| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Thursday, July 20, 2017 1:23:26 PM

Nasdaq Reversal's Historically A Very Good Omen

By Steve Deppe | July 18, 2017

The story for most of 2017's been the tremendous relative strength in the technology sector. The Nasdaq Composite (COMPQ) has easily outpaced the returns of the S&P500 over the trailing 3, 6, 9, and 12 months.

However, we all watched COMPQ run into a speed bump in June, declining from 6,341.70 to July 6th's swing low at 6,081.96, a -4.09% pullback. July 6th's low undercut June's low at 6,087.81, breaking a 7 month streak of higher monthly lows for the index. I found this important as historically when COMPQ trades below the prior month's low it generally doesn't reverse course and also trade above the prior month's high. When looking back through 475 months of trading data for COMPQ since 1978, only 44 calendar months traded below the prior months low and above the prior months high, otherwise known as an "Outside Month", an occurrence rate of just 9.26%. Therefore, COMPQ's reversal since July 6th, which is now an 8 day +4.18% winning streak culminating in today's high at 6,344.55, is grabbing my attention. And with today's trade beyond June's high at 6,341.70, COMPQ's now triggered its 45th "Outside Month".

We've now set the stage for a possible "Bullish Outside Reversal Month" (BORM). A BORM is defined as a calendar month that trades above the prior month's high, below the prior months low, and closes the month positive. Two of the three criteria are in place, all we need is a positive monthly close to finalize the BORM (a July close above 6,140.42 does the trick).

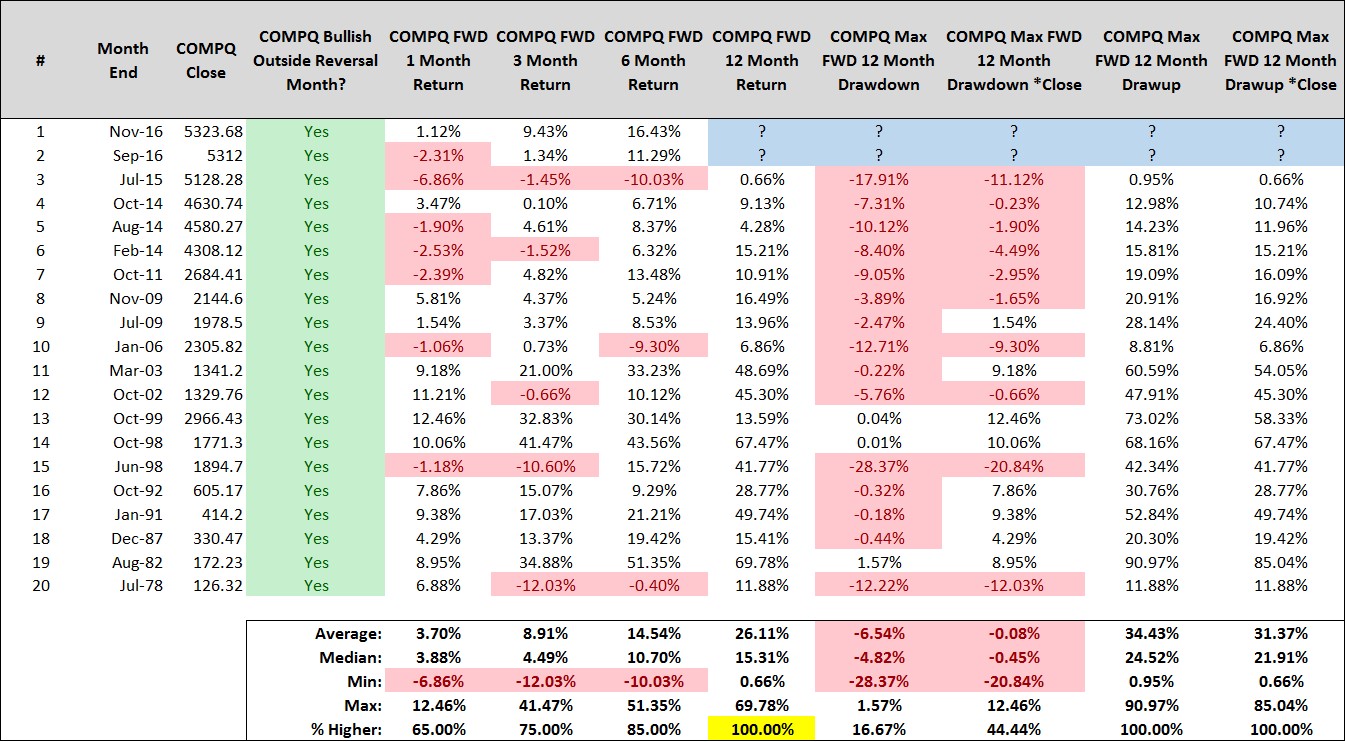

Since 1978, there's been 20 BORM's, 2 of which that have occurred within the last twelve months (Aug 2016 & Sept 2016) and 18 that occurred more than one year ago and thus have a full forward one year worth of price data for COMPQ. Of these 18 prior samples, the COMPQ has never traded down in price only return over the forward 12 months. The index is undefeated one year later for median returns of 15.31%. To be fair, I'd be remiss in not pointing out the BORM from July of 2015, where the the forward 12 month return was positive by the skin of its teeth and COMPQ traded in negatively for nearly the entire forward twelve months.

While BORM's have an undefeated price only return track record a full 12 calendar months after their occurrence, the path the index takes in reaching its final destination is also an important consideration. On average, BORM's haven't been associated with overly meaningful drawdowns over the forward 12 month period relative to COMPQ's price as of the month end signal date. The average maximum drawdown over the forward twelve months relative to COMPQ's month end signal date price is -6.54%. When calculating the average maximum drawdown over the forward twelve month period for all months since 1978, it's actually -12.26%. Additionally, there's only five historical samples that include a "correction", with "correction" being defined as a -10% or more maximum drawdown at any point over the forward twelve months relative to COMPQ's month end signal date price. In laymen's terms, 25% of the time things have gotten turbulent for COMPQ at some point over the forward one year following BORM's, while 75% of the time it's a relatively easy flight to the north. And remember, 100% of the time any nasty drawdown for COMPQ has been completely recovered no later than the end of the forward 12 month period.

In terms of drawups following BORM's, 100% of all samples have closed a calendar month higher than COMPQ's month end signal date price at some point over the forward one year. 17 of 18 samples (94%) have closed a calendar month more than 6% higher than COMPQ's month end signal date price at some point over the forward one year. And 16 of 18 (88%) samples have closed a calendar month more than 10% higher than COMPQ's month end signal date price at some point over the forward one year. They say calling tops is an "exercise in futility" and if history is any guide, July's monthly close probably won't be the "top" for COMPQ.

As always, none of the charts or sheets I share are ever a holy grail, they're not consistently predictive. That said, these charts and sheets are the reflection of the actions and behaviors of market participants placing transactions in COMPQ's constituents, both in the present and in the past. Their behavior at the moment demonstrates a rare and extreme eagerness to bid the holdings within COMPQ, so much so that when they went on sale in early July by a mere -4%, it was enough to bring eager buyers to the marketplace as if this was the sale of a lifetime. The only question left now is whether or not fresh new all-time high prices will bring eager sellers into the marketplace with even more authority than the buyers over the last 8 days. If it doesn't, we'll have our 21st BORM on July 31st, and that will point the compass north for COMPQ over the coming one year.

https://steve-deppe.squarespace.com/blog/2017/7/18/nasdaq-reversal-historically-a-good-omen

• DiscoverGold

By Steve Deppe | July 18, 2017

The story for most of 2017's been the tremendous relative strength in the technology sector. The Nasdaq Composite (COMPQ) has easily outpaced the returns of the S&P500 over the trailing 3, 6, 9, and 12 months.

However, we all watched COMPQ run into a speed bump in June, declining from 6,341.70 to July 6th's swing low at 6,081.96, a -4.09% pullback. July 6th's low undercut June's low at 6,087.81, breaking a 7 month streak of higher monthly lows for the index. I found this important as historically when COMPQ trades below the prior month's low it generally doesn't reverse course and also trade above the prior month's high. When looking back through 475 months of trading data for COMPQ since 1978, only 44 calendar months traded below the prior months low and above the prior months high, otherwise known as an "Outside Month", an occurrence rate of just 9.26%. Therefore, COMPQ's reversal since July 6th, which is now an 8 day +4.18% winning streak culminating in today's high at 6,344.55, is grabbing my attention. And with today's trade beyond June's high at 6,341.70, COMPQ's now triggered its 45th "Outside Month".

We've now set the stage for a possible "Bullish Outside Reversal Month" (BORM). A BORM is defined as a calendar month that trades above the prior month's high, below the prior months low, and closes the month positive. Two of the three criteria are in place, all we need is a positive monthly close to finalize the BORM (a July close above 6,140.42 does the trick).

Since 1978, there's been 20 BORM's, 2 of which that have occurred within the last twelve months (Aug 2016 & Sept 2016) and 18 that occurred more than one year ago and thus have a full forward one year worth of price data for COMPQ. Of these 18 prior samples, the COMPQ has never traded down in price only return over the forward 12 months. The index is undefeated one year later for median returns of 15.31%. To be fair, I'd be remiss in not pointing out the BORM from July of 2015, where the the forward 12 month return was positive by the skin of its teeth and COMPQ traded in negatively for nearly the entire forward twelve months.

While BORM's have an undefeated price only return track record a full 12 calendar months after their occurrence, the path the index takes in reaching its final destination is also an important consideration. On average, BORM's haven't been associated with overly meaningful drawdowns over the forward 12 month period relative to COMPQ's price as of the month end signal date. The average maximum drawdown over the forward twelve months relative to COMPQ's month end signal date price is -6.54%. When calculating the average maximum drawdown over the forward twelve month period for all months since 1978, it's actually -12.26%. Additionally, there's only five historical samples that include a "correction", with "correction" being defined as a -10% or more maximum drawdown at any point over the forward twelve months relative to COMPQ's month end signal date price. In laymen's terms, 25% of the time things have gotten turbulent for COMPQ at some point over the forward one year following BORM's, while 75% of the time it's a relatively easy flight to the north. And remember, 100% of the time any nasty drawdown for COMPQ has been completely recovered no later than the end of the forward 12 month period.

In terms of drawups following BORM's, 100% of all samples have closed a calendar month higher than COMPQ's month end signal date price at some point over the forward one year. 17 of 18 samples (94%) have closed a calendar month more than 6% higher than COMPQ's month end signal date price at some point over the forward one year. And 16 of 18 (88%) samples have closed a calendar month more than 10% higher than COMPQ's month end signal date price at some point over the forward one year. They say calling tops is an "exercise in futility" and if history is any guide, July's monthly close probably won't be the "top" for COMPQ.

As always, none of the charts or sheets I share are ever a holy grail, they're not consistently predictive. That said, these charts and sheets are the reflection of the actions and behaviors of market participants placing transactions in COMPQ's constituents, both in the present and in the past. Their behavior at the moment demonstrates a rare and extreme eagerness to bid the holdings within COMPQ, so much so that when they went on sale in early July by a mere -4%, it was enough to bring eager buyers to the marketplace as if this was the sale of a lifetime. The only question left now is whether or not fresh new all-time high prices will bring eager sellers into the marketplace with even more authority than the buyers over the last 8 days. If it doesn't, we'll have our 21st BORM on July 31st, and that will point the compass north for COMPQ over the coming one year.

https://steve-deppe.squarespace.com/blog/2017/7/18/nasdaq-reversal-historically-a-good-omen

• DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.