| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Tuesday, November 14, 2017 7:17:29 AM

CoT: Peek Into Future Through Futures – How Hedge Funds Are Positioned

By: Hedgopia | November 14, 2017

Following futures positions of non-commercials are as of Nov 7, 2017.

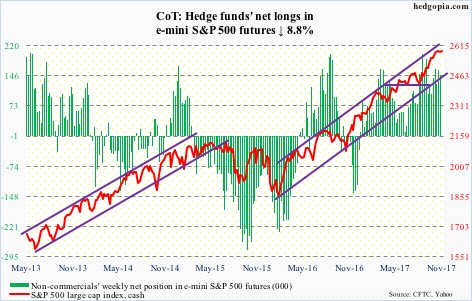

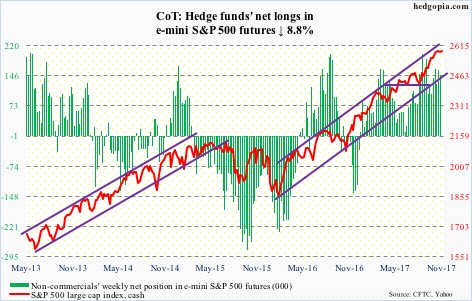

E-mini S&P 500: Currently net long 147.1k, down 14.2k.

In two out of six sessions through last Thursday, intraday pressure on the cash was snapped up, resulting in candles with long lower shadows. Since they have shown up in an uptrend or at the end of an uptrend, they have a better shot at being a hanging man than a hammer. The former is bearish, the latter bullish.

The bears need to take out the 10- and 20-day to get any traction, with the bulls defending the latter in the last three sessions.

There is plenty of room for the weekly chart to continue lower. Last week produced a spinning top.

SPY (SPDR S&P 500 ETF) continued to see outflows, with $5.4 billion leaving last week. VOO (Vanguard S&P 500 ETF) and IVV (iShares core S&P 500 ETF), however, saw inflows of $1.1 billion and $769 million (courtesy of ETF.com).

In the week through last Wednesday, another $4.7 billion moved into U.S.-based equity funds – now $21.3 billion in the last five (courtesy of Lipper). The S&P 500 has essentially gone nowhere in the last three weeks.

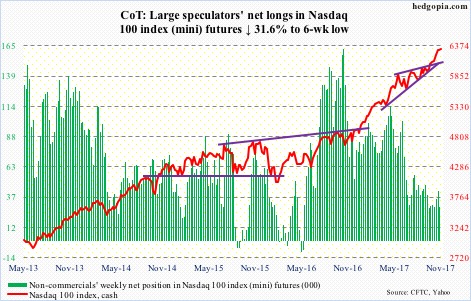

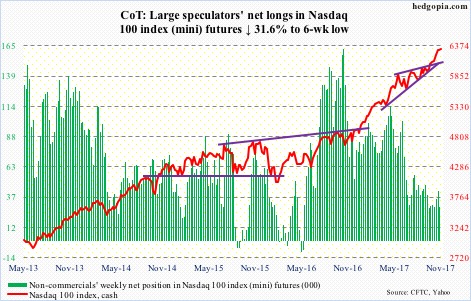

Nasdaq 100 index (mini): Currently net long 28.7k, down 13.3k.

Since a successful breakout retest of 6000 on October 25 through the all-time high of 6346.98 last Wednesday, the cash (6316.18) rallied 5.6 percent. That is in 11 sessions!

It remains to be seen if shorts played a role in this. End-October short interest on XLK (SPDR technology ETF) was elevated.

QQQ (PowerShares QQQ trust) continues to draw in flows – $1.4 billion last week (courtesy of ETF.com).

The risk in all this is that not all are participating in the rally. As of Monday, only 44.5 percent of Nasdaq stocks were above their 50-day, down from 77.8 percent on October 6.

This in and of itself does not mean the generals have to follow the soldiers lower. That said, the weekly chart seems to want to go lower.

There is gap support at 6130, and of course 6000.

Russell 2000 mini-index: Currently net short 1.7k, down 7.7k.

Small-caps’ underperformance versus large-caps continues.

The bulls and bears are fighting a real tug of war around the 50-day. Last week’s low of 1463.49 on the cash (1475.07) was also a successful retest of a break two months ago out of a rising wedge.

If this holds, resistance lies at 1485, and after that the 10- and 20-day – both dropping. In this scenario, some of the daily oversold conditions can get unwound. On the weekly basis, though, the index is way overbought.

In the meantime, non-commercials switched to net short after staying net long for four weeks.

IWM (iShares Russell 2000 ETF) saw outflows of $1.6 billion last week (courtesy of ETF.com). This was somewhat offset by inflows of $162 million into IJR (iShares core S&P small-cap ETF).

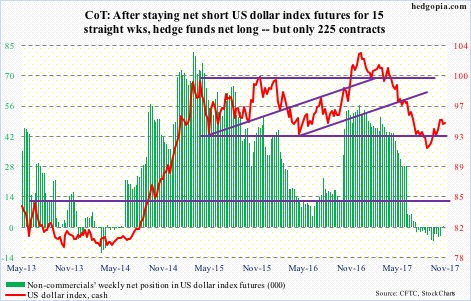

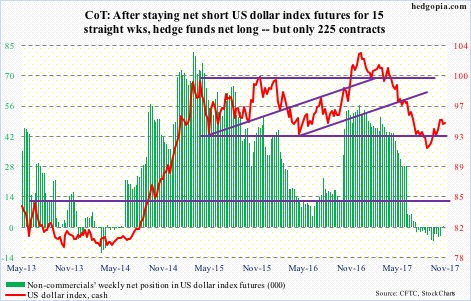

US Dollar Index: Currently net long 225, up 1k.

Last Tuesday’s high of 95.07 on the cash essentially tested – unsuccessfully – the prior high of 95.06 on October 27. On October 25, 10-year Treasury yields peaked at 2.48 percent.

The US dollar dollar index (94.39) rallied 4.5 percent in the past couple of months, and is primed to give at least some of it back.

Immediate support lies at 94, which also approximates the 20-day. The 50-day – rising – lies at 93.21.

Non-commercials dipped their toe in the net long arena. Let us see if they begin to aggressively add.

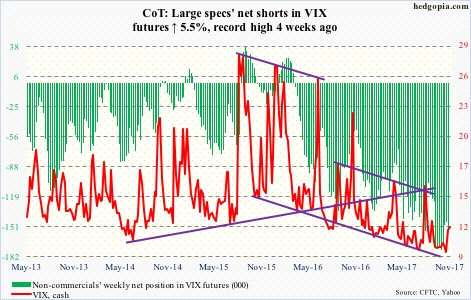

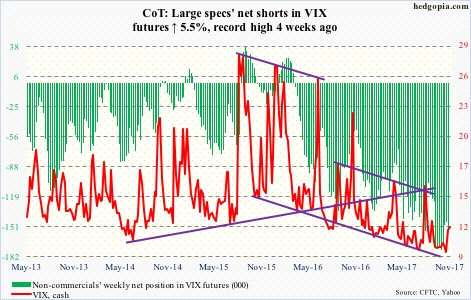

VIX: Currently net short 153.3k, up 8k.

The cash (11.50) shot up 2.41 intraday last Thursday to 12.19 but only to close up 0.72. In the 16 sessions leading up to this, this was the third instance in which VIX tried to rally past the 200-day but only to get slapped hard, resulting in a session with a long wick. Come Friday, volatility bulls launched another attack on that average – this time successfully.

The weekly chart is very oversold.

Meanwhile, after staying trapped in high 0.70s-low 0.80s in 10 out of 11 weeks, the VIX-to-VXV ratio closed at 0.83 last week, and has tons of room for unwinding. Coiled spring!

https://hedgopia.com/cot-peek-into-future-through-futures-how-hedge-funds-are-positioned-26/

• DiscoverGold

Click on "In reply to", for Authors past commentaries

By: Hedgopia | November 14, 2017

Following futures positions of non-commercials are as of Nov 7, 2017.

E-mini S&P 500: Currently net long 147.1k, down 14.2k.

In two out of six sessions through last Thursday, intraday pressure on the cash was snapped up, resulting in candles with long lower shadows. Since they have shown up in an uptrend or at the end of an uptrend, they have a better shot at being a hanging man than a hammer. The former is bearish, the latter bullish.

The bears need to take out the 10- and 20-day to get any traction, with the bulls defending the latter in the last three sessions.

There is plenty of room for the weekly chart to continue lower. Last week produced a spinning top.

SPY (SPDR S&P 500 ETF) continued to see outflows, with $5.4 billion leaving last week. VOO (Vanguard S&P 500 ETF) and IVV (iShares core S&P 500 ETF), however, saw inflows of $1.1 billion and $769 million (courtesy of ETF.com).

In the week through last Wednesday, another $4.7 billion moved into U.S.-based equity funds – now $21.3 billion in the last five (courtesy of Lipper). The S&P 500 has essentially gone nowhere in the last three weeks.

Nasdaq 100 index (mini): Currently net long 28.7k, down 13.3k.

Since a successful breakout retest of 6000 on October 25 through the all-time high of 6346.98 last Wednesday, the cash (6316.18) rallied 5.6 percent. That is in 11 sessions!

It remains to be seen if shorts played a role in this. End-October short interest on XLK (SPDR technology ETF) was elevated.

QQQ (PowerShares QQQ trust) continues to draw in flows – $1.4 billion last week (courtesy of ETF.com).

The risk in all this is that not all are participating in the rally. As of Monday, only 44.5 percent of Nasdaq stocks were above their 50-day, down from 77.8 percent on October 6.

This in and of itself does not mean the generals have to follow the soldiers lower. That said, the weekly chart seems to want to go lower.

There is gap support at 6130, and of course 6000.

Russell 2000 mini-index: Currently net short 1.7k, down 7.7k.

Small-caps’ underperformance versus large-caps continues.

The bulls and bears are fighting a real tug of war around the 50-day. Last week’s low of 1463.49 on the cash (1475.07) was also a successful retest of a break two months ago out of a rising wedge.

If this holds, resistance lies at 1485, and after that the 10- and 20-day – both dropping. In this scenario, some of the daily oversold conditions can get unwound. On the weekly basis, though, the index is way overbought.

In the meantime, non-commercials switched to net short after staying net long for four weeks.

IWM (iShares Russell 2000 ETF) saw outflows of $1.6 billion last week (courtesy of ETF.com). This was somewhat offset by inflows of $162 million into IJR (iShares core S&P small-cap ETF).

US Dollar Index: Currently net long 225, up 1k.

Last Tuesday’s high of 95.07 on the cash essentially tested – unsuccessfully – the prior high of 95.06 on October 27. On October 25, 10-year Treasury yields peaked at 2.48 percent.

The US dollar dollar index (94.39) rallied 4.5 percent in the past couple of months, and is primed to give at least some of it back.

Immediate support lies at 94, which also approximates the 20-day. The 50-day – rising – lies at 93.21.

Non-commercials dipped their toe in the net long arena. Let us see if they begin to aggressively add.

VIX: Currently net short 153.3k, up 8k.

The cash (11.50) shot up 2.41 intraday last Thursday to 12.19 but only to close up 0.72. In the 16 sessions leading up to this, this was the third instance in which VIX tried to rally past the 200-day but only to get slapped hard, resulting in a session with a long wick. Come Friday, volatility bulls launched another attack on that average – this time successfully.

The weekly chart is very oversold.

Meanwhile, after staying trapped in high 0.70s-low 0.80s in 10 out of 11 weeks, the VIX-to-VXV ratio closed at 0.83 last week, and has tons of room for unwinding. Coiled spring!

https://hedgopia.com/cot-peek-into-future-through-futures-how-hedge-funds-are-positioned-26/

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.