Wednesday, November 28, 2012 1:54:44 AM

Fighting Fiscal Phantoms

By PAUL KRUGMAN

Published: November 25, 2012

These are difficult times for the deficit scolds who have dominated policy discussion for almost three years. One could almost feel sorry for them, if it weren’t for their role in diverting attention from the ongoing problem of inadequate recovery, and thereby helping to perpetuate catastrophically high unemployment.

What has changed? For one thing, the crisis they predicted keeps not happening. Far from fleeing U.S. debt, investors have continued to pile in, driving interest rates to historical lows [ http://krugman.blogs.nytimes.com/2012/11/25/incredible-credibility/ ]. Beyond that, suddenly the clear and present danger to the American economy isn’t that we’ll fail to reduce the deficit enough; it is, instead, that we’ll reduce the deficit too much. For that’s what the “fiscal cliff” — better described as the austerity bomb — is all about: the tax hikes and spending cuts scheduled to kick in at the end of this year are precisely not what we want to see happen in a still-depressed economy.

Given these realities, the deficit-scold movement has lost some of its clout. That movement, by the way, is a hydra-headed beast, comprising many organizations that turn out, on inspection, to be financed and run by more or less the same people; dig down into many of these groups’ back stories and you will, in particular, find Peter Peterson, the private-equity billionaire, playing a key role.

But the deficit scolds aren’t giving up. Now yet another organization, Fix the Debt [ http://www.fixthedebt.org/core-principles ], is campaigning for cuts to Social Security and Medicare, even while making lower tax rates a “core principle.” That last part makes no sense in terms of the group’s ostensible mission, but makes perfect sense if you look at the array of big corporations, from Goldman Sachs to the UnitedHealth Group [ http://www.fixthedebt.org/uploads/files/CEO%20Fiscal%20Leadership%20Council%20Membership%2011-14-12.pdf ], that are involved in the effort and would benefit from tax cuts. Hey, sacrifice is for the little people.

So should we take this latest push seriously? No — and not just because these people, aside from exhibiting a lot of hypocrisy, have been wrong about everything so far. The truth is that at a fundamental level the crisis story they’re trying to sell doesn’t make sense.

You’ve heard the story many times: Supposedly, any day now investors will lose faith in America’s ability to come to grips with its budget failures. When they do, there will be a run on Treasury bonds, interest rates will spike, and the U.S. economy will plunge back into recession.

This sounds plausible to many people, because it’s roughly speaking what happened to Greece. But we’re not Greece, and it’s almost impossible to see how this could actually happen to a country in our situation.

For we have our own currency — and almost all of our debt, both private and public, is denominated in dollars. So our government, unlike the Greek government, literally can’t run out of money. After all, it can print the stuff. So there’s almost no risk that America will default on its debt — I’d say no risk at all if it weren’t for the possibility that Republicans would once again try to hold the nation hostage over the debt ceiling.

But if the U.S. government prints money to pay its bills, won’t that lead to inflation? No, not if the economy is still depressed.

Now, it’s true that investors might start to expect higher inflation some years down the road. They might also push down the value of the dollar. Both of these things, however, would actually help rather than hurt the U.S. economy right now: expected inflation would discourage corporations and families from sitting on cash, while a weaker dollar would make our exports more competitive.

Still, haven’t crises like the one envisioned by deficit scolds happened in the past? Actually, no. As far as I can tell, every example supposedly illustrating the dangers of debt involves either a country that, like Greece today, lacked its own currency, or a country that, like Asian economies in the 1990s, had large debts in foreign currencies. Countries with large debts in their own currency, like France after World War I [ http://krugman.blogs.nytimes.com/2012/11/23/franc-thoughts-on-bond-vigilantes/ ], have sometimes experienced big loss-of-confidence drops in the value of their currency — but nothing like the debt-induced recession we’re being told to fear.

So let’s step back for a minute, and consider what’s going on here. For years, deficit scolds have held Washington in thrall with warnings of an imminent debt crisis, even though investors, who continue to buy U.S. bonds, clearly believe that such a crisis won’t happen; economic analysis says that such a crisis can’t happen; and the historical record shows no examples bearing any resemblance to our current situation in which such a crisis actually did happen.

If you ask me, it’s time for Washington to stop worrying about this phantom menace — and to stop listening to the people who have been peddling this scare story in an attempt to get their way.

© 2012 The New York Times Company

http://www.nytimes.com/2012/11/26/opinion/krugman-fighting-fiscal-phantoms.html [with comments]

===

A Minimum Tax for the Wealthy

By WARREN E. BUFFETT

Published: November 25, 2012

Omaha

SUPPOSE that an investor you admire and trust comes to you with an investment idea. “This is a good one,” he says enthusiastically. “I’m in it, and I think you should be, too.”

Would your reply possibly be this? “Well, it all depends on what my tax rate will be on the gain you’re saying we’re going to make. If the taxes are too high, I would rather leave the money in my savings account, earning a quarter of 1 percent.” Only in Grover Norquist’s imagination does such a response exist.

Between 1951 and 1954, when the capital gains rate was 25 percent and marginal rates on dividends reached 91 percent in extreme cases, I sold securities and did pretty well. In the years from 1956 to 1969, the top marginal rate fell modestly, but was still a lofty 70 percent — and the tax rate on capital gains inched up to 27.5 percent. I was managing funds for investors then. Never did anyone mention taxes as a reason to forgo an investment opportunity that I offered.

Under those burdensome rates, moreover, both employment and the gross domestic product (a measure of the nation’s economic output) increased at a rapid clip. The middle class and the rich alike gained ground.

So let’s forget about the rich and ultrarich going on strike and stuffing their ample funds under their mattresses if — gasp — capital gains rates and ordinary income rates are increased. The ultrarich, including me, will forever pursue investment opportunities.

And, wow, do we have plenty to invest. The Forbes 400 [ http://www.forbes.com/sites/luisakroll/2012/09/19/the-forbes-400-the-richest-people-in-america/ ], the wealthiest individuals in America, hit a new group record for wealth this year: $1.7 trillion. That’s more than five times the $300 billion total in 1992. In recent years, my gang has been leaving the middle class in the dust.

A huge tail wind from tax cuts has pushed us along. In 1992, the tax paid by the 400 highest incomes in the United States (a different universe from the Forbes list) averaged 26.4 percent of adjusted gross income. In 2009, the most recent year reported, the rate was 19.9 percent. It’s nice to have friends in high places.

The group’s average income in 2009 was $202 million — which works out to a “wage” of $97,000 per hour, based on a 40-hour workweek. (I’m assuming they’re paid during lunch hours.) Yet more than a quarter of these ultrawealthy paid less than 15 percent of their take in combined federal income and payroll taxes. Half of this crew paid less than 20 percent. And — brace yourself — a few actually paid nothing.

This outrage points to the necessity for more than a simple revision in upper-end tax rates, though that’s the place to start. I support President Obama’s proposal to eliminate the Bush tax cuts for high-income taxpayers. However, I prefer a cutoff point somewhat above $250,000 — maybe $500,000 or so.

Additionally, we need Congress, right now, to enact a minimum tax on high incomes. I would suggest 30 percent of taxable income between $1 million and $10 million, and 35 percent on amounts above that. A plain and simple rule like that will block the efforts of lobbyists, lawyers and contribution-hungry legislators to keep the ultrarich paying rates well below those incurred by people with income just a tiny fraction of ours. Only a minimum tax on very high incomes will prevent the stated tax rate from being eviscerated by these warriors for the wealthy.

Above all, we should not postpone these changes in the name of “reforming” the tax code. True, changes are badly needed. We need to get rid of arrangements like “carried interest” that enable income from labor to be magically converted into capital gains. And it’s sickening that a Cayman Islands mail drop can be central to tax maneuvering by wealthy individuals and corporations.

But the reform of such complexities should not promote delay in our correcting simple and expensive inequities. We can’t let those who want to protect the privileged get away with insisting that we do nothing until we can do everything.

Our government’s goal should be to bring in revenues of 18.5 percent of G.D.P. and spend about 21 percent of G.D.P. — levels that have been attained over extended periods in the past and can clearly be reached again. As the math makes clear, this won’t stem our budget deficits; in fact, it will continue them. But assuming even conservative projections about inflation and economic growth, this ratio of revenue to spending will keep America’s debt stable in relation to the country’s economic output.

In the last fiscal year, we were far away from this fiscal balance — bringing in 15.5 percent of G.D.P. in revenue and spending 22.4 percent. Correcting our course will require major concessions by both Republicans and Democrats.

All of America is waiting for Congress to offer a realistic and concrete plan for getting back to this fiscally sound path. Nothing less is acceptable.

In the meantime, maybe you’ll run into someone with a terrific investment idea, who won’t go forward with it because of the tax he would owe when it succeeds. Send him my way. Let me unburden him.

Warren E. Buffett is the chairman and chief executive of Berkshire Hathaway.

© 2012 The New York Times Company

http://www.nytimes.com/2012/11/26/opinion/buffett-a-minimum-tax-for-the-wealthy.html [with comments]

--

More Chips For Tax Reform

By STEVEN RATTNER

November 24, 2012, 1:36 pm

Almost lost in the tug of war over whether the top income tax rate should be 35 percent or 39.6 percent is another consequential tax issue: the proper rate for capital gains and dividends.

It was the absurdly low rate on those forms of income — just 15 percent — that yielded Mitt Romney’s embarrassingly small tax payments. And that’s what also led to Warren E. Buffett’s lament that his tax rate was lower than his secretary’s.

So as we scurry around looking for new revenue to help address the yawning budget deficit, let’s zero in on this special preference.

President Obama has proposed much of the needed adjustment, including eliminating the special treatment of dividends and raising the tax on capital gains to 20 percent for the rich.

Personally, I would go further and raise the capital gains rate to 28 percent, right where it was during the strong recovery of Bill Clinton’s first term, and grab hold of a total of $300 billion of new revenues over the next decade.

Inevitably, a chorus of outrage would greet any such increase. Capital investment would be severely impaired! Some of the wealthy might decamp from America! With a new 3.8 percent Medicare tax on unearned income about to take effect, this would exacerbate the disincentives for investment!

Put me down as skeptical about such dire forecasts. During my 30 years on Wall Street, taxes on “unearned income” have bounced up and down with regularity, and I’ve never detected any change in the appetite for hard work and accumulating wealth on the part of myself or any of my fellow capitalists.

Remember also that corporate leaders have pretty much convinced policy makers of both parties that business taxes should be reformed to allow them to compete more effectively around the globe. Providing this relief makes sense, but since the benefits would flow to shareholders, this is yet another argument for higher taxes on dividends.

Increased revenues, meaning higher taxes, will be a central element of any successful long-term budget plan, and President Obama is right to insist that the wealthy — the slice of America that has come through the recession in by far the best financial health — should provide those funds.

Here’s the math: We need at least $4 trillion of long-term deficit reduction, with a substantial portion — on the order of $1.2 trillion — coming from new revenues.

That means other veins belonging to the wealthy will need to be tapped. Raising the tax rates for American households with incomes above $250,000 per year, as President Obama has proposed, would certainly be a productive and welcome step.

But viable alternative measures are available. At a minimum, we need to implement the “Buffett Rule,” the concept that Americans making more than $1 million a year should pay at least 30 percent of their income in taxes. This wouldn’t raise a huge amount of money — between $47 billion and $160 billion depending on what else is done to rates — but it would reinforce the responsibility of the wealthy to pay their fair share.

Sources: Treasury Department; Tax Policy Center; Joint Committee on Taxation

The New York Times

Another important step toward tax fairness would be to address the indefensibly low 15 percent tax rate on the famous “carried interest,” the fee received by private equity and certain hedge fund investors.

As a beneficiary of the carried interest loophole, I’ve seen firsthand the lack of any difference between the work involved in generating a carried interest and the work done by millions of other professionals who are taxed at the full 35 percent rate.

Another productive area for raising revenue would be limiting deductions available to the wealthy. The highest-income Americans don’t need tax-free health insurance, mortgage interest deductions or deferred taxation on retirement funds.

Mitt Romney himself proposed an efficient and effective approach: just limit the total amount of deductions. Even excluding charitable deductions from this limitation — as I would personally advocate — capping deductions at $25,000 would raise large amounts of revenue, an estimated $885 billion over the next 10 years.

While Mr. Romney called for applying the limitation to all Americans, a fairer approach would be to impose it only on the wealthiest.

These types of tax changes would have the ancillary benefit of defusing a specious argument that conservatives love to make: that raising the top rates on ordinary income would hurt small business.

Certainly no small business can claim to be damaged by a higher rate on dividends or capital gains or by the proprietor’s losing some tax deductions.

So I’m all for raising rates as President Obama has proposed. But in a divided government, compromise is needed, and happily there are other chips that can be put on the table as we bargain over how to raise the needed revenue from the wealthy.

© 2012 The New York Times Company

http://opinionator.blogs.nytimes.com/2012/11/24/more-chips-for-tax-reform/ [with comments]

--

Joe Scarborough: It Is 'Immoral' For Richest Americans To Pay 15% Tax Rate (VIDEO)

In a move that will surely rankle his fellow Republicans, Joe Scarborough criticized the GOP's tax policies and argued that wealthy Americans should pay more taxes on Monday's "Morning Joe."

The panel was discussing tax reform and Steve Rattner's New York Times editorial [ http://opinionator.blogs.nytimes.com/2012/11/24/more-chips-for-tax-reform/ (just above)], which suggested that President Obama should raise the tax rate on capital gains to 28%. Scarborough jumped in, arguing that the richest Americans can and should pay higher taxes.

"You see again this huge divide between the richest Americans and the poorest Americans... and you sit there going, you know what, these people that live in these mansions and have private jets and live an extraordinary life like few Americans live — they can probably deal with a 20 percent tax rate on capital gains instead of 15 percent," the MSNBC host said.

Scarborough further criticized, "Why are we fighting and risking our majorities protecting billionaires that are hedge fund guys who are paying 14 percent tax rates?"

He continued, "There's something immoral about these people paying fourteen, fifteen, sixteen percent of their taxes because the tax rates are the way they are while small business owners who make $250,000 a year in Manhattan and may employ four people are paying a 35% tax rate."

Copyright © 2012 TheHuffingtonPost.com, Inc.

http://www.huffingtonpost.com/2012/11/26/joe-scarborough-tax-rates_n_2191232.html [the above YouTube of the segment, the same as the Hulu of the segment embedded, at https://www.youtube.com/watch?v=Rie5qbldmYY ; with comments]

--

(linked in) http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81122451 and preceding and following)

--

Las Vegas Sands' Special Dividend: Sheldon Adelson's Casino Moves Up Payout To Avoid Fiscal Cliff Taxes

11/26/12

http://www.huffingtonpost.com/2012/11/26/las-vegas-sands-special-dividend_n_2194140.html [with comments]

--

If the Budget Debate Had a Nate Silver

By Dean Baker

11/26/2012

http://www.huffingtonpost.com/dean-baker/if-the-budget-debate-had_b_2192589.html [with comments]

--

Paul Krugman: Republicans Seem Ready To Throw Upper Middle Class 'Overboard'

Paul Krugman says that Republicans seem ready to throw the modestly rich "overboard" in a fiscal cliff deal.

By Bonnie Kavoussi

Posted: 11/27/2012 10:56 am EST Updated: Updated: 11/27/2012 1:30 pm EST

Paul Krugman says that the Republican Party may throw the modestly rich "overboard" to protect the fortunes of multi-millionaires.

In a blog post on Tuesday [ http://krugman.blogs.nytimes.com/2012/11/27/the-stiffs-and-the-players/ ], Krugman focuses on one tax proposal floated by Congressional Republicans that would essentially create a "tax bubble," disproportionately hurting the upper middle class. (Nate Silver has an explanation and a chart

here [ http://fivethirtyeight.blogs.nytimes.com/2012/11/26/congressional-proposal-could-create-bubble-in-tax-code/ ].) Krugman writes that taking this tack would let the GOP protect the super-rich at the expense of the working rich (using the decades-old language of Oliver Stone's Wall Street [ http://www.imdb.com/title/tt0094291/ ]) who make six-figure salaries.

"When push comes to shove, the GOP seems ready to throw the bottom 90 percent of the top 1 percent overboard, in order to protect its real patrons, the superelite," Krugman writes.

The Obama administration and Congress [ http://www.huffingtonpost.com/2012/11/25/seven-and-a-half-things-you-need-to-know_n_2189586.html ] are in talks to reach an agreement avoiding the fiscal cliff [ http://www.huffingtonpost.com/2012/11/09/star-wars-fiscal-cliff_n_2101432.html ]: a set of tax hikes and spending cuts scheduled to take place at the end of the year if they do not agree on a deficit reduction plan.

Some Congressional Republicans [ http://www.huffingtonpost.com/2012/11/25/lindsey-graham-violate-pledge-increase-taxes_n_2187944.html ], including House Speaker John Boehner [ http://www.huffingtonpost.com/huff-wires/20121126/us-fiscal-cliff-obama/ ], have said they are open to raising tax revenue but remain opposed to raising marginal tax rates. Here's a great explanation of marginal tax rates from economist Dean Baker [ http://www.cepr.net/index.php/blogs/beat-the-press/usa-today-is-too-dumb-for-words-when-ot-comes-to-taxes ] (h/t Jason Linkins):

The tax system brackets give marginal rates. This means that if the raise bumps you into a higher bracket then you pay more taxes only on the income in the higher bracket. Suppose that the tax bracket for income under $200k is 25 percent, and for income over $200k is 33 percent. If you get a raise that pushes your income from $195,000 to $205,000 then you only pay the higher 33 percent tax rate on the $5,000 that is above the $200k threshold not your whole income. Therefore, there is no (as in none, nada, not any) way that getting more money, and being pushed into a higher tax bracket will leave you with less money after taxes.

One Republican proposal [ http://www.nytimes.com/2012/11/23/us/politics/congress-looks-at-ways-to-leave-top-tax-rate-as-is.html?pagewanted=all ] would tax a household's entire income at the highest rate possible, rather than just the portion of income that exceeds a certain limit. Doing so would penalize some people for making more money, as Nate Silver notes [ http://fivethirtyeight.blogs.nytimes.com/2012/11/26/congressional-proposal-could-create-bubble-in-tax-code/ ].

Republican Congressmen [ http://www.huffingtonpost.com/huff-wires/20121126/us-fiscal-cliff-obama/ ] also have proposed raising tax revenue by limiting deductions, which could disproportionately hurt [ http://www.nytimes.com/2012/10/28/realestate/mortgages-who-really-benefits-from-interest-deductions.html ] the upper middle class. Some Senate Democrats have said [ http://www.huffingtonpost.com/2012/11/13/senate-democrats-consider-cap-deductions-romney-proposal_n_2121326.html ] they are open to capping deductions.

Copyright © 2012 TheHuffingtonPost.com, Inc.

http://www.huffingtonpost.com/2012/11/27/paul-krugman-republicans_n_2197125.html [with comments]

===

What's the GOP message if the economy booms?

A trader works at the New York Stock Exchange, which has seen rising prices due to optimism about the prospects of a "fiscal cliff" deal.

By David Frum, CNN Contributor

updated 11:54 AM EST, Mon November 26, 2012

Editor's note: David Frum, a CNN contributor, is a contributing editor at Newsweek and The Daily Beast. He is the author of eight books, including a new novel "Patriots" and his post-election e-book, "Why Romney Lost [ http://www.thedailybeast.com/articles/2012/11/08/why-romney-lost-by-david-frum-a-newsweek-ebook.html ]." Frum was a special assistant to President George W. Bush from 2001 to 2002.

(CNN) -- Here's the next thing the Republican party needs to rethink. What does it say if and when the United States returns to prosperity?

For five years, U.S. politics have been shaped by economic hardship. In 2008 and 2010, voters rejected the party in power, booting Republicans out of the White House, and then sweeping Democrats out of Congress.

Mitt Romney campaigned in 2012 on the slogan, "Obama isn't working." President Obama responded by attacking Romney as out of touch, assuming (probably correctly) that he could not win by running on his record.

But the indicators are suggesting that by 2013 and 2014, the Obama record will begin to look a lot better, assuming, that is, that the two parties in Washington don't recklessly push the country off the fiscal cliff at the end of the year.

The nation's economy added 171,000 jobs in October 2012, for a total of almost 700,000 in the four months before Election Day. More than half the jobs lost in the crash of 2008-2009 have now been recovered, even as public-sector employment has shrunk by a net 500,000.

The economy is recovering because consumers are less burdened by debt. They are paying down their credit cards, building home equity and strengthening their personal balance sheets.

As household debt burdens become lighter, consumers express more confidence. They are allowing themselves to spend a little more. They are even buying new homes again. Housing starts in October 2012 rose to a level 41.9% over a year before.

Accelerating economic activity is rapidly reducing the budget deficit. The deficit has contracted since 2009 at the fastest rate since the end of World War II, faster even than during the late 1990s boom.

Wages remain flat, and will likely stay flat until unemployment contracts more, but Americans can begin to see better times ahead for the first time in a long time.

News: GOP resistance to anti-tax pledge grows

As they do glimpse that better future, two things will happen in politics:

1) President Obama will begin to claim more credit. In 2012, the word "stimulus" went unmentioned by Democrats. It was Republicans who tried to make political use of the $800 billion spent on job creation in 2009-2011. In 2013-2014, however, the shoe may suddenly rematerialize on the other foot.

2) Republicans will discover that their old "Obama isn't working" theme has become obsolete. By 2014, again assuming that Congress does not leap off the fiscal cliff, it will likely look as if Obama is working. What then? If negative messaging failed in 2012, it will fail bigger in 2014.

For too long, the Republicans have predicted apocalypse, debt crisis, the loss of freedom, the overthrow of the constitution. As the economy improves, that doom-saying will seem even more out of touch than ever.

Republican political chances will depend on the Republican ability to devise a positive program to address the country's fiscal problems in ways that improve people's lives. It's a new day, guys, and it demands a new game.

The opinions expressed in this commentary are solely those of David Frum.

© 2012 Cable News Network. Turner Broadcasting System, Inc.

http://www.cnn.com/2012/11/26/opinion/frum-gop-prosperity/index.html [with comments]

===

Mandate with Destiny

by Hendrik Hertzberg

December 3, 2012 [issue of]

hanksgiving was still two weeks away when the Republican Party, to its evident shock, found itself stuffed, trussed, roasted, and ready to be served with all the trimmings. This was not the menu that the Party’s nominees, donors, and operatives had looked forward to. It was emphatically not the feast they had been primed to expect by their vulpine cheerleaders in the island universe of the illiberal media. ROMNEY BEATS OBAMA, HANDILY, Michael Barone trumpeted a few days before the election in the Examiner, Washington’s conservative giveaway daily. (The Chicago Tribune, back in ’48, had at least left out the “handily.”) “I think it’s this: a Romney win,” Peggy Noonan assured her Wall Street Journal blog readers the day before the polls opened. (“All the vibrations are right,” she explained.) Also on Election Eve, Dick Morris, a Fox News “analyst” reputed to be a pollster, promised “a landslide for Romney.” The same prediction—not just a win, a landslide—was bruited from the sinkholes (Glenn Beck) to the summits (George F. Will) of the right’s intellectual sierra.

News flash: the President won, handily. With late returns still trickling in, his popular-vote margin now exceeds four million, a million more than George W. Bush amassed when he ran for reëlection. (Obama’s electoral-college majority is also larger: 332 to Mitt Romney’s 206, as against Bush’s 286 to John Kerry’s 251.) When it came to this year’s thirty-three Senate races, Republican prophecies of a Republican takeover, universal some months ago, grew rarer as November approached, except on the farther-out reaches of conservative punditry. Human Events, which describes itself as Ronald Reagan’s favorite newspaper, and CBN, the religious-right TV network, each predicted a net gain of five seats for the G.O.P. Morris, who predicted a six-seat gain, gloated that a Republican Senate would be “Barack Obama’s parting gift to the Democratic Party.” That it was, except for the “parting” part. And except for the “Republican” part: not only did the Democratic caucus grow from fifty-three to fifty-five, Democratic senatorial candidates got a total of ten million more votes than their Republican opponents.

In 2004, the editorial board of the Wall Street Journal, conservatism’s Congregation for the Doctrine of the Faith, congratulated President Bush for “what by any measure is a decisive mandate for a second term” and exulted, “Mr. Bush has been given the kind of mandate that few politicians are ever fortunate enough to receive.” This year, examining similar numbers with different labels, the Journal came up with a sterner interpretation. “President Obama won one of the narrower re-elections in modern times,” its editorial announced. Also:

Mr. Obama will now have to govern the America he so relentlessly sought to divide—and without a mandate beyond the powers of the Presidency. Democrats will hold the Senate, perhaps with an additional seat or two. But Republicans held the House comfortably, so their agenda was hardly repudiated. . . . Speaker John Boehner can negotiate knowing he has as much of a mandate as the President.

Ah, yes: the House. The Republicans will have seven or eight fewer seats in that body, but hold it they did, and this fact is what those among them who are stuck at Stage 1 of Mme. Kübler-Ross’s five-stage topography of grief (“Denial”), and even a few who are tentatively assaying Stage 3 (“Bargaining”), are clinging to. (Talk radio is permanently tuned to Stage 2, “Anger,” and Stage 4, “Depression,” hangs heavy.) In the view of these Republicans, the election was a tie; and on the legitimacy of their most cherished goal—keeping rich folks’ taxes at their current historic lows or lowering them even more—they claimed vindication. “We just had an election, and the House of Representatives was elected committed to keeping taxes low,” Grover Norquist, custodian of the notorious no-tax-hikes-ever pledge signed by almost every Republican in Congress, told CBS’s Charlie Rose. (Norquist attributed the Presidential result to the Obama campaign’s success in portraying Romney as “a poopy-head.”) On ABC, Jonathan Karl asked Romney’s erstwhile running mate, Paul Ryan, if the electorate had given Obama any semblance of a mandate. “I don’t think so, because they also reëlected the House Republicans,” Ryan replied. “So whether people intended or not, we’ve got divided government.”

Actually, “people”—a majority of voters, or even a nontrivial minority—never “intend” divided government. Most people always vote straight Democratic or straight Republican, which means that most people always vote to put one party in charge. They may disagree about which party, and they would rather have their party control part of the government than none of it, but almost all of them prefer undivided government. This year, as usual, “people” wanted one party to run the whole show. That party was the Democrats. Republican House candidates won more seats, but Democratic House candidates won more votes—in the aggregate, about a million more.

For one party to win a majority of House seats with a minority of votes is a relatively rare occurrence. It has now happened five times in the past hundred years. In 1914 and 1942, the Democrats were the beneficiaries. In 1952, 1996, and this year, it was the Republicans’ turn to get lucky, and their luck is likely to hold for many election cycles to come. Gerrymandering routinely gets blamed for such mismatches, but that’s only part of the story. Far more important than redistricting is just plain districting: because so many Democrats are city folk, large numbers of Democratic votes pile up redundantly in overwhelmingly one-sided districts. Even having district lines drawn by neutral commissions instead of by self-serving politicians wouldn’t do much to alter this built-in structural bias. Of course, the perversities of our peculiar electoral machinery can cut both ways. Before November 6th, there was much speculation that Obama, like Bush in 2000, might lose the popular vote while winning in the electoral college. It didn’t happen, but the speculation was far from idle. If Romney had run more strongly throughout the country, he might have beaten Obama by as many as two million votes and still have lost the Presidency.

Even so, the reëlection of a Republican House was no more a repudiation of, for example, levying modestly higher taxes on the highest incomes than was the reëlection of the President or the strengthening of the Democratic majority in the Senate. “You know what? It won’t kill the country if we raise taxes a little bit on millionaires,” William Kristol, the editor of The Weekly Standard, a kind of Human Events for non-dummies, mused the other day on Fox News, of all places. Similar heresies are beginning to be whispered on Capitol Hill. But, given the track record of the past four years, it would be unwise to bet the farm on the proposition that the G.O.P. will edge away from nihilist obstructionism anytime soon. Stage 5, “Acceptance,” is still a few Republicans shy of a quorum.

© 2012 Condé Nast

http://www.newyorker.com/talk/comment/2012/12/03/121203taco_talk_hertzberg

--

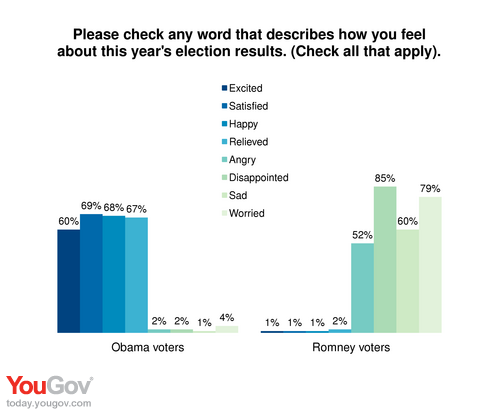

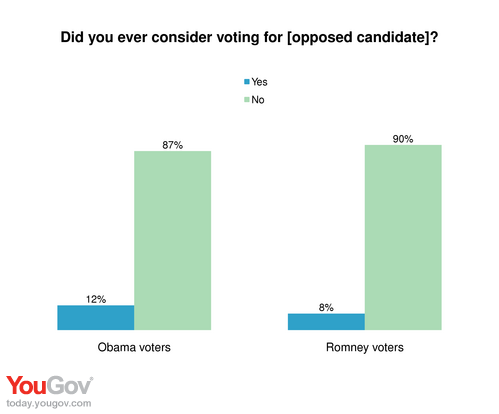

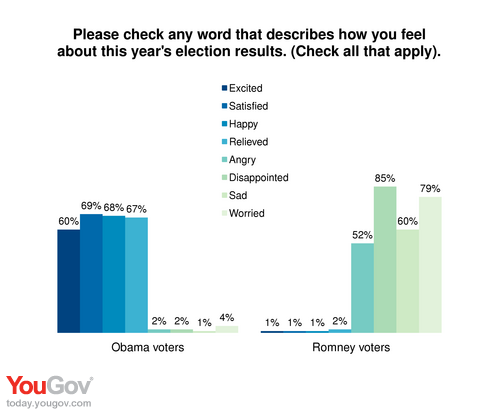

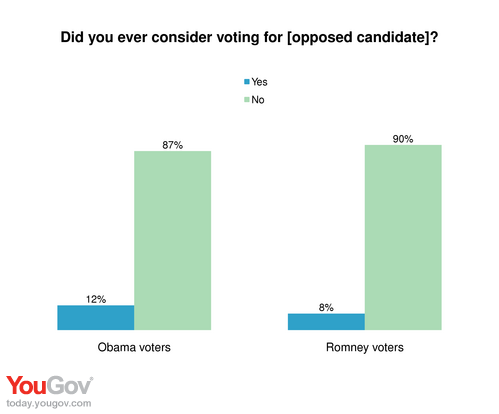

Romney's Supporters Upset with 2012 Election Outcome

11/26/2012

http://utahpolicy.com/view/full_story/20938830/article-Romney-s-Supporters-Upset-with-2012-Election-Outcome [with comment]

--

(linked in):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81840867 and preceding (and any future following)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81874694 (and any future following)

===

Alan Simpson Says He Hopes Grover Norquist Drowns in the Bathtub

It seems this ongoing feud between former Sen. Alan Simpson and anti-tax lobbyist Grover Norquist isn't going to end any time soon. Simpson went after Norquist again on Hardball this Tuesday while doing his usual fearmongering over the "fiscal cliff."

http://www.youtube.com/watch?v=tFBz3W8CBo8 [the complete segment; the portion with the quote embedded at http://www.buzzfeed.com/andrewkaczynski/alan-simpson-would-like-grover-norquist-to-drown-i (with comments)]

===

Medicaid Expansion Covers Millions At 'Modest' Cost To States: Report

Maine Gov. Paul LePage (R) opposes expanding Medicaid in his state under President Barack Obama's health care reform law. A new study says Maine could save money by doing so.

11/26/2012

Expanding Medicaid health benefits to everyone eligible under President Barack Obama's health care reform law would increase state spending on the program by just 3 percent while extending health coverage to more than 20 million people, according to a study [ http://www.kff.org/medicaid/8384.cfm ] released Monday by the Henry J. Kaiser Family Foundation and the Urban Institute.

[...]

http://www.huffingtonpost.com/2012/11/26/medicaid-expansion_n_2191912.html [with comments]

--

Getting My Uninsured Teeth Pulled In Mexico's Most Notorious Border Town

11/26/2012

http://www.huffingtonpost.com/joshua-ellis/mexico-dentists_b_2193029.html [with comments]

===

(linked in):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81595552 and preceding and following

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81782349 and following

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81799306 and preceding (and any future following;

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81687527 and preceding and following

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81831325 and preceding and following

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81835055 (and any future following);

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81875057 (and any future following)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81835723 and following;

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81874006 (and any future following)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81839588 and preceding (and any future following)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81839934 and preceding and following

By PAUL KRUGMAN

Published: November 25, 2012

These are difficult times for the deficit scolds who have dominated policy discussion for almost three years. One could almost feel sorry for them, if it weren’t for their role in diverting attention from the ongoing problem of inadequate recovery, and thereby helping to perpetuate catastrophically high unemployment.

What has changed? For one thing, the crisis they predicted keeps not happening. Far from fleeing U.S. debt, investors have continued to pile in, driving interest rates to historical lows [ http://krugman.blogs.nytimes.com/2012/11/25/incredible-credibility/ ]. Beyond that, suddenly the clear and present danger to the American economy isn’t that we’ll fail to reduce the deficit enough; it is, instead, that we’ll reduce the deficit too much. For that’s what the “fiscal cliff” — better described as the austerity bomb — is all about: the tax hikes and spending cuts scheduled to kick in at the end of this year are precisely not what we want to see happen in a still-depressed economy.

Given these realities, the deficit-scold movement has lost some of its clout. That movement, by the way, is a hydra-headed beast, comprising many organizations that turn out, on inspection, to be financed and run by more or less the same people; dig down into many of these groups’ back stories and you will, in particular, find Peter Peterson, the private-equity billionaire, playing a key role.

But the deficit scolds aren’t giving up. Now yet another organization, Fix the Debt [ http://www.fixthedebt.org/core-principles ], is campaigning for cuts to Social Security and Medicare, even while making lower tax rates a “core principle.” That last part makes no sense in terms of the group’s ostensible mission, but makes perfect sense if you look at the array of big corporations, from Goldman Sachs to the UnitedHealth Group [ http://www.fixthedebt.org/uploads/files/CEO%20Fiscal%20Leadership%20Council%20Membership%2011-14-12.pdf ], that are involved in the effort and would benefit from tax cuts. Hey, sacrifice is for the little people.

So should we take this latest push seriously? No — and not just because these people, aside from exhibiting a lot of hypocrisy, have been wrong about everything so far. The truth is that at a fundamental level the crisis story they’re trying to sell doesn’t make sense.

You’ve heard the story many times: Supposedly, any day now investors will lose faith in America’s ability to come to grips with its budget failures. When they do, there will be a run on Treasury bonds, interest rates will spike, and the U.S. economy will plunge back into recession.

This sounds plausible to many people, because it’s roughly speaking what happened to Greece. But we’re not Greece, and it’s almost impossible to see how this could actually happen to a country in our situation.

For we have our own currency — and almost all of our debt, both private and public, is denominated in dollars. So our government, unlike the Greek government, literally can’t run out of money. After all, it can print the stuff. So there’s almost no risk that America will default on its debt — I’d say no risk at all if it weren’t for the possibility that Republicans would once again try to hold the nation hostage over the debt ceiling.

But if the U.S. government prints money to pay its bills, won’t that lead to inflation? No, not if the economy is still depressed.

Now, it’s true that investors might start to expect higher inflation some years down the road. They might also push down the value of the dollar. Both of these things, however, would actually help rather than hurt the U.S. economy right now: expected inflation would discourage corporations and families from sitting on cash, while a weaker dollar would make our exports more competitive.

Still, haven’t crises like the one envisioned by deficit scolds happened in the past? Actually, no. As far as I can tell, every example supposedly illustrating the dangers of debt involves either a country that, like Greece today, lacked its own currency, or a country that, like Asian economies in the 1990s, had large debts in foreign currencies. Countries with large debts in their own currency, like France after World War I [ http://krugman.blogs.nytimes.com/2012/11/23/franc-thoughts-on-bond-vigilantes/ ], have sometimes experienced big loss-of-confidence drops in the value of their currency — but nothing like the debt-induced recession we’re being told to fear.

So let’s step back for a minute, and consider what’s going on here. For years, deficit scolds have held Washington in thrall with warnings of an imminent debt crisis, even though investors, who continue to buy U.S. bonds, clearly believe that such a crisis won’t happen; economic analysis says that such a crisis can’t happen; and the historical record shows no examples bearing any resemblance to our current situation in which such a crisis actually did happen.

If you ask me, it’s time for Washington to stop worrying about this phantom menace — and to stop listening to the people who have been peddling this scare story in an attempt to get their way.

© 2012 The New York Times Company

http://www.nytimes.com/2012/11/26/opinion/krugman-fighting-fiscal-phantoms.html [with comments]

===

A Minimum Tax for the Wealthy

By WARREN E. BUFFETT

Published: November 25, 2012

Omaha

SUPPOSE that an investor you admire and trust comes to you with an investment idea. “This is a good one,” he says enthusiastically. “I’m in it, and I think you should be, too.”

Would your reply possibly be this? “Well, it all depends on what my tax rate will be on the gain you’re saying we’re going to make. If the taxes are too high, I would rather leave the money in my savings account, earning a quarter of 1 percent.” Only in Grover Norquist’s imagination does such a response exist.

Between 1951 and 1954, when the capital gains rate was 25 percent and marginal rates on dividends reached 91 percent in extreme cases, I sold securities and did pretty well. In the years from 1956 to 1969, the top marginal rate fell modestly, but was still a lofty 70 percent — and the tax rate on capital gains inched up to 27.5 percent. I was managing funds for investors then. Never did anyone mention taxes as a reason to forgo an investment opportunity that I offered.

Under those burdensome rates, moreover, both employment and the gross domestic product (a measure of the nation’s economic output) increased at a rapid clip. The middle class and the rich alike gained ground.

So let’s forget about the rich and ultrarich going on strike and stuffing their ample funds under their mattresses if — gasp — capital gains rates and ordinary income rates are increased. The ultrarich, including me, will forever pursue investment opportunities.

And, wow, do we have plenty to invest. The Forbes 400 [ http://www.forbes.com/sites/luisakroll/2012/09/19/the-forbes-400-the-richest-people-in-america/ ], the wealthiest individuals in America, hit a new group record for wealth this year: $1.7 trillion. That’s more than five times the $300 billion total in 1992. In recent years, my gang has been leaving the middle class in the dust.

A huge tail wind from tax cuts has pushed us along. In 1992, the tax paid by the 400 highest incomes in the United States (a different universe from the Forbes list) averaged 26.4 percent of adjusted gross income. In 2009, the most recent year reported, the rate was 19.9 percent. It’s nice to have friends in high places.

The group’s average income in 2009 was $202 million — which works out to a “wage” of $97,000 per hour, based on a 40-hour workweek. (I’m assuming they’re paid during lunch hours.) Yet more than a quarter of these ultrawealthy paid less than 15 percent of their take in combined federal income and payroll taxes. Half of this crew paid less than 20 percent. And — brace yourself — a few actually paid nothing.

This outrage points to the necessity for more than a simple revision in upper-end tax rates, though that’s the place to start. I support President Obama’s proposal to eliminate the Bush tax cuts for high-income taxpayers. However, I prefer a cutoff point somewhat above $250,000 — maybe $500,000 or so.

Additionally, we need Congress, right now, to enact a minimum tax on high incomes. I would suggest 30 percent of taxable income between $1 million and $10 million, and 35 percent on amounts above that. A plain and simple rule like that will block the efforts of lobbyists, lawyers and contribution-hungry legislators to keep the ultrarich paying rates well below those incurred by people with income just a tiny fraction of ours. Only a minimum tax on very high incomes will prevent the stated tax rate from being eviscerated by these warriors for the wealthy.

Above all, we should not postpone these changes in the name of “reforming” the tax code. True, changes are badly needed. We need to get rid of arrangements like “carried interest” that enable income from labor to be magically converted into capital gains. And it’s sickening that a Cayman Islands mail drop can be central to tax maneuvering by wealthy individuals and corporations.

But the reform of such complexities should not promote delay in our correcting simple and expensive inequities. We can’t let those who want to protect the privileged get away with insisting that we do nothing until we can do everything.

Our government’s goal should be to bring in revenues of 18.5 percent of G.D.P. and spend about 21 percent of G.D.P. — levels that have been attained over extended periods in the past and can clearly be reached again. As the math makes clear, this won’t stem our budget deficits; in fact, it will continue them. But assuming even conservative projections about inflation and economic growth, this ratio of revenue to spending will keep America’s debt stable in relation to the country’s economic output.

In the last fiscal year, we were far away from this fiscal balance — bringing in 15.5 percent of G.D.P. in revenue and spending 22.4 percent. Correcting our course will require major concessions by both Republicans and Democrats.

All of America is waiting for Congress to offer a realistic and concrete plan for getting back to this fiscally sound path. Nothing less is acceptable.

In the meantime, maybe you’ll run into someone with a terrific investment idea, who won’t go forward with it because of the tax he would owe when it succeeds. Send him my way. Let me unburden him.

Warren E. Buffett is the chairman and chief executive of Berkshire Hathaway.

© 2012 The New York Times Company

http://www.nytimes.com/2012/11/26/opinion/buffett-a-minimum-tax-for-the-wealthy.html [with comments]

--

More Chips For Tax Reform

By STEVEN RATTNER

November 24, 2012, 1:36 pm

Almost lost in the tug of war over whether the top income tax rate should be 35 percent or 39.6 percent is another consequential tax issue: the proper rate for capital gains and dividends.

It was the absurdly low rate on those forms of income — just 15 percent — that yielded Mitt Romney’s embarrassingly small tax payments. And that’s what also led to Warren E. Buffett’s lament that his tax rate was lower than his secretary’s.

So as we scurry around looking for new revenue to help address the yawning budget deficit, let’s zero in on this special preference.

President Obama has proposed much of the needed adjustment, including eliminating the special treatment of dividends and raising the tax on capital gains to 20 percent for the rich.

Personally, I would go further and raise the capital gains rate to 28 percent, right where it was during the strong recovery of Bill Clinton’s first term, and grab hold of a total of $300 billion of new revenues over the next decade.

Inevitably, a chorus of outrage would greet any such increase. Capital investment would be severely impaired! Some of the wealthy might decamp from America! With a new 3.8 percent Medicare tax on unearned income about to take effect, this would exacerbate the disincentives for investment!

Put me down as skeptical about such dire forecasts. During my 30 years on Wall Street, taxes on “unearned income” have bounced up and down with regularity, and I’ve never detected any change in the appetite for hard work and accumulating wealth on the part of myself or any of my fellow capitalists.

Remember also that corporate leaders have pretty much convinced policy makers of both parties that business taxes should be reformed to allow them to compete more effectively around the globe. Providing this relief makes sense, but since the benefits would flow to shareholders, this is yet another argument for higher taxes on dividends.

Increased revenues, meaning higher taxes, will be a central element of any successful long-term budget plan, and President Obama is right to insist that the wealthy — the slice of America that has come through the recession in by far the best financial health — should provide those funds.

Here’s the math: We need at least $4 trillion of long-term deficit reduction, with a substantial portion — on the order of $1.2 trillion — coming from new revenues.

That means other veins belonging to the wealthy will need to be tapped. Raising the tax rates for American households with incomes above $250,000 per year, as President Obama has proposed, would certainly be a productive and welcome step.

But viable alternative measures are available. At a minimum, we need to implement the “Buffett Rule,” the concept that Americans making more than $1 million a year should pay at least 30 percent of their income in taxes. This wouldn’t raise a huge amount of money — between $47 billion and $160 billion depending on what else is done to rates — but it would reinforce the responsibility of the wealthy to pay their fair share.

Sources: Treasury Department; Tax Policy Center; Joint Committee on Taxation

The New York Times

Another important step toward tax fairness would be to address the indefensibly low 15 percent tax rate on the famous “carried interest,” the fee received by private equity and certain hedge fund investors.

As a beneficiary of the carried interest loophole, I’ve seen firsthand the lack of any difference between the work involved in generating a carried interest and the work done by millions of other professionals who are taxed at the full 35 percent rate.

Another productive area for raising revenue would be limiting deductions available to the wealthy. The highest-income Americans don’t need tax-free health insurance, mortgage interest deductions or deferred taxation on retirement funds.

Mitt Romney himself proposed an efficient and effective approach: just limit the total amount of deductions. Even excluding charitable deductions from this limitation — as I would personally advocate — capping deductions at $25,000 would raise large amounts of revenue, an estimated $885 billion over the next 10 years.

While Mr. Romney called for applying the limitation to all Americans, a fairer approach would be to impose it only on the wealthiest.

These types of tax changes would have the ancillary benefit of defusing a specious argument that conservatives love to make: that raising the top rates on ordinary income would hurt small business.

Certainly no small business can claim to be damaged by a higher rate on dividends or capital gains or by the proprietor’s losing some tax deductions.

So I’m all for raising rates as President Obama has proposed. But in a divided government, compromise is needed, and happily there are other chips that can be put on the table as we bargain over how to raise the needed revenue from the wealthy.

© 2012 The New York Times Company

http://opinionator.blogs.nytimes.com/2012/11/24/more-chips-for-tax-reform/ [with comments]

--

Joe Scarborough: It Is 'Immoral' For Richest Americans To Pay 15% Tax Rate (VIDEO)

Posted: 11/26/2012 9:48 am EST Updated: 11/27/2012 10:34 am EST

In a move that will surely rankle his fellow Republicans, Joe Scarborough criticized the GOP's tax policies and argued that wealthy Americans should pay more taxes on Monday's "Morning Joe."

The panel was discussing tax reform and Steve Rattner's New York Times editorial [ http://opinionator.blogs.nytimes.com/2012/11/24/more-chips-for-tax-reform/ (just above)], which suggested that President Obama should raise the tax rate on capital gains to 28%. Scarborough jumped in, arguing that the richest Americans can and should pay higher taxes.

"You see again this huge divide between the richest Americans and the poorest Americans... and you sit there going, you know what, these people that live in these mansions and have private jets and live an extraordinary life like few Americans live — they can probably deal with a 20 percent tax rate on capital gains instead of 15 percent," the MSNBC host said.

Scarborough further criticized, "Why are we fighting and risking our majorities protecting billionaires that are hedge fund guys who are paying 14 percent tax rates?"

He continued, "There's something immoral about these people paying fourteen, fifteen, sixteen percent of their taxes because the tax rates are the way they are while small business owners who make $250,000 a year in Manhattan and may employ four people are paying a 35% tax rate."

