Friday, July 25, 2014 1:36:44 AM

INDIAN SILVER IMPORTS: Near Record At A Quarter Of Global Mine Supply

Filed in Mining, Precious Metals by SRSrocco on July 23, 2014

It looks like at least one country is still taking advantage of

the extremely low paper price of silver.

From information just released, India continues to import a near

record amount of silver in 2014.

Even though silver imports slumped in June compared to last year,

demand is still extremely strong.

According to Mineweb’s article on India Silver Imports:

Market sources added that import of silver in the calendar year

of 2013 was around 5,819 tonnes, the highest ever.

The previous high was in 2008, when import was 5,048 tonnes.

However, despite the fall in June, sources said the first half

of 2014 has seen silver imports at 2,882 tonnes, as against

2,980 tonnes last year, for the first six months of 2013.

As the article states, India imported 2,882 tonnes of silver in

the first six months of the year, down slightly from

the previous record set last year at 2,980 tonnes.

We must remember, the Indian government enacted restrictions

on gold imports in 2013… forcing its citizens to purchase

silver instead.

On top of this, we had the huge smash in the paper price of silver from a high of $32 in the beginning of 2013, to a low of $18 in June. Again, even with falling silver imports in June, total silver imports are expected to reach 5,000 tonnes in 2014.

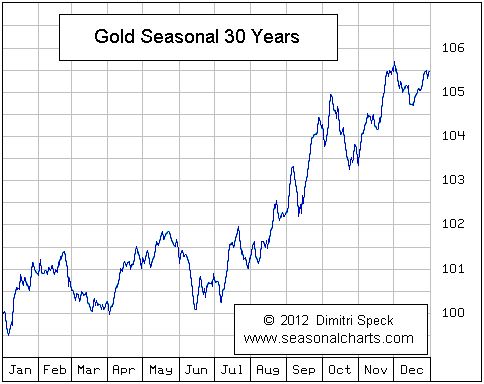

Just to put into perspective the amount of Indian silver imports, let’s look at the following chart:

By converting 2,880 tonnes of silver, we get 92.6 million ounces

of the shiny metal.

According to the 2014 World Silver Survey, global silver

production exceeded 800 million ounces in 2013 (not by much).

Thus, India imported 23%, nearly a quarter of global mine supply.

This is a substantial amount of silver when we compare it to their

domestic mine supply.

The chart below is from the Silver Institute website, provided by

data published at Thomson Reuters GFMS, the same organization that

releases the World Silver Survey and ironically…. one of the new

custodians for the SILVER FIX.

If we scroll down the chart, yes down below Kazakhstan, you will

see that India ranks thirteenth in the world at 12.1 million oz

of annual silver production.

With a population of over 1.2 billion, it’s no wonder India

needs to import silver to meet the demand of its citizens.

Total annual Indian silver production represents just one-tenth

of one percent of the population of the country.

What do you think will happen to silver demand in India when

its citizens realize their Rupee is just another lousy fiat

currency?

Furthermore, to add even more perspective on the subject of

silver mine supply vs. silver imports, I decided to include

the United States into the equation.

Using data from the Silver Institute, the USGS and information

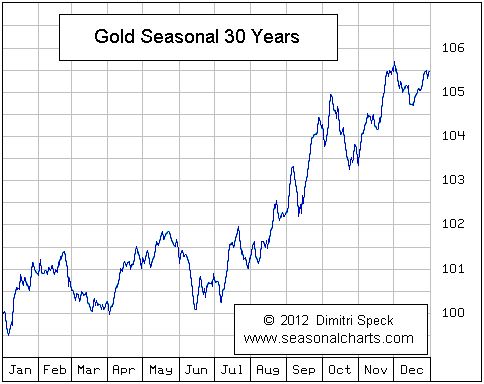

from the Mineweb article linked above, I threw together

the chart below.

Last year, India produced 12.1 million ounces of silver, while

it imported 15 times that amount at 187 million oz.

The United States performed a little better in the mining arena

by producing 35 million ounces versus 163.3 million oz of

silver imports…. nearly a 5 to 1 ratio.

If we combine the two… we come up with some startling results.

Total silver mine supply from these two countries equals

47 million ounces compared to the staggering 350 million oz

in silver imports.

Basically, India and the United States imported nearly half (44%)

of total global silver mine supply in 2013.

And.. if that isn’t eye-opening enough, Indian and U.S. domestic

mine supply only represent 13% of their total silver imports.

Which means, they import a hell of a lot of silver.

Of course these countries export some of this imported silver

as finished products… but still, it represents

a substantial amount.

So what happens when the world finally experiences a severe heart-

attack of its Fiat Monetary System? Yes, I realize there are still

individuals out there who believe the U.S.

Dollar is as good as gold and we will continue BAU –

Business As Usual for another 100 years.

Unfortunately, the degree of negative geopolitical, financial and

economic events are speeding up rapidly and it’s only a matter of

time before the horror movie, NIGHTMARE ON MAIN STREET opens at

a town near you.

Do we really believe top silver producing countries like Mexico

and Peru as well as many other South American countries will

continue to give away their silver for a mere pittance when

the Dollar finally loses its World Reserve status?

Investors around the world have no idea of the bargain they are

receiving by purchasing one of the best future stores of wealth….

at rock bottom prices.

This may seem like the same ole WORN-OUT rhetoric to precious

metal investors who are presently underwater with some of their

gold and silver holdings; however the focus has always been on

ACQUIRING OUNCES… not TRADING or valuing them in a fiat currency

that gets closer to going EXTINCT each passing day.

-END-

Mexico Looks To Back Peso With Silver: “Would Unleash a Global Power Shift”

Friday, July 11, 2014 10:44

http://beforeitsnews.com/survival/2014/07/mexico-looks-to-back-peso-with-silver-would-unleash-a-global-power-shift-2530606.html

Silver's Monetary Rise -

http://www.youtube.com/watch?v=D3MLn2UYw0A

U.S. Silver & Gold Inc - Latest Presentation -

http://www.us-silver.com/Investors/Presentations/default.aspx

http://www.us-silver.com/News-and-Events/News-Releases/News-Release-Details/2014/US-Silver--Gold-announces-results-of-shareholder-meeting/default.aspx

http://www.us-silver.com/

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=103709111

God Bless

Filed in Mining, Precious Metals by SRSrocco on July 23, 2014

It looks like at least one country is still taking advantage of

the extremely low paper price of silver.

From information just released, India continues to import a near

record amount of silver in 2014.

Even though silver imports slumped in June compared to last year,

demand is still extremely strong.

According to Mineweb’s article on India Silver Imports:

Market sources added that import of silver in the calendar year

of 2013 was around 5,819 tonnes, the highest ever.

The previous high was in 2008, when import was 5,048 tonnes.

However, despite the fall in June, sources said the first half

of 2014 has seen silver imports at 2,882 tonnes, as against

2,980 tonnes last year, for the first six months of 2013.

As the article states, India imported 2,882 tonnes of silver in

the first six months of the year, down slightly from

the previous record set last year at 2,980 tonnes.

We must remember, the Indian government enacted restrictions

on gold imports in 2013… forcing its citizens to purchase

silver instead.

On top of this, we had the huge smash in the paper price of silver from a high of $32 in the beginning of 2013, to a low of $18 in June. Again, even with falling silver imports in June, total silver imports are expected to reach 5,000 tonnes in 2014.

Just to put into perspective the amount of Indian silver imports, let’s look at the following chart:

By converting 2,880 tonnes of silver, we get 92.6 million ounces

of the shiny metal.

According to the 2014 World Silver Survey, global silver

production exceeded 800 million ounces in 2013 (not by much).

Thus, India imported 23%, nearly a quarter of global mine supply.

This is a substantial amount of silver when we compare it to their

domestic mine supply.

The chart below is from the Silver Institute website, provided by

data published at Thomson Reuters GFMS, the same organization that

releases the World Silver Survey and ironically…. one of the new

custodians for the SILVER FIX.

If we scroll down the chart, yes down below Kazakhstan, you will

see that India ranks thirteenth in the world at 12.1 million oz

of annual silver production.

With a population of over 1.2 billion, it’s no wonder India

needs to import silver to meet the demand of its citizens.

Total annual Indian silver production represents just one-tenth

of one percent of the population of the country.

What do you think will happen to silver demand in India when

its citizens realize their Rupee is just another lousy fiat

currency?

Furthermore, to add even more perspective on the subject of

silver mine supply vs. silver imports, I decided to include

the United States into the equation.

Using data from the Silver Institute, the USGS and information

from the Mineweb article linked above, I threw together

the chart below.

Last year, India produced 12.1 million ounces of silver, while

it imported 15 times that amount at 187 million oz.

The United States performed a little better in the mining arena

by producing 35 million ounces versus 163.3 million oz of

silver imports…. nearly a 5 to 1 ratio.

If we combine the two… we come up with some startling results.

Total silver mine supply from these two countries equals

47 million ounces compared to the staggering 350 million oz

in silver imports.

Basically, India and the United States imported nearly half (44%)

of total global silver mine supply in 2013.

And.. if that isn’t eye-opening enough, Indian and U.S. domestic

mine supply only represent 13% of their total silver imports.

Which means, they import a hell of a lot of silver.

Of course these countries export some of this imported silver

as finished products… but still, it represents

a substantial amount.

So what happens when the world finally experiences a severe heart-

attack of its Fiat Monetary System? Yes, I realize there are still

individuals out there who believe the U.S.

Dollar is as good as gold and we will continue BAU –

Business As Usual for another 100 years.

Unfortunately, the degree of negative geopolitical, financial and

economic events are speeding up rapidly and it’s only a matter of

time before the horror movie, NIGHTMARE ON MAIN STREET opens at

a town near you.

Do we really believe top silver producing countries like Mexico

and Peru as well as many other South American countries will

continue to give away their silver for a mere pittance when

the Dollar finally loses its World Reserve status?

Investors around the world have no idea of the bargain they are

receiving by purchasing one of the best future stores of wealth….

at rock bottom prices.

This may seem like the same ole WORN-OUT rhetoric to precious

metal investors who are presently underwater with some of their

gold and silver holdings; however the focus has always been on

ACQUIRING OUNCES… not TRADING or valuing them in a fiat currency

that gets closer to going EXTINCT each passing day.

-END-

Mexico Looks To Back Peso With Silver: “Would Unleash a Global Power Shift”

Friday, July 11, 2014 10:44

http://beforeitsnews.com/survival/2014/07/mexico-looks-to-back-peso-with-silver-would-unleash-a-global-power-shift-2530606.html

Silver's Monetary Rise -

http://www.youtube.com/watch?v=D3MLn2UYw0A

U.S. Silver & Gold Inc - Latest Presentation -

http://www.us-silver.com/Investors/Presentations/default.aspx

http://www.us-silver.com/News-and-Events/News-Releases/News-Release-Details/2014/US-Silver--Gold-announces-results-of-shareholder-meeting/default.aspx

http://www.us-silver.com/

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=103709111

God Bless

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.