| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Saturday, September 23, 2017 10:32:22 AM

CoT: Peek Into Future Through Futures – How Hedge Funds Are Positioned

By: Hedgopia | September 23, 2017

Following futures positions of non-commercials are as of Sep 19, 2017.

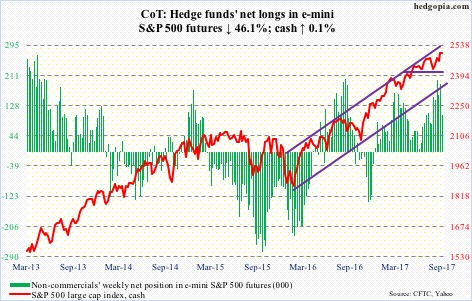

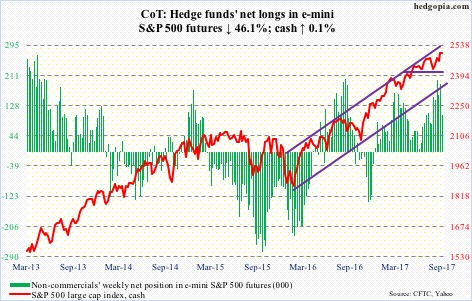

E-mini S&P 500: Currently net long 101.3k, down 86.7k.

Combined, SPY (SPDR S&P 500 ETF), VOO (Vanguard S&P 500 ETF) and IVV (iShares core S&P 500 ETF) in the week to Wednesday lost $2.1 billion – outflows of $3 billion and inflows of $761 million and $214 million, respectively (courtesy of ETF.com). In the same week, U.S.-based equity funds took in $803 million (courtesy of Lipper).

Also Wednesday, the S&P 500 (cash) rose to yet another intraday high of 2508.85, but not before giving off signs of fatigue. The week produced a doji, and Wednesday a hanging man.

Nearest support lies at 2480. If the bears seriously wrest control of near-term momentum – not outside the realm of possibility – the bulls’ real test lies at 2400.

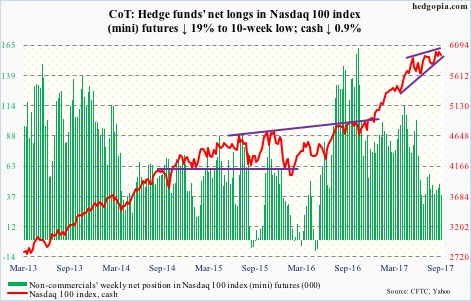

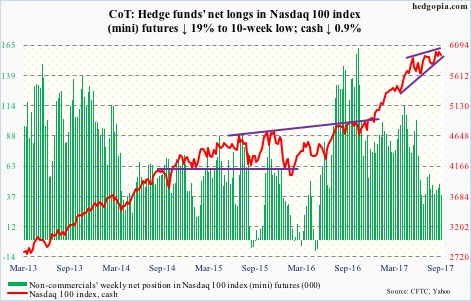

Nasdaq 100 index (mini): Currently net long 38.5k, down 9.1k.

The cash (5932.32) has been trapped in a rising wedge for nearly five months now. The upper end was tested Monday when the index rose to a new all-time high of 6012.95. The 6000 level has also resisted rally attempts for a couple of months now.

The wedge will be broken to the downside around 5860. The bulls do not want to see that happen, yet that may very well be the outcome in the days/weeks to come. For now, the bulls defended the 50-day Friday.

In the week to Wednesday, QQQ (PowerShares QQQ trust) did attract $741 million, but inflows have been sporadic.

Russell 2000 mini-index: Currently net short 3.7k, down 98.7k.

Friday, the cash came within less than a point of the all-time high of 1452.09 on July 25, but did score a record close.

Non-commercials likely contributed to this, having cut back net shorts by 98,671 contracts. It is possible this is not a clean number, as the CME’s e-mini Russell 2000 index – recently introduced – saw non-commercials switch from 38,318 net longs to 38,771 net shorts. Open interest in the latter has really gone up the past couple of weeks. Next week likely presents a clearer picture.

In the week ended Wednesday, IWM (iShares Russell 2000 ETF) attracted $1.9 billion (courtesy of ETF.com).

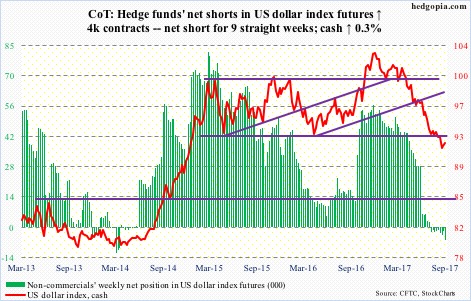

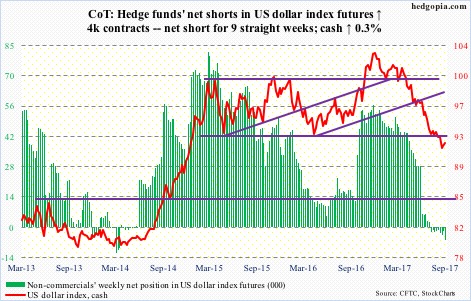

US Dollar Index: Currently net short 6.2k, up 4k.

Intraday between September 7 and 22, two-year yields – most susceptible to the Fed’s monetary policy – went from 1.27 percent to 1.46 percent, and 10-year yields between September 7 and 20 from 2.05 percent to 2.28 percent. Between the periods, the US dollar index (cash) was essentially flat to ever so slightly up.

The index either does not trust the recent backup in yields or is in the process of hammering out a decent bottom.

From early this year through recent lows, the dollar index shed 12-plus percent. Several rally attempts in the last couple of weeks have been repelled at broken support-turned-resistance at 92.50-60. This needs to be taken out if momentum were to shift to the bulls’ way.

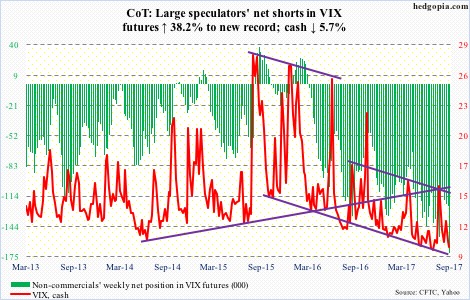

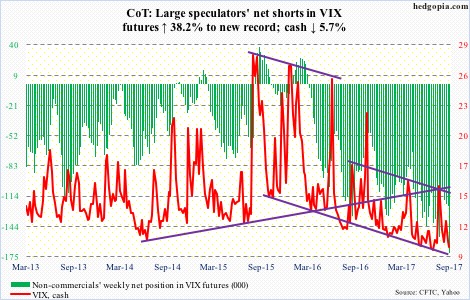

VIX: Currently net short 171.2k, up 47.4k.

During all five sessions this week, the cash dipped below 10 intraday, with the last three also closing below. The declining 10-day persistently provided resistance.

Non-commercials – who accumulated the most net shorts ever – got the direction right.

In the meantime, the 21-day CBOE equity put-to-call ratio dropped to .605 Tuesday. Several times in the past, the ratio in high .50s-low .60s have been a signal to get cautious on equities – at least short-term.

https://hedgopia.com/cot-peek-into-future-through-futures-how-hedge-funds-are-positioned-19/

• DiscoverGold

Click on "In reply to", for Authors past commentaries

By: Hedgopia | September 23, 2017

Following futures positions of non-commercials are as of Sep 19, 2017.

E-mini S&P 500: Currently net long 101.3k, down 86.7k.

Combined, SPY (SPDR S&P 500 ETF), VOO (Vanguard S&P 500 ETF) and IVV (iShares core S&P 500 ETF) in the week to Wednesday lost $2.1 billion – outflows of $3 billion and inflows of $761 million and $214 million, respectively (courtesy of ETF.com). In the same week, U.S.-based equity funds took in $803 million (courtesy of Lipper).

Also Wednesday, the S&P 500 (cash) rose to yet another intraday high of 2508.85, but not before giving off signs of fatigue. The week produced a doji, and Wednesday a hanging man.

Nearest support lies at 2480. If the bears seriously wrest control of near-term momentum – not outside the realm of possibility – the bulls’ real test lies at 2400.

Nasdaq 100 index (mini): Currently net long 38.5k, down 9.1k.

The cash (5932.32) has been trapped in a rising wedge for nearly five months now. The upper end was tested Monday when the index rose to a new all-time high of 6012.95. The 6000 level has also resisted rally attempts for a couple of months now.

The wedge will be broken to the downside around 5860. The bulls do not want to see that happen, yet that may very well be the outcome in the days/weeks to come. For now, the bulls defended the 50-day Friday.

In the week to Wednesday, QQQ (PowerShares QQQ trust) did attract $741 million, but inflows have been sporadic.

Russell 2000 mini-index: Currently net short 3.7k, down 98.7k.

Friday, the cash came within less than a point of the all-time high of 1452.09 on July 25, but did score a record close.

Non-commercials likely contributed to this, having cut back net shorts by 98,671 contracts. It is possible this is not a clean number, as the CME’s e-mini Russell 2000 index – recently introduced – saw non-commercials switch from 38,318 net longs to 38,771 net shorts. Open interest in the latter has really gone up the past couple of weeks. Next week likely presents a clearer picture.

In the week ended Wednesday, IWM (iShares Russell 2000 ETF) attracted $1.9 billion (courtesy of ETF.com).

US Dollar Index: Currently net short 6.2k, up 4k.

Intraday between September 7 and 22, two-year yields – most susceptible to the Fed’s monetary policy – went from 1.27 percent to 1.46 percent, and 10-year yields between September 7 and 20 from 2.05 percent to 2.28 percent. Between the periods, the US dollar index (cash) was essentially flat to ever so slightly up.

The index either does not trust the recent backup in yields or is in the process of hammering out a decent bottom.

From early this year through recent lows, the dollar index shed 12-plus percent. Several rally attempts in the last couple of weeks have been repelled at broken support-turned-resistance at 92.50-60. This needs to be taken out if momentum were to shift to the bulls’ way.

VIX: Currently net short 171.2k, up 47.4k.

During all five sessions this week, the cash dipped below 10 intraday, with the last three also closing below. The declining 10-day persistently provided resistance.

Non-commercials – who accumulated the most net shorts ever – got the direction right.

In the meantime, the 21-day CBOE equity put-to-call ratio dropped to .605 Tuesday. Several times in the past, the ratio in high .50s-low .60s have been a signal to get cautious on equities – at least short-term.

https://hedgopia.com/cot-peek-into-future-through-futures-how-hedge-funds-are-positioned-19/

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.