Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Has anyone seen anything on some sort of BLK filing/list on DTCC re: spot bitcoin ETF??

Thanks so much I-Glow!,.. good info and stats are important.

BigBake1, I saw a CEO who has a CE on the company claim that when he filed a 211 that the DTCC fees were $20,000.

I looked at the DTCC fees and couldn't get close to $20,000 in fees. But there were many fees I didn't understand.

Is it possible that an OTC non-filer to have that much in fees when filing a 211?

Wes Christian rarely wins any of his silly naked shorting lawsuits.

"Christian’s longtime sidekick, a data collector named David Wenger operating a firm called Shareintel, He adds that naked short-sellers have “driven thousands of companies out of business” — a whopper made without evidence by others for a long time.

“I’m not aware of any of these lawsuits or investigations that have really done anything,” says Peter Molk, a professor at the University of Florida. “It’s telling that you don’t see mainstream corporate-governance firms or activists taking on these naked-short cases.”

Shareintel provides junk research about Naked shorting.

Christian says without proof that the $100 trillion idea of the cost of naked shorting — more than double the market capitalization of every American public company combined — is laughably absurd. “There’s no example of a company that’s a good solid business, where we can explain its valuation and, only with naked short-selling, can we then explain its price drop,” J.B. Heaton, the managing member of One Hat Research, which provides expert testimony regarding litigation claims valuations and settlements, tells Forbes. “It’s bad lawyering in the face of potentially legitimate harm.”

"Christian sat for interviews numerous times with the late Robert David Steele, a Holocaust denier who once claimed NASA had a colony on Mars populated by kidnapped children turned into slaves. (Um, this is not true.) According to a note on Steele’s website, Steele was planning to include an interview with Christian in a documentary called Wall Street Treason & Crime before Steele died in August 2021."

“I’m not aware of any of these lawsuits or investigations that have really done anything,” says Peter Molk, a professor at the University of Florida. “It’s telling that you don’t see mainstream corporate-governance firms or activists taking on these naked-short cases.”

I believe that naked shorting is I significant but on every board a few are always screaming that it is some kind of shorting that is causing the price to drop - when is usually the insiders that are the problem.

"The Loony Conspiracy Theory Threatening Wall Street"?"

https://www.forbes.com/sites/brandonkochkodin/2023/06/22/the-loony-conspiracy-theory-threatening-wall-street/?sh=759801784ba1

Can someone tell me which SEC regulatory requirements impact the DTCC (and its subsidiaries)?

A later/working set of links to DTCC chlls and global locks, are at the bottom of the page, at this link:

https://www.clearstream.com/resource/blob/1316126/3d259da9312a5656a1c47cc4046c8e79/dtcc-global-locks-data.pdf

Yes. Like being caught in a time warp. And I suppose there's a whole new generation ready to be suckered.

Its like citing articles from 2001 and applying it today.....lol

No one has been interested in Wes Christian for more than a decade.

Ask Wes Christian about your conspiracy theory theory ;)

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=170978994

They don't, an issuer is the company, the DTCC does not deal with issuer's.

Doesn't matter if management changed, the fact is the ticker earned a chill and it is not reversible because the shell is under new management.

The DTCC only works with broker dealers and considering the new rules regarding Form 211... well that chill isn't going anywhere.

How does a new ceo remove a chill then that

was applied to the ticker back in 2014 under

Different management?

Well it is a lie, an issuer has no means of corresponding with the DTCC. There is no such thing as "Filing" with the the DTCC, worse there isnt a "fee" to pay, completely made up. I hope you do not own stock in that scam.

Hello there…. A question….

ceo of mdce said it filed with dtcc to have

chill removed… back on 8-13-21… (see tweet

Below) we are now a month into this…. Why

does it take so long to get dtcc chill removed…

Thanks for any response

Mdce shareholder

“SSM Monopoly Corp

Aug 13

$MDCE is now pink current, the DTC application

has been paid to remove the DTC Chill.

Because of the chill, brokers are clearing some

trades after market hours. Not dilution.”

New link for DTCC Chills and Global locks.

https://www.clearstream.com/clearstream-en/products-and-services/market-coverage/americas/united-states-of-america/dtcc-deposit-chills-and-global-locks-u-s-a--1281828

Seem they haven't chilled a stock for some time.

.

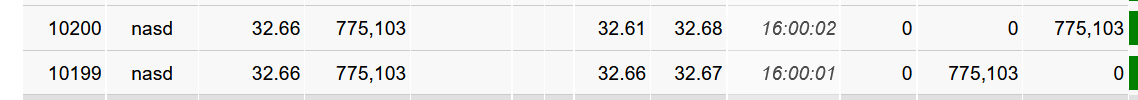

What does it mean when trades like these are posted after hours?

It is always the same number of shares in the BUY column, the same number under SELL.

https://ih.advfn.com/stock-market/NASDAQ/mr-cooper-COOP/trades

I have 2 questions about SR-DTC-2003-09

- Does somebody knows where you can finds the lists from DTC.

DTC told me: Our practice is to cancel 90 days after the publication of the notice to give our clients sufficient time to respond should they have knowledge that the company is still active.

- Does your broker has to warn you?

Thanks in advance.

Thanks for your response.

It's not really an award as per a lawsuit. Its a special distribution coming from the company's assets which are being held in escrow pending a court outcome in the state of Delaware.

Two weeks ago AABA issues a part of this special distribution of $8.33 per shared to the holders on record at the time of dissolution. I received it through my broker account, no counsel involved. The company has said another distribution is forthcoming. They cannot say when and how much though.

My discount broker is insisting i must remove these shares as thy are non-qualified for a registered account. My concern is losing ownership of these shares which would make me lose any potential future distribution. Its a substantial amount.

My quest is to find a way to have my name registered to these shares and to remove them from my account at the same time. Someway the distribution would have to find a way to me.

Thanks for your input.

A person cannot register shares at the DTCC. A broker sponsors a companies shares after FINRA approval of a ticker symbol.

If the stock was suspended and or revoked those shares under that CUSIP are done.

If you are awarded a class action lawsuit, the dispersement comes from the lawfirm representing you.

You need a legal counsel, not the DTCC.

Help, advice with Registering with DTC help

Newbie here, not sure if i am in the right forum or not, but i'm trying to figure out how to register my shares of AABA with the DTC so that when the court settlement payout comes, it comes to me.

My broker has told me I must get rid of these shares in my RRSP(Canada) because they are non-qualified and subject to penalty. Shares do not trade and the company,AABA, has been delisted. I have to get rid of shares,

( I cannot transfer to other accounts) but i also need to maintain ownership. They are registered with the DTC but i need to be sure my name is the registered owner. My discount broker, Questrade, is useless at offering any advice. Anyone have any suggestions? Thank You

Need the updated pdf consolidated format documentation. It seems like it updated yesterday but the new spec is behind their paywall. It’s found here: https://dtcclearning.com/products-and-services/equities-clearing/exchange-traded-fund-etf/etf-working-groups.html

I get the actual pcf file from my broker and the old spec is public. For whatever reason, the new update isn’t. Can anyone help?

I agree it is not, it seems we are now back to relying on the SEC to act and the SRO's to report. That wasn't working before and the SEC hasn't picked up on the pace of suspending and revoking shells fast enough.

"Quite simple the lack of DTCC actions and direct impact on pennystock trading no longer makes it a need for discussion. As long as gamblers can trade their stock with no restrictions there are little to no complaints."

Why does this not read as a good thing to me?

Quite simple the lack of DTCC actions and direct impact on pennystock trading no longer makes it a need for discussion. As long as gamblers can trade their stock with no restrictions there are little to no complaints. The only holdouts are the usual conspiracy theorists of the abusive naked short loons who still believe their 40 Billion share AS scams were shorted.

How can such a great informative board not have any posts for two years?

Ah, yes, "Deepcapture." They do for investment knowledge what "Infowars" does for political discourse.

When you have websites like deep capture and other bullshit conspiracy sites it will be perpetuated b6 the ignorant and unaware. There are very rarely those who will take the time and learn Reh SHO and it's reporting reuqirements. But most will just regurgitate what they read from others on IHUB and other wbe sites who want to believe that someone else is the cause of their bad investment.

Well, AlanCs are constantly being made. All it takes is being scammed and an inability to accept being scammed.

Add to that the Richard Altomares and Jonathan Bryants of the scam world, who blame their malfeasance on the ENSSFM, and there will always be more!

Agreed, the reason I posted it was due to the recent activity of restoring DTCC services to rather well known scams. In June there were groups of tickers restored including BEHL, Left behind games or the ole Rudy Rudiger beverage ticker, all have been restored.

Oddly enough some were restored just to be suspended shortly after like THRA. So this appears to be more of a cooperative effort allowing the SEC to regulate as opposed to the optics of the DTCC regulating by restricting services.

But... That's from almost a year ago, 6 December 2016. And I still don't really understand it. It seems DTCC, for some reason annoyed about the whole business, withdrew its earlier proposals without explanation, and didn't substitute any new ones.

And then it apparently shrugged and walked away, as the SEC gutted its power to impose chills and locks. I still don't get it.

New Rules approved by the SEC for Chills and Global Locks:

https://www.sec.gov/rules/sro/dtc/2016/34-79488.pdf

Please come explain this again to the rubes on the CCTC board. I think we may have another Alan C in the making!

I appreciate your knowledge and help!

Correct thus why the release of Short Interest reports are delayed as well as FTD data. It prevents exposing exact positions, especially in illiquid securities like the OTC.

You can sometimes spot short interest in FTD data but the stock is likely illiquid and very small positions and 9f course by the time the FTD report publishes the likelyhood of that position existing in the current day is very small.

I have only found a couple of examples over the years.

Yes, I assumed this info is kept private by the brokers as they would surely take advantage of such data. I was hoping to find a way to track this myself.

It is Short Volume, intra day. There is no such thing as Naked Short Interest and Equity Short Interest, those are made up terms based on the short volume report provided by FINRA for OTC.

As I said earlier there is no WY to know what position the short volume is, although we know it is almost always in the OTC long position transactions between Market Maker to Broker through Riskless Principal transactions.

Kind of what I thought. I sent a message to Finra learning center to ask same. No reply yet. Also, just found this OTC Short Report. The have in their chart two categories, Naked Short Interest, and Equity Short Interest. What is this RegSho data reported by Finra they have indicated as source?

True when talking Short Interest, I just assumed his questions were Shot Volume related, as days to cover the open position is T+3.

But as you stated Short Interest it is an averaged number of days based on trade volume. It is a metric that doesn't represent actual covering, but the minimum days it would take to close that Short Interest Position if it were to be closed.

I thought "days to cover" was how many sessions it would take for the current short position to be closed out, based on average daily volume.

Many of them--most, really--are 1 day, so it's not taking into account t+3.

No way to know retail vs intra day MM action. Just as no way to know if it is long or short position taken. That is why it is worthless raw data, it is just a piece of the picture, you see the rest in the FTD report as to settlement and of course actual short positions taken in the Bi Monthly Short Interest reports.

Days to cover is the number of days in which the trade transaction must be settled. The settlement process is currently trade day plus 3 additional trade days to cover either the shares to deliver or the cash to deliver. Here in a couple of months it will be adjusted to trade day plus 2, since typically 99.9% of trade transactions are settled just on Trade Date alone.

Thanks Big Bake I read this a few times to understand it....more or less!

So is there any way to know the volume of short positions taken by the retail trader?

Another question.. in either Finra or SEC I have seen a list.. what you referred to in your article here I believe... and so what does it mean by "days to cover"? thanks, best regards, monroe

Friend of mine sent an email, but the first time they just gave the OTC Market website as a reference...lol

They are as user friendly as DTC is...

He emailed them again this weekend for a more substantial answer

We'll see...

I will post here if they ever give the exact info about all those numbers

Well, neither do I... Why not just call the TA?

Agree, but it's more complicated then it was anyway

Thanks for sharing your knowledge even if i still don't know how they do those almost impossible things about the float...

Mostly the ones showing some "held at dtc" vs other ones without any of those

It isn't DTCC's fault. There's nothing new about this. The single largest nominee shareholder in any company is CEDE.

All the stock you own is held by CEDE, unless you happen to have some restricted stock, or some certs.

Really strange. Guess we'll never know what's really happening from now on...

Thanks to DTCC for really helping us make the OTC great again...lol

Yes. Street name stock is ALWAYS part of the float.

Yep.But what i want to know is: Are they part of the float like here, cuz 107 Million float looks impossible.

Complete non sense cuz the chart shows otherwise

107 Million shares were never traded since last r/s

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |