Replies to post #14564 on Keeping It Simple

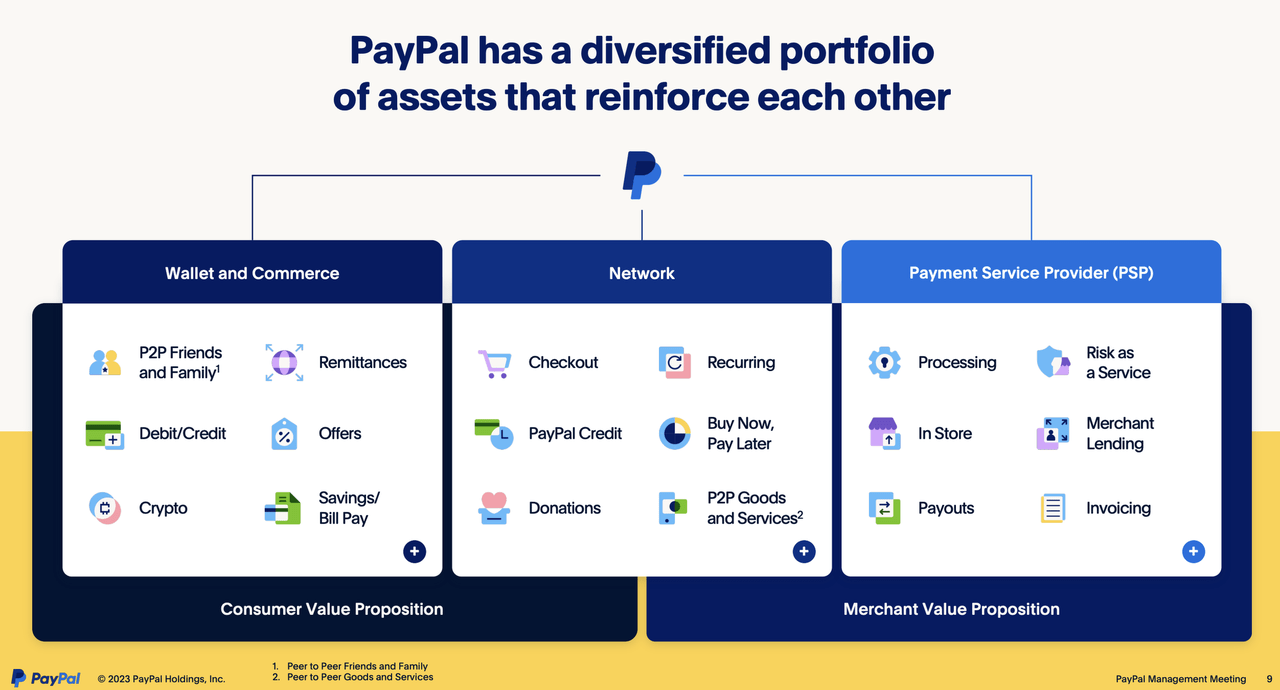

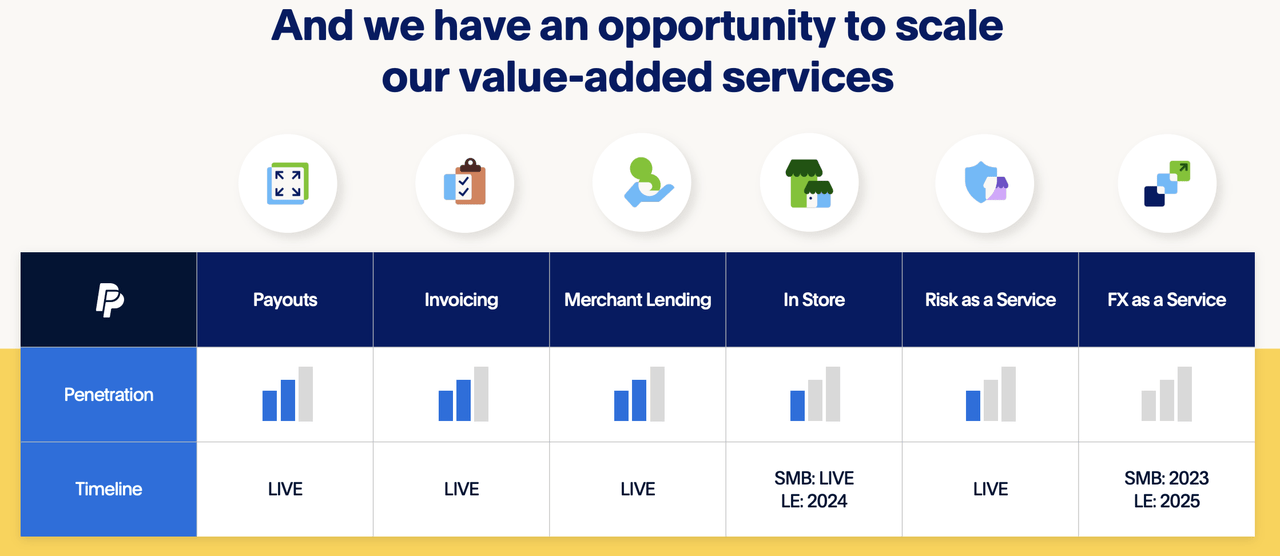

In addition, we talked about PPCP [PCP], which really is bringing a full stack processing capabilities in a full-stack platform to SMBs. We've never been in this market. We've never had a product to compete in this market, and this is amazing white space for us when we think about what we can do for SMBs.

SMBs – the PayPal brand to Checkout button is sort of an essential need for most SMBs. And so we bring real conversion and real lift to their business. The ability now to offer sort of the stack that can give them everything they need with one partner, we think, will be very, very compelling. And that, of course, has a much higher margin profile than what we would have on the LE side.

Let me show you some examples of things that we would do to drive users into becoming PayPal users. One example is package tracking. The value from the consumer is they get to track their packages from order all the way through delivery.

For the merchant, it does 2 things. One is that we've reduced the number of contacts for where is my package; and number 2 is we actually decreased the chargebacks related to non-delivered items. So whether they are a PayPal customer or a non-PayPal customer, we get to offer value added features and make it all available through the PayPal app.

A second example is smart receipts. With smart receipts, we're going to detail the items that are purchased, and then consumers can save these receipts to their PayPal Wallet for easy discovery, to track their history, to manage all of their finances. And within the wallet, what we'll do is we'll provide a surface. So it's very easy for merchants to cross-sell and upsell, giving merchants an ability to double the value of every given transaction, again changing the economics of using PayPal.

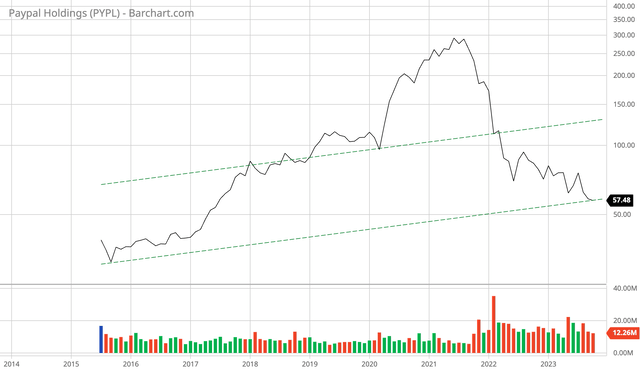

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |