Tuesday, July 29, 2014 5:17:44 AM

Silver Manipulation To End; $150 Per Ounce Possible - Video

Published in Market Update Precious Metals on 28 July 2014

By Mark O’Byrne

https://www.youtube.com/watch?v=6CJrYx-7XZI

Mark O’Byrne of GoldCore discusses silver and silver manipulation - see here

Silver for immediate delivery fell 0.4% to $20.68 an ounce in London this morning. Platinum added 0.4% to $1,485 an ounce. Palladium gained another 0.5% to $885.05 an ounce and is a whisker away from new 13 year nominal highs.

Gold and silver were marginally lower last week but both spiked towards the close on Friday which could be a harbinger for further price gains this week. Gold jumped $15.80 to as high as $1,308.20 in the last minutes of trade and silver surged to as high as $20.727.

Gold is marginally lower in London this morning after gold in Singapore ticked lower overnight. Futures trading volume surged from last week’s turgid trading and were 72% above the average for the past 100 days for this time of day, according to Bloomberg data.

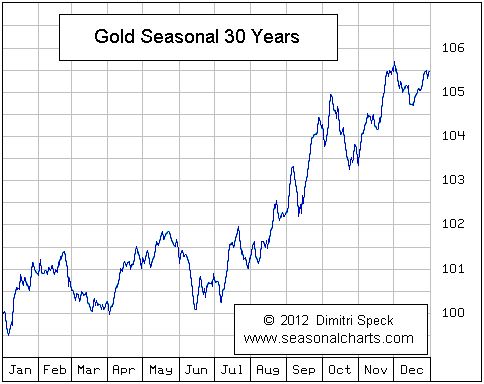

Silver in U.S. Dollars - 50, 100, 200 Simple Moving Averages (Thomson Reuters)

Silver was very resilient during last week’s bout of concentrated selling on the COMEX and remains above its key simple moving averages at $19.99, $20.19 and $20.21 -100, 50 and 200 day moving averages respectively (see chart). The technical picture for silver is text book bullish as are silver’s supply demandfundamentals.

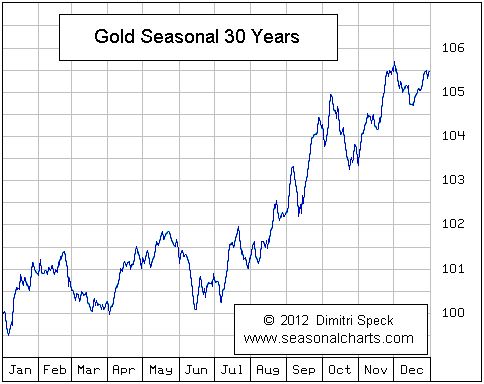

Gold in U.S. Dollars - 50, 100, 200 Simple Moving Averages (Thomson Reuters)

With the move higher late on Friday, gold is back above the 50, 100 and 200 day moving averages (see chart). Options expiration today and geopolitical tension has supported gold at the $1,300/oz level and silver at the $20/oz level.

Once options expiration is out of the way we expect higher prices for both precious metals in August.

Bank Suppression Of Silver Manipulation To End And Price Surge

Allegations of silver market manipulation went viral overnight with Bloomberg, the BBC, Reuters and media companies throughout the world covering the new lawsuit.

Deutsche Bank AG (DBK), HSBC Holdings Plc (HSBA) and Bank of Nova Scotia were accused in a lawsuit of rigging the price of billions of dollars in silver to the detriment of investors globally.

The banks unlawfully manipulated silver and its derivatives, an investor claims in a complaint filed yesterday in federal court in Manhattan. The banks abused their position of controlling the daily silver fix to reap illegitimate profit from trading, hurting other investors in the silver market who use the benchmark in billions of dollars of transactions, according to the suit.

The lawsuit is the latest to be brought against banks alleging manipulation of a benchmark. Suits have been filed against Deutsche Bank and Bank of Nova Scotia, HSBC and other banks in federal court in New York over allegations involving the London gold fix.

Manipulation of the silver market was covered in a just released ‘Get REAL’ Special on Silver presented by Jan Skoyles. Mark O'Byrne of Goldcore.com was interviewed and the interview was an in depth look at this silver market today.

Key topics discussed in the interview include

* The supply demand fundamentals of the silver market

* The manipulation of the silver market

* The importance of “joining the dots” and GATA

* CME and Thomson Reuters to manage new gold and silver fix

* The risk of manipulation through HFT, computer trading and ‘dark pools’

* “Meet the new boss; same as the old boss”

* The fix is in: Old boys, pints of beer, big cigars and top hats

* The importance of owning physical rather than paper or digital silver

* The importance of owning allocated and especially segregated silver

* The outlook for the unique industrial and precious metal that silver is

* Silver at over $150/oz in the coming years

‘Get Real: Silver’ can be watched here

end

Russia adds 541,000 oz last month or a huge 16.827 tonnes

Turkey adds 319,000 oz or 9.92 tonnes

Central Banks in Russia to Kazakhstan Boost Gold Reserves

By Maria Kolesnikova Jul 26, 2014 5:34 AM ET

Central banks for Russia to Kazakhstan and Mexico increased gold reserves as Germany trimmed its holdings, International Monetary Fund data show.

Kyrgyzstan, Tajikistan, Serbia, Greece and Equador also showed higher gold reserves for June, according to figures published today on the IMF website. Central banks had lowered world gold reserves for a second month by May to 1.022 billion troy ounces, IMF data show.

Gold advanced the most in four months in June as fighting in Ukraine to Iraq and Israel boosted demand for a haven. Hedge funds almost doubled net-long position in gold during June, U.S. Commodity Futures Trading Commission data show.

Russia increased its gold holdings, the world’s sixth-biggest, to 35.197 million ounces in June from 34.656 million ounces in May the IMF data show. The country is locked in its worst political crisis with the U.S. and its allies since the end of the Cold War after its annexation of Crimea this year and as western countries blame it for support of separatist rebels in eastern Ukraine.

Russia’s foreign reserves fell $39 billion to $472 billion in June, data from the central bank show. Gold accounts for 9.3 percent of the country’s reserves, according to the World Gold Council.

Turkey increased its holdings to 16.491 million ounces from 16.172 million ounces in May as it accepts gold in its reserve requirements from commercial banks, the IMF data show. The country ranks 13th largest by gold reserves, according to the gold council.

Germany, the second-biggest gold holder, lowered its holdings to 108.805 million ounces from 108.806 million ounces, the data show. Central bank goldings for China, the world’s biggest consumer, haven’t been updated since March at 33.89 million ounces.

After 12 straight years of gains, gold tumbled 28 percent in 2013 as an equity rally prompted some investors to lose faith in the metal. Bullion rose 6.2 percent in June, the most since February, and climbed 8.8 percent this year to $1,307.22 an ounce in London.

Today’s AM fix was USD 1,305.00, EUR 971.20 and GBP 768.55 per ounce.

Friday’s AM fix was USD 1,292.50, EUR 961.18 and GBP 761.64 per ounce.

Gold climbed $15.00 or 1.16% Friday to $1,307.40/oz and silver shot up $0.37 or 1.82% to $20.74/oz. Gold and silver were both down for the week - 0.24% and 0.53% respectively.

Malaysian plane was shot down by missile, US official says -

By Peter Leonard and Mstyslav Chernov |

ASSOCIATED PRESS JULY 17, 2014 -

http://www.bostonglobe.com/news/world/2014/07/17/passenger-plane-carrying-shot-down-adviser-ukrainian-official-says/m1sQJvByNCi7Vn5ncwEAjL/story.html

Gold prices surge after Malaysian Airlines flight MH17 shot down over Ukraine -

July 17th, 2014 16:02:14 GMT

by Adam Button | 0

The price of gold has risen more than $20 since the first reports

that a plane was shot down in Ukraine by a surface-to-air missile,

killing 295 passengers and 15 crew.

gold after Malaysian Airlines MH17 crash

gold intraday chart

Gold, bonds and the yen are the traditional safe havens

in times of geopolitical fear.

That’s exactly what we’re seeing now.

The initial reaction is always a flight to safe assets while

the details are sorted out.

The question traders are asking now is:

What are the consequences?

Does it put more pressure on Russia?

Is that a good thing to end the separatist conflict?

How will Malaysia, NATO and the US respond?

Normally, I always like to fade fear but there are some

legitimate reasons to be fearful and stay in safe assets here.

INSIDER TRADING AND FINANCIAL TERRORISM ON COMEX -

The first two days this week gold was subjected to a series of computer HFT-driven “flash crashes”

by PAUL CRAIG ROBERTS | INFOWARS.COM | JULY 17, 2014

http://www.infowars.com/insider-trading-and-financial-terrorism-on-comex/

A bill to audit the Fed.

The Sun's editorial is headined

"Congress Eyes Rules for the Fed" and it's posted here:

http://www.nysun.com/editorials/congress-eyes-rules-for-the-fed/88780/

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Dr. Paul Craig Roberts A Real Collapse in the Dollar, Gold Could Be

$30,000 an Ounce -

http://www.youtube.com/watch?v=pQQcfnrTL5s

India Imported 713 MT Of Silver In April, 1921 MT YTD -

Published: 17-07-2014 00:07

India Imported 713 MT Of Silver In April, 1921 MT YTD

Precious metals analysts have received a few gifts from the

authorities this year.

In January the Swiss Customs Administration (SCA) decided to

disclose their gold trade data country specific (previously only

the total import and export numbers of bullion were available),

also in January British customs (HMRC) decided to add gold in

their trade database (in previous years UK gold trade could only

be tracked through Eurostat),

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=103709111

God Bless

Published in Market Update Precious Metals on 28 July 2014

By Mark O’Byrne

https://www.youtube.com/watch?v=6CJrYx-7XZI

Mark O’Byrne of GoldCore discusses silver and silver manipulation - see here

Silver for immediate delivery fell 0.4% to $20.68 an ounce in London this morning. Platinum added 0.4% to $1,485 an ounce. Palladium gained another 0.5% to $885.05 an ounce and is a whisker away from new 13 year nominal highs.

Gold and silver were marginally lower last week but both spiked towards the close on Friday which could be a harbinger for further price gains this week. Gold jumped $15.80 to as high as $1,308.20 in the last minutes of trade and silver surged to as high as $20.727.

Gold is marginally lower in London this morning after gold in Singapore ticked lower overnight. Futures trading volume surged from last week’s turgid trading and were 72% above the average for the past 100 days for this time of day, according to Bloomberg data.

Silver in U.S. Dollars - 50, 100, 200 Simple Moving Averages (Thomson Reuters)

Silver was very resilient during last week’s bout of concentrated selling on the COMEX and remains above its key simple moving averages at $19.99, $20.19 and $20.21 -100, 50 and 200 day moving averages respectively (see chart). The technical picture for silver is text book bullish as are silver’s supply demandfundamentals.

Gold in U.S. Dollars - 50, 100, 200 Simple Moving Averages (Thomson Reuters)

With the move higher late on Friday, gold is back above the 50, 100 and 200 day moving averages (see chart). Options expiration today and geopolitical tension has supported gold at the $1,300/oz level and silver at the $20/oz level.

Once options expiration is out of the way we expect higher prices for both precious metals in August.

Bank Suppression Of Silver Manipulation To End And Price Surge

Allegations of silver market manipulation went viral overnight with Bloomberg, the BBC, Reuters and media companies throughout the world covering the new lawsuit.

Deutsche Bank AG (DBK), HSBC Holdings Plc (HSBA) and Bank of Nova Scotia were accused in a lawsuit of rigging the price of billions of dollars in silver to the detriment of investors globally.

The banks unlawfully manipulated silver and its derivatives, an investor claims in a complaint filed yesterday in federal court in Manhattan. The banks abused their position of controlling the daily silver fix to reap illegitimate profit from trading, hurting other investors in the silver market who use the benchmark in billions of dollars of transactions, according to the suit.

The lawsuit is the latest to be brought against banks alleging manipulation of a benchmark. Suits have been filed against Deutsche Bank and Bank of Nova Scotia, HSBC and other banks in federal court in New York over allegations involving the London gold fix.

Manipulation of the silver market was covered in a just released ‘Get REAL’ Special on Silver presented by Jan Skoyles. Mark O'Byrne of Goldcore.com was interviewed and the interview was an in depth look at this silver market today.

Key topics discussed in the interview include

* The supply demand fundamentals of the silver market

* The manipulation of the silver market

* The importance of “joining the dots” and GATA

* CME and Thomson Reuters to manage new gold and silver fix

* The risk of manipulation through HFT, computer trading and ‘dark pools’

* “Meet the new boss; same as the old boss”

* The fix is in: Old boys, pints of beer, big cigars and top hats

* The importance of owning physical rather than paper or digital silver

* The importance of owning allocated and especially segregated silver

* The outlook for the unique industrial and precious metal that silver is

* Silver at over $150/oz in the coming years

‘Get Real: Silver’ can be watched here

end

Russia adds 541,000 oz last month or a huge 16.827 tonnes

Turkey adds 319,000 oz or 9.92 tonnes

Central Banks in Russia to Kazakhstan Boost Gold Reserves

By Maria Kolesnikova Jul 26, 2014 5:34 AM ET

Central banks for Russia to Kazakhstan and Mexico increased gold reserves as Germany trimmed its holdings, International Monetary Fund data show.

Kyrgyzstan, Tajikistan, Serbia, Greece and Equador also showed higher gold reserves for June, according to figures published today on the IMF website. Central banks had lowered world gold reserves for a second month by May to 1.022 billion troy ounces, IMF data show.

Gold advanced the most in four months in June as fighting in Ukraine to Iraq and Israel boosted demand for a haven. Hedge funds almost doubled net-long position in gold during June, U.S. Commodity Futures Trading Commission data show.

Russia increased its gold holdings, the world’s sixth-biggest, to 35.197 million ounces in June from 34.656 million ounces in May the IMF data show. The country is locked in its worst political crisis with the U.S. and its allies since the end of the Cold War after its annexation of Crimea this year and as western countries blame it for support of separatist rebels in eastern Ukraine.

Russia’s foreign reserves fell $39 billion to $472 billion in June, data from the central bank show. Gold accounts for 9.3 percent of the country’s reserves, according to the World Gold Council.

Turkey increased its holdings to 16.491 million ounces from 16.172 million ounces in May as it accepts gold in its reserve requirements from commercial banks, the IMF data show. The country ranks 13th largest by gold reserves, according to the gold council.

Germany, the second-biggest gold holder, lowered its holdings to 108.805 million ounces from 108.806 million ounces, the data show. Central bank goldings for China, the world’s biggest consumer, haven’t been updated since March at 33.89 million ounces.

After 12 straight years of gains, gold tumbled 28 percent in 2013 as an equity rally prompted some investors to lose faith in the metal. Bullion rose 6.2 percent in June, the most since February, and climbed 8.8 percent this year to $1,307.22 an ounce in London.

Today’s AM fix was USD 1,305.00, EUR 971.20 and GBP 768.55 per ounce.

Friday’s AM fix was USD 1,292.50, EUR 961.18 and GBP 761.64 per ounce.

Gold climbed $15.00 or 1.16% Friday to $1,307.40/oz and silver shot up $0.37 or 1.82% to $20.74/oz. Gold and silver were both down for the week - 0.24% and 0.53% respectively.

Malaysian plane was shot down by missile, US official says -

By Peter Leonard and Mstyslav Chernov |

ASSOCIATED PRESS JULY 17, 2014 -

http://www.bostonglobe.com/news/world/2014/07/17/passenger-plane-carrying-shot-down-adviser-ukrainian-official-says/m1sQJvByNCi7Vn5ncwEAjL/story.html

Gold prices surge after Malaysian Airlines flight MH17 shot down over Ukraine -

July 17th, 2014 16:02:14 GMT

by Adam Button | 0

The price of gold has risen more than $20 since the first reports

that a plane was shot down in Ukraine by a surface-to-air missile,

killing 295 passengers and 15 crew.

gold after Malaysian Airlines MH17 crash

gold intraday chart

Gold, bonds and the yen are the traditional safe havens

in times of geopolitical fear.

That’s exactly what we’re seeing now.

The initial reaction is always a flight to safe assets while

the details are sorted out.

The question traders are asking now is:

What are the consequences?

Does it put more pressure on Russia?

Is that a good thing to end the separatist conflict?

How will Malaysia, NATO and the US respond?

Normally, I always like to fade fear but there are some

legitimate reasons to be fearful and stay in safe assets here.

INSIDER TRADING AND FINANCIAL TERRORISM ON COMEX -

The first two days this week gold was subjected to a series of computer HFT-driven “flash crashes”

by PAUL CRAIG ROBERTS | INFOWARS.COM | JULY 17, 2014

http://www.infowars.com/insider-trading-and-financial-terrorism-on-comex/

A bill to audit the Fed.

The Sun's editorial is headined

"Congress Eyes Rules for the Fed" and it's posted here:

http://www.nysun.com/editorials/congress-eyes-rules-for-the-fed/88780/

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Dr. Paul Craig Roberts A Real Collapse in the Dollar, Gold Could Be

$30,000 an Ounce -

http://www.youtube.com/watch?v=pQQcfnrTL5s

India Imported 713 MT Of Silver In April, 1921 MT YTD -

Published: 17-07-2014 00:07

India Imported 713 MT Of Silver In April, 1921 MT YTD

Precious metals analysts have received a few gifts from the

authorities this year.

In January the Swiss Customs Administration (SCA) decided to

disclose their gold trade data country specific (previously only

the total import and export numbers of bullion were available),

also in January British customs (HMRC) decided to add gold in

their trade database (in previous years UK gold trade could only

be tracked through Eurostat),

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=103709111

God Bless

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.