Details on my next pick-IWEB

Sorry I did not do this overview before:

IWEB is a Cloud Computing Company (hot sector)with a very low Market Capitalizattion of about $7.2 Million. IWEB is at $0.09 now and the 52 Week Trading Range is $0.05-$0.24

Last quarter, the Gross Margin Increased to 54.5% in the Fiscal First Quarter from 27.2% in the previous year. They cut their liabilities substantially from %9.6 Million to $600,000. But what I really like is that their technology is SELLING to major companies like Google Earth, Exxon Mobil, 2010 Winter Olympics, the 2010 G-20 Summit, the Ministry of Health in Canada and more.

BUT--Last week, IWEB hired on a successful data storage veteran with a pretty impressive resume. Karl Chen was with LeftHand Networks, where he built out the distribution channel. Lefthand was sold to Hewlett Packard for $360 Million. Chen's joining with IWEB, in my opinion, is a precursor to another build out of another distribution channel for an up and coming data storage company (IWEB)to eventually build it to be sold to another major player.

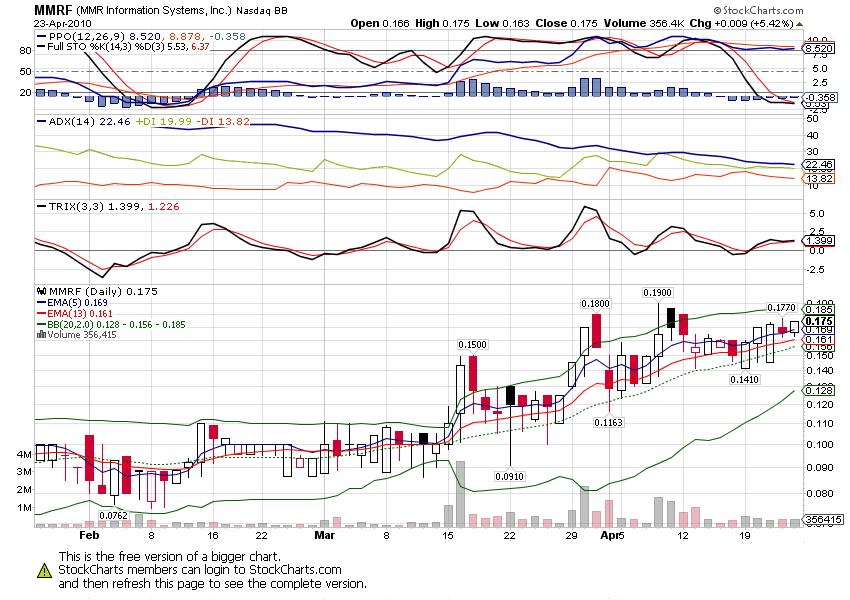

--- IWEB CHART is right at resistance. Expecting IWEB to do well this week.

CEO will be at well-attended investor's conference tomorrow. Watch IWEB for more volume as CEO reviews very recent positive news to a new audience.

Thanks, cargo.