Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

i80 Gold Corp (IAU)

2.71 ? 0.12 (4.63%)

Volume: 144,617 @12/10/21 4:00:00 PM EST

Bid Ask Day's Range

2.62 2.75 2.58 - 2.79

TSX:IAU Detailed Quote

Gold Will EXPLODE When This Happens... Mark Bristow | Inflation & Latest Price Prediction

$i-80 Gold Intersects High-Grade Gold in Underground Drilling at Granite Creek English

i-80 Gold Corp Logo (CNW Group/i-80 Gold Corp)

NEWS PROVIDED BY

i-80 Gold Corp

Oct 28, 2021, 06:00 ET

$Including 41.3 g/t Au over 7.1 m & 16.0 g/t Au over 7.3 m

RENO, Nev., Oct. 28, 2021 /PRNewswire/ -

$i-80 GOLD CORP. (TSX: IAU) (OTCQX: IAUCF) ("i-80", or the "Company")

is pleased to announce positive initial assay results from the ongoing

underground drill program at the Company's Granite Creek Property

("Granite Creek" or "the Property") located in Humboldt County, Nevada.

https://www.prnewswire.com/news-releases/i-80-gold-intersects-high-grade-gold-in-underground-drilling-at-granite-creek-301410644.html

$i-80 Gold Corp closes acquisition of Ruby Hill after Lone Tree and Buffalo Mountain transactions

Oct 19, 2021

$i-80 Gold Corp closes acquisition of Ruby Hill after Lone Tree and Buffalo Mountain transactions

54 viewsOct 19, 2021

$i-80 Gold Corp begins test mining program at its Granite Creek property in Nevada

66 views Sep 15, 2021

Proactive

i-80 Gold Initiates Underground Test Mining Program at Granite Creek, Nevada

T.IAU | 2 days ago

RENO, Nev., Sept.14, 2021 /PRNewswire/ - i-80 GOLD CORP. (TSX: IAU) (OTCQX: IAUCF) ("i-80", or the "Company") is pleased to announce that initial rehabilitation of the underground workings has been completed at the Company's Granite Creek Mine ("Granite Creek" or "the Property") property located in Humboldt County, Nevada and an underground test mining program is now underway.

Granite Creek hosts both open pit and underground resources and is located proximal to Nevada Gold Mines' ("NGM") Twin Creeks and Turquoise Ridge mines at the north end of the Battle Mountain-Eureka Trend at its intersection with the Getchell gold belt in Nevada. The underground deposit at Granite Creek represents one of the highest-grade gold deposits in North America with resource grades in excess of 10 grams per tonne gold (see Table 1 below).

$I-80 TO ACQUIRE LONE TREE/PROCESSING FACILITIES, BUFFALO MTN & RUBY HILL TO CREATE NEVADA MINING COMPLEX

$I-80 TO ACQUIRE LONE TREE/PROCESSING FACILITIES, BUFFALO MTN & RUBY HILL TO CREATE NEVADA MINING COMPLEX

https://www.i80gold.com/

Conference Call Replay

A recording of the call can be accessed until September 14, 2021.

North American Toll-free Replay: 1-888-203-1112

Replay Code: 8375917

https://www.i80gold.com/i-80-to-acquire-lone-tree-processing-facilities-buffalo-mtn-ruby-hill-to-create-nevada-mining-complex/

$I-80 GOLD INTERSECTS HIGH-GRADE GOLD IN OPEN PIT DRILLING AT GRANITE CREEK

6.80 g/t Au over 51.1 Metres – Oxide Mineralization below CX-Pit

Reno, Nevada, August 30, 2021 – i-80 GOLD CORP. (TSX:IAU) (OTCQX:IAUCF)

(“i-80”, or the “Company”) is pleased to announce that assay results

for the first hole drilled at the Company’s Granite Creek Property

(“Granite Creek” or “the Property”) located in Humboldt County, Nevada

has returned high-grade results that confirm the high-grade open pit

opportunity.

Hole iGM21-01, drilled from the bottom of the historic CX-Pit

intersected two zones of mineralization grading

3.17 g/t Au over 7.5 m and

6.80 g/t Au over 51.1 m (see Table 1).

The hole was drilled for metallurgical purposes into the main structure

below the pit (true widths unknown) and returned exceptional grades

that appear to be oxide mineralization based on an average cyanide

soluble to fire assay ratio of 0.94 over both intervals.

The surface drill program targeting open pit mineralization at Granite

Creek is complete (see Figure 2 below) and multiple assays remain

pending.

The drill program was focused on intersecting material to be used for

metallurgical and geotechnical purposes in advance of initiating

permitting for an open pit mine and on-site processing.

https://www.i80gold.com/i-80-gold-intersects-high-grade-gold-in-open-pit-drilling-at-granite-creek/

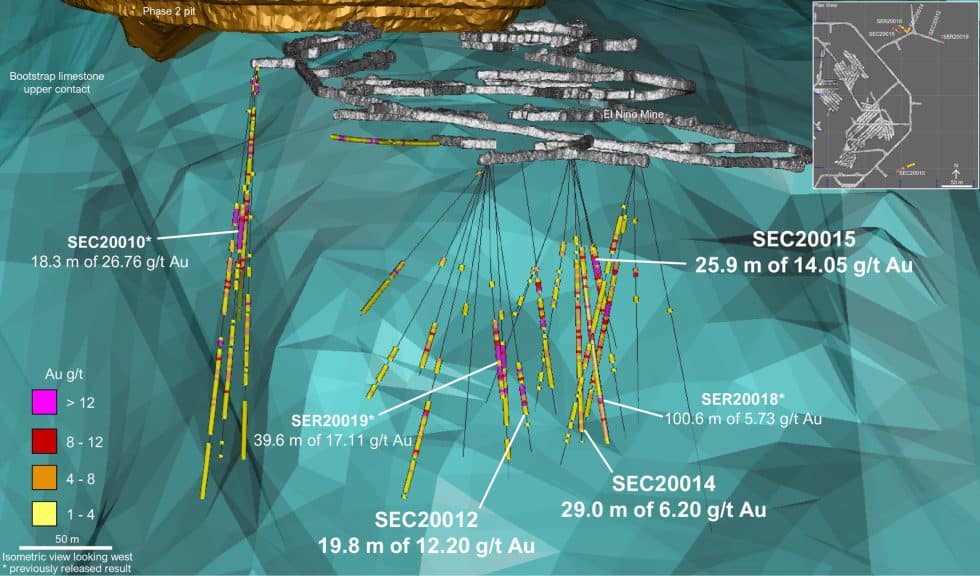

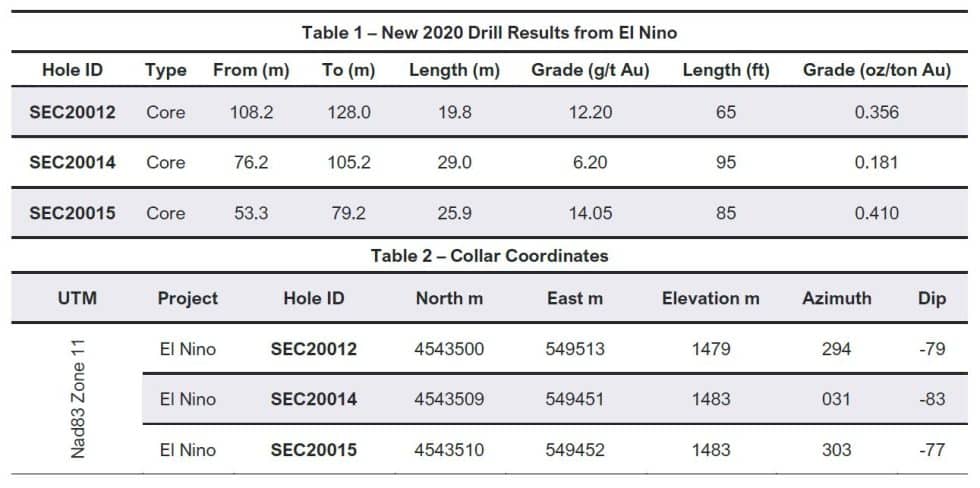

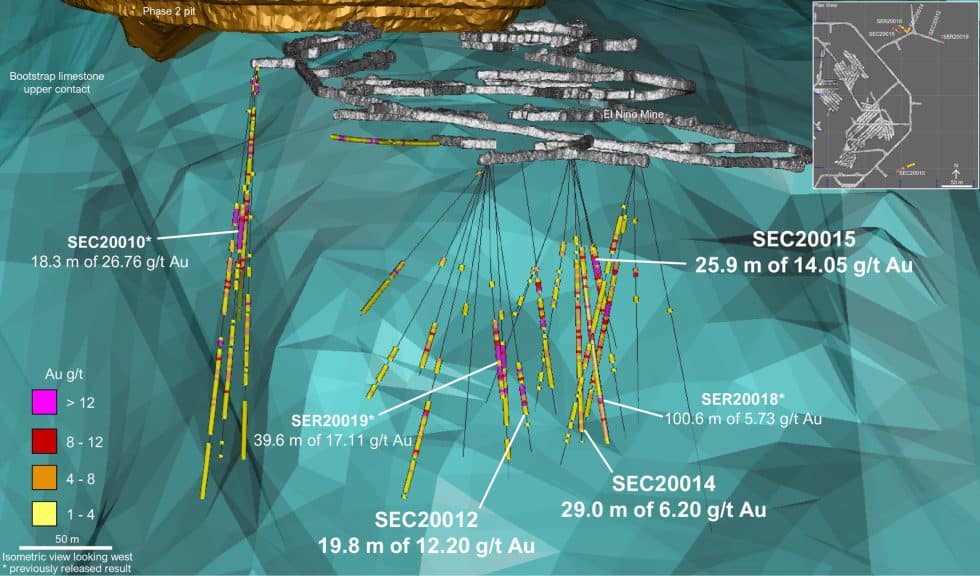

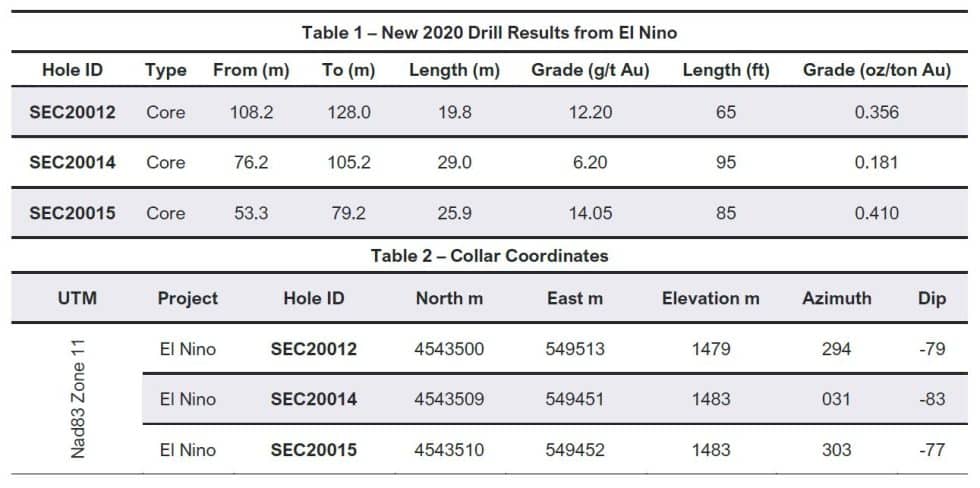

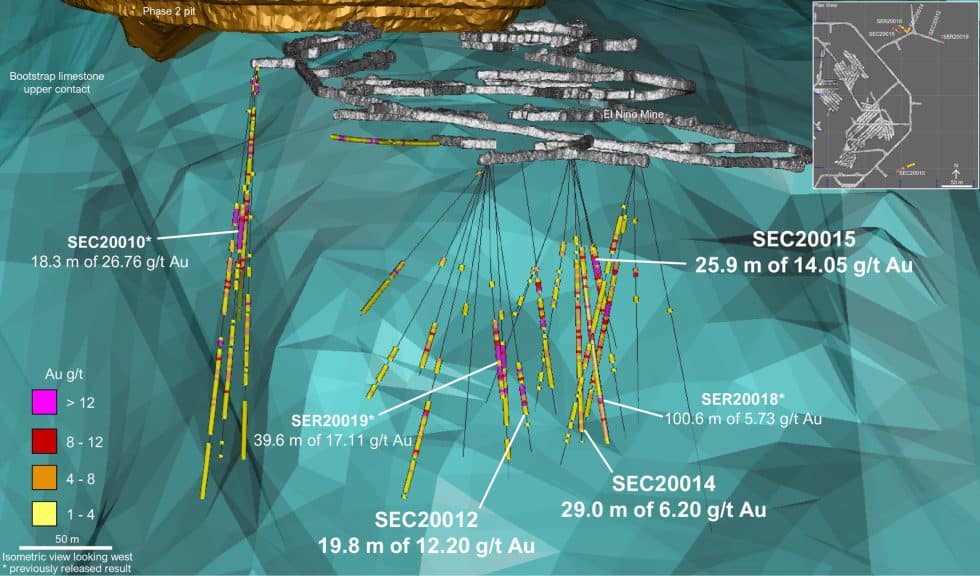

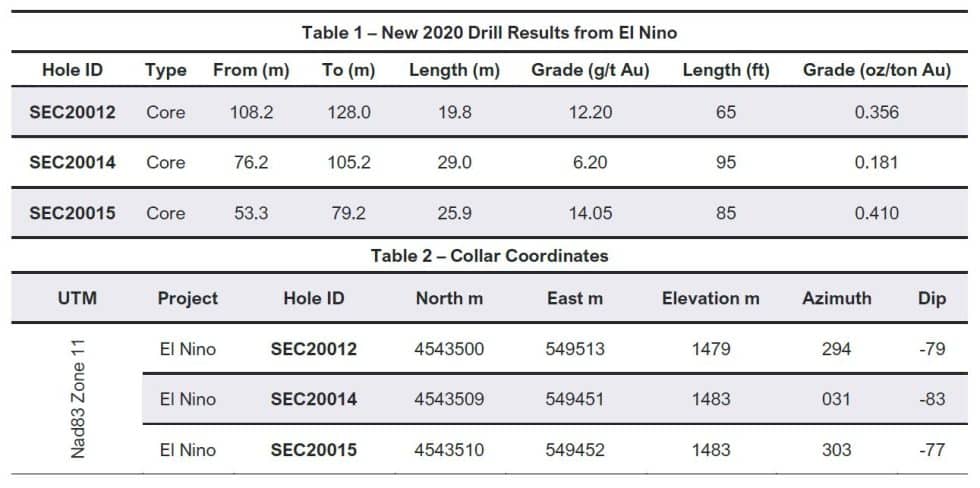

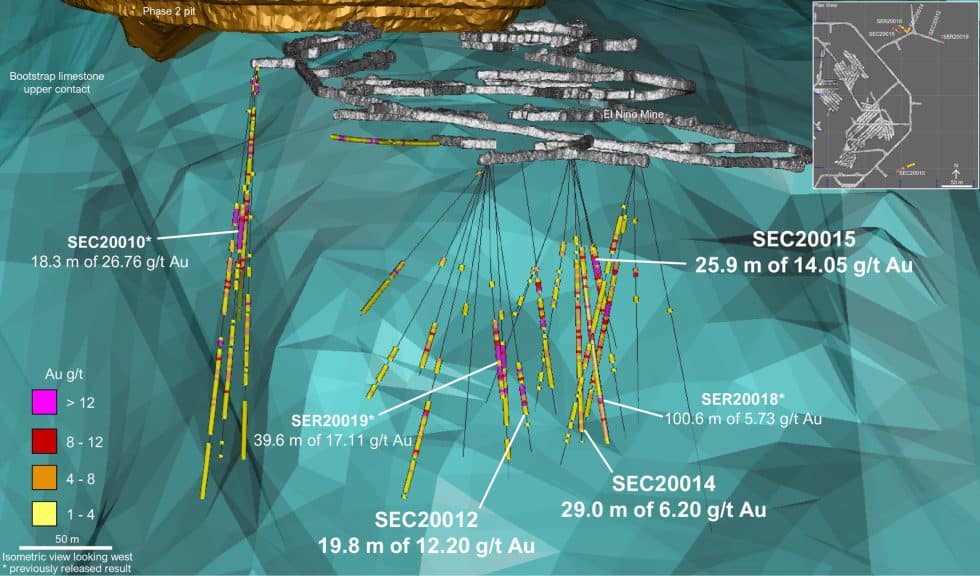

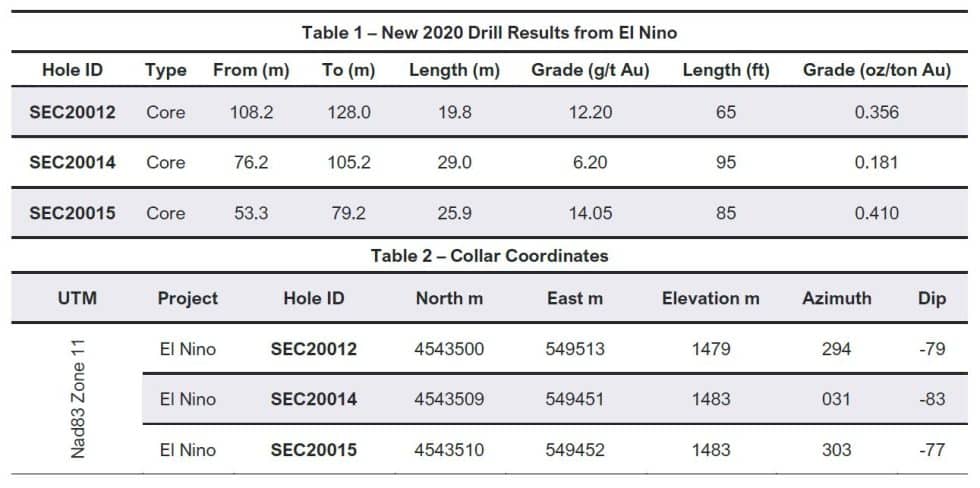

$SOUTH ARTURO GOLD MINE: Located along the northern section of the

productive Carlin Trend,

i-80 holds a 40% interest in the South Arturo Property in partnership with

Nevada Gold Mines, a joint venture between Barrick Gold Corporation and

Newmont Corporation, that owns the remaining 60% interest.

$The South Arturo Mine in Nevada is a joint venture, operated by Nevada Gold Mines LLC, with Barrick Gold Corporation (“Barrick”).

Several opportunities exist on the property including the recently

developed El Nino underground mine.

El Nino is the second mine to be developed at South Arturo and as with

the Phase 2 open pit it has delivered consistent results.

visit our website at

http://www.i80gold.com

Replay Code: 3652970

https://www.i80gold.com/i-80-gold-to-announce-second-quarter-financial-results-on-august-11-2021/

About i-80 Gold Corp.

i-80 Gold Corp is a Nevada-focused mining company aimed on achieving

mid-tier gold producer status through the development of the Company’s

advanced-stage project portfolio.

In addition to its producing mine, El Nino at South Arturo,

i-80 is advancing economic studies and test mining at

the Granite Creek Project, and planning for advanced

underground exploration at the McCoy-Cove Property.

For further information, please contact:

Ewan Downie – CEO

Matthew Gollat – EVP Business & Corporate Development

1.866.525.6450

Info@i80gold.com

http://www.i80gold.com

$i-80 Gold is currently producing gold at its El Nino mine at

South Arturo (joint venture with Nevada Gold Mines –

a joint venture between Barrick Gold Corporation and Newmont

Corporation).

i-80 Gold Begins Underground Drill Program At Granite Creek

i-80 Gold today reported that the overhauling of underground drill bays

has been completed, and underground drilling activities have begun at

the Granite Creek property situated in Humbolt County, Nevada.

https://thedeepdive.ca/i-80-gold-begins-underground-drill-program-at-granite-creek/

i-80 Gold Begins Underground Drill Program At Granite Creek

June 16, 2021 7:49 AM Christopher Messmer 0 Comments Gold, i-80 Gold Corp

$i-80 GOLD CORP. (TSX: IAU) today reported that the overhauling of underground drill bays has been completed, and underground drilling activities have begun at the Granite Creek property situated in Humbolt County, Nevada.

Granite Creek hosts open pit and underground resources on the property. The firms 22,000 metre drill program has begun, which focuses on both surface and underground drilling. The primary objective of the current program is to advance the project to production.

Underground drilling will be focusing on the delineating of sufficient resources for the development of a near–term mining and development plan. Surface drilling meanwhile will test mineralization for open pit definition and metallurgical purposes.

I-80 also declared that the Getchell Property is to be addressed as the Granite Creek property from this point onward. The decision was made to avoid confusion with the open pit at Getchell that’s situated at the nearby Turquoise Ridge mine property.

i-80 GOLD CORP. last traded on the TSX at $2.68.

i-80 Gold Begins Underground Drill Program At Granite Creek

i-80 Gold today reported that the overhauling of underground drill bays

has been completed, and underground drilling activities have begun at

the Granite Creek property situated in Humbolt County, Nevada.

https://thedeepdive.ca/i-80-gold-begins-underground-drill-program-at-granite-creek/

i-80 Gold Begins Underground Drill Program At Granite Creek

June 16, 2021 7:49 AM Christopher Messmer 0 Comments Gold, i-80 Gold Corp

$i-80 GOLD CORP. (TSX: IAU) today reported that the overhauling of underground drill bays has been completed, and underground drilling activities have begun at the Granite Creek property situated in Humbolt County, Nevada.

Granite Creek hosts open pit and underground resources on the property. The firms 22,000 metre drill program has begun, which focuses on both surface and underground drilling. The primary objective of the current program is to advance the project to production.

Underground drilling will be focusing on the delineating of sufficient resources for the development of a near–term mining and development plan. Surface drilling meanwhile will test mineralization for open pit definition and metallurgical purposes.

I-80 also declared that the Getchell Property is to be addressed as the Granite Creek property from this point onward. The decision was made to avoid confusion with the open pit at Getchell that’s situated at the nearby Turquoise Ridge mine property.

i-80 GOLD CORP. last traded on the TSX at $2.68.

$i-80 Gold Corp. (TSX: IAU): Newest Gold Producer in the Market. a Nevada-

Focused Mining Company, Goal of Achieving Mid-Tier Gold Producer Status;

Ewan Downie, CEO Interviewed

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia

University, NYC, USA

on 4/25/2021

We spoke with Ewan Downie, CEO and Director of i-80 Gold Corp. (TSX: IAU),

the newest gold producer in the market. i-80 Gold Corp is a Nevada-focused

mining company, with a goal of achieving mid-tier gold producer status.

$The Company is currently producing gold at its El Nino mine at

South Arturo (joint venture with Nevada Gold Mines –

a joint venture between Barrick Gold Corporation and Newmont

Corporation).

The Company is also advancing the development of its 100% owned,

feasibility-stage McCoy-Cove projects, located proximal

to Nevada Gold Mines’ Phoenix operation, and

its past producing Getchell project that is located immediately

south of Nevada Gold Mines’ Turquoise Ridge operation.

The PEA of the Getchell project is expected to be completed in H1 2021,

followed by the commissioning of a Preliminary Feasibility or

Feasibility Study, immediately after.

http://www.metalsnews.com/Metals+News/MetalsNews/Dr.+Allen+Alper,+PhD+Economic+Geology+and+Petrology,+Columbia+University,+NYC,+USA/FEATURED1353150/i80+Gold+Corp+(TSX+IAU)+Newest+Gold+Producer+in+the+Market+a+NevadaFocused+Mining+Company+Goal+of+Achieving+Mid.htm

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada-focused mining company with a goal of achieving mid-tier gold producer status. In addition to its producing mine, El Nino at South Arturo, i-80 is beginning to plan for future production growth through the potential addition of the Phases 1 & 3 projects at South Arturo and advancing the development of the Company’s Getchell and McCoy-Cove Projects.

Qualified Person

Tim George, PE, Manager of Engineering Services, is the Qualified Person

for the information contained in this press release and is a Qualified

Person within the meaning of National Instrument 43-101.

The primary assay laboratories for the South Arturo Mine are ALS

Minerals and American Assay Labs in Reno, Nevada. For a complete

description of sample preparation, analytical methods and QA/QC

procedures, refer to the technical report dated January 25, 2021

(effective date December 1, 2020), titled “Preliminary Feasibility

Study for the South Arturo Mine, Elko County, NV” located on i-80’s

website

https://i80gold.com

and at www.sedar.com.

Abbreviations used in this press release are available by following this link (click here).

https://i80gold.com/investors/#presentation

For further information, please contact:

Ewan Downie, CEO

1.888.346.1390

Info@i80gold.com

http://www.i80gold.com

https://i80gold.com/south-arturo/

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

$I-80 TO ACQUIRE LONE TREE/PROCESSING FACILITIES, BUFFALO MTN & RUBY HILL TO CREATE NEVADA MINING COMPLEX

$I-80 TO ACQUIRE LONE TREE/PROCESSING FACILITIES, BUFFALO MTN & RUBY HILL TO CREATE NEVADA MINING COMPLEX

https://www.i80gold.com/

Conference Call Replay

A recording of the call can be accessed until September 14, 2021.

North American Toll-free Replay: 1-888-203-1112

Replay Code: 8375917

https://www.i80gold.com/i-80-to-acquire-lone-tree-processing-facilities-buffalo-mtn-ruby-hill-to-create-nevada-mining-complex/

Reno, Nevada, September 7, 2021 – i-80 GOLD CORP. (TSX:IAU) (OTCQX:IAUCF) (“i-80”, or the “Company”) is very pleased to announce that it has entered into definitive agreements to create a comprehensive Nevada mining complex through an asset exchange agreement to acquire certain processing infrastructure, including an autoclave, and the Lone Tree and Buffalo Mountain gold deposits from Nevada Gold Mines LLC (“NGM”) via an asset exchange in consideration for: (i) the Company’s 40% ownership in the South Arturo Property which will consolidate 100% ownership of South Arturo in NGM, providing NGM with flexibility to pursue potential operational synergies with NGM’s other Nevada properties; (ii) assignment of i-80’s option to acquire the adjacent Rodeo Creek exploration property; (iii) contingent consideration of up to $50 million based on production from the Lone Tree property; and (iv) arrangement of substitute bonding (and release of NGM bonds) in respect of the Lone Tree and Buffalo Mountain reclamation obligations at closing. The Company has also entered into an acquisition agreement to acquire the Ruby Hill Mine from affiliates of Waterton Global Resource Management (“Waterton”). Additionally, i-80 has entered into a private placement commitment with NGM whereby, conditional on the asset exchange transaction being completed[1], NGM will acquire from i-80 up to 9.9% interest in new i-80 treasury common shares for aggregate proceeds not to exceed $50 million, and a non-binding term sheet with Orion Mine Finance (“Orion”) for up to $240 million in acquisition and development financing. Equinox Gold Corp (“Equinox”) has also indicated that it will participate in the equity private placement through the exercise of a portion of its anti-dilute rights.

Highlights of the transactions are as follows:

i-80 increases overall Inferred gold Mineral Resource more than three and a half times and more than doubles i-80’s overall gold Measured + Indicated Mineral Resources1

Ruby Hill deposits host more than 100 million ounces of indicated silver mineral resources and more than 70 million ounces of inferred silver mineral resources1

Secures for i-80, the ability to process all types of gold bearing mineralization at the centrally located Lone Tree processing facility situated on Interstate 80 once the necessary refurbishment of the facility is completed. The Lone Tree facility includes an autoclave, carbon-in-leach (CIL) mill, Floatation Plant, and heap leach facility

i-80 will produce gold from the Ruby Hill open pit and residual leaching at Lone Tree

NGM will provide i-80 with interim processing capacity at its autoclave facilities until the earlier of the three-year anniversary of the asset exchange closing and such time that the Lone Tree facility is operational and also at its roaster facilities for a period of 10-years, subject in each case to extension by mutual agreement

The Company is pursuing financing arrangements that complement the Company’s strong cash position ($70.1 million as at June 30, 2021) including:

Concurrent with the closing of the asset exchange, NGM will subscribe for new i-80 treasury common shares representing up to a 9.9% interest in i-80 through a private placement for proceeds not to exceed $50 million

The Company has entered into a non-binding term sheet with Orion for up to $140 million of acquisition financing, with an additional $100 million potentially available via an accordion feature, at the election of i-80

At the closing of the asset exchange, NGM will reimburse i-80 an amount of approximately $7.3 million for certain expenditures previously advanced in relation to the South Arturo Property[2]

Equinox Gold Corp., the Company’s largest shareholder, is expected to participate in the private placement financing through the exercise of its anti-dilution rights

i-80 has entered into a definitive exchange agreement (the “Exchange Agreement“) to acquire the Lone Tree and Buffalo Mountain gold deposits from Nevada Gold Mines LLC (“NGM”), including certain processing infrastructure, via an asset exchange in consideration for: (i) the Company’s 40% ownership in the South Arturo Property; (ii) assignment of i-80’s option to acquire the adjacent Rodeo Creek exploration property; (iii) contingent consideration of up to $50 million based on production from the Lone Tree property; and (iv) arrangement of substitute bonding (and release of NGM bonds) in respect of the Lone Tree and Buffalo Mountain reclamation obligations at closing. The Company has separately entered into a definitive membership interest purchase agreement (the “Ruby Hill Agreement“) to acquire the Ruby Hill Mine, which includes multiple deposits that collectively, have the potential to represent one of Nevada’s largest gold, silver and base metal endowments, from affiliates of Waterton Global Resource Management (“Waterton”). These two transactions are designed to position i-80 Gold as a prominent, stand alone, gold producer in the state of Nevada. Closing of each of the transactions with NGM, Waterton, Orion and the private placement are subject to the satisfaction of a number of conditions precedent detailed further below, including regulatory approvals and, in the case of Orion, completion of due diligence and the negotiation and execution of mutually satisfactory definitive documentation.

“These transformational acquisitions result in a significant increase in the Company’s mineral resource base, and position i-80 to become one of the largest gold producers in the State of Nevada with the capacity to process refractory and oxide mineralization”, stated Ewan Downie, Chief Executive Officer of i-80 Gold. “Importantly, i-80 gains a strategic advantage becoming one of only three companies in Nevada with infrastructure to process refractory mineral resources once the Lone Tree facility has been retrofitted to suit the Company’s deposits. We believe that this will allow i-80 to overcome a crucial barrier to entry that most of our peers face. In the interim, Nevada Gold Mines has agreed to provide processing capacity for i-80 mineral resources from the McCoy Cove, Granite Creek and Ruby Hill mines at its autoclave facilities until the earlier of three years from closing of the asset exchange and the date the Lone Tree facility becomes operational and will also provide i-80 with processing capacity for ore produced from the McCoy Cove mine at its roaster facilities for 10 years, in each case, subject to extension by mutual agreement, allowing i-80 to commence development of its assets on an expedited basis”.

The Lone Tree Property is being acquired from NGM, a joint-venture between the world’s two largest gold producers, Barrick Gold Corporation and Newmont Corporation. Lone Tree is a strategically located facility on Interstate 80, the primary highway through northern Nevada, and proximal to the northern Nevada railway, midway between i-80’s Granite Creek and McCoy-Cove projects (See Figure 1). The transaction with NGM will provide i-80 with important processing infrastructure including an autoclave, CIL mill, and a heap leach facility complete with assay lab and gold refinery, and also includes interim processing arrangements. NGM has further agreed to acquire up to a 9.9% interest in i-80 through a private placement at the Issue Price (as defined below) for proceeds not to exceed $50 million.

The producing Ruby Hill Mine is host to multiple deposits that collectively have the potential to represent one of the largest gold and silver resource endowments in the State of Nevada. Refractory mineralization from Ruby Hill is expected to be trucked to the Lone Tree Complex for processing following its refurbishment.

“The Lone Tree and Ruby Hill acquisitions will provide i-80 with substantial gold and silver resources and an opportunity to build a mid-tier gold producing company entirely within in the State of Nevada”, stated Matthew Gili, President and Chief Operating Officer of i-80 Gold. “Ruby Hill is host to multiple gold, silver, and poly-metallic deposits that remain wide open for expansion and is expected to be a major contributor to our goal of becoming the second largest producer in Nevada”.

Lone Tree Acquisition

Lone Tree represents a strategic acquisition for i-80, providing the Company with important infrastructure that, following successful refurbishment efforts, will allow it to process refractory and oxide mineralization. Currently on care and maintenance, the property hosts existing infrastructure that includes a whole ore autoclave with capacity of 1M tonnes/year, a flotation circuit with capacity of 1.8M tonnes/year, a CIC circuit & leach pad with 6.5M tonnes of remaining capacity, a tailings dam with 1.5M tonnes of remaining constructed capacity and an additional 10M tonnes of permitted capacity, a waste dump, along with several buildings useful for the development of all i-80’s projects including a warehouse, maintenance shop, admin building, and assay lab. The property is also host to substantial gold mineral resources1 and offers excellent exploration potential. All deposits at Lone Tree (Lone Tree, Second Chanse and Lynn) remain open for expansion.

Substantial open pit gold resources contained proximal to the Lone Tree open pit1

410,000 ounces of gold indicated mineral resources within 7.2M tonnes grading 1.77 g/t Au

2,764,000 ounces of gold inferred mineral resources within 50.7M tonnes grading 1.69 g/t Au

Resource expansion potential exists down-plunge of the main Lone Tree deposit and in the unmined Sequoia zone discovery where previous drilling returned multiple wide, high-grade, intercepts (50% estimated true width) including:

9.3 g/t Au across 45.7 m, 11.7 g/t Au across 16.8 m and 9.3 g/t Au across 15.2 m

Buffalo Mountain is a near-term development opportunity, located approximately 10 km southwest of Lone Tree, that has both open pit and underground potential. Previous drilling by NGM has outlined mineralization in two zones, with highlight intercepts (60-80% estimated true width) of:

5.6 g/t Au across 15.2 m, 7.9 g/t Au across 10.7 m and 1.4 g/t Au across 35.1 m in Second Chance deposit (open pit)

10.3 g/t Au across 9.1 m and 16.8 g/t Au across 6.1 m in the nearby Lynn Zone that warrants additional drilling

The Lone Tree and Buffalo Mountain Properties are being acquired by i-80’s wholly owned subsidiaries Goldcorp Dee LLC (“Goldcorp Dee”) and Au-Reka Gold LLC (“AuReka”) by way of asset exchange pursuant to the Exchange Agreement, in for (i) Goldcorp Dee’s 40% ownership in the South Arturo Property, (ii) assignment AuReka’s option to acquire the adjacent Rodeo Creek exploration property, (iii) contingent consideration of up to $50 million based on production from the Lone Tree property, and (iv) arrangement of substitute bonding (and release of NGM bonds) in respect of the Lone Tree and Buffalo Mountain reclamation obligations at closing. Conditional on closing of the asset exchange, NGM has also agreed to complete a private placement for up to a 9.9% interest in i-80 for proceeds not to exceed $50 million, described further under “Acquisition Financing” below. At the closing of the asset exchange, NGM will also reimburse i-80 approximately $7.3 million for amounts previously advanced by i-80 for the autonomous truck haulage test work completed at South Arturo and for funds advanced by i-80 that have not been used for reclamation activities.

In the event i-80 restarts the processing of ore at Lone Tree, NGM will be entitled to receive the following contingent payments of up to $50 million subject to the terms and conditions of the contingent consideration agreement:

An amount equal to $25.00 per recovered gold equivalent mineral reserve ounce identified in the feasibility study (the “Feasibility Study”) for the restart of mining at the Lone Tree mine (“Initial Contingent Consideration”), payable in two equal installments six months and 18 months following the later of commencement of commercial production at Lone Tree and the completion of the Feasibility Study; and

An amount equal to $25.00 per ounce of produced gold in excess of the number of recovered gold equivalent mineral reserve ounces (the “Continuing Contingent Consideration”), payable within five days after the end of each calendar quarter during which a payment of Continuing Contingent Consideration accrues, provided that the aggregate of the Initial Contingent Consideration and the Continuing Contingent Consideration shall not exceed $50 million.

i-80 considers the Lone Tree infrastructure to be a strategically located processing facility in Nevada, located on Interstate 80 with the Nevada Railway less than two kilometres to the north, and will be the platform from which i-80 intends to grow its business (see Figure 1 below).

Figure 1 – Aerial view of the Lone Tree Mine Site

The Lone Tree Deposit1 is host to a substantial gold resource that includes 410,000 ounces of gold (Indicated) at a grade of 1.77 g/t Au and 2,764,000 ounces (Inferred) at a grade of 1.69 g/t Au and offers substantial resource expansion potential at depth, down plunge (see Figure 2 below), and in the adjacent Sequoia zone (see Figure 3 below).

Figure 2 – 3D View of the Main Lone Tree Deposit including highlight intercepts

Figure 3 – 3D View displaying highlight intercepts drilled at the Sequoia Zone at Lone Tree

The Buffalo Mountain Property is located approximately 10 km to the West of Lone Tree (see Figure 4 below) and is host to multiple gold zones that have returned multiple significant intercepts including 10.3 g/t Au across 9.1 m and 16.8 g/t Au across 6.1 m at the Lynn zone and 5.6 g/t Au across 15.2 m and 7.9 g/t Au across 10.7 m in the Second Chanse zone (60-80% estimated true width). NGM has initiated the permitting of Buffalo Mountain for development and i-80 expects to continue this effort to commence mining Buffalo Mountain and processing material on the heap leach pad at Lone Tree. The Company expects to complete a mineral resource estimate for Buffalo Mountain in the future.

Figure 4 – Plan Displaying the location of the Buffalo Mountain Deposit in relation to Lone Tree

Closing of the transactions contemplated by the Exchange Agreement is subject to the satisfaction of a number of conditions precedent, including clearance under the Hart-Scott-Rodino Antitrust Improvement Act of 1976, as amended (the “HSR Act”), arrangement of substitute sureties (and release of existing NGM bonds) in respect of the Lone Tree and Buffalo Mountain reclamation obligations, and the approval of the Toronto Stock Exchange (“TSX”), among other customary conditions to closing. The NGM equity private placement (described under “Equity Financing” below) is expected to close concurrently with, and subject to, the closing of the transactions under the Exchange Agreement. The transactions contemplated under the Exchange Agreement and the Ruby Hill Agreement are not inter-conditional or conditional on the completion of the Orion financing transaction. The Orion financing is conditional upon, among other things, the completion of the transactions under the Exchange Agreement and the Ruby Hill Agreement.

Ruby Hill Acquisition

Ruby Hill represents one of Nevada’s premier mining projects with existing production from the Archimedes open pit, and a large property that is host to multiple gold, gold/silver, and polymetallic gold deposits, making it one of the largest and highest-grade, permitted, gold deposits in Nevada.

Substantial open pit gold and silver resources1 within the Mineral Point Trend

Indicated Mineral Resource of 203.2 Mt with an average grade of 0.49 g/t Au and 14.9 g/t Ag containing 3.2 million ounces of gold and 97.5 million ounces of silver

Inferred Mineral Resource of 157.3 Mt with an average grade of 0.37 g/t Au and 14.3 g/t Ag containing 1.9 million ounces of gold and 72.4 million ounces of silver

High-grade underground gold mineralization at the 426 Zone

Indicated Mineral Resource of 1.2 Mt with an average grade of 5.2 g/t Au containing 0.2 million ounces of gold

High-grade underground gold mineralization at the Ruby Deeps Zone that remains open along strike to the north

Inferred Mineral Resource of 8.2 Mt with an average grade of 6.0 g/t Au containing 1.6 million ounces of gold

High-grade poly-metallic mineralization has been defined within the Blackjack

i-80 is acquiring a 100% interest in the Ruby Hill mine and property for consideration of up to $150 million, including milestone payments that are subject to an early payment option that could reduce total consideration to $130 million as follows:

$75 million cash and $8 million in shares of i-80 at closing, priced based on the market price of i-80’s shares at the time of closing;

$17 million in cash and/or shares of i-80 payable on the earlier of 60 days following the issuance of a press release by the Company regarding the completion of a new or updated Mineral Resource estimate for the Ruby Hill Property or 15 months after closing, priced based on the market price of i-80’s shares at the time of such payment (the “First Milestone Payment”);

$15 million in cash and/or shares of i-80 payable on the earlier of 60 days following the issuance of a press release by the Company regarding the completion of a Feasibility Study for the Ruby Hill mine or 24 months after closing, priced based on the market price of i-80’s shares at the time of such payment (the “Second Milestone Payment”);

$15 million in cash and/or shares of i-80 payable on the earlier of 30 months after closing and 90 days following the announcement by the Company of a construction decision related to a deposit on any portion of the Ruby Hill Properties that is not currently being mined, priced based on the market price of i-80’s shares at the time of such payment (the “Third Milestone Payment”); and

$20 million in cash and/or shares of i-80 payable on the earlier of 36 months after closing and 90 days following the announcement by the Company of achieving Commercial Production related to a deposit on any portion of the Properties that is not currently being mined, priced based on the market price of i-80’s shares at the time of such payment (the “Fourth Milestone Payment”).

Up to 50% of the foregoing Milestone Payments may consist of i-80 shares, provided that the number of i-80 shares then held by Waterton after giving effect to the share issuance shall not exceed 9.99% of then issued and outstanding shares of i-80 calculated on a partially diluted basis. i-80 shall have the right to prepay the Second Milestone Payment by paying to Waterton, on or before 15 months following closing, $10 million provided that up to $7.5 million of such amount may be satisfied, at i-80’s option, in common shares of the Company, priced based on the market price of i-80’s shares at the time of such prepayment and i-80 shall have the right to prepay the aggregate of the Third and Fourth Milestone Payments by paying to Waterton, on or before 24 months following closing $20 million provided that up to $10 million of such amount may be satisfied, at i-80’s option, in common shares of the Company, priced based on the market price of i-80’s shares at the time of such prepayment, provided that the number of i-80 shares then held by Waterton after giving effect to the share issuance shall not exceed 9.99% of then issued and outstanding shares of i-80 calculated on a partially diluted basis.

Ruby Hill includes an open pit mine and related infrastructure (mill/heap leach) and is located immediately west of the town of Eureka proximal to Highway 50.

The Ruby Hill Property is host to multiple gold, silver and base metal deposits that collectively comprise one of Nevada’s largest mineral endowments that offer substantial upside. Open pit oxide and transitional resources occur in the Mineral Point, Archimedes West and Archimedes East Zones. Underground sulfide Mineral resources occur in the 426, Ruby Deeps and Blackjack Zones (Figure 5)

Figure 5 – Cross Section of the Ruby Hill Deposits

Multiple gold and polymetallic exploration targets exist on the property and i-80 will begin an aggressive exploration program immediately following closing. The Company will begin permitting for the construction of a decline to access the high-grade Ruby Deeps deposit and the Blackjack Zone with the intent of trucking refractory mineralization for processing at Lone Tree. Completion of the current mine plan at the Ruby Hill pit will continue with processing at the heap leach facility on the property. Ruby Hill also includes crushing and CIL processing infrastructure (see Figure 6)

Figure 6 – Ruby Hill Infrastructure

Closing of the transactions contemplated by the Ruby Hill Agreement are subject to the satisfaction of a number of conditions precedent, including regulatory approvals, and the approval of the TSX. i-80 expects to close the Orion financing transaction concurrently with the transactions contemplated by the Ruby Hill Agreement.

Acquisition Financing

In connection with the transactions contemplated by the Exchange Agreement, NGM has agreed to subscribe for new common shares from treasury at a price per share equal to C$2.62 (the “Issue Price“), (being the five day volume weighted average trading price of i-80’s common shares ending on the trading date prior to this announcement) in an amount equal to the lesser of $50 million and the amount that would result in NGM holding 9.9% of the issued and outstanding common shares of i-80 on a non-diluted basis, but after giving effect to the private placement (including any participation by other subscribers, including Equinox. upon exercise of its pre-emptive rights and any shares issued to Waterton on or prior to the private placement). The private placement with NGM is part of larger non-brokered private placement offering of common shares by i-80, which includes Orion, of up to $90 million at the Issue Price, not including any shares that may be issued to Equinox upon the exercise of their anti-dilute rights.

The Company has also entered into a non-binding term sheet with Orion for a comprehensive $140 million financing package, complementing the Company’s existing strong balance sheet. The Orion financing is contemplated to include a mix of equity and convertible securities, warrants as well as secured instruments, and has a target size of $140 million and, at the election of i-80, an accordion feature of up to an additional $100 million. The equity, convertible securities and the warrants will be priced based on the Issue Price subject to TSX approval.

“The financing packages secured and being pursued with Nevada Gold Mines and Orion, combined with interim processing arrangements, are meant to provide i-80 with the ability to immediately begin development of its substantial portfolio of advanced stage deposits located in one of the world’s most favourable jurisdictions for mining”, stated Matthew Gollat, EVP Business & Corporate Development for i-80. “The financing packages were structured to limit dilution to our shareholders while providing the Company with potential capacity to aggressively grow our business.”

This news release does not constitute an offer to sell or a solicitation of an offer to buy the common shares described herein in the United States or in any other jurisdiction, nor shall there be any sale of the common shares in any state in which such offer, solicitation or sale would be unlawful. The common shares have not been and will not be registered under the U.S. Securities Act, or any state securities laws, and accordingly, may not be offered or sold in the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom.

Financial & Legal Advisors

For the Lone Tree acquisition and financing, RBC Capital Markets is acting as financial advisor to i-80 and Bennett Jones LLP and Davis Graham & Stubbs LLP are acting as legal advisors.

For the Ruby Hill acquisition, Sprott Capital Partners is acting as financial advisor to i-80 and Dorsey & Whitney LLP is acting as lead legal advisor.

Conference Call & Webcast

The Company will host a live conference call and webcast on September 7, 2021, commencing at 8:30 am ET, providing the opportunity for analysts and investors to ask questions of i-80 Gold’s executive team.

Conference Call

North American Toll-free: 1-800-437-2398

Local: 1-647-792-1240

Webcast Link

Click HERE to access the webcast or visit our website at www.i80gold.com.

Conference Call Replay

A recording of the call can be accessed until September 14, 2021.

North American Toll-free Replay: 1-888-203-1112

Replay Code: 8375917

Notes:

Mineral resources are not mineral reserves and do not have demonstrated economic viability. See Tables 1, 2 & 3 at the end of this press release for Ruby Hill and Lone Tree mineral resource estimates and qualifiers. Ruby Hill effective date July 31, 2021, gold price $1,650/oz Au., Open pit cut-off grade 0.1 g/t Au. Lone Tree effective date July 31, 2021, gold price $1,650/oz Au, Open-pit cut off grade 0.65 g/t Au.

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada-focused mining company with a goal of achieving mid-tier gold producer status. The Company expects to close the acquisitions of the Lone Tree Complex and the Ruby Hill Project in H2 2021 and is advancing an underground development program for the 100%-owned Granite Creek Project and intends to advance the McCoy-Cove Property. i-80 is well financed with more than $70.1 million (as at June 30, 2021) in cash and has recently signed financing agreements with Nevada Gold Mines and non-binding term sheet with Orion to provide access to as much as $240 million.

Lone Tree Qualified Person

GeoGlobal LLC., under the supervision of Abani R. Samal, Ph.D., RM- SME, Fellow-SEG., a Qualified Person within the meaning of National Instrument 43-101 (“NI 43-101”), is the Qualified Person responsible for the Lone Tree mineral resource estimate. A technical report detailing the mineral resource estimate will be filed with Canadian Securities regulators within 45 days. Historic assays were most commonly sent to internal company labs of Newmont, Santa Fe, and Battle Mountain before being switched to ALS Chemex (now “ALS Minerals”), an independent, ISO 9001 accredited commercial mineral assay lab at the time. Common analytical methods used include fire assay, atomic absorption, gravimetry, and screen fire.

Ruby Hill Qualified Person

Mr. Christopher Wright, P. Geo., a Qualified Person within the meaning of NI 43-101, is the Qualified Person responsible for the Ruby Hill mineral resource estimate. Mr. Wright is an employee of Wood Canada Ltd. A technical report detailing the mineral resource estimate will be filed with Canadian Securities regulators within 45 days. Historic assays were commonly sent to a mix of ALS Minerals, ALS Chemex, and Chemex Labs, all independent labs. ALS Minerals complies with the requirements for the International Standards ISO 9001 and ISO 17025. ALS Chemex complied with ISO 9001. Assays by Chemex Labs were conducted before ISO standards were in place. Historic assaying practices included fire assays with gravimetric finish for samples over 10 grams per tonne.

Technical Information

Tim George, PE, is the Qualified Person for the information contained in this press release and a Qualified Person within the meaning of NI43-101.

For further information, please contact:

Ewan Downie – CEO

Matthew Gollat – EVP Business & Corporate Development

1.866.525.6450

Info@i80gold.com

www.i80gold.com

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including but not limited to, completion of the transactions contemplated by the Exchange Agreement, completion of the transactions contemplated by the Ruby Hill Agreement, completion of the equity private placement with NGM, Equinox Gold Corp. and/or other subscribers, completion of the financing transaction with Orion, completion of refurbishment and development activities at the Long Tree project, commencement of mining operations at the Lone Tree project or the Ruby Hill mine or mineral resource and reserve estimates and exploration, development and production potential. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the Company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: failure to satisfy of the relevant conditions to the completion of the transactions described herein, failure to obtain the relevant regulatory approvals, material adverse changes, exercise of termination rights by any relevant party, unexpected changes in laws, failure to complete the Orion financing transaction on satisfactory terms, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration, refurbishment, development or mining programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Cautionary Note to U.S. Investors Concerning Estimates of Resources: This press release uses the term “inferred resources.” “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. Information contained in the press release containing descriptions of any mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder that disclose mineral reserves and mineral resources in accordance with Industry Guide 7 or the SEC’s new mining disclosure rules in Regulation S-K 1300. SEC Industry Guide 7 does not recognize the existence of resources. Under Regulation S-K 1300, reserve and resource definitions are substantially similar to the corresponding CIM Definition Standards; however, there are differences between NI 43-101 and Regulation S-K 1300 and therefore information contained in the press release may not be comparable to similar information made public by public U.S. companies pursuant to the Regulation S-K 1300 or SEC Industry Guide 7.

https://i80gold.com

and at www.sedar.com.

Abbreviations used in this press release are available by following this link (click here).

https://i80gold.com/investors/#presentation

For further information, please contact:

Ewan Downie, CEO

1.888.346.1390

Info@i80gold.com

http://www.i80gold.com

https://i80gold.com/south-arturo/

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

i80 Gold Corp (IAU)

3.1 ? 0.4 (14.81%)

Volume: 992,410 @09/07/21 12:15:52 PM EDT

Bid Ask Day's Range

3.1 3.11 2.9 - 3.25

TSX:IAU Detailed Quote

I-80 TO ACQUIRE LONE TREE/PROCESSING FACILITIES, BUFFALO MTN & RUBY HILL TO CREATE NEVADA MINING COMPLEX

https://www.i80gold.com/

Conference Call Replay

A recording of the call can be accessed until September 14, 2021.

North American Toll-free Replay: 1-888-203-1112

Replay Code: 8375917

https://www.i80gold.com/i-80-to-acquire-lone-tree-processing-facilities-buffalo-mtn-ruby-hill-to-create-nevada-mining-complex/

Reno, Nevada, September 7, 2021 – i-80 GOLD CORP. (TSX:IAU) (OTCQX:IAUCF) (“i-80”, or the “Company”) is very pleased to announce that it has entered into definitive agreements to create a comprehensive Nevada mining complex through an asset exchange agreement to acquire certain processing infrastructure, including an autoclave, and the Lone Tree and Buffalo Mountain gold deposits from Nevada Gold Mines LLC (“NGM”) via an asset exchange in consideration for: (i) the Company’s 40% ownership in the South Arturo Property which will consolidate 100% ownership of South Arturo in NGM, providing NGM with flexibility to pursue potential operational synergies with NGM’s other Nevada properties; (ii) assignment of i-80’s option to acquire the adjacent Rodeo Creek exploration property; (iii) contingent consideration of up to $50 million based on production from the Lone Tree property; and (iv) arrangement of substitute bonding (and release of NGM bonds) in respect of the Lone Tree and Buffalo Mountain reclamation obligations at closing. The Company has also entered into an acquisition agreement to acquire the Ruby Hill Mine from affiliates of Waterton Global Resource Management (“Waterton”). Additionally, i-80 has entered into a private placement commitment with NGM whereby, conditional on the asset exchange transaction being completed[1], NGM will acquire from i-80 up to 9.9% interest in new i-80 treasury common shares for aggregate proceeds not to exceed $50 million, and a non-binding term sheet with Orion Mine Finance (“Orion”) for up to $240 million in acquisition and development financing. Equinox Gold Corp (“Equinox”) has also indicated that it will participate in the equity private placement through the exercise of a portion of its anti-dilute rights.

Highlights of the transactions are as follows:

i-80 increases overall Inferred gold Mineral Resource more than three and a half times and more than doubles i-80’s overall gold Measured + Indicated Mineral Resources1

Ruby Hill deposits host more than 100 million ounces of indicated silver mineral resources and more than 70 million ounces of inferred silver mineral resources1

Secures for i-80, the ability to process all types of gold bearing mineralization at the centrally located Lone Tree processing facility situated on Interstate 80 once the necessary refurbishment of the facility is completed. The Lone Tree facility includes an autoclave, carbon-in-leach (CIL) mill, Floatation Plant, and heap leach facility

i-80 will produce gold from the Ruby Hill open pit and residual leaching at Lone Tree

NGM will provide i-80 with interim processing capacity at its autoclave facilities until the earlier of the three-year anniversary of the asset exchange closing and such time that the Lone Tree facility is operational and also at its roaster facilities for a period of 10-years, subject in each case to extension by mutual agreement

The Company is pursuing financing arrangements that complement the Company’s strong cash position ($70.1 million as at June 30, 2021) including:

Concurrent with the closing of the asset exchange, NGM will subscribe for new i-80 treasury common shares representing up to a 9.9% interest in i-80 through a private placement for proceeds not to exceed $50 million

The Company has entered into a non-binding term sheet with Orion for up to $140 million of acquisition financing, with an additional $100 million potentially available via an accordion feature, at the election of i-80

At the closing of the asset exchange, NGM will reimburse i-80 an amount of approximately $7.3 million for certain expenditures previously advanced in relation to the South Arturo Property[2]

Equinox Gold Corp., the Company’s largest shareholder, is expected to participate in the private placement financing through the exercise of its anti-dilution rights

i-80 has entered into a definitive exchange agreement (the “Exchange Agreement“) to acquire the Lone Tree and Buffalo Mountain gold deposits from Nevada Gold Mines LLC (“NGM”), including certain processing infrastructure, via an asset exchange in consideration for: (i) the Company’s 40% ownership in the South Arturo Property; (ii) assignment of i-80’s option to acquire the adjacent Rodeo Creek exploration property; (iii) contingent consideration of up to $50 million based on production from the Lone Tree property; and (iv) arrangement of substitute bonding (and release of NGM bonds) in respect of the Lone Tree and Buffalo Mountain reclamation obligations at closing. The Company has separately entered into a definitive membership interest purchase agreement (the “Ruby Hill Agreement“) to acquire the Ruby Hill Mine, which includes multiple deposits that collectively, have the potential to represent one of Nevada’s largest gold, silver and base metal endowments, from affiliates of Waterton Global Resource Management (“Waterton”). These two transactions are designed to position i-80 Gold as a prominent, stand alone, gold producer in the state of Nevada. Closing of each of the transactions with NGM, Waterton, Orion and the private placement are subject to the satisfaction of a number of conditions precedent detailed further below, including regulatory approvals and, in the case of Orion, completion of due diligence and the negotiation and execution of mutually satisfactory definitive documentation.

“These transformational acquisitions result in a significant increase in the Company’s mineral resource base, and position i-80 to become one of the largest gold producers in the State of Nevada with the capacity to process refractory and oxide mineralization”, stated Ewan Downie, Chief Executive Officer of i-80 Gold. “Importantly, i-80 gains a strategic advantage becoming one of only three companies in Nevada with infrastructure to process refractory mineral resources once the Lone Tree facility has been retrofitted to suit the Company’s deposits. We believe that this will allow i-80 to overcome a crucial barrier to entry that most of our peers face. In the interim, Nevada Gold Mines has agreed to provide processing capacity for i-80 mineral resources from the McCoy Cove, Granite Creek and Ruby Hill mines at its autoclave facilities until the earlier of three years from closing of the asset exchange and the date the Lone Tree facility becomes operational and will also provide i-80 with processing capacity for ore produced from the McCoy Cove mine at its roaster facilities for 10 years, in each case, subject to extension by mutual agreement, allowing i-80 to commence development of its assets on an expedited basis”.

The Lone Tree Property is being acquired from NGM, a joint-venture between the world’s two largest gold producers, Barrick Gold Corporation and Newmont Corporation. Lone Tree is a strategically located facility on Interstate 80, the primary highway through northern Nevada, and proximal to the northern Nevada railway, midway between i-80’s Granite Creek and McCoy-Cove projects (See Figure 1). The transaction with NGM will provide i-80 with important processing infrastructure including an autoclave, CIL mill, and a heap leach facility complete with assay lab and gold refinery, and also includes interim processing arrangements. NGM has further agreed to acquire up to a 9.9% interest in i-80 through a private placement at the Issue Price (as defined below) for proceeds not to exceed $50 million.

The producing Ruby Hill Mine is host to multiple deposits that collectively have the potential to represent one of the largest gold and silver resource endowments in the State of Nevada. Refractory mineralization from Ruby Hill is expected to be trucked to the Lone Tree Complex for processing following its refurbishment.

“The Lone Tree and Ruby Hill acquisitions will provide i-80 with substantial gold and silver resources and an opportunity to build a mid-tier gold producing company entirely within in the State of Nevada”, stated Matthew Gili, President and Chief Operating Officer of i-80 Gold. “Ruby Hill is host to multiple gold, silver, and poly-metallic deposits that remain wide open for expansion and is expected to be a major contributor to our goal of becoming the second largest producer in Nevada”.

Lone Tree Acquisition

Lone Tree represents a strategic acquisition for i-80, providing the Company with important infrastructure that, following successful refurbishment efforts, will allow it to process refractory and oxide mineralization. Currently on care and maintenance, the property hosts existing infrastructure that includes a whole ore autoclave with capacity of 1M tonnes/year, a flotation circuit with capacity of 1.8M tonnes/year, a CIC circuit & leach pad with 6.5M tonnes of remaining capacity, a tailings dam with 1.5M tonnes of remaining constructed capacity and an additional 10M tonnes of permitted capacity, a waste dump, along with several buildings useful for the development of all i-80’s projects including a warehouse, maintenance shop, admin building, and assay lab. The property is also host to substantial gold mineral resources1 and offers excellent exploration potential. All deposits at Lone Tree (Lone Tree, Second Chanse and Lynn) remain open for expansion.

Substantial open pit gold resources contained proximal to the Lone Tree open pit1

410,000 ounces of gold indicated mineral resources within 7.2M tonnes grading 1.77 g/t Au

2,764,000 ounces of gold inferred mineral resources within 50.7M tonnes grading 1.69 g/t Au

Resource expansion potential exists down-plunge of the main Lone Tree deposit and in the unmined Sequoia zone discovery where previous drilling returned multiple wide, high-grade, intercepts (50% estimated true width) including:

9.3 g/t Au across 45.7 m, 11.7 g/t Au across 16.8 m and 9.3 g/t Au across 15.2 m

Buffalo Mountain is a near-term development opportunity, located approximately 10 km southwest of Lone Tree, that has both open pit and underground potential. Previous drilling by NGM has outlined mineralization in two zones, with highlight intercepts (60-80% estimated true width) of:

5.6 g/t Au across 15.2 m, 7.9 g/t Au across 10.7 m and 1.4 g/t Au across 35.1 m in Second Chance deposit (open pit)

10.3 g/t Au across 9.1 m and 16.8 g/t Au across 6.1 m in the nearby Lynn Zone that warrants additional drilling

The Lone Tree and Buffalo Mountain Properties are being acquired by i-80’s wholly owned subsidiaries Goldcorp Dee LLC (“Goldcorp Dee”) and Au-Reka Gold LLC (“AuReka”) by way of asset exchange pursuant to the Exchange Agreement, in for (i) Goldcorp Dee’s 40% ownership in the South Arturo Property, (ii) assignment AuReka’s option to acquire the adjacent Rodeo Creek exploration property, (iii) contingent consideration of up to $50 million based on production from the Lone Tree property, and (iv) arrangement of substitute bonding (and release of NGM bonds) in respect of the Lone Tree and Buffalo Mountain reclamation obligations at closing. Conditional on closing of the asset exchange, NGM has also agreed to complete a private placement for up to a 9.9% interest in i-80 for proceeds not to exceed $50 million, described further under “Acquisition Financing” below. At the closing of the asset exchange, NGM will also reimburse i-80 approximately $7.3 million for amounts previously advanced by i-80 for the autonomous truck haulage test work completed at South Arturo and for funds advanced by i-80 that have not been used for reclamation activities.

In the event i-80 restarts the processing of ore at Lone Tree, NGM will be entitled to receive the following contingent payments of up to $50 million subject to the terms and conditions of the contingent consideration agreement:

An amount equal to $25.00 per recovered gold equivalent mineral reserve ounce identified in the feasibility study (the “Feasibility Study”) for the restart of mining at the Lone Tree mine (“Initial Contingent Consideration”), payable in two equal installments six months and 18 months following the later of commencement of commercial production at Lone Tree and the completion of the Feasibility Study; and

An amount equal to $25.00 per ounce of produced gold in excess of the number of recovered gold equivalent mineral reserve ounces (the “Continuing Contingent Consideration”), payable within five days after the end of each calendar quarter during which a payment of Continuing Contingent Consideration accrues, provided that the aggregate of the Initial Contingent Consideration and the Continuing Contingent Consideration shall not exceed $50 million.

i-80 considers the Lone Tree infrastructure to be a strategically located processing facility in Nevada, located on Interstate 80 with the Nevada Railway less than two kilometres to the north, and will be the platform from which i-80 intends to grow its business (see Figure 1 below).

Figure 1 – Aerial view of the Lone Tree Mine Site

The Lone Tree Deposit1 is host to a substantial gold resource that includes 410,000 ounces of gold (Indicated) at a grade of 1.77 g/t Au and 2,764,000 ounces (Inferred) at a grade of 1.69 g/t Au and offers substantial resource expansion potential at depth, down plunge (see Figure 2 below), and in the adjacent Sequoia zone (see Figure 3 below).

Figure 2 – 3D View of the Main Lone Tree Deposit including highlight intercepts

Figure 3 – 3D View displaying highlight intercepts drilled at the Sequoia Zone at Lone Tree

The Buffalo Mountain Property is located approximately 10 km to the West of Lone Tree (see Figure 4 below) and is host to multiple gold zones that have returned multiple significant intercepts including 10.3 g/t Au across 9.1 m and 16.8 g/t Au across 6.1 m at the Lynn zone and 5.6 g/t Au across 15.2 m and 7.9 g/t Au across 10.7 m in the Second Chanse zone (60-80% estimated true width). NGM has initiated the permitting of Buffalo Mountain for development and i-80 expects to continue this effort to commence mining Buffalo Mountain and processing material on the heap leach pad at Lone Tree. The Company expects to complete a mineral resource estimate for Buffalo Mountain in the future.

Figure 4 – Plan Displaying the location of the Buffalo Mountain Deposit in relation to Lone Tree

Closing of the transactions contemplated by the Exchange Agreement is subject to the satisfaction of a number of conditions precedent, including clearance under the Hart-Scott-Rodino Antitrust Improvement Act of 1976, as amended (the “HSR Act”), arrangement of substitute sureties (and release of existing NGM bonds) in respect of the Lone Tree and Buffalo Mountain reclamation obligations, and the approval of the Toronto Stock Exchange (“TSX”), among other customary conditions to closing. The NGM equity private placement (described under “Equity Financing” below) is expected to close concurrently with, and subject to, the closing of the transactions under the Exchange Agreement. The transactions contemplated under the Exchange Agreement and the Ruby Hill Agreement are not inter-conditional or conditional on the completion of the Orion financing transaction. The Orion financing is conditional upon, among other things, the completion of the transactions under the Exchange Agreement and the Ruby Hill Agreement.

Ruby Hill Acquisition

Ruby Hill represents one of Nevada’s premier mining projects with existing production from the Archimedes open pit, and a large property that is host to multiple gold, gold/silver, and polymetallic gold deposits, making it one of the largest and highest-grade, permitted, gold deposits in Nevada.

Substantial open pit gold and silver resources1 within the Mineral Point Trend

Indicated Mineral Resource of 203.2 Mt with an average grade of 0.49 g/t Au and 14.9 g/t Ag containing 3.2 million ounces of gold and 97.5 million ounces of silver

Inferred Mineral Resource of 157.3 Mt with an average grade of 0.37 g/t Au and 14.3 g/t Ag containing 1.9 million ounces of gold and 72.4 million ounces of silver

High-grade underground gold mineralization at the 426 Zone

Indicated Mineral Resource of 1.2 Mt with an average grade of 5.2 g/t Au containing 0.2 million ounces of gold

High-grade underground gold mineralization at the Ruby Deeps Zone that remains open along strike to the north

Inferred Mineral Resource of 8.2 Mt with an average grade of 6.0 g/t Au containing 1.6 million ounces of gold

High-grade poly-metallic mineralization has been defined within the Blackjack

i-80 is acquiring a 100% interest in the Ruby Hill mine and property for consideration of up to $150 million, including milestone payments that are subject to an early payment option that could reduce total consideration to $130 million as follows:

$75 million cash and $8 million in shares of i-80 at closing, priced based on the market price of i-80’s shares at the time of closing;

$17 million in cash and/or shares of i-80 payable on the earlier of 60 days following the issuance of a press release by the Company regarding the completion of a new or updated Mineral Resource estimate for the Ruby Hill Property or 15 months after closing, priced based on the market price of i-80’s shares at the time of such payment (the “First Milestone Payment”);

$15 million in cash and/or shares of i-80 payable on the earlier of 60 days following the issuance of a press release by the Company regarding the completion of a Feasibility Study for the Ruby Hill mine or 24 months after closing, priced based on the market price of i-80’s shares at the time of such payment (the “Second Milestone Payment”);

$15 million in cash and/or shares of i-80 payable on the earlier of 30 months after closing and 90 days following the announcement by the Company of a construction decision related to a deposit on any portion of the Ruby Hill Properties that is not currently being mined, priced based on the market price of i-80’s shares at the time of such payment (the “Third Milestone Payment”); and

$20 million in cash and/or shares of i-80 payable on the earlier of 36 months after closing and 90 days following the announcement by the Company of achieving Commercial Production related to a deposit on any portion of the Properties that is not currently being mined, priced based on the market price of i-80’s shares at the time of such payment (the “Fourth Milestone Payment”).

Up to 50% of the foregoing Milestone Payments may consist of i-80 shares, provided that the number of i-80 shares then held by Waterton after giving effect to the share issuance shall not exceed 9.99% of then issued and outstanding shares of i-80 calculated on a partially diluted basis. i-80 shall have the right to prepay the Second Milestone Payment by paying to Waterton, on or before 15 months following closing, $10 million provided that up to $7.5 million of such amount may be satisfied, at i-80’s option, in common shares of the Company, priced based on the market price of i-80’s shares at the time of such prepayment and i-80 shall have the right to prepay the aggregate of the Third and Fourth Milestone Payments by paying to Waterton, on or before 24 months following closing $20 million provided that up to $10 million of such amount may be satisfied, at i-80’s option, in common shares of the Company, priced based on the market price of i-80’s shares at the time of such prepayment, provided that the number of i-80 shares then held by Waterton after giving effect to the share issuance shall not exceed 9.99% of then issued and outstanding shares of i-80 calculated on a partially diluted basis.

Ruby Hill includes an open pit mine and related infrastructure (mill/heap leach) and is located immediately west of the town of Eureka proximal to Highway 50.

The Ruby Hill Property is host to multiple gold, silver and base metal deposits that collectively comprise one of Nevada’s largest mineral endowments that offer substantial upside. Open pit oxide and transitional resources occur in the Mineral Point, Archimedes West and Archimedes East Zones. Underground sulfide Mineral resources occur in the 426, Ruby Deeps and Blackjack Zones (Figure 5)

Figure 5 – Cross Section of the Ruby Hill Deposits

Multiple gold and polymetallic exploration targets exist on the property and i-80 will begin an aggressive exploration program immediately following closing. The Company will begin permitting for the construction of a decline to access the high-grade Ruby Deeps deposit and the Blackjack Zone with the intent of trucking refractory mineralization for processing at Lone Tree. Completion of the current mine plan at the Ruby Hill pit will continue with processing at the heap leach facility on the property. Ruby Hill also includes crushing and CIL processing infrastructure (see Figure 6)

Figure 6 – Ruby Hill Infrastructure

Closing of the transactions contemplated by the Ruby Hill Agreement are subject to the satisfaction of a number of conditions precedent, including regulatory approvals, and the approval of the TSX. i-80 expects to close the Orion financing transaction concurrently with the transactions contemplated by the Ruby Hill Agreement.

Acquisition Financing

In connection with the transactions contemplated by the Exchange Agreement, NGM has agreed to subscribe for new common shares from treasury at a price per share equal to C$2.62 (the “Issue Price“), (being the five day volume weighted average trading price of i-80’s common shares ending on the trading date prior to this announcement) in an amount equal to the lesser of $50 million and the amount that would result in NGM holding 9.9% of the issued and outstanding common shares of i-80 on a non-diluted basis, but after giving effect to the private placement (including any participation by other subscribers, including Equinox. upon exercise of its pre-emptive rights and any shares issued to Waterton on or prior to the private placement). The private placement with NGM is part of larger non-brokered private placement offering of common shares by i-80, which includes Orion, of up to $90 million at the Issue Price, not including any shares that may be issued to Equinox upon the exercise of their anti-dilute rights.

The Company has also entered into a non-binding term sheet with Orion for a comprehensive $140 million financing package, complementing the Company’s existing strong balance sheet. The Orion financing is contemplated to include a mix of equity and convertible securities, warrants as well as secured instruments, and has a target size of $140 million and, at the election of i-80, an accordion feature of up to an additional $100 million. The equity, convertible securities and the warrants will be priced based on the Issue Price subject to TSX approval.

“The financing packages secured and being pursued with Nevada Gold Mines and Orion, combined with interim processing arrangements, are meant to provide i-80 with the ability to immediately begin development of its substantial portfolio of advanced stage deposits located in one of the world’s most favourable jurisdictions for mining”, stated Matthew Gollat, EVP Business & Corporate Development for i-80. “The financing packages were structured to limit dilution to our shareholders while providing the Company with potential capacity to aggressively grow our business.”

This news release does not constitute an offer to sell or a solicitation of an offer to buy the common shares described herein in the United States or in any other jurisdiction, nor shall there be any sale of the common shares in any state in which such offer, solicitation or sale would be unlawful. The common shares have not been and will not be registered under the U.S. Securities Act, or any state securities laws, and accordingly, may not be offered or sold in the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom.

Financial & Legal Advisors

For the Lone Tree acquisition and financing, RBC Capital Markets is acting as financial advisor to i-80 and Bennett Jones LLP and Davis Graham & Stubbs LLP are acting as legal advisors.

For the Ruby Hill acquisition, Sprott Capital Partners is acting as financial advisor to i-80 and Dorsey & Whitney LLP is acting as lead legal advisor.

Conference Call & Webcast

The Company will host a live conference call and webcast on September 7, 2021, commencing at 8:30 am ET, providing the opportunity for analysts and investors to ask questions of i-80 Gold’s executive team.

Conference Call

North American Toll-free: 1-800-437-2398

Local: 1-647-792-1240

Webcast Link

Click HERE to access the webcast or visit our website at www.i80gold.com.

Conference Call Replay

A recording of the call can be accessed until September 14, 2021.

North American Toll-free Replay: 1-888-203-1112

Replay Code: 8375917

Notes:

Mineral resources are not mineral reserves and do not have demonstrated economic viability. See Tables 1, 2 & 3 at the end of this press release for Ruby Hill and Lone Tree mineral resource estimates and qualifiers. Ruby Hill effective date July 31, 2021, gold price $1,650/oz Au., Open pit cut-off grade 0.1 g/t Au. Lone Tree effective date July 31, 2021, gold price $1,650/oz Au, Open-pit cut off grade 0.65 g/t Au.

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada-focused mining company with a goal of achieving mid-tier gold producer status. The Company expects to close the acquisitions of the Lone Tree Complex and the Ruby Hill Project in H2 2021 and is advancing an underground development program for the 100%-owned Granite Creek Project and intends to advance the McCoy-Cove Property. i-80 is well financed with more than $70.1 million (as at June 30, 2021) in cash and has recently signed financing agreements with Nevada Gold Mines and non-binding term sheet with Orion to provide access to as much as $240 million.

Lone Tree Qualified Person

GeoGlobal LLC., under the supervision of Abani R. Samal, Ph.D., RM- SME, Fellow-SEG., a Qualified Person within the meaning of National Instrument 43-101 (“NI 43-101”), is the Qualified Person responsible for the Lone Tree mineral resource estimate. A technical report detailing the mineral resource estimate will be filed with Canadian Securities regulators within 45 days. Historic assays were most commonly sent to internal company labs of Newmont, Santa Fe, and Battle Mountain before being switched to ALS Chemex (now “ALS Minerals”), an independent, ISO 9001 accredited commercial mineral assay lab at the time. Common analytical methods used include fire assay, atomic absorption, gravimetry, and screen fire.

Ruby Hill Qualified Person

Mr. Christopher Wright, P. Geo., a Qualified Person within the meaning of NI 43-101, is the Qualified Person responsible for the Ruby Hill mineral resource estimate. Mr. Wright is an employee of Wood Canada Ltd. A technical report detailing the mineral resource estimate will be filed with Canadian Securities regulators within 45 days. Historic assays were commonly sent to a mix of ALS Minerals, ALS Chemex, and Chemex Labs, all independent labs. ALS Minerals complies with the requirements for the International Standards ISO 9001 and ISO 17025. ALS Chemex complied with ISO 9001. Assays by Chemex Labs were conducted before ISO standards were in place. Historic assaying practices included fire assays with gravimetric finish for samples over 10 grams per tonne.

Technical Information

Tim George, PE, is the Qualified Person for the information contained in this press release and a Qualified Person within the meaning of NI43-101.

For further information, please contact:

Ewan Downie – CEO

Matthew Gollat – EVP Business & Corporate Development

1.866.525.6450

Info@i80gold.com

www.i80gold.com

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including but not limited to, completion of the transactions contemplated by the Exchange Agreement, completion of the transactions contemplated by the Ruby Hill Agreement, completion of the equity private placement with NGM, Equinox Gold Corp. and/or other subscribers, completion of the financing transaction with Orion, completion of refurbishment and development activities at the Long Tree project, commencement of mining operations at the Lone Tree project or the Ruby Hill mine or mineral resource and reserve estimates and exploration, development and production potential. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the Company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: failure to satisfy of the relevant conditions to the completion of the transactions described herein, failure to obtain the relevant regulatory approvals, material adverse changes, exercise of termination rights by any relevant party, unexpected changes in laws, failure to complete the Orion financing transaction on satisfactory terms, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration, refurbishment, development or mining programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Cautionary Note to U.S. Investors Concerning Estimates of Resources: This press release uses the term “inferred resources.” “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. Information contained in the press release containing descriptions of any mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder that disclose mineral reserves and mineral resources in accordance with Industry Guide 7 or the SEC’s new mining disclosure rules in Regulation S-K 1300. SEC Industry Guide 7 does not recognize the existence of resources. Under Regulation S-K 1300, reserve and resource definitions are substantially similar to the corresponding CIM Definition Standards; however, there are differences between NI 43-101 and Regulation S-K 1300 and therefore information contained in the press release may not be comparable to similar information made public by public U.S. companies pursuant to the Regulation S-K 1300 or SEC Industry Guide 7.

$I-80 GOLD INTERSECTS HIGH-GRADE GOLD IN OPEN PIT DRILLING AT GRANITE CREEK