Thursday, April 09, 2015 1:36:24 PM

BMIX has recently released news of a significant diamond find as indicated below which leads me to think they these guys know what they are doing:

http://finance.yahoo.com/news/brazil-minerals-inc-reports-largest-143000944.html

Brazil Minerals, Inc. (OTCBB: BMIX) (the "Company" or "BMIX") announced today that it had mined its largest rough diamond to date at 4.01 carats. This gem has very good appearance and no visible points or inclusions, and thus appears to be able to yield high color and clarity grades. The Company plans to have this rough diamond cut and polished before selling it. ...

BMIX owns 100% of MDB, a Brazilian producer and seller of polished and rough diamonds, gold bars, and industrial-use sand. MDB operates a fully-operational mining concession with the largest alluvial processing plant for diamonds and gold in Latin America, and has the Brazilian permit to export its production. …

BMIX has a relied upon National Instrument (NI) 43-101 that was issued by ”Qualified Person” and Professional Geologist Paul J. Daigle, Senior Project Geologist at Vaaldiam, on March 30th, 2007, prior to the commencement of their mining activities in the area that’s known at the… “Technical Report Duas Barras Diamond Project, Brazil, Presenting Details of Diamond Resources Compliant with Canadian National Instrument 43-101” (henceforth “Duas Barras NI 43-101”).

For Inquiring minds, an NI 43-101 is a Technical Report that is derived from Technical Data to help deduce the strong ”potential” valuation that exists confirmed from a Professional Geologists. Per the CIM DEFINITION STANDARDS for Mineral Resources and Mineral Reserves (originally derived as a Canadian standard)… a NI 43-101 uses the terms below...

http://www.crirsco.com/cim_definition_standards_2010.pdf

Inferred Mineral Resource

An Inferred Mineral Resource? is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

Indicated Mineral Resource

An Indicated Mineral Resource? is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

Mineral Resources are sub-divided in order of increasing geological confidence to include more than the terms I indicated above such as Measured, Proven, and Probable, but I am focusing on the two indicated above (Inferred and Indicated) because of those being the two indicated within the NI 43-101 that BMIX is using.

Generally, an US based company will have to account for Probable or Proven reserves as defined by the SEC section (a) of Industry Guide 7 as indicated just as an FYI below:

http://web.cim.org/standards/MenuPage.cfm?sections=177,183&menu=226

http://web.cim.org/standards/documents/Block474_Doc32.pdf

With BMIX, since it is a US based company, the NI 43-101 and its terms that are used are not defined terms under SEC Industry Guide 7 and generally will not be used in reports and registration statements filed with the SEC. However, they are definitely used to help assess the ”actual” and ”potential” valuation of a company and are well respected within the market and have been for years.

Read the post below to maybe get a little better understanding about the NI 43-101:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=57937445

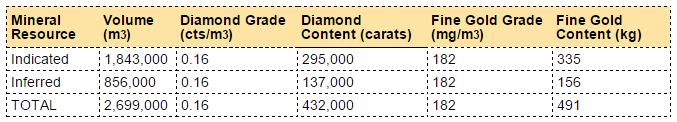

Very important is that the Duas Barras NI 43-101 contains on its page 9 the following table of resources:

Important to Note: The Duas Barras NI 43-101 is on file with Canada’s securities commission at www.sedar.com by searching under “Vaaldiam” and thereafter navigating to the entry entitled “Technical Report (NI 43-101)-English dated April 12, 2007.”

To further understand what is meant by these Mineral Resource amounts indicated above and since I am far from being a mining expert, multiply the amount of diamonds per carat and let’s discuss the millions of dollars that ”potentially” exists here with BMIX.

Diamonds Indicated = 295,000 Carats

Diamonds Inferred = 137,000 Carats

Total Resource of Diamonds = 432,000 Carats

From what I have learned, each size range of diamonds has its own price grid matrix. The price could range from as low as $1,400 per carat to as high as $26,950 per carat as the high:

http://www.diamondregistry.com/1-carat-diamond-price.htm

There are many variables that must be considered to determine the exact price, but for the purpose of this post, I will use what I had seen as a low in a particular example elsewhere of $1,400 per carat to derive the ”potential” valuation from the ”Indicated” and ”Inferred” amount of diamonds:

Potential Value/Diamonds Indicated = 295,000 Carats x $1,400 = $413,000,000

Potential Value/Diamonds Inferred = 137,000 Carats x $1,400 = $191,800,000

Potential Value/Total Resource of Diamonds = 432,000 Carats x $1,400 = $604,800,000

Again, please understand, I am not a mining expert. The value above could be considered lower if the amount per carat is truly much lower than what I was able to find or much higher as the quality of the diamond would mean a lot. Still, even if you reduce the amount in half or by a third or by a quarter, one should still be able to see the potential. Respectfully, please review and share your thoughts.

Keep in mind too... we need to also consider the amount of gold per kilogram or convert it into ounces to get what additional valuation should be considered.

Also, for inquiring minds, the thoughts above were derive through logical deduction from their indicated NI 43-101. I am confident that BMIX is fully aware of the SEC not acknowledging the NI 43-101 and knows that the SEC recognizes the Industry Guide 7 Standards as can be researched below:

SEC Industry Guide 7

http://web.cim.org/standards/MenuPage.cfm?sections=177,183&menu=226

INDUSTRY GUIDE 7: Description of Property by lssuers Engaged or to be Engaged in Significant Mining Operations

http://web.cim.org/standards/documents/Block474_Doc32.pdf

Regardless, as I have stated above, the NI 43-101 is a very legitimate document that is well respected throughout the entire market. In my opinion, the valuation is confirmed to exist here with BMIX.

v/r

Sterling

Sterling's Trading & Investing Strategies:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39092516

Recent ATLX News

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/09/2024 02:30:09 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/06/2024 11:01:55 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/17/2024 02:30:41 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/14/2024 04:55:05 PM

- Form 5 - Annual statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/14/2024 03:23:59 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/12/2024 09:30:35 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/27/2024 02:30:09 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/13/2024 02:30:22 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:24 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:13 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/05/2024 10:00:31 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/05/2024 02:30:07 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/30/2023 02:25:19 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/30/2023 02:20:14 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/23/2023 02:30:35 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 02:30:07 AM

VPR Brands LP Reports Record Annual Financial Performance for Fiscal Year 2023 • VPRB • Apr 19, 2024 11:24 AM

Coinllectibles' Subsidiary, Grand Town Development Limited, Acquires Rare Song Dynasty Ceramics Worth Over USD28million • COSG • Apr 18, 2024 8:03 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM

Glucotrack Announces Expansion of Its Continuous Glucose Monitoring Technology to Epidural Glucose Monitoring • GCTK • Apr 17, 2024 8:00 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • BLOZF • Apr 16, 2024 8:52 AM