Friday, September 27, 2013 1:24:13 PM

Stericycle -- >>> Stericycle - Replicating A Successful Strategy Abroad

Sep 23 2013

http://seekingalpha.com/article/1707662-stericycle-replicating-a-successful-strategy-abroad?source=yahoo

Stericycle Inc. (SRCL) is the domestic market leader (32% share) providing medical waste management services to large quantity (LQ) and small quantity (SQ) medical waste generators. Shares have grown by 30x since 2000 through organic investments and acquisitions. The underlying business strategy capitalizes on regulation that mandates proper collection, transportation and disposal of medical waste. SRCL grew by targeting SQ clients with basic waste services and gaining incremental revenue upselling ancillary offerings to a client base of 550k accounts. The company is introducing new ancillary services domestically and rolling up the industry abroad with the same strategy that drove robust US growth in the last decade. Accordingly, continued execution on a familiar strategy will result in sustainable, and profitable, business growth. I estimate shares are worth $151, thus offering 30% upside through FY14.

More Than Just Medical Waste Management

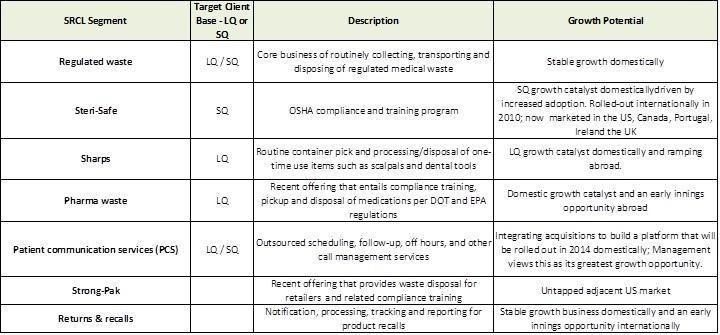

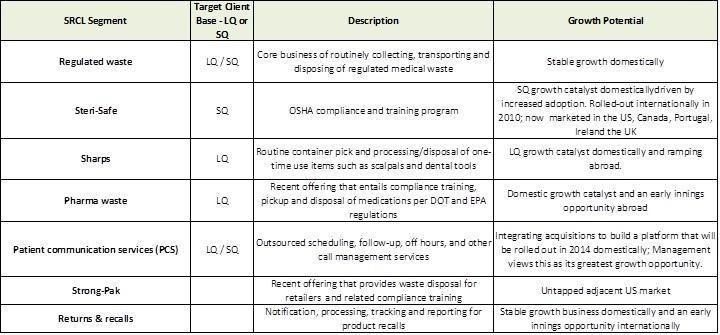

SRCL is essentially a one-stop shop for various medical waste needs with its core business being medical waste collection and disposal. The SRCL business model is to supplement organic growth with acquisitions for regional concentration, thus allowing for better route economies. SRCL then upsells ancillary services to existing customers once an expansive platform is in place. This approach has resulted in 10yr revenue CAGR of 17%, where upselling drives incremental margins. As an example, a base SQ customer with waste services has a mid-50's gross margin, compared to high 60's with a premium service like Steri-Safe. The company breaks out revenues by two segments - recalls & returns and regulated medical waste (RMW), of which the latter houses the ancillary business lines (please see below table for a segment overview). US operations (13% FY12 revenue growth) are currently driven by secondary services such as Steri-Safe for SQ, in addition to Sharps and Pharma Waste for LQ. Patient communication services will be rolled out to SRCL's client base in FY14 and it stands to be one of the company's greatest growth opportunities. International operations (17% FY12 revenue growth) are currently driven by Steri-Safe and will be boosted by increased adoption of ancillaries as the company increases its client base and route density. Both will act as a platform from which additional services can be delivered to existing clients internationally.

(click to enlarge)

Low-Cost Medical Waste Manager

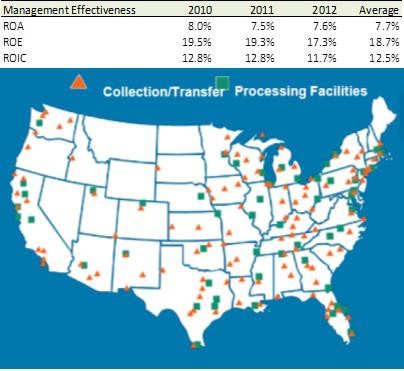

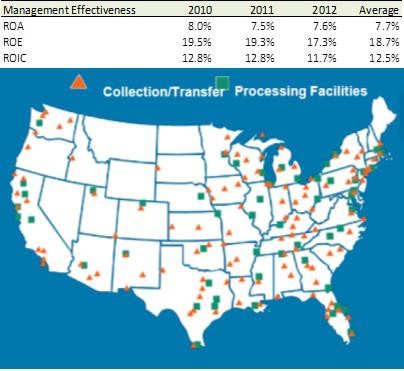

SRCL has a leg up on the competition as it is the low-cost provider. Strategic moves by management to consolidate the industry have put SRCL in an enviable position where route density increases profitability. Management has led 323 acquisitions since 1993 with the end goal being to increase regional concentration and rationalize operations with a focus on increasing efficiency. The company now has a network of 358 collection and processing facilities that allows SRCL to undercut competitors on pricing and maintain profitability through better route economies (see chart below for facility footprint). Transportation costs eat up approximately 50% of COGS. SRCL is more efficient with its fleet spending less time driving between client locations while consuming less fuel. Without a large domestic footprint (much like its competitors - Waste Management has 23), transportation costs can reduce gross margins and erode any low-pricing advantage. Management's contributions to this strategy with prudent capital allocation can't be underestimated. Capital allocation is perhaps the most important factor for companies complementing organic growth with acquisitions. Management has executed consistently, compounding book value per share at 17% over the last 10 years, in line with revenues. Management experience gives SRCL a distinct advantage as it attempts to consolidate secondary markets to achieve low-cost provider status internationally.

Industry Growth Drivers

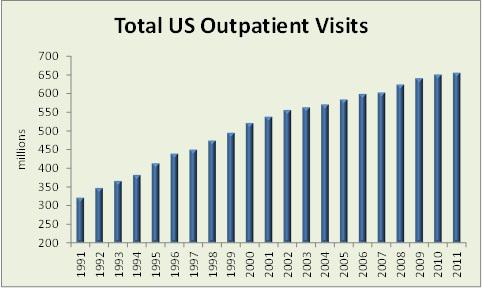

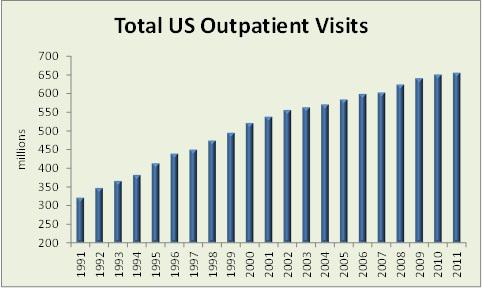

Industry growth benefits from both cost pressures resulting from regulation and secular trends in patient visits. Medical waste is regulated by agencies such as the Dept. of Labor (OSHA), DOT, EPA and DEA. Hazardous medical waste must be collected, transported and processed through regulated methods that require documentation and reporting every step along the way. Costs of regulatory compliance have relegated waste management to outsourcing providers who have expertise processing waste economically. The industry is now mostly outsourcing waste management due to regulation, as opposed to in-house processing as done in the late 80s when SRCL began consolidating providers. Continued US/international medical waste regulation will further drive outsourcing to specialized providers through heightened costs of regulation. The Affordable Care Act, should it ultimately come to fruition, stands to insure millions of individuals who previously lacked coverage. Accordingly, patient volumes could increase substantially for outpatient facilities (i.e. SQ business) who offer lower cost services than hospitals. Patient visits continue to move to outpatient facilities, rather than hospitals, both domestically and in Europe. Total US outpatient visits have increased 104% since 1991 while hospital admissions have remained relatively flat (See chart below). Along with this trend comes increased need for SQ clients to manage medical waste. Most SQ clients lack training and resources necessary for proper compliance and SRCL has focused on such clients for these reasons. Industry growth will also continue to be a function of selling ancillary medical services to an underpenetrated service base. Only 20-30% of SRCL's client base has adopted multiple offerings and industry providers are targeting greater adoption through sales efforts.

(click to enlarge)

Additional Color On Margins

Gross margins have more than doubled since FY96 from 21% to 45% in FY12. Two factors underlie this impressive feat. One is the transition from lower margin LQ business to a more fragmented SQ client base where pricing power is higher and where the potential revenue opportunity is greater. Typical SQ clients could generate 9x more revenue per account with premium services such as Patient Communication Services (PCS) and Steri-Safe, while LQ clients have an additional revenue opportunity of 4x. For these reasons, economics favor SQ generators where margins can be impacted to a greater extent. Second, is what I discussed above with route density. Critical mass is achieved with scale. I estimate SRCL reached an inflection point in the late 90's/early 2000's. Margins ramped 18 percentage points in a matter of four years from FY96-FY00. Incremental facility tuck-ins bolstered transportation route efficiency and profitability. The company was aggressively expanding its network as customer growth increased 490% over the same period. The below charts illustrate that critical mass (i.e. significant margin expansion) was achieved when SRCL surpassed 100-200 transportation and processing facilities. Note, the charts also evidence diminishing profitability when industry capacity becomes saturated, as could be the case in for US operations in years to come. Current operations in Europe are eerily similar to SRCL's US business in the early 2000s. Its route footprint is approaching critical mass (154 facilities FY12), gross margins run in the low 30's and revenues are predominantly LQ based. Management is replicating a familiar strategy by investing abroad in route concentration, while focusing on an untapped market of higher-margin SQ clients. It is likely international margins will trend along a similar path as US operations once critical mass is reached abroad. Fortunately, management has experience executing such a strategy, which provides compelling support that SRCL can capitalize on prospects in Europe.

(click to enlarge)

Replicating US Strategy In Europe

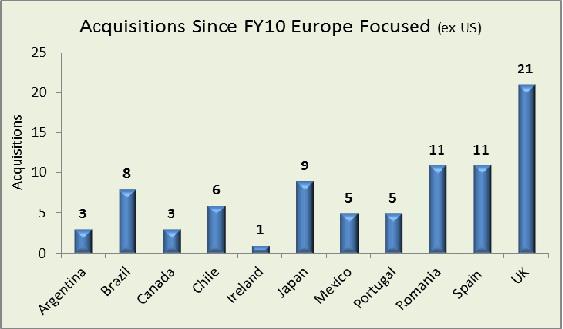

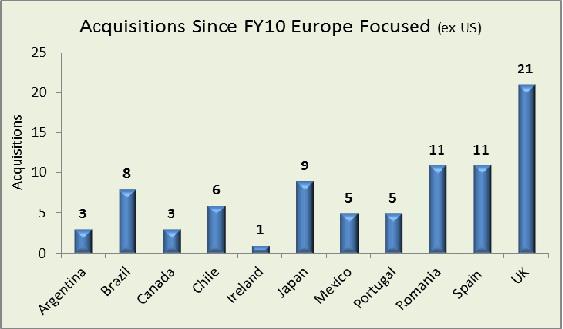

Since 2000, share prices have grown at a 32% CAGR on the back of margin and revenue expansion driven by an SQ focused strategy, acquisitions and upselling ancillary services in the US. Management is replicating the same strategy in Europe through industry consolidation where it can attain critical mass and low-pricing status. Europe is mostly low-margin, bulk LQ business currently and the company is acquiring competitors to increase route density while targeting high-margin SQ business (sound familiar?). SRCL must have an expansive platform in place so that it gains route economies allowing it to underprice competitors and roll-out ancillary services to win SQ clients. SRCL is gaining SQ penetration with its Steri-Safe offering. Steri-Safe is now offered in the UK, Ireland, Portugal and is soon to be rolled out in Spain where acquisition activity has been aggressive. The UK market evidences how successful this strategy has been as SQ business in the UK as a proportion of total UK revenues has grown approximately four percentage points annually to 32%. As other countries come online, it is likely SQ accounts will be similarly penetrated with consolidated gross margins expanding 200-300bps as international revenues comprise a larger portion of total revenues. Note, this process takes years to accomplish, will likely require additional debt issuances (current net debt to capital 45%) and may have a slower growth rate than the US as SRCL doesn't have an early-mover advantage in Europe. Keep in mind, Europe is not all about SQ potential. Sharps and recalls & returns operations should bolster growth for LQ accounts. Sharps business is poised to drive revenues as it has currently done in the US. SRCL recently brought a UK plant online in FY12 for its Sharps waste management and services are now offered in Ireland, Portugal and recently introduced in Spain.

(click to enlarge)

International Growth With a US Kicker

Revenue sustainability comes into question whenever double-digit growth is the norm. For SRCL, top-line growth will continue from not only international, but also from US contributions. SRCL has grown domestic revenues by a 13% CAGR since 2008 (21% internationally) through introducing niche services built off its existing distribution platform. Sharps and Steri-Safe are prime examples as each was introduced as a secondary service to gain incremental revenue and margins with existing clients. Looking long-term, the focus will shift to PCS in the US. PCS will continue to be driven by cost pressures from increased regulation, notably Medicare reimbursements for Hospitals. Current legislation details how hospitals will receive Medicare reimbursements based upon patient satisfaction surveys. Surveys address levels of physician care to quality of hospital offerings, and perhaps most importantly for SRCL, effectiveness of communication with patients. PCS allows hospitals to outsource patient communications and call management to those with such expertise. Enhanced patient relations should result from consistent contact and scheduling, 24-hour call center management and post-discharge calls, thus resulting in better survey results and higher reimbursements. Moreover, PCS alleviates cost pressures for hospitals that are investing to improve operations internally with the goal of improved treatment quality and survey results. SRCL acquired PCS providers NotifyMD and Beryl Healthcare in FY11 and FY12, respectively, and both are leaders in patient communications outsourcing. SRCL is integrating operations and technology platforms throughout FY13, and upselling this service is on track to begin domestically in FY14. If 25% of SRCL's client base signs up for PCS services, the company would stand to gain $866m-$1210m annually, thus potentially boosting revenues by 63%. Moreover, PCS gross margins currently run in the mid-40s. It's in the early stages of the growth cycle. As operations are integrated the SRCL way with a focus on efficiency gains and profitability, consolidated margins should benefit.

Geographic Based Valuation

The SRCL story will take years to play out and I am comfortable holding shares for an extended period as I believe expansion of both the top and bottom line is sustainable. Shares have consistently traded at premium valuations (1.9x the industry P/S average) and multiples will react as Europe and ancillary US growth seasons. I tend to look at valuation as a set of binary outcomes and the situation simply materializes as either favorable or not. I am comforted that the more probable outcome of the in between means I make a considerable return. In a best case scenario, shares are worth $212, and conversely, $90 in a worst case scenario. The "in between" results in a $151 price target, thus offering 30% upside through FY14 and a risk-to-reward of 3.5x. I am valuing SRCL shares by breaking down domestic and international operations and applying a proper P/S multiple to each. Since business abroad is utilizing the same SQ penetration and ancillary upsell strategy executed successfully in the US, I am assuming international will track along a similar trajectory. Valuing consolidated SRCL operations traditionally on a P/E, P/B, and EV/EBITDA basis yields similar price target results.

(click to enlarge)

Risks

I believe there are three primary risks to my thesis on SRCL. 1) PCS business is a new adjacent market for SRCL but unrelated directly to medical waste management. The company may be unsuccessful in its attempts to profitably integrate operations and then upsell PCS to its customer base. 2) Multiples could compress from premium levels if growth abroad (or with PCS) fails to materialize. SRCL is targeting SQ business in Europe for margin expansion and top-line growth, and not executing on this strategy would likely see multiples fall. 3) In the intermediate-term, margin directionality is relatively neutral for SRCL. There are signs of saturation domestically as the company has acquired lower margin business in recent years. Further down the income statement, net margins have minor tailwinds in coming years. Probable future debt issuances will offset some benefits of gross margin expansion and SG&A leverage.

