Wednesday, June 25, 2014 3:47:35 PM

U.S. Govt to PLUNDER Citizens during COLLAPSE | BrotherJohnF (VIDEO)

Lots of Silver Info Here!!!

http://www.youtube.com/watch?v=npGCdDPxPEU

http://investmentwatchblog.com/u-s-govt-to-plunder-citizens-during-collapse-brotherjohnf/

The MOST Amazing SILVER News EVER! (VIDEO)

http://www.youtube.com/watch?v=Knk6hV7Rl18

http://investmentwatchblog.com/the-most-amazing-silver-news-ever/

Singapore to launch gold contract as Asia eyes price alternatives -

Tue Jun 24, 2014 7:40am EDT

By A. Ananthalakshmi

SINGAPORE, June 24 (Reuters) -

Singapore is set to announce the launch of a gold futures contract

on Wednesday, two sources familiar with the matter said, joining a

race in Asia to provide a viable alternative to the metal's

global benchmark which is under regulatory scrutiny.

The physically settled contract will trade on the Singapore Exchange.

This and other planned contracts in Hong Kong and China could cut

Asian reliance on gold's spot price benchmark in London and

futures bellwether in New York.

"Having a local price for local markets ensures that markets are

more efficient and that the price accurately reflects where the

metal is locally trading," said Ruth Crowell, chief executive of

industry group London Bullion Market Association.

"As more markets develop, local prices for precious metals will

become more tailored."

The Singapore Exchange did not respond to phone calls or an email

seeking comment.

The price benchmark for gold is the so-called London 'fix',

determined by a group of four banks over a teleconference.

The process has drawn attention recently, after regulators in

Europe and the United States started to probe benchmarks in

several markets following the Libor manipulation case in 2012.

China and India account for more than half of global gold

consumption but Asia still largely relies on the London fix for

reference.

The fix is set twice daily, at 1030 and 1500 London time -

both much after Asian markets close.

Asia's fast-growing consumption of gold in recent years and

ambitions by countries such as China and Singapore to be trading

hubs have led them to explore providing benchmarks.

The recent scrutiny of the London fix and accusations of

manipulation have accelerated the process in Asia.

China, the world's biggest producer and consumer of gold, is set

to launch three physical gold contracts in an upcoming

international exchange in Shanghai's pilot free trade zone.

It is also looking to launch gold derivatives later.

CME Group Inc, the world's No.1 futures exchange, plans to launch a

physically deliverable gold futures contract in Asia, most likely

in Hong Kong, sources familiar with the matter told Reuters in

April.

UPHILL TASK

While the Asian contracts may help set local benchmarks, their

influence in global markets may be quite limited unless they can

garner enough liquidity to match or overtake trading volumes in

London and New York.

CME's COMEX gold contract is the most-traded bullion futures

contract with 2013 volumes nearly four times higher than

the second-biggest gold contract, on

the Shanghai Futures Exchange, according to Thomson Reuters GFMS.

Liquidity in Asia has been a problem, with

the Hong Kong Mercantile Exchange -

which used to trade gold and silver futures -

shutting down last year, partly because of low volumes.

Regulators later found suspected irregularities in

the firm's operations.

In 2010, the Singapore Exchange launched a gold contract but

later pulled it on weak investor appetite.

"If you need a price discovery function, then COMEX serves us

pretty well," said Yuichi Ikemizu, branch manager

for Standard Bank in Tokyo.

"The fact is the liquidity is there and not in the local

exchanges."

China has the best chance among Asian nations of having an impact

on global gold pricing as it already has well-established

physical and futures markets though it still needs to open up

the markets to foreign players, say traders.

"As the Chinese market becomes bigger and it opens up to foreign players some more, it might end up completing the troika with London and New York," said one trader in Hong Kong. (Editing by Muralikumar Anantharaman)

http://www.reuters.com/article/2014/06/24/gold-asia-pricing-idUSL4N0P42BW20140624

Jim Sinclair: Russia Can Collapse US Economy, Gold Update, Silver is Gold on Steroids & More -

http://www.youtube.com/watch?v=KXGPzDq45gM

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=103668642

http://www.youtube.com/watch?v=TBPQuNsY-Kc#t=20

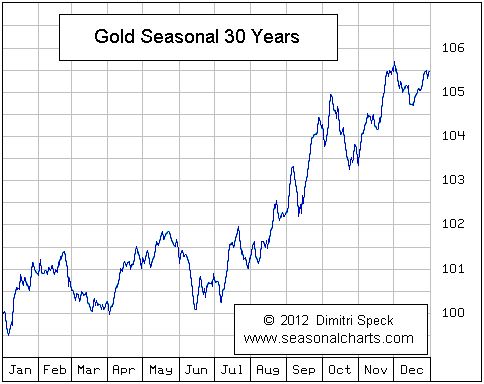

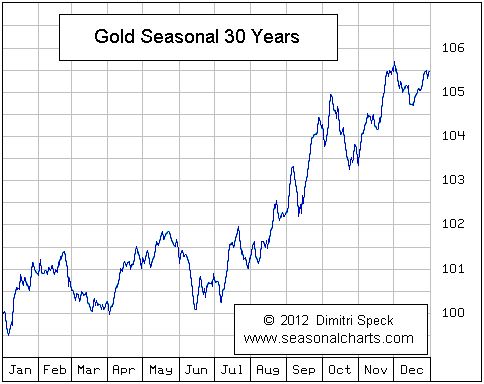

Gold Soars Seasonally In June -

This chart TA the historical trend of the price of gold,

based on 30 years of data -

the price usually rises until January-February.

The challenge is to catch the June lows -

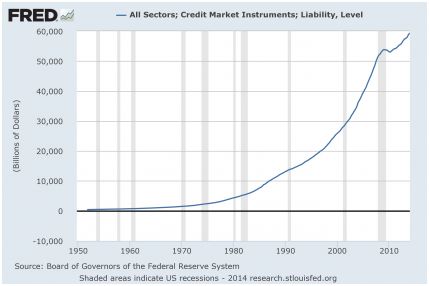

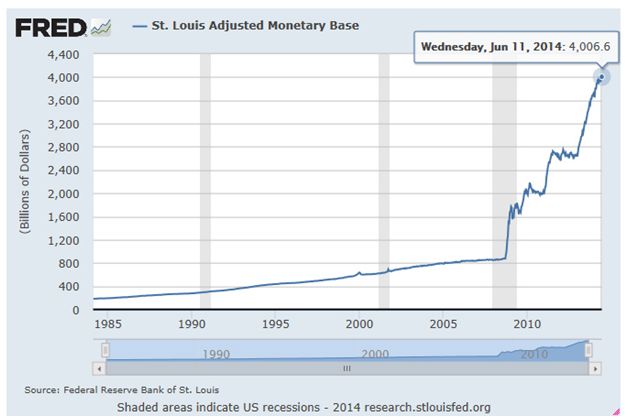

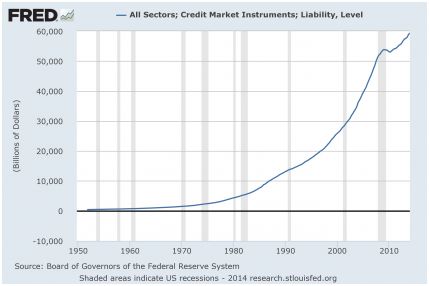

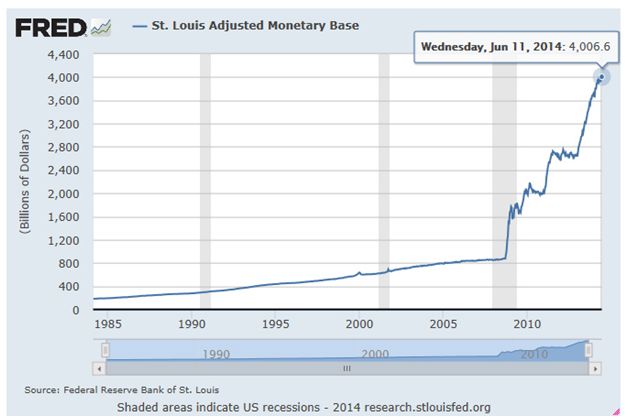

This chart courtesy Federal Reserve Bank of St. Louis

shows the total amount of debt in the USA

is now 60 trillion dollars.

This cannot possibly be paid off, and it will be inflated away.

Gold and silver will benefit.

"Gold, unlike all other commodities, is a currency...and

the major thrust in the demand for gold is not for jewelry.

It’s not for anything other than an escape from what is perceived

to be a fiat money system, paper money,

that seems to be deteriorating."

-– Alan Greenspan, ex-US Federal Reserve Chairman,

August 23, 2011

Lots of Silver Info Here!!!

http://www.youtube.com/watch?v=npGCdDPxPEU

http://investmentwatchblog.com/u-s-govt-to-plunder-citizens-during-collapse-brotherjohnf/

The MOST Amazing SILVER News EVER! (VIDEO)

http://www.youtube.com/watch?v=Knk6hV7Rl18

http://investmentwatchblog.com/the-most-amazing-silver-news-ever/

Singapore to launch gold contract as Asia eyes price alternatives -

Tue Jun 24, 2014 7:40am EDT

By A. Ananthalakshmi

SINGAPORE, June 24 (Reuters) -

Singapore is set to announce the launch of a gold futures contract

on Wednesday, two sources familiar with the matter said, joining a

race in Asia to provide a viable alternative to the metal's

global benchmark which is under regulatory scrutiny.

The physically settled contract will trade on the Singapore Exchange.

This and other planned contracts in Hong Kong and China could cut

Asian reliance on gold's spot price benchmark in London and

futures bellwether in New York.

"Having a local price for local markets ensures that markets are

more efficient and that the price accurately reflects where the

metal is locally trading," said Ruth Crowell, chief executive of

industry group London Bullion Market Association.

"As more markets develop, local prices for precious metals will

become more tailored."

The Singapore Exchange did not respond to phone calls or an email

seeking comment.

The price benchmark for gold is the so-called London 'fix',

determined by a group of four banks over a teleconference.

The process has drawn attention recently, after regulators in

Europe and the United States started to probe benchmarks in

several markets following the Libor manipulation case in 2012.

China and India account for more than half of global gold

consumption but Asia still largely relies on the London fix for

reference.

The fix is set twice daily, at 1030 and 1500 London time -

both much after Asian markets close.

Asia's fast-growing consumption of gold in recent years and

ambitions by countries such as China and Singapore to be trading

hubs have led them to explore providing benchmarks.

The recent scrutiny of the London fix and accusations of

manipulation have accelerated the process in Asia.

China, the world's biggest producer and consumer of gold, is set

to launch three physical gold contracts in an upcoming

international exchange in Shanghai's pilot free trade zone.

It is also looking to launch gold derivatives later.

CME Group Inc, the world's No.1 futures exchange, plans to launch a

physically deliverable gold futures contract in Asia, most likely

in Hong Kong, sources familiar with the matter told Reuters in

April.

UPHILL TASK

While the Asian contracts may help set local benchmarks, their

influence in global markets may be quite limited unless they can

garner enough liquidity to match or overtake trading volumes in

London and New York.

CME's COMEX gold contract is the most-traded bullion futures

contract with 2013 volumes nearly four times higher than

the second-biggest gold contract, on

the Shanghai Futures Exchange, according to Thomson Reuters GFMS.

Liquidity in Asia has been a problem, with

the Hong Kong Mercantile Exchange -

which used to trade gold and silver futures -

shutting down last year, partly because of low volumes.

Regulators later found suspected irregularities in

the firm's operations.

In 2010, the Singapore Exchange launched a gold contract but

later pulled it on weak investor appetite.

"If you need a price discovery function, then COMEX serves us

pretty well," said Yuichi Ikemizu, branch manager

for Standard Bank in Tokyo.

"The fact is the liquidity is there and not in the local

exchanges."

China has the best chance among Asian nations of having an impact

on global gold pricing as it already has well-established

physical and futures markets though it still needs to open up

the markets to foreign players, say traders.

"As the Chinese market becomes bigger and it opens up to foreign players some more, it might end up completing the troika with London and New York," said one trader in Hong Kong. (Editing by Muralikumar Anantharaman)

http://www.reuters.com/article/2014/06/24/gold-asia-pricing-idUSL4N0P42BW20140624

Jim Sinclair: Russia Can Collapse US Economy, Gold Update, Silver is Gold on Steroids & More -

http://www.youtube.com/watch?v=KXGPzDq45gM

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=103668642

http://www.youtube.com/watch?v=TBPQuNsY-Kc#t=20

Gold Soars Seasonally In June -

This chart TA the historical trend of the price of gold,

based on 30 years of data -

the price usually rises until January-February.

The challenge is to catch the June lows -

This chart courtesy Federal Reserve Bank of St. Louis

shows the total amount of debt in the USA

is now 60 trillion dollars.

This cannot possibly be paid off, and it will be inflated away.

Gold and silver will benefit.

"Gold, unlike all other commodities, is a currency...and

the major thrust in the demand for gold is not for jewelry.

It’s not for anything other than an escape from what is perceived

to be a fiat money system, paper money,

that seems to be deteriorating."

-– Alan Greenspan, ex-US Federal Reserve Chairman,

August 23, 2011

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.