Sunday, March 03, 2013 3:48:30 PM

MINE has released some very significant news on Feb 27, 2013 that the company's subsidiary, Level 5 Beverage Company, Inc., has entered into a Premium Product Development Agreement with Power Brands:

http://ih.advfn.com/p.php?pid=nmona&article=56483871

MINE currently is made up of two subsidiaries; Level 5 Beverage Co. (LEVEL 5) and Minerco Resources, Inc.

http://www.minercoresources.com/

Level 5 Beverage Co. (LEVEL 5) -- The new management team of the company, with the approval of the board of directors, has voted to expand the company's business model to include a progressive retail division. Based on the company's management experience and its existing presence in Central America, the company's first retail venture will be in the beverage industry, specializing in coffee and energy/vitamin drinks.

http://www.level5beverage.com/

Minerco Resources, Inc. -- A development stage company, operates as a progress developer, producer, and provider of clean, renewable energy solutions in Latin America. It owns 100% of the rights to 2 hydro electric projects and 1 wind project in Honduras. The company was founded in 2007 and is based in Katy, Texas.

Below are some step by step thoughts that I have compiled to help derive a ”Potential” .12+ Fundamental Valuation from Level 5 Beverage Co. (LEVEL 5) which is one of MINE’s subsidiaries. There is also much to talk about for what to soon expect from their other subsidiary, but I will focus on Level 5 for the purpose of deriving a valuation within this post. Some DD that was previously posted by a poster who goes by Walker here within the IHub forum is the person that led me to MINE. It is his DD post and the comment below that led me to derive this ”Potential” .12+ Fundamental Valuation:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=84589019

“If Level 5 can gain 1% of 5 Hour Energy Market Share, that is 60k bottles a day at 3.00 a bottle is 180k a day in sales, 365 days is $65,700,000.00 ( yes 65 million).”

So based on the DD provided by Walker, of which we all should consider to be speculation at this point although strong, he deduces that MINE’s subsidiary (Level 5) has the potential to generate $65,700,000 per year if it captures only 1% of the market that exists for 5 Hour Energy Drink. After first reading his post, I had some concerns for believing that such a feat could be achieved. However, then later I did more DD and derived the post below which led me to 100% agree with Walker in thinking that it would be fair to believe that MINE, through its subsidiary Level 5, could capture 1% of the market that exists for 5 Hour Energy Drink.

Before reading any further to see how I derived a ”potential’ fundamental valuation of .12+ per share for MINE, please read the post below to make sure you understand why Walker and I believe this:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=84928274

The MINE & Power Brands Synchronization…

When you think of MINE (Minerco Resources, Inc.) and them confirming in their previous PR below that their subsidiary, Level 5 Beverage Company, Inc., has retained Power Brands as its beverage consultant, I think it is important to see both MINE and Power Brands as ”one” synchronized company:

http://ih.advfn.com/p.php?pid=nmona&article=55182533

http://www.powerbrands.us/

This is extremely important for all of us here in MINE to understand and to know to be the primary reason why MINE, through its beverage subsidiary Level 5 Beverage Company, Inc., is set for substantial growth. So for now, until MINE graduates to much higher levels, it is safe to consider Power Brands and MINE as one until MINE reaches a certain level of growth/maturity. Read below the comments from Darin Ezra, Power Brands CEO, to understand why I say this:

http://powerbrands.us/_/test/full-house-beverage-world.pdf

“You can think of Power Brands as a CEO managing your company for a fee,” Ezra explains. “Instead of paying a CEO $300,000 a year plus bonuses, you pay Power Brands a fraction of that and we manage it as a CEO would manage your company.”

“We’ve turned down a lot of business, some pretty big contracts, because the client absolutely will not listen to us and they do not know what they’re doing at all,” he admits. “We also won’t take money from people if we don’t think they could afford it. That’s just an ethical decision. …”

“…“We know what we do, we have the answers for all the questions. We’ve been there and done that 1,000 times. But it’s about being able to put the right people in the right seats.”…

Please further review below as I elaborate on why we can expect great things and why I believe we are in great hands. Again, really focus on and see the synergy between Power Brands and Level 5 Beverage Company, Inc. (MINE).

Power Brands is currently providing the same services to Level 5 Beverage Company, Inc. (MINE) that they had previously provided to Evolution Fresh, Inc. to help create, manufacture, market and sell Evolution Fresh, Inc. beverages:

http://www.evolutionfresh.com/en-us/

Below is confirmation that Evolution Fresh, Inc. later matured into something very big because of the support from Power Brands as Evolution Fresh, Inc. was later bought out by Starbucks which trades on the NASDAQ GS under the ticker of SBUX at $54.00+ per share as indicated below:

http://www.starbucks.com/

http://finance.yahoo.com/q?s=SBUX

Starbucks Acquires Evolution Fresh for $30 Million

http://money.cnn.com/2011/11/10/news/companies/starbucks_juice_evolution_fresh/index.htm

http://news.starbucks.com/article_display.cfm?article_id=635

SEATTLE, March 19, 2012 - Four months after acquiring Evolution Fresh, Inc., Starbucks Coffee Company (NASDAQ:SBUX) today announced the opening of the first Evolution Fresh™ store and the transformation of the brand’s look and feel to better reflect the pure, natural ingredients in each beverage and its strategic expansion and growth. The Bellevue, Wash. store opening and refreshed branding positions Evolution Fresh as a leader in the $3.4 billion and growing cold-crafted juice category and furthers its commitment to evolve and enhance the customer experience with innovative and wholesome products.

Darin Ezra, the CEO of Power Brands, went on to launch several successful beverage brands including Go Girl energy drink, which was recently acquired by a major manufacturer of Coca Cola products and distributor of Anheuser-Busch products.

http://www.powerbrands.us/bios.htm

That major manufacturer that acquired Go Girl was Nor-Cal Beverage Co.

http://www.gogirlenergy.com/company-information/

http://www.gogirlenergy.com/

Here’s a little more history about the Power Brands CEO, Darin Ezra…

http://powerbrands.us/_/test/full-house-beverage-world.pdf

CEO Darin Ezra first launched Power Brands several years ago to develop and manage two brands: Kabbalah Energy Drink, a companion product of Kabbalah Water in which the company had a small equity stake, and Go Girl Energy drink, which was an early entry into the burgeoning for-women-only energy sub-segment that Power Brands owned outright, but sold a few years ago to West Sacramento, CA-based Nor-Cal Beverage Co.

http://www.ncbev.com/

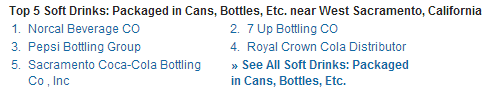

To get an idea of just how big Nor-Cal Beverage Co. is, look below to see that it has been in business for over 76 years, has over 500+ employees, and is listed as the #1 Top 5 Soft Drinks companies that are packaged in cans, bottle, etc. in the West Sacramento, CA area ahead of 7up, Pepsi, Coca Cola, and Royal Crown:

http://www.manta.com/c/mmc8qxd/nor-cal-beverage-co-inc

Go Girl at the Emmy's

http://www.youtube.com/watch?v=dfB6ARt0C9w

Go Girl Energy Drink on CBS Sunday Morning

http://www.youtube.com/watch?v=HonwgjiEaAE

Power Brands also worked with the rapper 50 cent to launch his Street King Energy Shot which is now known as SK Energy. SK Energy won GNC 2012 Energy Shot of the Year, winning formulation, graphic design, and product launch (other awards indicated within the link below too from other companies Power Brands supported):

http://powerbrands.us/_/test/awards.php

Case Study: An Energetic Brand Inspired by Rapper 50 Cent

http://powerbrands.us/_/test/street-king.php

50 Cent And Joan Rivers Co-star In 'Street King' Commercial

http://rapfix.mtv.com/2012/05/03/50-cent-joan-rivers-street-king-commercial/

http://www.bevnet.com/news/2012/street-king-rebranded-as-sk-energy

…Manufactured by Texas-based Big Red, which also has a sales and distribution role and minority stake in the brand, SK Energy debuted in September 2011 with a marketing and social mission to “feed a hungry child” by donating the cost of one meal to the United Nations World Food Program with the sale of every shot. The brand gained a key partner in January with The Honickman Group, an independent Pepsi distributor known for its deep and wide reach in the New York and Mid-Atlantic regions. By the beginning of the year, the product was distributed in 40,000 retail locations and gained authorizations at a number of chains including GNC, Rite Aid, Duane Reade, RaceTrac. Pure Growth co-founder Chris Clarke stated that he hopes to double distribution of SK Energy by the end of the year. …

Power Brands also helped to create, manufacture, market and sell Neuro Beverage Drinks. Here’s a picture of Darin Ezra, the Power Brands CEO, taking a picture with Donald Trump with their Neuro Beverage Drinks: http://www.powerbrands.us/darinanddonald.htm

http://drinkneuro.com/

Read through the Power Brands Clients List below and you will see that they have helped beverage products to mature from hundreds of clients to include Diet Red Bull, Diet Pepsi, Gatorade, Mountain Dew, Nestle, Omega 3 Water, Pepsi, Sierra Mist, Street King, WalMart, and hundreds of others:

http://powerbrands.us/_/test/clients.php

Power Brands have developed over 300 brands as more of them are indicated below:

http://www.powerbrands.us/portfolio.htm

A small portion of the Power Brands Clients List:

http://powerbrands.us/_/test/clients.php

Something else very important to note is that MINE is a fully reporting stock that trades on the OTCQB:

http://www.otcmarkets.com/stock/MINE/company-info

This means that MINE is very transparent as they file their financials with the Securities and Exchange Commission (SEC). Being on the OTCQB also means that not only does MINE file their financials with the SEC, but they file the required audited financials with the SEC which can be viewed below:

http://finance.yahoo.com/q/sec?s=MINE+SEC+Filings

http://www.otcmarkets.com/stock/MINE/filings

I think anyone reading this post should get the point that I am trying to make. This is not even half of the due diligence (DD) that’s out there floating around about the magnitude of Power Brands being on board, but I’ll stop for now to keep from making this post too long. They have significantly help over 300 companies as confirmed from their client list that I posted above. All of which have their own success stories. It is very obvious that Power Brands have a huge team of very powerful contacts. These contacts are all part of Level 5 Beverage Company, Inc. (MINE) contacts now.

Bottom line, from the due diligence (DD) above, I hope that all know what to expect now that news was released confirming that Level 5 Beverage Company, Inc., the subsidiary of MINE (Minerco Resources, Inc.), has retained Power Brands as its beverage consultant. Again and very important, this is why I think it is important to see both Level 5 Beverage Company, Inc. (MINE) and Power Brands as ”one” synchronized company until full maturity has been achieved:

http://ih.advfn.com/p.php?pid=nmona&article=55182533

We are in good hands!!!

Now let’s talk about this .12+ valuation. For the purpose of this valuation post, its renewable energy operations or any other new operations to be added will be considered some extra gravy for now because I will only focus on MINE’s potential derived from Level 5 Beverage Co. (LEVEL 5). To add, below are some key variables that I will use to help derive this ”potential” valuation:

Key Variables

1 ** Revenues of $65,700,000

2 ** Worst case scenario situation of Outstanding Shares (OS) considered at maxed Authorized Shares (AS) amount of 1,175,000,000 Shares http://www.otcmarkets.com/stock/MINE/company-info

3 ** 11.70% Net Profit Margin/ Beverages - Soft Drinks Industry/Consumer Goods Sector http://biz.yahoo.com/p/348conameu.html

4 ** 19.50 P/E Ratio/Beverages - Soft Drinks Industry/Consumer Goods Sector http://biz.yahoo.com/p/348conameu.html

Net Profit = $65,700,000 Revenues x .1170 Net Profit Margin for Beverage Industry

Net Profit = $7,686,900

Earnings Per Share (EPS) = Net Profit ÷ OS

EPS = $7,686,900 ÷ 1,175,000,000 shares

EPS = .0065

Expected Price Per Share = EPS x Price to Earnings (P/E) Ratio

Expected Price Per Share = .0065 EPS x 19.5 P/E Ratio

Expected Price Per Share = .126 per share

This means that given the above fundamental variables, the expected price per share for MINE could be justified to be trading within the .126 per share range if MINE is only able to capture only 1% of the market that exists for 5 Hour Energy Drink as laid out originally from the DD provided by Walker (much appreciated). The OS is far less than the 1,175,000,000 shares I used as the OS to derive this .12+ valuation, but I used 1,175,000,000 shares as the OS and the fundamental denominator used to give a ”worst case scenario” for us shareholders here in MINE. The OS was reported from the company’s Transfer Agent (TA) to have been 300+ million as of last week. As you can see, we are far from the 1,175,000,000 shares as the AS so using that number is very conservative to say the least.

If for some reason the thought of capturing 1% of the market that exists for 5 Hour Energy Drink is yet still too aggressive, then consider MINE/Level 5 only capturing ”half” of that 1% of the market that exists for 5 Hour Energy Drink. That would mean a share price fundamentally valued at half of the .126 per share which would equate to .063 per share. Given the share structure and the team that is on board to grow the company (Power Brands), I think such a small percentage is definitely doable.

I’ve noted this before in an earlier post, but I think it is again worth noting. Very important to note is that MINE is a fully reporting stock that trades on the OTCQB:

http://www.otcmarkets.com/stock/MINE/company-info

This means that MINE is very transparent as they file their financials with the Securities and Exchange Commission (SEC). Being on the OTCQB also means that not only does MINE file their financials with the SEC, but they file the required audited financials with the SEC which can be viewed below:

http://finance.yahoo.com/q/sec?s=MINE+SEC+Filings

http://www.otcmarkets.com/stock/MINE/filings

Something of importance to note, read this post below courtesy of GM_Tech:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=85157484

From these last series of Minerco Resources, Inc. (MINE) updates alone, one should be able to see that they have some very serious plans for moving forward in the queue. You just don’t see penny stocks file a FORM N-Q with the SEC very often. Although, subliminal, I think this could be very huge.

Read below the definition, but I must first ask…

Do we have a large business investment company here in MINE that we are not aware of just yet? Or why else would MINE file a Form N-Q?

I say this because notice particularly how the definition of a Form N-Q specifically states that …Small business investment companies are not required to file form N-Q…

Definition of Form N-Q:

http://www.investopedia.com/terms/s/sec-form-n-q.asp

Now read the Form N-Q that was filed by MINE:

http://ih.advfn.com/p.php?pid=nmona&article=56485619

Within the Form N-Q for MINE, the fund that is listed within that filing is the Columbia Funds Series Trust I. After doing a little research on the Columbia Funds Series Trust I, it looks like the filing above with the SEC reflects an important connection of the Columbia Funds Series Trust I being a new Mutual Fund that’s part of the Columbia Management of Funds that’s on board to support MINE.

https://www.columbiamanagement.com/

It looks like the Columbia Management of Funds is going to be connected through MINE to three of its other Mutual Funds through its new Columbia Funds Series Trust I, as indicated within the Form N-Q filed with the SEC below:

http://ih.advfn.com/p.php?pid=nmona&article=56485619

Total from Above Fund’s Investments = $6,198,520,112

Total Net Unrealized Appreciation = $1,453,311,000

Before fully absorbing this valuation post and DD above… make sure to ask yourself this one question…

Does this valuation post means that MINE should be trading at .126+ per share right now?

Hopefully your answer is… NO! The company would have to grow into the valuation above. All I did was to lay out a format to be able to gage where MINE could fundamentally begin to trade ”if” all of the stars as mentioned above starts to align to have things fall into place.

However, I will say that the stars are beginning to align and I truly do believe that MINE is significantly undervalued at these current levels. As I had explain in the DD and post above, with MINE retaining Power Brands to lead them through this new growth for their subsidiary, Level 5, the odds are tremendously in their favor for success. To add, consider the information above about the Form N-Q that was recently filed under MINE too. It looks like there are some heavy hitters on board here with MINE.

v/r

Sterling

Sterling's Trading & Investing Strategies:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=39092516

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.