Monday, October 24, 2016 7:20:28 AM

Everything continues to suggests that the big down move is done and we should at least maintain the current range, Early signs of some upward movement exist but need to appear more consistently before we can even think of acting on that basis.

The first forty-five minutes were essentially a $1.06/9 higher-volume sideways period. We opened low ($1.08) and did not start a drop, but just did very low/no-volume (but for an early 10K $1.09 block trade) sideways $1.08/9 through 9:39. Then a weak drop occurred on 9:41-:43's 13K $1.08->$1.07->$1.06 followed by a few low-volume minutes at $1.0700/xx. 9:50-10:09 stepped up from a low of $1.06 at 9:50 to $1.07/8 at 9:51, $1.0850 by 10:03 and $1.09 by 10:06. Then all the gain is taken away as 10:10-:15's 16.5K goes $1.09->$1.09->$1.07->$1.06.

Then it looked like we were going to see another weak down day as we did a long mostly low-volume, some medium and no-volume, $1.06/7 (with a couple low-volume one-minute blips to $1.07xx) from 10:16-11:43.

But a low-volume move to $1.08 by 11:49 and a couple more minutes $1.07xx/$1.08 was followed by 12:03-:06's 29.2K rise to $1.11.

The re-trace this time, 11:44-12:32 on very low/no-volume, only went down to $1.07/8 and was followed by a long, mostly low/no-volume $1.07/8 until 13:56's ~9.5K $1.0750 (100)/$1.08 ended that.

Then came the unexpected, a move to $1.08/9 on 13:56/7's 10K. Very low/no-volume, mostly' $1.08/9, occurred through 15:59 and 16:00 closed us at $1.10.

All day there was a more balanced hitting of the bids and asks than had recently been seen.

There were no pre-market trades.

09:30-09:46 opened the day with a 2,111 sell for $1.08, put b/a at 9:31 to 16.6K:900 $1.08/10, did 9:32's 10.8K (incl 10K $1.09 blk) $1.09->$1.08, 9:33's ~1.1K $1.08/$1.0850, and had 9:35's b/a 8.6K:7.7K $1.08/9. 9:41's ~9.9K $1.08->$1.07 (100) kicked off a weak drop that included 9:42's 100 $1.07, 9:43's 3.3K $1.0661->$1.0601->$1.0650->$1.07, 9:44's 200 $1.07, 9:45's 1.1K $1.0728/33, and the period ended on 9:46's 700 $1.07.

9:47-10:09, after three no-trades minutes, began a slow mostly very low/no-volume (but lots of one-minute volume spikes) move upwards on 9:50's 3.6K $1.06->$1.07. Then hit 9:51's 8.2K $1.07/8, 9:56's b/a 3.1K:1.4K $1.07/8, 9:57's b/a 5.9K:400 $1.08/9, 10:04's 100 $1.09, 10:07's b/a 10.4K:1.8K $1.08/9. The period ended on 10:09's 100 $1.09.

10:10-11:44, began stepping back down on 10:10's 300 $1.09->$1.08. Then hit 10:13's ~15K $1.08->$1.07, 10:15's 1K $1.07->$1.06, 10:20's b/a 11.2K:5.3K $1.06/7, 11:03 12K:5K $1.06/7, 11:11 16.1K:2.7K $1.06/7, 11:19 18.5K:2.7K $1.06/7, 11:33 19K:3.5K $1.06/7, 11:37 3K:1K $1.07/8. The period ended on 11:44's 100 $1.07.

11:45-12:06, after two no-trades minutes, began an initially slow climb higher on 11:47's 1.1K $1.0757/83. Then came 11:49's b/a of 2.5K:2.3K $1.07/8, 12:03's 10.6K $1.08->$1.07->$1.10, 12:04's 14.7K $1.08->$1.11->$1.09, 12:04's 3.4K:900 $1.07/9. The period ended on 12:06's 2.8K $1.11->$1.10->$1.09.

12:07-13:53, after one no-trades minute, began a quick, mostly low/no-volume, drop on 12:08's 200 $1.10->$1.0967. B/a at 12:09 was 600:5.9K $1.09/10, 12:28 11.4K:2.9K $1.07/8, 12:37 14.5K:4.4K $1.07/8, 12:51 12.4K:4.4K $1.07/8, 13:05 12.1K:3.3K $1.07/8, 13:30 22.2K:8K $1.07/8, 13:45 24.7K:9.7K $1.07/8. The period ended on 13:53's 1.6K $1.07/8.

13:54-16:00, after two no-trades minutes, had 13:56's b/a of 600:3.7K $1.08/9. That began ... on 13:56-:58's 10.5K $1.08->$1.09->$1.08. B/a at 14:03 was 100:2.8K 1.08/9, 14:43 800:5.3K $1.08/9, 15:04 6.6K:1.6K $1.08/9, 15:35 6.1K:4.9K $1.08/9, 15:59 11.9K:3K $1.08/9. The period and day ended on 15:59's ~10.1K $1.08/$1.0801->$1.08->$1.09->$1.08/$1.0801-$1.09->$1.08 and 16:00's 400 $1.10.

There were no AH trades.

Excluding the opening and closing trades (didn't qualify), there were 7 larger trades (>=5K & 2 4K+) totaling 39,400, 15.34% of day's volume, with a $1.0840 VWAP. Percentage of day's volume is a bit lower than normal due to only one "larger larger trade". Regardless, the intra-day price action, with both ups and downs, and the buy percentage remaining relatively strong suggests we don't have any big weakness likely near-term.

Worth noting in the above is the buy percentage behavior as VWAP tried to move lower. This is strong intra-day behavior by that percentage and ending at 50%+ is also strong.Ending Period Period Period __Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High _Dollar Val._ VWAP___ Volume Buy ~%

09:46 28902 $1.0601 $1.0900 $31,264.74 $1.0818 11.25% 37.86% Incl 09:32 $1.0900 10,000

10:09 36039 $1.0600 $1.0900 $38,870.27 $1.0786 14.03% 46.60% Incl 10:03 $1.0801 5,000 10:06 $1.0880 5,000

10:06 $1.0898 4,000

11:44 79167 $1.0600 $1.0900 $84,587.78 $1.0685 30.83% 45.61%

12:06 34135 $1.0700 $1.1100 $37,277.63 $1.0921 13.29% 53.31% Incl 10:13 $1.0800 5,000 10:18 $1.0600 5,800

12:03 $1.1000 4,600

13:53 34923 $1.0700 $1.1000 $37,692.15 $1.0793 13.60% 52.36%

16:00 41213 $1.0750 $1.1000 $44,639.57 $1.0831 16.05% 50.15%

On the traditional TA front, movements were:

Note that in spite of an open, low and high substantially below yesterday's open, low and high, the close was higher. Considering the news that caused all this and adding in today was a Friday, these are not bad results. Adding in the trading volume continuing to reduce and being below the 10-day average prior to the dilution announcement supports my take that this is a normal short-term consolidation following a negative catalyst.__Open_ ___Low_ __High_ _Close_ Volume_

Today -8.47% -0.93% -5.93% 0.92% -36.86%

Prior 7.27% 7.00% -0.84% -1.80% -83.53%

On my minimal chart yesterday I said { Today was the third day and the higher open and low on reducing volume suggests the expected behavior is beginning. The reducing intra-day price range suggests we are beginning to enter a short consolidation period, which would be the first step exiting the big downward move before any appreciation starts in earnest. } Today's narrowing range, during which we saw a down open, lower low and high but higher close fits with the scenario I believe was indicated yesterday.

The experimental 13-period Bollinger limits are still diverging and the mid-point is falling.

On my one-year chart the 10, 20, 50 and 200-day SMAs continue descending and the 50-day is only $0.00993 above the 200-day. I thought we might get a "Death Cross" today but a slightly higher close and faulty estimating by me makes that a fail. Yesterday I said { ... we might get a slightly higher range tomorrow as we exit my three-day window. } Ah, 'twas not to be! We got a higher close but the last 15:59 trades were $1.08, which would give us a close down a penny. All the SMAs should continue to drop barring a substantial near-term rise.

