November 14, 2012

Toronto Stock Exchange - EXN

TORONTO, Nov. 14, 2012 /CNW/ -

Excellon Resources Inc.

(TSX: EXN) ("Excellon" or "the Company"), Mexico's highest grade

silver producer, is pleased to announce financial results for

the third quarter of 2012 and provide an updated

outlook on fourth quarter production.

"While the third quarter of 2012 was difficult due to the

illegal blockade at

La Platosa, we remain on course for a successful year and

have had a profitable first nine months.

We have now returned to full production at La Platosa, the

highest grade and one of the lowest cost silver mines in Mexico,"

stated Peter Crossgrove, Executive Chairman.

"We are looking forward to a successful fourth quarter on both

the production and exploration fronts.

Our 2012 production to date versus the same period in 2011 has

realized significantly higher silver and zinc grades, as well as

higher metal recoveries across the board, both of which should

lessen the impact of production lost during the third quarter."

Mr. Crossgrove continued,

"Our third quarter discovery of Source-style mineralization at

the Rincon del Caido area is currently being followed-up on

aggressively with four diamond drills.

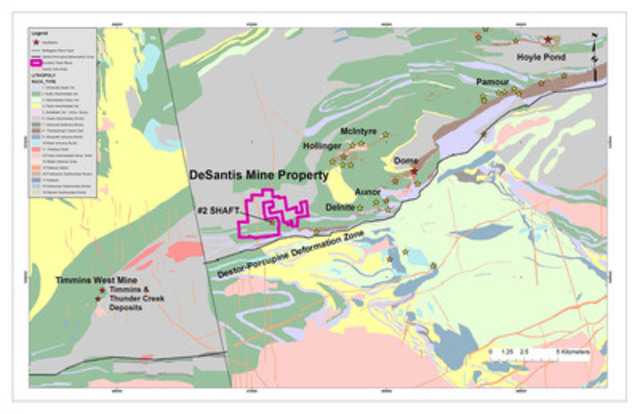

We have also recently commenced a 5,000-metre drill program at

the DeSantis Project near Timmins on new and promising targets

and we are preparing to resume drilling at our

Beschefer Project in Quebec early in 2013."

Highlights of the Nine-Month Period Ended September 30, 2012

High-grade production of 830,100 ounces grading

876 g/t Ag (25.55 oz/T Ag) at

net cash costs of $5.31;

Discovery of new Source-style mineralization at Rincon del Caido,

with results including:

132 g/t (3.8 oz/T) Ag, 3.13% Pb and 1.74% Zn over 55.5 m, including

336 g/t (10 oz/T) Ag, 3.27% Pb, 1.96% Zn over 4.10 m in LP1019;

146 g/t (4.3 oz/T) Ag, 2.8% Pb, 1.9% Zn and

0.216 g/t Au over 43.4 m, including 381 g/t (11.1 oz/T) Ag, 10.6%

Pb, 11.5% Zn, 0.354 g/t Au over 5.8 m in LP1023A;

Expenditures, fully funded from cash flow, include:

$2.4 million on drilling at La Platosa for both mantos and Source

mineralization;

$1.3 million on drilling at the DeSantis and Beschefer properties

in Canada;

$1.9 million in capital expenditures at

the La Platosa Mine and Miguel Auza Mill;

$2.4 million to repurchase a 1% net smelter return royalty on

the La Platosa Mine, immediately accretive to cash flow -

no further royalties payable on La Platosa;

$2.9 million to repurchase

5.1 million common shares of the Company;

$5 million invested in the Sprott Physical Silver Trust

representing an underlying investment of

134,732 ounces of silver;

Four drills currently turning at La Platosa

to follow up on Source-style discovery,

one rig turning at DeSantis on new and promising targets;

Financial position remains strong, with cash, marketable

securities and trade receivables

totaling $11.8 million as at September 30, 2012.

Financial and Operating Highlights:

Production at the La Platosa Mine was halted from July 8, 2012 to

October 16, 2012 due to an illegal blockade of the mine site.

Financial results for the three and nine-month periods ended

September 30, 2012 and 2011 are as follows:

http://www.excellonresources.com/Investors/Press-Releases.aspx?CnwID=135078

Peter McGaw recommends EXN on a recent video interview on Industry Watch.

Click here to watch the full interview

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=81295651

Recent EXN News

- Disclosure of the Total Number of Voting Rights and Shares Forming the Share Capital as at 30th April 2024 • Business Wire • 05/03/2024 12:50:00 PM

- Déclaration du nombre total de droits de vote et d’actions composant le capital social au 30 avril 2024 • Business Wire • 05/03/2024 12:50:00 PM

- EXCLUSIVE NETWORKS – INFORMATION FINANCIERE DU 1ER TRIMESTRE 2024 • Business Wire • 04/29/2024 03:45:00 PM

- Exclusive Networks – First Quarter 2024 Financial Update • Business Wire • 04/29/2024 03:45:00 PM

- Exclusive Networks: Availability of Its 2023 Universal Registration Document, Annual General Shareholders’ Meeting of June 6, 2024 • Business Wire • 04/05/2024 03:09:00 PM

- MISE A DISPOSITION DU DOCUMENT D’ENREGISTREMENT UNIVERSEL 2023, ASSEMBLEE GENERALE ANNUELLE DES ACTIONNAIRES DU 6 JUIN 2024 • Business Wire • 04/05/2024 03:09:00 PM

- Exclusive Networks: Disclosure of the Total Number of Voting Rights and Shares Forming the Share Capital as at 31st March 2024 • Business Wire • 04/04/2024 08:55:00 AM

- Exclusive Networks : Déclaration du nombre total de droits de vote et d’actions composant le capital social au 31 mars 2024 • Business Wire • 04/04/2024 08:55:00 AM

- Exclusive Networks annonce une étape majeure dans sa stratégie de croissance dans la région Asie-Pacifique avec l'acquisition de NEXTGEN Group • Business Wire • 03/28/2024 06:00:00 AM

- Exclusive Networks Announces a Major Step in Its Growth Strategy in APAC with NEXTGEN Group Acquisition • Business Wire • 03/28/2024 06:00:00 AM

- Exclusive Networks : Déclaration du nombre total de droits de vote et d’actions composant le capital social au 29 Février 2024. • Business Wire • 03/05/2024 04:43:00 PM

- Exclusive Networks: Disclosure of the Total Number of Voting Rights and Shares Forming the Share Capital as at 29 February 2024 • Business Wire • 03/05/2024 04:43:00 PM

- Exclusive Networks –FY-23 Financial Results • Business Wire • 02/29/2024 06:00:00 AM

- EXCLUSIVE NETWORKS – RESULTATS FINANCIERS 2023 • Business Wire • 02/29/2024 06:00:00 AM

- Déclaration du nombre total de droits de vote et d’actions composant le capital social au 31 Janvier 2024. • Business Wire • 02/05/2024 05:09:00 PM

- Disclosure of the Total Number of Voting Rights and Shares Forming the Share Capital as at 31 January 2024. • Business Wire • 02/05/2024 05:09:00 PM

- Déclaration du nombre total de droits de vote et d’actions composant le capital social au 31 Décembre 2023 • Business Wire • 01/05/2024 08:36:00 AM

- Disclosure of the Total Number of Voting Rights and Shares Forming the Share Capital as at 31 December 2023 • Business Wire • 01/05/2024 08:36:00 AM

- Exclusive Networks renforce son offre de services avec l'acquisition de Consigas • Business Wire • 12/18/2023 05:00:00 PM

- Exclusive Networks Strengthens Its Services Offering With the Acquisition of Consigas • Business Wire • 12/18/2023 05:00:00 PM

- Disclosure of the Total Number of Voting Rights and Shares Forming the Share Capital as at 30 November 2023 • Business Wire • 12/05/2023 07:45:00 AM

- Déclaration du nombre total de droits de vote et d’actions composant le capital social au 30 Novembre 2023 • Business Wire • 12/05/2023 07:45:00 AM

- Exclusive Networks – Third Quarter 2023 Financial Update • Business Wire • 11/07/2023 06:00:00 AM

- EXCLUSIVE NETWORKS – INFORMATION FINANCIERE DU 3eme TRIMESTRE 2023 • Business Wire • 11/07/2023 06:00:00 AM

- Déclaration du nombre total de droits de vote et d’actions composant le capital social au 31 Octobre 2023 • Business Wire • 11/03/2023 03:09:00 PM

FEATURED Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • May 8, 2024 9:05 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM

Moon Equity Holdings, Corp. Announces Acquisition of Wikolo, Inc. • MONI • May 7, 2024 9:48 AM

Cannabix Technologies Launches New Compact Breath Logix Workplace Series and Prepares for Delivery to South Africa • BLOZF • May 7, 2024 8:51 AM