Replies to post #30071 on Pilgrim Petroleum Corp. (PGPM)

05/18/17 11:53 PM

05/19/17 12:48 AM

05/19/17 6:51 AM

05/19/17 6:57 AM

05/19/17 6:59 AM

05/19/17 5:48 PM

Pilgrim Petroleum PLC a private company and subsidiaries, an independent oil and gas company, has completed its acquisition of an 79% controlling interest in the announced acquisition of Bakken, Eagle Ford and Woodford Shale assets for approximately $330 million net of customary closing adjustments. The assets include approximately 210,000 acres with most of the position held by production.

Addison, TX -

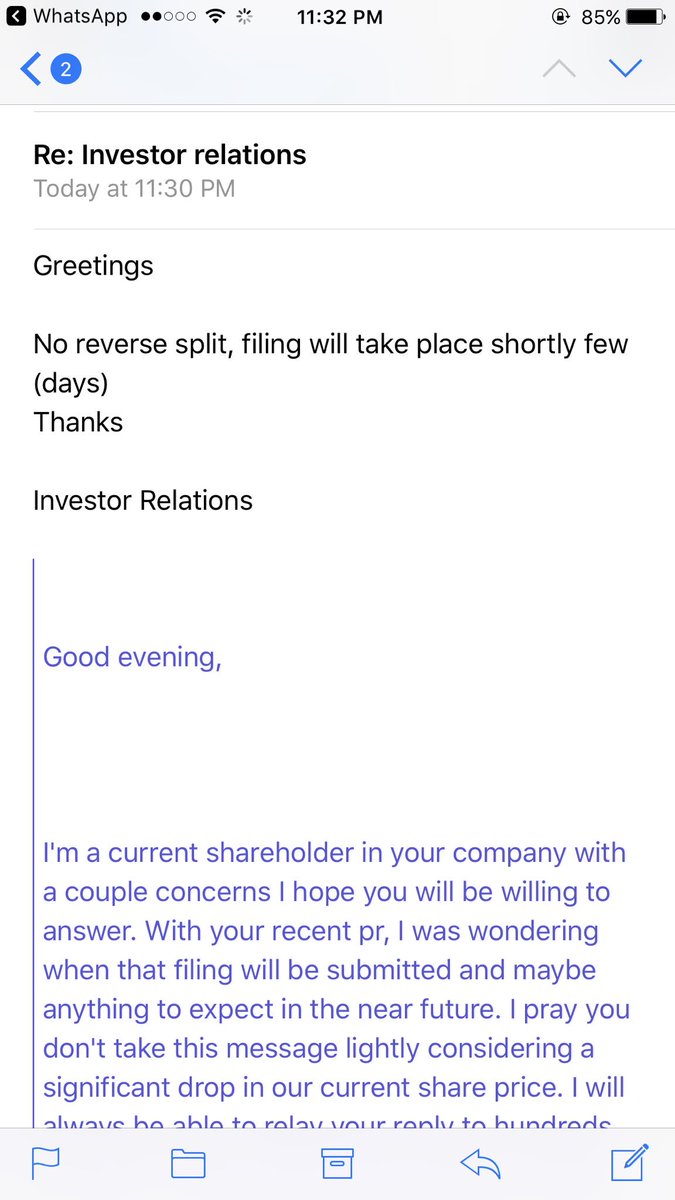

Addison, Texas â?? April 27, 2017 Pilgrim Petroleum Corporation (PGPM), an independent oil and gas company and parent of Pilgrim Petroleum PLC, is pleased to announce that the company will be filing initial Information Disclosure as Q1 2017 operations and proceed with reorganization plans including filing of all disclosures required by OTC Markets, FINRA and SEC. This also will include an additional investment to enable RETIRING ALL OR NEARLY ALL THE CURRENT LIABILITIES OF THE COMPANY. This reorganization and additional investment continues the strong belief in and commitment in the company and assets.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |