3-13-17 Qtly CC-Transcript, PR(Financials Q3FY17/qe1-31-17), updated Avid Revenues History Table By Quarter…

=> Total Revs May06-Jan17: $213.3mm/Avid + $24.1mm/Govt + $2.4mm/Lic. = $239.9mm.

Cash at 1-31-17: $41.5mm (Op. Cash Burn for q/e 1-31-17 was $6.3mm – see below).

As of Mar. 10, 2017, there were 297,709,478 shares outstanding.

This large post has 3 sections:

I. 3-13-17 Q3/FY17 Qtly. Earnings Conf. Call TRANSCRIPT (q/e 1-31-17)

II. 3-13-17 PPHM Press Release: Q3/FY17 Earnings & Developments

III. Updated Table of Avid Revenues By Quarter (May’06-Current)

…Recall: Peregrine’s FY runs May-Apr, so FY’17 = May’16-Apr’17.

((( Orig. transcript from SeekingAlpha.com [ http://tinyurl.com/zjnz76k ], with numerous corrections made. )))

Link to webcast replay: http://ir.peregrineinc.com/events.cfm => http://edge.media-server.com/m/p/2aw6274a

FULL TRANSCRIPT… 3-13-2017 FY’17/Q3 Earnings Conf. Call (q/e 1-31-17) (King/Shan/Worsley/Lytle)

WELCOME & FWD-LOOKING STATEMENTS: Tim Brons, Vida Strategic Partners (IR) http://www.peregrineinc.com

CEO STEVE KING – OPENING COMMENTS:

Thanks to all of you who have dialed in, and to all of you who are participating via webcast today. During the quarter, Avid’s revenue growth continued, representing a strong indicator of the increasing value of this contract development & mfg. organization, or CDMO, business. The steady growth of this business over the past 5 years has been remarkable, at almost 40% compounded annual growth rate, and we are pleased to see the trend continuing, even as we move through a number of process validations for clients, which we believe and expect to further support growth in the future, as potentially some or all of these products enter commercialization. Commercial production has been the cornerstone of our revenue growth, and being able to potentially expand the number of commercial products we manufacture, while supporting the expansion of the existing commercial products into new territories, is a priority. Making these process validation activities, along with the recent successful preapproval inspection for a major market, are very important milestones and are continuing to grow the Company. We already produce drug specimens for several commercial products that are marketed in over 15 countries. Taking together, we are building a solid foundation for future growth of the business through new introductions and by continuing to support the current customers through clinical development and into commercialization. An important component of our Avid growth strategy is capacity expansion within our Myford facility. We are currently on track to install two 2,000-liter bioreactors in the facility within the next few months, with a book of business for the reactors already in place. We believe the total capacity potential of the facility, when operating in campaign mode, can exceed more than $75mm annually, bringing us to well over $100mm in total potential revenue between our 2 mfg. facilities, providing us with adequate capacity to continue Avid revenue growth through FY’18. As we look beyond this FY and into the future, based on current operations & projected demand from our clients, we have also recently secured addl. space adjacent to our Myford facility, which we already have the use for as part of our growing operations. And additionally, would also allow us to further expand mfg. capacity based on committed business. While we will only begin converting space into mfg. capacity once client commitments and other necessary financing is in place, this puts us in an excellent position for continuing to grow the business beyond the coming FY. We already see Avid as a tremendously important asset with solid upside potential that it often overlooked as a value driver for the overall company. With projected revenue of over $60mm for the current FY, this is already a strong business in an industry that is expecting substantial growth over the next decade, and we are excited about future of the Company. We believe the recent improvement of stock price is a growing recognition of the value of Avid, and having the full value of the Avid business reflected in our stock price is a top priority.

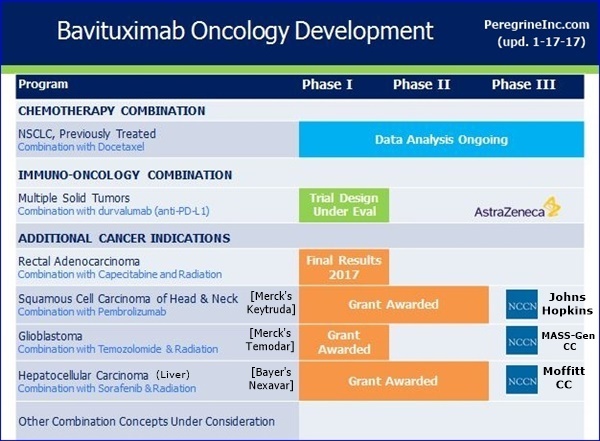

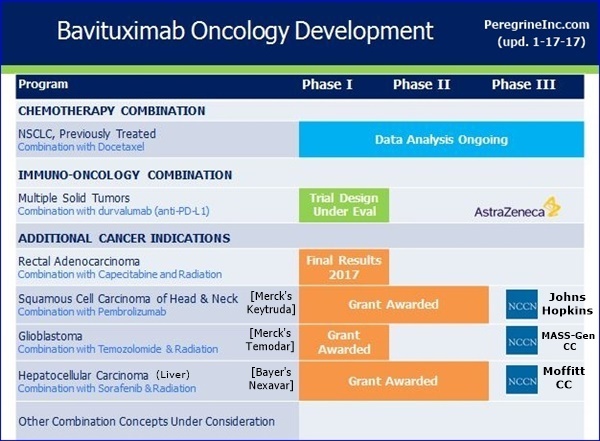

During the quarter, we also achieved a number of goals on the other side of our business, drug development. While we are moving our dev. programs forward on a tight budget, we are working with some of the top research institutions in the world to explore the best ways to advance our lead bavituximab program. These efforts are highlighted by the 3 clinical trials under our collaboration with the National Comprehensive Cancer Network (NCCN), which are advancing as planned, and we expect at least 2 of the trials to be initiated by mid-year. Also during the quarter, working independently and in conjunction with our collaborators, we had multiple abstract accepted for presentations at AACR’17 in April [AACR’17:http://tinyurl.com/zzldh9n ]. These findings reinforce our belief that an immune activating mechanism, like bavituximab, can be an important component of combination cancer treatment approaches by significantly impacting the tumor microenvironment, creating a more favorable environment for checkpoint inhibitors. We look forward to further emphasizing the value of this research as the presentations are made and as the new trials get underway. Needless to say, we are excited to be working together with the world class researchers and clinicians at Memorial Sloan Kettering, UT Southwestern, and the NCCN.

Additionally during the quarter, our collaboration at the UTSW-MC published positive proof-of-content data for our recently licensed Exosome-based Cancer Detection Platform [2-9-17/UTSW’s Dr. Alan Schroit, PPHM SAB: http://tinyurl.com/jhv57ua ], which could have broad potential for patients with cancer. Results of the study showed that researchers were able to distinguish between healthy subjects and patients with ovarian tumors, based on the level of exosomes containing phosphatidylserine found in their blood. Further analysis of the PS positive exosome levels allowed researchers to further distinguish between malignant and benign tumors. While the work in this program is early, we are highly encouraged by the observed cancer detection capability of this platform, and we are actively seeking a partner to advance this diagnostic.

As a whole, even though we have reduced our R&D expenditures, we are pleased that collaborations, such as those with Memorial Sloan Kettering, NCCN and UTSW [Collabs: http://tinyurl.com/heg9t3v ], are allowing us to continue the advancement of our therapeutic & diagnostic programs as we continue to evaluate the best ways for advancing bavituximab and other PS targeting agents. The combined effort of the Avid bio-manufacturing business and these important collaborations are allowing us to make great strides in all fronts. I will now turn the call over to the other members of our team who will give you a detailed overview of our clinical and corporate activities, as well as our Avid Bioservices contract mfg. business. We will begin with Joe Shan...

JOE SHAN (VP/Clin.&Reg. Affairs) – CLINICAL TRIALS:

During the quarter, we continued to wrap-up patient treatment and follow-up with our SUNRISE trial. While the study was discontinued in Feb.2016, follow-up data collection continues, and patients assigned to bavituximab containing arm were allowed to continue receiving study drugs, if the investigators determined it was in the patients’ best interest. This has been a valuable effort and we are very pleased with the amount of data that has been collected over the past year. It is important to mention that we are now working diligently to transition the remaining patients still receiving bavituximab to compassionate-use programs. We have recently concluded data collection and are now working towards day-to-day slots and beginning our final analyses, and hope to present results later in the year. We’re in the meantime evaluating ways to advance bavituximab with immune stimulating therapies as resources permit, while supporting the stated corporate profitability goals. Concurrently, we’re completing patient sample testing from the comprehensive SUNRISE Biomarker Program [Biomarkers: http://tinyurl.com/jrenezs ]. Biomarkers play an increasingly important role in helping identify specific patient characteristics that correlate with or even potentially predict response to a treatment. For this reason, our SUNRISE study protocol pre-specified the collection of thousands of patient samples for exploratory analyses over a wide range of possible biomarkers. Through this effort, our team identified a correlation between pre-treatment levels of beta-2 glycoprotein-1 [B2GPI] and overall survival, which was presented at ESMO last October. In early April, at the upcoming AACR Annual Meeting, we will present data from an analysis of pre-treatment interferon gamma [IFN-y]. As the remaining SUNRISE patient samples are tested, we plan to correlate these data with the final clinical data, and plan to share these results as they become available later this year.

Now turning to new trials, I’m happy to report that the 3 clinical trials to be funded through our collaboration with the NCCN are advancing as expected. The first study, expected to begin patient enrolment shortly, is being conducted by Dr. Jessica Frakes, at the Moffitt Cancer Center. This study, which builds upon a prior investigator sponsor trial, will evaluate the combination of Stereotactic Body Radiation Therapy, sorafenib, and bavituximab, for the treatment of Unresectable Hepatocellular [Liver] Carcinoma. We are interested in this trial design as radiation has been shown to increased PS expression on the surface of tumor cells, induce immunogenic tumor cell depth, and increase tumor specific T-cell activity. In addition, NCCN has recently communicated that both the study of bavituximab, temozolomide, and radiation in newly diagnosed Glioblastoma and the trial of bavituximab & temozolomide in recurrent Head & Neck cancer, which has progressed on checkpoint inhibitor treatment, are on track to be initiated by mid-year. This concludes my comments today. I’ll now turn the call over to Steve Worsley…

----------NCCN:

[...#1: Ph1/HepC-Related Hepatocellular(Liver) (Bavi+RAD+Sorafenib), MOFFITT CANCER CENTER - PI: Jessica Frakes, MD - https://clinicaltrials.gov/ct2/show/NCT02989870

...#2: P1-2/Newly Diag. Glioblastoma (Bavi+RAD+Merck’s Temodar), MASS-GEN. CANCER CENTER - PI: Elizabeth Gerstner, MD

...#3: Ph2/Progressive Squamous Head+Neck (Bavi+Merck’s Keytruda), JOHNS-HOPKINS(Sidney Kimmel CC) - PI: Ranee Mehra, MD (See: http://tinyurl.com/h8gzkww ) ]

STEPHEN WORSLEY (VP/Bus.Dev.)

As previewed by Steve, our Avid business is strong and we are taking steps to establish sustained growth in the near-term and in the future. In the near-term, we are aggressively working to expand our client base, and in Q3 we signed another new client for a late-stage clinical product. We are currently in discussions with a number of prospective new clients, and we expect to sign addl. clients in the coming months. In the long-term, it is essential that we read the market appropriately and respond to the existing needs. At last year’s ISPE/FDA/PQRI Quality Meeting in WashDC, industry leaders gathered to address the most important trends and pressing needs of the CDMO industry with several key takeaways. First, the industry is set for a biologics boom. Today, amongst all pharmaceuticals segments, the oncology market is experiencing the fastest growth at 11% annually. Biosimilars are expected to grow to 25B by 2020, and biologic sales, which currently represent 45% of the top 100 drugs, are expected to increase to 52% by 2020. It is important to note that a majority of our clients are focused on the fast-growing biologics segment of the oncology market. One of the most serious points made by industry leaders was the need to address drug shortages, which, according to Janet Woodcock (Dir. of the FDA CDER) poses a huge risk to patients. According to the FDA, drug shortages peaked in 2011 with 251 shortages reported. Since then, 117 new drug shortages were reported in 2012, with another 44 reported in 2013. A large portion of drug shortages have been and continue to be sterile injectable and other acute drugs, including oncology drugs. Two of the major reasons for such shortages are quality mfg. problems and a lack of production capacity. In consideration of the CDMO industries’ greatest needs, including biologics production expertise, continuous manufacturing, quality and capacity, Avid is uniquely positioned to thrive in the future. Myford is a state-of-the-art model facility capable of providing our customers with the expertise, capacity, and quality required to support the drug supply demand of the pharmaceutical industry. Our quality standards are among the highest in the industry, and we just successfully completed another FDA preapproval inspection in Feb.2017, receiving zero 483 citations. With our current & planned facilities, we believe Avid is well positioned to respond to the needs of this industry and take advantage of this growing global market. This concludes my comments today. I’ll now turn the call over to CFO Paul Lytle…

PAUL LYTLE (CFO): [1-31-17 10Q iss. 3-13-17: http://tinyurl.com/zlozrv4 ]

Before I begin, I’d like to reiterate our financial goal of achieving profitability on an overall basis, starting 15 months from this current qtr-end. Our strategy for achieving this goal is to grow revenue from our contract mfg. business, while reducing our overall spending on R&D. During the first 9mos of FY17, we have made excellent progress toward both of these goals. I’ll first address our contract mfg. revenue. During Q3/FY17, we reported revenue of $10.7mm, and we’ve recognized $39.7mm over the past 9mos. This represents revenue growth of 61% for the qtr and 55% for the 9mos, compared to the same prior year period. Now looking ahead, we are increasing our full FY17 [fye 4-30-17] revenue guidance from $50-55mm to $60-65mm that is supported by our current revenue backlog of $70mm under committed contracts. This new revenue guidance translates into potential revenue growth of between 35% & 47% over FY16.

I’ll now address our efforts to reduce overall spending on R&D. As we announced last July, our R&D strategy has changed. Our goal was to reduce R&D spending by 50% this FY, and to focus our internal drug development efforts on small, cost effective, early stage clinical trials designed to attract potential partners to further advance our products. As we executed on this plan, our R&D expenses for Q3 and 9mo periods decreased 60% & 50% respectively compared to the same prior year period, confirming we are on track with this significant decrease in R&D spending. The result of the strategy has translated into a reduction in our net loss by 54% for Q3 and 48% for the 9mo period vs. the same prior year periods. And while we have achieved a significant decrease in our net loss this FY, our cash position has also decreased by approx. $20mm since the beginning of the FY. Therefore, we want continue to be diligent & thoughtful in our capital raising efforts. To maintain a stable and growing mfg. business, we must continue to raise sufficient capital to support this business. During the current 9mo. period, we carefully raised $11.6mm in net proceeds from the sale of common stock vs. $43.4mm we raised during the same period last year. Our mfg. business is not only valued based on the quality of the operations, but is also based on our ability to sustain our operations. As the business expands, our cash on hand should also increase to support this growing operation.

Switching gears now, I’d like to address our plans to preserve our NASDAQ listing. At a backdrop, last April, we were notified by the NASDAQ that our share price did not meet the $1 min. bid price for 30 consecutive days, which is a requirement for continued listing on the NASDAQ market. At that time, we were automatically afforded an initial compliance period of 180 days or until Oct. 10, 2016 to regain compliance. At the end of the initial compliance period, we requested and were granted a 180 day extension to regain compliance. This 2nd extension period will end on April 10, 2017. Let me discuss our strategy and future steps we plan to take over the next few months. First & foremost, we have determined that it is not in the best interest of our stockholders to affect a reverse stock split prior to April 10, 2017. If our share price does not trade above $1 for 10 consecutive trading days by April 10th, we expect to receive a notice of delisting. If we received this notice, we will appeal this decision within the required 7 days and this appeal will stay any delisting actions by NASDAQ. At that point, NASDAQ will schedule a hearing, which is typically held within 45 days, and we will present our plan to regain compliance. We are considering several paths to regain compliance, including having addl. time to continue to allow the market to adjust, to reflect the current value of Avid as evidence with the recent movement in our share price. The hearing panel could afford us up to 180 addl. days to regain compliance, although this addl. time is not guaranteed and this decision is at the discretion of the NASDAQ’s hearing panel. If we are not afforded addl. time from this panel, it is important to note that our stockholders approved the Board’s ability to implement a reverse stock split at a ratio of up to 1:7 as a means to regain compliance and to preserve our listing on NASDAQ. During this entire process, Peregrine will continue to be listed on that NASDAQ capital market as it does today. We will keep you informed on any material developments through our SEC filings on Form 8-K as we execute on this plan. With that, this concludes my financial overview. And I will now open the call up for questions...

Q&A: [beg. 20:30]

1. Kumara Raja - Noble Life Science Partners http://noblelsp.com/research

KR: ”On the Exosome-based cancer detection platform, you presented some positive data on the ovarian cancer. What other cancers, there is expression of possible serum and what kind of trials are you guys conducting there? And what is the next step for collaboration for this platform, like what needs to be done in terms of trials that need to be done and the state of offset? And also, in terms of the SUNRISE trials, what are you seeing in patients who are continuing on bavituximab? What kind of benefits are you seeing there? And you’ve talked about Compassionate Use Program, what needs to be done for that in different countries? And then, in terms of cost of contract mfg., it looks like that there has been an increase during Q3 compared to the similar time frame last year. What is the reason for that? And what should we expect in terms of cost of manufacturing going forward?”

Steve King: I’ll take a stab at the first piece of this, and then turn it over to Joe to answer the questions on the SUNRISE study, and then Paul on the cost of mfg. question. I think it's important on the PS-exosome diagnostics that this is a simple blood test. And so what we’ve been focusing our efforts on is really refining the assay into a format that would be easily implemented at a number of different sites vs. if you’re just doing it in a research-type setting. And that’s all being really done with internal expertise we already have in-house. As far as validating other tumors, we do believe this really could be a good marker across many different tumor types. So, while the initial effort has been focused on ovarian cancer, we do have an interest in implementing this into all of our future clinical studies as a simple blood collection; so including potentially the NCCN studies, for instance, and other collaborations. But also there are sample sources of serum that we can obtain, as well as working with our collaborators at UTSW and Memorial Sloan Kettering to look at other tumor types. So although our primary interests are breast cancer, lung cancer, and expanding into the other tumor types, liver cancer, which we looked at before, and really validating it across the board, because one of the bigger goals would be if this could potentially be a prognostic for the treatment of bavituximab - we’re a long way from that, but at least we have a tool and we can look at it in the conjunction of the tumors [???]. We think there’s very broad potential for this technology. As far as running any actual clinical studies, our goal is really to bringing the program forward to do the proof-of-concept based on our collaborations and then to find a partner to move forward to be further advancement and take on both the cost of the future development, as well as the commercialization with us receiving some downstream royalties & milestones to most of these types of agreements. For the question regarding patients that are still on bavi and how are they doing, and the Compassionate Use, I’ll turn it over to Joe.

Joe Shan: For SUNRISE overall, while there was no significant difference between the bavituximab+docetaxel arm and the docetaxel alone arm, there are of course patients still as we mentioned still receiving bavituximab, so that gives you an indication that there are patients that are not only, what we call long-term survivors but there are diseases that stabilized. That’s why it's was important that the trial is formally concluded that we allow the patients the opportunity to continue receiving bavituximab under compassionate use. The biomarker analysis is still ongoing, and we’re also hoping to wrap that up in the next few months. Those data will be presented as they’re become available, but the first observation that we’ve reported on already, we mentioned the correlation between beta-2glycoprotein-1 [B2GPI] levels, which is an important protein for bavituximab to bind, so that’s important confirmation of a biomarker for drug activity. And, like I mentioned, there will be a presentation on other cytokine biomarker, interferon gamma [IFN-y], in about 2 weeks time [4-3-17 AACR’17 http://tinyurl.com/zzldh9n ]. Regarding the compassionate use, the procedure varies from country-to-country, but basically, investigators that have patients still receiving bavituximab need to file an IND or expanded access to application in the U.S. It’s a single patient IND, and in Europe it's under the expanded access. It’s a bit of paper work, but we’re assisting where we can, but basically the investigator takes responsibility from that point on, and the approvals are pretty quick.

Steve King: That’s one of the things that we see with bavituximab is, while we’re all disappointed that the overall trial results weren’t what we expected, certainly, you see these anecdotal signs where we obviously see a number of patients that are still on therapy who are then coming in for quite now very long extended period of time, we feel like they’re getting benefit. You see these anecdotal signs activity in those patients that have been on therapy, and for us that’s one of the reasons we’re still very happy and actually excited about the collaborations at Sloan Kettering and UTSW, in particular, where there’s not just an interest in studying bavituximab in preclinical models, but actually taking some of that data and eventually turning that into clinical indications where the drug excels. We look forward to keeping everyone updated on those activities at AACR, ASCO, and beyond. Then the other question on the cost of mfg, I’ll turn it over to Paul.

Paul Lytle: Let me just say the backdrop we’re really excited about Avid, and what we’ve done so far. We have great projections this year hitting $60-65mm in potential revenue. And it's just a phenomenal year that could be anywhere from 35% to 47% increase over the previous FY. Last FY, we did about $44mm in revenue, and that represented about 66% growth over the previous FY. So, as Steve Worsley mentioned, I think this industry is set for a boom, and we're feeling the impact of that and it's great part of the business. On the costing side, as we mentioned on previous calls, our Franklin facility, generally have a higher gross margin, because of the lower cost structure. That particular facility is smaller, it has lower overhead costs, and is running at a higher capacity. Whereas our Myford facility currently is a much larger facility, has a higher cost structure. It absorbs depreciation and also it's not utilized fully right now as we're in the process of doing process validation runs. And these particular runs are done in a series, so they're not done in campaign mode where you can maximize the usage of the facility, and that just causes a higher burden for those runs and higher costs for those runs, causing the gross margins on an overall basis to decline. But as Myford becomes more fully utilized, we expect the margins to get back in place where we’ve seen them before, between the 40% and 48% range. And we think, as Steve Worsley mentioned, there’s the opportunity to get there based on where the industry is going and what the demand is.

----

Apr1-5: AACR 2017, WashDC http://tinyurl.com/zdsbds8 - SUMMARY of PPHM’s 5 AACR’17 ABSTRACTS:

1. MSKCC(Wolchok Lab)+PPHM: 4-2-17/1pm #574, “PSTargeting+RAD+AntiPD1 Promotes Anti-Tumor Activity, Melanoma” (same as SITC'16/11-14-16 http://tinyurl.com/js3fca4 )

2. MSKCC(Wolchok Lab)+PPHM: 4-3-17/8am #1651, “PSTargeting+Adoptive TCell Transfer (ACT) Eliminates Adv. Tumors w/o Off-Target Toxicities, Melanoma” <=NEW(2nd) Joint MemSloan(Wolchok Lab)/PPHM study, see: http://tinyurl.com/h3ylrku

3. PPHM: 4-4-17/8am #3652, “PSTargeting+LAG3+AntiPD1 Significantly Enhances Anti-Tumor Activity, Triple- MBC”

4. IMMUNOVACCINE+PPHM: 4-4-17/8am #3657, ”PSTargeting Enhances Anti-Tumor Activity of a Tumor Vaccine(DepoVax), HPV-Induced Tumor” https://www.imvaccine.com

5. PPHM+VANDERBILT+PRECISIONMEDICINE+PROVIDENCECC: 4-3-17/1pm #CT159/25 (Session: Ph2/3 Clinical Trials in Progress), “IFN-y Analysis In Blood & Tissue as a Potential Prognostic and/or Predictive Biomarker” (abstract embargoed, Sunrise Biomarker #3) – MORE on Biomarkers: http://tinyurl.com/jrenezs

Jun2-6: ASCO 2017, Chicago https://am.asco.org (Abstracts: Titles/MidAPR, Full=May17)

1. Thomas Yip (FBR & Co.): http://www.fbr.com

TY: ”Good to see Avid continuing to grow, with higher revenue guidance. Glad to hear some new progress on exosome program as well. Looking at your new revenue guidance, it looks like the coming Q4 [q/e 4-30-17] will be the big quarter. So, should we expect to see similar seasonality fluctuations from qtr-to-qtr for the next FY’18?”

Paul Lytle: There iare number of variables that go into the revenue recognition. Some of it is driven by the timing of doing runs, and remember that these runs typically from beginning to end, are around 4-5mos time periods. So, you’re going to have the natural variability there as to how many actually started in a given time period that could end in a qtr. The 2nd is, in the past we’ve had some issues, which recently seem to have been resolved with some of the testing labs and the ability to get test results, which impacted lot release and the timing of shipping, and when the clients were ready to accept the material. So given that, there’s going to be some natural variability. Hopefully, as we get the Myford facility really up and running and it converts over into a more consistent flow of business going through there, which we expect over time as some of those process validations turn into commercial production, then hopefully, we’ll have a pretty good level of stabilization. But, by the nature of the business, you’re going to have a little bit of lumpiness. It may be a bit exaggerated between Q3 and Q4, but overall we think as Myford comes into constant production then naturally the number is going to grow, and therefore, the amount of variability we’ll see should decrease. But the key thing is that we’re bringing in new customers and aligning ourselves up for that future business, because that’s where the real value is going to come from.

TY: ”Re: Avid backlog of $70mm, are they selling type contracts or do they have a period of time that you need to fulfill these orders?”

Steve King: We typically get a rolling forecast from our clients, which covers generally 9-15 mo. periods, with a committed period, and then we get a viewpoint of their future business after that. We talk about our backlog, it is all committed business from a number of clients for production that they need. The production schedule then flows off of those projections of when they need the material delivered. We start it months in advance so we’re in a position to deliver it during those quarters in which they projected they need the material.

TY: ”You said the Myford plant expansion will happen in a couple of months, which will put us towards the 1H of FY’18. How should we account for the expansion costs, will they be reflected primarily between now to 1H of FY’18 in COGS or will that be an underlying item?”

Paul Lytle: When we talk about expansion, Thomas, we’re talking about the installation of two 2,000 liter bioreactors which will be installed in our existing Myford facility, and will allow us addl. capacity at a higher scale to meet some of our customers’ demands that are currently adhere the book of business work. And the cost of those bioreactors is nominal compared to the overall cost of facility, and it will be negligible compared to the opportunity that we can generate from those bioreactors.

TY: ”So we shouldn’t project higher costs for the next couple of quarters?”

Paul Lytle: Yes. Correct.

TY: ”Re: Bavi, I don’t see any new NCCN trials for lung cancer. Should we expect future Phase1/2 trials to focus primarily on exploring other solid tumor indications, or do you plan to re-address NSCLC in the future?”

Steve King: The NCCN process is relatively independent from us. It's a competitive process in which the investigators from any of the NCCN institutions can submit their proposals for clinical studies. None of the studies are happening in lung cancer, but that was just part of their overall competitive process. As we’re evaluating and looking at the rest of the data from SUNRISE, which gives us more insight into the lung cancer potential of bavituximab, then we will consider, addl. lung cancer studies in the future. Right now, we’re just evaluating where we’re at and what those studies could potentially look like. But, as has been the overall goal of the Company, which is continue to take control our R&D expenses and to move toward profitability for the next 15mos now. But yes, we still have an interest in lung cancer. It’s obviously a complicated space, maybe getting more complicated with expected approvals and PDUFA dates and what have you coming up that could further change the landscape. The bottom line is there are still patients who are not getting cured. The research community and clinical community is focused on the tumor microenvironment as the potential root cause, and as we have these collaborations that have results coming up at AACR and beyond, they’re indicating that that could be Bavi’s sweet spot. So, as we put together our data set with what the market needs, our lung cancer is still attractive. It’s a huge indication and still lots of need there. While we’re happy to see the great progress in treating those patients, there’s still lot of patients who still need lot more options.

MR. KING’S CLOSING COMMENTS:

I’d like to thank you all again for participating in today’s phone call. As always, I want to thank our stockholders for their continued support, and I would like to especially thank our patients, their families and the investigators that are participating in our bavituximab clinical trials. With that, we will now conclude the call.

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = == = = =

3-13-17/PR: Peregrine Pharmaceuticals Reports Financial Results for 3rd Quarter of FY 2017 and Recent Developments

**Avid Revenue Guidance Increased to $60-65 Million for Full FY 2017 and Contracted Backlog of Future Business Currently at $70 Million

**Multiple Preclinical Studies Demonstrating Bavituximab's Ability to Enhance Activity of Immune Stimulating Therapies Accepted for Presentation at AACR

http://ir.peregrineinc.com/releasedetail.cfm?ReleaseID=1017192

TUSTIN, March 13, 2017: Peregrine Pharmaceuticals, Inc. (NASDAQ:PPHM, PPHMP), a biopharmaceutical company committed to improving patient lives by manufacturing high quality products for biotechnology and pharmaceutical companies, and advancing its proprietary R&D pipeline, today announced financial results for the third quarter of fiscal year (FY) 2017 ended January 31, 2017, and provided an update on its contract manufacturing business, preclinical and clinical pipeline, and other corporate developments.

Highlights Since October 31, 2016

"During the third quarter, Avid's revenue growth continued, which is a strong indicator of the increasing value of this contract development and manufacturing organization (CDMO) business. The steady growth of this business over the past 5 years has been remarkable and we are pleased to see the trend continuing as we move through a number of process validations for clients, which we expect to spur further growth in the future as some or all of those products move to commercialization. We see Avid as a tremendously important asset with solid upside potential that is often overlooked as a value driver for the overall organization. With projected revenue of over $60 million for the current fiscal year, this is already a strong business in an industry that is expecting substantial growth over the next decade and we are excited about the future of the company," stated Steven W. King, President and CEO officer of Peregrine, and President of Avid Bioservices. "An important component of our Avid growth strategy is capacity expansion within our Myford facility. We are currently on track to install two 2,000-liter bioreactors in the facility within the next few months with a book of business for the reactors already in place. We believe the total capacity potential of the facility, when operating in campaign mode, can exceed more than $75 million annually bringing us to well over $100 million in total potential revenue between our two manufacturing facilities, and giving us adequate capacity to continue Avid revenue growth through FY 2018. As we look to the future, based on current operations and projected demand from our existing clients, we have also recently secured additional space within the same building as our Myford facility for which we already have use as part of our existing operations but would also allow us to further expand capacity based on committed business. While we will only begin converting the space into manufacturing capacity once client commitments and other necessary financing is in place, this puts us in an excellent position for continuing to grow the business beyond the coming fiscal year."

Mr. King continued, "During the quarter, we also achieved a number of goals on the development front. These efforts are highlighted by the three clinical trials under our collaboration with the National Comprehensive Cancer Network (NCCN) which are advancing as planned, and we expect at least two of the trials to be initiated by mid-year. Additionally, we and our collaborators will be presenting a number of studies at the upcoming AACR annual meeting [AACR’17: http://tinyurl.com/zaz525l ], including data from researchers at Memorial Sloan Kettering that support the ability of PS-targeting agents, including bavituximab, to significantly impact the tumor microenvironment, creating a more favorable environment for checkpoint inhibitors. Additionally, our collaborators at the University of Texas Southwestern Medical Center published positive proof-of-concept data for our recently-licensed exosome-based cancer detection platform, which could have broad potential for patients with cancer. Even though we have reduced our R&D expenditures, we are pleased that collaborations such as these are allowing us to continue the advancement of our therapeutic and diagnostic programs as we continue to evaluate the best ways for moving our bavituximab and other PS-targeting programs forward. The combined efforts of growing the Avid biomanufacturing business and these important collaborations are allowing us to make great strides on all fronts."

Avid Bioservices Highlights:

"The Avid business continues to build momentum. During the third quarter of FY 2017, contract manufacturing revenue increased 61% to $10.7 million compared to the third quarter of FY 2016. Given this performance, and our expected fourth quarter results, we are increasing our full FY 2017 revenue guidance from $50 to $55 million, to $60 to $65 million," stated Paul Lytle, CFO of Peregrine. "We are also pleased to report that we recently leased 42,000 square feet within the same building as our Myford facility, allowing us to leverage existing oversized utilities and infrastructure that should allow us greater operational efficiency and overall cost savings. While we design the new facility within this new space, it's important to note that our two existing commercial facilities have sufficient capacity to continue to grow our contract manufacturing revenue in FY 2018."

The company is increasing its manufacturing revenue guidance for the full FY 2017 from $50-55 million, to $60-65 million.

Avid's current manufacturing revenue backlog is $70 million, representing estimated future manufacturing revenue to be recognized under committed contracts. This backlog primarily covers revenue to be recognized during the remainder of fiscal year 2017 and fiscal year 2018.

Clinical Development Highlights:

-- The three clinical trials under the collaboration with the NCCN are advancing as planned.

* Moffitt Cancer Center - “A Phase I Trial of Sorafenib and Bavituximab Plus Stereotactic Body Radiation Therapy for Unresectable Hepatitis C Associated Hepatocellular Carcinoma”. This protocol is approved and patient screening is expected soon.

* Massachusetts General Hospital Cancer Center - “Phase I/II Clinical Trial of Bavituximab with Radiation and Temozolomide for Patients with Newly Diagnosed Glioblastoma”. This trial is on track to be initiated by mid-calendar 2017.

* The Sidney Kimmel Comprehensive Cancer Center at Johns Hopkins - “Phase II Study of Pembrolizumab and Bavituximab for Progressive Recurrent/Metastatic Squamous Cell Carcinoma of the Head and Neck”. This trial is on track to be initiated by mid-calendar 2017.

-- The company is continuing its comprehensive biomarker analysis of data collected in the Phase III SUNRISE trial [See Biomarkers summary: http://tinyurl.com/jrenezs ].

* Through this analysis, and as reported previously, Peregrine scientists have identified a correlation between overall survival and pre-treatment levels of the biomarker, beta-2 glycoprotein-1 (B2GP1).

* The results of an analysis of pre-treatment interferon gamma (IFN-y) will be the subject of a presentation at AACR entitled: “IFN-y Analysis in Blood and Tissue as a Potential Prognostic and/or Predictive Biomarker”

Research Highlights:

-- Peregrine scientists and collaborators from Memorial Sloan Kettering Cancer Center will present preclinical results from multiple studies at the upcoming AACR meeting in April [AACR’17: http://tinyurl.com/zaz525l ]. Each study evaluates the use of a bavituximab equivalent in combination with immune stimulating therapies. The following abstracts will be presented:

* Memorial Sloan Kettering: Targeting Phosphatidylserine in Combination with Adoptive T Cell Transfer Eliminates Advanced Tumors without Off-Target Toxicities in a Melanoma Preclinical Model

* Memorial Sloan Kettering (initial findings presented at SITC): Phosphatidylserine Targeting Antibody in Combination with Tumor Radiation and Immune Checkpoint Blockade Promotes Anti-Tumor Activity in Mouse B16 Melanoma

* Peregrine (initial findings presented at the 2016 Society for Immunotherapy of Cancer Meeting): Combinational Activity of LAG3 and PD-1 Targeted Therapies is Significantly Enhanced by the Addition of Phosphatidylserine Targeting Antibodies and Establishes an Anti-Tumor Memory Response in Murine Triple Negative Breast Cancer

-- Collaborators from the University of Texas Southwestern Medical Center at Dallas, recently published positive proof-of-concept findings for Peregrine's recently licensed exosome-based cancer detection platform in the peer-reviewed journal, Oncotarget [2-9-17: http://tinyurl.com/jhv57ua Senior Author: Dr. Alan Schroit, PPHM SAB]. Results demonstrated that those patients with malignant ovarian cancer displayed significantly higher blood PS exosome levels than those with benign tumors, and the malignant and benign groups displayed significantly higher blood PS exosome levels than the healthy subjects.

Financial Highlights and Results:

-- Peregrine continues to execute its previously-announced strategy to reach sustained profitability by increasing contract manufacturing revenue while decreasing research and development expenses, with the goal of reaching profitability 15 months from now. During the first nine months of FY 2017, the company made significant progress toward this goal with contract manufacturing revenues increasing 55% compared to the first nine months of FY 2016 and research and development expenses decreasing by 50% compared to the first nine months of FY 2016.

Contract manufacturing revenue from Avid's biomanufacturing services provided to its third-party customers increased to $10,747,000 for the third quarter of FY 2017 compared to $6,672,000 for the third quarter of FY 2016.

Total costs and expenses for the third quarter of FY 2017 were $18,544,000, compared to $23,576,000 for the third quarter of FY 2016. For the third quarter of FY 2017, research and development expenses decreased 60% to $5,989,000, compared to $15,156,000 for the third quarter of FY 2016. Cost of contract manufacturing increased to $7,974,000 in the third quarter of FY 2017 compared to $3,896,000 for the third quarter of FY 2016, primarily due to an increase in the cost of contract manufacturing associated with higher reported revenue. Also contributing to this increase and impacting gross margins for the period is the higher cost of operating the new Myford facility as well as the higher cost associated with performing process validation runs during the quarter. For the third quarter of FY 2017, selling, general and administrative expenses increased slightly to $4,581,000 compared to $4,524,000 for the third quarter of FY 2016 primarily due to the company's growing manufacturing business.

Peregrine's consolidated net loss attributable to common stockholders was $9,216,000 or $0.04 per share, for the third quarter of FY 2017, compared to a net loss attributable to common stockholders of $18,227,000, or $0.08 per share, for the same prior year quarter.

Peregrine reported $41,528,000 in cash and cash equivalents as of January 31, 2017, compared to $61,412,000 at fiscal year ended April 30, 2016.

More detailed financial information and analysis may be found in Peregrine's Quarterly Report on Form 10-Q, which will be filed with the Securities and Exchange Commission today. [ http://tinyurl.com/zlozrv4 ]

CONFERENCE CALL: Peregrine will host a conference call and webcast this afternoon, March 13, 2017, at 4:30 PM EDT (1:30 PM PDT).

To listen to the conference call, please dial (877) 312-5443 or (253) 237-1126 and request the Peregrine Pharmaceuticals conference call. To listen to the live webcast, or access the archived webcast, please visit: http://ir.peregrineinc.com/events.cfm .

ABOUT PEREGRINE PHARMACEUTICALS, INC.

Peregrine Pharmaceuticals, Inc. is a biopharmaceutical company committed to improving the lives of patients by delivering high quality pharmaceutical products through its contract development and manufacturing organization (CDMO) services and through advancing and licensing its investigational immunotherapy and related products. Peregrine's in-house CDMO services, including cGMP manufacturing and development capabilities, are provided through its wholly-owned subsidiary Avid Bioservices, Inc. ( http://www.avidbio.com) , which provides development and biomanufacturing services for both Peregrine and third-party customers. The company is also working to evaluate its lead immunotherapy candidate, bavituximab, in combination with immune stimulating therapies for the treatment of various cancers, and developing its proprietary exosome technology for the detection and monitoring of cancer. For more information, please visit http://www.peregrineinc.com .

ABOUT AVID BIOSERVICES

Avid Bioservices provides a comprehensive range of process development, high quality cGMP clinical and commercial manufacturing services for the biotechnology and biopharmaceutical industries. With over 15 years of experience producing monoclonal antibodies and recombinant proteins in batch, fed-batch and perfusion modes, Avid's services include cGMP clinical and commercial product manufacturing, purification, bulk packaging, stability testing and regulatory strategy, submission and support. The company also provides a variety of process development activities, including cell line development and optimization, cell culture and feed optimization, analytical methods development and product characterization. For more information about Avid, please visit http://www.avidbio.com .

PEREGRINE PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (UNAUDITED)

THREE MONTHS ENDED

JANUARY 31, NINE MONTHS ENDED

JANUARY 31,

2017 2016 2017 2016

REVENUES:

Contract manufacturing revenue $ 10,747,000 $ 6,672,000 $ 39,726,000 $ 25,574,000

License revenue — 37,000 — 329,000

Total revenues 10,747,000 6,709,000 39,726,000 25,903,000

COSTS AND EXPENSES:

Cost of contract manufacturing 7,974,000 3,896,000 26,477,000 13,245,000

Research and development 5,989,000 15,156,000 21,580,000 43,264,000

Selling, general and administrative 4,581,000 4,524,000 14,625,000 13,839,000

Total costs and expenses 18,544,000 23,576,000 62,682,000 70,348,000

LOSS FROM OPERATIONS (7,797,000 ) (16,867,000 ) (22,956,000 ) (44,445,000 )

OTHER INCOME (EXPENSE):

Interest and other income 25,000 34,000 71,000 691,000

Interest and other expense (2,000 ) (14,000 ) (2,000 ) (14,000 )

Total other income, net 23,000 20,000 69,000 677,000

NET LOSS $ (7,774,000 ) $ (16,847,000 ) $ (22,887,000 ) $ (43,768,000 )

COMPREHENSIVE LOSS $ (7,774,000 ) $ (16,847,000 ) $ (22,887,000 ) $ (43,768,000 )

Series E preferred stock accumulated dividends (1,442,000 ) (1,380,000 ) (3,558,000 ) (3,448,000 )

NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS $ (9,216,000 ) $ (18,227,000 ) $ (26,445,000 ) $ (47,216,000 )

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING:

Basic and Diluted 260,811,553 227,389,225 248,407,470 209,549,670

BASIC AND DILUTED LOSS PER COMMON SHARE $ (0.04 ) $ (0.08 ) $ (0.11 ) $ (0.23 )

PEREGRINE PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

JANUARY 31,

2017 APRIL 30,

2016

Unaudited

ASSETS

CURRENT ASSETS:

Cash and cash equivalents $ 41,528,000 $ 61,412,000

Trade and other receivables 5,883,000 2,859,000

Inventories 33,829,000 16,186,000

Prepaid expenses and other current assets 1,747,000 1,351,000

Total current assets 82,987,000 81,808,000

Property and equipment, net 24,143,000 24,302,000

Restricted cash 600,000 600,000

Other assets 3,587,000 2,333,000

TOTAL ASSETS $ 111,317,000 $ 109,043,000

LIABILITIES AND STOCKHOLDERS' EQUITY

CURRENT LIABILITIES:

Accounts payable $ 7,696,000 $ 8,429,000

Accrued clinical trial and related fees 3,127,000 7,594,000

Accrued payroll and related costs 5,637,000 5,821,000

Deferred revenue 26,367,000 10,030,000

Customer deposits 26,210,000 24,212,000

Other current liabilities 941,000 1,488,000

Total current liabilities 69,978,000 57,574,000

Deferred rent, less current portion 1,325,000 1,395,000

Commitments and contingencies

STOCKHOLDERS' EQUITY:

Preferred stock—$0.001 par value; authorized 5,000,000 shares; 1,647,760 and 1,577,440 issued and outstanding at January 31, 2017 and April 30, 2016, respectively 2,000 2,000

Common stock—$0.001 par value; authorized 500,000,000 shares; 271,068,464 and 236,930,485 issued and outstanding at January 31, 2017 and April 30, 2016, respectively 271,000 237,000

Additional paid-in capital 571,904,000 559,111,000

Accumulated deficit (532,163,000 ) (509,276,000 )

Total stockholders' equity 40,014,000 50,074,000

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 111,317,000 $ 109,043,000

Safe Harbor *snip*

CONTACTS:

• Stephanie Diaz (Investors) Vida Strategic Partners 415-675-7401 sdiaz@vidasp.com

• Tim Brons (Media) Vida Strategic Partners 415-675-7402 tbrons@vidasp.com

- - - - - - - - -

[From 10-Q header: “As of Mar. 10 2017, there were 297,709,478 shares outstanding.”

- - - - - - - - - - - - - - - - -

Latest 10K 4-30-16 iss. 7-14-16 PR: http://tinyurl.com/h8eqtg5 (Cash 4-30-16=$61.4mm)

Latest 10Q 1-31-17 iss. 3-13-17 http://tinyurl.com/zlozrv4 PR: http://tinyurl.com/grhwjvy (Cash 1-31-17=$41.5mm)

ALL SEC filings for PPHM: http://tinyurl.com/6d4jw8

= = = = = = = = = = = = = = = = = = = = = = = = = = = =

Updated PPHM REVS-BY-QTR TABLE, now thru FY17'Q3(qe 1-31-17), per the 10-Q ( http://tinyurl.com/zlozrv4 ) issued 3-13-17.

• Total Revs since May’06: ($213.3mm/Avid + $24.1mm/Govt + $2.5mm/Lic.) = $239.9mm

• 3-13-17: FY'17 (May'16-Apr'17) Avid revs guidance $60-65mm (Committed B/L=$70mm).

• Deferred-Revs at 1-31-17 total $26.4mm, UP from $18.0mm at 10-31-16.

• Cust.Deposits at 1-31-17 total $26.2mm, DOWN from $26.9mm at 10-31-16.

• Inventories at 1-31-17 total $33.8mm, UP from $25.9mm at 10-31-16.

• Avid’s Gross-Profit over last 4 qtrs: $22.3mm on revs of $58.5mm (GP%=38%)

• Recall, Avid Rev$ from Gov’t DTRA Contract work (6/30/08 – 4/15/11, totaling $24.15mm), went into GOVT-REVS, not AVID-REVS, in the Financials.

Avid’s website: http://www.avidbio.com

AVID PROFITABILITY (GROSS*) BY QTR:

QTR Avid-Rev$ CostofMfg$ Gross-Profit$ GP%

FY13Q1 7-31-12 4,135,000 2,024,000 2,111,000 51%

FY13Q2 10-31-12 6,061,000 3,703,000 2,358,000 39%

FY13Q3 1-31-13 6,961,000 3,651,000 3,310,000 47%

FY13Q4 4-30-13 4,176,000 3,217,000 959,000 23%

FY14Q1 7-31-13 4,581,000 2,670,000 1,911,000 42%

FY14Q2 10-31-13 7,354,000 4,195,000 3,159,000 43%

FY14Q3 1-31-14 3,885,000 2,416,000 1,469,000 38%

FY14Q4 4-30-14 6,474,000 3,829,000 2,645,000 41%

FY15Q1 7-31-14 5,496,000 3,583,000 1,913,000 35%

FY15Q2 10-31-14 6,263,000 4,139,000 2,124,000 34%

FY15Q3 1-31-15 5,677,000 3,113,000 2,564,000 45%

FY15Q4 4-30-15 9,308,000 4,758,000 4,550,000 49%

FY16Q1 7-31-15 9,379,000 4,608,000 4,771,000 51%

FY16Q2 10-31-15 9,523,000 4,741,000 4,782,000 50%

FY16Q3 1-31-16 6,672,000 3,896,000 2,776,000 42%

FY16Q4 4-30-16 18,783,000 9,721,000 9,062,000 48%

FY17Q1 7-31-16 5,609,000 3,062,000 2,547,000 45%

FY17Q2 10-31-16 23,370,000 15,441,000 7,929,000 34%

FY17Q3 1-31-17 10,747,000 7,974,000 2,773,000 26%

FY13 TOTAL: 21,333,000 12,595,000 8,738,000 41%*

FY14 TOTAL: 22,294,000 13,110,000 9,184,000 41%*

FY15 TOTAL: 26,744,000 15,393,000 11,151,000 42%*

FY16 TOTAL: 44,357,000 22,966,000 21,391,000 48%*

*Avid Net-Profit (ie, incl. Selling, G&A) not split out from PPHM-Corp. in the financials.

.

PPHM REVENUES (in thousands) DEFERRED

-------REVENUES------- REVENUES INVEN-

Quarter Avid Govt Lic. TOTAL Avid Govt TORIES

FY07Q1 7-31-06 398 0 23 421 317 0 971

FY07Q2 10-31-06 636 0 48 684 1388 0 1899

FY07Q3 1-31-07 347 0 16 363 2202 0 1325

FY07Q4 4-30-07 2111 0 129 2240 1060 0 1916

FY08Q1 7-31-07 1621 0 4 1625 1820 0 2363

FY08Q2 10-31-07 1863 0 29 1892 1338 0 3500

FY08Q3 1-31-08 1662 0 13 1675 1434 0 2394

FY08Q4 4-30-08 751 0 150 901 2196 0 2900

FY09Q1 7-31-08 1193 324 0 1517 4021 980 4628

FY09Q2 10-31-08 983 958 0 1941 6472 1701 6700

FY09Q3 1-31-09 5778 1048 0 6826 4805 3262 5547

FY09Q4 4-30-09 5009 2683 175 7867 3776 3871 4707

FY10Q1 7-31-09 2070 4671 9 6750 5755 2332 6177

FY10Q2 10-31-09 5308 1510 78 6896 4260 3989 5850

FY10Q3 1-31-10 2945 6854 78 9877 3052 76 3861

FY10Q4 4-30-10 2881 1461 78 4420 2406 78 3123

FY11Q1 7-31-10 983 2111 115 3209 3719 47 4692

FY11Q2 10-31-10 3627 966 78 4671 2447 35 3555

FY11Q3 1-31-11 1922 882 79 2883 4300 40 3915

FY11Q4 4-30-11 1970 681 78 2729 5617 0 5284

FY12Q1 7-31-11 5439 0 216 5655 4145 0 4481

FY12Q2 10-31-11 4154 0 78 4232 2012 0 3178

FY12Q3 1-31-12 3203 0 78 3281 2552 0 2722

FY12Q4 4-30-12 1987 0 78 2065 3651 0 3611

FY13Q1 7-31-12 4135 0 116 4251 6056 0 5744

FY13Q2 10-31-12 6061 0 78 6139 6221 0 5426

FY13Q3 1-31-13 6961 0 78 7039 5061 0 4635

FY13Q4 4-30-13 4176 0 78 4254 4171 0 4339

FY14Q1 7-31-13 4581 0 107 4688 4164 0 5679

FY14Q2 10-31-13 7354 0 0 7354 3468 0 4033

FY14Q3 1-31-14 3885 0 0 3885 4329 0 5224

FY14Q4 4-30-14 6474 0 0 6474 5241 0 5530

FY15Q1 7-31-14 5496 0 0 5496 4670 0 5998

FY15Q2 10-31-14 6263 0 37 6300 3612 0 5379

FY15Q3 1-31-15 5677 0 0 5677 5752 0 6148

FY15Q4 4-30-15 9308 0 0 9308 6630 0 6148

FY16Q1 7-31-15 9379 0 292 9671 8291 0 10457

FY16Q2 10-31-15 9523 0 0 9523 9688 0 12554

FY16Q3 1-31-16 6672 0 37 6709 15418 0 15189

FY16Q4 4-30-16 18783 0 0 18783 15418 0 15189

FY17Q1 7-31-16 5609 0 0 5609 21531 0 25274

FY17Q2 10-31-16 23370 0 0 23370 21531 0 25274

FY17Q3 1-31-17 10747 0 0 10747 26367 0 33829

Totals: 213295 24149 2453 239897 <=since5/1/2006

.

TOTAL REV’s BY YEAR (Avid+Gov’t+Lic):

FY04 4-30-04 3,314 …Avid(CMO)= 3,039 (Avid-Revs don’t incl. Govt-SVCS)

FY05 4-30-05 4,959 …Avid(CMO)= 4,684

FY06 4-30-06 3,193 …Avid(CMO)= 3,005

FY07 4-30-07 3,708 …Avid(CMO)= 3,492

FY08 4-30-08 6,093 …Avid(CMO)= 5,897

FY09 4-30-09 18,151 …Avid(CMO)= 12,963

FY10 4-30-10 27,943 …Avid(CMO)= 13,204

FY11 4-30-11 13,492 …Avid(CMO)= 8,502

FY12 4-30-12 15,233 …Avid(CMO)= 14,783

FY13 4-30-13 21,683 …Avid(CMO)= 21,333

FY14 4-30-14 22,401 …Avid(CMO)= 22,294

FY15 4-30-15 26,781 …Avid(CMO)= 26,744

FY16 4-30-16 44,686 …Avid(CMO)= 44,357

...Total Gov’t Revs from 7-2008 inception thru FY11Q1(Apr’11): $24.15mm

.

PPHM’S QTLY. NET LOSS BY QTR:

FY08Q1 7-31-07 4,656,000

FY08Q2 10-31-07 6,207,000

FY08Q3 1-31-08 6,154,000

FY08Q4 4-30-08 6,159,000

FY09Q1 7-31-08 5,086,000

FY09Q2 10-31-08 4,497,000

FY09Q3 1-31-09 3,332,000

FY09Q4 4-30-09 3,609,000

FY10Q1 7-31-09 2,428,000

FY10Q2 10-31-09 2,787,000

FY10Q3 1-31-10 1,538,000

FY10Q4 4-30-10 7,741,000

FY11Q1 7-31-10 7,695,000

FY11Q2 10-31-10 7,513,000

FY11Q3 1-31-11 8,929,000

FY11Q4 4-30-11 10,014,000

FY12Q1 7-31-11 8,092,000

FY12Q2 10-31-11 12,055,000

FY12Q3 1-31-12 11,090,000

FY12Q4 4-30-12 10,882,000

FY13Q1 7-31-12 7,664,000

FY13Q2 10-31-12 8,753,000

FY13Q3 1-31-13 4,914,000

FY13Q4 4-30-13 8,449,000

FY14Q1 7-31-13 7,600,000

FY14Q2 10-31-13 7,790,000

FY14Q3 1-31-14 9,724,000

FY14Q4 4-30-14 10,248,000

FY15Q1 7-31-14 13,129,000

FY15Q2 10-31-14 12,100,000

FY15Q3 1-31-15 12,994,000

FY15Q4 4-30-15 12,135,000

FY16Q1 7-31-15 13,723,000

FY16Q2 10-31-15 13,198,000

FY16Q3 1-31-16 16,847,000

FY16Q4 4-30-16 11,884,000

FY17Q1 7-31-16 11,057,000

FY17Q2 10-31-16 4,056,000

FY17Q3 1-31-17 7,774,000

= = = = = = = =

OPER. CASH BURNS* BY QTR(FROM THE 10-Q/K’S):

FY10Q1 7-31-09 2,024,000 (from 10Q pg.25)

FY10Q2 10-31-09 2,351,000 (Q1+Q2: 4,375,000 pg.28)

FY10Q3 1-31-10 1,158,000 (Q1+Q2+Q3: 5,533,000 pg.30)

FY10Q4 4-30-10 6,375,000 (FY’10: 11,908,000 10K pg.58)

FY11Q1 7-31-10 6,567,000 (from 10Q pg.24)

FY11Q2 10-31-10 6,167,000 (Q1+Q2: $12,734,000 pg.25)

FY11Q3 1-31-11 7,736,000 (Q1+Q2+Q3: $20,470,000 pg.26)

FY11Q4 4-30-11 8,961,000 (FY’11: 29,431,000 10K pg.54)

FY12Q1 7-31-11 6,984,000 (from 10Q pg.25)

FY12Q2 10-31-11 11,668,000 (Q1+Q2: 18,652,000 pg.25)

FY12Q3 1-31-12 8,490,000 (Q1+Q2+Q3: 27,142,000 pg.25)

FY12Q4 4-30-12 11,265,000 (FY’12: 38,407,000 10K pg.55)

FY13Q1 7-31-12 6,742,000 (from 10Q pg.21)

FY13Q2 10-31-12 6,162,000 (Q1+Q2: 12,904,000 pg.23)

FY13Q3 1-31-13 3,597,000 (Q1+Q2+Q3: 16,501,000 pg.23)

FY13Q4 4-30-13 7,053,000 (FY’13: 23,554,000 10K pg.60)

FY14Q1 7-31-13 5,750,000 (from 10Q pg.23)

FY14Q2 10-31-13 5,834,000 (Q1+Q2: 11,584,000 10Q pg.24)

FY14Q3 1-31-14 7,875,000 (Q1+Q2+Q3: 19,459,000 10Q pg.26)

FY14Q4 4-30-14 8,706,000 (FY’14: 28,165,000 10K pg.55)

FY15Q1 7-31-14 11,076,000 (from 10Q pg.23)

FY15Q2 10-31-14 9,947,000 (Q1+Q2: 21,023,000 10Q pg.25)

FY15Q3 1-31-15 11,116,000 (Q1+Q2+Q3: 32,139,000 10Q pg.26)

FY15Q4 4-30-15 10,474,000 (FY’15: 42,613,000 10K pg.54)

FY16Q1 7-31-15 12,306,000 (from 10Q pg.25)

FY16Q2 10-31-15 11,701,000 (Q1+Q2: 24,007,000 10Q pg.26)

FY16Q3 1-31-16 15,086,000 (Q1+Q2+Q3: 39,093,000 10Q pg.27)

FY16Q4 4-30-16 10,112,000 (FY'16: 49,205,000 10K pg.39)

FY17Q1 7-31-16 9,607,000 (from 10Q pg.22)

FY17Q2 10-31-16 2,565,000 (Q1+Q2: 12,172,000 10Q pg.24)

FY17Q3 1-31-17 6,274,000 (Q1+Q2+Q3: 18,446,000 10Q pg.24)

FY’09 total Op-Burn: $14,715,000

FY’10 total Op-Burn: $11,908,000

FY’11 total Op-Burn: $29,431,000

FY’12 total Op-Burn: $38,407,000

FY’13 total Op-Burn: $23,554,000

FY’14 total Op-Burn: $28,165,000

FY’15 total Op-Burn: $42,613,000

FY’16 total Op-Burn: $49,205,000

*The 10-Q’s define OPER.BURN as, ”Net cash used in operating activities before chgs. in operating assets & liabilities”.

The 7-21-2001 10Q explains OP.BURN very nicely:

“RESULTS OF OPERATIONS. Before we discuss the Company's total expenses (cash & non-cash expenses), we would like to discuss the Company's operational burn rate (cash expenses used in operations, net of interest and other income) for q/e July 31, 2001 compared to the same period in the prior year. The operational burn rate is calculated by taking the net income (loss) from operations and subtracting all non-cash items, such as the recognition of deferred license revenue, depreciation and amortization and stock-based compensation expense.”

Period Halozyme Cust-A Other-Custs

FYE 4-30-14 91% 1% 8%

FYE 4-30-15 79% 12% 9%

FYE 4-30-16 69% 26% 5%

Q/E 7-31-16 65% 29% 6%

Q/E 10-31-16 77% 10% 13%

Q/E 1-31-17 29% 56% 15%

- - - - - - - - PPHM’s Fiscal Qtr’s (FY runs May – April):

FY’10-Q3 = q/e 1-31-10 – rep. 3-11-10 Thu (B4 mkt)

FY’10-Q4 = q/e 4-30-10 – rep. 7-14-10 Wed (after mkt)

FY’11-Q1 = q/e 7-31-10 – rep. 9-9-10 Thu (after mkt)

FY’11-Q2 = q/e 10-31-10 – rep. 12-9-10 Thu (after mkt)

FY’11-Q3 = q/e 1-31-10 – rep. 3-11-11 Fri (after mkt)

FY’11-Q4 = q/e 4-30-11 – rep. 7-14-11 Thu (after mkt)

FY’12-Q1 = q/e 7-31-11 – rep. 9-9-11 Fri (B4 mkt)

FY’12-Q2 = q/e 10-31-11 – rep. 12-12-11 Mon (after mkt)

FY’12-Q3 = q/e 1-31-12 – rep. 3-9-12 Fri (after mkt)

FY’12-Q4 = q/e 4-30-12 – rep. 7-16-12 Mon (after mkt)

FY’13-Q1 = q/e 7-31-12 – rep. 9-10-12 Mon (B4 mkt)

FY’13-Q2 = q/e 10-31-12 – rep. 12-10-12 Mon (after mkt)

FY’13-Q3 = q/e 1-31-13 – rep. 3-12-13 Tue (after mkt)

FY’13-Q4 = q/e 4-30-13 – rep. 7-11-13 Thu (after mkt)

FY’14-Q1 = q/e 7-31-13 – rep. 9-9-13 Mon (after mkt)

FY’14-Q2 = q/e 10-31-13 – rep. 12-10-13 Tue (after mkt)

FY’14-Q3 = q/e 1-31-14 – rep. 3-7-14 Fri (B4 mkt)

FY’14-Q4 = q/e 4-30-14 – rep. 7-14-14 Mon (after mkt)

FY’15-Q1 = q/e 7-31-14 – rep. 9-9-14 Tue (after mkt)

FY’15-Q2 = q/e 10-31-14 – rep. 12-10-14 Wed (after mkt)

FY’15-Q3 = q/e 1-31-15 – rep. 3-12-15 Thu (after mkt)

FY’15-Q4 = q/e 4-30-15 – rep. 7-14-15 Tue (after mkt)

FY’16-Q1 = q/e 7-31-15 – rep. 9-9-15 Wed (after mkt)

FY’16-Q2 = q/e 10-31-15 – rep. 12-10-15 Thu (after mkt)

FY’16-Q3 = q/e 1-31-16 – rep. 3-9-16 Wed (B4 mkt)

FY’16-Q4 = q/e 4-30-16 – rep. 7-14-16 Thu (after mkt)

FY’17-Q1 = q/e 7-31-16 – rep. 9-8-16 Thu (after mkt)

FY’17-Q2 = q/e 10-31-16 – rep. 12-12-16 Mon (after mkt)

FY’17-Q3 = q/e 1-31-17 – rep. 3-13-17 Mon (after mkt)

= = = = = = = = = = = =

“Going Concern” statement ELIMINATED from 4-30-13 10-K issued 7-11-2013…

2012: 4-30-12 10-K iss. 7-16-12 http://tinyurl.com/79o57b2

Pg.68: “As more fully described in Note 2, the Company’s recurring losses from operations and recurring negative cash flows from operating activities raise substantial doubt about its ability to continue as a going concern.”

2013 & 2014 & 2015 10-K's: http://tinyurl.com/p58jcbw etc...=> ((((NO GOING CONCERN STATEMENT INCLUDED.))))

CASH a/o 4-30-13: $35.2mm

CASH a/o 6-30-13: $42.6mm

CASH a/o 7-31-13: $41.6mm

CASH a/o 10-31-13: $44.4mm

CASH a/o 1-31-14: $63.2mm

CASH a/o 2-15-14: $79.7mm

CASH a/o 4-30-14: $77.5mm

CASH a/o 6-30-14: $78.3mm

CASH a/o 7-31-14: $73.3mm

CASH a/o 10-31-14: $64.4mm

CASH a/o 1-31-15: $55.2mm

CASH a/o 4-30-15: $68.0mm

CASH a/o 7-31-15: $59.0mm

CASH a/o 10-31-15: $72.0mm

CASH a/o 1-31-16: $67.5mm

CASH a/o 4-30-16: $61.4mm

CASH a/o 7-31-16: $44.2mm

CASH a/o 10-31-16: $41.5mm

= = = = = = = = = = A look at #Employees per the 10K’s…

2011 10-K: "As of 4-30-11, we employed 154 full-time emps & 2 part-time emps”

2012 10-K: "As of 4-30-12, we employed 172 full-time emps & 2 part-time emps."

2013 10-K: "As of 4-30-13, we employed 182 full-time emps & 5 part-time emps."

2014 10-K: "As of 4-30-14, we employed 180 full-time emps & 4 part-time emps."

2015 10-K: "As of 4-30-15, we employed 211 full-time emps & 4 part-time emps."

2016 10-K: "As of 4-30-16, we employed 281 full-time emps & 3 part-time emps."

3-9-17: Ronin Cap+SWIM Partners (John Stafford+Stephen White*) acquire 9.4% stake (24,308,415sh.) in PPHM (via 13D’s)

...3-1-17: Ronin/17,565,843 + SWIM/3,494,166 = 21,060,009sh. 8.2% http://tinyurl.com/jr42u23 (13D)

...3-9-17: Ronin/20,814,248 + SWIM/3,494,166 = 24,308,415sh. 9.4% http://tinyurl.com/huundwu (13D)

…...NOTES: As a Group, ie, “people that share the furtherance of a common objective/concerted action”. 13D’s are reserved for ACTIVE INVESTORS who may be “interested in agitating for some kind of a change at the company”. See John Stafford/XENCOR BOD(18yrs service): http://tinyurl.com/hcmsv8p