| Followers | 2 |

| Posts | 113 |

| Boards Moderated | 0 |

| Alias Born | 09/26/2012 |

Monday, January 13, 2014 12:19:57 PM

How Much Volume Is Enough For Liquidity?

Have you ever asked yourself, “What should be the minimum volume requirement for the stocks and ETFs I trade?” If so, you’re definitely not alone.

It’s an important question, yet the answer is not black and white (despite what you may have heard from other traders). Read on and I will tell you why…

What Is Average Daily Trading Volume? Why Does It Matter?

Average Daily Trading Volume (“ADTV”) is a measure of the number of shares traded per day, averaged over a specific period of time (we use 50 days).

While this is not a technical indicator that seeks to predict the future direction of an equity, it is nevertheless important because it helps traders to assess the liquidity of a stock or ETF.

When a stock is highly liquid, you can easily enter and exit positions without directly influencing the stock’s price. Conversely, you can know which securities to avoid because they are too illiquid to trade.

Knowing the ADTV of an equity is also important because it establishes a benchmark from which to spot key volume spikes that are the footprint of institutional accumulation.

If, for example, a stock has an ADTV of 500,000 shares, but suddenly trades 2,000,000 shares one day, that means volume spiked to 4 times (400%) its average daily level.

If such a volume surge was also accompanied by a substantial price gain for the day, it is a definitive sign that banks, mutual funds, hedge funds, and other institutions were supporting the stock.

4 Key Questions To Determine If A Stock Is Liquid Enough To Trade

Although ADTV by itself could be used as a concrete “line in the sand” to determine if a stock is liquid enough to trade, there are too many other factors that play a part in that role.

Following are four key questions that, when combined with ADTV, can help you to more accurately determine whether a stock can be traded or should be left alone.

1.) How Many Shares Will I Trade? (Size Matters)

If you are only planning to buy 100 shares of a stock, the ADTV of an equity basically becomes a non-issue because it will be easy to liquidate such a small position, even in a very thinly traded stock.

However, if you intend to buy 5,000 shares of that same stock, you need to more seriously consider whether or not it will be difficult to eventually exit the position with minimal slippage and volatility.

Regardless of what you may have heard, size matters (at least in this scenario).

2.) How High Is The Average Dollar Volume?

Average Dollar Volume (not to be confused with Average Daily Trading Volume) is a number that is determined by multiplying the share price of a stock times its average daily trading volume (ADTV).

For example, a $25 stock with an ADTV of 800,000 shares has exactly the same dollar volume of a $50 stock with an ADTV of just 400,000 shares. In both cases, the Average Dollar Volume is 20 million ($25 X 800,000 or $50 X 400,000).

For institutional investors and traders who rely on making big trades, Average Dollar Volume is a more important number than ADTV.

In the example above, an institutional trader would consider both of those stocks to be equal with regard to liquidity.

As a general rule of thumb, an Average Dollar Volume of 20 million or greater provides pretty good liquidity for most traders.

If you trade a very large account (and accordingly large position size), consider an average dollar volume above 80 million to be extremely liquid.

By knowing the Average Dollar Volume of a stock, you can lower your minimum ADTV requirement if the stock is trading at a higher price.

3.) How Long Will I Hold?

Are you a daytrader, swing trader, or position trader? The length of time you typically hold stocks has a direct relationship to suitable minimum volume requirements (click here for a comparison of trading timeframes).

A daytrader who scalps for tiny 10 or 20 cent gains must limit himself to trading only in thick stocks where millions of shares per day change hands (equities with tight spreads and extremely high liquidity).

On the other hand, a position trader who rides the profit in uptrending stocks for many months can trade in much thinner stocks because they can scale out of positions over the course of several days or weeks.

Although I originally started as a daytrader (in the late ’90s), I now focus exclusively on swing and position trading stocks in my managed accounts and newsletter.

4.) Am I Trading Individual Stocks Or ETFs?

In individual stocks, ADTV and/or Average Dollar Volume plays a big role in determining a stock’s liquidity.

But with ETFs (exchange traded funds), average volume levels are largely irrelevant because ETFs are open-end funds. This means new units (shares) can be created or redeemed as necessary; supply and demand therefore has little effect.

Even if an ETF has no buyers or sellers for several hours, the bid and ask prices continue to move in correlation with the market value of the ETF, which is derived from the prices of individual underlying stocks.

As such, you should be much less concerned with the average volume of an ETF than with an individual stock.

In my nightly stock and ETF pick newsletter, I generally use a minimum ADTV requirement of 100k-500k shares for individual stocks (depending on share size of the position), but may go as low as 50k shares for ETFs (in order to achieve greater asset class diversity).

While liquidity is not of concern when trading ETFs, you should still be aware that ETFs with a very low ADTV may have wider spreads between the bid and ask prices.

To remedy this, you may simply use limit orders in such situations. Since I trade for many points, not pennies, occasionally paying up a few cents does not bother me.

For further details on the subject of ETFs and liquidity, check out Why ETF Trading Volume Does Note Determine ETF Liquidity.

How To Easily Determine The Liquidity Of A Stock/ETF

Although there are free financial websites that provide you with the ADTV and/or Average Dollar Volume of stocks, the fastest and best way to gauge the liquidity of a stock is by plotting the data on a stock chart of a quality trading platform.

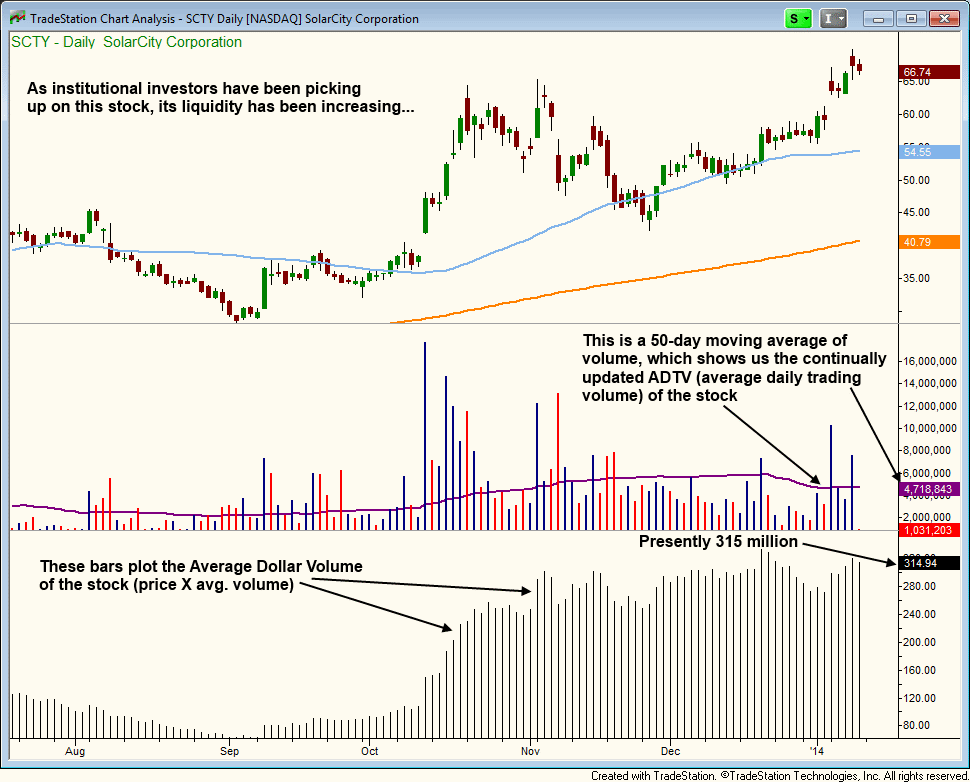

Below is the daily chart of SolarCity ($SCTY), which I bought in The Wagner Dailynewsletter on December 19 (still long as of January 10, with an unrealized price gain of 26%):

The chart above is pretty self-explanatory. The top section shows the price action (and a few moving averages), the middle shows daily volume bars and 50-day ADTV, and the bottom bars plot the Average Dollar Volume (in millions).

With an ADTV of nearly 5 million shares and an Average Dollar Volume of 315 volume, $SCTY is a highly liquid stock that is “institutional-friendly.”

It’s Important, But Don’t Get Hung Up

If you want to avoid surprise price reactions when it comes time to close out your trades, pay attention to the ADTV and/or Average Dollar Volume of stocks. Doing so ensures there is sufficient liquidity to prevent your trades from directly affecting the stock prices.

Nevertheless, you must realize that determining whether or not a stock has sufficient liquidity is not as clear-cut as merely picking an arbitrary number such as 500,000 minimum shares per day.

Further, you should understand that Average Dollar Volume gives a more complete and accurate picture of a stock’s liquidity than ADTV alone. Your individual trading timeframe also plays a role in determining which stocks can be traded.

Frankly, I feel many individual retail traders get too hung up about the average daily volume of a stock. Unless you’re a whale with a massive trading account, your individual transactions within a stock will usually have a minimal (if any) effect on the price.

Of much greater importance is just focusing on buying leading stocks with strong institutional support (these stocks are typically quite active anyway).

If a company has a history of outstanding earnings growth, or a revolutionary product that’s selling like suntan lotion at the beach, it’s even okay to buy thinly traded stocks.

But just be sure to reduce your share size to compensate for greater price volatility (I always list our portfolio position size for each new stock/ETF pick).

Have you ever asked yourself, “What should be the minimum volume requirement for the stocks and ETFs I trade?” If so, you’re definitely not alone.

It’s an important question, yet the answer is not black and white (despite what you may have heard from other traders). Read on and I will tell you why…

What Is Average Daily Trading Volume? Why Does It Matter?

Average Daily Trading Volume (“ADTV”) is a measure of the number of shares traded per day, averaged over a specific period of time (we use 50 days).

While this is not a technical indicator that seeks to predict the future direction of an equity, it is nevertheless important because it helps traders to assess the liquidity of a stock or ETF.

When a stock is highly liquid, you can easily enter and exit positions without directly influencing the stock’s price. Conversely, you can know which securities to avoid because they are too illiquid to trade.

Knowing the ADTV of an equity is also important because it establishes a benchmark from which to spot key volume spikes that are the footprint of institutional accumulation.

If, for example, a stock has an ADTV of 500,000 shares, but suddenly trades 2,000,000 shares one day, that means volume spiked to 4 times (400%) its average daily level.

If such a volume surge was also accompanied by a substantial price gain for the day, it is a definitive sign that banks, mutual funds, hedge funds, and other institutions were supporting the stock.

4 Key Questions To Determine If A Stock Is Liquid Enough To Trade

Although ADTV by itself could be used as a concrete “line in the sand” to determine if a stock is liquid enough to trade, there are too many other factors that play a part in that role.

Following are four key questions that, when combined with ADTV, can help you to more accurately determine whether a stock can be traded or should be left alone.

1.) How Many Shares Will I Trade? (Size Matters)

If you are only planning to buy 100 shares of a stock, the ADTV of an equity basically becomes a non-issue because it will be easy to liquidate such a small position, even in a very thinly traded stock.

However, if you intend to buy 5,000 shares of that same stock, you need to more seriously consider whether or not it will be difficult to eventually exit the position with minimal slippage and volatility.

Regardless of what you may have heard, size matters (at least in this scenario).

2.) How High Is The Average Dollar Volume?

Average Dollar Volume (not to be confused with Average Daily Trading Volume) is a number that is determined by multiplying the share price of a stock times its average daily trading volume (ADTV).

For example, a $25 stock with an ADTV of 800,000 shares has exactly the same dollar volume of a $50 stock with an ADTV of just 400,000 shares. In both cases, the Average Dollar Volume is 20 million ($25 X 800,000 or $50 X 400,000).

For institutional investors and traders who rely on making big trades, Average Dollar Volume is a more important number than ADTV.

In the example above, an institutional trader would consider both of those stocks to be equal with regard to liquidity.

As a general rule of thumb, an Average Dollar Volume of 20 million or greater provides pretty good liquidity for most traders.

If you trade a very large account (and accordingly large position size), consider an average dollar volume above 80 million to be extremely liquid.

By knowing the Average Dollar Volume of a stock, you can lower your minimum ADTV requirement if the stock is trading at a higher price.

3.) How Long Will I Hold?

Are you a daytrader, swing trader, or position trader? The length of time you typically hold stocks has a direct relationship to suitable minimum volume requirements (click here for a comparison of trading timeframes).

A daytrader who scalps for tiny 10 or 20 cent gains must limit himself to trading only in thick stocks where millions of shares per day change hands (equities with tight spreads and extremely high liquidity).

On the other hand, a position trader who rides the profit in uptrending stocks for many months can trade in much thinner stocks because they can scale out of positions over the course of several days or weeks.

Although I originally started as a daytrader (in the late ’90s), I now focus exclusively on swing and position trading stocks in my managed accounts and newsletter.

4.) Am I Trading Individual Stocks Or ETFs?

In individual stocks, ADTV and/or Average Dollar Volume plays a big role in determining a stock’s liquidity.

But with ETFs (exchange traded funds), average volume levels are largely irrelevant because ETFs are open-end funds. This means new units (shares) can be created or redeemed as necessary; supply and demand therefore has little effect.

Even if an ETF has no buyers or sellers for several hours, the bid and ask prices continue to move in correlation with the market value of the ETF, which is derived from the prices of individual underlying stocks.

As such, you should be much less concerned with the average volume of an ETF than with an individual stock.

In my nightly stock and ETF pick newsletter, I generally use a minimum ADTV requirement of 100k-500k shares for individual stocks (depending on share size of the position), but may go as low as 50k shares for ETFs (in order to achieve greater asset class diversity).

While liquidity is not of concern when trading ETFs, you should still be aware that ETFs with a very low ADTV may have wider spreads between the bid and ask prices.

To remedy this, you may simply use limit orders in such situations. Since I trade for many points, not pennies, occasionally paying up a few cents does not bother me.

For further details on the subject of ETFs and liquidity, check out Why ETF Trading Volume Does Note Determine ETF Liquidity.

How To Easily Determine The Liquidity Of A Stock/ETF

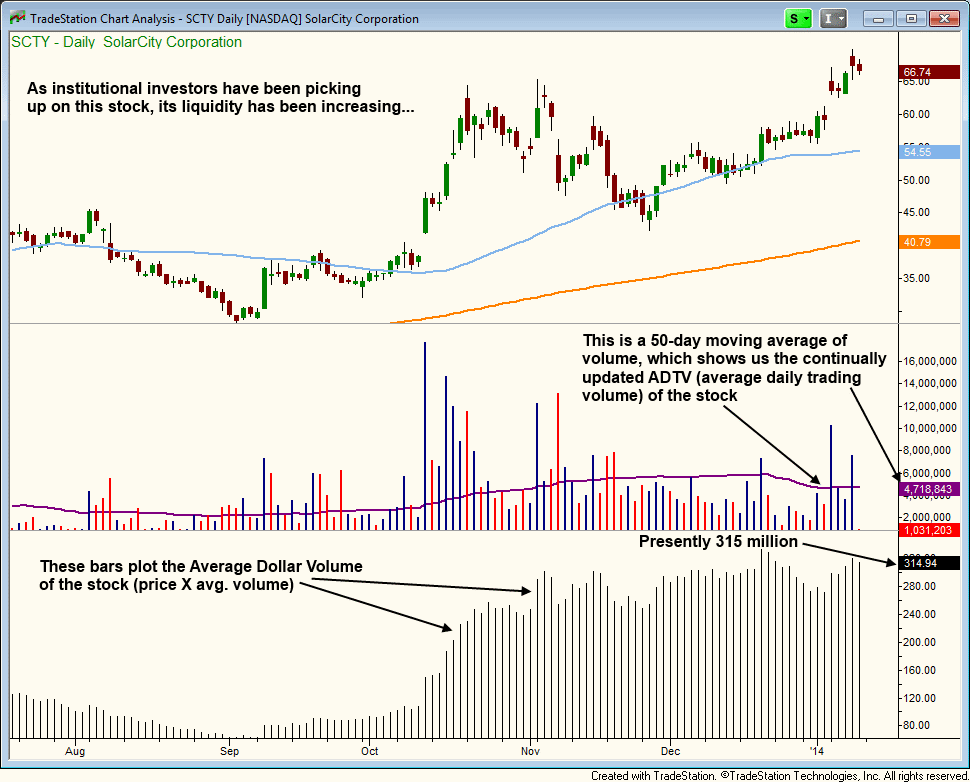

Although there are free financial websites that provide you with the ADTV and/or Average Dollar Volume of stocks, the fastest and best way to gauge the liquidity of a stock is by plotting the data on a stock chart of a quality trading platform.

Below is the daily chart of SolarCity ($SCTY), which I bought in The Wagner Dailynewsletter on December 19 (still long as of January 10, with an unrealized price gain of 26%):

The chart above is pretty self-explanatory. The top section shows the price action (and a few moving averages), the middle shows daily volume bars and 50-day ADTV, and the bottom bars plot the Average Dollar Volume (in millions).

With an ADTV of nearly 5 million shares and an Average Dollar Volume of 315 volume, $SCTY is a highly liquid stock that is “institutional-friendly.”

It’s Important, But Don’t Get Hung Up

If you want to avoid surprise price reactions when it comes time to close out your trades, pay attention to the ADTV and/or Average Dollar Volume of stocks. Doing so ensures there is sufficient liquidity to prevent your trades from directly affecting the stock prices.

Nevertheless, you must realize that determining whether or not a stock has sufficient liquidity is not as clear-cut as merely picking an arbitrary number such as 500,000 minimum shares per day.

Further, you should understand that Average Dollar Volume gives a more complete and accurate picture of a stock’s liquidity than ADTV alone. Your individual trading timeframe also plays a role in determining which stocks can be traded.

Frankly, I feel many individual retail traders get too hung up about the average daily volume of a stock. Unless you’re a whale with a massive trading account, your individual transactions within a stock will usually have a minimal (if any) effect on the price.

Of much greater importance is just focusing on buying leading stocks with strong institutional support (these stocks are typically quite active anyway).

If a company has a history of outstanding earnings growth, or a revolutionary product that’s selling like suntan lotion at the beach, it’s even okay to buy thinly traded stocks.

But just be sure to reduce your share size to compensate for greater price volatility (I always list our portfolio position size for each new stock/ETF pick).

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.