Friday, March 31, 2017 4:58:34 PM

*** NEW in this update: 1) New video of diamond and gold recovery plant is released in March 2017; 2) A qualified geologist has started to prepare an Industry Guide 7 technical report on the properties owned by Brazil Minerals; 3) Per 11/29/16 PR, the Company now expects its Brazil-based operations to be cash flow profitable by the second quarter of 2017 or possibly sooner; 4) PPS projections updated to reflect the new tiny share structure.

TABLE OF CONTENTS

1) The Company

2) The Property

3) The People

4) Frequently Asked Questions

1) The Company

Brazil Minerals, Inc. (OTC: BMIX) is a producer of diamonds, gold, sand, and industrialized mortar. The company also owns 30 mineral rights for gold and diamonds, including 10 mining concessions, the highest level of right to mine in Brazil.

Brazil Mineral's short-term intention is to become a profitable company with virtually no debt.

Growth in Valuable Assets

BMIX progress has been steady, and can be measured in at least two quantifiable ways. First, in terms of mineral assets, in early 2013, the company's initial year of operations under the current business model and management team, they had 3 mineral rights. Now BMIX has 30 mineral rights in its subsidiaries as follows:

i) 10 mineral rights that are mining concessions, the highest level of mineral right in Brazil (“Concessão de Lavra”) – all 10 mining concessions are diamond and gold, and once concession also includes sand as a mineral;

ii) 8 mineral rights for diamond and gold that have status just below mining concession (“Requerimento de Lavra”), which allows the company to apply for both an upgrade to mining concession and to conduct limited commercial mining;

iii) 8 mineral rights for diamond and gold or solely gold in the research permit phase (“Autorização de Resquisa”), and;

iv) 4 mineral rights for diamond and gold in the phase of application for research permit (“Requerimento de Pesquisa”).

Growth in Product Mix

The second manner in which Brazil Minerals expanded as a company from 2013 to now is in the product mix output from our Brazilian subsidiaries. In 2013 the company produced and sold rough diamonds and gold. In 2014 they added polished diamonds. In 2015 BMIX added sand and mortar, a product made from their sand.

Deep Knowledge of Brazil & Strong Culture

Unlike most other listed mining companies operating in Brazil, BMIX team is comprised almost completely of Brazilians, all of whom have been hand-picked. The company's CEO and Chairman spent years in the U.S. venture capital and private equity and has modeled the company with the essential entrepreneur tenets of hard-work, meritocracy, and frugality.

Share Structure:

O/S: 67,304,523 as of 3/31/17 (Verified by Transfer Agent)

https://www.otcmarkets.com/stock/BMIX/profile

Shares held by the CEO (His salary has been paid entirely in BMIX common shares): 3,031,028 as of 2/16/17

https://ih.advfn.com/p.php?pid=nmona&article=73883076

Shares held by Peter Goldy: 2,203,637 as of 11/16/16

http://ih.advfn.com/p.php?pid=nmona&article=72931541

A/S: 100,000,000

Website: http://www.brazil-minerals.com/

YouTube Channel: https://www.youtube.com/channel/UChcTI9t1v-E-9MJ7mMtH_tA

Facebook: https://www.facebook.com/brazilmineralsbmix

2) The Property

BMIX owns 100% of Mineração Duas Barras Ltda. (“MDB”), a Brazilian producer and seller of polished and rough diamonds, gold bars, and industrial-use sand. MDB operates a fully-operational mining concession with the largest alluvial processing plant for diamonds and gold in Latin America, and has the Brazilian permit to export its production.

BMIX also owns 50% of RST Recursos Minerais Ltda. (“RST”), a Brazilian company with 10 mining concessions and 12 other mineral rights for diamond and gold. Many of the RST areas are located near MDB’s plant, and all of them are in the Jequitinhonha River valley, a well-known area for diamonds and gold for over two centuries.

RST property was acquired from two Brazilian individuals, unrelated to the company, 50% of RST for approximately $254,000. Previously in 2008, RST had been transacted for $10.5 million; the buyer paid $2 million and subsequently was unable to pay the remainder because of the global financial crisis. The RST mineral rights remained largely untouched until our acquisition.

On 4/29/16 Brazil Minerals announced that it obtained approval of a report regarding Apui/Borba gold project from the local mining department. BMIX's Apui/Borba Project titled right covers 24,708 acres, a surface area that is 15% larger than the island of Manhattan in New York. The project has potential mineralization of 4.3 million ounces of gold. Read more about this impressive property by following the two links below:

http://ih.advfn.com/p.php?pid=nmona&article=71320402

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=122338476

Finally, in August 2016, BMIX obtained three more large claims on gold-producing areas.

1) A priority for an exploration license on a gold mineral right covering 4,925 acres in Crixas, extending to an adjacent municipality, in the state of Goias in central Brazil. The Crixas area is one of the largest gold hubs in Latin America. It is home to several gold mines and projects from AngloGold Ashanti and Cleveland Mining, which combined have disclosed potential reserves of more than 8 million ounces of gold.

http://ih.advfn.com/p.php?pid=nmona&article=72212837

2) A mineral claim for gold covering 773 acres in the municipality of Paracatu, in the state of Minas Gerais. Paracatu is where the largest gold mine in Brazil, named Morro do Ouro, is located. Morro de Ouro is an open-pit mine owned by global firm Kinross Gold, with 2015 reported proven and probable reserves of 9.645 million ounces of gold and annual production of 477,622 ounces of gold.

http://ih.advfn.com/p.php?pid=nmona&article=72306313

3) A new mineral rights claim for gold covering 4,669 acres within the well-known area in the state of Minas Gerais in Brazil called "Iron Quandrangle". The closest larger city to this new claim is Itabira. This region, known for both iron and gold mining, has excellent logistics and is also close to the states capital, Belo Horizonte.

http://ih.advfn.com/p.php?pid=nmona&article=72420243

Check out all of BMIX mining rights by following the direct link below:

http://investorshub.advfn.com/uimage/uploads/2016/4/19/szxkyclaims.jpg

BMIX Documented Reserves

In 2006-2007, then Toronto Stock Exchange Venture -listed Vaaldiam Resources Ltd. (“Vaaldiam”) spent an estimated $2.0 million for detailed drilling and technical studies leading to the NI 43-101 geological report and bankable feasibility of the property, as well as an estimated $2.0 million for removal of overgrowth on the property. The total cost of development of MDB by Vaaldiam is estimated at $10 million.

The link to the resultant NI 43-101 is below. Keep in mind that the official study was done for only 7% of the MDB's total concession area. There is still a 93% chunk of MDB's property that has not been officially assayed. And let’s not forget about the 50% ownership in adjacent RST properties that include 10 mining concessions and 12 other mineral rights for diamond and gold.

http://www.brazil-minerals.com/wp-content/uploads/2013/02/Duas-Barras-NI-43-101.pdf

What the heck is NI 43-101? Read below:

https://en.wikipedia.org/wiki/National_Instrument_43-101

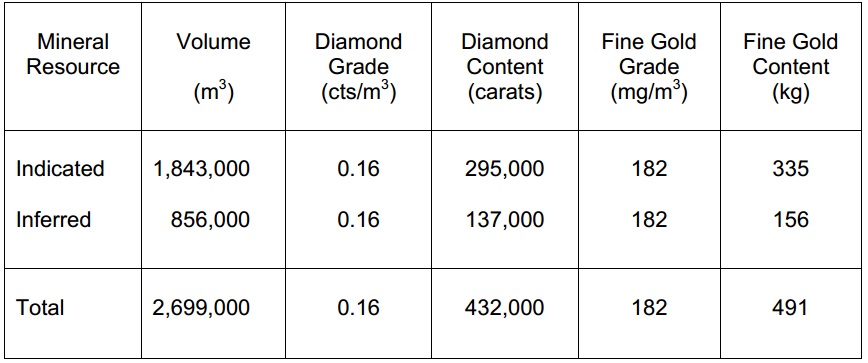

Excerpt from the BMIX NI 43-101:

The numbers are astounding! Some thoughts and reflections on them can be found in stervc's excellent post below:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112576227

To make things even better, a qualified geologist has started to prepare an Industry Guide 7 technical report on the properties owned by Brazil Minerals. This study will permit the Company to publish information on all of its gold and diamond potential to the U.S. markets, as the Industry Guide 7 format is the reporting standard currently acceptable by the U.S. Securities and Exchange Commission (the SEC).

http://ih.advfn.com/p.php?pid=nmona&article=73019795

To fully appreciate the magnitude of the BMIX potential with their 100%-owned MDB property, it is most useful to look at the performance of the previous owner:

"Vaaldiam launched production at Duas Barras in September 2007 and produced 33,385 carats of diamonds valued at an average $165 per carat in the first 11 months of operation. Gross sales revenues from the mine to date, including 1,036 ounces of gold recovered for the period September 2007 through July 2008 reached $6.5 million."

http://www.diamonds.net/news/NewsItem.aspx?ArticleID=23120

Moreover, during February 2008 a 15.68 carat diamond was recovered at the Duas Barras mine which is the largest diamond recovered to date at this mine. This diamond was sold in the second quarter for US$78,400 or US$5,000 per carat.

http://globaldocuments.morningstar.com/documentlibrary/document/29cf493380fe9217.msdoc/original

RST MINING PERMITS WERE RECEIVED ON 4/19/16 PER PR BELOW

http://ih.advfn.com/p.php?pid=nmona&article=71171071&symbol=BMIX

The company now has all of the required permits for RST area. The previous operator in these areas had an annual diamond production as high as 74,395 carats in 1983 and as low as 15,285 carats in 1967, from the data set available. The previous operator essentially did not mine inland, which is where BMIX will focus its efforts. Read the related PR below:

http://www.brazil-minerals.com/wp-content/uploads/2015/07/BMIX-PR-13.JUL_.2015.pdf

First gold yields from the RST property were released on July 20th 2016 - test run of 6.8 cubic meters of material produced 59.1 grams (approximately 1.9 troy ounces) of 96% gold, now molten into a gold bar, as seen on a picture below:

http://ih.advfn.com/p.php?pid=nmona&article=72011238

Recently, a long-term BMIX equity holder provided funds through direct stock investments to allow for the acquisition of a second industrial-size gold-recovery centrifuge that will nearly double the current output in the near future.[/color]

http://ih.advfn.com/p.php?pid=nmona&article=73853654

BMIX Diamond & Gold Processing Plants

The MDB plant was originally built in 2006-2007 by then Toronto Stock Exchange Venture -listed Vaaldiam Resources Ltd. (“Vaaldiam”) at a cost of approximately $2.5 million. To the best of BMIX’s knowledge, the diamond and gold processing plant at Duas Barras is the largest alluvial recovery plant of its kind in Latin America.

In addition to a large stationary MDB plant, BMIX is now transitioning into portable mini-plants that are highly scalable and can be deployed at multiple properties at once. See the diamond and gold recovery mini-plant in operation below:

Other Developments:

Brazil Minerals mines primarily for diamonds and gold, but the company also has vast reserves of industrial-quality sand that provides an effortless cash flow for the company. Read more below:

http://www.brazil-minerals.com/wp-content/uploads/2015/02/BMIX-Press-Release-02.FEB_.2015.pdf

http://www.brazil-minerals.com/wp-content/uploads/2014/12/BMIX-Press-Release-03.DEC_.2014.pdf

The company's sand qualifies for use in the profitable fracking industry, as described in the following PR. The company's reserves of high-quality sand are between 500k and 1M tons. This will translate into millions of dollars of easily-extractable revenue.

http://www.brazil-minerals.com/wp-content/uploads/2015/08/BMIX-PR-25.AUG_.2015.pdf

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=115456325

The company also uses its vast sand reserves for high-quality mortar production and sale -- read more in the PR below:

"Brazil Minerals, Inc. had established a subsidiary in Brazil called Hercules Brasil Ltda. to pursue opportunities in the construction materials business. Initially, Hercules is focused on the production and sale of mortar. A medium size plant that can produce mortar, grout and other industrialized sand products has been fully built and is operating."

http://www.brazil-minerals.com/wp-content/uploads/2015/08/BMIX-PR-13.AUG_.2015.pdf

In fact, the company's brand of mortar was recently chosen for use in a new 17-story building (see picture of the building below):

Additionally, BMIX’s Hercules mortar line has recently been accepted and bought for distribution by Pontual, one of the largest retailers of tiles and other construction supplies in Montes Claros.

http://www.brazil-minerals.com/wp-content/uploads/2015/11/BMIX-PR-30.NOV_.2015.pdf

Finally, on July 13 2016 BMIX announced that the company formally received title from the local mining department to two manganese claims, both placed in a new wholly owned subsidiary. These mineral rights cover 4,700 acres and are located 75 and 110 miles, respectively, from the Company's gold and diamond operations, in the state of Minas Gerais in Brazil. Both of these claims intersect known colluvial laterite deposits with high potential for mineralization of manganese and possibly iron ore as well. Read more about yet another potential cashflow source for BMIX in the PRs below:

http://ih.advfn.com/p.php?pid=nmona&article=71958804

http://ih.advfn.com/p.php?pid=nmona&article=72420243

For the history lovers, more details on the mining along the Rio Jequitinhonha river can be found by following this link:

http://www.allaboutgemstones.com/diamond_mines_brazil.html

3) The People

BMIX boasts an enviable executive team that is in the early stages executing a business model which mirrors that of successful, multi-billion dollar market cap mining stocks. For a full list of BMIX management and advisers please refer to the "corporate" section on the company's website. DD on select members of the BMIX team is available below.

http://www.brazil-minerals.com/corporate/management/

Management: CEO - Dr. Marc Fogassa

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112766681

https://www.linkedin.com/in/marcfogassa

Board of Directors - Ambassador Roger Noriega (Washington, DC)

Ambassador Roger Noriega is an independent member of the Board of Directors of Brazil Minerals, Inc. Mr. Noriega was U.S. Assistant Secretary of State from July 2003 to August 2005, appointed by President George W. Bush and confirmed by the U.S Senate. In that capacity, Mr. Noriega managed a 3,000-person team of professionals in Washington and 50 diplomatic posts to design and implement political and economic strategies in Canada, Latin America, and the Caribbean.

Board of Advisors - Ambassador John Bell

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112767084

4) Frequently Asked Questions

Q: BMIX DD is impressive, but doesn't all this seem too good to be true? Why is BMIX trading so low?

A: BMIX is trading so low because in 2014 the company was in urgent need of cash to seize the remaining % ownership of the MDB property as well as 50% ownership of all RST properties before they were usurped by another party. To make it possible in a timely manner, the company resorted to toxic financing which was simply the fastest option at the time. This move was essential for LONG-TERM viability of BMIX. Then, while the company was in its weakest first quarter of 2015 (historically, due to Brazilian weather), the toxic lenders proceeded to do what they do best -- dump their holdings all at once with disregard for the stock's PPS. The simple concept of supply and demand came into play. The toxic debt resulted in too many shares supplied too fast, and there was not enough demand at the time to absorb all of the shares at higher prices. Since that time the company has continued to build a solid foundation for a long-term successful production of diamonds and gold and was not aggressively focusing on its stock price in particular. Now that the production is afoot and the company is expecting to be cash flow positive by the end of Q2/2017, I expect them to start working towards strengthening their stock valuation as well.

Q: So what do you think is fair PPS for BMIX?

A: I will provide two different perspectives below:

1) Combining revenue streams from gold, diamonds, sand, mortar and royalty-based partnerships, BMIX can reasonably make $3M net profit as early as end of FY 2017. An average P/E ratio for mining companies is 25-30. It is often higher than that for younger mining companies with many virgin claims, but let's consider the worst case scenario of 20, just to be conservative. So with a net income of $3M, the OS count of 100M (given the worst-case scenario of maxed out A/S), and the P/E ratio of 20, that comes out to $0.60 per share.

$3M/100M = $0.03 x 20 = $0.60

Reflecting upon the revenues obtained by the previous operator of BMIX property, $3M in net BMIX profit for the year is very doable for 2017. And the P/E of 20 is very conservative considering how many claims with future potential BMIX possesses. Add to that the upcoming hype from the penny traders who are starved for the stocks that actually have net profits, and the PPS potential here extends way beyond the $0.60 even at a maxed out A/S of 100M. This, obviously, represents a HUGE return from these levels.

2) In September 2014, Goldman Small Cap Research Report pinned a target market cap for BMIX at $25,380,000 (84.6M x $0.30).

http://www.brazil-minerals.com/wp-content/uploads/2013/02/Goldman-Small-Cap-Research-Report-BMIX.pdf

Given that the company's current OS is 67,304,523, the above market cap corresponds to a PPS of $0.38

Also, keep in mind that this target was established BEFORE all the new developments. For instance, BMIX has acquired many more property rights since then, established additional cash flow from sand and mortar sales, as well as developed royalty-generating partnerships. So, arguably, a reasonable market cap target should be significantly higher today.

Q: The property seems like a real winner - hundreds of thousands of carats of documented diamond reserves in only 7% of the entire area of the mineral rights available at MDB is utmost impressive. But the natural question is WHY then the previous owner failed?

A: To answer this, I will quote the CEO himself from one of the recent interviews:

The issue with the [previous] company was that it had 300 employees elsewhere in Brazil taking hold of ground for exploration. It had huge, huge research costs, so any semblance of profitability from diamond production was diluted by expenses elsewhere. The company also had 110 employees at the mine — we have 18 — and it had five vice presidents at the mine while we have one general manager.

In summary, Vaaldiam (the previous company) had 300 workers elsewhere in Brazil in various exploratory, non-revenue projects. When the 2008 financial crisis hit the markets, Vaaldiam left Brazil due to being unable to satisfy local social security payments and other demands. Initially, BMIX acquired a 55% stake in MDB, and subsequent rounds of acquisition have brought the percentage ownership to 86.88%, and then finally to 100% ownership as of today.

Q: How do we know that the CEO is not just using the shareholders here? Does Dr. Fogassa have any skin in the game?

A: Of course! The CEO has a lot of vested interest in BMIX. Dr. Fogassa now owns over 3M common shares of BMIX as of the last filing:

https://ih.advfn.com/p.php?pid=nmona&article=73883076

Dr. Fogassa graduated from MIT, then Harvard medical school, and then Harvard business school. Trust me when I say that he could be making a big chunk of money out there by either practicing medicine in a nice group in Boston, or even more so by staying at Goldman Sachs as a medical/technological financier. Instead, he dropped everything and went all-in into his baby company - Brazil Minerals. Moreover, instead of burning through the precious and scarce start-up capital, he decided to pay his own salary IN COMMON BMIX SHARES instead of cash. From my personal conversation with the CEO, he spends most of his days submerged in BMIX business -- and what does he get in return? Only common BMIX shares! Dr. Fogassa is a man in his late 40s boasting credentials that are nothing short of stunning who gave up several types of lucrative jobs where he could be making $400K+ per year from a cushy air-conditioned office in Boston or NYC, and is instead spending his days in dirt and gravel in Brazil while getting only BMIX common shares in return! The man is as invested in this company as it gets, if you ask me.

Q: Are there any research reports on BMIX?

A: Sure, in September 2014, Goldman Small Cap Research issued a report in which they called Brazil Minerals “The Most Attractive Revenue-Generating Mining Stock.” Read the full report below:

http://www.brazil-minerals.com/wp-content/uploads/2013/02/Goldman-Small-Cap-Research-Report-BMIX.pdf

Q: Any interviews with the CEO that I should check out?

A: I think one of the best interviews with Dr. Fogassa was done by TheStreet and can be read below:

http://www.thestreet.com/story/12937096/1/brazil-minerals-pursuing-profitable-diamond-and-gold-mining.html

Some of my personal thoughts and reflections on the interview can be found in the following posts:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114401500

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114401650

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114621398

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114402899

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114403120

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114403295

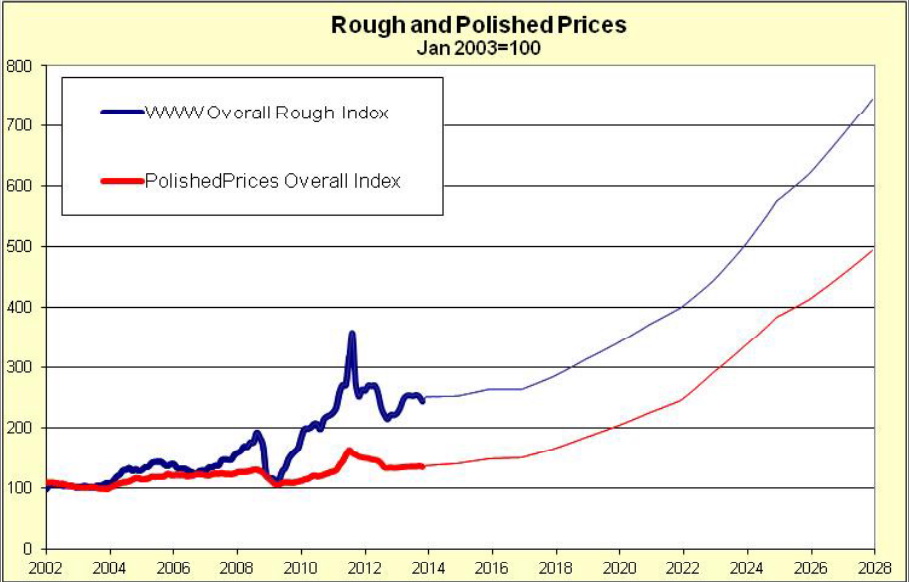

Q: Do you think the world’s high demand for rough and polished diamonds will continue into the future?

A: Yes I do, and I am not the only one who thinks so.

Source: http://www.diamondwww.com/files/presentation/Scotai_Bank_Jan_14.pdf

BMIX DAILY CHART

i.t.m.d.

This post is my personal opinion. I do not provide investment advice.

i.t.m.d.

Recent ATLX News

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/09/2024 02:30:09 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/06/2024 11:01:55 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/17/2024 02:30:41 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/14/2024 04:55:05 PM

- Form 5 - Annual statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/14/2024 03:23:59 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/12/2024 09:30:35 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/27/2024 02:30:09 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/13/2024 02:30:22 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:24 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:13 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/05/2024 10:00:31 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/05/2024 02:30:07 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/30/2023 02:25:19 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/30/2023 02:20:14 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/23/2023 02:30:35 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 02:30:07 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM