Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

ECOR

electroCore Inc

5.83

0.21 (3.74%)

Volume: 11,502

Day Range: 5.62 - 5.986

Bid: 5.70

Ask: 5.99

Last Trade Time: 4:00:00 PM EST

Total Trades: 180

thank you for the update $ECOR

Yesterday's presentation was informative, value and shows the great potential for ECOR

ECOR

electroCore Inc

5.9293

0.1593 (2.76%)

Volume: 10,489

Day Range: 5.8317 - 6.31

Bid: 5.52

Ask: 5.92

Last Trade Time: 4:00:00 PM EST

Total Trades: 201

$ECOR good news

Record third quarter 2023 net sales of $4.5 million, an increase of approximately 128% over third quarter 2022

Company increases revenue guidance for full year 2023 to $15.0 million - $15.5 million

Data Highlighting Non-invasive Vagus Nerve Stimulation (nVNS) for Treatment of Symptoms of Gastroparesis Presented at 2023 American College of Gastroenterology Annual Meeting • GlobeNewswire Inc. • 10/24/2023 12:00:00 PM

6 NEWS ITEMS FOR OCTOBER

Data Highlighting Non-invasive Vagus Nerve Stimulation (nVNS) for Treatment of Symptoms of Gastroparesis Presented at 2023 American College of Gastroenterology Annual MeetingGlobeNewswire | 10/24/2023

electroCore Announces Two-Year Extension of gammaCore™ Device Listing in the NHS Supply Chain CatalogueGlobeNewswire | 10/17/2023

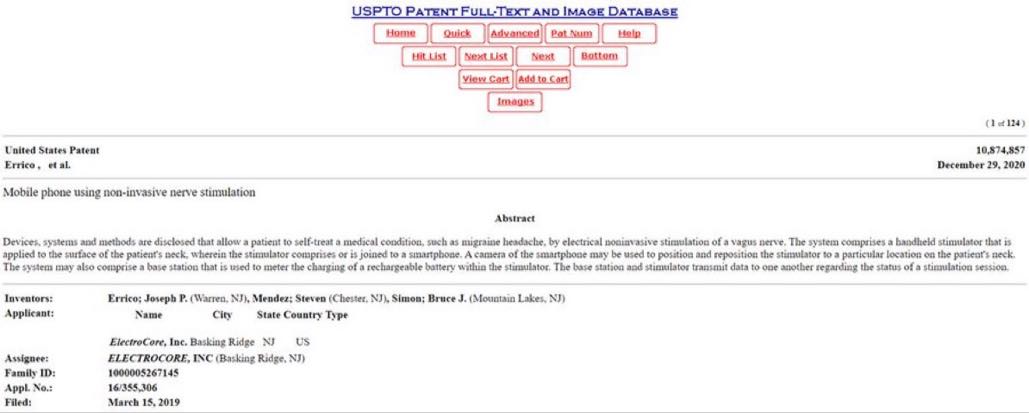

electroCore Expands Intellectual Property Portfolio for Non-Invasive Vagus Nerve Stimulation (nVNS) TechnologyGlobeNewswire | 10/11/2023

Data Highlighting Non-Invasive Vagus Nerve Stimulation (nVNS) for Treatment of Acute Neurological Injury Presented at 2023 World Stroke CongressGlobeNewswire | 10/10/2023

electroCore to Announce Third Quarter Financial Results on Wednesday, November 8GlobeNewswire | 10/09/2023

electroCore to Participate in the Lytham Partners Fall 2023 Virtual Investor ConferenceGlobeNewswire | 10/05/2023

HAPPY FRIDAY 11-03-2023

PPS BASING NICELY PETER $ECOR

Financial release next week. Maybe it will have another move

hi peter, was out shopping. anything could $ECOR otc pinks still bear mode

10-0-15-2022

$ECOR good moving and maybe major news around the corner

GOOD MORNING PETER

electroCore to Present at iAccess Alpha’s – Top 10 Best Ideas from the Buyside Virtual Conference

ECOR

electroCore Inc

5.09

0.14 (2.83%)

Volume: 23,284

Day Range: 4.75 - 5.02

Last Trade Time: 7:18:11 PM EDT

$ECORhi peter, great news item <> commercial-stage bioelectronic medicine and wellness company

$ECOR electroCore, Inc. Announces Distribution Agreement with Reliefband Technologies, LLC

Source: GlobeNewswire Inc.

electroCore, Inc. (Nasdaq: ECOR), a commercial-stage bioelectronic medicine and wellness company, announced today that ReletexTM by Reliefband, the first and only FDA cleared non-invasive neuromodulation device available by prescription for nausea and vomiting, will be distributed and billed exclusively by electroCore, Inc. within the Department of Veterans Affairs (VA) and other Federal Supply Schedule (FSS) eligible entities.

“Reliefband is a leading innovator in wearable technology for the treatment of nausea and vomiting,” commented Rich Ransom, Chief Executive Officer of Reliefband Technologies. “Partnering with electroCore to distribute our prescription non-invasive, non-drug, neuromodulation device seemed like a natural fit. We are excited about the collaboration and hopeful the relationship will provide our veterans access to another FDA cleared non-drug solution.”

“We are thrilled to be offering the Reletex product within VA hospitals and other FSS eligible entities,” commented Dan Goldberger, Chief Executive Officer of electroCore. “We continue to build out our commercial sales organization and look for unique and complementary therapies which can be made available to our customer base. The drug-free, patient-controlled Reletex product is ideal for veterans suffering from nausea and vomiting and we believe it will be well adopted by customers who utilize neuromodulation devices such as our existing gammaCore™ therapy to treat medical conditions.”

About Reliefband Technologies, LLC

Reliefband is a world leader in neuromodulation and wearable technology. The company’s patented, clinically proven wearable solution quickly prevents and effectively treats nausea and vomiting. Its unique, FDA-cleared neuromodulation technology was originally developed for use in hospitals and alters nerve activity through targeted delivery of gentle pulses to the underside of the wrist to “turn off” feelings of nausea and vomiting. Reliefband is a drug-free alternative that eliminates the discomfort associated with nausea and vomiting. The Reliefband wearable solution has been an industry leader for more than 20 years and is available OTC, at Reliefband.com and Amazon.com.

About ReletexTM

Reletex is an advanced pulse generator that utilizes neuromodulation technology. It is the First-Class II neuromodulation device cleared by the FDA for the therapy of nausea and vomiting. Reletex is a single patient use device and can function with its included set of non-replaceable/non-rechargeable batteries for approximately 150 hours when used on setting 3. Reletex is available by prescription for the treatment of nausea and vomiting as an adjunct to antiemetics.

About electroCore, Inc.

electroCore, Inc. is a commercial stage bioelectronic medicine and wellness company dedicated to improving health through its non-invasive vagus nerve stimulation (“nVNS”) technology platform. Our focus is the commercialization of medical devices for the management and treatment of certain medical conditions and consumer product offerings utilizing nVNS to promote general wellbeing and human performance in the United States and select overseas markets.

For more information, visit www.electrocore.com.

Forward-Looking Statements

This press release and other written and oral statements made by representatives of electroCore may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements about electroCore's business prospects and clinical and product development plans; its pipeline or potential markets for its technologies; the timing, outcome and impact of regulatory, clinical and commercial developments; the Company’s business prospects through distribution of Reletex within the Department of Veterans Affairs or other FSS eligible entities or other new markets or other distribution agreements and other statements that are not historical in nature, particularly those that utilize terminology such as "anticipates," "will," "expects," "believes," "intends," other words of similar meaning, derivations of such words and the use of future dates. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, the ability to raise the additional funding needed to continue to pursue electroCore’s business and product development plans, the inherent uncertainties associated with developing new products or technologies, the ability to commercialize gammaCore™, the potential impact and effects of COVID-19 on the business of electroCore, electroCore’s results of operations and financial performance, and any measures electroCore has and may take in response to COVID-19 and any expectations electroCore may have with respect thereto, competition in the industry in which electroCore operates and overall market conditions. Any forward-looking statements are made as of the date of this press release, and electroCore assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law. Investors should consult all of the information set forth herein and should also refer to the risk factor disclosure set forth in the reports and other documents electroCore files with the SEC available at www.sec.gov.

Contact:

ECOR Investor Relations

(973) 302-9253

investors@electrocore.com

ECOR

electroCore Inc

5.48

0.54 (10.93%)

Volume: 25,150

Day Range: 4.95 - 5.48

Last Trade Time: 7:20:13 PM EDT

ECOR

electroCore Inc

4.10

0.06 (1.49%)

Volume: 79,182

Day Range: 4.05 - 4.19

Last Trade Time: 4:53:14 PM EDT

All good Pete .We took a large pos in WBD -its the future of streaming hope you are enjoying life fruits of your labor....

ECOR

electroCore Inc

5.035

-0.295 (-5.53%)

Volume: 12,498

Day Range: 5.00 - 5.58

Last Trade Time: 5:49:19 PM EDT

ECOR

electroCore Inc

5.035

-0.295 (-5.53%)

Volume: 12,498

Day Range: 5.00 - 5.58

Last Trade Time: 5:49:19 PM EDT

ECOR

electroCore Inc

6.10

-0.2435 (-3.84%)

Volume: 30,653

Day Range: 6.10 - 6.69

Bid: 6.10

Ask: 6.27

Last Trade Time: 2:53:44 PM EDT

Total Trades: 217

Getting hit up

ECOR

electroCore Inc

6.1394

-0.1005 (-1.61%)

Volume: 12,455

Day Range: 6.05 - 6.355

Last Trade Time: 5:30:29 PM EDT

ECOR

electroCore Inc

6.31

-0.04 (-0.63%)

Volume: 8,948

Day Range: 6.2423 - 6.40

Last Trade Time: 6:57:56 PM EDT

Upgrade to Real-Time

$ECOR $7 on the deck

Let me know the company name and I will buying it. Family is all good. It is all about ROI so anything we can support and help the company, the people and ourselves. I am all in

Thank you Peter. I hope all is going well for you and your family. ECOR has a good product and I hope it helps people. I invested in a friends company that does the same kind of vagus nerve work and it shows promise so ECOR is onto something that can help people and Im all for that. Be well

Just got an email from my son that we sold a good amount of ECOR on Fri that he bought around the 3.00 area and sold above 5.00. that is the reason why he plays these penny stocks. Have a great day and watch for the next big mover. Im watching the waves rolls in lol.

THANK YOU, IT IS, ECOR

electroCore Inc

3.8636

0.2086 (5.71%)

Volume: 11,514

Day Range: 3.67 - 3.9601

Bid: 3.82

Ask: 3.89

Last Trade Time: 2:25:19 PM EDT

Total Trades: 133

Report of eVNS in vivo trial for TBI is GOOD NEWS. TBI treatment is surgery, with 25% or more mortality within 30 days of procedure. Survivors often have post-op neurological deficit, with no current effective treatment available. eVNS can be post-op therapy. Cost of treating TBI can go into mid-6 figures, so price sensitivity for a device isn't an issue. Problem will be to identify sub-groups that will be responsive and conducting long follow up clinical trials. Trauma trials are difficult to do well. Capital intensive and long, but good bet for eVNS technology. TBI treatment would probably be Class III device, depending on claims. Better than head aches.

traders like repore' $ecor

For "outside investors", the present is grim and the future will be worse. ECOR founders & insiders will try to recapitalize company, award themselves post recap options & restricted stock. Early investors will be lucky to get $0.01 on their investment dollar.

until revs higher going under $2

ECOR

electroCore Inc

3.31

0.00 (0.00%)

Volume: 12,727

Day Range: 3.14 - 3.35

Bid: 3.27

Ask: 3.31

Last Trade Time: 3:20:54 PM EST

Total Trades: 173

Expected lifespan of company is 15 months

22.3% share price decline since reverse split. Insiders might buy if price declines after earnings call to support price.

ECOR

electroCore Inc

3.22

0.09 (2.88%)

Volume: 9,337

Day Range: 3.12 - 3.29

Bid: 3.20

Ask: 3.27

Last Trade Time: 4:00:00 PM EST

Total Trades: 219

South Africa GDP per capita - $7,000US. From my experience, not a market to write home about.

|

Followers

|

41

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1032

|

|

Created

|

06/22/18

|

Type

|

Free

|

| Moderators | |||

| Shs Outstand | 29.77M |

| Shs Float | 26.32M |

| Short Float | 11.46% |

| Inst Own | 19.60% |

| Debt/Eq NO DEBT | 0.00 |

| Book/sh | 0.57 |

| Employees | 51 |

| electroCore, Inc., a commercial stage medical device company, engages in the development and commercialization of a range of patient administered non-invasive vagus nerve stimulation (nVNS) therapies. The company is developing gammaCore, a prescription-only nVNS therapy for the acute treatment of pain associated with migraine and episodic cluster headache in adults. Its lead product is gammaCore Sapphire, a rechargeable and reloadable handheld delivery system for multi-year use prescribed on a monthly basis. The company was founded in 2005 and is headquartered in Basking Ridge, New Jersey. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

|

| |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |