Tuesday, November 21, 2023 1:44:08 AM

The September 2019 Mnuchin's Treasury Housing Reform plan was released pursuant to a Presidential Memorandum.

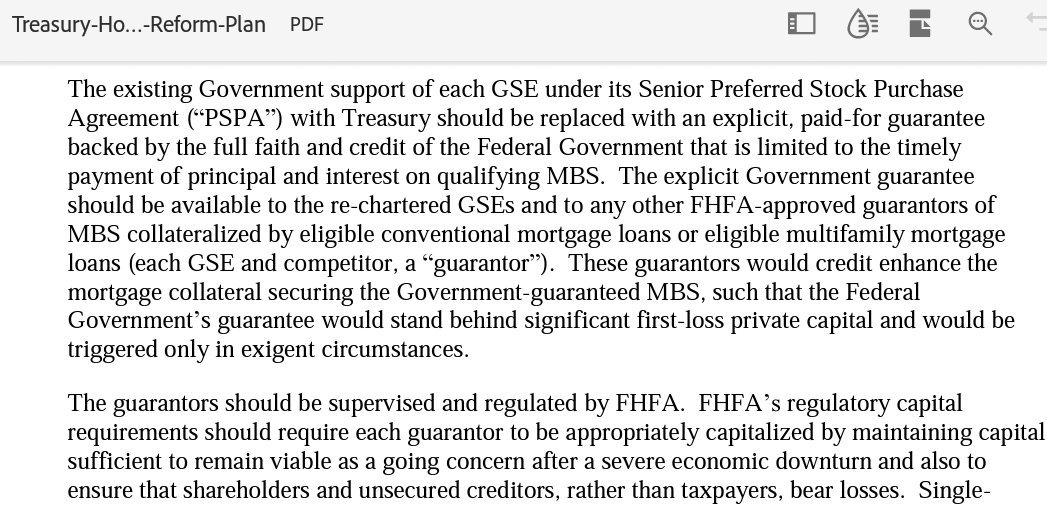

Mnuchin outlined his vision for America with a China-sponsored Government Explicit Guarantee on MBS.

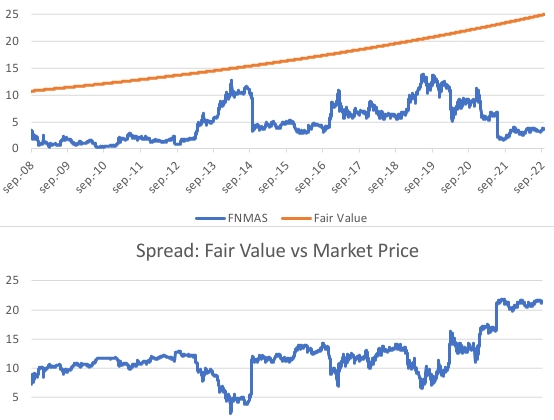

This is why the FHFA first priced the Resecuritizations in FnF, unveiled by Freddie Mac in June 2022, at 50 bps. Later it was changed to 9.375 bps when they realized that the Trump Administration got it all wrong in its broad alliance with China, because Trump was just attempting to substitute the plan for the release of FnF in the making since 2011.

The U.S. Treasury and HUD submitted a Housing Finance System revamp on February 2011, with a Report to Congress 11 days after the deadline, which is typical in the UST, at the request of the Wall Street Reform and Consumer Protection Act of 2010, better known as the Dodd-Frank law (the same law that makes FnF and the banks release an annual Stress Test), as "recommendations on ending the Conservatorships, no later than January 31, 2011".

The reason why Trump, China and Goldman Sachs concealed it, is because the 3 options outlined, have one thing in common: a Privatized Housing Finance System, which means that the guarantors are subject to the Basel framework for capital requirements or, as the option 3 states: "Stringent capital requirements".

In brief:

1- Privatized Housing Finance System + targeted assistance: FHA, USDA, VA.

2- 1 + Govt guarantee in crisis.

3- 1 + Govt Catastrophic-Loss reinsurance.

DeMarco began to work on it right away:

Then, the CSP, UMBS, CSS, pilot programs with the States' HFAs and, finally, the Resecuritizations unveiled by Freddie Mac in June 2022 that allows the option 3 with a Govt Catastrophic-Loss Reinsurance, which means that the MBSs are still guaranteed by the private guarantors and the Reinsurance is triggered upon bankruptcy of the guarantor.

It can be private reinsurance and then, we would be talking about either option 1 or 2.

This is why the FHFA repriced the Resecuritizations to 9.375 bps.

The idea that Trump wanted to put an end to the conservatorship is laughable, when he imposed the NWS 2.0 (the Common Equity is still being transferred to the UST, through the offset -reduction of Retained Earnings- when the SPS LP is increased for free in the same amount as the Net Worth increase in the quarter. This effect is concealed when the gifted SPS are missing on the balance sheets.) and he just wanted to supplant the law in force and the ongoing process for the release from conservatorship required in the Dodd-Frank law and the Separate Account plan in accordance to the law from the onset, because he also called for a swap SPS for Cs ("reprivatization" slogan peddled also by Bill Ackman) and exercising the Warrant (an illegal collateral in the Charter Act)

But the plotters are insatiable and they insist on their plan to supplant the original mandate by law.

So, because it was a requirement by law and submitted in a Report to Congress, whereas the Mnuchin plan was unveiled pursuant to a simple Presidential Memorandum, the plotters directed a rookie representative to introduce the bill HR 5549 on September 18, 2023: "To require the Secretary of the Treasury to submit to the Congress completed proposals for the termination of the conservatorships of Fannie Mae and Freddie Mac", a replica of the mandate in the Dodd-Frank law of 2010.

More "back to the future", like those calling for a "restructuring" in FnF today, thinking that we are still with $400 billion capital shortfall like in September 2008.

ECGI Holdings Announces LOI to Acquire Pacific Saddlery to Capitalize on $12.72 Billion Market Potential • ECGI • Jun 13, 2024 9:50 AM

Fifty 1 Labs, Inc. Announces Major Strategic Advancements and Shareholder Updates • CAFI • Jun 13, 2024 8:45 AM

Snakes & Lattes Opens Pop-Up Location at The Wellington Market in Toronto: A New Destination for Fun and Games - Thanks 'The Well', PepsiCo, Indie Pale House & All Sponsors & Partners for Their Commitment & Assistance Throughout The Process • FUNN • Jun 13, 2024 8:18 AM

HealthLynked Introduces Innovative Online Medical Record Request Form Using DocuSign • HLYK • Jun 12, 2024 8:00 AM

Ubiquitech Software Corp (OTC:UBQU) Posts $624,585 Quarterly Revenue - Largest Quarter Since 2018 • UBQU • Jun 11, 2024 10:13 AM

Element79 Gold Corp Files for OTCQB Uplisting, Provides Financial Update • ELEM • Jun 11, 2024 9:25 AM