Replies to post #287863 on Hannover House Inc (HHSE)

04/29/19 11:48 AM

04/30/19 2:54 AM

05/03/19 8:31 AM

05/03/19 11:25 AM

05/06/19 1:08 AM

05/07/19 2:09 PM

05/08/19 10:10 AM

.gif)

05/10/19 11:50 AM

05/11/19 2:57 PM

05/12/19 8:48 PM

05/13/19 11:57 AM

05/14/19 11:19 AM

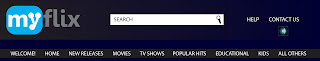

It's getting hard to state the exact count now of available programming for the MyFlix launch - but these two new supplier studios definitely put the inventory at more than 12,000 titles... and the ready-for-initial-launch count at north of 5,000 titles.

05/15/19 2:29 PM

It's getting hard to state the exact count now of available programming for the MyFlix launch - but these two new supplier studios definitely put the inventory at more than 12,000 titles... and the ready-for-initial-launch count at north of 5,000 titles.

05/16/19 10:42 AM

It's getting hard to state the exact count now of available programming for the MyFlix launch - but these two new supplier studios definitely put the inventory at more than 12,000 titles... and the ready-for-initial-launch count at north of 5,000 titles.

05/17/19 12:35 AM

05/21/19 8:04 AM

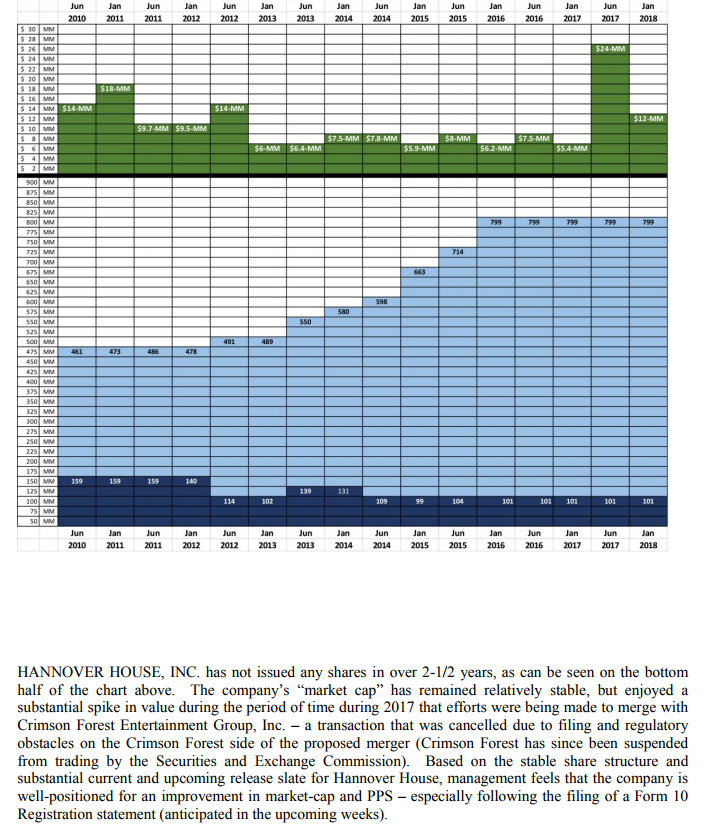

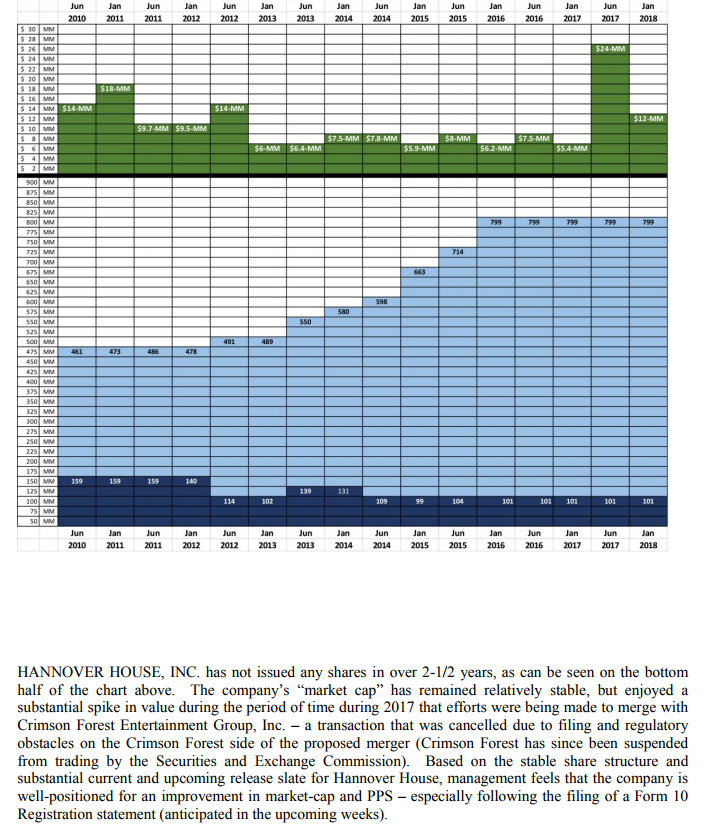

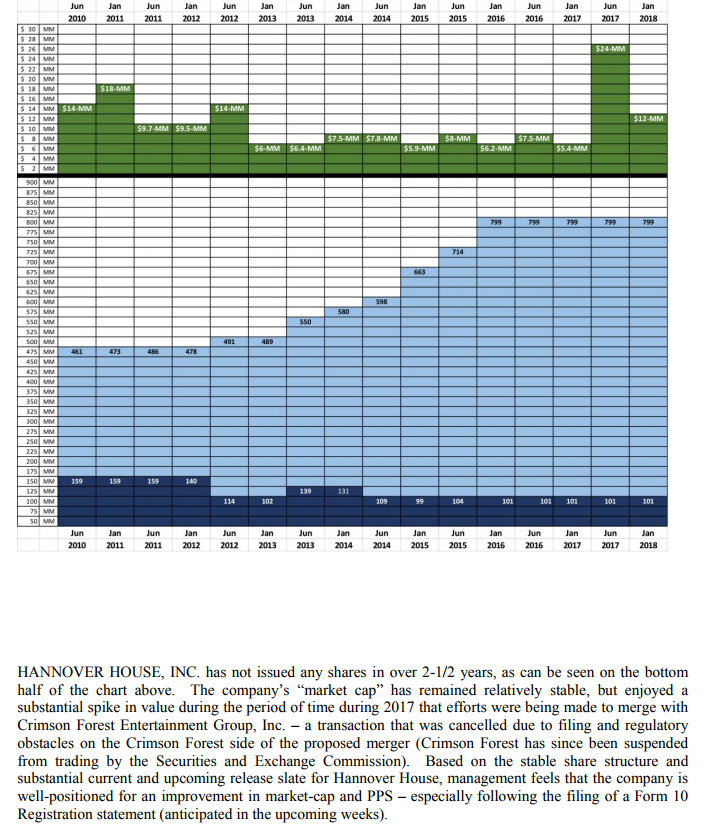

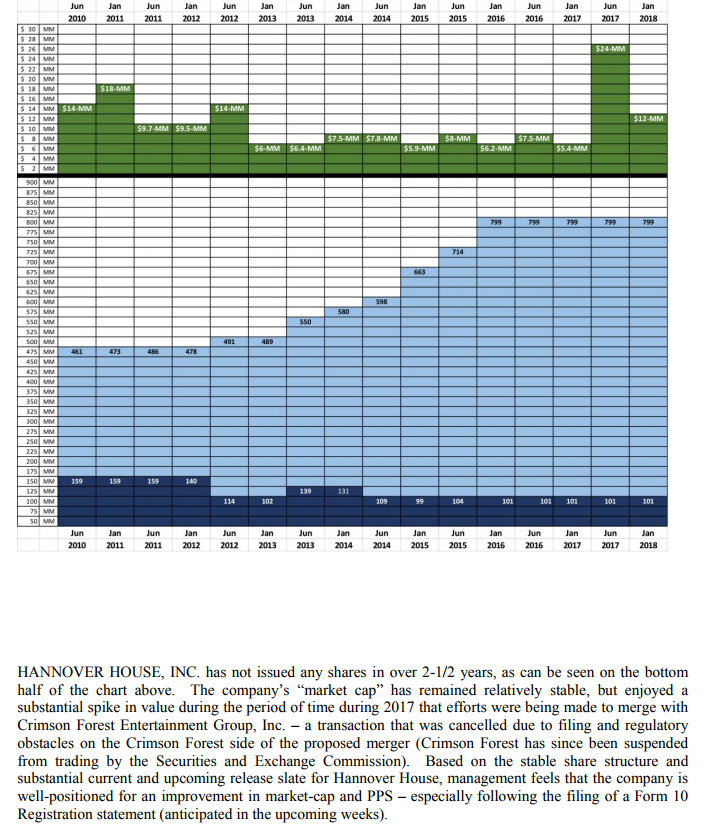

While there are over 2,000 individual shareholders holding stock in Hannover House, Inc., the vast majority of freely-trading shares are held by approximately thirty-two (32) total shareholders, whose combined HHSE holdings collectively represent over 85% of the total of all shares. It's the long-support and significant positions of these "friendly longs" that has given HHSE stock its strong buoyancy and resilience, despite extraordinary efforts by short-sellers and stock-board trolls over the years to negatively impact the PPS.

http://hannoverhousemovies.blogspot.com/2019/04/hannover-house-update-on-shareholders.html

We received an email confirmation this morning from the OTC Markets that our year-end filings were finally approved under full compliance under the new disclosure requirements. The biggest delay was the belief by the OTC Markets that HHSE had neglected to "fill out" the Item 3 Chart of STOCK ISSUANCES over the prior two years. They could NOT believe that an OTC Pink company had VIRTUALLY ZERO STOCK ISSUANCES in the prior two years, and therefore, held-up approval of our filing until we filled out their Item 3 Table. It was not until after the Transfer Agent verified that HHSE had NOT issued any stock in the past two years - in fact, NO SHARE ISSUANCES in the prior 42-months - that the OTC Markets accepted our filing as complete.

http://hannoverhousemovies.blogspot.com/2019/05/hhse-compliance-otc-markets.html

05/23/19 11:33 AM

05/23/19 11:50 AM

It's getting hard to state the exact count now of available programming for the MyFlix launch - but these two new supplier studios definitely put the inventory at more than 12,000 titles... and the ready-for-initial-launch count at north of 5,000 titles.

05/23/19 5:09 PM

.gif)

06/03/19 3:16 AM

06/04/19 7:23 PM

06/06/19 5:49 PM

06/07/19 2:04 PM

06/07/19 11:32 PM

06/07/19 11:58 PM

06/08/19 12:32 AM

06/08/19 1:02 AM

06/09/19 6:38 PM

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |