Sunday, January 26, 2014 11:16:53 PM

SHARE BUYBACKS - IMPORTANT NUMBERS FOR REVIEW!!

NOTE: July entry: "Stock Reduction".

NTEK allots $3mm for buybacks in 2014. If we average their buys,

from $0.01 to $0.20, how many shares would NTEK have acquired?

Average share price : Price/mm = What $3mm buys?

1) $0.01 : $10,000/mm = 300mm shares

2) $0.05 : $50,000/mm = 60mm shares

3) $0.10 : $100,000/mm = 30mm shares

4) $0.15 : $150,000/mm = 20mm shares

5) $0.20 : $200,000/mm = 15mm shares

NOTE: The 2014 O/S is expected to be 488mm in 2014.

Let's deduct the buybacks...

2014 max O/S - Buybacks = NEW O/S

1) 488mm - 300mm = 188mm O/S

2) 488mm - 60mm = 428mm O/S

3) 488mm - 30mm = 458mm O/S

4) 488mm - 20mm = 468mm O/S

5) 488mm - 15mm = 453mm O/S

NOTE: The restricteds are currently at 76mm.

They represent the only shares NOT in the float & carry a

1yr restriction from the date of issuance. Most are held

by the CEO (Clear Memories acq), BOD-members, management

(~10mm to former Roku exec, Aaron Taylor for example) &

staff.

Thus, NanoTech could buy the remaining 76mm Restricted

Shares through 2014 at a price point just under $0.04

It appears as though NanoTech just put a VERY CLEAR

floor under this stock in support of the company &

shareholder interests.

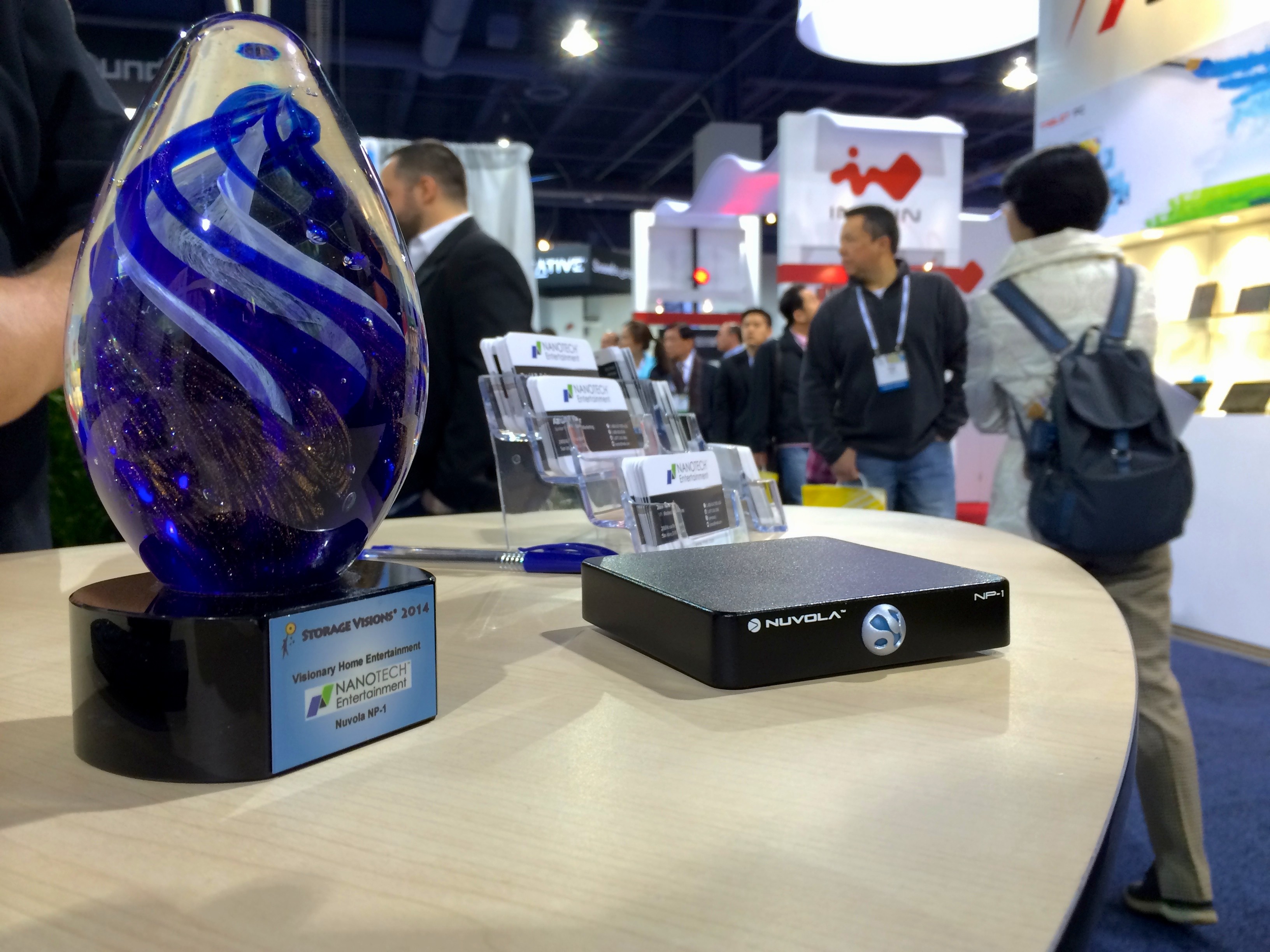

2014 Multi AWARD-WINNING 4K Streaming Media Player!!!

NTEK

North Bay Resources Announces Mt. Vernon Gold Mine Bulk Sample, Sierra County, California • NBRI • Sep 11, 2024 9:15 AM

One World Products Issues Shareholder Update Letter • OWPC • Sep 11, 2024 7:27 AM

Kona Gold Beverage Inc. Reports $1.225 Million in Revenue and $133,000 Net Profit for the Quarter • KGKG • Sep 10, 2024 1:30 PM

Element79 Gold Corp Announces 2024 Clover Work Plans & Nevada Portfolio Updates • ELMGF • Sep 10, 2024 11:00 AM

Nightfood Holdings Inc. Completes Major Step on Uplist Journey by Closing Strategic All-Stock Acquisition of CarryoutSupplies.com • NGTF • Sep 10, 2024 8:15 AM

Element79 Gold Corp. Announces Sale of 100% Interest in Elder Creek, North Mill Creek, and Elephant Projects to 1472886 B.C. Ltd. • ELEM • Sep 9, 2024 9:34 AM