Tuesday, October 18, 2016 9:11:56 AM

This is an Edited Version as of Close of Business Monday, Oct 17, 2016:

CGRW is a very good comparison for CGRA to ”compare and contrast” to truly reflect how undervalued CGRA is. Please, anyone reading this, understand that this is no knock against CGRW, but is nothing more than some thoughts to reflect why I believe CGRA is undervalued here at these levels.

CGRA = .023 per share as of COB Oct 17, 2016

CGRW = $2.58 per share as of COB Oct 17, 2016

CGRA Last Quarterly Filing = $1,750,000 Net Income

http://ih.advfn.com/p.php?pid=nmona&article=72214630

CGRW Last Quarterly Filing = $(95,476) Net Loss

http://www.otcmarkets.com/financialReportViewer?symbol=CGRW&id=159281

CGRA Outstanding Shares (OS) = 391,597,994 Shares

http://www.otcmarkets.com/stock/CGRA/profile

CGRW Outstanding Shares (OS) = 102,073,434 Shares

http://www.otcmarkets.com/stock/CGRW/profile

CGRA Market Capital (MC) = 391,597,994 Shares (OS) x .023 share price = $9,006,754

http://www.otcmarkets.com/stock/CGRA/profile

CGRW Market Capital (MC) = 102,073,434 Shares (OS) x $2.58 share price = $263,349,460

http://www.otcmarkets.com/stock/CGRW/profile

CGRA = 4 Marijuana Operations with 3 Companies (Outdoor & Indoor)

CGRW = 1 Marijuana Operation with 1 Company (Outdoor & Indoor)

CGRA = Buildings on 47 acres and 90,000 Square Feet

CGRW = Buildings on 20 acres and 10,000 Square Feet

CGRA = 1,940 Marijuana Plants (through wholly owned subsidiary through Wildfire)

CGRW = 1,500 Marijuana Plants

In Summary: Both companies present some solid opportunities as an investment, but I personally like what CGRA presents better because it appears to be far more undervalued in comparison. If you compare and contrast the Market Caps between CGRA and CGRW, you will see that CGRW trades at a Market Cap that is more than 29 times higher than that of CGRA. Based on potential from comparing and contrasting CGRA to CGRW, it could be debated that CGRA should be currently trading in the .667 per share range as derived from below:

.023 CGRA Share Price x 29 Times MC Greater = .667 per share for CGRA’s MC potential versus CGRW’s

The .667 per share price mentioned above is only a new base of which I think would be fair market value for CGRA to achieve when you compare and contrast what CGRA has versus what CGRW has. I say a new base because that valuation thought is only based on its marijuana operations. It does not include their US $3,405,186,000 in Oil & Gas Reserves, Gold, Silver, Lead, and Zinc Reserves:

This also does not include the CGRA $2.7 Billion Net Valuation in Magnesium Dolomite as confirmed from below:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=124811375

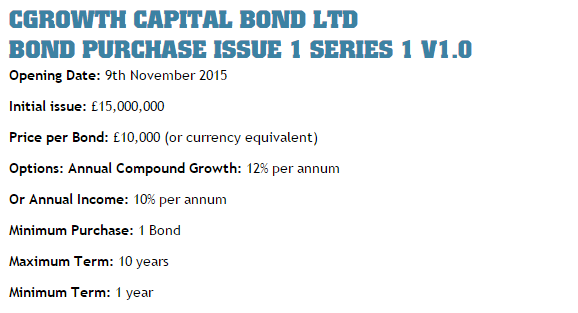

To add, CGRA has a Bond that was approved to finance the company for £30,000,000 British Pounds Sterling (~$40,000,000 USD) that was approved/confirmed from AON which trades on the NYSE at over $100+ per share as indicated below:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121446187

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121443217

http://ceolive.tv/cgra/

The Bond was ”primarily” approved for these Oil & Gas Operations below:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=125112224

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=123989477

Those added details above are what makes CGRA a better investment… in my opinion. I’m not sure what kind of Leasing Agreement that CGRW has with its clients, but CGRA agreements, per the recent CEO interview, gives them an initial $1.5 Million and a max of over $2 Million per client/company per parcel with currently having 3 companies listed within the Washington state database while having a max capacity of up to nine clients/companies (3 companies per each of the 3 parcels). This means that CGRA can obtain $4.5 Million to over $6 Million in Leasing Fees for 3 companies or $13.5 Million to over $18 Million in Leasing Fees for 9 companies. Again, most, if not all of such amount would be considered Net Income which would suggest what I had posted below which is also within the next section:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=125736864

To further add… again… no knock against CGRW, but if CGRW is trading at $2.58 per share for the logic I posted above, then in comparison, these .15 to .30 per share valuation thoughts below are very conservative at best for CGRA…

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=125842746

CGRA/Wildfire Huge Marijuana Cultivation Update

For those who are new to CGRA, the operations that is carrying out this harvest consists of 1,940 marijuana plants to where CGRA has 100% operational control over all of the production through its ”wholly owned subsidiary” Chewelah Properties:

https://twitter.com/WildfireMJ

Above is the recent marijuana outdoor cultivation update recently released on twitter regarding the CGRA wholly owned subsidiary, Chewelah Properties, LLC, through its Leasing Program to Wildfire to cultivate, produce, and process marijuana for their 47 acres worth of land/property.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=125736864

CGRA .15 to .30 Price Projection

Important to Note: Just go look at some of the other marijuana stocks that are growing and processing marijuana that are trading far higher and some with a worse share structure and you will clearly see that CGRA has more potential for growth than most, if not all of them. This is why I believe that it is only a matter of time before the rest of the market learns about CGRA.

CGRA has 47 acres of approved licensed buildings and land to grow and process marijuana. Again, CGRA is not doing any growing or processing of marijuana, but with that much land and facilities that have already gone through the rigorous approval processes for Stevens County and the state of Washington to obtain approval already, I suspect that they will be learning of a few more potential tenants that would like to lease their land and facilities in my opinion; indoor and outdoor. If the Federal Government decides to re-class marijuana to downgrade its scheduled rating as many suspect, then CGRA will be able to grow and process marijuana itself while continuing to lease their approved land to others too.

I am confident that CGRA could easily be somewhere in the area between .15 to .30+ per share in the near future for the reasons posted below that have been ”officially” released by the company:

CGRA Marijuana License Approval for Stevens County and State of Washington

CGrowth Capital Receives Clearance for Cannabis Operations in Washington State

http://cgrowthcapital.com/cgrowth-capital-receives-clearance-for-cannabis-operations-in-washington-state/

** CGRA can now proceed with its plans to lease portions or all of its 47-acre site to company’s legally producing and/or processing cannabis and its byproducts in the state of Washington.

** The Company previously announced an initial lease to Wildfire Cannabis Company (“Wildfire”), a Tier 3 cannabis operation. Under its license, Wildfire is qualified to manage up to 30,000 square feet of plant production.

** CGRA has received a Determination of Non-Significance (“DNS”) from Stevens County regarding the Company’s application to allow its Eastern Washington industrial facility to transition from a mineral processing site to one that can grow and process cannabis.

** For more information about the SEPA determination, please visit the Stevens County Building Division website to download the determination: http://www.co.stevens.wa.us/landservices/building_division.php

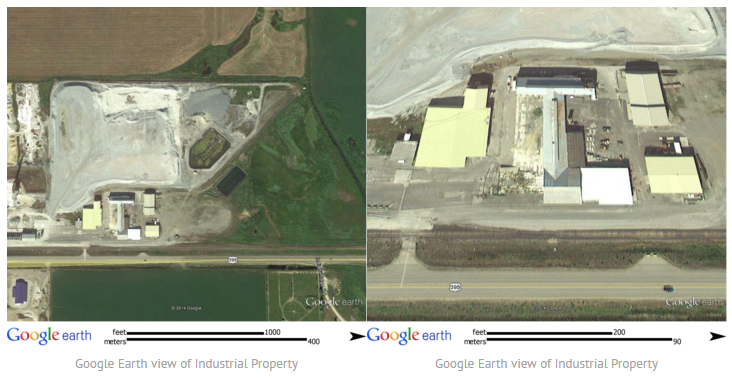

Google Earth view of Industrial Property now transformed into Marijuana Grow and Processing Facility

(For a complete understanding, CGRA does not grow, process or sell marijuana. They lease their licensed facility to those who are licensed to do so.)

http://cgrowthcapital.com/real-estate/

Fact: CGRA has one hundred percent (100%) operational control over all production from its ”wholly owned subsidiary” Chewelah Properties:

http://www.cgrowthcapital.com/#!dolomite/c755

Fact: CGRA combined ”Net” Revenue Interests are 100% working interest in all operations and mineral leases:

http://www.cgrowthcapital.com/#!dolomite/c755

Fact: The 5-year Lease Agreement from its marijuana operational tenants in the state of Washington anticipates payments in excess of $2,000,000 annually, to include base rent, tenant improvements, common area maintenance charges, ancillary rentable areas, and administration fees:

http://finance.yahoo.com/news/cgrowth-capital-inc-executes-commercial-133000700.html

Fact: CGRA has its Chewelah Properties listed within the Washington State Government database under the Washington State Liquor and Cannabis Board website being leased by the following companies; WILDFIRE CANNABIS COMPANY, RANDOLPH AND MORTIMER, and WONDER WEST GROUP:

(Click on the section titled “Marijuana License Applicants” then click on the spreadsheet that pops up to view to see the now ”Active” status for Wildfire)

http://www.liq.wa.gov/records/frequently-requested-lists

Fact: Confirmation that from the Washington state tax website proving that CGRA owns the land which consists of three tax parcels reference from the Chewelah Properties:

http://propertysearch.trueautomation.com/PropertyAccess/Property.aspx?cid=0&year=2014&prop_id=47404

Fact: CGRA Authorized Shares (AS) amount is 500,000,000 Shares

Fact: CGRA Outstanding Shares (OS) amount is 391,597,994 Shares

Fact: CGRA Restricted Shares amount is 132,534,002 Shares

Fact: CGRA Float Shares amount is 259,063,992 Shares

(The numbers above are per the CGRA Transfer Agent (TA) Pacific Stock Transfer

800-785-7782.)

Stevens County Building Division website to download the approval:

http://www.co.stevens.wa.us/landservices/building_division.php

Here's part of Page 1 of 6:

http://www.co.stevens.wa.us/landservices/documents/DNSDecisionChewelahProp.pdf

Fair Speculation: If the Lease Agreement that CGRA has with Wildfire Cannabis Company is expected to generate over $2 Million per year, then it is ”fair speculation” to presume that the total of now ”three” companies now having Leasing Agreements with CGRA will generate over $6 Million per year.

Fair Speculation: I think it’s also fair to presume that since each company will be taking on all of the risk, all of the expenses, and of the debt, and etc. towards the maturation of any and all of those marijuana operations, the over $6 Million generated to be given to CGRA as a lease payment, should be considered as ”Net Income” for CGRA. Even as a worse cast scenario, half would be ”Net Income” for CGRA in my opinion.

Now let’s derive a ”potential” valuation by deriving an Earnings Per Share (EPS) to multiply by a Price to Earnings (P/E) Ratio from the variables that we know to exist from the info above.

Net Income ÷ OS = EPS

EPS X P/E Ratio = Share Price Valuation

Key Variables to Derive a Fundamental Valuation

** Net Income = $6,000,000

** OS = 391,597,994 Shares

** P/E Ratio for Marijuana Industry = 20.00 (Presumably)

$6,000,000 ÷ 391,597,994 Shares (OS) = .0153 EPS

.0153 EPS x 20 P/E Ratio = .306 Per Share Price Valuation

In my opinion, this means that with the now approved Marijuana License, this signifies a new beginning for CGRA which should very easily lead the company in the direction to obtain the level I have indicated above. Just in case I forgot any key variables that are unknown for whatever the reason or even if I am only half right with the thoughts above regarding the $6 million in Net Income, CGRA should easily have a fair value at .15+ per share. Also, if any of the variables above should change, just use the ”Substitution Property” as the fundamental formula for assessing a valuation would still apply.

CGrowth Capital Announces Two Additional Tier 3 Cannabis Tenants at Washington State Facility

http://cgrowthcapital.com/cgrowth-capital-announces-two-additional-tier-3-cannabis-tenants-at-washington-state-facility/

CGRA vs CGRW Comparison

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121470903

(Use the Substitution Property to replace key variables that might have changed.)

CGrowth Capital Releases Financial Overview on Annual Report

http://cgrowthcapital.com/cgrowth-capital-releases-financial-overview-on-annual-report/

http://finance.yahoo.com/news/cgrowth-capital-releases-corporate-april-141400066.html

** 61 barrels of oil in its first 18 hours of operation.

** Project is a 3,400-acre oil and gas project in Wyoming.

** $250,000,000 Proven and Probable Oils Reserves.

** £15,000,000.00 British Pounds Sterling ($21M+ USD) to fund operational growth.

** Beginning to bring online an initial series of 12 wells.

** Another 12 wells being evaluated for workover and production.

** Previous total was 24 wells now 30 wells.

** This project is located directly adjacent to Anadarko’s EOR Project in the Salt Creek Field, Wyoming.

** Salt Creek Field is Wyoming's largest oil field.

** Anadarko property that is directly adjacent to CGRA’s property has over 2 billion barrels of original oil in place, with only a portion of that recovered to-date.

http://www.cgrowthcapitalbond.com/files/3414/4778/4745/Powder_River_Resources_Inc_-_Business_Plan_and_Detail_Aug_2015_Update.pdf

CGRA Potential Revenues from its 30 Oil/Gas Wells

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=125112224

CGRA wholly owned subsidiary CGrowth Capital Bond, Ltd. has received initial subscriptions of its £15,000,000.00 British Pounds Sterling (“GBP”) bond offering in the amount of £7,300,000.00 GBP

http://cgrowthcapital.com/cgrowth-capital-provides-update-and-confirms-funding-on-corporate-bond/

http://www.cgrowthcapitalbond.com/

CGRA Preliminary $2.7 Billion Net Valuations on Dolomite Reserve

https://globenewswire.com/news-release/2015/07/28/755778/10143556/en/CGrowth-Capital-Inc-Announces-Preliminary-Net-Valuations-on-Dolomite-Reserve.html

SILVERDALE, Wash., July 28, 2015 (GLOBE NEWSWIRE) -- via PRWEB - CGrowth Capital, Inc. (OTC Pink: CGRA) (the "Company") is pleased to announce preliminary results and net valuations on its magnesium dolomite reserve. Taking into account the physical characteristics of the site, water tables, and anticipated mining expenses, the immediate probable mineral reserve has been set at 63% of the initial survey reserve of 505m cubic yards – which calculates out at 420m tons of material – significantly exceeding initial expectations. The estimated economic benefit from the site, after accounting for royalty, reclamation, and loss, has been estimated at a net value of approximately $2.7 billion.

v/r

Sterling

Sterling's Trading & Investing Strategies:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39092516

Recent CGRA News

- CGRA Remains Significantly Undervalued Despite Discovery of Lithium Bearing Rock • InvestorsHub NewsWire • 03/05/2024 03:24:44 PM

- CGrowth Capital Inc. Confirms Discovery of Lithium Bearing Rock in Exploration Breakthrough • InvestorsHub NewsWire • 02/23/2024 02:49:22 PM

- CGrowth Capital Inc. Provides Update on Lithium Mining Project • InvestorsHub NewsWire • 01/25/2024 03:34:37 PM

- CGrowth Capital Inc. Granted Four New Prospecting Licenses, Unveils Detailed Rollout Schedule, and Key Milestones for Lithium Mining Project • InvestorsHub NewsWire • 12/29/2023 02:24:53 PM

- CGrowth Capital Inc. Discovers Promising Lithium Bearing Pegmatite Deposits in Tenements Following Comprehensive Study and Survey • InvestorsHub NewsWire • 12/19/2023 06:21:13 PM

- CGrowth Capital Inc. Bolsters Mining Division with Team Expansion and Expert Appointments • InvestorsHub NewsWire • 12/12/2023 04:22:02 PM

- CGrowth Capital Inc. Granted 7 New Prospecting Licenses by The Ministry of Minerals and Mining Commission of Tanzania • InvestorsHub NewsWire • 12/08/2023 06:53:36 PM

- CGrowth Capital Inc. Sets Stage for Exciting 2024 with Savage Barbell Apparel Expansion • InvestorsHub NewsWire • 11/28/2023 04:15:30 PM

- CGrowth Capital Inc. Highlights Recent Achievements and Strategic Focus in Company Update • InvestorsHub NewsWire • 11/21/2023 07:37:17 PM

- CGrowth Capital Secures $1 Million in Non-Debt Financing • InvestorsHub NewsWire • 11/16/2023 07:34:12 PM

- CGrowth Capital Inc. Nears Key Milestone in Lithium Mining Expansion • InvestorsHub NewsWire • 09/26/2023 12:08:01 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM