Tuesday, September 27, 2016 11:13:45 PM

*** NEW in this update: 1) The company's last aggressive toxic note has been extinguished - read the section "Variable-rate Debt Status" for details; 2) BMIX has set up a subsidiary in Brazil to hold its mineral rights for manganese - the company is open to a sale of this non-core subsidiary on receipt of an attractive offer; 3) BMIX continues to add mining claims to its massive portfolio with a new mineral rights claim for gold covering 4,669 acres within the well-known area in the state of Minas Gerais; 4) My two PPS projections have been revised to reflect the worst-case scenario of a maxed out 12.5B A/S.

TABLE OF CONTENTS

1) The Company

2) The Property

3) The People

4) Frequently Asked Questions

5) Variable-rate Debt Status

1) The Company

Brazil Minerals, Inc. (OTC: BMIX) is a producer of diamonds, gold, sand, and industrialized mortar. The company also owns 30 mineral rights for gold and diamonds, including 10 mining concessions, the highest level of right to mine in Brazil.

Brazil Mineral's short-term intention is to become a profitable company with virtually no debt.

Growth in Valuable Assets

BMIX progress has been steady, and can be measured in at least two quantifiable ways. First, in terms of mineral assets, in early 2013, the company's initial year of operations under the current business model and management team, they had 3 mineral rights. Now BMIX has 30 mineral rights in its subsidiaries as follows:

i) 10 mineral rights that are mining concessions, the highest level of mineral right in Brazil (“Concessão de Lavra”) – all 10 mining concessions are diamond and gold, and once concession also includes sand as a mineral;

ii) 8 mineral rights for diamond and gold that have status just below mining concession (“Requerimento de Lavra”), which allows the company to apply for both an upgrade to mining concession and to conduct limited commercial mining;

iii) 8 mineral rights for diamond and gold or solely gold in the research permit phase (“Autorização de Resquisa”), and;

iv) 4 mineral rights for diamond and gold in the phase of application for research permit (“Requerimento de Pesquisa”).

Growth in Product Mix

The second manner in which Brazil Minerals expanded as a company from 2013 to now is in the product mix output from our Brazilian subsidiaries. In 2013 the company produced and sold rough diamonds and gold. In 2014 they added polished diamonds. In 2015 BMIX added sand and mortar, a product made from their sand.

Deep Knowledge of Brazil & Strong Culture

Unlike most other listed mining companies operating in Brazil, BMIX team is comprised almost completely of Brazilians, all of whom have been hand-picked. The company's CEO and Chairman spent years in the U.S. venture capital and private equity and has modeled the company with the essential entrepreneur tenets of hard-work, meritocracy, and frugality.

Share Structure:

Follow the link to see the CEO's public reassurance AGAINST R/S:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=117657598

O/S: 9,866,110,799 as of 8/15/16 (10-Q)

Shares held by the CEO (His salary is paid entirely in BMIX common shares): 1,414,109,863 as of 6/20/16

http://ih.advfn.com/p.php?pid=nmona&article=71774769

Shares held by Peter Goldy (Large investor who has been aggressively buying BMIX shares in the open market at high triple zero prices): 115,449,085 as of 7/27/15

http://ih.advfn.com/p.php?pid=nmona&article=67789541

http://ih.advfn.com/p.php?pid=nmona&article=67892142

A/S: 12,500,000,000

Website: http://www.brazil-minerals.com/

YouTube Channel: https://www.youtube.com/channel/UChcTI9t1v-E-9MJ7mMtH_tA

Facebook: https://www.facebook.com/brazilmineralsbmix

2) The Property

BMIX owns 100% of Mineração Duas Barras Ltda. (“MDB”), a Brazilian producer and seller of polished and rough diamonds, gold bars, and industrial-use sand. MDB operates a fully-operational mining concession with the largest alluvial processing plant for diamonds and gold in Latin America, and has the Brazilian permit to export its production.

BMIX also owns 50% of RST Recursos Minerais Ltda. (“RST”), a Brazilian company with 10 mining concessions and 12 other mineral rights for diamond and gold. Many of the RST areas are located near MDB’s plant, and all of them are in the Jequitinhonha River valley, a well-known area for diamonds and gold for over two centuries.

RST property was acquired from two Brazilian individuals, unrelated to the company, 50% of RST for approximately $254,000. Previously in 2008, RST had been transacted for $10.5 million; the buyer paid $2 million and subsequently was unable to pay the remainder because of the global financial crisis. The RST mineral rights remained largely untouched until our acquisition.

On 4/29/16 Brazil Minerals announced that it obtained approval of a report regarding Apui/Borba gold project from the local mining department. BMIX's Apui/Borba Project titled right covers 24,708 acres, a surface area that is 15% larger than the island of Manhattan in New York. The project has potential mineralization of 4.3 million ounces of gold. Read more about this impressive property by following the two links below:

http://ih.advfn.com/p.php?pid=nmona&article=71320402

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=122338476

Finally, in August 2016, BMIX obtained three more large claims on gold-producing areas.

1) A priority for an exploration license on a gold mineral right covering 4,925 acres in Crixas, extending to an adjacent municipality, in the state of Goias in central Brazil. The Crixas area is one of the largest gold hubs in Latin America. It is home to several gold mines and projects from AngloGold Ashanti and Cleveland Mining, which combined have disclosed potential reserves of more than 8 million ounces of gold.

http://ih.advfn.com/p.php?pid=nmona&article=72212837

2) A mineral claim for gold covering 773 acres in the municipality of Paracatu, in the state of Minas Gerais. Paracatu is where the largest gold mine in Brazil, named Morro do Ouro, is located. Morro de Ouro is an open-pit mine owned by global firm Kinross Gold, with 2015 reported proven and probable reserves of 9.645 million ounces of gold and annual production of 477,622 ounces of gold.

http://ih.advfn.com/p.php?pid=nmona&article=72306313

3) A new mineral rights claim for gold covering 4,669 acres within the well-known area in the state of Minas Gerais in Brazil called "Iron Quandrangle". The closest larger city to this new claim is Itabira. This region, known for both iron and gold mining, has excellent logistics and is also close to the states capital, Belo Horizonte.

http://ih.advfn.com/p.php?pid=nmona&article=72420243

Check out all of BMIX mining rights by following the direct link below:

http://investorshub.advfn.com/uimage/uploads/2016/4/19/szxkyclaims.jpg

BMIX Documented Reserves

In 2006-2007, then Toronto Stock Exchange Venture -listed Vaaldiam Resources Ltd. (“Vaaldiam”) spent an estimated $2.0 million for detailed drilling and technical studies leading to the NI 43-101 geological report and bankable feasibility of the property, as well as an estimated $2.0 million for removal of overgrowth on the property. The total cost of development of MDB by Vaaldiam is estimated at $10 million.

The link to the resultant NI 43-101 is below. Keep in mind that the official study was done for only 7% of the MDB's total concession area. There is still a 93% chunk of MDB's property that has not been officially assayed. And let’s not forget about the 50% ownership in adjacent RST properties that include 10 mining concessions and 12 other mineral rights for diamond and gold.

http://www.brazil-minerals.com/wp-content/uploads/2013/02/Duas-Barras-NI-43-101.pdf

What the heck is NI 43-101? Read below:

https://en.wikipedia.org/wiki/National_Instrument_43-101

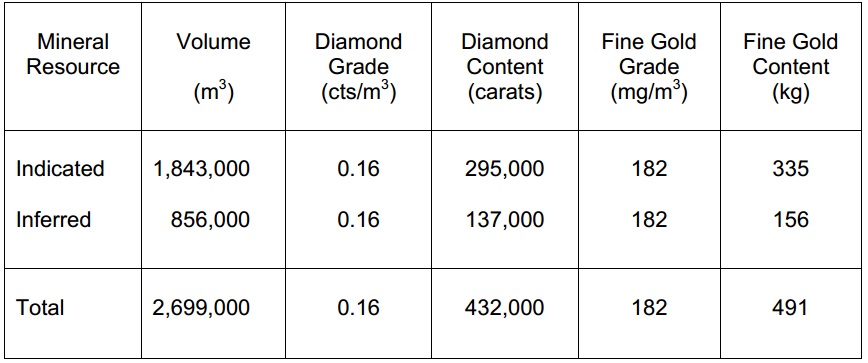

Excerpt from the BMIX NI 43-101:

The numbers are astounding! Some thoughts and reflections on them can be found in stervc's excellent post below:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112576227

To fully appreciate the magnitude of the BMIX potential with their 100%-owned MDB property, it is most useful to look at the performance of the previous owner:

"Vaaldiam launched production at Duas Barras in September 2007 and produced 33,385 carats of diamonds valued at an average $165 per carat in the first 11 months of operation. Gross sales revenues from the mine to date, including 1,036 ounces of gold recovered for the period September 2007 through July 2008 reached $6.5 million."

http://www.diamonds.net/news/NewsItem.aspx?ArticleID=23120

Moreover, during February 2008 a 15.68 carat diamond was recovered at the Duas Barras mine which is the largest diamond recovered to date at this mine. This diamond was sold in the second quarter for US$78,400 or US$5,000 per carat.

http://globaldocuments.morningstar.com/documentlibrary/document/29cf493380fe9217.msdoc/original

Finally, let's take a look at the projected revenues from the RST property which will produce first yields in May 2016:

"Recently, BMIX's technical team performed calculations as to what can be expected from this new mining area. This area contains "white gravel", well formed, and known from our research drilling to contain diamonds and gold. Lacking for now a precise measure of density, our team used the "best" and "worst" densities seen for diamonds and gold from "white gravel" obtained at other areas which we mined within the same geological environment and at similar distance from the Jequitinhonha River. The "best" historical densities were 0.960 carats of diamonds and 0.766 grams of gold, both per cubic meter. The "worst" were 0.120 carats of diamonds and 0.439 grams of gold, also per cubic meter.

Our plant processes 45 cubic meters of gravel per hour, and therefore over a shift of eight hours in one working day it is capable of processing 360 cubic meters of gravel. Using only the "worst" densities, and assuming rough diamonds being sold at US$130/carat and gold being sold at $34.25 per gram (note: we sell 96% purity bars), the revenues from diamonds and gold per each day of plant operating with one shift would be approximately US$11,000 based upon such assumptions. If the plant worked 20 days per month, the monthly revenues based upon our assumptions would be US$220,000, thereby permitting BMIX to become highly profitable if such revenues could be achieved and maintained on an ongoing basis. Of note, this new mining area is part of a large mineral right, which certain experts say could last for 10 or more years of mining."

http://www.brazil-minerals.com/wp-content/uploads/2015/09/BMIX-PR-21.SET_.2015.pdf

RST MINING PERMITS WERE RECEIVED ON 4/19/16 PER PR BELOW

http://ih.advfn.com/p.php?pid=nmona&article=71171071&symbol=BMIX

The company now has all of the required permits for RST area. The previous operator in these areas had an annual diamond production as high as 74,395 carats in 1983 and as low as 15,285 carats in 1967, from the data set available. The previous operator essentially did not mine inland, which is where BMIX will focus its efforts. Read the related PR below:

http://www.brazil-minerals.com/wp-content/uploads/2015/07/BMIX-PR-13.JUL_.2015.pdf

First gold yields from the RST property were released on July 20th 2016 - test run of 6.8 cubic meters of material produced 59.1 grams (approximately 1.9 troy ounces) of 96% gold, now molten into a gold bar, as seen on a picture below:

http://ih.advfn.com/p.php?pid=nmona&article=72011238

Given the vastness of the company's mining claims, BMIX is wisely exploring various partnerships which would allow the company to increase its cash flow with minimal operational costs.

One of such negotiations is with a Chinese gold company with an initial site visit planned for July 2016:

BMIX believes that the recent conversations with the CEO of a mining group from China have progressed well. Among next steps being planned is a visit of 2-3 members of such company to BMIXs mineral rights and operations in July 2016.

http://finance.yahoo.com/news/brazil-minerals-inc-provides-general-144400876.html

BMIX is also in discussions with three different Brazilian investors to expand its cash flow by receipt of royalties from exploration for diamonds, gold, and sand in some of the 31 mineral rights that the Company owns in the valley of the Jequitinhonha River in the state of Minas Gerais. Besides these areas, the Company also owns one mineral right for gold in the state of Amazonas.

http://www.marketwatch.com/story/brazil-minerals-inc-announces-progress-on-several-fronts-2016-02-01

In fact, BMIX announced its first royalty partnership on June 20th 2016.

The company's partner will bring its own mini-plant to one of BMIXs areas; all work will be open for supervision by the Company at all times. The deal is attractive in that BMIX will have essentially no costs, and in return will receive 25% of the gross production of gold and diamonds.

http://ih.advfn.com/p.php?pid=nmona&article=71893476

BMIX Processing Plant

The MDB plant was originally built in 2006-2007 by then Toronto Stock Exchange Venture -listed Vaaldiam Resources Ltd. (“Vaaldiam”) at a cost of approximately $2.5 million. To the best of BMIX’s knowledge, the diamond and gold processing plant at Duas Barras is the largest alluvial recovery plant of its kind in Latin America.

BMIX is not your run-of-the-mill "developmental stage" penny stock -- check out the fully-operational plant in action in the video below:

Other Developments:

Brazil Minerals mines primarily for diamonds and gold, but the company also has vast reserves of industrial-quality sand that provides an effortless cash flow for the company. Read more below:

http://www.brazil-minerals.com/wp-content/uploads/2015/02/BMIX-Press-Release-02.FEB_.2015.pdf

http://www.brazil-minerals.com/wp-content/uploads/2014/12/BMIX-Press-Release-03.DEC_.2014.pdf

The company's sand qualifies for use in the profitable fracking industry, as described in the following PR. The company's reserves of high-quality sand are between 500k and 1M tons. This will translate into millions of dollars of easily-extractable revenue.

http://www.brazil-minerals.com/wp-content/uploads/2015/08/BMIX-PR-25.AUG_.2015.pdf

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=115456325

The company also uses its vast sand reserves for high-quality mortar production and sale -- read more in the PR below:

"Brazil Minerals, Inc. had established a subsidiary in Brazil called Hercules Brasil Ltda. to pursue opportunities in the construction materials business. Initially, Hercules is focused on the production and sale of mortar. A medium size plant that can produce mortar, grout and other industrialized sand products has been fully built and is operating."

http://www.brazil-minerals.com/wp-content/uploads/2015/08/BMIX-PR-13.AUG_.2015.pdf

In fact, the company's brand of mortar was recently chosen for use in a new 17-story building (see picture of the building below):

Additionally, BMIX’s Hercules mortar line has recently been accepted and bought for distribution by Pontual, one of the largest retailers of tiles and other construction supplies in Montes Claros.

http://www.brazil-minerals.com/wp-content/uploads/2015/11/BMIX-PR-30.NOV_.2015.pdf

Finally, on July 13 2016 BMIX announced that the company formally received title from the local mining department to two manganese claims, both placed in a new wholly owned subsidiary. These mineral rights cover 4,700 acres and are located 75 and 110 miles, respectively, from the Company's gold and diamond operations, in the state of Minas Gerais in Brazil. Both of these claims intersect known colluvial laterite deposits with high potential for mineralization of manganese and possibly iron ore as well. Read more about yet another potential cashflow source for BMIX in the PRs below:

http://ih.advfn.com/p.php?pid=nmona&article=71958804

http://ih.advfn.com/p.php?pid=nmona&article=72420243

For the history lovers, more details on the mining along the Rio Jequitinhonha river can be found by following this link:

http://www.allaboutgemstones.com/diamond_mines_brazil.html

3) The People

BMIX boasts an enviable executive team that is in the early stages executing a business model which mirrors that of successful, multi-billion dollar market cap mining stocks. For a full list of BMIX management and advisers please refer to the "corporate" section on the company's website. DD on select members of the BMIX team is available below.

http://www.brazil-minerals.com/corporate/management/

Management: CEO - Dr. Marc Fogassa

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112766681

https://www.linkedin.com/in/marcfogassa

Board of Directors - Ambassador Roger Noriega (Washington, DC)

Ambassador Roger Noriega is an independent member of the Board of Directors of Brazil Minerals, Inc. Mr. Noriega was U.S. Assistant Secretary of State from July 2003 to August 2005, appointed by President George W. Bush and confirmed by the U.S Senate. In that capacity, Mr. Noriega managed a 3,000-person team of professionals in Washington and 50 diplomatic posts to design and implement political and economic strategies in Canada, Latin America, and the Caribbean.

Board of Advisors - Ambassador John Bell

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112767084

Board of Advisors - Christopher Hayes (Washington, DC)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114635759

4) Frequently Asked Questions

Q: BMIX DD is impressive, but doesn't all this seem too good to be true? Why is BMIX trading so low?

A: BMIX is trading so low because in 2014 the company was in urgent need of cash to seize the remaining % ownership of the MDB property as well as 50% ownership of all RST properties before they were usurped by another party. To make it possible in a timely manner, the company resorted to toxic financing which was simply the fastest option at the time. This move was essential for LONG-TERM viability of BMIX. Then, while the company was in its weakest first quarter of 2015 (historically, due to Brazilian weather), the toxic lenders proceeded to do what they do best -- dump their holdings all at once with disregard for the stock's PPS. The simple concept of supply and demand came into play. The toxic debt resulted in too many shares supplied too fast, and there was not enough demand at the time to absorb all of the shares at higher prices. The toxic debt is nearly gone now (See Part #5 of this DD compilation), the OS is still attractive for a penny stock with such immense potential, and so very shortly, the stock's price can finally begin its ascend back to fair levels.

Q: So what do you think is fair PPS for BMIX?

A: I will provide two different perspectives below:

1) Combining revenue streams from gold, diamonds, sand, mortar and royalty-based partnerships, BMIX can reasonably make $3M net profit as early as FY 2017. An average P/E ratio for mining companies is 25-30. It is often higher than that for younger mining companies with many virgin claims, but let's consider the worst case scenario of 20, just to be conservative. So with a net income of $3M, the OS count of 12.5B (given the worst-case scenario of maxed out A/S), and the P/E ratio of 20, that comes out to $0.0048 per share.

$3M/12.5B = $0.00024 x 20 = $0.0048

Given the projections presented in 9/21/15 PR, and reflecting upon the revenues shown by the previous operator of this mine, $3M in net BMIX profit for the year is very doable in 2017. And the P/E of 20 is very conservative considering how many claims with future potential BMIX possesses. Add to that the upcoming hype from the penny traders who are starved for the stocks that actually have net profits, and the PPS potential here extends way beyond the $0.0048 even at an A/S of 12.5B. This, obviously, represents a HUGE return from these levels.

2) In September 2014, Goldman Small Cap Research Report pinned a target market cap for BMIX at $25,380,000 (84.6M x $0.30).

http://www.brazil-minerals.com/wp-content/uploads/2013/02/Goldman-Small-Cap-Research-Report-BMIX.pdf

Let's once again consider the worst-case scenario of 12.5B OS, in which case that market cap corresponds to a PPS of $0.002.

Also, keep in mind that this target was established BEFORE all the new developments. For instance, BMIX has acquired many more property rights since then, established additional cash flow from sand and mortar sales, as well as developed several royalty-generating partnerships. So, arguably, a reasonable market cap target should be significantly higher today.

Q: The property seems like a real winner - hundreds of thousands of carats of documented diamond reserves in only 7% of the entire area of the mineral rights available at MDB is utmost impressive. But the natural question is WHY then the previous owner failed?

A: To answer this, I will quote the CEO himself from one of the recent interviews:

The issue with the [previous] company was that it had 300 employees elsewhere in Brazil taking hold of ground for exploration. It had huge, huge research costs, so any semblance of profitability from diamond production was diluted by expenses elsewhere. The company also had 110 employees at the mine — we have 18 — and it had five vice presidents at the mine while we have one general manager.

In summary, Vaaldiam (the previous company) had 300 workers elsewhere in Brazil in various exploratory, non-revenue projects. When the 2008 financial crisis hit the markets, Vaaldiam left Brazil due to being unable to satisfy local social security payments and other demands. Initially, BMIX acquired a 55% stake in MDB, and subsequent rounds of acquisition have brought the percentage ownership to 86.88%, and then finally to 100% ownership as of today.

Q: How do we know that the CEO is not just using the shareholders here? Does Dr. Fogassa have any skin in the game?

A: Of course! The CEO has a lot of vested interest in BMIX. Dr. Fogassa now owns over 1.4 BILLION common shares of BMIX as of the last Form 4 filing:

http://ih.advfn.com/p.php?pid=nmona&article=71774769

Dr. Fogassa graduated from MIT, then Harvard medical school, and then Harvard business school. Trust me when I say that he could be making a big chunk of money out there by either practicing medicine in a nice group in Boston, or even more so by staying at Goldman Sachs as a medical/technological financier. Instead, he dropped everything and went all-in into his baby company - Brazil Minerals. Moreover, instead of burning through the precious and scarce start-up capital, he decided to pay his own salary IN COMMON BMIX SHARES instead of cash. From my personal conversation with the CEO, he spends most of his days submerged in BMIX business. And what does he get in return? Only common BMIX shares! Dr. Fogassa is a man in his late 40s boasting credentials that are nothing short of stunning who gave up several types of lucrative jobs where he could be making $400K+ per year from a cushy air-conditioned office in Boston or NYC, and is instead spending his days elbows-deep in dirt and gravel in Brazil while getting only BMIX common shares in return! The man is as invested in this company as it gets, if you ask me.

Q: Are there any research reports on BMIX?

A: Sure, in September 2014, Goldman Small Cap Research issued a report in which they called Brazil Minerals “The Most Attractive Revenue-Generating Mining Stock.” Read the full report below:

http://www.brazil-minerals.com/wp-content/uploads/2013/02/Goldman-Small-Cap-Research-Report-BMIX.pdf

Q: Any interviews with the CEO that I should check out?

A: I think one of the best interviews with Dr. Fogassa was done by TheStreet and can be read below:

http://www.thestreet.com/story/12937096/1/brazil-minerals-pursuing-profitable-diamond-and-gold-mining.html

Some of my personal thoughts and reflections on the interview can be found in the following posts:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114401500

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114401650

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114621398

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114402899

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114403120

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114403295

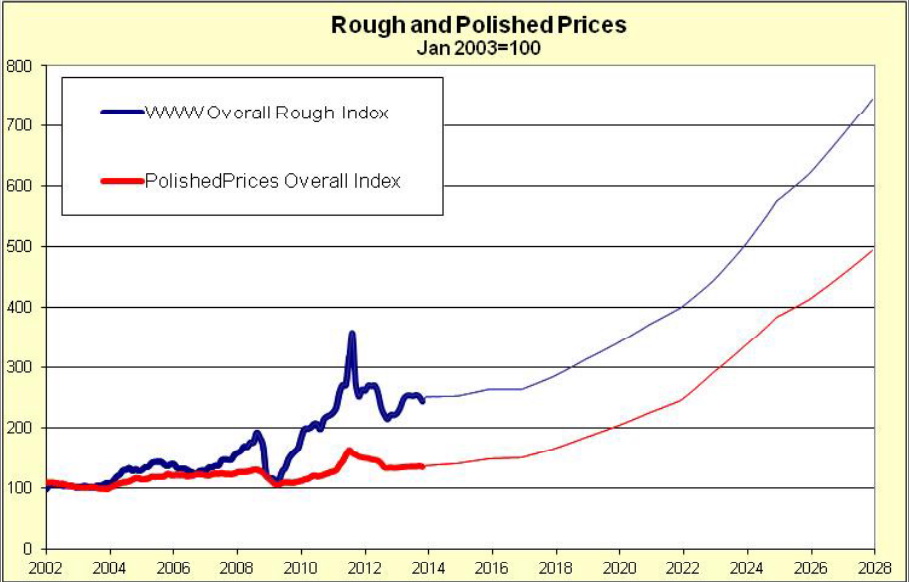

Q: Do you think the world’s high demand for rough and polished diamonds will continue into the future?

A: Yes I do, and I am not the only one who thinks so.

Source: http://www.diamondwww.com/files/presentation/Scotai_Bank_Jan_14.pdf

5) Variable-rate Debt Status

Perhaps the biggest malady in the world of penny stocks is variable-rate convertible debt, often called "toxic debt." The companies, in most cases, are not allowed to sell shares directly into the open market, so they found a way to circumvent that rule by borrowing money from toxic lenders who, in turn, get the right to obtain their money back by selling the company's shares themselves at a certain % discount to the recent market price of the security. This results in a vicious cycle where the toxic lender obtains a batch of shares in a given company, dumps them immediately and all at once to overwhelm the demand and to decrease the stock's market price. As the price of the security plunges, the lender is then entitled to reload an even larger number of shares because the conversion rate is tied to the stock's market price. The toxic lender is re-issued the shares and proceeds to dump them again -- and so the vicious cycle continues until the debt is paid off.

In 2014, Brazil Minerals was in urgent need of cash to seize the remaining % ownership of the MDB property as well as 50% ownership of all RST properties before they were usurped by another party. To make it possible in a timely manner, the company resorted to toxic financing which was simply the fastest option at the time. This move was essential for LONG-TERM viability of BMIX. Then, while the company was in its weakest first quarter of 2015 (historically, due to Brazilian weather), the toxic lenders proceeded to do what they do best -- dump their holdings all at once with disregard for the stock's PPS. The simple concept of supply and demand came into play. The toxic debt resulted in too many shares supplied too fast, and there was not enough demand at the time to absorb all of the shares at a higher price - this is the reason why BMIX trades at such a laughable market cap right now.

The good news is that the variable-rate toxic debt of Brazil Minerals is essentially gone now. In fact, there were only two toxic lenders remaining as of September 2016. You could see both of them on L2 as VFIN and VNDM. The one behind VNDM has a small note and is not selling anything at all - perhaps they chose to hold on to their shares in BMIX as a long-term investment. As a proof, go to the link below, type in "BMIX" and choose the most recent available data for the month of July. 46% of the volume that month was VFIN, and ZERO shares were sold by VNDM.

http://otce.finra.org/MonthlyShareVolume

In essence, it was the selling pressure by VFIN that was keeping BMIX down, and now the toxic note behind it has been completely extinguished as per PR below!

http://ih.advfn.com/p.php?pid=nmona&article=72420243

So the selling pressure from the toxic notes is essentially gone now, but there has been another source of dilution hiding in the preferred shares. In a demonstration of his commitment to common shareholders, the CEO is actually getting rid of preferred shares by converting them into % ownership of one of the company's many subsidies -- essentially eliminating further dilution to common shares in the future. Read more about the related transactions in the two PRs below:

http://ih.advfn.com/p.php?pid=nmona&article=72103016

http://ih.advfn.com/p.php?pid=nmona&article=72270642

In summary, BMIX is a legitimate company with tons of credible and verifiable DD available out there, assets of enormous potential, unlike most other triple zero stocks no longer encumbered by the toxic debt, and finally the company whose CEO has shown commitment to common shareholders while being the largest holder of common shares himself.

BMIX DAILY CHART

i.t.m.d.

This post is my personal opinion. I do not provide investment advice.

i.t.m.d.

Recent ATLX News

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/09/2024 02:30:09 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/06/2024 11:01:55 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/17/2024 02:30:41 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/14/2024 04:55:05 PM

- Form 5 - Annual statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/14/2024 03:23:59 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/12/2024 09:30:35 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/27/2024 02:30:09 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/13/2024 02:30:22 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:24 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:13 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/05/2024 10:00:31 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/05/2024 02:30:07 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/30/2023 02:25:19 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/30/2023 02:20:14 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/23/2023 02:30:35 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 02:30:07 AM

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM