Monday, October 17, 2016 11:57:17 AM

For those who are new to CGRA, the operations that is carrying out this harvest consists of 1,940 marijuana plants to where CGRA has 100% operational control over all of the production through its ”wholly owned subsidiary” Chewelah Properties:

https://twitter.com/WildfireMJ

Above is the recent marijuana outdoor cultivation update recently released on twitter regarding the CGRA wholly owned subsidiary, Chewelah Properties, LLC, through its Leasing Program to Wildfire to cultivate, produce, and process marijuana for their 47 acres worth of land/property.

Now this post below is looking a little closer at sight...

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=125736864

CGRA .15 to .30 Price Projection

Important to Note: Just go look at some of the other marijuana stocks that are growing and processing marijuana that are trading far higher and some with a worse share structure and you will clearly see that CGRA has more potential for growth than most, if not all of them. This is why I believe that it is only a matter of time before the rest of the market learns about CGRA.

CGRA has 47 acres of approved licensed buildings and land to grow and process marijuana. Again, CGRA is not doing any growing or processing of marijuana, but with that much land and facilities that have already gone through the rigorous approval processes for Stevens County and the state of Washington to obtain approval already, I suspect that they will be learning of a few more potential tenants that would like to lease their land and facilities in my opinion; indoor and outdoor. If the Federal Government decides to re-class marijuana to downgrade its scheduled rating as many suspect, then CGRA will be able to grow and process marijuana itself while continuing to lease their approved land to others too.

I am confident that CGRA could easily be somewhere in the area between .15 to .30+ per share in the near future for the reasons posted below that have been ”officially” released by the company:

CGRA Marijuana License Approval for Stevens County and State of Washington

CGrowth Capital Receives Clearance for Cannabis Operations in Washington State

http://cgrowthcapital.com/cgrowth-capital-receives-clearance-for-cannabis-operations-in-washington-state/

** CGRA can now proceed with its plans to lease portions or all of its 47-acre site to company’s legally producing and/or processing cannabis and its byproducts in the state of Washington.

** The Company previously announced an initial lease to Wildfire Cannabis Company (“Wildfire”), a Tier 3 cannabis operation. Under its license, Wildfire is qualified to manage up to 30,000 square feet of plant production.

** CGRA has received a Determination of Non-Significance (“DNS”) from Stevens County regarding the Company’s application to allow its Eastern Washington industrial facility to transition from a mineral processing site to one that can grow and process cannabis.

** For more information about the SEPA determination, please visit the Stevens County Building Division website to download the determination: http://www.co.stevens.wa.us/landservices/building_division.php

Google Earth view of Industrial Property now transformed into Marijuana Grow and Processing Facility

(For a complete understanding, CGRA does not grow, process or sell marijuana. They lease their licensed facility to those who are licensed to do so.)

http://cgrowthcapital.com/real-estate/

Fact: CGRA has one hundred percent (100%) operational control over all production from its ”wholly owned subsidiary” Chewelah Properties:

http://www.cgrowthcapital.com/#!dolomite/c755

Fact: CGRA combined ”Net” Revenue Interests are 100% working interest in all operations and mineral leases:

http://www.cgrowthcapital.com/#!dolomite/c755

Fact: The 5-year Lease Agreement from its marijuana operational tenants in the state of Washington anticipates payments in excess of $2,000,000 annually, to include base rent, tenant improvements, common area maintenance charges, ancillary rentable areas, and administration fees:

http://finance.yahoo.com/news/cgrowth-capital-inc-executes-commercial-133000700.html

Fact: CGRA has its Chewelah Properties listed within the Washington State Government database under the Washington State Liquor and Cannabis Board website being leased by the following companies; WILDFIRE CANNABIS COMPANY, RANDOLPH AND MORTIMER, and WONDER WEST GROUP:

(Click on the section titled “Marijuana License Applicants” then click on the spreadsheet that pops up to view to see the now ”Active” status for Wildfire)

http://www.liq.wa.gov/records/frequently-requested-lists

Fact: Confirmation that from the Washington state tax website proving that CGRA owns the land which consists of three tax parcels reference from the Chewelah Properties:

http://propertysearch.trueautomation.com/PropertyAccess/Property.aspx?cid=0&year=2014&prop_id=47404

Fact: CGRA Authorized Shares (AS) amount is 500,000,000 Shares

Fact: CGRA Outstanding Shares (OS) amount is 391,597,994 Shares

Fact: CGRA Restricted Shares amount is 132,534,002 Shares

Fact: CGRA Float Shares amount is 259,063,992 Shares

(The numbers above are per the CGRA Transfer Agent (TA) Pacific Stock Transfer

800-785-7782.)

