Thursday, January 03, 2013 11:29:41 PM

In regards to STOA

I have yet to post any thing more than simple basic links, Fins, and general data.

I'm sure you've taken the time to look over quite a few things, but just in case you haven't here are a few links and tidbits.

First and foremost: http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8872651

Remember the latest 8k? This is posted inside quarter results:

" On December 20, 2012, the Board of Directors of the Company appointed Mr. James Wang, a Director on the Company’s Board, to also serve as the Company’s President and Chief Executive and Financial Officer, effective immediately, to fill the vacancy caused by Mr. Yu’s resignation.

Who is this guy? http://soconison.com/portcom.html

Mr. Wang (age 49) has been a director of the Company since March 1, 2012 and was previously a Managing Director of Soconison Technology Ventures, a venture capital firm focused on technology, media and telecom investments, since October 2003. He is a twenty-five year veteran of technology investing and entrepreneurship and began his career at First Boston as a NASDAQ trader in fledgling companies, incl. Intel, Apple Computer, Microsoft and Lotus Development. He later transitioned to technology investment banking where he arranged over $800 million in funding for companies in semiconductors, data storage and programmable logic. Since the mid-1990's Mr. Wang has worked in Silicon Valley as an angel investor and has also started several companies, including a micro storage device company which was sold to Maxtor, and a Storage Area Networking company that was sold to Lucent. He holds a MS in Computer Science from MIT and a MBA from UCLA.

Top Notch I'd say, that was just out Dec 21st

Current Assets Page1

License fee receivables $250,000 Sept 30th 2012

before that? Zero

Cash and cash equivalents $518,326 and before that? $40,373

Authorized 250,000,000 shares at par value of $ 0.002 each

Issued and outstanding 39,042,847 shares as of September 30, 2012 and 26,871,131 shares as of December 31, 2011

check out page 3

Page 10 'overview'

Sitoa Global specializes in providing e-commerce solutions and services that facilitate multi-channel B2C (business-to-consumer) and B2B (business-to-business) transactions. Its solutions and services enable e-commerce transactions with speed and efficiency, and allow an interactive and engaging customer experience as well as targeted marketing and advertising.

The Company’s revenues are generated from one-time integration fees for the implementation of e-commerce solutions as well as recurring license and service fees including revenue share agreements. The Company currently hosts five existing e-commerce solutions:

1. 4-GS, Ltd. ( www.4-gs.com ) is a B2B e-commerce platform that optimizes supply chain sourcing for international enterprise customers through B2B Search Engine Optimization (SEO), e-catalog and inventory management systems and a transaction platform.

2. ZBL Cybermarketing, Ltd. is Google's largest Search Engine Marketing (SEM) and Search Engine Optimization (SEO) provider in Northern China and utilizes the Company’s e-commerce solutions to identify and engage targeted consumer segments and optimize purchase conversions.

3. iMedia, Ltd. is a mobile advertising platform that enables online vendors to reach and engage its customer audience through mobile ads and apps. It is the No. 1 mobile advertising agency to the No. 1 media portal QQ which is the largest instant messaging operator in China with 360 million users and 86% market share.

4. Chunjie365 ( www.chunjie365.com ) is a bi-lingual e-commerce site in China targeting consumer and corporate online customers looking to purchase both U.S. specialty products and Chinese gift items that are rare and unique. Chunjie365 has partnered with several U.S. and Asian specialty product manufacturers and has made more than 1,000 gift items available on its site.

5. Sonsi, Inc. ( www.sonsi.lanebryant.com ) is a destination e-commerce site for women sizes 12 and up and allows them to purchase retail clothing products as well as social networking through Sonsi Living, www.sonsiliving.com

Recent Developments

The Company has recently entered into a strategic partnership agreement with a division of China International Trust and Investment Corporation (CITIC). CITIC will utilize the Company’s software technology and catalog management system to develop and expand its evolving Business-to-Business (“B2B”) trading platform. CITIC is a large state-owned multinational conglomerate of the People's Republic of China, established in 1979. It is one of the largest diversified conglomerates in Asia with a balanced development of both financial and non-financial businesses across forty-four subsidiaries. CITIC was enlisted in the Fortune Global 500 for the third consecutive year in 2011, ranking 221 st .

Page 10, another key NOTE:

"On September 30, 2012, we had a working capital of $269,096 compared with a working capital deficit of $477,511 on December 31, 2011. The decrease is due to an increase in cash and cash equivalents, and reduction of current liabilities. Operating activities used $636,811 in cash in the nine months ended September 30, 2012. Investing activities in the nine months ended September 30, 2012 used zero. Financing activities provided $1.114,764 in the nine months ended September 30, 2012.

Revenue Recognition

We earned revenue from providing hosting and integration services to 4-GS, Ltd., ZBL Cybermarketing, Ltd., i-Media, Ltd., Chunjie365 and Sonsi Inc. For all five companies, we provide e-commerce solutions with our US engineering team and outsourced personnel in Asia. We charge 4-GS, ZBL Cybermarketing and i-Media monthly minimum integration and hosting fees plus additional professional hourly fees for project management and consulting. The fee arrangement with those three companies is covered under the strategic partnership agreement with Soconison Technology Ventures, dated July 11, 2011. Soconison Technology Ventures is a shareholder in 4-GS, ZBL Cybermarketing and i-Media. From Chunjie365, we receive a revenue share of their e-commerce transactions. From Sonsi, we earn monthly minimum hosting fees plus hourly professional fees for additional integration services. We also amortize the license fee that we received from CITIC over the life of the license agreement.

Read page 11, Results of Operations:

Another excellent sign here:

Net Loss

The Company had a net loss of $638,941 and $641,619 for the three months ended September 30, 2012 and 2011, respectively, and $973,991 and $1,032,612 for the nine months ended September 30, 2012 and 2011, respectively. The decrease is due to recognizing revenue from our customers.

Take time with the above Q

Other important data:

http://ih.advfn.com/p.php?pid=nmona&article=49118115

Click on the names and research:

http://www.sitoaglobal.com/

http://soconison.com/portcom.html

http://www.chunjie365.com/

http://www.shopshipusa.com/cgi-sys/defaultwebpage.cgi

http://www.magnagroupllc.com/

Notice who magna group is? http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8978875 That was Dec 20th http://www.otcmarkets.com/stock/STOA/filings

Are you starting to understand the BIG Picture here?

Understand something about this commitment: http://www.globenewswire.com/news-release/2011/11/02/460302/236848/en/Sitoa-Global-Receives-Letter-of-Commitment-for-10-8-Million-in-Funding-From-Strategic-Partner.html?print=1

It is a LETTER of COMMITMENT, not a signed check and deposit. Certain criteria no doubt was needed to be in place too include Management, etc.

Who is US$10.8 million from AIV Ltd

Who is Bill Porter? http://ih.advfn.com/p.php?pid=nmona&article=49118115

Always ask yourself.... why was this at .30c for the 52wk high, and better said... why would investors have PAID that much then?

http://stockcharts.com/c-sc/sc?s=STOA&p=D&yr=1&mn=0&dy=0&i=p84909050309&r=1357150451749

Is that reason why they paid that much then now becoming fruitful?

Everything here was/is available and more... dig deep to try and understand why this might be a really good stock to hold.

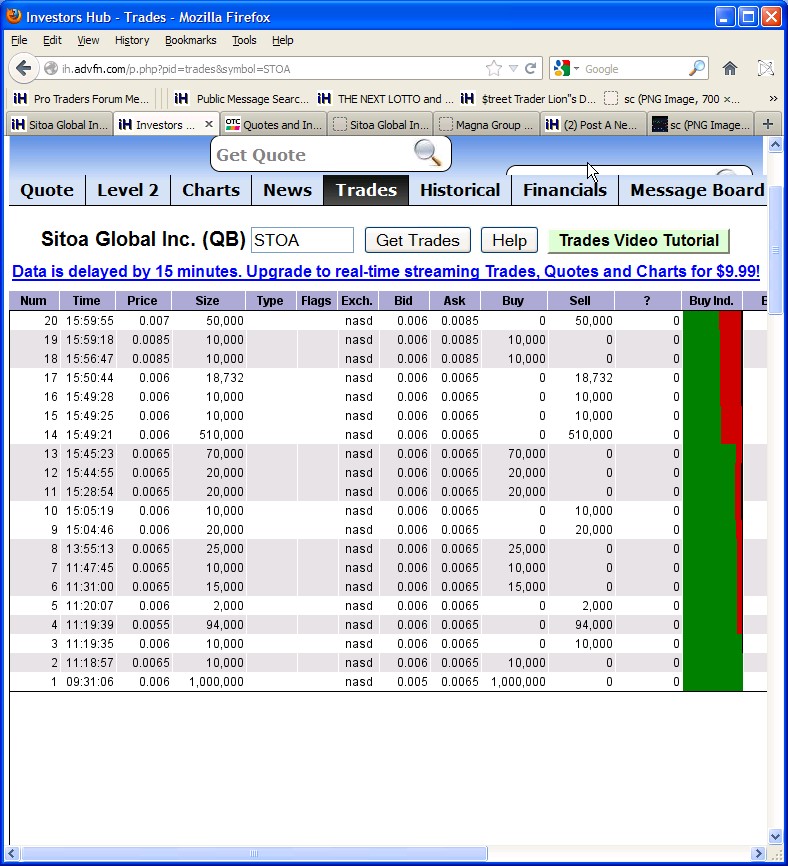

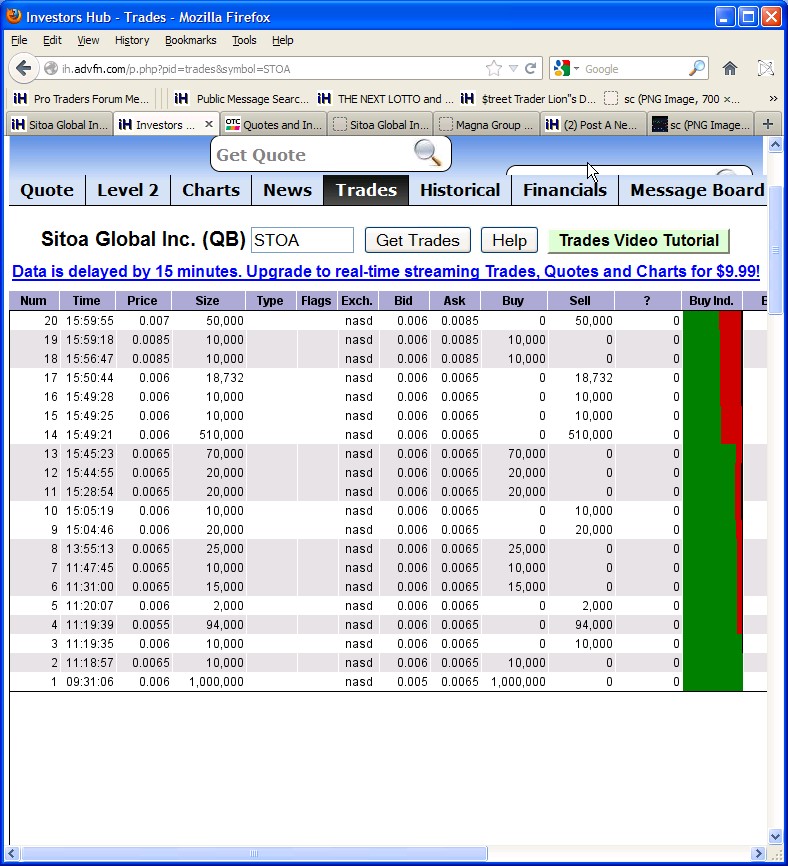

Why did someone the morning of Jan 3rd 2013 pay $6,000 for 1million shares?

Also there were NO sells today, the 510k posted as a sell was actually a buy. It's my opinion the MM/Group are still recovering shares short [even though it may not be a lot], thus posting them as sells. 1_Day A/D actually dropped about 650k on paper, but other data including knowing who bought changes everything.

This is another reason why not to chase, try and buy at the BID when possible IF>>> you decided STOA is a good play for you.

SuperC

I have yet to post any thing more than simple basic links, Fins, and general data.

I'm sure you've taken the time to look over quite a few things, but just in case you haven't here are a few links and tidbits.

First and foremost: http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8872651

Remember the latest 8k? This is posted inside quarter results:

" On December 20, 2012, the Board of Directors of the Company appointed Mr. James Wang, a Director on the Company’s Board, to also serve as the Company’s President and Chief Executive and Financial Officer, effective immediately, to fill the vacancy caused by Mr. Yu’s resignation.

Who is this guy? http://soconison.com/portcom.html

Mr. Wang (age 49) has been a director of the Company since March 1, 2012 and was previously a Managing Director of Soconison Technology Ventures, a venture capital firm focused on technology, media and telecom investments, since October 2003. He is a twenty-five year veteran of technology investing and entrepreneurship and began his career at First Boston as a NASDAQ trader in fledgling companies, incl. Intel, Apple Computer, Microsoft and Lotus Development. He later transitioned to technology investment banking where he arranged over $800 million in funding for companies in semiconductors, data storage and programmable logic. Since the mid-1990's Mr. Wang has worked in Silicon Valley as an angel investor and has also started several companies, including a micro storage device company which was sold to Maxtor, and a Storage Area Networking company that was sold to Lucent. He holds a MS in Computer Science from MIT and a MBA from UCLA.

Top Notch I'd say, that was just out Dec 21st

Current Assets Page1

License fee receivables $250,000 Sept 30th 2012

before that? Zero

Cash and cash equivalents $518,326 and before that? $40,373

Authorized 250,000,000 shares at par value of $ 0.002 each

Issued and outstanding 39,042,847 shares as of September 30, 2012 and 26,871,131 shares as of December 31, 2011

check out page 3

Page 10 'overview'

Sitoa Global specializes in providing e-commerce solutions and services that facilitate multi-channel B2C (business-to-consumer) and B2B (business-to-business) transactions. Its solutions and services enable e-commerce transactions with speed and efficiency, and allow an interactive and engaging customer experience as well as targeted marketing and advertising.

The Company’s revenues are generated from one-time integration fees for the implementation of e-commerce solutions as well as recurring license and service fees including revenue share agreements. The Company currently hosts five existing e-commerce solutions:

1. 4-GS, Ltd. ( www.4-gs.com ) is a B2B e-commerce platform that optimizes supply chain sourcing for international enterprise customers through B2B Search Engine Optimization (SEO), e-catalog and inventory management systems and a transaction platform.

2. ZBL Cybermarketing, Ltd. is Google's largest Search Engine Marketing (SEM) and Search Engine Optimization (SEO) provider in Northern China and utilizes the Company’s e-commerce solutions to identify and engage targeted consumer segments and optimize purchase conversions.

3. iMedia, Ltd. is a mobile advertising platform that enables online vendors to reach and engage its customer audience through mobile ads and apps. It is the No. 1 mobile advertising agency to the No. 1 media portal QQ which is the largest instant messaging operator in China with 360 million users and 86% market share.

4. Chunjie365 ( www.chunjie365.com ) is a bi-lingual e-commerce site in China targeting consumer and corporate online customers looking to purchase both U.S. specialty products and Chinese gift items that are rare and unique. Chunjie365 has partnered with several U.S. and Asian specialty product manufacturers and has made more than 1,000 gift items available on its site.

5. Sonsi, Inc. ( www.sonsi.lanebryant.com ) is a destination e-commerce site for women sizes 12 and up and allows them to purchase retail clothing products as well as social networking through Sonsi Living, www.sonsiliving.com

Recent Developments

The Company has recently entered into a strategic partnership agreement with a division of China International Trust and Investment Corporation (CITIC). CITIC will utilize the Company’s software technology and catalog management system to develop and expand its evolving Business-to-Business (“B2B”) trading platform. CITIC is a large state-owned multinational conglomerate of the People's Republic of China, established in 1979. It is one of the largest diversified conglomerates in Asia with a balanced development of both financial and non-financial businesses across forty-four subsidiaries. CITIC was enlisted in the Fortune Global 500 for the third consecutive year in 2011, ranking 221 st .

Page 10, another key NOTE:

"On September 30, 2012, we had a working capital of $269,096 compared with a working capital deficit of $477,511 on December 31, 2011. The decrease is due to an increase in cash and cash equivalents, and reduction of current liabilities. Operating activities used $636,811 in cash in the nine months ended September 30, 2012. Investing activities in the nine months ended September 30, 2012 used zero. Financing activities provided $1.114,764 in the nine months ended September 30, 2012.

Revenue Recognition

We earned revenue from providing hosting and integration services to 4-GS, Ltd., ZBL Cybermarketing, Ltd., i-Media, Ltd., Chunjie365 and Sonsi Inc. For all five companies, we provide e-commerce solutions with our US engineering team and outsourced personnel in Asia. We charge 4-GS, ZBL Cybermarketing and i-Media monthly minimum integration and hosting fees plus additional professional hourly fees for project management and consulting. The fee arrangement with those three companies is covered under the strategic partnership agreement with Soconison Technology Ventures, dated July 11, 2011. Soconison Technology Ventures is a shareholder in 4-GS, ZBL Cybermarketing and i-Media. From Chunjie365, we receive a revenue share of their e-commerce transactions. From Sonsi, we earn monthly minimum hosting fees plus hourly professional fees for additional integration services. We also amortize the license fee that we received from CITIC over the life of the license agreement.

Read page 11, Results of Operations:

Another excellent sign here:

Net Loss

The Company had a net loss of $638,941 and $641,619 for the three months ended September 30, 2012 and 2011, respectively, and $973,991 and $1,032,612 for the nine months ended September 30, 2012 and 2011, respectively. The decrease is due to recognizing revenue from our customers.

Take time with the above Q

Other important data:

http://ih.advfn.com/p.php?pid=nmona&article=49118115

Click on the names and research:

http://www.sitoaglobal.com/

http://soconison.com/portcom.html

http://www.chunjie365.com/

http://www.shopshipusa.com/cgi-sys/defaultwebpage.cgi

http://www.magnagroupllc.com/

Notice who magna group is? http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8978875 That was Dec 20th http://www.otcmarkets.com/stock/STOA/filings

Are you starting to understand the BIG Picture here?

Understand something about this commitment: http://www.globenewswire.com/news-release/2011/11/02/460302/236848/en/Sitoa-Global-Receives-Letter-of-Commitment-for-10-8-Million-in-Funding-From-Strategic-Partner.html?print=1

It is a LETTER of COMMITMENT, not a signed check and deposit. Certain criteria no doubt was needed to be in place too include Management, etc.

Who is US$10.8 million from AIV Ltd

Who is Bill Porter? http://ih.advfn.com/p.php?pid=nmona&article=49118115

Always ask yourself.... why was this at .30c for the 52wk high, and better said... why would investors have PAID that much then?

http://stockcharts.com/c-sc/sc?s=STOA&p=D&yr=1&mn=0&dy=0&i=p84909050309&r=1357150451749

Is that reason why they paid that much then now becoming fruitful?

Everything here was/is available and more... dig deep to try and understand why this might be a really good stock to hold.

Why did someone the morning of Jan 3rd 2013 pay $6,000 for 1million shares?

Also there were NO sells today, the 510k posted as a sell was actually a buy. It's my opinion the MM/Group are still recovering shares short [even though it may not be a lot], thus posting them as sells. 1_Day A/D actually dropped about 650k on paper, but other data including knowing who bought changes everything.

This is another reason why not to chase, try and buy at the BID when possible IF>>> you decided STOA is a good play for you.

SuperC

Pro Traders Forum http://investorshub.advfn.com/Pro-Traders-Forum-18631/

Pre_Event Loading http://investorshub.advfn.com/Pre_EVENT-Front_Loading-25622/

2013 1st Call http://investorshub.advfn.com/Pro-Traders-2013-1st-Call-List-26023/

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.