Wednesday, February 06, 2013 12:04:32 PM

>>> Why 3 Marijuana Sympathy Plays Could Follow In The Footsteps Of Medical Marijuana, Inc. And Drop By 28%

February 6, 2013

by: Fraud Research Institute

http://seekingalpha.com/article/1159931-why-3-marijuana-sympathy-plays-could-follow-in-the-footsteps-of-medical-marijuana-inc-and-drop-by-28?source=yahoo

Influential economist Benjamin Graham once said, "Most of the time common stocks are subject to irrational and excessive price fluctuations in both directions as the consequence of the ingrained tendency of most people to speculate or gamble ... to give way to hope, fear and greed."

The Fraud Research Institute believes that Wall Street's best example of this irrational behavior at the moment is a basket of small cap public companies doing business in the marijuana sector. Specifically, our research into the 4 most actively traded marijuana stocks in the OTC markets leads us to believe that Medical Marijuana, Inc. (MJNA.PK) is the leader of the peer group and that most price fluctuations among the other 3 stocks mimic the recent behavior of MJNA.PK because they are merely sympathy plays.

The purpose of this research report is to determine (1) whether these marijuana stocks are just beginning to heat up or perhaps it is a case of dumb money chasing wildly overvalued stocks and (2) whether these recent fluctuations are a result of fundamental changes from within the actual companies or perhaps these high-flying marijuana stocks are indeed a great spectacle of the irrational and excessive price fluctuations described in the Benjamin Graham quote.

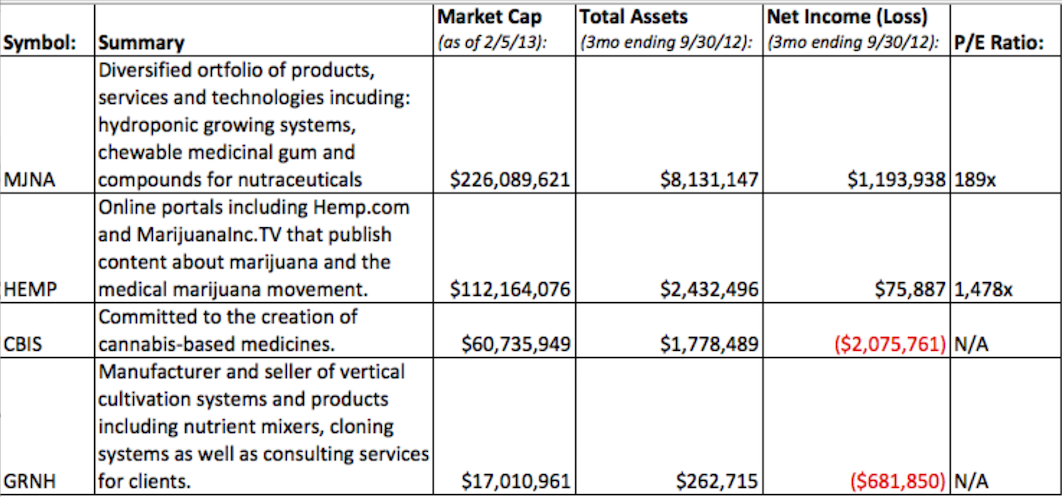

Peer Group Comparison - The Companies

Our peer group of small cap marijuana stocks consists of:

Medical Marijuana, Inc.

Hemp, Inc. (HEMP.PK)

Cannabis Science, Inc. (CBIS.OB)

GreenGro Technologies, Inc. (GRNH.PK)

All four of these marijuana stocks are very different. Perhaps the most significant difference is the fact that all four marijuana stocks operate very different business models that range everywhere from a diversified portfolio of wholly-owned products and services to a startup online portal focusing on the publication of marijuana-related content through sites such as Hemp.com. Only two of the four public companies are profitable with market caps exceeding $100,000,000 dollars.

Perhaps the only similarity among all four stocks is that they all trade at outrageously high valuations. Setting aside all speculation about the rapidly changing external business environments for medical marijuana companies, there have been zero material developments related to any of these companies' internal operations that are expected to have a material impact on fundamentals.

It is our opinion that any arguments made by proponents of marijuana stocks that attempt to rationalize a 100% or 200% increase in a company's market capitalization solely based on the rapidly changing external business environment are sheer nonsense.

Although these four companies are technically in the same sector, they are all completely different businesses and have very different intrinsic values. Despite the fact that these four companies have very different operations and long-term objectives, it is astounding to compare the short-term price fluctuations for these four stocks.

The Fundamentals

By now we have established the unusually direct correlation between each stock's trading activity despite how different each of these companies are. It is our opinion that this is a result of the Peer Leader / Sympathy Stock dynamic whereby the fluctuations of MJNA's stock have an effect on the trading patterns of the other stocks.

Despite all of our findings, the most important question has not been answered - are there any lucrative opportunities to profit from this irrational and inefficient volatility among small cap marijuana stocks?

In our opinion a very lucrative opportunity exists if MJNA continues to show weakness: short selling shares of Hemp, Inc.

First, we believe that HEMP has the weakest balance sheet among the marijuana stocks with market caps exceeding $100,000,000. Of the $2,421,496 total assets listed on the balance sheet over 90% of all assets consist of software. The largest asset on HEMP's balance sheet is LPO Software. We have been unable to determine how the company arrived at the $1.8M valuation for their Legal Processing Software and because the stock trades on the pink sheets that question may never be answered. Regardless, Legal Process Outsourcing ("LPO") software is increasingly common with a growing number of competitors and until we are able to learn from the management team how this LPO software is valued we will remain skeptical.

HEMP has less than $300 cash on hand and hard, tangible assets make up a very small percentage of total assets.

Regarding the income statement for Hemp, Inc., the primary source of over 95% of revenues come from Stock Sales. Again, because HEMP trades on the pink sheets it is very difficult to get a definitive answer on what this entails but it raises some big question marks from members of our research team.

After digging into the financial statements of all four marijuana stocks we hold a very strong opinion that HEMP has the weakest balance sheet and operational results relative to the lofty $112,000,000 dollar market cap and it is for this reason we believe that HEMP is by far the most overvalued marijuana stock of the peer group and therefore may be a lucrative opportunity for short-biased traders.

Conclusion

Small cap marijuana stocks have been some of the most volatile and actively traded stocks in the OTC markets. While they have made triple-digit gains over the course of the last few trading sessions, MJNA.PK fell by 28% on Tuesday, February 5, 2013 and we believe this could mark the beginning of the end for all four marijuana stocks discussed in this research report.

Our belief that MJNA.PK's 28% drop marks the beginning of the end is based largely on the actual reason why these stocks are moving - irrational fluctuations driven by greed as traders chase the marijuana sympathy stocks to hyper inflated prices. The three sympathy stocks will follow the movements of the peer group leader, including yesterday's 28% drop by MJNA.PK.

It is difficult to explain the current movements in the small cap marijuana sector better than Benjamin Graham did with his quote at the very beginning of this research report. Recent price fluctuations can be completely attributed to people's ingrained tendency to gamble and therefore investors considering any of these small cap marijuana stocks should exercise extreme caution.

<<<

February 6, 2013

by: Fraud Research Institute

http://seekingalpha.com/article/1159931-why-3-marijuana-sympathy-plays-could-follow-in-the-footsteps-of-medical-marijuana-inc-and-drop-by-28?source=yahoo

Influential economist Benjamin Graham once said, "Most of the time common stocks are subject to irrational and excessive price fluctuations in both directions as the consequence of the ingrained tendency of most people to speculate or gamble ... to give way to hope, fear and greed."

The Fraud Research Institute believes that Wall Street's best example of this irrational behavior at the moment is a basket of small cap public companies doing business in the marijuana sector. Specifically, our research into the 4 most actively traded marijuana stocks in the OTC markets leads us to believe that Medical Marijuana, Inc. (MJNA.PK) is the leader of the peer group and that most price fluctuations among the other 3 stocks mimic the recent behavior of MJNA.PK because they are merely sympathy plays.

The purpose of this research report is to determine (1) whether these marijuana stocks are just beginning to heat up or perhaps it is a case of dumb money chasing wildly overvalued stocks and (2) whether these recent fluctuations are a result of fundamental changes from within the actual companies or perhaps these high-flying marijuana stocks are indeed a great spectacle of the irrational and excessive price fluctuations described in the Benjamin Graham quote.

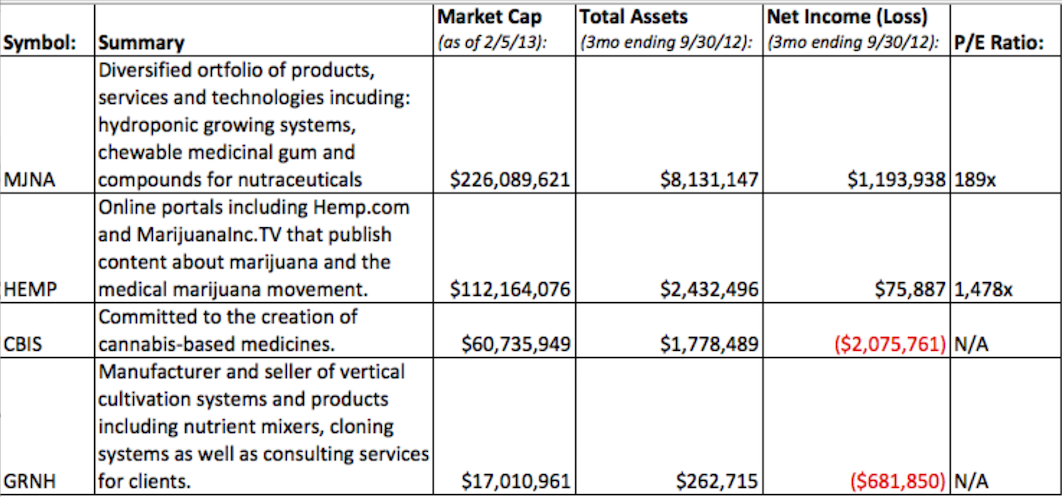

Peer Group Comparison - The Companies

Our peer group of small cap marijuana stocks consists of:

Medical Marijuana, Inc.

Hemp, Inc. (HEMP.PK)

Cannabis Science, Inc. (CBIS.OB)

GreenGro Technologies, Inc. (GRNH.PK)

All four of these marijuana stocks are very different. Perhaps the most significant difference is the fact that all four marijuana stocks operate very different business models that range everywhere from a diversified portfolio of wholly-owned products and services to a startup online portal focusing on the publication of marijuana-related content through sites such as Hemp.com. Only two of the four public companies are profitable with market caps exceeding $100,000,000 dollars.

Perhaps the only similarity among all four stocks is that they all trade at outrageously high valuations. Setting aside all speculation about the rapidly changing external business environments for medical marijuana companies, there have been zero material developments related to any of these companies' internal operations that are expected to have a material impact on fundamentals.

It is our opinion that any arguments made by proponents of marijuana stocks that attempt to rationalize a 100% or 200% increase in a company's market capitalization solely based on the rapidly changing external business environment are sheer nonsense.

Although these four companies are technically in the same sector, they are all completely different businesses and have very different intrinsic values. Despite the fact that these four companies have very different operations and long-term objectives, it is astounding to compare the short-term price fluctuations for these four stocks.

The Fundamentals

By now we have established the unusually direct correlation between each stock's trading activity despite how different each of these companies are. It is our opinion that this is a result of the Peer Leader / Sympathy Stock dynamic whereby the fluctuations of MJNA's stock have an effect on the trading patterns of the other stocks.

Despite all of our findings, the most important question has not been answered - are there any lucrative opportunities to profit from this irrational and inefficient volatility among small cap marijuana stocks?

In our opinion a very lucrative opportunity exists if MJNA continues to show weakness: short selling shares of Hemp, Inc.

First, we believe that HEMP has the weakest balance sheet among the marijuana stocks with market caps exceeding $100,000,000. Of the $2,421,496 total assets listed on the balance sheet over 90% of all assets consist of software. The largest asset on HEMP's balance sheet is LPO Software. We have been unable to determine how the company arrived at the $1.8M valuation for their Legal Processing Software and because the stock trades on the pink sheets that question may never be answered. Regardless, Legal Process Outsourcing ("LPO") software is increasingly common with a growing number of competitors and until we are able to learn from the management team how this LPO software is valued we will remain skeptical.

HEMP has less than $300 cash on hand and hard, tangible assets make up a very small percentage of total assets.

Regarding the income statement for Hemp, Inc., the primary source of over 95% of revenues come from Stock Sales. Again, because HEMP trades on the pink sheets it is very difficult to get a definitive answer on what this entails but it raises some big question marks from members of our research team.

After digging into the financial statements of all four marijuana stocks we hold a very strong opinion that HEMP has the weakest balance sheet and operational results relative to the lofty $112,000,000 dollar market cap and it is for this reason we believe that HEMP is by far the most overvalued marijuana stock of the peer group and therefore may be a lucrative opportunity for short-biased traders.

Conclusion

Small cap marijuana stocks have been some of the most volatile and actively traded stocks in the OTC markets. While they have made triple-digit gains over the course of the last few trading sessions, MJNA.PK fell by 28% on Tuesday, February 5, 2013 and we believe this could mark the beginning of the end for all four marijuana stocks discussed in this research report.

Our belief that MJNA.PK's 28% drop marks the beginning of the end is based largely on the actual reason why these stocks are moving - irrational fluctuations driven by greed as traders chase the marijuana sympathy stocks to hyper inflated prices. The three sympathy stocks will follow the movements of the peer group leader, including yesterday's 28% drop by MJNA.PK.

It is difficult to explain the current movements in the small cap marijuana sector better than Benjamin Graham did with his quote at the very beginning of this research report. Recent price fluctuations can be completely attributed to people's ingrained tendency to gamble and therefore investors considering any of these small cap marijuana stocks should exercise extreme caution.

<<<

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.