Stevens County Building Division website to download the approval:

http://www.co.stevens.wa.us/landservices/building_division.php

Here's part of Page 1 of 6:

http://www.co.stevens.wa.us/landservices/documents/DNSDecisionChewelahProp.pdf

Fair Speculation: If the Lease Agreement that CGRA has with Wildfire Cannabis Company is expected to generate over $2 Million per year, then it is ”fair speculation” to presume that the total of now ”three” companies now having Leasing Agreements with CGRA will generate over $6 Million per year.

Fair Speculation: I think it’s also fair to presume that since each company will be taking on all of the risk, all of the expenses, and of the debt, and etc. towards the maturation of any and all of those marijuana operations, the over $6 Million generated to be given to CGRA as a lease payment, should be considered as ”Net Income” for CGRA. Even as a worse cast scenario, half would be ”Net Income” for CGRA in my opinion.

Now let’s derive a ”potential” valuation by deriving an Earnings Per Share (EPS) to multiply by a Price to Earnings (P/E) Ratio from the variables that we know to exist from the info above.

Net Income ÷ OS = EPS

EPS X P/E Ratio = Share Price Valuation

Key Variables to Derive a Fundamental Valuation

** Net Income = $6,000,000

** OS = 391,597,994 Shares

** P/E Ratio for Marijuana Industry = 20.00 (Presumably)

$6,000,000 ÷ 391,597,994 Shares (OS) = .0153 EPS

.0153 EPS x 20 P/E Ratio = .306 Per Share Price Valuation

In my opinion, this means that with the now approved Marijuana License, this signifies a new beginning for CGRA which should very easily lead the company in the direction to obtain the level I have indicated above. Just in case I forgot any key variables that are unknown for whatever the reason or even if I am only half right with the thoughts above regarding the $6 million in Net Income, CGRA should easily have a fair value at .15+ per share. Also, if any of the variables above should change, just use the ”Substitution Property” as the fundamental formula for assessing a valuation would still apply.

CGrowth Capital Announces Two Additional Tier 3 Cannabis Tenants at Washington State Facility

http://cgrowthcapital.com/cgrowth-capital-announces-two-additional-tier-3-cannabis-tenants-at-washington-state-facility/

CGRA vs CGRW Comparison

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=121470903

(Use the Substitution Property to replace key variables that might have changed.)

CGrowth Capital Releases Financial Overview on Annual Report

http://cgrowthcapital.com/cgrowth-capital-releases-financial-overview-on-annual-report/

http://finance.yahoo.com/news/cgrowth-capital-releases-corporate-april-141400066.html

** 61 barrels of oil in its first 18 hours of operation.

** Project is a 3,400-acre oil and gas project in Wyoming.

** $250,000,000 Proven and Probable Oils Reserves.

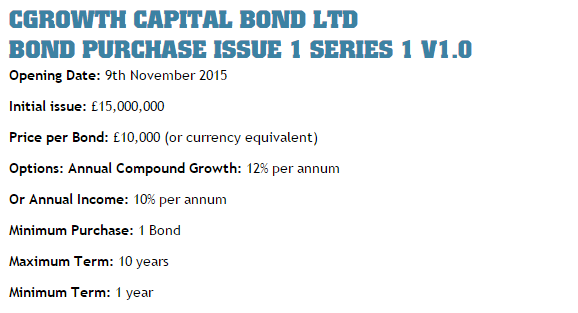

** £15,000,000.00 British Pounds Sterling ($21M+ USD) to fund operational growth.

** Beginning to bring online an initial series of 12 wells.

** Another 12 wells being evaluated for workover and production.

** Previous total was 24 wells now 30 wells.

** This project is located directly adjacent to Anadarko’s EOR Project in the Salt Creek Field, Wyoming.

** Salt Creek Field is Wyoming's largest oil field.

** Anadarko property that is directly adjacent to CGRA’s property has over 2 billion barrels of original oil in place, with only a portion of that recovered to-date.

http://www.cgrowthcapitalbond.com/files/3414/4778/4745/Powder_River_Resources_Inc_-_Business_Plan_and_Detail_Aug_2015_Update.pdf

CGRA Potential Revenues from its 30 Oil/Gas Wells

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=125112224

CGRA wholly owned subsidiary CGrowth Capital Bond, Ltd. has received initial subscriptions of its £15,000,000.00 British Pounds Sterling (“GBP”) bond offering in the amount of £7,300,000.00 GBP

http://cgrowthcapital.com/cgrowth-capital-provides-update-and-confirms-funding-on-corporate-bond/

http://www.cgrowthcapitalbond.com/

CGRA Preliminary $2.7 Billion Net Valuations on Dolomite Reserve

https://globenewswire.com/news-release/2015/07/28/755778/10143556/en/CGrowth-Capital-Inc-Announces-Preliminary-Net-Valuations-on-Dolomite-Reserve.html

SILVERDALE, Wash., July 28, 2015 (GLOBE NEWSWIRE) -- via PRWEB - CGrowth Capital, Inc. (OTC Pink: CGRA) (the "Company") is pleased to announce preliminary results and net valuations on its magnesium dolomite reserve. Taking into account the physical characteristics of the site, water tables, and anticipated mining expenses, the immediate probable mineral reserve has been set at 63% of the initial survey reserve of 505m cubic yards – which calculates out at 420m tons of material – significantly exceeding initial expectations. The estimated economic benefit from the site, after accounting for royalty, reclamation, and loss, has been estimated at a net value of approximately $2.7 billion.

v/r

Sterling

Sterling's Trading & Investing Strategies:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39092516

Recent CGRA News

- CGRA Remains Significantly Undervalued Despite Discovery of Lithium Bearing Rock • InvestorsHub NewsWire • 03/05/2024 03:24:44 PM

- CGrowth Capital Inc. Confirms Discovery of Lithium Bearing Rock in Exploration Breakthrough • InvestorsHub NewsWire • 02/23/2024 02:49:22 PM

- CGrowth Capital Inc. Provides Update on Lithium Mining Project • InvestorsHub NewsWire • 01/25/2024 03:34:37 PM

- CGrowth Capital Inc. Granted Four New Prospecting Licenses, Unveils Detailed Rollout Schedule, and Key Milestones for Lithium Mining Project • InvestorsHub NewsWire • 12/29/2023 02:24:53 PM

- CGrowth Capital Inc. Discovers Promising Lithium Bearing Pegmatite Deposits in Tenements Following Comprehensive Study and Survey • InvestorsHub NewsWire • 12/19/2023 06:21:13 PM

- CGrowth Capital Inc. Bolsters Mining Division with Team Expansion and Expert Appointments • InvestorsHub NewsWire • 12/12/2023 04:22:02 PM

- CGrowth Capital Inc. Granted 7 New Prospecting Licenses by The Ministry of Minerals and Mining Commission of Tanzania • InvestorsHub NewsWire • 12/08/2023 06:53:36 PM

- CGrowth Capital Inc. Sets Stage for Exciting 2024 with Savage Barbell Apparel Expansion • InvestorsHub NewsWire • 11/28/2023 04:15:30 PM

- CGrowth Capital Inc. Highlights Recent Achievements and Strategic Focus in Company Update • InvestorsHub NewsWire • 11/21/2023 07:37:17 PM

- CGrowth Capital Secures $1 Million in Non-Debt Financing • InvestorsHub NewsWire • 11/16/2023 07:34:12 PM

- CGrowth Capital Inc. Nears Key Milestone in Lithium Mining Expansion • InvestorsHub NewsWire • 09/26/2023 12:08:01 PM

- CGrowth Capital Inc.'s Sports Division Expands Globally, Secures Major European Retail Deal • InvestorsHub NewsWire • 08/09/2023 12:41:56 PM

- CGrowth Capital Inc. Discovers Significant High-Grade Lithium Deposits • InvestorsHub NewsWire • 07/05/2023 02:29:43 PM

- CGrowth Capital Consolidates Lithium Tenement Portfolio in Tanzania Amid Renewed Mining Confidence • InvestorsHub NewsWire • 05/25/2023 03:05:24 PM

- CGrowth Capital Targets Lithium Boom with Major Tanzanian Investment • InvestorsHub NewsWire • 05/18/2023 02:13:29 PM

- CGrowth Capital Inc. Unveils Star Studded Executive Board for Its Sports Division • InvestorsHub NewsWire • 05/18/2023 11:24:28 AM

- CGrowth Capital Unveils New Mining Division Targeting High-Demand Clean Energy and Precious Metals • InvestorsHub NewsWire • 05/17/2023 03:29:25 PM

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM