.com

http://www.katexploration.com

http://www.marketwire.com/press-release/KAT-Exploration-Signs-Three-Year-Option-Agreement-Contract-With-Vale-1274884.htm

EMAIL FROM KEN STEAD RE: THE SIGNIFICANCE OF VALE DEAL

Posted by: siljie Date: Saturday, June 12, 2010 9:28:00 AM

In reply to: None Post # of 61799

Email response from Ken for some insights:

My QSN: First of all, I'm excited that Vale is interested! Well done, and congratulations to all of us! The PR says that VALE has paid $20,000 (and possible 75,000 for extending this 3 yrs) to own the option to JV with KATX. If Vale chooses to spend at least .75 million for exploration costs, they then own 80% of the claims, and 20% stays with KAT. My first question is, what if Vales does not choose to do this, but chooses to exercise the option to JV, what kind of terms might we be looking at, and is it better for KATX to fund the exploration ourselves, prove up reserves and get a more valuable deal?

Ken's ANS: First off, the $20K & $75K is money that is paid at the beginning of each anniversary date is just to cover the cost of administration. No major company will pay much of anything until they are pretty certain there's something there. If Vale does not complete the 3 year deal and spend .75 million (which would take them to a feasiblity study so they know there's a deposit there) then the property returns to KAT 100%. The advantage KAT has is, VALE is building a $2.5 billion refinery just to the south of the Lucky properties and need copper for process. If there is a deposit there worth mining they will not sit on it as that’s their reason for working… in such an urgent way.

My QSN: 2ndly, why has KATX agreed to give up 80% of its interests in return for this sub-million exploration cost, the exchange appears vastly disproportionate? I am not knowledgeable on the mining industry, so I'm not sure if really the 80:20 will turn out to be a really balanced exchange eventually accounting for all associated costs etc (I don't know these). And/Or perhaps it is justified to significantly sweeten the deal for VALE for subsequent dealings to work out in our favour. Please give me some insights into these.

Ken's ANS: After the 3 year option is execised then comes a feasibilty study which would cost nothing less then $50 million to which Vale will have to pay 80% of the cost. If there is not an ecomomical deposit then we've saved our money and Vale has wasted its. Also, most deals like this for a smaller company like KAT might just stand the chance of only being able to retain a 2% NSR(net smeltering royality). A copper/silver deposit such as could possibly be on the Lucky property has the potential to be valued at $5 billion and much more. That being the case KAT owning 20% of the deposit would equal in value of $1 billion for KAT, which any company would be happy to own. Therefore 20% of an economical deposit has tremendous value for a company.

I sent this today around noon time Europe, and got a reply in 45min.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=51220992

So how significant would that 20% be for us? Have a look at some of the deals these junior exploration companies worked out that made them worth BILLIONS: http://miningmarkets.ca/issues/story.aspx?aid=1000334564&type=Print+Archives

Now take a look at our Lucky properties.

-graphic courtesy of Rick-UK

Read more here http://investorshub.advfn.com/boards/read_msg.aspx?message_id=50326701

Oh yes, and:

MOUNT PEARL, Newfoundland, July 2, 2009 (GLOBE NEWSWIRE) – Kat Exploration Inc. is pleased to announce its "Lucky" Property is ready for drilling.

http://finance.yahoo.com/news/Kat-Exploration-Announces-pz-2778940824.html?x=0&.v=1

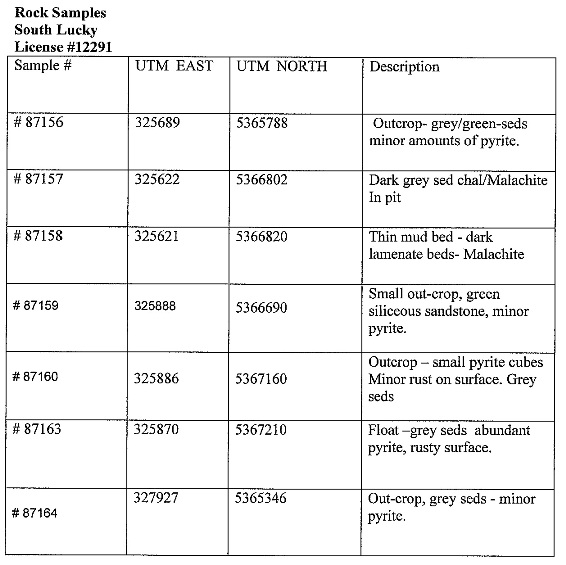

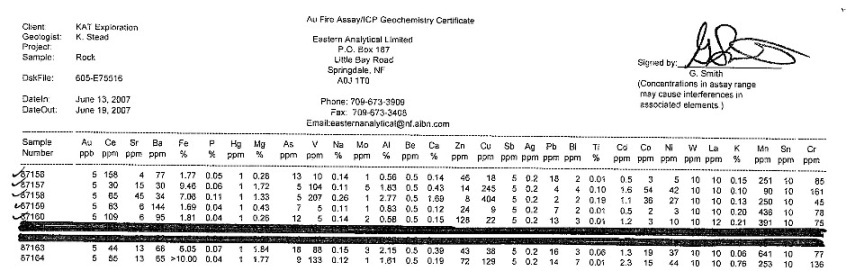

Here’s some data from previous work done on South Lucky (see whole report at http://gis.geosurv.gov.nl.ca/geofilePDFS/ReceivedBatch22/002C_0178.pdf ):

-Thanks to “homevendor” for finding this one.

NOTE: to convert ppm (parts per million) to percent (%) divide the ppm value by 10,000

Recent KATX News

- Form 10-K - Annual report [Section 13 and 15(d), not S-K Item 405] • Edgar (US Regulatory) • 06/20/2024 11:58:38 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM