Monday, January 07, 2013 11:42:01 PM

PCSV .065 Jan 7th News: PCS Announces 63% Increase in Q3 Revenues Over FY2012 Q3

8:02a ET January 7, 2013 (Market Wire)

PCS Edventures!.com, Inc., (OTCQB: PCSV) a leading provider of K-16 programs focused on Science, Technology, Engineering and Mathematics (STEM), today announced its preliminary Q3 revenues of $601,748.

The Company reported pre-audit revenues for the quarter ended December 31, 2012 with revenue of $601,748, up 63% from the same quarter last year with revenues of $368,743.

The source of revenues was primarily robotics related sales into the afterschool market. Educational robotics kit sales worldwide are projected to exceed $1.6B in 2014, and PCS Edventures is actively pursuing this market. The establishment of these robotics products into organizations across the United States continues to expand the PCS footprint in the US educational robotics market.

In addition, revenues from the new Learning Center pilot program launched this fiscal year increased from $8,522 in Q2 to $22,702 in Q3, a 188% increase due in part to the retail response to holiday sales. The Company is actively exploring retail strategies to offset the dip in institutional revenues traditionally seen in Q3.

Robert Grover, PCS CEO, said, "We decided to release these preliminary revenue numbers to notify shareholders that we are continuing to make improvements on a quarterly basis, and are working very hard to continue this trend. Our continued success with educational robotics is thrilling, and our business plan continues to evolve as we gather data and metrics on our other initiatives. We plan to grow a number of very stable and dependable revenue streams to maximize shareholder value."

Krystal Wright, PCS Controller, cautioned shareholders and investors by saying "I wish to emphasize that these revenue figures are pre-audit and do not represent management's review or closing adjustments and are preliminary only. We are unable to release any information on earnings or other details until our audit is complete."

That said 1st Call Friends let's discuss in brief area of last 10Q.

Common stock, no par value, 90,000,000 and 60,000,000 authorized shares, respectively; 47,532,429 and 44,889,336 shares issued and outstanding, respectively.

Not sure about the float, posted here: http://www.investorpoint.com/stock/pcsv-Pcs%20Edventures!.Com%20Inc/share-information/

Float: 40.35 m

10-Q Date:

Received_ Nov 14,

Period Ending_2012 Sept 30, 2012

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8916538

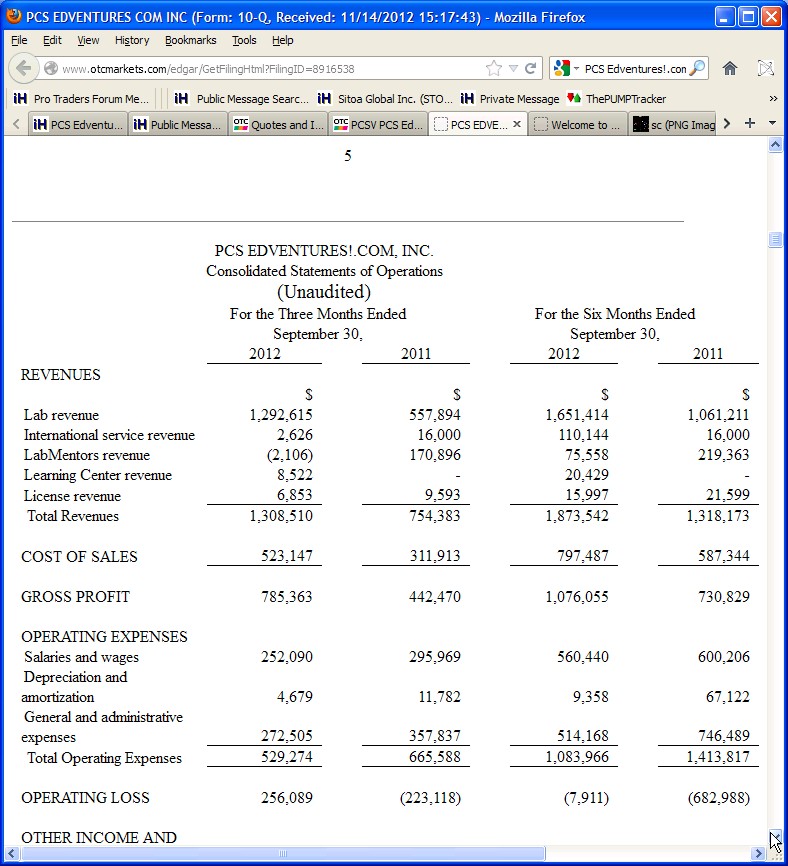

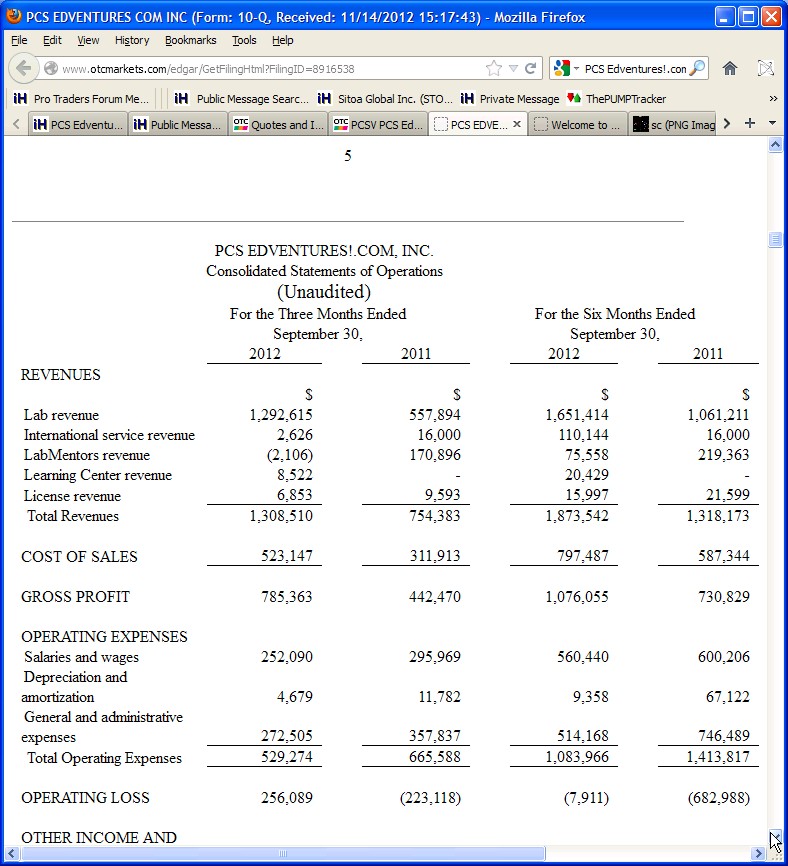

Results of Operations

For the quarter ended September 30, 2012, the Company reported a net comprehensive income of $97,986, as compared to a net comprehensive loss for the quarter ended September 30, 2011, of ($316,707).

For the six months ended September 30, 2012, the Company reported a net comprehensive loss of ($264,383), as compared to a net comprehensive loss of ($923,827) for the six-months ended September 30, 2011, an improvement of 71%

An increase in revenue, reduced operating expenses and a decrease in interest and debt expense due to the discounting of debt and the issuance of warrants attached to financing in the prior year, partially offset by the loss on the change in fair value of derivatives in the current year contributed to the improved results.

Revenue for the quarter ended September 30, 2012, was $1,308,510, as compared to revenue during the quarter ended September 30, 2011 of $754,383, an increase of 73% this quarter over the same quarter last year. Cost of sales and gross profit as a percentage of sales were consistent between the periods.

Revenue for the six-months ended September 30, 2012, was $1,873,542, as compared to revenue during the six-months ended September 30, 2011 of $1,318,173, an increase of 42% over the same period in the prior year. Cost of sales and gross profit as a percentage of sales were consistent between the periods.

Operating expenses for the three and six-month periods ended September 30, 2012, decreased by $136,314 (20%) and $329,851 (23%) as compared to the same periods ended September 30, 2011.

Given the PR today announcing: preliminary Q3 revenues of $601,748 up 63% from the same quarter last year with revenues of $368,743.

And considering 10Q ending Sept 30th:

NET COMPREHENSIVE INCOME/(LOSS)

$97,986 verses >>> $ (316,707) $ (264,383) $ (923,827)

NET LOSS ATTRIBUTABLE TO COMMON SHAREHOLDERS

$ 89,750 verses>>> $ (316,707) $(272,619) $(923,827)

Income/(Loss) per Share Basic and Diluted

$0.00 verses>>> ($0.01) ($0.01) ($0.02)

This company definitely seems to be on the right track.

In brief recent news items:

Today

PCS Announces 63% Increase in Q3 Revenues Over FY2012 Q3

PCS Edventures!.com, Inc., (OTCQB: PCSV) a leading provider of K-16 programs focused on Science, Technology, Engineering and Mathematics (STEM), today announced its preliminary Q3 revenues of $601,748.

Market Wire

11/15/2012

PCS Edventures! Announces Record Breaking Q2 and Earnings

PCS Edventures!.com, Inc., (OTCQB: PCSV) a leading provider of K-16 programs focused on Science, Technology, Engineering and Mathematics (STEM), today announced strong results for its second quarter of FY2013.

Market Wire

11/08/2012

PCS Announces Fulfillment of $209,000 Robotics Order

PCS Edventures!.com, Inc., (OTCBB: PCSV) a leading provider of K-16 programs focused on Science, Technology, Engineering and Mathematics (STEM), today announced the successful fulfillment and invoicing of a $209,000 robotics purchase order receive…Market Wire

10/15/2012

PCS Announces Fulfillment of $740,000 Robotics Order

PCS Edventures!.com, Inc., (OTCBB: PCSV) a leading provider of K-16 programs focused on Science, Technology, Engineering and Mathematics (STEM), today announced the successful fulfillment, invoicing, and collection of the $740,000 robotics purchase…Market Wire

The source of revenues was primarily robotics related sales into the afterschool market. Educational robotics kit sales worldwide are projected to exceed $1.6B in 2014

Building robotics for all school ages:

http://www.sedl.org/cgi-bin/mysql/afterschool/science.cgi?resource=12

http://pcsedu.com/news/

Really good video, stick with it.... :)

52-Wk Range .025 - .33

PCSV Chart: http://stockcharts.com/c-sc/sc?s=PCSV&p=d&b=4&g=0&id=p17970548896

Take time to digest all PCSV information. I believe that sense it trades fairly thin but not too thin... and after your DD if you decide to purchase I would immediately have a price fixed/open-sell at a set price.

I am only going to post this hear... so I think that during the rest of the week bid-buying could be a good option.

Also I believe there are more free trading shares now: http://www.profitspi.com/stock/view.aspx?v=price-and-chart&p=19571&i=PCSV&pv=recent-symbols&pp=PCSV#&&vs=634932163629359806 JMO!

I believe the next 2 quarters could be exciting.

As those who know me understand the majority of the time I do not have a price in mind... time dictates that as things progress. But I see no reason why a 100% profit is not attainable in 2013.

Remember too the run to .35c in Aug was on 22k, free trading shares have no doubt increased thus having future one or two day spikes should be considerably less.

Research Mode Friends!

Research Everything http://www.otcmarkets.com/stock/PCSV/company-info

If I have made errors do not hesitate to PM me and I will correct.

Again, please keep this site from chatter. And as you can see this one hasn't been followed too closely: http://investorshub.advfn.com/PCS-Edventurescom-PCSV-9082/

http://investorshub.advfn.com/boards/msgsearch.aspx?searchstr=pcsv

Do not chase, watch closely as it settles in each day: http://www.profitspi.com/stock/view.aspx?v=price-and-chart&p=19571&i=PCSV&pv=recent-symbols&pp=PCSV#&&vs=634932168544430932

This one may not be for you! :)

sc

8:02a ET January 7, 2013 (Market Wire)

PCS Edventures!.com, Inc., (OTCQB: PCSV) a leading provider of K-16 programs focused on Science, Technology, Engineering and Mathematics (STEM), today announced its preliminary Q3 revenues of $601,748.

The Company reported pre-audit revenues for the quarter ended December 31, 2012 with revenue of $601,748, up 63% from the same quarter last year with revenues of $368,743.

The source of revenues was primarily robotics related sales into the afterschool market. Educational robotics kit sales worldwide are projected to exceed $1.6B in 2014, and PCS Edventures is actively pursuing this market. The establishment of these robotics products into organizations across the United States continues to expand the PCS footprint in the US educational robotics market.

In addition, revenues from the new Learning Center pilot program launched this fiscal year increased from $8,522 in Q2 to $22,702 in Q3, a 188% increase due in part to the retail response to holiday sales. The Company is actively exploring retail strategies to offset the dip in institutional revenues traditionally seen in Q3.

Robert Grover, PCS CEO, said, "We decided to release these preliminary revenue numbers to notify shareholders that we are continuing to make improvements on a quarterly basis, and are working very hard to continue this trend. Our continued success with educational robotics is thrilling, and our business plan continues to evolve as we gather data and metrics on our other initiatives. We plan to grow a number of very stable and dependable revenue streams to maximize shareholder value."

Krystal Wright, PCS Controller, cautioned shareholders and investors by saying "I wish to emphasize that these revenue figures are pre-audit and do not represent management's review or closing adjustments and are preliminary only. We are unable to release any information on earnings or other details until our audit is complete."

That said 1st Call Friends let's discuss in brief area of last 10Q.

Common stock, no par value, 90,000,000 and 60,000,000 authorized shares, respectively; 47,532,429 and 44,889,336 shares issued and outstanding, respectively.

Not sure about the float, posted here: http://www.investorpoint.com/stock/pcsv-Pcs%20Edventures!.Com%20Inc/share-information/

Float: 40.35 m

10-Q Date:

Received_ Nov 14,

Period Ending_2012 Sept 30, 2012

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8916538

Results of Operations

For the quarter ended September 30, 2012, the Company reported a net comprehensive income of $97,986, as compared to a net comprehensive loss for the quarter ended September 30, 2011, of ($316,707).

For the six months ended September 30, 2012, the Company reported a net comprehensive loss of ($264,383), as compared to a net comprehensive loss of ($923,827) for the six-months ended September 30, 2011, an improvement of 71%

An increase in revenue, reduced operating expenses and a decrease in interest and debt expense due to the discounting of debt and the issuance of warrants attached to financing in the prior year, partially offset by the loss on the change in fair value of derivatives in the current year contributed to the improved results.

Revenue for the quarter ended September 30, 2012, was $1,308,510, as compared to revenue during the quarter ended September 30, 2011 of $754,383, an increase of 73% this quarter over the same quarter last year. Cost of sales and gross profit as a percentage of sales were consistent between the periods.

Revenue for the six-months ended September 30, 2012, was $1,873,542, as compared to revenue during the six-months ended September 30, 2011 of $1,318,173, an increase of 42% over the same period in the prior year. Cost of sales and gross profit as a percentage of sales were consistent between the periods.

Operating expenses for the three and six-month periods ended September 30, 2012, decreased by $136,314 (20%) and $329,851 (23%) as compared to the same periods ended September 30, 2011.

Given the PR today announcing: preliminary Q3 revenues of $601,748 up 63% from the same quarter last year with revenues of $368,743.

And considering 10Q ending Sept 30th:

NET COMPREHENSIVE INCOME/(LOSS)

$97,986 verses >>> $ (316,707) $ (264,383) $ (923,827)

NET LOSS ATTRIBUTABLE TO COMMON SHAREHOLDERS

$ 89,750 verses>>> $ (316,707) $(272,619) $(923,827)

Income/(Loss) per Share Basic and Diluted

$0.00 verses>>> ($0.01) ($0.01) ($0.02)

This company definitely seems to be on the right track.

In brief recent news items:

Today

PCS Announces 63% Increase in Q3 Revenues Over FY2012 Q3

PCS Edventures!.com, Inc., (OTCQB: PCSV) a leading provider of K-16 programs focused on Science, Technology, Engineering and Mathematics (STEM), today announced its preliminary Q3 revenues of $601,748.

Market Wire

11/15/2012

PCS Edventures! Announces Record Breaking Q2 and Earnings

PCS Edventures!.com, Inc., (OTCQB: PCSV) a leading provider of K-16 programs focused on Science, Technology, Engineering and Mathematics (STEM), today announced strong results for its second quarter of FY2013.

Market Wire

11/08/2012

PCS Announces Fulfillment of $209,000 Robotics Order

PCS Edventures!.com, Inc., (OTCBB: PCSV) a leading provider of K-16 programs focused on Science, Technology, Engineering and Mathematics (STEM), today announced the successful fulfillment and invoicing of a $209,000 robotics purchase order receive…Market Wire

10/15/2012

PCS Announces Fulfillment of $740,000 Robotics Order

PCS Edventures!.com, Inc., (OTCBB: PCSV) a leading provider of K-16 programs focused on Science, Technology, Engineering and Mathematics (STEM), today announced the successful fulfillment, invoicing, and collection of the $740,000 robotics purchase…Market Wire

The source of revenues was primarily robotics related sales into the afterschool market. Educational robotics kit sales worldwide are projected to exceed $1.6B in 2014

Building robotics for all school ages:

http://www.sedl.org/cgi-bin/mysql/afterschool/science.cgi?resource=12

http://pcsedu.com/news/

Really good video, stick with it.... :)

52-Wk Range .025 - .33

PCSV Chart: http://stockcharts.com/c-sc/sc?s=PCSV&p=d&b=4&g=0&id=p17970548896

Take time to digest all PCSV information. I believe that sense it trades fairly thin but not too thin... and after your DD if you decide to purchase I would immediately have a price fixed/open-sell at a set price.

I am only going to post this hear... so I think that during the rest of the week bid-buying could be a good option.

Also I believe there are more free trading shares now: http://www.profitspi.com/stock/view.aspx?v=price-and-chart&p=19571&i=PCSV&pv=recent-symbols&pp=PCSV#&&vs=634932163629359806 JMO!

I believe the next 2 quarters could be exciting.

As those who know me understand the majority of the time I do not have a price in mind... time dictates that as things progress. But I see no reason why a 100% profit is not attainable in 2013.

Remember too the run to .35c in Aug was on 22k, free trading shares have no doubt increased thus having future one or two day spikes should be considerably less.

Research Mode Friends!

Research Everything http://www.otcmarkets.com/stock/PCSV/company-info

If I have made errors do not hesitate to PM me and I will correct.

Again, please keep this site from chatter. And as you can see this one hasn't been followed too closely: http://investorshub.advfn.com/PCS-Edventurescom-PCSV-9082/

http://investorshub.advfn.com/boards/msgsearch.aspx?searchstr=pcsv

Do not chase, watch closely as it settles in each day: http://www.profitspi.com/stock/view.aspx?v=price-and-chart&p=19571&i=PCSV&pv=recent-symbols&pp=PCSV#&&vs=634932168544430932

This one may not be for you! :)

sc

Pro Traders Forum http://investorshub.advfn.com/Pro-Traders-Forum-18631/

Pre_Event Loading http://investorshub.advfn.com/Pre_EVENT-Front_Loading-25622/

2013 1st Call http://investorshub.advfn.com/Pro-Traders-2013-1st-Call-List-26023/

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.