The oscillators I watch yesterday continued mixed but with all but momentum and full stochastic weakening. RSI, full stochastic and MFI remained oversold and all others were below neutral. Today RSI, momentum, Williams %R, full stochastic, and accumulation/distribution improved marginally, MFI (untrusted by me) weakened, and ADX-related stayed almost flat. RSI and MFI remain in oversold while Williams %R and full stochastic are barely above oversold. Everything remains well below neutral.

The experimental 13-period Bollinger limits, $1.0287 and $1.5483 ($1.0679 and $1.5398 yesterday) continue diverging with a falling mid-point.

All in, conventional TA suggests low volume with only marginal aggregate improvement in the oscillators easily negate the small improvement in closing price, suggesting no near-term upward movement with strength yet. The small improvements do offer the possibility that the downward move has ended. But the indications of that are not yet strong.

The less conventional ending buy percentage combined with the intra-day strength in that offer a stronger suggestion that the downward move is over and we should be able to at least maintain sideways here. If we get another day or two of similar buy percentages we should see a small upward move.

Percentages for daily short sales and buys moved in the same direction (YAY!) and the buy percentage ended up at 50% (best since 10/5's ~55%). Better, intra-day it stayed >= 50% from 12:06 (53.3%) to the end of day. Usually we get a sag somewhere in the (late?) afternoon and end in the low-to-mid-4x% range. I'm thinking this supports that we exited that three-day window and started setting up for normal behavior and whatever the next move will be.

Countering that, maybe, is that short percentage moved even further above my desired range (needs re-check), but it was a very small move so maybe not significant at all.

In aggregate, knowing that normally a good percentage of shorts are nothing but MMs churning the waters to scarf their profits, I think the greater importance today lies with the buy percentage behavior intra-day and the ending value. I don't expect it to last but I do think it shows a strong inclination to see our current price range as attractive entry points and/or covering buy points, both of which suggest the move lower has been (will be?) arrested.

The spread continued narrowing and is now close to what we would expect when a big move has ended and normal consolidation is commencing or about to commence. Of course it's not guaranteed that consolidation will ensue or continue for long, but it is a very common follow-on to a big catalyst-inspired move.

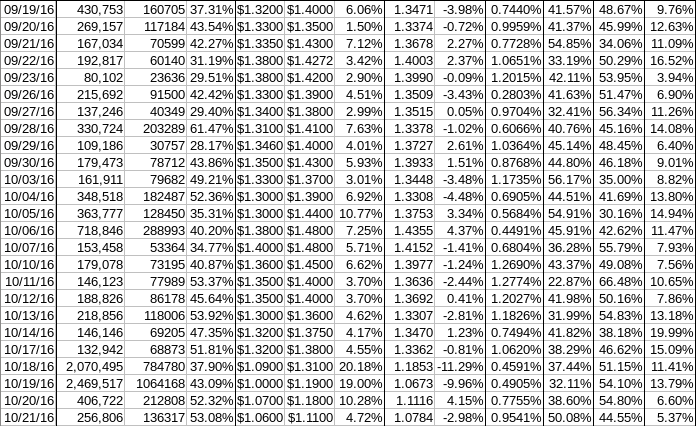

The VWAP's last twenty-four readings held for the second day at 14 positives and 10 negatives. Change since 09/19 is -$0.2687, -19.94%, and the averages of the rolling 24-day period seen in the last few days (latest first) are now -0.8505%, -0.8923%, -1.0866%, -0.6859%, -0.2351%, -0.6179%, -0.8203%, -0.6925%, -0.9581%, and -1.4117%.

All in, only the short percentage and falling VWAP are enough to cause concern for the moment. Applying some judgement, which might be faulty, I think short percentage is not a concern for now. The VWAP falling is more of a concern but even that requires some judgement. Yesterday had a 4.15% increase and today's ~-3% still left the VWAP a penny higher than 10/19, the second day of the big drop. This is typical of entering a short consolidation before making another notable move one way or the other.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.