Wrapping It Up

SRCL is the kind of company where you look at a historical 10y chart and kick yourself for not having the foresight to have initiated a position previously. The question then becomes is now too late and is the model sustainable for years to come? I believe the answer is undoubtedly yes since the company is undertaking a proven strategy abroad, complemented by a middle innings opportunity domestically. While I believe shares are worth $151 through FY14, holding onto SRCL could result in far greater returns for those with such patience.

<<<

Sep 23 2013

http://seekingalpha.com/article/1707662-stericycle-replicating-a-successful-strategy-abroad?source=yahoo

Stericycle Inc. (SRCL) is the domestic market leader (32% share) providing medical waste management services to large quantity (LQ) and small quantity (SQ) medical waste generators. Shares have grown by 30x since 2000 through organic investments and acquisitions. The underlying business strategy capitalizes on regulation that mandates proper collection, transportation and disposal of medical waste. SRCL grew by targeting SQ clients with basic waste services and gaining incremental revenue upselling ancillary offerings to a client base of 550k accounts. The company is introducing new ancillary services domestically and rolling up the industry abroad with the same strategy that drove robust US growth in the last decade. Accordingly, continued execution on a familiar strategy will result in sustainable, and profitable, business growth. I estimate shares are worth $151, thus offering 30% upside through FY14.

More Than Just Medical Waste Management

SRCL is essentially a one-stop shop for various medical waste needs with its core business being medical waste collection and disposal. The SRCL business model is to supplement organic growth with acquisitions for regional concentration, thus allowing for better route economies. SRCL then upsells ancillary services to existing customers once an expansive platform is in place. This approach has resulted in 10yr revenue CAGR of 17%, where upselling drives incremental margins. As an example, a base SQ customer with waste services has a mid-50's gross margin, compared to high 60's with a premium service like Steri-Safe. The company breaks out revenues by two segments - recalls & returns and regulated medical waste (RMW), of which the latter houses the ancillary business lines (please see below table for a segment overview). US operations (13% FY12 revenue growth) are currently driven by secondary services such as Steri-Safe for SQ, in addition to Sharps and Pharma Waste for LQ. Patient communication services will be rolled out to SRCL's client base in FY14 and it stands to be one of the company's greatest growth opportunities. International operations (17% FY12 revenue growth) are currently driven by Steri-Safe and will be boosted by increased adoption of ancillaries as the company increases its client base and route density. Both will act as a platform from which additional services can be delivered to existing clients internationally.

(click to enlarge)

Low-Cost Medical Waste Manager

SRCL has a leg up on the competition as it is the low-cost provider. Strategic moves by management to consolidate the industry have put SRCL in an enviable position where route density increases profitability. Management has led 323 acquisitions since 1993 with the end goal being to increase regional concentration and rationalize operations with a focus on increasing efficiency. The company now has a network of 358 collection and processing facilities that allows SRCL to undercut competitors on pricing and maintain profitability through better route economies (see chart below for facility footprint). Transportation costs eat up approximately 50% of COGS. SRCL is more efficient with its fleet spending less time driving between client locations while consuming less fuel. Without a large domestic footprint (much like its competitors - Waste Management has 23), transportation costs can reduce gross margins and erode any low-pricing advantage. Management's contributions to this strategy with prudent capital allocation can't be underestimated. Capital allocation is perhaps the most important factor for companies complementing organic growth with acquisitions. Management has executed consistently, compounding book value per share at 17% over the last 10 years, in line with revenues. Management experience gives SRCL a distinct advantage as it attempts to consolidate secondary markets to achieve low-cost provider status internationally.

Industry Growth Drivers

Industry growth benefits from both cost pressures resulting from regulation and secular trends in patient visits. Medical waste is regulated by agencies such as the Dept. of Labor (OSHA), DOT, EPA and DEA. Hazardous medical waste must be collected, transported and processed through regulated methods that require documentation and reporting every step along the way. Costs of regulatory compliance have relegated waste management to outsourcing providers who have expertise processing waste economically. The industry is now mostly outsourcing waste management due to regulation, as opposed to in-house processing as done in the late 80s when SRCL began consolidating providers. Continued US/international medical waste regulation will further drive outsourcing to specialized providers through heightened costs of regulation. The Affordable Care Act, should it ultimately come to fruition, stands to insure millions of individuals who previously lacked coverage. Accordingly, patient volumes could increase substantially for outpatient facilities (i.e. SQ business) who offer lower cost services than hospitals. Patient visits continue to move to outpatient facilities, rather than hospitals, both domestically and in Europe. Total US outpatient visits have increased 104% since 1991 while hospital admissions have remained relatively flat (See chart below). Along with this trend comes increased need for SQ clients to manage medical waste. Most SQ clients lack training and resources necessary for proper compliance and SRCL has focused on such clients for these reasons. Industry growth will also continue to be a function of selling ancillary medical services to an underpenetrated service base. Only 20-30% of SRCL's client base has adopted multiple offerings and industry providers are targeting greater adoption through sales efforts.

(click to enlarge)

Additional Color On Margins

Gross margins have more than doubled since FY96 from 21% to 45% in FY12. Two factors underlie this impressive feat. One is the transition from lower margin LQ business to a more fragmented SQ client base where pricing power is higher and where the potential revenue opportunity is greater. Typical SQ clients could generate 9x more revenue per account with premium services such as Patient Communication Services (PCS) and Steri-Safe, while LQ clients have an additional revenue opportunity of 4x. For these reasons, economics favor SQ generators where margins can be impacted to a greater extent. Second, is what I discussed above with route density. Critical mass is achieved with scale. I estimate SRCL reached an inflection point in the late 90's/early 2000's. Margins ramped 18 percentage points in a matter of four years from FY96-FY00. Incremental facility tuck-ins bolstered transportation route efficiency and profitability. The company was aggressively expanding its network as customer growth increased 490% over the same period. The below charts illustrate that critical mass (i.e. significant margin expansion) was achieved when SRCL surpassed 100-200 transportation and processing facilities. Note, the charts also evidence diminishing profitability when industry capacity becomes saturated, as could be the case in for US operations in years to come. Current operations in Europe are eerily similar to SRCL's US business in the early 2000s. Its route footprint is approaching critical mass (154 facilities FY12), gross margins run in the low 30's and revenues are predominantly LQ based. Management is replicating a familiar strategy by investing abroad in route concentration, while focusing on an untapped market of higher-margin SQ clients. It is likely international margins will trend along a similar path as US operations once critical mass is reached abroad. Fortunately, management has experience executing such a strategy, which provides compelling support that SRCL can capitalize on prospects in Europe.

(click to enlarge)

Replicating US Strategy In Europe

Since 2000, share prices have grown at a 32% CAGR on the back of margin and revenue expansion driven by an SQ focused strategy, acquisitions and upselling ancillary services in the US. Management is replicating the same strategy in Europe through industry consolidation where it can attain critical mass and low-pricing status. Europe is mostly low-margin, bulk LQ business currently and the company is acquiring competitors to increase route density while targeting high-margin SQ business (sound familiar?). SRCL must have an expansive platform in place so that it gains route economies allowing it to underprice competitors and roll-out ancillary services to win SQ clients. SRCL is gaining SQ penetration with its Steri-Safe offering. Steri-Safe is now offered in the UK, Ireland, Portugal and is soon to be rolled out in Spain where acquisition activity has been aggressive. The UK market evidences how successful this strategy has been as SQ business in the UK as a proportion of total UK revenues has grown approximately four percentage points annually to 32%. As other countries come online, it is likely SQ accounts will be similarly penetrated with consolidated gross margins expanding 200-300bps as international revenues comprise a larger portion of total revenues. Note, this process takes years to accomplish, will likely require additional debt issuances (current net debt to capital 45%) and may have a slower growth rate than the US as SRCL doesn't have an early-mover advantage in Europe. Keep in mind, Europe is not all about SQ potential. Sharps and recalls & returns operations should bolster growth for LQ accounts. Sharps business is poised to drive revenues as it has currently done in the US. SRCL recently brought a UK plant online in FY12 for its Sharps waste management and services are now offered in Ireland, Portugal and recently introduced in Spain.

(click to enlarge)

International Growth With a US Kicker

Revenue sustainability comes into question whenever double-digit growth is the norm. For SRCL, top-line growth will continue from not only international, but also from US contributions. SRCL has grown domestic revenues by a 13% CAGR since 2008 (21% internationally) through introducing niche services built off its existing distribution platform. Sharps and Steri-Safe are prime examples as each was introduced as a secondary service to gain incremental revenue and margins with existing clients. Looking long-term, the focus will shift to PCS in the US. PCS will continue to be driven by cost pressures from increased regulation, notably Medicare reimbursements for Hospitals. Current legislation details how hospitals will receive Medicare reimbursements based upon patient satisfaction surveys. Surveys address levels of physician care to quality of hospital offerings, and perhaps most importantly for SRCL, effectiveness of communication with patients. PCS allows hospitals to outsource patient communications and call management to those with such expertise. Enhanced patient relations should result from consistent contact and scheduling, 24-hour call center management and post-discharge calls, thus resulting in better survey results and higher reimbursements. Moreover, PCS alleviates cost pressures for hospitals that are investing to improve operations internally with the goal of improved treatment quality and survey results. SRCL acquired PCS providers NotifyMD and Beryl Healthcare in FY11 and FY12, respectively, and both are leaders in patient communications outsourcing. SRCL is integrating operations and technology platforms throughout FY13, and upselling this service is on track to begin domestically in FY14. If 25% of SRCL's client base signs up for PCS services, the company would stand to gain $866m-$1210m annually, thus potentially boosting revenues by 63%. Moreover, PCS gross margins currently run in the mid-40s. It's in the early stages of the growth cycle. As operations are integrated the SRCL way with a focus on efficiency gains and profitability, consolidated margins should benefit.

Geographic Based Valuation

The SRCL story will take years to play out and I am comfortable holding shares for an extended period as I believe expansion of both the top and bottom line is sustainable. Shares have consistently traded at premium valuations (1.9x the industry P/S average) and multiples will react as Europe and ancillary US growth seasons. I tend to look at valuation as a set of binary outcomes and the situation simply materializes as either favorable or not. I am comforted that the more probable outcome of the in between means I make a considerable return. In a best case scenario, shares are worth $212, and conversely, $90 in a worst case scenario. The "in between" results in a $151 price target, thus offering 30% upside through FY14 and a risk-to-reward of 3.5x. I am valuing SRCL shares by breaking down domestic and international operations and applying a proper P/S multiple to each. Since business abroad is utilizing the same SQ penetration and ancillary upsell strategy executed successfully in the US, I am assuming international will track along a similar trajectory. Valuing consolidated SRCL operations traditionally on a P/E, P/B, and EV/EBITDA basis yields similar price target results.

(click to enlarge)

Risks

I believe there are three primary risks to my thesis on SRCL. 1) PCS business is a new adjacent market for SRCL but unrelated directly to medical waste management. The company may be unsuccessful in its attempts to profitably integrate operations and then upsell PCS to its customer base. 2) Multiples could compress from premium levels if growth abroad (or with PCS) fails to materialize. SRCL is targeting SQ business in Europe for margin expansion and top-line growth, and not executing on this strategy would likely see multiples fall. 3) In the intermediate-term, margin directionality is relatively neutral for SRCL. There are signs of saturation domestically as the company has acquired lower margin business in recent years. Further down the income statement, net margins have minor tailwinds in coming years. Probable future debt issuances will offset some benefits of gross margin expansion and SG&A leverage.

Wrapping It Up

SRCL is the kind of company where you look at a historical 10y chart and kick yourself for not having the foresight to have initiated a position previously. The question then becomes is now too late and is the model sustainable for years to come? I believe the answer is undoubtedly yes since the company is undertaking a proven strategy abroad, complemented by a middle innings opportunity domestically. While I believe shares are worth $151 through FY14, holding onto SRCL could result in far greater returns for those with such patience.

<<<

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.