Copyright © 2012 TheHuffingtonPost.com, Inc.

http://www.huffingtonpost.com/2012/11/26/joe-scarborough-tax-rates_n_2191232.html [the above YouTube of the segment, the same as the Hulu of the segment embedded, at https://www.youtube.com/watch?v=Rie5qbldmYY ; with comments]

--

(linked in) http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81122451 and preceding and following)

--

Las Vegas Sands' Special Dividend: Sheldon Adelson's Casino Moves Up Payout To Avoid Fiscal Cliff Taxes

11/26/12

http://www.huffingtonpost.com/2012/11/26/las-vegas-sands-special-dividend_n_2194140.html [with comments]

--

If the Budget Debate Had a Nate Silver

By Dean Baker

11/26/2012

http://www.huffingtonpost.com/dean-baker/if-the-budget-debate-had_b_2192589.html [with comments]

--

Paul Krugman: Republicans Seem Ready To Throw Upper Middle Class 'Overboard'

Paul Krugman says that Republicans seem ready to throw the modestly rich "overboard" in a fiscal cliff deal.

By Bonnie Kavoussi

Posted: 11/27/2012 10:56 am EST Updated: Updated: 11/27/2012 1:30 pm EST

Paul Krugman says that the Republican Party may throw the modestly rich "overboard" to protect the fortunes of multi-millionaires.

In a blog post on Tuesday [ http://krugman.blogs.nytimes.com/2012/11/27/the-stiffs-and-the-players/ ], Krugman focuses on one tax proposal floated by Congressional Republicans that would essentially create a "tax bubble," disproportionately hurting the upper middle class. (Nate Silver has an explanation and a chart

here [ http://fivethirtyeight.blogs.nytimes.com/2012/11/26/congressional-proposal-could-create-bubble-in-tax-code/ ].) Krugman writes that taking this tack would let the GOP protect the super-rich at the expense of the working rich (using the decades-old language of Oliver Stone's Wall Street [ http://www.imdb.com/title/tt0094291/ ]) who make six-figure salaries.

"When push comes to shove, the GOP seems ready to throw the bottom 90 percent of the top 1 percent overboard, in order to protect its real patrons, the superelite," Krugman writes.

The Obama administration and Congress [ http://www.huffingtonpost.com/2012/11/25/seven-and-a-half-things-you-need-to-know_n_2189586.html ] are in talks to reach an agreement avoiding the fiscal cliff [ http://www.huffingtonpost.com/2012/11/09/star-wars-fiscal-cliff_n_2101432.html ]: a set of tax hikes and spending cuts scheduled to take place at the end of the year if they do not agree on a deficit reduction plan.

Some Congressional Republicans [ http://www.huffingtonpost.com/2012/11/25/lindsey-graham-violate-pledge-increase-taxes_n_2187944.html ], including House Speaker John Boehner [ http://www.huffingtonpost.com/huff-wires/20121126/us-fiscal-cliff-obama/ ], have said they are open to raising tax revenue but remain opposed to raising marginal tax rates. Here's a great explanation of marginal tax rates from economist Dean Baker [ http://www.cepr.net/index.php/blogs/beat-the-press/usa-today-is-too-dumb-for-words-when-ot-comes-to-taxes ] (h/t Jason Linkins):

The tax system brackets give marginal rates. This means that if the raise bumps you into a higher bracket then you pay more taxes only on the income in the higher bracket. Suppose that the tax bracket for income under $200k is 25 percent, and for income over $200k is 33 percent. If you get a raise that pushes your income from $195,000 to $205,000 then you only pay the higher 33 percent tax rate on the $5,000 that is above the $200k threshold not your whole income. Therefore, there is no (as in none, nada, not any) way that getting more money, and being pushed into a higher tax bracket will leave you with less money after taxes.

One Republican proposal [ http://www.nytimes.com/2012/11/23/us/politics/congress-looks-at-ways-to-leave-top-tax-rate-as-is.html?pagewanted=all ] would tax a household's entire income at the highest rate possible, rather than just the portion of income that exceeds a certain limit. Doing so would penalize some people for making more money, as Nate Silver notes [ http://fivethirtyeight.blogs.nytimes.com/2012/11/26/congressional-proposal-could-create-bubble-in-tax-code/ ].

Republican Congressmen [ http://www.huffingtonpost.com/huff-wires/20121126/us-fiscal-cliff-obama/ ] also have proposed raising tax revenue by limiting deductions, which could disproportionately hurt [ http://www.nytimes.com/2012/10/28/realestate/mortgages-who-really-benefits-from-interest-deductions.html ] the upper middle class. Some Senate Democrats have said [ http://www.huffingtonpost.com/2012/11/13/senate-democrats-consider-cap-deductions-romney-proposal_n_2121326.html ] they are open to capping deductions.

Copyright © 2012 TheHuffingtonPost.com, Inc.

http://www.huffingtonpost.com/2012/11/27/paul-krugman-republicans_n_2197125.html [with comments]

===

What's the GOP message if the economy booms?

A trader works at the New York Stock Exchange, which has seen rising prices due to optimism about the prospects of a "fiscal cliff" deal.

By David Frum, CNN Contributor

updated 11:54 AM EST, Mon November 26, 2012

Editor's note: David Frum, a CNN contributor, is a contributing editor at Newsweek and The Daily Beast. He is the author of eight books, including a new novel "Patriots" and his post-election e-book, "Why Romney Lost [ http://www.thedailybeast.com/articles/2012/11/08/why-romney-lost-by-david-frum-a-newsweek-ebook.html ]." Frum was a special assistant to President George W. Bush from 2001 to 2002.

(CNN) -- Here's the next thing the Republican party needs to rethink. What does it say if and when the United States returns to prosperity?

For five years, U.S. politics have been shaped by economic hardship. In 2008 and 2010, voters rejected the party in power, booting Republicans out of the White House, and then sweeping Democrats out of Congress.

Mitt Romney campaigned in 2012 on the slogan, "Obama isn't working." President Obama responded by attacking Romney as out of touch, assuming (probably correctly) that he could not win by running on his record.

But the indicators are suggesting that by 2013 and 2014, the Obama record will begin to look a lot better, assuming, that is, that the two parties in Washington don't recklessly push the country off the fiscal cliff at the end of the year.

The nation's economy added 171,000 jobs in October 2012, for a total of almost 700,000 in the four months before Election Day. More than half the jobs lost in the crash of 2008-2009 have now been recovered, even as public-sector employment has shrunk by a net 500,000.

The economy is recovering because consumers are less burdened by debt. They are paying down their credit cards, building home equity and strengthening their personal balance sheets.

As household debt burdens become lighter, consumers express more confidence. They are allowing themselves to spend a little more. They are even buying new homes again. Housing starts in October 2012 rose to a level 41.9% over a year before.

Accelerating economic activity is rapidly reducing the budget deficit. The deficit has contracted since 2009 at the fastest rate since the end of World War II, faster even than during the late 1990s boom.

Wages remain flat, and will likely stay flat until unemployment contracts more, but Americans can begin to see better times ahead for the first time in a long time.

News: GOP resistance to anti-tax pledge grows

As they do glimpse that better future, two things will happen in politics:

1) President Obama will begin to claim more credit. In 2012, the word "stimulus" went unmentioned by Democrats. It was Republicans who tried to make political use of the $800 billion spent on job creation in 2009-2011. In 2013-2014, however, the shoe may suddenly rematerialize on the other foot.

2) Republicans will discover that their old "Obama isn't working" theme has become obsolete. By 2014, again assuming that Congress does not leap off the fiscal cliff, it will likely look as if Obama is working. What then? If negative messaging failed in 2012, it will fail bigger in 2014.

For too long, the Republicans have predicted apocalypse, debt crisis, the loss of freedom, the overthrow of the constitution. As the economy improves, that doom-saying will seem even more out of touch than ever.

Republican political chances will depend on the Republican ability to devise a positive program to address the country's fiscal problems in ways that improve people's lives. It's a new day, guys, and it demands a new game.

The opinions expressed in this commentary are solely those of David Frum.

© 2012 Cable News Network. Turner Broadcasting System, Inc.

http://www.cnn.com/2012/11/26/opinion/frum-gop-prosperity/index.html [with comments]

===

Mandate with Destiny

by Hendrik Hertzberg

December 3, 2012 [issue of]

hanksgiving was still two weeks away when the Republican Party, to its evident shock, found itself stuffed, trussed, roasted, and ready to be served with all the trimmings. This was not the menu that the Party’s nominees, donors, and operatives had looked forward to. It was emphatically not the feast they had been primed to expect by their vulpine cheerleaders in the island universe of the illiberal media. ROMNEY BEATS OBAMA, HANDILY, Michael Barone trumpeted a few days before the election in the Examiner, Washington’s conservative giveaway daily. (The Chicago Tribune, back in ’48, had at least left out the “handily.”) “I think it’s this: a Romney win,” Peggy Noonan assured her Wall Street Journal blog readers the day before the polls opened. (“All the vibrations are right,” she explained.) Also on Election Eve, Dick Morris, a Fox News “analyst” reputed to be a pollster, promised “a landslide for Romney.” The same prediction—not just a win, a landslide—was bruited from the sinkholes (Glenn Beck) to the summits (George F. Will) of the right’s intellectual sierra.

News flash: the President won, handily. With late returns still trickling in, his popular-vote margin now exceeds four million, a million more than George W. Bush amassed when he ran for reëlection. (Obama’s electoral-college majority is also larger: 332 to Mitt Romney’s 206, as against Bush’s 286 to John Kerry’s 251.) When it came to this year’s thirty-three Senate races, Republican prophecies of a Republican takeover, universal some months ago, grew rarer as November approached, except on the farther-out reaches of conservative punditry. Human Events, which describes itself as Ronald Reagan’s favorite newspaper, and CBN, the religious-right TV network, each predicted a net gain of five seats for the G.O.P. Morris, who predicted a six-seat gain, gloated that a Republican Senate would be “Barack Obama’s parting gift to the Democratic Party.” That it was, except for the “parting” part. And except for the “Republican” part: not only did the Democratic caucus grow from fifty-three to fifty-five, Democratic senatorial candidates got a total of ten million more votes than their Republican opponents.

In 2004, the editorial board of the Wall Street Journal, conservatism’s Congregation for the Doctrine of the Faith, congratulated President Bush for “what by any measure is a decisive mandate for a second term” and exulted, “Mr. Bush has been given the kind of mandate that few politicians are ever fortunate enough to receive.” This year, examining similar numbers with different labels, the Journal came up with a sterner interpretation. “President Obama won one of the narrower re-elections in modern times,” its editorial announced. Also:

Mr. Obama will now have to govern the America he so relentlessly sought to divide—and without a mandate beyond the powers of the Presidency. Democrats will hold the Senate, perhaps with an additional seat or two. But Republicans held the House comfortably, so their agenda was hardly repudiated. . . . Speaker John Boehner can negotiate knowing he has as much of a mandate as the President.

Ah, yes: the House. The Republicans will have seven or eight fewer seats in that body, but hold it they did, and this fact is what those among them who are stuck at Stage 1 of Mme. Kübler-Ross’s five-stage topography of grief (“Denial”), and even a few who are tentatively assaying Stage 3 (“Bargaining”), are clinging to. (Talk radio is permanently tuned to Stage 2, “Anger,” and Stage 4, “Depression,” hangs heavy.) In the view of these Republicans, the election was a tie; and on the legitimacy of their most cherished goal—keeping rich folks’ taxes at their current historic lows or lowering them even more—they claimed vindication. “We just had an election, and the House of Representatives was elected committed to keeping taxes low,” Grover Norquist, custodian of the notorious no-tax-hikes-ever pledge signed by almost every Republican in Congress, told CBS’s Charlie Rose. (Norquist attributed the Presidential result to the Obama campaign’s success in portraying Romney as “a poopy-head.”) On ABC, Jonathan Karl asked Romney’s erstwhile running mate, Paul Ryan, if the electorate had given Obama any semblance of a mandate. “I don’t think so, because they also reëlected the House Republicans,” Ryan replied. “So whether people intended or not, we’ve got divided government.”

Actually, “people”—a majority of voters, or even a nontrivial minority—never “intend” divided government. Most people always vote straight Democratic or straight Republican, which means that most people always vote to put one party in charge. They may disagree about which party, and they would rather have their party control part of the government than none of it, but almost all of them prefer undivided government. This year, as usual, “people” wanted one party to run the whole show. That party was the Democrats. Republican House candidates won more seats, but Democratic House candidates won more votes—in the aggregate, about a million more.

For one party to win a majority of House seats with a minority of votes is a relatively rare occurrence. It has now happened five times in the past hundred years. In 1914 and 1942, the Democrats were the beneficiaries. In 1952, 1996, and this year, it was the Republicans’ turn to get lucky, and their luck is likely to hold for many election cycles to come. Gerrymandering routinely gets blamed for such mismatches, but that’s only part of the story. Far more important than redistricting is just plain districting: because so many Democrats are city folk, large numbers of Democratic votes pile up redundantly in overwhelmingly one-sided districts. Even having district lines drawn by neutral commissions instead of by self-serving politicians wouldn’t do much to alter this built-in structural bias. Of course, the perversities of our peculiar electoral machinery can cut both ways. Before November 6th, there was much speculation that Obama, like Bush in 2000, might lose the popular vote while winning in the electoral college. It didn’t happen, but the speculation was far from idle. If Romney had run more strongly throughout the country, he might have beaten Obama by as many as two million votes and still have lost the Presidency.

Even so, the reëlection of a Republican House was no more a repudiation of, for example, levying modestly higher taxes on the highest incomes than was the reëlection of the President or the strengthening of the Democratic majority in the Senate. “You know what? It won’t kill the country if we raise taxes a little bit on millionaires,” William Kristol, the editor of The Weekly Standard, a kind of Human Events for non-dummies, mused the other day on Fox News, of all places. Similar heresies are beginning to be whispered on Capitol Hill. But, given the track record of the past four years, it would be unwise to bet the farm on the proposition that the G.O.P. will edge away from nihilist obstructionism anytime soon. Stage 5, “Acceptance,” is still a few Republicans shy of a quorum.

© 2012 Condé Nast

http://www.newyorker.com/talk/comment/2012/12/03/121203taco_talk_hertzberg

--

Romney's Supporters Upset with 2012 Election Outcome

11/26/2012

http://utahpolicy.com/view/full_story/20938830/article-Romney-s-Supporters-Upset-with-2012-Election-Outcome [with comment]

--

(linked in):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81840867 and preceding (and any future following)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81874694 (and any future following)

===

Alan Simpson Says He Hopes Grover Norquist Drowns in the Bathtub

Published on Nov 27, 2012 by Buzz Sourse

It seems this ongoing feud between former Sen. Alan Simpson and anti-tax lobbyist Grover Norquist isn't going to end any time soon. Simpson went after Norquist again on Hardball this Tuesday while doing his usual fearmongering over the "fiscal cliff."

http://www.youtube.com/watch?v=tFBz3W8CBo8 [the complete segment; the portion with the quote embedded at http://www.buzzfeed.com/andrewkaczynski/alan-simpson-would-like-grover-norquist-to-drown-i (with comments)]

===

Medicaid Expansion Covers Millions At 'Modest' Cost To States: Report

Maine Gov. Paul LePage (R) opposes expanding Medicaid in his state under President Barack Obama's health care reform law. A new study says Maine could save money by doing so.

11/26/2012

Expanding Medicaid health benefits to everyone eligible under President Barack Obama's health care reform law would increase state spending on the program by just 3 percent while extending health coverage to more than 20 million people, according to a study [ http://www.kff.org/medicaid/8384.cfm ] released Monday by the Henry J. Kaiser Family Foundation and the Urban Institute.

[...]

http://www.huffingtonpost.com/2012/11/26/medicaid-expansion_n_2191912.html [with comments]

--

Getting My Uninsured Teeth Pulled In Mexico's Most Notorious Border Town

11/26/2012

http://www.huffingtonpost.com/joshua-ellis/mexico-dentists_b_2193029.html [with comments]

===

(linked in):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81595552 and preceding and following

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81782349 and following

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81799306 and preceding (and any future following;

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81687527 and preceding and following

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81831325 and preceding and following

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81835055 (and any future following);

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81875057 (and any future following)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81835723 and following;

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81874006 (and any future following)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81839588 and preceding (and any future following)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81839934 and preceding and following

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.