Friday, January 11, 2013 6:14:35 AM

Tulsa Megachurch Lawsuit: Victory Christian Center Says Mother Can't Claim Damages For Abuse

This undated photo provided by the Tulsa County Sheriff's Office shows Chris Denman. The former janitor at a Tulsa megachurch engulfed in a sex-abuse scandal was sentenced to 55 years in prison Wednesday, Dec. 12, 2012 after he pleaded guilty to raping a 13-year-old girl in the church's stairwell.

(AP Photo/Tulsa County Sheriff's Office, File)

01/07/13 01:56 PM ET EST

TULSA, Okla. — A judge has refused to dismiss a civil lawsuit that accuses a Tulsa megachurch of trying to cover up the rape of a 13-year-old girl by a worker on the church's campus.

The Victory Christian Center had argued that the girl's mother, who filed the suit, was not entitled to any relief under the law. A judge on Monday rejected the church's request to dismiss the lawsuit.

Ex-janitor Chris Denman was sentenced to 55 years in prison after pleading guilty to multiple sex-related charges. Denman admitted raping the teenage girl in a stairwell on church property.

The lawsuit accuses employees of not reporting the August rape to the authorities while the church conducted an in-house investigation.

The mother is seeking more than $75,000 in damages.

Copyright 2013 The Associated Press

http://www.huffingtonpost.com/2013/01/07/tulsa-megachurch-lawsuit_n_2425203.html [with comments]

--

Maldives Girl Faces Flogging After Alleged Rape

01/08/2013

http://www.huffingtonpost.com/2013/01/07/maldives-flogging-rape_n_2425420.html [with comments]

--

Arthur Schirmer Trial: Retired Pastor Allegedly Murdered Wife Betty Jean By Staging Car Crash

Arthur Schirmer, 64, has been accused of killing his wife, Betty Jean, in 2008. He has also been charged with killing his first wife, Jewel, in 1999.

01/07/13 05:03 PM ET EST

STROUDSBURG, Pa. — A retired Pennsylvania pastor charged with killing both of his wives is on trial in the death of his second wife.

Arthur "A.B." Schirmer, 64, is charged with killing Betty Jean Schirmer in 2008 and staging a car accident to cover it up. A panel of 12 jurors and four alternates was chosen Monday. Opening statements are expected Tuesday at the Monroe County Courthouse in Stroudsburg.

Schirmer also stands accused of killing his first wife, Jewel, in 1999. A trial date hasn't been set.

A grand jury has said Schirmer likely used blunt objects to kill his wives.

The retired clergyman, who led churches in Lebanon and Reeders, Pa., denies hurting either woman, and his adult children have said they support him.

The trial will likely center on Schirmer's claim that his 56-year-old wife died as the result of a Pocono Mountains car crash.

Schirmer told investigators he was driving Betty Schirmer to the hospital around 2 a.m. on July 15, 2008, so she could be treated for jaw pain. He said a deer crossed their path, causing him to lose control of the car.

The accident was minor, but his wife suffered multiple skull and facial fractures and died at the hospital. Her death was initially ruled an accident.

Police took a second look after an October 2008 suicide at Reeders United Methodist, where Schirmer had served as pastor since 2001. Authorities determined that Schirmer had been having an affair with his secretary – the suicidal man's wife.

Schirmer resigned from the church about two weeks after the suicide. He was charged in 2010.

Police and prosecutors in Lebanon County decided to take another look at his first wife's death after her husband of 31 years was charged in Betty Schirmer's death.

Schirmer has long claimed he was out for a run on April 23, 1999, when he returned home to find Jewel Schirmer's body in a pool of blood at the bottom of the basement steps. Although she had suffered a fractured skull as well as injuries to her face, body, arms and legs, the coroner made no determination as to whether her death was an accident or a homicide, and the case was closed.

But a grand jury recently concluded Jewel's injuries weren't consistent with a fall down the stairs, and Lebanon County prosecutors charged Schirmer in September.

Copyright 2013 The Associated Press

http://www.huffingtonpost.com/2013/01/08/arthur-schirmer-trial-murder-wife-betty-jean_n_2430862.html [with embedded video report, and comments]

--

Indonesia Province To Ban Women From Straddling Motorbikes

01/07/13

http://www.huffingtonpost.com/2013/01/07/indonesia-straddling-ban-_n_2425064.html [with embedded video report, and comments]

--

Melissa Nelson, Dental Assistant Fired For Being Attractive, Disputes Court Ruling That Sided With Boss

Melissa Nelson was fired from her job as a dental assistant after her employer deemed her a threat to his marriage.

By Lindsay Wilkes-Edrington

Posted: 01/10/2013 3:56 pm EST | Updated: 01/10/2013 6:15 pm EST

Melissa Nelson worked as a dental assistant for 10 years and thought she would make it her lifelong career. But that dream came to a sudden end in 2010 when her employer fired her for being too attractive.

Fort Dodge, Iowa, dentist James Knight said he fired Nelson to save his marriage, and in December the Iowa State Court backed his argument [ http://www.huffingtonpost.com/2012/12/21/bosses-irresistible-workers_n_2348381.html ]. Justice Edward Mansfield wrote that such firings are not unlawful discrimination because they are motivated by feelings and emotions, not gender.

On HuffPost Live Wednesday, Nelson and her attorney, Paige Fielder, disputed the ruling and said they hope to have it overturned. Fielder filed a petition this week requesting a rehearing.

"The only reason he was attracted to her at all was because she was a woman," Fielder said. "The fact that it came from his feelings is not inconsistent with the fact that she's a woman. Since they admitted it, it's perplexing to me why it was dismissed."

Brad Dacus, president of the Pacific Justice Institute, told HuffPost Live's Caroline Modrassey-Tehrani that anyone who understands the male psyche knows that it would have been difficult for the dentist to turn off his feelings for Nelson.

"Men and women think differently," Dacus told HuffPost Live.

Terry O'Neill, president of the National Organization for Women (NOW), called the firing "harassment in its classic form."

Watch the Full Segment [ http://live.huffingtonpost.com/#r/segment/fired-for-being-irresistible%2C-dentists-assistant-fired-for-being-hot/50e482e0fe34446c2100018b ] on HuffPost Live.

Copyright © 2013 TheHuffingtonPost.com, Inc.

http://www.huffingtonpost.com/2013/01/10/melissa-nelson-dental-assistant-fired-hot_n_2444222.html [with embedded video of a portion of the full linked segment, and comments]

--

Jodi Arias Conflicting Images of Devout Mormon or Jealous Killer

Jan. 10, 2013

http://abcnews.go.com/US/jodi-arias-conflicting-images-devout-mormon-jealous-killer/story?id=18173913 [with comments]

--

Mike Huckabee Slams Obama Cabinet's Lack Of Diversity

01/10/2013

http://www.huffingtonpost.com/2013/01/09/mike-huckabee-obama-cabinet_n_2443695.html [with embedded video report, and comments]

===

Rush Limbaugh Compares Gay Marriage Acceptance To Pedophilia 'Normalization'

01/08/2013

http://www.huffingtonpost.com/2013/01/08/rush-limbaugh-gay-marriage-pedophilia-normalized_n_2431805.html [with comments]

--

Rev. Charles Engelhardt And Bernard Shero Trial Begins On Charges Of Raping Former Philadelphia Altar Boy

Rev. Charles Engelhardt, in September, leaving a Philadelphia court.

01/07/13 07:43 PM ET EST

PHILADELPHIA — Jury selection began Monday in the trial of a Roman Catholic priest and a former Catholic school teacher charged with sexually assaulting a former altar boy.

Four jurors were chosen on the first day of jury selection in the case against the Rev. Charles Engelhardt and Bernard Shero. The case had been spun off from last year's high-profile trial of a church official charged with helping the Philadelphia Archdiocese cover up abuse complaints.

Engelhardt, 65, and Shero, 49, have pleaded not guilty to sexually assaulting the boy in the late 1990s.

Their accuser is a troubled 23-year-old policeman's son. He has a long history of drug addiction and arrests for drugs and petty crimes, and his credibility is expected to be the key trial issue.

He told a grand jury that he was passed around by three predators, starting when he was 10 years old, at St. Jerome's parish in northeast Philadelphia.

The young man said now-defrocked priest Edward Avery sexually assaulted him after Mass. He said Engelhardt assaulted him after catching him drinking wine in the sacristy and Shero, his sixth-grade teacher, attacked him after offering him a ride home.

Avery is serving 2 1/2 to five years in prison after admitting he assaulted the boy. Engelhardt and Shero face much longer terms if convicted at trial. A gag order prevents lawyers from commenting on the case.

Lawyers representing Engelhardt and Shero wanted them tried separately from the defendants in last year's case. The Rev. William Lynn, 62, is appealing his conviction in that landmark case, while serving a three- to six-year prison term. Lynn was the first U.S. church supervisor convicted of endangering children by helping the church shuttle accused priests from parish to parish.

Copyright 2013 The Associated Press

http://www.huffingtonpost.com/2013/01/07/rev-charles-engelhardt-bernard-shero-trial-rape-altar-boy_n_2423933.html [with embedded video report, and comments]

--

Scott Lively, 'Kill The Gays' Bill Supporter And Evangelist, On Trial For Crimes Against Humanity

By Meredith Bennett-Smith

Posted: 01/07/2013 12:42 pm EST | Updated: 01/07/2013 3:08 pm EST

On Monday, Scott Lively will tell a federal court why he supports Uganda's extreme persecution of gays and lesbians.

The U.S. evangelist and anti-gay crusader's trial begins Jan. 7 in Massachusetts. Lively is being sued for crimes against humanity by the organization Sexual Minorities of Uganda, represented by the Center for Constitutional Rights (CCR) [ http://ccrjustice.org/ ].

From the CCR website [ http://ccrjustice.org/LGBTUganda/ ]:

The suit alleges that Lively’s involvement in anti-gay efforts in Uganda, including his active participation in a conspiracy to strip away fundamental rights from LGBT persons constitutes persecution. This is the first known Alien Tort Statute (ATS) case seeking accountability for persecution on the basis of sexual orientation and gender identity.

The ATS allows suits to be brought to American courts by non-U.S. citizens [ http://www.cja.org/article.php?id=435 ] who claim to be victims of violations of international law (such as crimes against humanity) perpetrated outside the U.S.

While Lively's name may not be familiar to the majority of Americans, he is known to those fighting for LGBT rights in Uganda. According to the New York Times [ http://www.nytimes.com/2012/03/15/us/ugandan-gay-rights-group-sues-scott-lively-an-american-evangelist.html ], the suit against Lively alleges that he "conspired with religious and political leaders in Uganda to whip up anti-gay hysteria with warnings that gay people would sodomize African children and corrupt their culture." Vince Warren, executive director of the CCR, argues in a Washington Post blog that Lively calls himself the "'father' of the anti-gay movements [ http://www.washingtonpost.com/blogs/guest-voices/post/scott-lively-gets-his-day-in-court/2013/01/04/e5bd0514-5686-11e2-8b9e-dd8773594efc_blog.html ]" in Uganda.

In 2009, the African nation considered enacting a bill, referred to by some as the "Kill the Gays [id.]" bill, that would have imposed the death sentence on active homosexuals living with HIV or in cases of same-sex rape, per the Times [ http://www.nytimes.com/2012/03/15/us/ugandan-gay-rights-group-sues-scott-lively-an-american-evangelist.html ]. As part of the bill, an undefined category of "serial offenders" would also be eligible for death. The Times notes that one of Lively's Ugandan contacts proposed the bill.

Uganda's "Kill the Gays" bill was initially dropped after an international outcry but was reintroduced in February 2012 [ http://www.nytimes.com/2012/02/29/world/africa/ugandan-lawmakers-push-anti-homosexuality-bill-again.html?pagewanted=all ]. It is possible that this new version of the bill may nix the capital punishment clause, according to The Times. Lively voiced his support for the revision on his blog [ http://www.scottlively.net/2012/12/11/why-i-endorse-the-revised-anti-homosexuality-bill-in-uganda/ ], writing, "Since the alternative to passing this bill is to allow the continuing, rapid, foreigner-driven homosexualization of Ugandan culture, I am giving the revised Anti Homosexuality Bill my support."

In an interview with Current TV in 2010 [ http://www.youtube.com/watch?v=08HpzqZAQ_g (below)], Lively was reluctant to back the death penalty aspect of the bill, but he said the situation was a tough one.

"People like myself are stuck," Lively said. "Am I going to endorse something that goes too far to protect the whole society?"

In that interview, Lively also called Uganda a faithfully Christian country, and virulently anti-gay pastor Martin Ssempa a friend and a "good man."

Ssempa, working as the leader of the Makerere Community Church in Uganda's capital city of Kampala, is known for sensationalist tactics against the LGBT community, including repeating the discredited myth that homosexuality is tied to pedophilia [ http://www.livescience.com/13409-myths-gay-people-debunked-sexual-orientation.html ]. Ssempa has also reportedly screened hardcore gay pornography at churches and conferences [ http://www.npr.org/templates/story/story.php?storyId=128491183 ] in Uganda.

Lively previously drew the ire of organizations like the Southern Poverty Law Center for co-authoring a book titled The Pink Swastika, published in 1995. In it, Lively argued that some of Hitler's closest advisers were gay, and that they helped mastermind the Holocaust [ http://www.splcenter.org/get-informed/intelligence-report/browse-all-issues/2005/spring/holy-war/making-myths ].

"While we cannot say that homosexuals caused the Holocaust, we must not ignore their central role in Nazism," write Lively and co-author Kevin Abrams. "To the myth of the 'pink triangle' — the notion that all homosexuals in Nazi Germany were persecuted — we must respond with the reality of the 'pink swastika.'"

Watch Lively's full 2010 interview with Current TV below [ http://www.youtube.com/watch?v=08HpzqZAQ_g (embedded)]:

Copyright © 2013 TheHuffingtonPost.com, Inc.

http://www.huffingtonpost.com/2013/01/07/scott-lively-kill-the-gays-bill-supporter-on-trial-crimes-against-humanity_n_2425003.html [with comments]

--

Fischer Defends Scott Lively, Warns Left Will "Exterminate" Opponents

http://www.rightwingwatch.org/content/bryan-fischer-praises-scott-lively-and-suggests-his-critics-are-satanically-inspired

Bryan Fischer of the AFA says Scott Lively "did the same kind of stuff [in Uganda] that we do every day on 'Focal Point'".

http://www.youtube.com/watch?v=yF--eR5Ic5Y [embedded/further (linked) at http://www.huffingtonpost.com/2013/01/09/bryan-fischer-scott-lively_n_2440789.html (with comments)]

--

Exodus International, 'Ex-Gay' Group, Releases Ironically Hilarious Blooper Reel (VIDEO)

01/08/2013

http://www.huffingtonpost.com/2013/01/08/exodus-international-ex-gay-group-hilarious-blooper-reel_n_2433728.html [video (original at http://vimeo.com/55965360 ) embedded; with comments]

--

Louie Giglio, Pastor Under Fire For Anti-Gay Sermon, Withdraws From Obama Inauguration Ceremony

01/10/2013

http://www.huffingtonpost.com/2013/01/10/louie-giglio-anti-gay-obama-inauguration_n_2448796.html [with embedded video report, and comments]

--

Louie Giglio's Obama Inauguration Withdrawal Slammed By Bryan Fischer

01/10/2013

[...]

@BryanJFischer

Bryan Fischer

The bully bigots at Big Gay win huge victory for fascistic intolerance. Louie Giglio forced out of inauguration.

January 10, 2013 5:11 pm

[...]

@BryanJFischer

Bryan Fischer

Bouncing Giglio a shameful display of intolerant anti-Christian bigotry and hate. Welcome to Obama's America.

January 10, 2013 5:20 pm

... Fischer's full blog, titled "Bully Bigots at Big Gay declare war on Obama inauguration pastor," on the Rightly Concerned website here [ http://www.afa.net/Blogs/BlogPost.aspx?id=2147531039 ].

[...]

http://www.huffingtonpost.com/2013/01/10/louie-giglio-pastor-withdrawal-bryan-fischer_n_2449735.html [with comments]

--

http://www.huffingtonpost.com/2013/01/09/pope-gay-marriage-ad-new-zealand_n_2442308.html [with comments]

===

Taft High School Shooting: Suspect In Custody In Taft, California

01/10/2013

http://www.huffingtonpost.com/2013/01/10/taft-high-school-shooting_n_2449261.html [with comments]

--

Taft High School Armed Guard Was 'Snowed In,' Not Present During Shooting

01/10/2013

http://www.huffingtonpost.com/2013/01/10/taft-high-school-armed-guard_n_2450710.html [with comments]

--

Steven Roger Johnson Charged With Murdering, Dismembering Wife Manya Jewel Johnson With Saw

01/09/13

http://www.huffingtonpost.com/2013/01/09/steven-roger-johnson-murder-charges_n_2444153.html

--

Understanding the Second Amendment

By Geoffrey R. Stone.

Edward H. Levi Distinguished Service Professor of Law, University of Chicago

Opponents of laws regulating the sale, manufacture and use of guns fervently invoke the Second Amendment. In their view, the Second Amendment ("a well-regulated militia being necessary to the security of a free state, the right of the people to keep and bear arms shall not be infringed") forbids the government to regulate guns. Period. End of discussion.

But it is more complicated than that. At the outset, let's put aside the argument that the "well-regulated militia" clause signficantly narrows the scope of the Second Amendment. Although most judges and lawyers endorse that interpretation, the Supreme Court, in its controversial five-to-four decision in District of Columbia v. Heller, rejected that understanding of the text.

So, let's consider that matter "settled." Let's assume, then, that the Second Amendment reads: "The right of the people to keep and bear arms shall not be infringed." Now, that sure sounds absolute. But it's not that simple.

Consider, for example, the First Amendment, which provides: "Congress shall make no law ... abridging the freedom of speech." This also sounds absolute. But does the First Amendment mean that the government cannot constitutionally regulate speech?

Justice Oliver Wendell Holmes put that possibility to rest in 1919 with a famous hypothetical. "The most stringent protection of free speech," he observed, "would not protect a man falsely shouting fire in a theater and causing a panic." In other words, even though the text of the First Amendment sounds absolute, it is not.

But how can this be so? Doesn't the text mean what it says? Here's the catch: Even though it is true that "Congress shall make no law ... abridging the freedom of speech," we still have to define what we mean by "the freedom of speech" that Congress may not abridge. The phrase "the freedom of speech," in other words, is not self-defining. And as Justice Holmes demonstrated with his hypothetical, it does not cover an individual who falsely shouts "fire!"in a crowded theater.

But that is only the beginning, for despite the seemingly absolute language of the First Amendment, the Supreme Court has long-held that the government may regulate speech in a great many situations. In appropriate circumstances, for example, a speaker can be punished for defaming another individual, for making threats, for selling obscenity, for distributing child pornography, for inciting a murder, for "leaking" confidential information, for using a loudspeaker at night in a residential neighborhood, for handing out leaflets on a public bus, for erecting a too-large billboard, and for using naughty words on television, to cite just a few of many possible examples.

Thus, although the First Amendment seems absolute in its protection of "the freedom of speech," the Supreme Court has reasonably recognized that it does not guarantee us the right to say whatever we please, whenever we please, wherever we please, in whatever manner we please. The "freedom of speech" is subject to regulation.

The same is of course true of the Second Amendment. Even if we agree that the Second Amendment forbids the government to "infringe" the right to "keep and bear arms," that does not mean that the government cannot reasonably regulate the manufacture, sale, ownership and possession of firearms. Indeed, this is precisely what Justice Scalia said in his opinion for the Court in Heller.

It is time for opponents of gun control to stop mindlessly shouting "The Second Amendment!!" as if that ends the discussion. It does not. Just as there is no First Amendment right to falsely yell fire in a crowded theatre, there is no Second Amendment right to carry an AK-47 there.

And that is only the beginning of what the Second Amendment does not guarantee.

Copyright © 2013 TheHuffingtonPost.com, Inc. (emphasis in original)

http://www.huffingtonpost.com/geoffrey-r-stone/understanding-the-second_b_2436549.html [with comments]

--

Unhinged Tactical Response CEO threatens to ‘start killing people’ over Obama’s gun control

By David Edwards

Thursday, January 10, 2013 9:57 EST

The CEO of a Tennessee company that specializes weapons and tactical training is threatening to “start killing people” if President Barack Obama moves forward with gun control measures.

In a video posted to YouTube and Facebook [ https://www.facebook.com/JamesYeagerofTacticalResponse/posts/326250230824503 ] on Wednesday, Tactical Response CEO James Yeager went ballistic over reports [ http://www.washingtonpost.com/blogs/post-politics/wp/2013/01/09/biden-vows-white-house-action-on-gun-control/ ] that the president could take executive action with minor gun control measures after the mass shooting of 20 school children in Connecticut last month.

After the Drudge Report likened Obama [ http://rawreplaymedia.com/media/2012/1212/drudge_hitler_stalin_130109a.jpg (next below)]

to Adolf Hitler and Joseph Stalin on Wednesday, pro-gun conservatives expressed outrage [ http://www.rawstory.com/rs/2013/01/09/fox-news-guest-obamas-gun-control-plan-is-papers-please-like-nazi-germany/ ] over the idea that the White House could act without Congress.

“Vice President [Joe] Biden is asking the president to bypass Congress and use executive privilege, executive order to ban assault rifles and to impose stricter gun control,” Yeager explained in his video message. “Fuck that.”

“I’m telling you that if that happens, it’s going to spark a civil war, and I’ll be glad to fire the first shot. I’m not putting up with it. You shouldn’t put up with it. And I need all you patriots to start thinking about what you’re going to do, load your damn mags, make sure your rifle’s clean, pack a backpack with some food in it and get ready to fight.”

The CEO concluded: “I’m not fucking putting up with this. I’m not letting my country be ruled by a dictator. I’m not letting anybody take my guns! If it goes one inch further, I’m going to start killing people.”

As The Atlantic noted on Wednesday [ http://www.theatlanticwire.com/politics/2013/01/dont-worry-nra-obama-cant-do-big-things-guns-without-congress/60778/ ], gun advocates can stop “freaking out” because Obama cannot ban assault weapons or close the gun show loophole without Congress.

The president, however, can take small steps [ http://www.theatlanticwire.com/politics/2012/12/what-obama-can-do-guns-without-congress/60104/ ] like modernizing the background check system and limiting importation of assault rifles.

By Thursday morning, the video promising violence in response to gun control measures had been removed from Yeager’s YouTube page [ http://www.youtube.com/watch?v=aorMJoMDN-Q ], but the link had not been removed from Facebook.

Calls to Yeager and Tactical Response were not returned by the time of publication.

Watch this video, uploaded to YouTube on Jan. 9, 2013 [ http://www.youtube.com/watch?v=CiM-ZPuAhJ0 ].

[video embedded; video since 'removed by the user']

Update (11:15 a.m. ET): Yeager has replaced his YouTube video [ https://www.youtube.com/watch?v=k_C9QJ41Jx0 (next below)]

Watch this portion of the video that James Yeager removed from the original clip, broadcast Jan. 9, 2013.

[video embedded]

UPDATE: Yeager uploaded a second video to YouTube on Thursday, in which he advised that no one should do “anything rash.” He added that he didn’t “condone anybody committing any kind of felonies up to and including any aggravated assaults or murders.” Watch the video [ http://www.youtube.com/watch?v=W2kkax7WOKI ] below:

http://www.rawstory.com/rs/2013/01/10/unhinged-tactical-response-ceo-threatens-to-start-killing-people-over-obamas-gun-control/ [with comments]

--

Boy kills neo-Nazi dad: Protecting family or premeditated murder?

Jeffrey Hall holds a neo-Nazi flag in Riverside in 2010. He was fatally shot by his son in May 2011.

Credit: Associated Press

Phil Willon in Riverside

January 10, 2013 | 4:30am

The fate of a 12-year-old boy charged with killing his neo-Nazi father now rests in the hands of a Riverside County Superior Court judge who must decide whether the youngster knew what he did was wrong, and what should be done with him.

During closing arguments in the murder trial on Wednesday, contrasting images flashed on a courtroom wall of a 12-year-old boy who pointed a gun at the head of his father, Jeffrey Hall, and pulled the trigger, killing him, in May 2011.

One photograph captured Jeffrey Hall and his children frolicking in the surf, the other showed his son gripping a toy gun and flashing a Nazi salute along with his dad and a hooded Klansman.

The son's attorney, Public Defender Matthew Hardy, told Riverside County Superior Court Judge Jean P. Leonard that hate "cooked" inside the boy during years of being his father's punching bag and after hearing Hall threaten to burn down the family's Riverside home with his wife and children inside.

"He believed, in his own damaged way, that what he was doing was justified," Hardy said. "He felt he had to kill his dad to protect the family."

Hardy said the boy was "almost genetically programmed to commit violence."

"This young man never had a chance," Hardy said.

Chief Deputy Dist. Atty. Michael Soccio, however, urged the judge not to let the boy escape into the "Alice in Wonderland" juvenile justice system to avoid responsibility for a cold-blooded murder.

Hall was dozing on the living room couch, posing no imminent danger and "probably drunk" when he was shot, Soccio said. The boy also had revealed his plans to his little sister the day before, the prosecutor argued.

"He chose on his own to sneak downstairs and kill a sleeping parent," Soccio said. "He made the choice to kill his father."

Soccio said Hall's affiliation with the National Socialist Movement, while abhorrent to most, didn't mean he was a bad parent, nor did it justify his murder.

If the judge agrees with the defense, the boy would be released, possibly into the foster care system. If she finds him responsible, she could send the youngster to a state prison facility for juveniles or a treatment facility for delinquents, or place him on probation. The boy could remain in juvenile custody until he is 23, at which time the district attorney's office has the rarely used option of petitioning the court to extend his sentence one year at a time.

Copyright 2013 Los Angeles Times

http://latimesblogs.latimes.com/lanow/2013/01/boy-kills-neo-nazi-dad-protecting-family-or-premeditated-murder.html [with comments]

--

Wyoming Mounts Unconstitutional Attack On Non-Existent Gun Laws

By Annie-Rose Strasser on Jan 10, 2013 at 3:10 pm

Vice President Joe Biden will not deliver his suggestions for gun violence prevention measures to the President until Tuesday [ http://thinkprogress.org/politics/2013/01/10/1430611/bidens-gun-violence-event-interrupted-by-news-of-another-school-shooting/ ]. But, in a move that is as unconstitutional as it is presumptuous, lawmakers in Wyoming have already mounted their effort to block whatever legislative measures Biden might suggest. They aim to nullify any federal law that they do not like, and to create punishments for federal agents who might try to enforce new gun safety measures.

In a bill sponsored by eight representatives and two state senators, the lawmakers stipulate that “any federal law which attempts to ban a semi-automatic firearm or to limit the size of a magazine of a firearm or other limitation on firearms in this state shall be unenforceable in Wyoming.” These two measures have been among Biden’s proposals. The Wyoming bill [ http://legisweb.state.wy.us/2013/Introduced/HB0104.pdf ] also makes it a felony to enforce federal gun laws:

Any official, agent or employee of the United States government who enforces or attempts to enforce any act, order, law, statute, rule or regulation of the United States government upon a personal firearm, a firearm accessory or ammunition that is owned or manufactured commercially or privately in Wyoming and that remains exclusively within the borders of Wyoming shall be guilty of a felony. and, upon conviction, shall be subject to imprisonment for not more less than one (1) year and one (1) day or more than five (5) years, a fine of not more than two thousand dollars ($2,000.00) five thousand dollars ($5,000.00), or both[...]

Any federal law, rule, regulation or order created or effective on or after January 1, 2013

shall be unenforceable within the borders of Wyoming if the law, rule, regulation or order attempts to:

(i) Ban or restrict ownership of a semiautomatic firearm or any magazine of a firearm; or

(ii) Require any firearm, magazine or other firearm accessory to be registered in any manner.

There’s just one glaring problem with the legislators’ plan: If the federal government were to pass such measures, the bill would be unconstitutional.

The constitutional theory they are implementing is called “nullification [ http://thinkprogress.org/justice/2012/01/18/406357/strict-constitutionalist-ron-paul-endorses-nullification-as-a-very-good-idea/ ]” — where a state nullifies a federal law, in this case gun safety measures. The constitution actually stipulates that federal law “shall be the supreme law of the land [ http://thinkprogress.org/justice/2012/09/14/846981/north-carolina-supreme-court-justice-to-speak-to-nullificationist-group-that-compared-obama-to-hitler/ ].”

But the lawmakers seem to be ignoring that issue. Wyoming State Senator Larry Hicks tells the Washington Examiner [ http://washingtonexaminer.com/wyoming-lawmakers-propose-bill-to-nullify-new-federal-gun-laws/article/2518133 ] that the he believes the measure is constitutional under the tenth and second amendments. His colleague, Rep. Kendell Kroeker adds that, no matter the constitutionality, “I think that its necessary when the federal government violates our rights in the Constitution we have to act.”

This isn’t the first effort by the Wyoming legislature to circumvent federal law. On the state’s ballot in November, lawmakers added a proposed constitutional amendment that would have exempted the state from Obamacare [ http://thinkprogress.org/justice/2012/10/31/1114081/wyoming-ballot-includes-unconstitutional-attack-on-obamacare/ ].

© 2013 Center for American Progress Action Fund (emphasis in original)

http://thinkprogress.org/justice/2013/01/10/1431641/wyoming-nullification-gun-laws/ [with comments]

--

Joe Walsh Obamacare Opposition Prompts Tea Party Favorite To Suggest People 'Break The Law'

01/10/2013

Former Rep. Joe Walsh (R-Ill.), a staunch opponent [ http://www.dailyherald.com/article/20120701/news/707019844/ ] of the Affordable Care Act, suggested people "defy and or break the law and engage in civil disobedience" in response to Obamacare restrictions or new gun laws.

"We may have to shed blood every couple hundred years to preserve our freedoms," Walsh told supporters at a rally, according to Chicago's DNAinfo [ http://www.dnainfo.com/chicago/20130110/chicago/joe-walsh-suggests-breaking-law-fight-obamacare-chicago ].

Walsh also criticized conservatives who don't "understand we're at war [with progressives.]" ...

[...]

http://www.huffingtonpost.com/2013/01/10/joe-walsh-obamacare_n_2447143.html [with comments]

===

World Freedom Index 2013: Canadian Fraser Institute Ranks Countries

01/10/2013

http://www.huffingtonpost.com/2013/01/09/world-freedom-index-2013_n_2440620.html [with comments]

--

Flipping Off Police Officers Constitutional, Federal Court Affirms

A U.S. federal appeals court ruled Thursday that giving police the finger -- as done here by arrested activists of the Ukrainian womens' movement, FEMEN -- is not grounds for being pulled over.

01/04/2013

http://www.huffingtonpost.com/2013/01/03/flip-off-police_n_2403563.html [with comments]

--

Federal Court Halts Illegal NYPD Stop-And-Frisks

Jan 9, 2013

http://thinkprogress.org/justice/2013/01/09/1422131/federal-court-halts-illegal-nypd-stop-and-frisks/ [with comments]

--

Tyler Perry, Sharpton push probe into case of missing Florida men

Published January 10, 2013

FoxNews.com

Three influential black leaders — filmmaker Tyler Perry, the Rev. Al Sharpton and NAACP President Ben Jealous — are pushing for further investigation into a decade-old case of two Florida men who disappeared after separate encounters with a now-fired sheriff’s deputy.

The three men will hold a 10:30 a.m. news conference on Thursday at Collier County’s South Regional Library in East Naples, where they will discuss the next steps for the missing person investigations of Terrance Williams and Felipe Santos.

Santos, then 23, and Williams, then 27, disappeared three months apart in the Naples area in 2003 after crossing paths with Collier County Sheriff Deputy Steven Calkins. He was never charged, but was fired the next year.

“Cases such as these highlight a growing concern about the lack of media coverage when it comes to missing person cases involving people of color,” a statement publicizing the event said, according to the Naples Daily News.

Blacks made up about 13 percent of the U.S. population, yet they accounted for 33 percent of missing persons cases in 2011, according to FBI data cited by the newspaper.

Perry and Sharpton appeared together in February on MSNBC regarding the North Naples cases after the popular filmmaker saw a television show featuring Williams.

“They were put into the back of Deputy Calkins’ car and never heard from again,” Perry wrote on his personal blog in April. “And to this day Deputy Steve Calkins is a free man. I guess it’s time to march in Naples now.”

Marcia Williams, Terrance Williams’ mother, told the newspaper on Tuesday that she’s withholding comment until the press conference.

Santos, according to the Naples Daily News, disappeared in October 2003 after he was arrested for driving without a license. In a department memo, Calkins indicated he didn’t take Santos to jail, but rather dropped him off at a local supermarket.

Three months later, Williams disappeared after encountering Calkins. Witnesses and reports said Williams was having car troubles when Calkins spotted him near Naples Memorial Gardens, a cemetery in North Naples. Calkins said at the time he took Williams to a nearby supermarket and never saw him again.

Calkins, a 17-year veteran, was later fired from the sheriff’s office in August 2004 after giving inconsistent accounts of his encounter with Williams. He’s been deemed a person of interest in the case, the Naples Daily News reports.

Click [ http://www.naplesnews.com/news/2013/jan/08/tyler-perry-rev-al-sharpton-coming-naples-search-a/ ] for more from the Naples Daily News.

©2013 FOX News Network, LLC

http://www.foxnews.com/us/2013/01/10/tyler-perry-sharpton-push-probe-into-case-florida-missing-men/

===

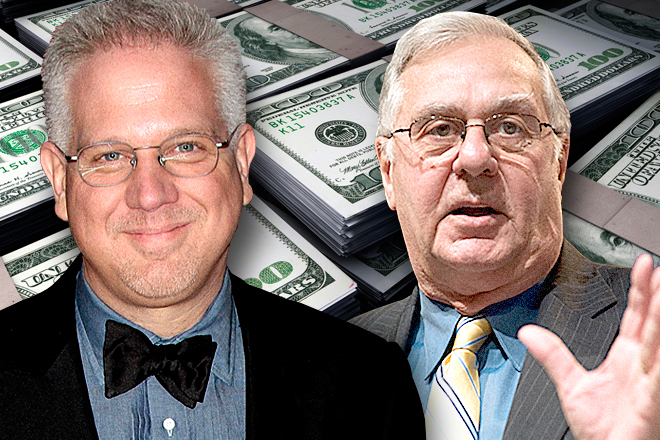

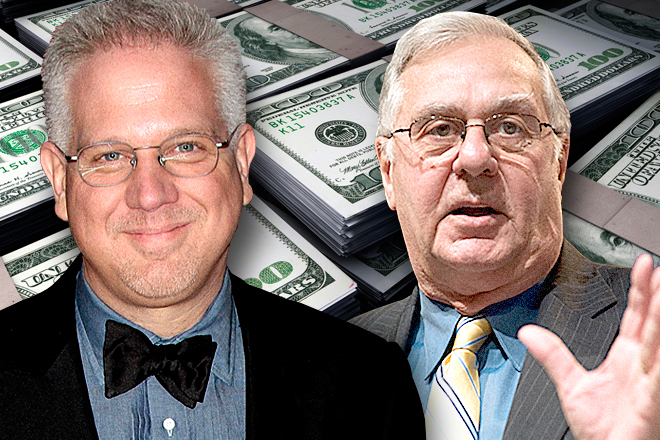

The conservative movement is still an elaborate moneymaking venture

The story of FreedomWorks' big Glenn Beck payout encapsulates the right-wing media

Jan 7, 2013

http://www.salon.com/2013/01/07/the_conservative_movement_is_still_an_elaborate_moneymaking_venture/ [with comments]

--

12 most despicable things Fox News did in 2012

From producing its own anti-Obama video to spinning furiously on unemployment, the network had a banner year

Jan 5, 2013

http://www.salon.com/2013/01/05/12_most_despicable_things_fox_news_did_in_2012/ [with comments]

===

Israel’s True Friends

Pete Marovich/European Pressphoto Agency

By ROGER COHEN

Published: January 7, 2013

London

PRESIDENT Obama’s decision to nominate Chuck Hagel, a maverick Republican with enough experience of war to loathe it, as his next secretary of defense is the right choice for many reasons, chief among them that it will provoke a serious debate on what constitutes real friendship toward Israel.

That debate, which will unfold during Senate confirmation hearings, is much needed because Jewish leadership in the United States is often unrepresentative of the many American Jews who have moved on from the view that the only legitimate support of Israel is unquestioning support of Israel, and the only mark of friendship is uncritical embrace of a friend.

Senator Lindsey Graham, Republican of South Carolina, fired an opening salvo by telling CNN that, “This is an in-your-face nomination by the president to all of us who are supportive of Israel.”

The comment, based on Hagel’s lack of enthusiasm for war on Iran and his single allusion to advocates of Israel as “the Jewish lobby,” was of a piece with last year’s in-your-face Republican line that Obama, a strong supporter of Israeli security, had thrown Israel “under the bus.”

Jewish voters, who overwhelmingly favored Obama once again, despite Prime Minister Benjamin Netanyahu’s unsubtle nudges, demonstrated at the ballot box what they thought of this characterization of the president.

Identifying Israel’s enemies is easy. Khaled Meshal, the Hamas leader, illustrated why when he declared: “Palestine is ours from the river to the sea and from the south to the north. There will be no concession on an inch of the land. We will never recognize the legitimacy of the Israeli occupation and therefore there is no legitimacy for Israel, no matter how long it will take.”

That is the sort of absolutist, annihilation-bent position that has been a losing proposition since 1948 and will continue to undermine the legitimate Palestinian quest for statehood [ http://www.nytimes.com/2011/09/17/world/middleeast/Abbas-Security-Council-United-Nations-Vote.html?pagewanted=all ] alongside a secure Israel — the one embraced by Palestinian President Mahmoud Abbas — for as long as it is advocated by self-serving merchants of hatred.

But deciding who Israel’s real friends are is more difficult — and that decision is critical both for Israel itself and for the future of U.S. policy toward the Jewish state.

The question has been on the president’s mind for a long time. During the 2008 campaign, in a meeting with the Cleveland Jewish community, Obama said [ http://kristof.blogs.nytimes.com/2008/02/27/obama-and-israel/ ]: “This is where I get to be honest and I hope I’m not out of school here. I think there is a strain within the pro-Israel community that says unless you adopt an unwavering pro-Likud approach to Israel that you’re anti-Israel and that can’t be the measure of our friendship with Israel. If we cannot have an honest dialogue about how do we achieve these goals, then we’re not going to make progress.”

He suggested that to equate asking “difficult questions” with “being soft or anti-Israel” was a barrier to moving forward.

Five years on, that needed dialogue has scarcely advanced. Self-styled “true friends” of Israel now lining up against the Hagel nomination are in fact true friends only of the Israeli right that pays no more than lip service to a two-state peace (when it even does that); scoffs at Palestinian national aspirations and culture; dismisses the significant West Bank reforms that have prepared Palestine for statehood; continues with settlement construction on the very shrinking land where a Palestinian state is envisaged (and was granted nonmember observer status [ http://www.un.org/News/Press/docs/2012/ga11317.doc.htm ] at the United Nations last November by 138 votes to 9 with 41 abstentions, including Germany); cannot find a valid Palestinian interlocutor on the face of the earth despite the moderate reformist leadership of Abbas and Prime Minister Salam Fayyad; ignores the grave implications for Israel of its unsustainable, corrosive dominion over another people and the question of how Israel can remain Jewish and democratic without a two-state solution (it cannot); bays for war with Iran despite the contrary opinions of many of Israel’s intelligence and military leaders; and propels Israel into repetitive miniwars of dubious strategic value.

These “true friends” shout the loudest. They are well-organized and remorseless.

Then there are the other friends of Israel, the quieter ones, the many who are unwaveringly committed to Israel’s security within its 1967 borders (with agreed land swaps); who believe continued settlement expansion in the West Bank is self-defeating and wrong; who hold that a good-faith quest for a two-state solution that will involve painful compromises on both sides (Palestinian abandonment of the “right of return” and Israeli abandonment of conquered land) is the only true path to Israeli security and the salvaging of its core Jewish values; who counsel against go-it-alone military adventurism against Iran; and who are troubled by a rightward nationalist drift in Israel whose central political tenet seems to be that holding on to all the land is doable and sustainable.

Hagel, like Obama, is a quiet strong friend of Israel. The movement against him is a relic of a binary with-Israel or against-Israel vision that does not have the true interests of Israel or the United States at heart.

*

Related News

Obama’s Pick for Defense Is an Ally, and a Lightning Rod (January 7, 2013)

http://www.nytimes.com/2013/01/07/us/obama-expected-to-select-hagel-for-defense-post.html

*

© 2013 The New York Times Company

http://www.nytimes.com/2013/01/08/opinion/israels-true-friends.html [with comments]

--

The Ascendant 'Smear Wing' of the Conservative Movement

The right once inveighed against "Borking" and race-baiting. In opposing Chuck Hagel, a part of its neoconservative wing is doing both.

Jan 8 2013

http://www.theatlantic.com/politics/archive/2013/01/the-ascendant-smear-wing-of-the-conservative-movement/266903/ [with comments]

--

U.S. Is Open to Withdraw Afghan Force After 2014

January 8, 2013

http://www.nytimes.com/2013/01/09/world/asia/us-is-open-to-withdraw-afghan-force-after-2014.html

--

Michele Bachmann Intelligence Committee Reappointment Draws Petition From PFAW

01/09/2013

http://www.huffingtonpost.com/2013/01/08/michele-bachmann-intelligence-committee_n_2435006.html [with embedded video report, and comments]

===

The Soul of America

By Sen. Bernie Sanders

Independent U.S. Senator from Vermont

Posted: 01/09/2013 10:04 am

Despite such terminology as "fiscal cliff" and "debt ceiling," the great debate taking place in Washington now has relatively little to do with financial issues. It is all about ideology. It is all about economic winners and losers in American society. It is all about the power of Big Money. It is all about the soul of America.

In America today, we have the most unequal distribution of wealth and income of any major country on earth, and more inequality than at any time period since 1928. The top 1 percent owns 42 percent of the financial wealth of the nation, while, incredibly, the bottom 60 percent own only 2.3 percent. One family, the Walton family of Wal-Mart, owns more wealth than the bottom 40 percent of Americans. In terms of income distribution in 2010, the last study done on this issue, the top 1 percent earned 93 percent of all new income while the bottom 99 percent shared the remaining 7 percent.

Despite the reality that the rich are becoming much richer while the middle class collapses and the number of Americans living in poverty is at an all-time high, the Republicans and their billionaire backers want more, more, and more. The class warfare continues.

My Republican colleagues say that the deficits are a spending problem, not a revenue problem. What these deficit-hawk hypocrites won't talk about is their spending. They won't discuss what they did to dig the country into this $1 trillion deep deficit hole. They waged wars in Afghanistan and Iraq without paying for them. They gave away huge tax breaks for the rich. They squandered taxpayer dollars on the pharmaceutical industry by making it illegal to let Medicare bargain for lower drug prices. They also rescinded financial regulations that enabled Wall Street to operate like a gambling casino, leading to a severe recession that eroded tax revenue and left more than 14 percent of American workers unemployed or underemployed.

Now, despite the deficits their policies helped to create and despite the enormous suffering which exists in our society, the Republicans want to cut Social Security, veterans' programs, Medicare, Medicaid, education, nutrition programs, and virtually every program which benefits low- and moderate-income Americans. They choose to turn their backs on the economic reality facing a significant part of our population: high unemployment, reduced wages, 50 million without health insurance, college graduates saddled with enormous student debt and elderly people living in desperation. And they have tried to slam the door on any further discussion about how to raise revenue by ending tax loopholes and unfair tax breaks.

Republicans like Senator Minority Leader Mitch McConnell who say the revenue debate is over don't want you to consider these facts:

• Federal revenue today, at 15.8 percent of GDP, is lower today than it was 60 years ago. During the last year of the Clinton administration, when we had a significant federal surplus, federal revenue was 20.6 percent of GDP.

• Today corporate profits are at an all-time high, while corporate income tax revenue as a percentage of GDP is near a record low.

• In 2011, corporate revenue as a percentage of GDP was just 1.2 percent -- lower than any other major country in the Organization for Economic Cooperation and Development, including Britain, Germany, France, Japan, Canada, Norway, Australia, South Korea, Switzerland, Norway, Italy, Ireland, Poland, and Iceland.

• In 2011, corporations paid just 12 percent of their profits in taxes, the lowest since 1972.

• In 2005, one out of four large corporations paid no income taxes at all while they collected $1.1 trillion in revenue over that one-year period.

We know where the Republicans are coming from. What about the Democrats? Will President Obama fulfill his campaign pledge to "protect the middle class" or will he surrender to right-wing blackmail? Will Democrats in the House and Senate stand with the vast majority of our citizens and such organizations as AARP, the National Committee to Preserve Social Security and Medicare, the AFL-CIO, the American Legion, the Veterans of Foreign Wars and every other veterans' organization in the fight against cuts to Social Security and veterans' programs, or will they agree to a disastrous corporate-backed "chained CPI" concept which makes major benefit cuts to those programs and raises taxes on low-income workers?

The simple truth is there are relatively easy ways to deal with the deficit crisis -- without attacking the elderly, the children the sick or the poor.

For example, we have got to eliminate loopholes in the tax code that allow large corporations and the wealthy to avoid more than $100 billion in taxes every year by setting up offshore tax shelters in places like the Cayman Islands, Bermuda and the Bahamas. This situation has become so absurd that one five-story office building in the Cayman Islands is now the "home" to more than 18,000 corporations.

Further, we must also end tax breaks for companies shipping American jobs overseas. Today, the United State government continues to reward companies that move American manufacturing jobs abroad, despite the fact that millions of American jobs have been outsourced to China, Mexico, and other low wage countries over the past decade. The Joint Committee on Taxation (the official revenue scorekeeper in Congress) has estimated that we could raise more than $582 billion in revenue over the next decade by eliminating these offshore tax loopholes.

We must also recognize that Wall Street recklessness caused the economic crisis, and it has a responsibility to reduce the deficit. Establishing a 0.03 percent Wall Street speculation fee, similar to what we had from 1914-1966, would dampen the dangerous level of speculation and gambling on Wall Street, encourage the financial sector to invest in the productive economy and reduce the deficit by more than $350 billion over 10 years.

We are entering a pivotal moment in the modern history of our country. Do the elected officials in Washington stand with ordinary Americans -- working families, children, the elderly, the poor -- or will the extraordinary power of billionaire campaign contributors and Big Money prevail? The American people, by the millions, must send Congress the answer to that question.

Copyright © 2013 TheHuffingtonPost.com, Inc.

http://www.huffingtonpost.com/rep-bernie-sanders/the-soul-of-america_b_2439576.html [with comments]

--

The Big Fail

By PAUL KRUGMAN

Published: January 6, 2013

San Diego

It’s that time again: the annual meeting of the American Economic Association and affiliates, a sort of medieval fair that serves as a marketplace for bodies (newly minted Ph.D.’s in search of jobs), books and ideas. And this year, as in past meetings, there is one theme dominating discussion: the ongoing economic crisis.

This isn’t how things were supposed to be. If you had polled the economists attending this meeting three years ago, most of them would surely have predicted that by now we’d be talking about how the great slump ended, not why it still continues.

So what went wrong? The answer, mainly, is the triumph of bad ideas.

It’s tempting to argue that the economic failures of recent years prove that economists don’t have the answers. But the truth is actually worse: in reality, standard economics offered good answers, but political leaders — and all too many economists — chose to forget or ignore what they should have known.

The story, at this point, is fairly straightforward. The financial crisis led, through several channels, to a sharp fall in private spending: residential investment plunged as the housing bubble burst; consumers began saving more as the illusory wealth created by the bubble vanished, while the mortgage debt remained. And this fall in private spending led, inevitably, to a global recession.

For an economy is not like a household. A family can decide to spend less and try to earn more. But in the economy as a whole, spending and earning go together: my spending is your income; your spending is my income. If everyone tries to slash spending at the same time, incomes will fall — and unemployment will soar.

So what can be done? A smaller financial shock, like the dot-com bust at the end of the 1990s, can be met by cutting interest rates. But the crisis of 2008 was far bigger, and even cutting rates all the way to zero wasn’t nearly enough.

At that point governments needed to step in, spending to support their economies while the private sector regained its balance. And to some extent that did happen: revenue dropped sharply in the slump, but spending actually rose as programs like unemployment insurance expanded and temporary economic stimulus went into effect. Budget deficits rose, but this was actually a good thing, probably the most important reason we didn’t have a full replay of the Great Depression.

But it all went wrong in 2010. The crisis in Greece was taken, wrongly, as a sign that all governments had better slash spending and deficits right away. Austerity became the order of the day, and supposed experts who should have known better cheered the process on, while the warnings of some (but not enough) economists [ http://www.nytimes.com/2010/07/02/opinion/02krugman.html ] that austerity would derail recovery were ignored. For example, the president of the European Central Bank confidently asserted that “the idea that austerity measures could trigger stagnation is incorrect.”

Well, someone was incorrect, all right.

Of the papers presented at this meeting, probably the biggest flash came from one by Olivier Blanchard and Daniel Leigh of the International Monetary Fund. Formally, the paper represents the views only of the authors; but Mr. Blanchard, the I.M.F.’s chief economist, isn’t an ordinary researcher, and the paper has been widely taken as a sign that the fund has had a major rethinking of economic policy.

For what the paper concludes is not just that austerity has a depressing effect on weak economies, but that the adverse effect is much stronger than previously believed. The premature turn to austerity, it turns out, was a terrible mistake.

I’ve seen some reporting describing the paper as an admission from the I.M.F. that it doesn’t know what it’s doing. That misses the point; the fund was actually less enthusiastic about austerity than other major players. To the extent that it says it was wrong, it’s also saying that everyone else (except those skeptical economists) was even more wrong. And it deserves credit for being willing to rethink its position in the light of evidence.

The really bad news is how few other players are doing the same. European leaders, having created Depression-level suffering in debtor countries without restoring financial confidence, still insist that the answer is even more pain. The current British government, which killed a promising recovery by turning to austerity, completely refuses to consider the possibility that it made a mistake.

And here in America, Republicans insist that they’ll use a confrontation over the debt ceiling — a deeply illegitimate action in itself — to demand spending cuts that would drive us back into recession.

The truth is that we’ve just experienced a colossal failure of economic policy — and far too many of those responsible for that failure both retain power and refuse to learn from experience.

© 2013 The New York Times Company

http://www.nytimes.com/2013/01/07/opinion/krugman-the-big-fail.html [with comments]

--

Paul Krugman Warns: 'We Are Crippling Our Future'

01/09/2013

http://www.huffingtonpost.com/2013/01/08/paul-krugman-aea-meeting-2013_n_2434563.html [with comments]

--

Obama Medicare Reform May Turn Into Wider Health Care Debate

* Heathcare costs may provide Medicare debate common ground

* Experts see scope for new competition in Medicare, tax changes

* White House mum on specifics

By David Morgan

Posted: 01/06/2013 11:12 am EST | Updated: 01/07/2013 9:23 am EST

WASHINGTON, Jan 6 (Reuters) - President Barack Obama could seek common ground with Republicans in the looming battle over Medicare spending by broadening the debate over entitlement reform to encompass the spiraling healthcare costs that confront a wide range of Americans.

In recent public remarks the president has identified the U.S. healthcare system's sky-high price tag - by far the highest in the world - as a driving force for Medicare reform.

The administration is expected to release a report on 2011 national healthcare expenditures on Monday that should further underline well-known trends. In 2010, health spending hovered at almost 18 percent of U.S. gross domestic product.

Healthcare experts, including former Obama advisers, say the White House appears to be considering ideas for Medicare, the popular health insurance program for the elderly and disabled, that could become models for the overall health landscape.

And in some good news for Obama, whose 2010 Affordable Care Act has been a lightning rod for Republican opposition, experts also see the political climate brightening for efforts to control the rise in healthcare costs generally.

"My expectation is that the president will offer a mix of ideas on the Medicare program that will not be about middle-income beneficiary cuts," said Neera Tanden, a former Obama healthcare adviser who heads the Center for American Progress, a think tank with strong Democratic Party ties.

"My hope is that he'll look at a variety of ideas to use this negotiation, just like we used (healthcare reform), to push forward on healthcare cost reductions," she said.

The White House declined to comment and it was not clear whether Obama plans to offer new initiatives or simply repackage existing proposals as broader cost-cutting initiatives.

Bold new steps geared to lessen the healthcare burden on all Americans could alter the tenor of the Medicare debate and help the president appeal for popular support in staving off Republican calls for deeper structural changes.

Obama's remarks have been vague so far. On Dec. 31 he told reporters: "I'm willing to reduce our government's Medicare bills by finding new ways to reduce the cost of healthcare in this country. That's something that we all should agree on."

Analysts guess that Obama could press for more price competition among drug makers, insurers and healthcare providers within Medicare, or for an acceleration of measures adopted as part of the 2010 Act that aim to move the national care delivery system away from its current fee-for-service cost structure.

Experts also see a potential role for tax reform - specifically, a reduction of the longstanding exclusion that protects individual workers from having their employer-sponsored health coverage taxed as a benefit.

The $2.8 trillion U.S. healthcare system costs nearly $9,000 a year for every man, woman and child. Growth has long outpaced inflation by wide margins, and following the U.S. recession of 2008 and 2009 has contributed to tepid job creation, low wage expansion and a stubbornly high level of personal bankruptcies.

Medicare, long considered a program that U.S. politicians would touch at their peril, is acknowledged, along with the national Medicaid program for the poor, to be a major driver of the deficit. The aging population puts Medicare on a collision course with major financial difficulties; the so-called Medicare trust fund is on pace to run out of money in 2024.

Government forecasters say Medicare spending alone will top $1 trillion in 2021, against $590 billion today, while total U.S. healthcare spending will balloon to $4.8 trillion.

MEDICARE AS AN INCUBATOR FOR BROAD CHANGE

Obama was attacked repeatedly during the 2012 presidential campaign about the $716 billion in reductions to Medicare spending growth contained within his signature healthcare reform, which itself remains under attack from many Republicans.

New initiatives would probably not end discussion of existing proposals to shave Medicare spending, including potential higher costs for wealthier beneficiaries and a possible increase in the enrollment age to 67 from 65.

A project by the Bipartisan Policy Center, led by former Senate Majority Leaders Tom Daschle, a Democrat, and Bill Frist, a Republican, is expected to make new proposals for reining in healthcare costs in the next few weeks.

Others, including Mike Leavitt, a former aide to Mitt Romney and healthcare adviser to George W. Bush, have launched efforts to address costs among states, while the nonpartisan Commonwealth Fund plans to announce its own strategy shortly.

Medicare serves about 50 million people and accounts for more than 20 percent of U.S. healthcare spending. As such, reforms in treatment practices fostered by Medicare could very well work their way through the entire healthcare system.

Analysts say Obama could embrace the policies proposed in 2012 by Tanden's group, which contends that billions of dollars can be saved by expanding competitive bidding within Medicare, making costs and services more transparent, slimming down administrative costs and reforming medical education.

Those initiatives, they say, could be combined with current White House proposals that seek to realign Medicare's drug payment policies with Medicaid for poorer beneficiaries, adjust payment increases to acute-care providers, increase means testing for outpatient care and drug benefits and change the way Medicare compensates providers for bad patient debts.

Any changes that look like the imposition of government price controls would not pass muster with Republicans, warned Alison Fraser of the conservative Heritage Foundation.

Ideas that boost market competition within Medicare might get a better response, she added. (Editing by Ros Krasny and Maureen Bavdek)

Copyright 2013 Thomson Reuters

http://www.huffingtonpost.com/2013/01/06/obama-medicare-reform_n_2420777.html [with comments]

--

Rick Perry Versus the School Children of Texas

01/06/2013

http://www.huffingtonpost.com/jim-moore/rick-perry-education_b_2421776.html [with comments]

--

Easing of Rules for Banks Acknowledges Reality

By ANDREW ROSS SORKIN

January 7, 2013, 8:44 pm

When a global committee of regulators and central bankers agreed to a new set of rules for the banking system a year and a half ago, Jamie Dimon, the chief executive of JPMorgan Chase, told The Financial Times, “I’m very close to thinking the United States shouldn’t be in Basel anymore. I would not have agreed to rules that are blatantly anti-American.”

Over the last weekend, Mr. Dimon finally got what he had wanted: a form of deregulation of sorts. The new international capital requirements for banks, known as Basel III — apologies if your eyes are glazing over — were significantly relaxed by regulators.

Instead of requiring banks to maintain, by 2015, a certain amount of assets that can quickly be turned into cash, the most stringent deadline was pushed to 2019. Perhaps more important, the type of assets that could be counted in a bank’s liquidity requirement was changed to be more flexible, including securities backed by mortgages, for example, instead of simply sovereign debt.

This sounds boring, but it is important stuff. Increasing bank capital and liquidity requirements — think of it as the size of a bank’s rainy day fund — is arguably more significant than all of the new laws in the Dodd-Frank Wall Street Reform and Consumer Protection Act. The more capital a bank is required to hold, the lower the chance it could suffer a run on the bank like Lehman Brothers did in 2008.

Given memories of the financial crisis, the idea that regulators would loosen rules even a smidgen is considered a huge giveaway. The conventional wisdom is that the banks are the big winners and the regulators are, once again, patsies, capitulating under pressure to the all-powerful financial industry. The headlines tell the story: “Banks Win 4-Year Delay as Basel Liquidity Rule Loosened,” Bloomberg declared. The Financial Times splashed, “ ‘Massive Softening’ of Basel Rules.” “Bank Regulators Retreat,” the Huffington Post said. Reuters described the new regulations as a “light touch.”

Mayra Rodríguez Valladares, a managing principal at MRV Associates, a regulatory consulting firm, put it this way, “With every part of Basel III that is gutted, we are increasingly back where we were at the eve of the crisis.” She went on to say, “In today’s financial world, regulators pretend to supervise while banks pretend to be liquid.”

But this is a knee-jerk response.

While there is no question that the original rules would do a better job preventing the next 100-year flood in the banking system, their quick adoption most likely would have created their own drag on the economy because bank lending would most likely have been curtailed.

“If Basel had been implemented this year as written, it almost certainly would have thrown the U.S. and other economies into a recession more than going over the fiscal cliff ever would have,” John Berlau of the Competitive Enterprise Institute, a research organization promoting free markets, wrote. Mr. Berlau, who may have a penchant for hyperbole, had been calling the deadline the Basel cliff. He added, “Basel III has been delayed, and for Main Street growth and financial stability, that is all to the good.”

Mr. Berlau is right. In truth, the reason that regulators ultimately chose to relax the rules was simple practicality: many banks in Europe and some in the United States would have never been able to meet the requirements without significantly reducing the amount of credit they were to extend to Main Street over the next two years, according to people involved in the Basel decision process.

That’s the other side of the regulatory coin that Main Street often forgets about. At the time that the original rules were written in 2010, the consensus among economists was that the global economy would be in much better shape today than it is.

“Nobody set out to make it stronger or weaker, but to make it more realistic,” Mervyn A. King, governor of the Bank of England, explained.

Let’s be clear: high capital requirements are a good thing to do to reduce risk in the system. And there is no question that the banks, especially in the United States, are in a much stronger position than they were. Let’s also stipulate that the Basel committee did a horrible job before the financial crisis in setting and enforcing proper standards. Basel’s loosening of rules before the crisis that worsened the pain of the global banking system.

But the push for stricter rules just as the global economy is trying to nurse itself back to health, simply to satisfy the public, rather to find a solution that balances the risks to the economy and the banking system, would have been a mistake. The chances of a leverage-induced crisis from Wall Street banks right now is quite low.

The challenge for regulators is making sure their memories aren’t so short that they seek to scale back the rules again.

Copyright 2013 The New York Times Company

http://dealbook.nytimes.com/2013/01/07/easing-of-rules-for-banks-acknowledges-reality/ [with comments]

--

Consumer watchdog strikes balance with mortgage rules

A home for sale is seen in Los Angeles, California, October 25, 2010.

Credit: Reuters/Lucy Nicholson

By Emily Stephenson and Margaret Chadbourn

WASHINGTON/BALTIMORE | Thu Jan 10, 2013 6:24pm EST

(Reuters) - The U.S. consumer watchdog on Thursday finalized new mortgage rules that are expected to have little short-term impact on the housing market but could prevent banks from returning to the pre-crisis practice of churning out risky subprime mortgages.

The Consumer Financial Protection Bureau, in one of its most sweeping moves to date, struck a balance with the new rules that drew guarded praise from both consumer groups and lenders.

The rules will force banks to verify a potential borrower's income, the amount of debt they have, and their employment.

They also give banks incentives to issue safer, lower-priced loan products by offering lenders legal shields for such "qualified mortgages."

The CFPB tried to find a middle ground, stopping short of giving banks the blanket legal protection they had lobbied for, but also not giving borrowers broad powers to sue lenders if they feel they were saddled with a burdensome mortgage.

Richard Cordray, the director of the CFPB, said the rules were tailored to ensure they would not stifle the slow recovery of the housing market, while giving consumers more protection.

"When consumers sit down at the closing table, they shouldn't be set up to fail with mortgages they can't afford," Cordray said in a statement.

Mortgage lending reform is a top priority for the consumer bureau, which is also working on appraisal standards and rules governing how mortgage servicers process loans.

Lenders and consumer groups have anxiously awaited the "qualified mortgage" rules, which are among the most controversial the government watchdog is required to issue by the 2010 Dodd-Frank financial reform law.

Each had feared a narrow definition of a "qualified mortgage," saying such an approach could limit the types of home loans offered.

Stakeholders were still digesting the 804-page package of rules, but said they do not expect they will radically change the mortgage market. Instead, they will likely prevent a return to reckless lending in the future.

David Moskowitz, deputy general counsel at Wells Fargo, said that the new rules are largely in line with the current, more conservative industry underwriting standards.

"It's entirely consistent with how we think about basic underwriting," said Moskowitz, who spoke at an event the CFPB held in Baltimore to unveil the new rules.

Some consumer groups questioned whether the rules shield lenders too much from lawsuits, but they generally applauded the guidelines. The Center for Responsible Lending President Mike Calhoun called them a "reasonable approach to mortgage lending, for the most part."

"Applying these fair, understandable standards to the mortgage market will foster a more competitive and robust housing industry," he said.

SAFE HARBOR FOR LENDERS

Dodd-Frank directed regulators to designate a category of "qualified mortgages" that would automatically be considered compliant with the ability-to-repay requirement. The rule was first set in motion by the Federal Reserve and then handed off to the consumer bureau in July 2011.

The CFPB said it would define "qualified mortgages" as those that have no risky loan features and fees that add up to no more than 3 percent of the loan amount.

These loans would go to borrowers whose debt does not exceed 43 percent of their income.

The loans would carry extra legal protection for lenders under a two-tiered system that appears to create a compromise between the housing industry and consumer advocates.

Under the new rules, the highest level of protection would go to lower-priced, qualified mortgages. Such prime loans generally will go to less-risky consumers with sound credit histories, the bureau said.

Higher-priced loans would receive less protection and most so-called jumbo loans will not meet the new criteria. That puts the burden on banks to implement tighter lending standards for loans that surpass the government conforming loan-limit, which is capped at $417,000 in most areas and goes as high as $729,750 in expensive real-estate markets.

Bank groups had lobbied the bureau for a full "safe harbor" to all qualified loans, preventing consumers from claiming in lawsuits that they did not have the ability to repay them.

Some analysts said the fact that banks got a tiered safe harbor represented a win for the financial industry.

"It is far less onerous than what banks expected," said Jaret Seiberg, senior policy analyst at Guggenheim Securities. He said lenders will likely only originate QM loans in the near term.

CREDIT AVAILABILITY

CFPB officials said they were sensitive to concerns about credit tightening, and designed the rules with provisions meant to keep credit flowing and smooth the transition.

The new rules establish an additional category of loans that would be temporarily treated as qualified. These mortgages could be given to those who exceed the 43 percent debt-to-income ratio as long as they met the underwriting standards required by Fannie Mae, Freddie Mac or other U.S. government housing agencies.

"We are in ... for the last several years an unnaturally tight mortgage market, and we recognize the need for that market to transition back to normalcy. And it's starting to happen," CFPB's Cordray said in an interview.

He said absent congressional reform of the housing finance giants, Fannie Mae and Freddie Mac, the CFPB rules will jumpstart the secondary mortgage market by providing certainty about what mortgage products are going to be made.

Currently, Fannie and Freddie and the Federal Housing Administration guarantee nine out of every 10 new home loans.

The provision would phase out in seven years, or sooner if housing agencies issue their own qualified mortgage rules or if the government ends its support of Fannie Mae and Freddie Mac, the two housing finance giants it rescued in 2008.

Regulators also proposed creating a qualified mortgage category that would apply to community banks and credit unions.

Banks will have until January 2014 to comply with the new rules, the consumer bureau said.

(Reporting by Margaret Chadbourn and Emily Stephenson; Editing by Tim Ahmann, Lisa Shumaker, Leslie Gevirtz, Andrew Hay and Jim Marshall)

Copyright 2013 Thomson Reuters

http://www.reuters.com/article/2013/01/10/us-financial-regulation-mortgages-idUSBRE90904V20130110 [with comments]

--

New mortgage rules give small banks a chance

January 10, 2013

http://www.washingtonpost.com/business/economy/smaller-lenders-could-get-bigger-slice-of-mortgage-market-thanks-to-new-rules/2013/01/10/95f381da-5b35-11e2-beee-6e38f5215402_story.html [with comments]

--

The CFPB's New Mortgage Rule: A Good Start, but Only a Start

By the Editors

Jan 10, 2013 5:32 PM CT

If the years leading up to the U.S. housing bust were rife with lax underwriting, the opposite problem has occurred in its aftermath: Excessively tight credit is making it impossible for many borrowers to obtain mortgages.

Enter the Consumer Financial Protection Bureau, which this week unveiled a much-awaited rule intended to strengthen mortgage standards and provide more legal protection to lenders. In requiring that lenders verify the ability of borrowers to repay their loans, the CFPB aims to safeguard consumers against deceptive practices and provide legal protection to banks, which have been wary of lending, fearful that borrowers would eventually default and sue.

The CFPB’s qualified-mortgage rule, which goes into effect next year and was required under the 2010 Dodd-Frank Act, gets many things right: It requires lenders to consider specific factors in determining whether a borrower can repay a loan, including income, overall debt, employment status and credit history. Borrowers’ total debt payments -- including car loans, school loans and mortgages -- can’t exceed 43 percent of their pretax income.

The rule prohibits many of the exotic loan features, such as interest-only payments, that fed the housing bubble. It also smartly avoids being overly prescriptive. It doesn’t, for example, require a certain level of down payment, which could wind up denying credit to otherwise-qualified borrowers.

Missing Pieces

Yet the CFPB’s rule alone won’t open the lending spigot. Other pieces must fall into place, including finalizing -- and harmonizing -- a rule detailing which types of mortgages will be exempt from a requirement that lenders retain a 5 percent financial stake in loans that are packaged into securities and sold.

Capital levels for banks must also be firmed up so companies can determine how much they can safely lend. Most important, the U.S. must outline its plans for Fannie Mae and Freddie Mac (FMCC), which own or guarantee about 84 percent of mortgages, including whether the U.S. will continue to offer a mortgage guarantee at all.

The latter question is crucial given the CFPB’s new rule, which will probably lead to fewer types of loans and a heavier reliance on the 30-year fixed-rate mortgage. That product, largely unique to the U.S., has traditionally come with a government guarantee.

The CFPB’s rule, intended to set the industry standard for mortgages, gives huge deference to Fannie Mae and Freddie Mac. For example, it grants legal protection to loans that don’t meet the 43 percent debt-to-income test if they satisfy the underwriting standards of Fannie Mae (FNMA), Freddie Mac and the Federal Housing Administration. The CFPB said this bypass, which could last as long as seven years, was necessary given the “fragile state of the mortgage market.”

As we’ve said, the time has come for a serious overhaul of housing finance, including limiting the government guarantee and adequately pricing it to reflect risk. Fannie Mae and Freddie Mac are profitable again and have stopped drawing on the Treasury. Housing prices are rising and foreclosures are beginning to stabilize.

If the roles of Fannie and Freddie aren’t soon clarified, the companies could become permanent wards of the state. Even Fannie Mae’s chief executive officer, Timothy Mayopoulos, said at a Bloomberg Government breakfast that the company’s mortgage dominance has reached an unhealthy and unsustainable level.

To bring back private capital, lenders need to know what constitutes a qualified residential mortgage and is thus free from risk-retention requirements, also known as the “skin in the game” rule. The rule, which six federal agencies are writing, is supposed to largely mirror the CFPB’s, yet a proposal last year differed in many ways, including imposing a 20 percent down- payment requirement.