Wednesday, June 24, 2015 12:18:33 PM

TABLE OF CONTENTS

1) The Company

2) The Property

3) The People

4) Frequently Asked Questions

5) Variable-rate Debt Status

1) The Company

Brazil Minerals, Inc. (OTC: BMIX) is a U.S. publicly-traded company with current revenues from sales of rough and polished diamonds, gold, and sand. Our intention is to continue to grow and become a premier diversified and profitable company focused on Brazil. We believe that our team is our main strength. In our team, we combine over 100 years of deep Brazilian business expertise and strong American experience in finance, private equity & venture capital. Our goal is to become an attractive and liquid alternative for investment in Brazil, the 6th largest global economy.

The company has recently concluded the build-out of a facility for cutting and polishing diamonds. Currently, a percentage of the rough diamonds mined at the company's property are directed to this facility and the result is a steady supply of polished diamonds. Such polished diamonds sell for 5 to 15 times the price of rough diamonds. Because of the fine quality of its gems, BMIX sells its polished diamonds ungraded to a marquee 11-store jewelry chain in Brazil that has been operating since 1944. Other polished diamonds are exported to the U.S. for grading and certification at the Gemological Institute of America (“GIA”) before being sold to private investors. The GIA is the diamond industry’s premier laboratory for grading and certification. In August 2014, the Gemological Institute of America (“GIA”) visited MDB’s facilities. This is a huge step that illustrates the quality of the Company’s diamond products.

Share Structure:

O/S: 852,191,645 as of 6/16/15

Shares held by the CEO (His salary is paid entirely in BMIX common shares): 79,411,879 as of 6/24/15

A/S: 4,000,000,000

Website: http://www.brazil-minerals.com/

Facebook: https://www.facebook.com/brazilmineralsbmix

2) The Property

BMIX owns 100% of Mineração Duas Barras Ltda. (“MDB”), a Brazilian producer and seller of polished and rough diamonds, gold bars, and industrial-use sand. MDB operates a fully-operational mining concession with the largest alluvial processing plant for diamonds and gold in Latin America, and has the Brazilian permit to export its production.

BMIX also owns 50% of RST Recursos Minerais Ltda. (“RST”), a Brazilian company with 10 mining concessions and 12 other mineral rights for diamond and gold. Many of the RST areas are located near MDB’s plant, and all of them are in the Jequitinhonha River valley, a well-known area for diamonds and gold for over two centuries.

BMIX Documented Reserves

In 2006-2007, then Toronto Stock Exchange Venture -listed Vaaldiam Resources Ltd. (“Vaaldiam”) spent an estimated $2.0 million for detailed drilling and technical studies leading to the NI 43-101 geological report and bankable feasibility of the property, as well as an estimated $2.0 million for removal of overgrowth on the property. The total cost of development of MDB by Vaaldiam is estimated at $10 million.

The link to the resultant NI 43-101 is below. Keep in mind that the official study was done for only 7% of the MDB's total concession area. There is still a 93% chunk of MDB's property that has not been officially assayed. And let’s not forget about the 50% ownership in adjacent RST properties that include 10 mining concessions and 12 other mineral rights for diamond and gold.

http://www.brazil-minerals.com/wp-content/uploads/2013/02/Duas-Barras-NI-43-101.pdf

What the heck is NI 43-101? Read below:

https://en.wikipedia.org/wiki/National_Instrument_43-101

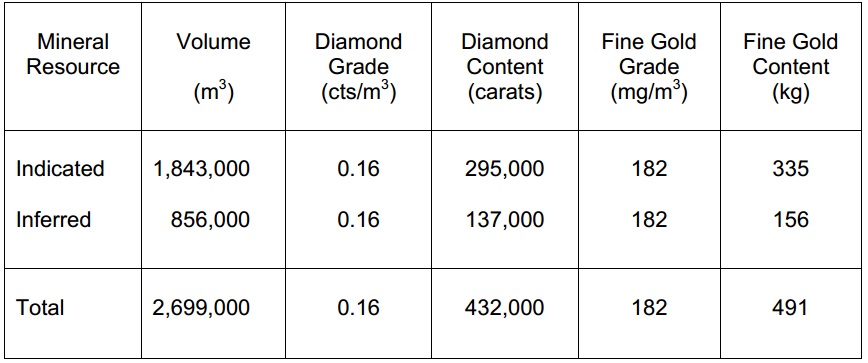

Excerpt from the BMIX NI 43-101:

The numbers are, indeed, astounding! Some thoughts and reflections on them can be found in the following two posts:

By me:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114621398

By stervc:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112576227

BMIX Processing Plant

The MDB plant was originally built in 2006-2007 by then Toronto Stock Exchange Venture -listed Vaaldiam Resources Ltd. (“Vaaldiam”) at a cost of approximately $2.5 million. To the best of BMIX’s knowledge, the diamond and gold processing plant at Duas Barras is the largest alluvial recovery plant of its kind in Latin America.

BMIX is not your run-of-the-mill "developmental stage" penny stock -- check out the fully-operational plant in action in the video below:

Other Developments:

In addition to the parts of the property that are currently generating revenue, BMIX recently announced completion of the first phase of geological assessment of NEW diamond & gold area with strong results. Read below:

http://www.brazil-minerals.com/wp-content/uploads/2015/04/BMIX-PR-27.APR_.2015.pdf

http://www.brazil-minerals.com/wp-content/uploads/2015/05/BMIX-PR-30.APR_.2015.pdf

http://www.brazil-minerals.com/wp-content/uploads/2015/05/BMIX-PR-26.MAY_.2015.pdf

Moreover, not only does the property generate diamonds and gold, it is also an excellent source of industrial-quality sand that can provide an effortless cash flow for the company. Read more below:

http://www.brazil-minerals.com/wp-content/uploads/2015/02/BMIX-Press-Release-02.FEB_.2015.pdf

http://www.brazil-minerals.com/wp-content/uploads/2014/12/BMIX-Press-Release-03.DEC_.2014.pdf

Finally, the company recently announced that it has cut its Brazilian fixed costs by an impressive 50% as a result of the relocation of its Brazilian administration to an office 15 miles away from its diamond, gold, and sand mine operations. The office was previously located over 300 miles away from it. More below:

http://www.brazil-minerals.com/wp-content/uploads/2015/06/BMIX-PR-15.JUN_.2015.pdf

For the history lovers, more details on the mining along the Rio Jequitinhonha river can be found by following this link:

http://www.allaboutgemstones.com/diamond_mines_brazil.html

3) The People

BMIX boasts an enviable executive team that is in the early stages executing a business model which mirrors that of successful, multi-billion dollar market cap mining stocks. For a full list of BMIX management and advisers please refer to the "corporate" section on the company's website. DD on select members of the BMIX team is available below.

http://www.brazil-minerals.com/corporate/management/

Management: CEO - Dr. Marc Fogassa

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112766681

https://www.linkedin.com/in/marcfogassa

Board of Directors - Ambassador Roger Noriega (Washington, DC)

Ambassador Roger Noriega is an independent member of the Board of Directors of Brazil Minerals, Inc. Mr. Noriega was U.S. Assistant Secretary of State from July 2003 to August 2005, appointed by President George W. Bush and confirmed by the U.S Senate. In that capacity, Mr. Noriega managed a 3,000-person team of professionals in Washington and 50 diplomatic posts to design and implement political and economic strategies in Canada, Latin America, and the Caribbean.

Board of Advisors - Ambassador John Bell

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112767084

Board of Advisors - Christopher Hayes (Washington, DC)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114635759

4) Frequently Asked Questions

Q: BMIX DD is impressive, but doesn't all this seem too good to be true? Why is BMIX trading so low?

A: BMIX is trading so low because in 2014 the company was in urgent need of cash to seize the remaining % ownership of the MDB property as well as 50% ownership of all RST properties before they were usurped by another party. To make it possible in a timely manner, the company resorted to toxic financing which was simply the fastest option at the time. The move was essential for LONG-TERM viability of BMIX. Then, while the company was in its weakest first quarter of 2015 (historically, due to Brazilian weather), the toxic lenders proceeded to do what they do best -- dump their holdings all at once, without the regard for PPS. The simple concept of supply and demand came into play. The toxic debt resulted in too many shares supplied too fast, and there was not enough demand at the time to absorb all of the shares at higher PPS. The toxic debt is nearly gone now (See Part #5 of this DD), the OS is still extremely attractive for a penny stock, and so very shortly, the PPS can finally begin its ascend back to a fair level.

Q: So what do you think is fair PPS for BMIX?

A: I will provide two different perspectives below:

1) BMIX can reasonably make $2M net profit as early as 2016 given that they are already fully-operational with diamond, gold AND sand sales compounding at the same time. An average P/E ratio for mining companies is 25-30. It is often higher than that for younger mining companies with many virgin claims, but let's consider the worst case scenario of 20, just to be conservative. So with a net income of $2M, the OS count of 1B, and the P/E ratio of 20, that comes out to $0.04 per share.

$2M/1B = $0.002 x 20 = $0.04

From everything I have found so far, and reflecting upon the revenues shown by the previous operator of this mine, $2M in net profit for the year is very doable in 2016 for BMIX. And the P/E of 20 I used is very conservative considering how many claims with future potential BMIX really has. Add to that the upcoming hype from the penny traders who are starved for the stocks that actually have net profits, and the PPS potential here extends way beyond the $0.04 as early as 2016. This, obviously, represents a HUGE return from these levels.

2) In September 2014, Goldman Small Cap Research Report pinned a target market cap for BMIX at $25,380,000 (84.6M x $0.30).

http://www.brazil-minerals.com/wp-content/uploads/2013/02/Goldman-Small-Cap-Research-Report-BMIX.pdf

Given the last known OS of 852M, that corresponds to a PPS of $0.029.

Also, keep in mind that this target was established BEFORE many new developments. For instance, BMIX has acquired many more property rights since then, as well as established additional cash flows from sand. So, arguably, a reasonable target should be even higher now.

Q: The property seems like a real winner - $1.4B USD in documented diamond reserves on only 7% of the entire area of the mineral rights available at MDB is utmost impressive. But the natural question here is WHY then the previous owner failed?

A: To answer this, I will quote the CEO himself from one of the recent interviews:

The issue with the [previous] company was that it had 300 employees elsewhere in Brazil taking hold of ground for exploration. It had huge, huge research costs, so any semblance of profitability from diamond production was diluted by expenses elsewhere. The company also had 110 employees at the mine — we have 18 — and it had five vice presidents at the mine while we have one general manager.

In summary, Vaaldiam (the previous company) had 300 workers elsewhere in Brazil in various exploratory, non-revenue projects. When the 2008 financial crisis hit the markets, Vaaldiam left Brazil unable to satisfy local social security payments and other demands. Initially, BMIX acquired a 55% stake in MDB, and subsequent rounds of acquisition have brought the percentage ownership to 86.88%, and then finally to 100% ownership as of today.

Q: How do we know that the CEO is not just using the shareholders here? Does Dr. Fogassa have any skin in the game?

A: Of course! The CEO has a lot of vested interest in BMIX. Dr. Fogassa owns 79.4M common shares of BMIX as of the last Form 4 filing:

http://ih.advfn.com/p.php?pid=nmona&article=67436060

Dr. Fogassa graduated from MIT, then Harvard MD, and then Harvard MBA. Trust me when I say that he could be making a good chunk of money out there by either practicing medicine in a nice group in Boston, or even more so by staying at Goldman Sachs as a medical/technological financier. Instead, he dropped everything and went all-in into BMIX. Moreover, instead of burning through the precious and scarce start-up capital, he decided to pay his own salary IN COMMON BMIX SHARES instead of cash. From my personal conversation with the CEO, he is spending most of his days at the mine – in a scorching Brazilian heat. And what does he get in return? Only common BMIX shares. He is a guy in his mid-40s, with credentials that are nothing short of stunning, who gave up several types of jobs where he could make $500K+ per year from a cushy air-conditioned office in Boston or NYC, and is instead spending his days elbows deep in dirt and gravel in Brazil while getting only BMIX shares in return! I think Dr. Fogassa is as invested in this company as it gets, even if it only looks like 10% of the OS on paper.

Q: Are there any recent research reports on BMIX?

A: Sure, in September 2014, Goldman Small Cap Research issued a report in which they called Brazil Minerals “The Most Attractive Revenue-Generating Mining Stock.” Read the full report below:

http://www.brazil-minerals.com/wp-content/uploads/2013/02/Goldman-Small-Cap-Research-Report-BMIX.pdf

Additionally, BMIX was featured in TCR, a well-regarded mining newsletter, with a price target for its common stock approximately eight times greater than the stock's closing price at the time. Read the news release below:

http://www.brazil-minerals.com/wp-content/uploads/2015/04/BMIX-Press-Release-20.APR_.2015.pdf

Q: Any interviews with the CEO that I should check out?

A: I think one of the best interviews with Dr. Fogassa was done by TheStreet and can be read below:

http://www.thestreet.com/story/12937096/1/brazil-minerals-pursuing-profitable-diamond-and-gold-mining.html

Some of my personal thoughts and reflections on the interview can be found in the posts below:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114401500

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114401650

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114621398

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114402899

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114403120

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114403295

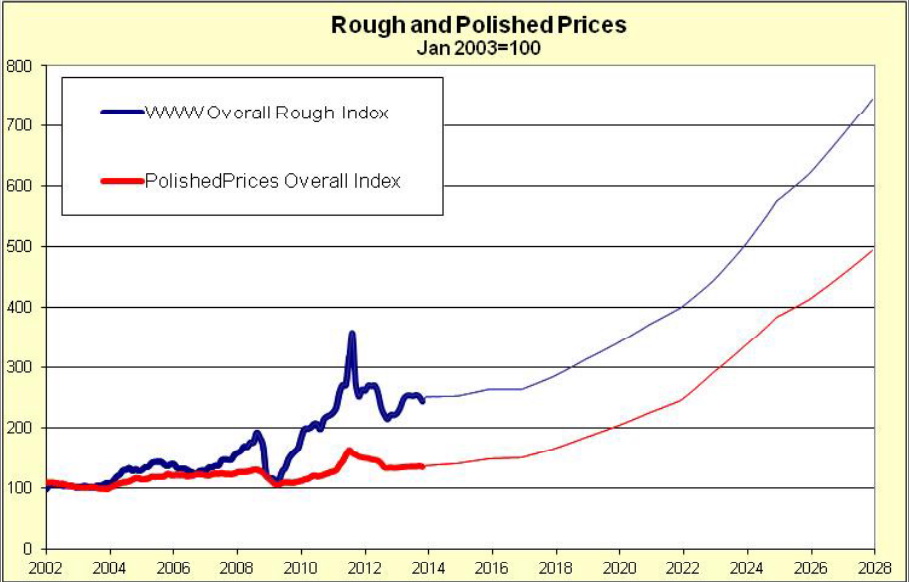

Q: Do you think the world’s high demand for rough and polished diamonds will continue into the future?

A: Yes I do, and I am not the only one who thinks so.

Source: http://www.diamondwww.com/files/presentation/Scotai_Bank_Jan_14.pdf

Q: Is there a corny “hand-drawn style” Youtube video out there that would explain more about BMIX vertical integration plans and their vanadium & titanium projects?

A: Funny you should ask! There is an older video just like that (still mentions 58% ownership in MDB when it is 100% ownership today) but the video elaborates nicely on those particular questions:

5) Variable-rate Debt Status

Perhaps the biggest malady in the world of penny stocks is variable-rate convertible debt, often called "toxic debt." The companies, in most cases, are not allowed to sell shares directly into the open market, so they found a way to circumvent that rule by borrowing money from the toxic lenders who, in turn, get the right to obtain their money back by selling the company's shares themselves at a certain % discount to the recent market price of the security. This results in a vicious cycle where the toxic lender obtains a batch of shares in a given company, dumps them immediately and all at once to overwhelm the demand and to decrease the stock's market price. As the price of the security plunges, the lender is then entitled to reload an even larger number of shares because the conversion rate is tied to the stock's market price. The toxic lender is re-issued the shares and proceeds to dump them again -- and so the vicious cycle continues until the debt is paid off.

In 2014, Brazil Minerals was in urgent need of cash to seize the remaining % ownership of the MDB property as well as 50% ownership of all RST properties before they were usurped by another party. To make it possible in a timely manner, the company resorted to toxic financing which was simply the fastest option at the time. The move was essential for LONG-TERM viability of BMIX. Then, while the company was in its weakest first quarter of 2015 (historically, due to Brazilian weather), the toxic lenders proceeded to do what they do best -- dump their holdings all at once, without the regard for PPS. The simple concept of supply and demand came into play. The toxic debt resulted in too many shares supplied too fast, and there was not enough demand at the time to absorb all of the shares at higher PPS.

The good news here is that the variable-rate debt of Brazil Minerals is almost gone, and it will be very shortly that BMIX will rise back to its fair PPS levels due to no longer being encumbered by the onslaught of converted shares. Various members of this board have been keeping track of the progress on BMIX variable-rate debt. Unlike many other penny stocks, BMIX team has also been very transparent about their debt situation making accurate calculations possible.

http://www.brazil-minerals.com/wp-content/uploads/2015/05/BMIX-PR-5.MAY_.2015.pdf

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=114663191

In summary, according to the calculations and the public updates from the company, as of 6/24/15 there are approximately 50-60M shares worth of variable-rate debt left to be converted and sold before ALL such debt is finished. Given the impressive daily volumes in BMIX, getting rid of variable-rate debt will be a matter of DAYS from now. I expect a blockbuster PR to skyrocket the stock's price once all variable-rate debt is gone from BMIX books.

BMIX DAILY CHART

i.t.m.d.

This post is my personal opinion. I do not provide investment advice.

i.t.m.d.

Recent ATLX News

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 06/05/2024 08:10:17 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/10/2024 09:00:25 PM

- Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material • Edgar (US Regulatory) • 05/07/2024 08:30:16 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/06/2024 09:19:52 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/09/2024 02:30:09 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/06/2024 11:01:55 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/17/2024 02:30:41 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/14/2024 04:55:05 PM

- Form 5 - Annual statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/14/2024 03:23:59 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/12/2024 09:30:35 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/27/2024 02:30:09 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/13/2024 02:30:22 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:24 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:13 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/05/2024 10:00:31 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/05/2024 02:30:07 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/30/2023 02:25:19 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/30/2023 02:20:14 AM

FEATURED Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM