Wednesday, March 12, 2014 8:15:07 PM

Move over, small-time Bitcoin exchange startups—Wall Street has arrived

Gentlemen, start your trading bots. Things are about to get crazy.

by Cyrus Farivar - Mar 12 2014, 1:45pm EDT

FINANCE

antanacoins

On Wednesday morning, Perseus Telecom and Atlas jointly launched their new high-speed trading platform for Bitcoin and likely other cryptocurrencies in the future. Perseus is a firm that specializes in high-speed financial data networks, while Atlas is a relative newcomer to the Wall Street scene since starting in 2013.

"The platform's debut puts Bitcoin trading much closer to the modern world of automated and secure trading. Atlas deals will have a matching speed of 30 millionths of a second. Modern trading firms colocate their systems as physically close to the “matching engines” as possible as a way to gain a few milliseconds of edge over others.

“Perseus offers high precision trading access in colocation centers worldwide, and adding Atlas as a new and highly liquid platform is an immediate response to customers demanding Bitcoin trading,” Perseus CEO Jock Percy said in a statement. “The Perseus Digital Currency Initiative is providing governance strictly supporting KYC (Know Your Customer) and AML (Anti-Money Laundering) principles.”

The two firms have founded what they call the “Digital Currency Initiative,” aimed at creating a set of industry-wide guidelines. The end goal is to reach “high precision trading standards executed each day by leading market makers, hedge funds, and investment banks.”

The new Atlas platform has already been running as a “soft launch” for some time now, Atlas CEO Shawn Sloves told Ars.

Sloves also noted that this new platform was not accelerated by MtGox's demise.

"[Perseus and Atlas'] backgrounds both on the trading infrastructure and the telecom side has been servicing ultra low latency clients, it takes years of capital and experience to achieve this type of setup," he said. "It cannot be replicated overnight or in a short period of time. This is an incredible achievement by both our companies. Regardless [of whether] MtGox failed or not, we went ahead and built this out. Our client focus is not necessarily users who had accounts at MtGox."

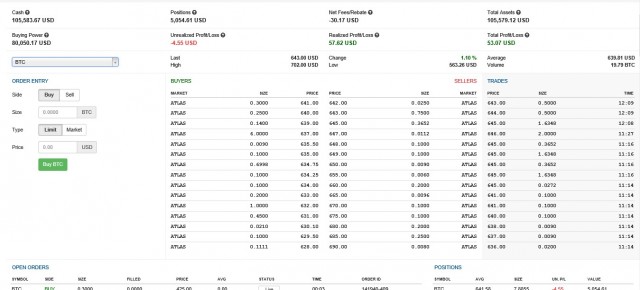

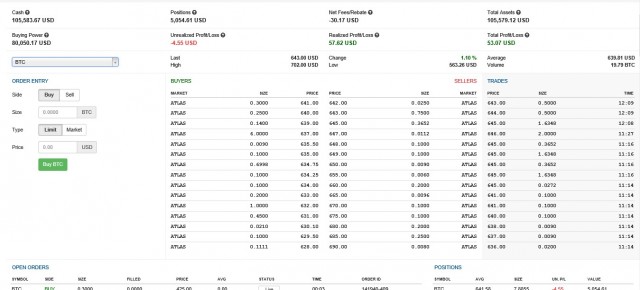

Enlarge / Here's the front-end of the new Atlas trading platform.

Atlas ATS

“I expect that this will help make more transparent liquid markets”

Bitcoin industry watchers say that this marks a notable turning point in the digital currency’s evolution.

“I expect more robust Bitcoin exchanges to emerge and replace the existing set of incumbents,” Gil Luria, a Bitcoin analyst at Wedbush Securities, told Ars by e-mail. “The new exchanges will be either venture capital-backed or units of existing financial institutions. That means they will have the resources to build robust platforms that are scalable, secure, and compliant. I expect that this will help make more transparent liquid markets for Bitcoin and its derivatives, which will translate to less price volatility and better utility for Bitcoin businesses.”

In an investor’s note released last month, Luria wrote that he is largely bullish on Bitcoin. Wedbush noted that it “will be accepting Bitcoin on a limited basis for previously published reports on the topic of cryptocurrency.”

Luria wrote:

More important, we see signs that entrepreneurs and developers are swarming to the Bitcoin platform (page 2). We see this as the best indication of the potential for Bitcoin as these developers are allocating their most valuable resource—development hours. We found nearly 3,000 Github repositories, double from six months ago, which was double from the previous six months. We believe nearly $86 million of venture funds have been invested in Bitcoin companies, mostly over the last 12 months, which does not include the >$200 million and counting we believe have been invested in mining equipment.

James Angel, a visiting finance professor at the Wharton School at the University of Pennsylvania, told Ars by e-mail that Atlas’ new platform debut is “not surprising.”

“With the interest of respectable [venture capital firms] and financial firms in Bitcoin, it makes sense for existing vendors of exchange services in other assets (like Atlas) to offer Bitcoin,” he said. “If you have a good trading platform that can trade currencies, it is pretty easy to add Bitcoin. Thus, it is a low-cost venture for an outfit like Atlas to do. By locating in the industry-standard data centers such as Equinix where the other financial players are located, they make it easier for mainstream financial industry participants to connect."

“Atlas claims to perform transactions in 30 microseconds, which is roughly the same speed as the best equity exchanges in the US," Angel said. "This kind of speed will allow electronic market makers to provide liquidity, lowering bid-ask spreads. Also, it will permit firms that scrape news feeds electronically to respond very quickly.”

The biggest takeaway from the Atlas news? The new platform may finally be a sign that Bitcoin’s freewheeling, anonymous, crypto-libertarian days are coming to an end.

“Wouldn’t you place your bitcoins at a place where the transactions are more likely to be honored?” Ivo Welch a finance professor at the University of California, Los Angeles, wrote to Ars. “There is an irony here. Bitcoins exist to avoid institutions, and now we will have institutions.”

http://arstechnica.com/business/2014/03/move-over-small-time-bitcoin-exchange-startups-wall-street-has-arrived/

Gentlemen, start your trading bots. Things are about to get crazy.

by Cyrus Farivar - Mar 12 2014, 1:45pm EDT

FINANCE

antanacoins

On Wednesday morning, Perseus Telecom and Atlas jointly launched their new high-speed trading platform for Bitcoin and likely other cryptocurrencies in the future. Perseus is a firm that specializes in high-speed financial data networks, while Atlas is a relative newcomer to the Wall Street scene since starting in 2013.

"The platform's debut puts Bitcoin trading much closer to the modern world of automated and secure trading. Atlas deals will have a matching speed of 30 millionths of a second. Modern trading firms colocate their systems as physically close to the “matching engines” as possible as a way to gain a few milliseconds of edge over others.

“Perseus offers high precision trading access in colocation centers worldwide, and adding Atlas as a new and highly liquid platform is an immediate response to customers demanding Bitcoin trading,” Perseus CEO Jock Percy said in a statement. “The Perseus Digital Currency Initiative is providing governance strictly supporting KYC (Know Your Customer) and AML (Anti-Money Laundering) principles.”

The two firms have founded what they call the “Digital Currency Initiative,” aimed at creating a set of industry-wide guidelines. The end goal is to reach “high precision trading standards executed each day by leading market makers, hedge funds, and investment banks.”

The new Atlas platform has already been running as a “soft launch” for some time now, Atlas CEO Shawn Sloves told Ars.

Sloves also noted that this new platform was not accelerated by MtGox's demise.

"[Perseus and Atlas'] backgrounds both on the trading infrastructure and the telecom side has been servicing ultra low latency clients, it takes years of capital and experience to achieve this type of setup," he said. "It cannot be replicated overnight or in a short period of time. This is an incredible achievement by both our companies. Regardless [of whether] MtGox failed or not, we went ahead and built this out. Our client focus is not necessarily users who had accounts at MtGox."

Enlarge / Here's the front-end of the new Atlas trading platform.

Atlas ATS

“I expect that this will help make more transparent liquid markets”

Bitcoin industry watchers say that this marks a notable turning point in the digital currency’s evolution.

“I expect more robust Bitcoin exchanges to emerge and replace the existing set of incumbents,” Gil Luria, a Bitcoin analyst at Wedbush Securities, told Ars by e-mail. “The new exchanges will be either venture capital-backed or units of existing financial institutions. That means they will have the resources to build robust platforms that are scalable, secure, and compliant. I expect that this will help make more transparent liquid markets for Bitcoin and its derivatives, which will translate to less price volatility and better utility for Bitcoin businesses.”

In an investor’s note released last month, Luria wrote that he is largely bullish on Bitcoin. Wedbush noted that it “will be accepting Bitcoin on a limited basis for previously published reports on the topic of cryptocurrency.”

Luria wrote:

More important, we see signs that entrepreneurs and developers are swarming to the Bitcoin platform (page 2). We see this as the best indication of the potential for Bitcoin as these developers are allocating their most valuable resource—development hours. We found nearly 3,000 Github repositories, double from six months ago, which was double from the previous six months. We believe nearly $86 million of venture funds have been invested in Bitcoin companies, mostly over the last 12 months, which does not include the >$200 million and counting we believe have been invested in mining equipment.

James Angel, a visiting finance professor at the Wharton School at the University of Pennsylvania, told Ars by e-mail that Atlas’ new platform debut is “not surprising.”

“With the interest of respectable [venture capital firms] and financial firms in Bitcoin, it makes sense for existing vendors of exchange services in other assets (like Atlas) to offer Bitcoin,” he said. “If you have a good trading platform that can trade currencies, it is pretty easy to add Bitcoin. Thus, it is a low-cost venture for an outfit like Atlas to do. By locating in the industry-standard data centers such as Equinix where the other financial players are located, they make it easier for mainstream financial industry participants to connect."

“Atlas claims to perform transactions in 30 microseconds, which is roughly the same speed as the best equity exchanges in the US," Angel said. "This kind of speed will allow electronic market makers to provide liquidity, lowering bid-ask spreads. Also, it will permit firms that scrape news feeds electronically to respond very quickly.”

The biggest takeaway from the Atlas news? The new platform may finally be a sign that Bitcoin’s freewheeling, anonymous, crypto-libertarian days are coming to an end.

“Wouldn’t you place your bitcoins at a place where the transactions are more likely to be honored?” Ivo Welch a finance professor at the University of California, Los Angeles, wrote to Ars. “There is an irony here. Bitcoins exist to avoid institutions, and now we will have institutions.”

http://arstechnica.com/business/2014/03/move-over-small-time-bitcoin-exchange-startups-wall-street-has-arrived/

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.