Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Hallo, Mr. Winkelman

Just writing to see if this thread it's still alive or not.

Best regards.

Pedro

For all of you that thought I had become sick or had died I like to let you know I am fine. . I have been busy with other work so that the attention to this Forum has suffered.

From now on I and again working on presenting relevant information on Vortex AIM, which is now in Version 1.31d available with updated features that make it operation easier.

It has e real-time price change indicator;

The ROTAC and ROTAI Yield are now on the Interface Screen instantly "switchable" so you can see how lathe the Real real yield is bases on the principle of the "Internal Rate of Return" using a time based yield formula in which all the "earnings" and expenses that are necessary for maintaining an investment are processed as the occur on the precise date:

For ROTAC Yield that includes the proper accounting for adding Capital to the Reserve or subtracting Capital from it. This includes dividend, interest gain and all costs as they apply;

For ROTAI Yield that includes the dynamic equity earnings and costs but not "dead" Capital additions as that capital is not invested in equity until shares are bought. So a dividend is an Equity Equity Gain but is added as Cash to the Reserve and in effect it is treated like sale of shares but the share number remains the same. So in essence essence one gets extra shares for free if the dividend is used to buy new shares which increase the Equity Value. In the Standard AIM operation such a dividend can also be treated as buying shares without any Reserve reduction.

For your information I have placed a Vortex AIM promotion article on Face Book:

https://www.facebook.com/conrad.winkelman.

The follow-up consideration:

How would Case 1 and Case 2 work out for VORTEX AIMing ?

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=102450242

Considering that the Vortex Trading Functions are

Vortex Buy Advice = (PC-V)*/(1-Fb)

Vortex Sell Advice = (PC-V)*/(1-Fs)

you can see at a glance that the Vortex Method is a Ratio Trading System

and the Buying and the Selling have the general mathematical form of

Buying: . . . y=Ab*x

Selling:. . . y=As*x

Considering that for Case 1 the PC is being Updated by each Buy" and for Case 2 it is not, then you need to consider that in Vortex AIM the Ratio System retains the same Trading Ratio based on an equity price change, so that raising the PC to the new equity value V(new) after a trade, in Case 1, does not change the trading Rates, which are defined by the Constants Ab and As.

After each trade the PC(new)= V(new).

For this reason the accumulation of Step-wise Buys in Case 1 results in the same Total Buy Amount for a single large Buy in Case 2, as long as the price changes remain identical for both cases

For Vortex Case 1 and Case 2 of my Ocroft Method Options are Identical.

I have discussed an interesting AIM Alternative that was suggested by Ocroft here on the AIM User Forum:

I agree with Ocroft that on the average The Ocroft Method (TOM) will outperform the Standard AIM Method:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=102449505

Results for the second phase of the SPY Demo Portfolio between 03-01-2011 and 09005-2014:

I use only the End positions. The starting positions for this sensid phase are defined as the End Positions in the previous Post.

Second Period: 03-07-2012 to 09-05 2014

Yield Performance is calculated for the entire investment period of 41,5 months, For the several Optimization runs shorter periods were used.

Capital Investment total = $ 40000 [$ 20000 Capital was added~1 year ago]

Reserve Cash = $ 45873. . .partially received dividends are included in this(See Note 1).

Equity Value = $ 940. . . .Due to the rising Share Price triggering predominant Selling Trades

Share price = $ 187,96

Share price Gain from 127,05 ~3,5 years ago = 47,94 % over 3 years and ~5,5 months.

That is an Annual Share Price Gain of 13,9 % .. .Which is also ~ the Buy & Hold Gain

ROTAC Yield = 7,44 %

* Cash Fraction = 0,98

* Buy Threshold = 5%

* Sell Threshold = 10%

* Buy Aggression = 0,96

* Sell Aggression = 0,70

Due to the low volatility the optimizations drifted to larger aggressively but the low volatility also reduced the trading frequency. Still the Vortex ROTAC yield dropped behind the Buy & Hold Yield by ~6,5 % because of the trading costs. This is considerably worse than for the first 1,5 years...

Note 1

I must add to my embarrassment here that since 21 September 2012 I have neglected to add the Dividends. . . .A calculation shows that about $ 270 Dividend should be added to the value of the Reserve and the Total Value. The corrected Yield is then approximately 7,84 %. . .This is not significant, so the overall conclusion that the yield is still substantially less, and that the Buy & Hold Yield of almost 14 % stands as substantially higher.

ROTAI Yield at this End Point = 23,26 %

This is substantially higher than the ROTAI Yield of 14,01 in the first 1,5 year.

If the $ 270 Dividend would have been added then the ROTAI yield would have been ~ 23,26%(7,84/7/44) = 24, 5 % and THAT is substantially higher that the 14 % Annual Buy & Hold Gain.

I will retroactively add the missing Dividends in this Demo and report the effect om the End Yields per May 9th 2014.

The point of this optimizing is that using an Optimization Program VOP the yield in this case was greatly improved over the 41,5 month Investment Period, which is due to that fact that earlier I had estimated the Trading thresholds at 7% and then reduced them to 3 and 4 % which was actually too low. The VOP Program corrected that and I reset these threshgolds to 5% for buying and 10 % for selling.

Clearly it must be emphasized that this result of improvement from optimization can not be applied indiscriminately to other stocks that have behaved drastically different from SPY.

In this period the Price Chart shows a steadily increasing share price without great dips and without high peaks. For comparably gentle price behavior I would predict that Optimization such as I have practiced works fine!

A 25 % annual Yield for SPY over a period of 41,5 months, compared to 14 % Buy & Hold is quite a reasonable achievement.

The essential point in this SPY Demo is that for the ROTAI Case the Time Average Investment. . .The money actually at Risk. . . was calculated at only $ 5116 while the same for the ROTAC case the Time Average Capital was about $ 20750 for the same period.

Another point that was discovered is that I was selling SPY too fast as the price rose. I should have stopped the rapid sell off for the rising Trend Channel and lowered the Sell Aggression and increased the Buy Aggression, in order to retain the share quantity much higher than I did.

Here is the corrected text of the post I withdrew:

Among other things I have been attending to lately, I have been struggling to get Windows 7 functioning properly. . .No success yet. Some errors prevent me to download some drivers(scanning and sound and Printing) frown

Also O have an Error that causes the MS Back-up not to work frown. . .I have been ”suffering” this for 1,5 months now.

****************************

All the time I have continued running some 3 Demo's on the SP500 SPY, and on a set of Dutch Penny. . . a Calamity portfolio. . .just for Fun, since 03-01-2011 foe SPY to today, with VORTEX, trying to get an optimized strategy using our Optimization Program. . .(only Dutch language so far). People interested could buy a Copy of it for € 100 and experience the development as we go, getting free Updates.

SPY has not show a great deal of volatility and has been steadily rising in value these 3.5 years. . .resulting in the performance for which Buy & Hold Method would have been better, if I had used the simple ROI Yield Calculation. . .as some of you use: The ROI Method without considering a variable amount of Investment that over the years applies.

My approach was as follows, as of 03-01-2011 with $ 20000 Inlay:

Parameters are

* Cash Fraction = 0,72

* Buy Threshold = 7%

* Sell Threshold = 7%

* Buy Aggression = 0,8

* Sell Aggression = 0,6 . . .This means that I buy more aggressively than I sell, which drives the Portfolio towards Share Accumulation (Increasing Equity Value).

If I reverse the Aggression Factors then that drives the Portfolio towards Liquidation (This interesting if it is to generate cash income).

1) January 2011 I started with Parameters more or less as I had found best the previous periods with a volatile SPY. As the time goes on. . .during say 6 months or so I monitor the volatility and if it proves to be too low I lower the Buy-Sell Thresholds a bit and at 6 months or so I run an optimization with VOP. . .Vortex Optimization Program . . . on the last 6 months history and then I resets the Vortex parameters for optimized Yield %.

The Cash Fraction can then be rebalanced to suit, if judged necessary. I use my "fingerspietzinggeful" for that smile.

The Vortex Program also allows for adding Cash at any time and adjusts the total investment to an Period Average that as the Investment for the period. The Optimization Process uses a fixed CER that is started with for that Run.

2) After this a new Staring condition is defined for VOP. . . Essentially the Test Portfolio is Reset to a New Start Condition for the Next Optimization Run. The Vortex Portfolio itself runs from the Starting Date. Trading costs and Interest on Cash are accounted for in Vortex but also in the VOP. . . This prevents the yield to be suppressed by too frequent trading!

Starting Price = $ 127,05

3) Results after almost 1,5 year:

At the start volatility was much lower than expected and was adjusted somewhere during the period manually to

Buy = 3 %

Sell = 4%. . .Aggressions unchanged.

The subsequent VOP Runs showed it should have been around 5%. . .I had a snappy Trigger Finger J

Share Price = $ 137,4

Share Price Gain = 9,91% but for the ~1,5 year that is 6 annually.

Vortex ROTAC Yield = 6,68% Annually

This is based on Total Averaged Cash Inlay. . .which remains in this case at $ 20000, but If I had added $ 10000 at the 1-year point the capital base would be $ 30000 but for the yield calculation @ 61,5 year it would be [20000*1 + 10000*0,5]/1,5 = $25000/1,5 = $ 16667 for the 1,5-year average. In this case ANY cash injection is treated as an Cash Inlay and any withdrawal is treated as a Negative Inlay. I prefer this way as it models The real World Investment Environment.

Vortex ROTAI Yield = 14,01 % Annually

This is based on only The Money for which shares are bought and expenses required to maintain the investment. If shares are sold the investment base gets smaller. If cash is added or taken out NOTHING changes except the Yield on the Cash gets higher or lower.

The Cash in itself is NOT at RISK an is not treated as an investment for Equity. Obviously this method. . . .very similar to the ROCAR that some AIMers use but it is more realistic and is automatically calculated for the Portfolio.

Interesting to note that the trading cost in the first 1,5 years have NOT reduced the Buy & Hold Yield compared to the ROI Method but in spite of the trading costs the performance was 4% higher even with the low SPY volatility [In this example I had a constant € 20000 Cash Inlay]. Any AIM-trader would have had pay the same trading fees as the Vortex AIMer, so a regular AIMer might have had a higher yield for the same type of trading but the yield would have been overstated. Moreover, the high Vortex trading aggressions of 0,8 and 0,6 are considerably higher than for a standard Lichello AIM. It is therefore safe to state that a standard AIM for SPY between 03-01-2012 and 03-07-2012 would have had a much lower yield than the 6,68 % Annually that Vortex AIM scored. Does anyone that aimed SPY in that 1,5 year period still have any yield data thereof?

With the 14% ROTAI Yield that really shows that the Vortex AIM Method created an hypothetical Yield Improvement, due to intermediate trading on price changes. . .in spite of the trading costs incurred. . .by using this fundamental AIM Principal of

Buy Low Sell High

Again and again when prices fluctuate.

The end Position of the Spy Portfolio is at 03-07-2012 is:

Cash Reserve = $ 14093

Equity Value = $ 7941

Portfoli Value = $ 22034

Interest earned = $ 411

Trading cost = $ 120

Dividend paid = $ 227

[The dividend is, in this case, calculated in as Gain but it was not yet included here as intermediately added capital. . .Using the ROTAC method this could be treated as capital added. If you receive Cash dividend on your bank account it becomes a choice to add it to the Reserve if the Portfolio or not smile In this case it was added ro the Reserve but NOT treated as an extra Capital Injection but under the ROTAC Principle it could have been].

Of course, experienced AIMers know al these aspects already and accept the risk of Under-performance and AIM for the likely Gain of Over-performance, relative to the Buy & Hold Method.

I made a point of it here for Newcomers to AIMing that might find the Vortex Method an interesting alternative Automatic Investment Program that has an extensive Portfolio Administration Section, for managing their investment.

More results from between June 2012 to May 10, 2014, in the next posting.

Hi everyone, I am still alive!

Among Other things I have been struggling to get Windows 7 functioning properly. . .No success yet. Some errors prevent me to download some drivers(scanning and sound and Printing) ![]()

Also O have an Error that causes the MS Back-up not to work ![]() . . .I have been ”suffering” this for 1,5 months now.

. . .I have been ”suffering” this for 1,5 months now.

****************************

All the time I have continued running some 3 Demo's on the SP500 SPY, and on a set of Dutch Penny. . . a Calamity portfolio. . .just for Fun, since 03-01-2011 foe SPY to today, with VORTEX, trying to get an optimized strategy using our Optimization Program. . .(only Dutch language so far). People interested could buy a Copy of it for € 100 and experience the development as we go, getting free Updates.

SPY has not show a great deal of volatility and has been steadily rising in value these 3.5 years. . .resulting in the performance for which Buy & Hold Method would have been better, if I had used the simple ROI Yield Calculation. . .as some of you use: The ROI Method without considering a variable amount of Investment that over the years applies.

My approach was as follows, as of 03-01-2011 with $ 20000 Inlay:

Parameters are

* Cash Fraction = 0,72

* Buy Threshold = 7%

* Sell Threshold = 7%

* Buy Aggression = 0,8

* Sell Aggression = 0,6 . . .This means that I buy more aggressively than I sell, which drives the Portfolio towards Share Accumulation (Increasing Equity Value).

If I reverse the Aggression Factors then that drives the Portfolio towards Liquidation (This interesting if it is to generate cash income).

1) January 2011 I started with Parameters more or less as I had found best the previous periods with a volatile SPY. As the time goes on. . .during say 6 months or so I monitor the volatility and if it proves to be too low I lower the Buy-Sell Thresholds a bit and at 6 months or so I run an optimization with VOP. . .Vortex Optimization Program . . . on the last 6 months history and then I resets the Vortex parameters for optimized Yield %.

The Cash Fraction can then be rebalanced to suit, if judged necessary. I use my "fingerspietzing-geful" for that ![]() .

.

The Vortex Program also allows for adding Cash at any time and adjusts the total investment to an Period Average that as the Investment for the period. The Optimization Process uses a fixed CER that is started with for that Run.

2) After this a new Staring condition is defined for VOP. . . Essentially the Test Portfolio is Reset to a New Start Condition for the Next Optimization Run. The Vortex Portfolio itself runs from the Starting Date. Trading costs and Interest on Cash are accounted for in Vortex but also in the VOP. . . This prevents the yield to be suppressed by too frequent trading!

Starting Price = $ 127,05

3) Results after 6 months:

At the start volatility was much lower than expected and was adjusted manually to

Buy = 3 %

Sell = 4%. . .Aggressions unchanged.

The subsequent VOP Run showed it should have bee around 5%. . .I had a snappy Trigger Finger J

Share Price = $ 137,4

Share Price Gain = 9,91% but for 1 year that is 18,02 %

ROTAC Yield = 6,68% Annually

This is based on Total Averaged Cash Inlay. . .which remains in this case at $ 20000, but If I had added $ 10000 at the 3-month point the capital base would be $ 30000 but for the yield calculation @ 6 month it would be [20000*3 + 10000*3]/6 = $90000/6 = $ 15000 for the 6-month average. In this case ANY cash injection is treated as an Cash Inlay and any withdrawal is treated as a Negative Inlay. I prefer this way as it models The real World Investment Environment.

ROTAI Yield = 14,01 % Annually

This is based on only The Money for which shares are bought and expenses required to maintain the investment. If shares are sold the investment base gets smaller. If cash is added or taken out NOTHING changes except the Yield on the Cash gets higher or lower.

The Cash in itself is NOT at RISK an is not treated as an investment for Equity. Obviously this method. . . .very similar to the ROCAR that some AIMers use but it is more realistic and is automatically calculated for the Portfolio.

Interesting to note that the trading cost in the first 6 months has reduced a Buy & Hold Yield by about 8 % compared to the ROI Method [In this example I had a constant € 20000 Cash Inlay]. Any AIM-trader would have had pay the same trading fees as the Vortex AIMer, so regular AIMer with the ROI @ say 12 % would overstate the ROI Yield which actually was about 10%.

With the 14% ROTAI Yield the really shows that the Vortex AIM Method created an actual Yield Improvement due to intermediate trading on price changes. . .in spite of the trading costs. . .by using

Buy Low Sell High

Frequently.

Of course, experienced AIMers know al this t and accept the risk of underperformance relative to the Buy & Hold Method.

I made a point of it here for Newcomers to AIMing that might find the Vortex Method an interesting alternative Automatic Investment Program that has an extensive Portfolio Administration Section for managing the investment.

More Results till 2014 in the next posting.

Hi everyone, I am still alive!

Among Other things I have been struggling to get Windows 7 functioning properly. . .No success yet. Some errors prevent me to download some drivers(scanning and sound and Printing) ![]()

Also O have an Error that causes the MS Back-up not to work ![]() . . .I have been ”suffering” this for 1,5 months now.

. . .I have been ”suffering” this for 1,5 months now.

****************************

All the time I have continued running some 3 Demo's on the SP500 SPY, and on a set of Dutch Penny. . . a Calamity portfolio. . .just for Fun, since 03-01-2011 foe SPY to today, with VORTEX, trying to get an optimized strategy using our Optimization Program. . .(only Dutch language so far). People interested could buy a Copy of it for € 100 and experience the development as we go, getting free Updates.

SPY has not show a great deal of volatility and has been steadily rising in value these 3.5 years. . .resulting in the performance for which Buy & Hold Method would have been better, if I had used the simple ROI Yield Calculation. . .as some of you use: The ROI Method without considering a variable amount of Investment that over the years applies.

My approach was as follows, as of 03-01-2011 with $ 20000 Inlay:

Parameters are

* Cash Fraction = 0,72

* Buy Threshold = 7%

* Sell Threshold = 7%

* Buy Aggression = 0,8

* Sell Aggression = 0,6 . . .This means that I buy more aggressively than I sell, which drives the Portfolio towards Share Accumulation (Increasing Equity Value).

If I reverse the Aggression Factors then that drives the Portfolio towards Liquidation (This interesting if it is to generate cash income).

1) January 2011 I started with Parameters more or less as I had found best the previous periods with a volatile SPY. As the time goes on. . .during say 6 months or so I monitor the volatility and if it proves to be too low I lower the Buy-Sell Thresholds a bit and at 6 months or so I run an optimization with VOP. . .Vortex Optimization Program . . . on the last 6 months history and then I resets the Vortex parameters for optimized Yield %.

The Cash Fraction can then be rebalanced to suit, if judged necessary. I use my "fingerspietzing-geful" for that ![]() .

.

The Vortex Program also allows for adding Cash at any time and adjusts the total investment to an Period Average that as the Investment for the period. The Optimization Process uses a fixed CER that is started with for that Run.

2) After this a new Staring condition is defined for VOP. . . Essentially the Test Portfolio is Reset to a New Start Condition for the Next Optimization Run. The Vortex Portfolio itself runs from the Starting Date. Trading costs and Interest on Cash are accounted for in Vortex but also in the VOP. . . This prevents the yield to be suppressed by too frequent trading!

Starting Price = $ 127,05

3) Results after 6 months:

At the start volatility was much lower than expected and was adjusted manually to

Buy = 3 %

Sell = 4%. . .Aggressions unchanged.

The subsequent VOP Run showed it should have bee around 5%. . .I had a snappy Trigger Finger J

Share Price = $ 137,4

Share Price Gain = 9,91% but for 1 year that is 18,02 %

ROTAC Yield = 6,68% Annually

This is based on Total Averaged Cash Inlay. . .which remains in this case at $ 20000, but If I had added $ 10000 at the 3-month point the capital base would be $ 30000 but for the yield calculation @ 6 month it would be [20000*3 + 10000*3]/6 = $90000/6 = $ 15000 for the 6-month average. In this case ANY cash injection is treated as an Cash Inlay and any withdrawal is treated as a Negative Inlay. I prefer this way as it models The real World Investment Environment.

ROTAI Yield = 14,01 % Annually

This is based on only The Money for which shares are bought and expenses required to maintain the investment. If shares are sold the investment base gets smaller. If cash is added or taken out NOTHING changes except the Yield on the Cash gets higher or lower.

The Cash in itself is NOT at RISK an is not treated as an investment for Equity. Obviously this method. . . .very similar to the ROCAR that some AIMers use but it is more realistic and is automatically calculated for the Portfolio.

Interesting to note that the trading cost in the first 6 months has reduced a Buy & Hold Yield by about 8 % compared to the ROI Method [In this example I had a constant € 20000 Cash Inlay]. Any AIM-trader would have had pay the same trading fees as the Vortex AIMer, so regular AIMer with the ROI @ say 12 % would overstate the ROI Yield which actually was about 10%.

With the 14% ROTAI Yield the really shows that the Vortex AIM Method created an actual Yield Improvement due to intermediate trading on price changes. . .in spite of the trading costs. . .by using

Buy Low Sell High

Frequently.

Of course, experienced AIMers know al this t and accept the risk of underperformance relative to the Buy & Hold Method.

I made a point of it here for Newcomers to AIMing that might find the Vortex Method an interesting alternative Automatic Investment Program that has an extensive Portfolio Administration Section for managing the investment.

More Results till 2014 in the next posting.

>>>>This is why it is sometimes a good method to have Average Settings and leave things alone generally<<<

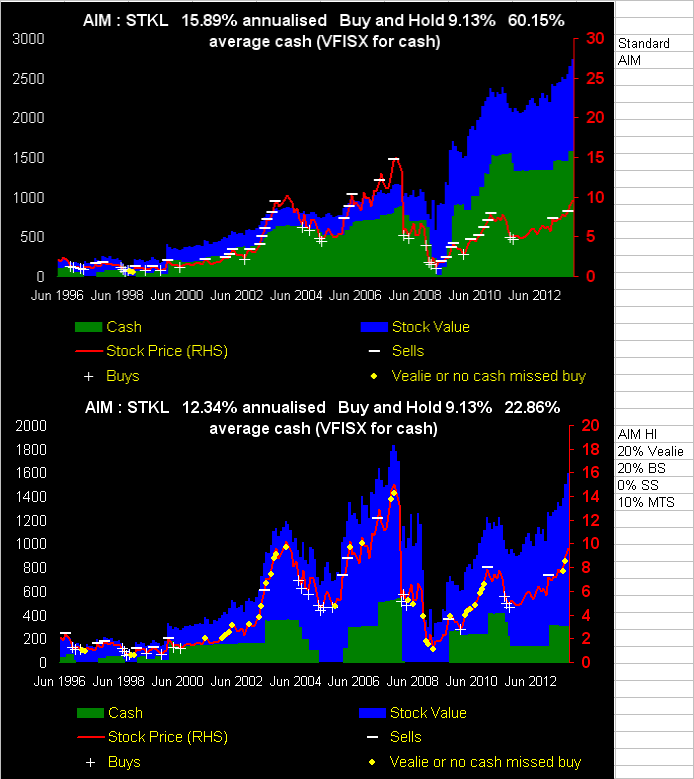

That is certainly my viewpoint. When the market has its next drop I don't want to be using AIM Hi and be holding only 20% cash.

I would rather be 50% cash now and 80% cash just before the next drop.

Toofuzzy

I agree Toof. . .

There are various conflicting ideas. . .I think all of them have been discussed at one time or more times on the Forums here.

This is why it is sometimes a good method to have Average Settings and leave things alone generally, and for others that have a good grip on something special they want to use to set the parameters that is specifically good for THAT and then keep a sharp eye on the prices or trends and re-adjust as required.

Hi Conrad

>>>>Clearly, delaying delaying the Buys using a MACRO Filter is not a form of Cash Burn Rate Reduction but rather it serves to invest the available cash more efficiently at a lower price. <<<<

It also allows you to sell at higher prices.

The advantages are well known but the disadvantages are that if the Trading Range is not very wide a lot of volatility capture could be missed if the Buy and Sell Limits with the MACRO filter are far apart.

I imagine this is true also and why I have not done it.

I have thought of using a 13 day and 30 MA crossover. With something like 50 and 200 day the price has to move too much against you before you trade. So you give up a lot whether buying or selling.

Toofuzzy

Hi Clive & Toofuzzy,

Interesting discussion on Not Buying when AIM indicates a Buy and there is still cash "on board".

For the Vortex AIM program this simply has to be an "external" decision of the Investor by way Market Indicators, like Moving Average Crossovers. . . like the MACRO Don Carson use to use some years ago. Such extra Management tools are not part of the Vortex Program. Do you know of anyone that includes such automatic Buy Delays in their AIM program itself? I would think it is not something that is required for AIMers. I would rather advise that the Investor himself decides not to execute such particular Buy Advices. That way he remains in conscious control of What he is doing and Why.

Clearly, delaying delaying the Buys using a MACRO Filter is not a form of Cash Burn Rate Reduction but rather it serves to invest the available cash more efficiently at a lower price. The advantages are well known but the disadvantages are that if the Trading Range is not very wide a lot of volatility capture could be missed if the Buy and Sell Limits with the MACRO filter are far apart. This can happen when these limits are set close to the Trading Range Limits. In using the Trading Limits the extra work to be done it to find out the optimum Trading Limit Settings may be beyond mist AIMers. I think this is where the Vortex Optimiser could be used, but then we would have to program these limits into the Algorithm as well which we have not done as yet. . .

Is there some other way to find the optimum Trading Limits for not executing buys and sells?

In regards to running out of money with Vortex AIM it automatically refuses to execute any Buy when the Reserve is too low. In the Excel version one can set the Buy Reduction Factor at any value to Reduce the Cash Burn Factor as the Cash starts to get low. For example if a Buy exceed the value of the Reserve then one can still execute the Buy with say 60% of the Reserve (Buy Factor = 0,6) or use any other fraction. This Buy Reduction Factor is build in as a variable parameter but is not available in the Windows Version. In the windows version this problem is solved by adding a small amount of money to the reserve but then Vortex gives the full Buy as an Advice but then the AIMer can simply execute a 60^% Buy himself! This way he has perfect control of the Cash Burn Rate.

Hi Toofuzzy

Am I Aiming the TLT or the gold? Am I using the gold as CASH?

Hi Clive

>>>>So even though AIM HI was out of cash for some periods when AIM was indicating to buy more shares, the overall outcome was still reasonable. <<<<

Yeah I have run out of cash with regular AIM and found it to be self - correcting. If you don't get a buy the next sale is delayed, the security needs to go higher, and you get a better price.

Of course you may miss a few round trips than way.

Toofuzzy

Hi Clive

>>>

Even if you hold just one AIM buy trade amount of TLT (and gold), then whenever AIM does indicate a buy trade you might find for whatever reason the share price is down the value of TLT (or gold) may have risen and be a more appropriate choice of 'cash' to deploy into more shares.

If for instance cash deposits had risen 4%, but TLT had risen 10% then that 'cash' buys the additional stock at a relatively cheaper price. <<<<<

You totally lost me.

Am I Aiming the TLT or the gold? Am I using the gold as CASH?

If TLT is up 10% how am I buying it at a relatively cheaper price?

Don't even TRY to answer my question. It will just confuse me more.

You need to start the example over.

Toofuzzy

With AIM Hi AIMing STKL my guess is that you would have run out of cash to buy more stock with

Hi Toofuzzy

TLT is a 20 + year US Treasury Exchange Traded Fund

It tends to have spikes in value at times like 2003 and 2009 when stocks are going down.

I would not own it now as I expect it to drop 40% in value at some point when interest rates peak.

Hi Clive

With AIM Hi AIMing STKL my guess is that you would have run out of cash to buy more stock with unless you started when STKL was at a bottom .

Toofuzzy

Hi Toofuzzy

Regarding not buying more if something goes down a lot. I have done very well with STKL as it went from 6 to 15, back to 5 and is now just under 10

TLT is a 20 + year US Treasury Exchange Traded Fund

It tends to have spikes in value at times like 2003 and 2009 when stocks are going down.

I would not own it now as I expect it to drop 40% in value at some point when interest rates peak.

In the mean time I am not starting any new AIM accounts and am trying to increase my cash.

Toofuzzy

Hi Toofuzzy,

<In 2003 and 2009 my account was cut in half even though I was diversified>

What a Bummer! This can indeed go wrong for the best ones!. . .Crashes are by nature unmanagealble. We see that during earth quakes and tsunamies. . . people expect te be helped but many fall between wall and ship and suffer.

In that sense a Crash of market prices of a stock going to zero is different than simply experiencing a Dip. I am very conservative with my own money now. . I can not affort to losse big amounts so I simply Play with small amounts now and then. . . small enough that I can affort to loose it.

For example I Aimed Antonov Transmissions. . . A Penny Stock and it recently was taken off the exchange. . .the value stood as € 130 (sic) ![]() . . The stock will remain hanging around and it might betaken back or it might vanish. . . Generally with my Vortex Investing in the past I did quite well. The thing that killed me fianacially was thrusting "friend". . In the end I was chaeate out of % 50000. .you mat have read my story on that. . I am reluctant to trust people again.

. . The stock will remain hanging around and it might betaken back or it might vanish. . . Generally with my Vortex Investing in the past I did quite well. The thing that killed me fianacially was thrusting "friend". . In the end I was chaeate out of % 50000. .you mat have read my story on that. . I am reluctant to trust people again.

On the Penny Stocks I am AIMing a Demo Port Folio with 8 stocks left in it on the Dutch Local Exchabes. . .Antonov was in it but I have removed it from the Portfolio. Each stocj is AIMed seprately but they are lumped in "Mutual Fund" portfolio. The Aiming is done more or less as I would normally do except that I use the Turbo Method. . .put in extra cash when it is needed. Of course I know this is not typicalfor most AImers but I do it to score a point on a Mutial Fund Portfolio about which I know nothing about the details of the stocks other than that they are penny Stocks and can go Bust, like Antonov did.

The "Fund" has been running since Feb-16-2012 till now. I strated with Antonov and added 8 stocks over a short time and recently removes Antonov The Dmo Antonov was much bigger that the Real one I had The paremeters have been mostly constant at the firts choices:

Fund Yield ROTAC (bases on time average capital inlay)= 314 % yr.

Fund Yield ROTAI (base on time averaged equity Buys)= **** % Off the Chart ![]() . Perhaps I can find the % in the Fund Report:

. Perhaps I can find the % in the Fund Report:

From extracted data in the Reportthe ROTAI = 1373,15 % yr for the 20 month period.

Three Stocks have negative yiels of - 0,07/-14,4/-22,7 % Thr est hight positive Yields the rest 30,6/78,5/****/**** %. There were not enough digits allocated for these **** percentages.

Trading cost = € 7875

Interest earned = € 32406

![]()

Of course this is not realistic. . I use it as a tool to get a feel of the mechanisms but it shows also what we know generally already. . .a Mutual Fund with a wide base will not likely disappear. . unless you let a guy like Bernie Madoff run the show ![]() .

.

Anyhow: What is TLT ?

It is clear, you have had enough exprience to form a valid opinion on the ups and downd on AIM Investing, so have I. I have lost very few accounts and have spend enough time looking at the traps that there are but also at the methods that give good results. . it takes time to do what I do, and I am fundamentally a more agressive investor as you appear to be. . when I have money to play with that is.

The most important thing is Risk Avoidance and that does not mean avoiding high Yield Stocks. . .it means understanding the dangers and to avoid them.

Thanks for the feed back.

In 2003 and 2009 my account was cut in half even though I was diversified. I thought CASH was enough of a diversifier. I now know better and will eventually add TLT as an AIMed account when interest rates invert.

I am also moving away from individual stocks, or at least that is my intention as funds can not go to zero and so I feel more confident in buying as they go down.

A few individual stocks I have owned have gone bankrupt (Meditrust, American Home Mortgage ) and Double Hull Tankers, Fuel Teck, Sunpower, Chiqita are deep divers for me.

Regarding not buying more if something goes down a lot. I have done very well with STKL as it went from 6 to 15, back to 5 and is now just under 10. Also have done well with SCCO and WRI

Toofuzzy

Toofuzzy,

You have made a claim as a generality without supporting the this is generally happening!

<If you have a security that stays relatively flat or just on a mild projectory and optimize for that, if the security then crashes, you have not allowed for enough cash>

When people are investing. . . with or without AIMing. . . equities do not generally "Crash" routinely. . .It is just the other way around. . .equity crashes are rare. No matter what you do when an equity crashes suddenly and deeply then there is something wrong and in most case the best thing is to Bail Out.

The case in which an equity is FLAT you better not invest in it at all. Let talk reality for AIMing

1 The equity must be volatile

2 The equity must be relatively safe so the likelihood for a crash is very low.

Lets take the perfect example for an AIM Equity such as a Saw Tooth or Sine Wave profile:

3 Such an theoretical equity optimises identically irregardless you start at the top or at the bottom. The optimised point are obvious at the top and the bottom of the Trading Range:

a. At the bottom 100% Equity

b. At the top 100% Reserve

You do not even need any optimisation. .it is a trivial case.

If the stock crashes at the top. . . @ 100 In the Money. . .to a point deeply below the bottom only a fool would invest any further and will wait what happens. If he stock drops to the normal bottom of the Trading Range there is generally no reason to assume it will crash so you go in 100% In the Equity. . .so far so good. . .that is what you want.

Should at that point the equity drop a little lower then there is no panic. .usually it will rebound. . .If you have chosen am equity that is regarded SAFE by any standard then you wait for the rebound OR better yet, buy extra equity from other resources that you have. . .Only a fool will put ALL his savings in an investment unless he had magical power to see that he will not lose it. . .people with magical power would be fools anyway if they us a system like AIM ![]() . . .Buying extra equity when the Reserve stand at 0 is an excellent investment method. With Vortex I call it Vortex TurboVest!

. . .Buying extra equity when the Reserve stand at 0 is an excellent investment method. With Vortex I call it Vortex TurboVest!

Anyway if an equity crashes deeply then something is very wrong and one should bail out. I there is only a drop beyond the normal bottom then waiting is advised. . A rebound usually occurs

There is nothing to worry about. If the stock has crashed and remains a penny stock or becomes worthless de money is lost anyway. The case you refer to would be a rarity and is therefore not relevant.

It is better, in such a case to run 10 years with an Optimised AIM than to play safe and use non-performing parameters. If one is scared for a 1 in a hundred cases that an Equity does not recover from a DEEP DIP then he should his money in a bank account and do gardening all day long.

In case a real stock does not at all follow the price behaviour that was used for the optimisation then the parameters should be changes anyway in a manner that is best for the occasion.

This type of AIM investing requires spending time on it .

The type of AIMing you advocate . . .with all sorts of conservative settings and looking at the market one per month. . . is fine too, for people that have no time to spend on their AIMing not to studying how to get an optimised yield.

Playing 100% Safe is a legitimate Life Style. . I am not arguing against that. . .It is a choice. . I grant you that.

Using one’s skill to Play the Stock Market with an optimised AIM, and to endeavour to maximize investment yield that way, is another choice ![]()

Retirement AIM:

In regards to AIMing specifically for Retirement purpose I have explained that in my book The Vortex Method and on this Forum as well. I call that application Vortex RAIM.

A Refresher on it is found on the AIM Users Forum:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=91934703.

>>>>>1 Start with optimization using historical data;

2 Run the real AIM with approximately the optimized data but temper the aggression factors of Vortex somewhat;

3 Run the AIM for say 6 months or so to see how the trend develops, if the Price behavior is drastically different then the optimized parameters will not be effective;

4 Redo the optimization after removing a 6 months data at the back-end of the old Data-Set and optimise to the current date. This would reset the Parameters with historical data shifted to the latest date. . .Then wait 6 month again and if required repeat the optimization.

In case the stock behavior remains “on “ target” then the result will be close to the optimum. . . if not then you keep re-optimizing. <<<<

The issue still remains:

If you have a security that stays relatively flat or just on a mild projectory and optimize for that, if the security then crashes, you have not allowed for enough cash. Even if you alter your parameters, it might be too late. If you then optimize for a security that is very volatile and the volatility decreases, yiu might be holding too much cash or did something to spread the trades out more than they need to be.

Personally I will always think of changing the parameters at the wrong time so I just leave them alone.

Toofuzzy

Hi Too Fuzzy,

You are addressing a well known issue that has been discussed in general many times. Your argument is quite valid but it does not fully apply to my post you are reacting to.

First let me state that the term "Back Testing" appears to be used in two different ways on the AIM Forum and no doubt I have not always been consistent as I used it too in a way it is probably not meant.

In various posts Back Testing with AIM appears simply to be Running of a set of historical stock prices with a standard parameter set and perhaps a run with another favourite parameter set suggested by others as being good too, and to compare the results with the Buy & Hold Results or to compare the AIM results with the results of another type of programme. . .This was, I believe the type of Back testing that was discussed lately by Ganaraska.

I have exclusively directed my self to the Optimisation of a historical Dataset and to use that Dataset for an actual Investment run. It is clear to all that have participated ion these discussions that these optimised parameters would only be useful if the future data was approximately repetition of the historical Dataset. I have had many discussion with Mark Hing of A.I. on the issue. There is no disagreement on the weak part of Optimisation. Mark and I discussed a method that was potentially useful:

1 Start with optimisation using historical data;

2 Run the real AIM with approximately the optimised data but temper the aggression factors of Vortex somewhat;

3 Run the AIM for say 6 months or so to see how the trend develops, if the Price behaviour is drastically different then the optimised parameters will not be effective;

4 Redo the optimisation after removing a 6 months data at the back-end of the old DataSet and optimise to the current date. This would reset the Parameters with historical data shifted to the latest date. . .Then wait 6 month again and if required repeat the optimisation.

In case the stock behaviour remains “on “ target” then the result will be close to the optimum. . . if not then you keep re-optimising.

In SPY1, using Windows Vortex AIM I had already started on 03-01-2011 using parameters from some manual optimisation of the Historical Dataset Long before that and I AIMed SPY1 for about 8 @ 9 months without changing any parameters. In the mean time we had started developed our Optimisation Program and started trials some times in 2012. Up In 2011 I still used the manual Optimisation method with the Vortex Excel Spread sheet and on that basis I modified the parameters based on a re-optimisation. All the Demo investment were made in Vortex Windows with parameter optimisation done with historical data in Excel. This was exactly the method developed by me in discussion with Mark Hing advice on the generalities that he had already developed himself for AI.

At the end of 2102 and for 2013 I repeated the optimisations about two times but these times with rather short historical periods. This is so because in Vortex I only had downloaded Spy prices since May 2011 and our Optimisation Program can only take prices out of the Vortex Windows Data Bank. So for the Spy1 Run the result are based on optimisations using historical data and the decision that a new optimisation was needed was an Overlay Management Decision. . this is something any Investment manger must do.

IN [b[SPY2 and SPY3 I used a different approach and altered the parameters 2 times. . .beyond what was indicated by the Optimisation Program ( Manager Interference) after the start-up, giving 3 parameter sets for a ~ 2,7 year Run.

This provides some extra information in regards to what I am doing. Most of the content was directed to present our Optimisation program and that I had started using it and that if anyone would be interested they could acquire a copy when they are using Vortex. It is of course clear that the short period I used for the Machine Optimisations that my numerical results may not be demonstrably indicative of a very high yield.

The Vortex SPY ROTAC Yields since January 2011 to now, that lie in the range of 10 to 12 % annually, may well be very similar to the results people on the AIM USER Forum have been getting. It is interesting to know what other AIM Investors have scored with their aim for the same period.

I can understand how backtesting can give you an education as to how AIMing works and what you might expect, but if you actually use any specific results, aren't you just data mining, as future results are not necessarily correlated to past results.

Look at C prior to 2009 vs after.

Toofuzzy

Hi Vortex AIM users and Forum Readers:

We have developed a Vortex AIM Parameter Optimisation program called Vortex Back Test . . .VBT . . . to be coupled onto the Vortex AIM Windows program (Vortex). This is the way it works:

1 Select an Equity: The Data Base of Vortex is used for loading up the stock prices into VBT. These prices were previously downloaded from Yahoo by the Vortex Investor. . .his choice. These stock prices are not necessarily all used in Vortex but are there to be used as the investor sees fit;

2 The investor opens the VBT Module and selects an Equity;

3 The Period for the Test Rub is selected,

4 The parameters for the Test Run are entered:

*Number of Shares

*Percentage Reserve

* Trading Cost: Fixed Min. + Percentage IF Min. Amount is exceeded;

5 Holding Zones %

* Buy: Start Value/Step size/Stop Value

* Sell: Start Value/Step size/Stop Value

6 Aggression Factor Fractions

* Buy: Start Value/Step size/Stop Value

* Sell: Start Value/Step size/Stop Value

Additionally various buttons are presented for:

* Run Results. . .It present the % ROTAC Yield for each Data Set in Chart form as well as in a List Form

* Sow File. . .Equity Details

* Make Test File. . .Make your own Test Data

* Example Test File. . .Here you can choose a number of standard equity rice profiles for a chosen period, such as: Sine Wave, Block Wave, Saw Tooth Wave and Random Prices.

The Back Test program optimises the 4 Parameter settings based on Yield Maximization.

**************************************************************************

At the moment I am Running 3 SPY Demo Portfolios using generally the optimised parameters as given by this program. In some cases intermediate Optimisation Runs are done for shorted periods in the Past and the parameters adjusted. The idea here is that is a trend deviates from the previously optimised Price History then a new optimisation of more recent price developments is required.

SPY1 is a long term Demo starting at 03-01-2011 till to date. There are 94 Datasets. Latest transaction on August 5

Equity + cash to start = 20000

Equity = 5600

Interest on Reserve = 2% Compounded at each Trade

Reserve = 14389,05. . . .Trading cost of 10,95 already deducted.

Shares N= 44,08. . .N could simply be truncated for integer ..values but are not in this run.

Buy Holding Zone = 7,5 %

Sell Holding Zone = 19 % till August 2012

***************************************

Buy Holding Zone = 7,0 %

Sell Holding Zone = 7,0 % till September 15-2012

**************************************

Buy Holding Zone = 5,5 %

Sell Holding Zone = 10 % till current date

Percentage Interest on Reserve =

Remark:

The changes in Holding Zone settings were based on the development at the time. I have not recorded the specific reasons for these changes but normally when I see some reason for a change I do change some settings. The Chart indicates a reduction in Volatility that would indicate lowering the Hold Zones.

The Aggression Factors remained as originally set.

Buy Aggression = 0,8

Sell Aggression = 0,6. . .the Aggression factors turned out to be rather high automatically as the stock volatility was rather low these + 2,5 years.

Results per 06-09-2013. . .No extra Capital was added but Costs and Dividends are recorded as time variable -/+ Cash additions.

ROTAC Profit & Yield = 6036,85 & 11,88% Annualised

ROTAI Profit & Yield = 5362,65 & 26.41 % Annualised

Trading Cost = 137

Dividend = 43 <------Forgotten to add most dividend Payments ![]()

Interest Earned = 630

______________________________________________________________

SPY2 is almost identical but has only 91 DatSets. On 01-06 2012 the Sell Aggression was increased form 0,6 to 0,85(very high selling aggression)as an experiment.

Interest on Reserve = 2 % but is Compounded at each Trading Point

ROTAC Profit & Yield = 5568,77 & 10,91 % Annualised

ROTAI profit & Yield = 4944,50 & 21,48 % Annualised

Trading Cost = 278

Dividend = 44 <-----Most dividend payment are Forgotten here ![]()

Interest Earned = 580

Clearly the increase in the Sell Aggression has minimally reduced the ROTAC Yield but more significantly reduced to the ROTAI Yield. Considering the rising trend that developed after June 2012 this result is logical. . .With a rising trend the Sell Aggression should be lowered so that the benefit of the rising price can be captured. . .as is the case for SPY1.

From the Price Chart it is shown that in June 2012 the price was in a dropping trend. . .the increased Sell Aggression was a logical Bet. . .. . .not from an AIM methodology consideration but from Trend Betting consideration. From the Price Chart it is clear that just beyond that point in June 2012 the prices started rising again and I should have lowered the Sell Aggression again ![]() . . .but I did not to see the effect of it.

. . .but I did not to see the effect of it.

____________________________________________________________

SPY 3 Is a run for the same period with more intuitive intermittent changes in Hold Zones, Aggression Factors and extra cash Addition.

The Run has 80 Datasets. Hold Zones varied frequently based on interpretations of perceived volatility. . which was rather low and generally fluctuated between 7 and 1 & but on the average around 3 or 4 %.

Aggression Factors Buy/Sell started at 0,8/0,6 and were gradually increased from Dec 2012 to currently 0,96/o,93

In July 2013 an extra 20000 was added to the Reserve due to Reserve depletion from the more aggressive trading.

The number off Trades was obviously higher due to the relatively low Holding Zones.

Interest on Reserve = 2%/yr is compounded at yacht Trade Point.

ROTAC Profit & Yield = 5713,14 & 10,33 %

ROTAI Profit & Yield = 4660,67 & 27,31 %

Trading Cost = 278

Dividend = 260

Interest Earned = 793

The ROTAC Yield has suffered a bit due to more frequent trading but the ROTAI Yield has benefited from the higher Trade aggressions and the more frequent Trading.

The Vortex Program provides to important Reports:

1 Portfolio Revue. This contains all relevant Financial and Trading Result Details that are necessary For Income Tax Reporting;

2 Activity Report. This shows all the individual Trades, Cash Mutations and Costs

Hi 1step, I know what you are saying is very very true!

A number of years ago I participated in a Investment System Exhibition and after that there was a definite uplift in the interest and extra sales for a while but after that interest faded again.

At this point in time I have been working on this off and on for 20 years on this specific Microsoft-based program, and countless hour of development work and debugging work we have put into it.

The underlying truth is that even though I have been worked on AIMing for more that 30 years since 1981 it has never left the Hobby Stage next to my other work. In order to gear up to get VORTEX to the level of a serious commercial product I would have to start competing with the commercial activities like that of Mark Hing with his AI, and others like him, and mount a similar marketing campaign. . .That seems to me like something similar to climbing to the top of Mount Everest. . .It is much easier and efficient to look at a documentary of others that got the top of that mountain.

I can not seriously compete on the level that is required for capturing a share of a market that Mark Hing is operating in. The type of marketing that is required to capture a part of the American market (for any product) seems to be a bit "dishonest" . . "Selling The Sizzle" instead of selling the steak". . .Every time I get confronted with American Marketing examples I find them almost "offensive" in regards to the fact that the Sizzle is being marketed and the quality and features of the "Steak" are not mentioned.

I have once discussed marketing techniques(generally) in relation to book-writing techniques and someone that knew how to separate the chaff from the grain told me this:

"The popularity of a book is inversely proportional to the number of formulas that are present therein. When people peruse a book and they see a lot of equations and charts they put it back very quickly and look for one that has only text and photographs in it".

Of course, if one is marketing via Internet the title of a book or the name of the product needs to catch the imagination of the readers. . in that sense the name Vortex Method appears to be meaningless to almost anyone. . .I would have to think of another name. . I hate to do that!

When I write something about a technique I need to enter the essentials of it in my promotion and that becomes a “book” with Formulas and Charts. Evidently that does little for marketing the product. . .people want to hear that they will get rich over night while they are sleeping. This would be a distorttion of the truth. Vortex Aiming is a lot of work that sleeping.

Honestly, I have no more steam on the kettle to start such a commercial campaign and to spend another 5 years on it to break into a markets that appears to be limited anyway. Somehow I feel: “I have tried it long enough”.

Would you like to buy the Vortex Program for a pittance and do the marketing for yourself?

I tried to sell it before and got no bites. For people that like AIMing it appears that they like to tinker just like I do and they rather develop their own “AIM Derivatives” than buy a program developed by others.

That is not a problem. . .

I am like that too ![]()

Hi Conrad

In marketing , everything is exsposure and catching your imagination. e.g. lichello's title of his book. With due respect few know anything about aim. Especially with Lichellos book not being published anymore.

You need to translate your book into English which has a larger speaker base. You can condense it,

Make sure it is readable and include your sample trial software program with it. Try different titles till you have a winner.

See what happened when Praveen changed his title it moved to a number one position. I think you have a worthy program.

praveen also kept it very simple in presentation. Though it was a well thought out plan.

You have a very analytical mind that is very sharp and a lot of readers aren't at your level.

I hope you didnt't give up.

1step

Being Back is relative.

There appears to be very few people showing interest in Vortex Aiming so I check the site less frequently.

It is mostly my own doing. . .I am not realy marketing the program in an agressive manner and this causes the interest in it to wane.

Anybody that is interested in taking over the program is welcome to do so!

I am runnung out of steam ![]()

Regards.

Was wondering what happened. Glad to see you are back.

Ray

I have been "off-line" here for a while.

Just want to let all of you know "I am Back".

Interesting new Development!

For he Vortex AIM Program(Vortex)a Back Testing & Optimization Subroutine has been developed. Currently Version 1.00 already works!

Its features are

1 Historical stock prices for any Equity are taken out of the stock prices already downloaded into the Vortex Data Bank;

2 The date-range for the Back Test and Optimization can be selected;

3 The Parameters of Vortex can be entered from a minimum to a maximum value in an Entry Matrix;

4 The simulation starts with a number of shares and automatically all the parameter values are used with a given step-size to calculate the Fund Yield Percentage for the Test Period. For simple back testing only single parameter-values that are considered important are entered. For an optimization you enter a range of parameter-values;

5 The Parameter Set for the Absolute Maximum Point(AMP) is given in an Output Matrix ;

6 The AMP Result may not be a practical operating point: It could be valid only for a very narrow range of share prices, or even only for a single price that may never return. If this is the case you can search in the numerical Output List for any Local Maximum Point(LMP). Often you will find that a local maximum will be valid for a wide range of prices so that the Maximum Yield occurs over a broad Parameter Set Range for your Investment. Such a Parameter Set gives a better operating point. The future price behavior around a broad historical optimum price range for any fund is more likely to repeat itself than for a very narrow AMP. . .such an AMP price range seldom (or never) repeats itself.

The current Subroutine does not cover all the Parameters in Vortex at this time. In the future it might use all of the following parameters:

- Initial Investment and Total Capital allocated

- Buy & Sell Hold Zones

- Buy & Sell Aggression Factors

- Minimum Trade Amount

- Trade Cost and Interest on Reserve

- Cash Burn Brake Point + Reduced Cash Burn Rate to a predefined point at Reserve Exhaustion.

The cost of this Subroutine, available as an Option, is not yet determined and depends strongly on how many parameter are to be included in the future.

Regards,

Hi Conrad,

Thank you. I understand. You have given me a lot to think about and I appreciate.

Best regards,

Ray

Hi HL99,

Thank you for your response. I was sure that was the case, but I thought I would check with you just in case to see if anything else might be involved.

Regards,

Ray

Hi Ray,

You seem to have a good grasp of the minimum buy interval, and Conrad already made some good points about using a less progressive step interval for higher priced stocks. (such as the 15%/16%/18% sequence)

You can continue to use AIM in an otherwise normal fashion. The system will keep track of your purchases, and you can follow the sell signals it issues once the price recovers. You don't have to use a "minimum sell interval" unless you want to.

As Conrad said, the minimum buy interval is really just a way to slow down the cash burn rate by ignoring buy signals that are above the predetermined price. It otherwise needn't interfere with the functioning of the system.

Hello Ray

I really like your suggestion of using a Dollar Amount decline for Consecutive Buy Indicators instead of using Percentage Declines as a method to slow down the Cash Burn rate.

To make sure I am understanding this correctly, please let me know if this is correct:

An investor has a stock which he purchased for $10 a share. He decides to let it decline 15% before he makes his first purchase. When the price declines to $8.50 he makes his first Buy (a decline of $1.50).

Now then, he doesn’t make his second consecutive Buy until it drops an additional $1.50, or down to $7.00 a share ($8.50 minus $1.50).

His third consecutive Buy would be around $5.50 ($7.00 minus $1.50).

Let me first point out that the method of using the

Minimum Buy Interval

Minimum Sell Interval

as is first suggested by Chuck Chakrapani in the Money Spinner and as I have outlined this on the AIM Forum See this for the Calculation Method:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=78924095

I seen to remember that this only used for small value stocks.

Note that according to this Money Spinner Method when you start with a price of 5 the Min. Buy Price =4,17 and that is a price drop of 16,7 %.

What you are doing, starting at a Hold Zone of 15%, is on principle the same thing but when you get to the price of 5 the %-drop in price is already 27 %

Price/New price/Price Drop

10,00 / 0,85 / 0,15

8,50 / 0,82 / 0,18

7,00 / 0,79 / 0,21

5,50 / 0,73 / 0,27

4,00 / 0,63 / 0,38

2,50 / 0,40 / 0,60

This would of course be a good way of reducing the Cash Burn Rate. I think I may have mentioned before that this amounts to an exponentially increasing Holding Zone. I had this idea on the past but at the time I tried to implement that as a mathematical formula. This a lot simpler. In Vortex AIM I have not formalised this. At the moment the User enters a percentage and the program advises a Trade at that percentage. The user can easily use the above table and after the Buy at 15% drop can enter the 18% drop and after a Buy at 18% he can enter 21%. . . etc. That is a few seconds work. This way you have to work your way back up the ladder when the price starts rising.

On the Selling side he can do the same thing. It takes a bit more work to adjust the Holding Zones. This could be automated. . .sure. . .but the question is: “What do you do if you use a Share Price of 100 to start with?”. You might want to start with 15% but is it effective to use 18/21/27/38 but the likelihood that a $ 100 stock will behave like that will be rare, and then you might want to be worried if it does J. Using a less progressive drop may then be better like 15/16/18/21/24.

In the AIM Forum we have discussed such Step Ladders quite a bit with ls7550 and he seems to think that it is a good way of sequencing the trades. The Step Sizes are calculated form the Trading Range Band.

In the Money Spinner it was done with a Manual Method but it could be changed into an algorithm so that the Ladder Step Size could be made more or less aggressive. .Using the Money Spinner basic approach you could use X% instead of 10% and us Y shares in stead of 100 shares. I think I discussed that option in one of my posts.

Of course, using the Filter Method. . .Ref. Ocroft. . . to not Buy until a price reversal occurs is also a very good way to reduce the Cash Burning.

Hello Ray

I really like your suggestion of using a Dollar Amount decline for Consecutive Buy Indicators instead of using Percentage Declines as a method to slow down the Cash Burn rate.

To make sure I am understanding this correctly, please let me know if this is correct:

An investor has a stock which he purchased for $10 a share. He decides to let it decline 15% before he makes his first purchase. When the price declines to $8.50 he makes his first Buy (a decline of $1.50).

Now then, he doesn’t make his second consecutive Buy until it drops an additional $1.50, or down to $7.00 a share ($8.50 minus $1.50).

His third consecutive Buy would be around $5.50 ($7.00 minus $1.50).

Let me first point out that the method of using the

Minimum Buy Interval

Minimum Sell Interval

as is first suggested by Chuck Chakrapani in the Money Spinner and as I have outlined this on the AIM Forum See this for the Calculation Method:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=78924095

I seen to remember that this only used for small value stocks.

Note that according to this Money Spinner Method when you start with a price of 5 the Min. Buy Price =4,17 and that is a price drop of 16,7 %.

What you are doing, starting at a Hold Zone of 15%, is on principle the same thing but when you get to the price of 5 the %-drop in price is already 27 %

Price/New price/Price Drop

10,00 / 0,85 / 0,15

8,50 / 0,82 / 0,18

7,00 / 0,79 / 0,21

5,50 / 0,73 / 0,27

4,00 / 0,63 / 0,38

2,50 / 0,40 / 0,60

This would of course be a good way of reducing the Cash Burn Rate. U think I may have mentioned before that this amount to an exponentially increasing Holding Zone. I had this idea on the past but at the time I tried to implement that as a mathematical formula. This a lot simpler. In Vortex Aim I have not formalised this. At the moment the User enters a percentage and the program advises a Trade at that percentage. The user can easily use the above table and after the Buy at 15% drop can enter the 18% drop and after a Buy at 18% he can enter 21%. . . etc. That is a few seconds work.

On the Selling side he can do the same thing. It takes a bit more work to adjust the Holding Zones. This could be automated. . .sure. . .but the question is: “What do you do if you use a Share Price of 100 to start with?”. You might want to start with 15% but is it effective to use 18/21/27/38 but the likelihood that a $ 100 stock will behave like that will be rare, and then you might want to be worried if it does J. Using a less progressive drop may then be better like 15/16/18/21/24.

In the AIM Forum we have discussed such Step Ladders quite a bit with ls7550 and he seems to think that it is a good way of sequencing the trades. The Step Sizes are calculated form the Trading Range Band.

Ref. Discussion on Hold Zones:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=80296664

Hi Karw,

I will try to interpret his with a data Set for SPY

Your suggestion for Hold Zones are:

Sell Hold Zone % = sigma / (PC/sh - sigma)

Buy Hold Zone % = sigma / (PC/sh + sigma)

I do this for 13 months data 14 data point.

I just want to see if this is the right method:

1-8-2011 / 122,22

1-9-2011 / 113,15

3-10-2011 / 125,5

1-11-2011 / 124,99

1-12-2011 / 125,5

3-1-2012 / 131,32

1-2-2012 / 137,02

1-3-2012 / 140,81

2-4-2012 / 139,87

1-5-2012 / 131,47

1-6-2012 / 136,1

2-7-2012 / 137,71

1-8-2012 / 141,16

31-8-2012 / 141,16

STDV Full Population: sigma =18,651 <-----Is this right with your Sigma calculation?

PC = 17475 @ 1-8-2011

PC/sh= Starting Price =122,22

S Holdzone = 18,651/(122,22-18,651) =0,180 ----> 18 %

B HoldZone = 18,651/(122,22+18,651) = 0,0,13 -----> 13 %

This appears reasonable for not having any other information.

**************************************************************

If I do the same thing for my latest optimization Run and actual prices in the Spy Demo Run I get this:

Demo Run SPY 20 Data Points

29-05-12 / 133,01

04-06-12 / 127,44

08-06-12 / 132,41

15-06-12 / 134,14

19-06-12 / 135,7

26-06-12 / 131,98

03-07-12 / 137,41

06-07-12 / 135,49

12-07-12 / 133,15

17-07-12 / 135,43

25-07-12 / 133,93

03-08-12 / 139,35

13-08-12 / 140,77

16-08-12 / 141,99

24-08-12 / 141,51

30-08-12 / 140,49

05-09-12 / 140,91

06-09-12 / 143,77

14-09-12 / 147,24

18-09-12 / 146,62

STDV Full Population: sigma = 5,1

PC = 8751 @ 29-05-12

PC/sh= Starting Price =133

S Holdzone = 5,1/(133-5,1) =0,04 ----> 4 %

B HoldZone = 5,1/(133+5,1) = 0,037 -----> 3,7 %

The optimization results for this run were

Sell Hold Zone = 13 % ------ Does not agree with Sigma Method

Buy Hold Zone = 4 % ------Does agree with Sigma Method

What do you make of this?

The SPY optimisation looks at the high price of 147 which gives an indication of the rising trend at the end of the run and finds the optimum Sell Hold Zone at 13 %

In the SPY Demo I had set the B Hold Zone at 3,5% and the Sell Hold Zone at 12 %.

Heartland 99:

I have been without a computer for about a week so I haven’t been able to ask you any questions.

I really like your suggestion of using a Dollar Amount decline for Consecutive Buy Indicators instead of using Percentage Declines as a method to slow down the Cash Burn rate.

To make sure I am understanding this correctly, please let me know if this is correct:

An investor has a stock which he purchased for $10 a share. He decides to let it decline 15% before he makes his first purchase. When the price declines to $8.50 he makes his first Buy (a decline of $1.50).

Now then, he doesn’t make his second consecutive Buy until it drops an additional $1.50, or down to $7.00 a share ($8.50 minus $1.50).

His third consecutive Buy would be around $5.50 ($7.00 minus $1.50).

Etc., etc.

My questions are do you use this method with the AIM formula….Portfolio Controls, SAFEs, etc.?

Or, do you use some methodology other than AIM to determine how many shares to purchase whenever the stock drops the predetermined Dollar Amount?

Thanks for your help.

Best Regards,

Ray

I got into this sort of investing in the early 1980-ties after reading the Money Spinner but did not take-up in that Min Trade Interval and then started reading Lichello. It was only after I discovered the Residual Buy(RB)that I wanted to get rid of it. . .not for the same reason you have though. . .My reason was more logical: "Why design a Trade Advisor Function and then have a Buy Advice again at the same price? That is silly. . .After one designs a Trade Advice then at the same price the Trade Advise=0 must come out of it. . .I am an Engineer![]() A design must make sense! I called the RBf The Lichello Flaw

A design must make sense! I called the RBf The Lichello Flaw ![]() . . .Got a lot of Flack on that.

. . .Got a lot of Flack on that.

I had not really analysed the effect of the RB but it was discussed then as a too great a Cash Burn Rate(CBR) for AIM. After I created Vortex AIM simply to get Advice= 0 after every Buy, using the PC-Update to give PC=V I automatically got a Bonus with the Buy Function

Buy = )PV-V)*M ---------> M= 1/(1-f)

With f being the PC-Update Fraction instead of the 0,5 for AIM. Using the value of f as a Trade Size Controller(Trade Aggression Factor) I had no longer a need for the SAFE because I could set the trade size as I wanted using the Aggression Factor.

But the problem of the Cash Burn Rate is still always there IF the trade size are too large, but to set P=V after a Buy has the Advantage of providing a natural Brake, similar to the SAFE acting as a brake on the buying with constant Hold Zone. Using a Hold Zone of 20 % for prise of 100 the Trade Prices become 80, 64, 52, 41. . . progressively smaller in an exponential decay manner . .this is good for preserving cash for declining prices but not good when the price decline reverses. This is the point where the use of a Filter comes in. . .you wait for an reversal and invest at close to the bottom

At one point I considered using Exponent ional Trade Multiplier that would make the Trades bigger as the price reached the limit of the Trading Range. . .but this does not work for Deep Divers and the Mathematics became too complex to get it done.

Recently I abandoned creating new mathematical adaptation to Vortex on . . I now think that frequent optimisation of the parameters is the solution. . I have a good way of doing it. Beyond that if the price get out of the trading range I tend to think the filter option is to be used.

That is a really good idea. Each incremental decline is a larger percentage decline than the previous purchased decline. In your example the first purchase was based upon a 17% decline, the second purchase would have been on a 20% decline, and the third purchase would have been on a 26% decline, etc.

This is something I had never thought about. Gives me something to serious consider.

Guess the first question that comes to mind is when do you sell after making a couple of consecutive purchases?

One thing comes to mind is that if you sold the shares bought on a decline when they recovered to the previous purchase price you would have a good LIFO profit. The shares bought at $4.15 would be sold when they reached $5.00 for a 20% profit; the shares bought at $3.30 would be sold when they reached $4.15 for a profit of 26% profit, etc.

Is that the way one would do their Sells? Or, do you have another method?

Thanks for sharing this idea with me.

Regards,

Ray

Hi Ray,

In his book Lichello warns against spending money like a "drunken sailor", however it is my opinion that is exactly what happens by doing AIM by the book. The first purchase is usually meaningful, but subsequent purchases are not a prudent use of the cash reserve....they are actually a foolish use of one's money because of the Residual Buy problem.

I tend to agree with you on this matter--I would prefer to buy just once at each price level, and wait for a subsequent drop before investing more.

In addition to Conrad's Vortex, I like the Minimum Buying Increment idea that Conrad and I discussed here in previous posts (under the Money Spinner subject lines). The general idea is to figure an initial drop, in stock price, where you would be comfortable purchasing and then requiring that same drop before investing more.

For example, if a $5.00 stock drops 17%, that would be $5.00 - $0.85= $4.15 for the initial purchase price.

Any subsequent purchase would require a drop of at least $0.85, so for example the next purchase at $3.30, then $2.45, etc.

This seems to accomodate a large drop (such as 2008-09) quite well.

I guess the reason I think like this is because when I first began investing many years ago, (I'm 70), I learned the "Constant Value or Constant Dollar" method of investing. I am sure that you are aware of this money management method of buying and selling around a "constant" or set dollar investment. For instance, one might have $100,000 in a fund or stock. They decide that they will buy or sell anytime the stock gains or losses $5,000. So if the value increases to $105,000 they would sell $5,000 and bring the value back to its "constant" $100,000 value. Reverse that action if it should decline to $95,000.

The problem with investing that way is because it requires someone to keep a very large cash reserve in case of a large market decline.

Now then, when I read Lichello's book back in 2004 I like the idea of using a SAFE value to dampen down the buying as a stock declined. I never did like the idea of using a Portfolio Control and increasing it whenever a purchase is made. That is more or less market timing because that is telling an investor that the decline will be over soon and to make as many purchases as possible and make each purchase as large as possible. An investor can't predict how far the market will fall. Also, the idea of waiting 30 days between purchases might leave a lot of money on the table that might otherwise have been made if the investor had a better way of making his purchase.

I got burned in 2008-2009 and ran out of cash way too early before the market finally bottomed out. I then decided there had to be a better way.

One other thing I thought about this morning. That is, since every purchase is a more meaningful purchase doing it the way I suggested, then one does not need to keep such a large cash reserve on hand.

For instance, suppose one decides to use a 10% SAFE and a 10% Minimum Transaction for their settings. This means that their stock has to decline 17% to trigger the first purchase. It also means that the stock will need to decline 17% for each additional purchase after that if the Portfolio Control is reset to the Stock Value after each purchase. So, an investor might figure that he will keep a cash reserve on hand to handle a 50% decline in value. All he needs to do is figure out how much 3 Buys would cost (17% X 3 = 51%) and that is how much cash he would need to keep in reserve. I know those numbers aren't exact, but they are close enough.

In his book Lichello warns against spending money like a "drunken sailor", however it is my opinion that is exactly what happens by doing AIM by the book. The first purchase is usually meaningful, but subsequent purchases are not a prudent use of the cash reserve....they are actually a foolish use of one's money because of the Residual Buy problem.

Anyway, this is my opinion.

Regards,

Ray

You are welcome any time Ray to explore the differences I have have created between AIM and Vortex. The more interesting thing in your approach is that you are the first to think on this like I do!

Take your time. . .

Regards

Hi Conrad,

It will take me a few days to digest all of this. I am unfamiliar with the terminology you are using. Chances are that I will have some questions for you.

Regards,

Ray

Ref Post # 35885 on AIM Users Bulletin Board.

Hi Ray. . .Your question caught my attention.

I the past a great number of discussion have been held in this. I was the one that originally found the Residual Buy very illogical. . . and coined the term “The Lichello Flaw”. In the meantime I no longer call it a flaw and agree that it is feature.

I have specifically created Vortex AIM to get rid of the Residual Buy and created the following method to do so. . .it appears exactly what you have in mind:

PC2 = PC1 + f*Buy

And from this I formalised the analysis andI caluclated the value of f to make the Buy to Include the Residual Buy. All he time I had in mind simply to modify AIM a bit, not really intending to createa comopletely different method. . .For example I had no intention right-a-way to update the PC after a Sell.

The analysis showed that the Buy contained the f-factor and became

Buy =(PC1-V)* 1/(1-f) = (PC1-V)*Mb. . . Mb = Multiplication Factor for the Buy

and so the PC Update modification became

PC2=PC1 + f*(PC1-V)/(1-f)

PC2=PC1 + f/(1-f)*(PC1-V)------> This results in PC = V2