Sunday, October 21, 2012 9:36:14 AM

A Coming Commodity Shortage

Dear member,

Contrary to what fair-weather commentators are saying now, the commodity markets remain firmly in a super cycle. This super cycle began following the tech and equity boom of the early 2000s. Historically, over the past hundred years, these cycles have lasted between 16 and 20 years. With interest rates across the world at or near record lows and multi-billion dollar infrastructure initiatives erupting from China to India to Turkey, and even in the United States, there is no end in sight for the current natural resource and commodity cycle. Recessions and short-term economic spasms can only slow down commodity demand momentarily. Population growth, urbanization of rural communities and currency devaluation continue to drive demand for commodities.

In every past commodity super cycle, this one being no different, there are 'tipping points'. Tipping points occur when supply can't keep up with demand. At various points during the commodity super cycle, nearly every major metal reaches its 'tipping point' and prices skyrocket. This happened with uranium in 2006, molybdenum in 2007, rare earths in 2009, silver in 2010 and graphite being the most recent and short-lived occurring in 2011. Our team strongly believes we are approaching a tipping point for zinc.

Zinc is a base metal which has been overlooked by the mainstream media for years. That's about to change.

With any trend there are early adopters and there are followers. Although we are not the first to pick up on the coming supply deficit for zinc, we believe that within the next 3-6 months there will be a rush to zinc assets and an increase in M&A activity within the sector. The following quote was taken from March of 2012, as the fundamentals surrounding zinc quietly surfaced.

"Zinc may represent the next big base metal play. Zinc will shift into 'deficit' (at latest by 2014) due to ongoing demand growth in the face of significant global mine depletion in mid-decade. In 2013, the closure of the Brunswick mine in Canada, Century in Australia and Vedanta's Lisheen mine in Ireland will shift sentiment towards zinc, with prices rallying in anticipation of tightening supplies. In the second half of this decade, zinc demand will be boosted by a recovery in G7 construction activity, particularly in the USA."

- Scotia Bank (Toronto, Canada; March 2012)

That statement was made over 6 months ago and although zinc is currently not in a supply deficit, it will be soon. Zinc prices will begin to rally in anticipation of tightening supply. The market is always looking 6 to 9 months ahead of the present and the institutions and large cap miners are preparing now.

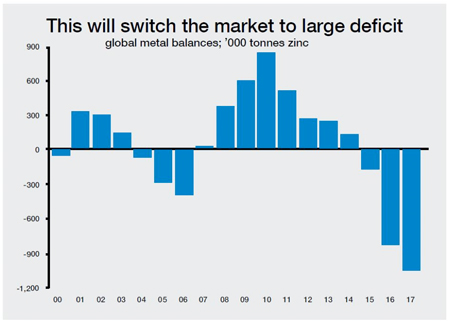

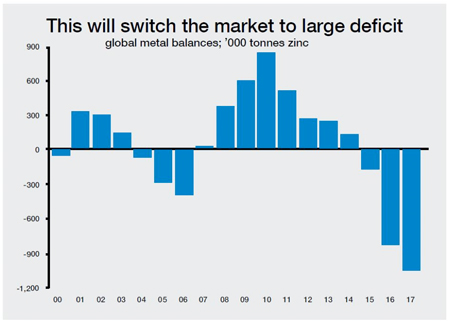

Supply Deficit Looming

Source: www.crugroup.com

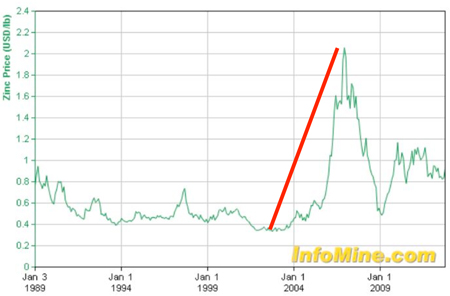

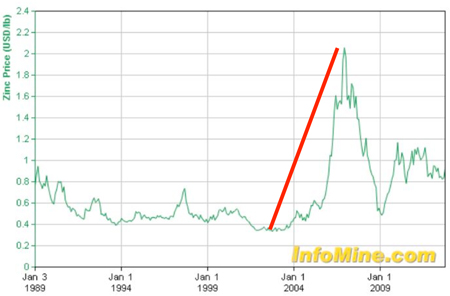

The last time the zinc market entered a supply deficit, its value more than quadrupled! Zinc's price went from less than $0.40 per pound in 2003 to over $2 per pound in 2006. Fortunes were made in the sector.

Zinc Price Action When Market Enters Deficit

(the above chart extends to October 19, 2012 when zinc closed at $0.84 per pound)

When the financial crisis of 2008 hit, zinc's price, along with every other commodity, collapsed. However, as mentioned above, even the worst recession cannot STOP continued demand for a base metal so critical to economic growth - it can only temporarily slow it down. This, coupled with extreme population growth and the urbanization of billions of people, resulted in zinc quickly recovering most of its gains from the mid 2000s. After recovering from the 2008 meltdown, zinc increased to more than $1 per pound and was back in its uptrend (up over 100% from early 2000 prices). Zinc has been consolidating since its rise to over $2 per pound back in 2005 and 2006.

What investors should be focused on is that the coming zinc deficits are predicted to be twice as severe as those which occurred in the mid 2000s. With no quick solution to the approaching supply deficit, given that many of the largest zinc mines have depleted their ore and are shutting down, prices are expected to rise. Demand for zinc is also expected to increase, which will put further pressure on supply and drive up prices.

Wood Mackenzie has been analyzing base metals for over 40 years. They released a statement on zinc in April of this year.

"Zinc has the most promising fundamental outlook among the metals... The zinc price is expected to be rangebound for the most part of this year before starting its ascent towards the end of 2012 in anticipation of a tight market. Brook Hunt expects the zinc price to average US$1.24/lb in 2014 and steadily climb thereafter, possibly challenging the previous high of US$2.08/lb that was reached in late 2006."

- Brook Hunt (Wood Mackenzie; April 2012)

Although zinc enjoyed a few years of record high prices in the mid 2000s, thanks to a significant supply shortage, the supply deficit approaching is anticipated to be much more severe. For this reason, we believe hitting its old high of US$2.08 per pound is very realistic.

The following graph should bridge the gap from a visual standpoint.

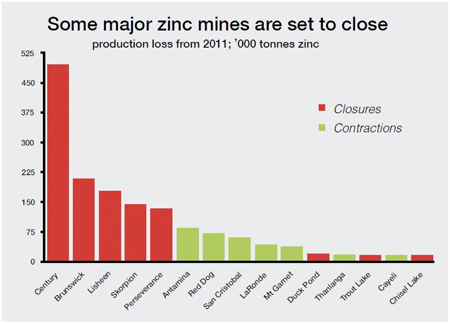

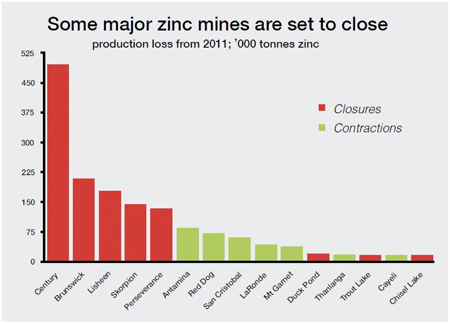

Source: www.crugroup.com

The mine closures listed above leave out a critical zinc mine also scheduled to be shut down: Lundin Mining's Galmoy Zinc Mine in Ireland, which is scheduled to close at the end of 2012. The result of these closures will see the market lose more than a million tonnes of annual production. Although zinc has enjoyed sufficient supply for many years, this surplus environment is coming to an end in a period where zinc demand is hitting all-time highs. New mines will be in high demand to aid in the deficit. The initial shock to the market should provide at least 18 to 24 months of catch up, where the industry will be hungry for zinc assets and M&A activity will be in full swing.

The reality that zinc is heading into a supply deficit within 12-18 months is the reason we are writing you this week. We are not going to miss out on this opportunity.

Once these zinc mines across the world, which are scheduled for shut-down, close their doors forever it will be too late to begin the search for viable zinc assets of the next generation. The big players move ahead of trends. They don't join them. The preparation for a shortfall won't begin in 2014, when the supply deficit is expected to hit, but long before that. In fact, it is happening right now. The best chance to make money is to get in front of these trends before they go mainstream.

Currently, global demand for refined zinc is expected to rise by 4.4% to 13.41 million tonnes in 2012. The US demand growth is seen at 5.1% for the year while countries like India, Brazil, Korea and Turkey are also projected to be strong.

On the production side, global zinc mine production is predicted to rise only 3.9%, to 13.45 million tonnes, while refined zinc production may rise 4.4% to 13.66 million tonnes. In 2013 the rise in production is expected to be minor; and by 2014, production is expected to be eclipsed by demand. This is bringing about new awareness to a metal that the developed and developing world can't grow without.

Zinc and Infrastructure

The wide usage of zinc goes relatively unnoticed. However, zinc is the fourth most widely consumed metal in the world after iron, aluminum and copper. Zinc has strong anti-corrosive properties and bonds well with other metals. For this reason, just over one-half of the zinc produced is used in zinc galvanizing, which is the process of adding thin layers of zinc to iron or steel to prevent rusting. Think of all the steel and iron being used around the world for infrastructure projects. All of these projects need zinc.

The OECD (the Organisation for Economic Co-operation and Development) has estimated yearly investment requirement for worldwide infrastructure projects to be roughly $600 billion for the next 20 years - only to guarantee the provision of water. That is annual infrastructure expenditures of more than half a trillion dollars each year, for 20 years straight. That's a staggering amount of money and new zinc mines are desperately needed to feed this demand. The OECD expects China to spend upwards of $2 trillion until 2030 for infrastructure to produce and distribute energy. In North America, the OECD believes the US and Canada must invest roughly $1.8 trillion in electricity facilities. Every country, including India and Russia, have massive infrastructure plans that will be extremely costly and require an exorbitant amount of zinc.

Zinc and its Many Uses

Zinc is a metal that sees its usage and demand increase almost every year. With an increasing global population there is more demand for zinc. It is this type of commodity you want to be holding before a deficit, as there is no substitute.

Brook Hunt commented that, "It is estimated that demand will grow 2-3% per year, especially in industries such as construction, automotive and transport due to zinc`s long useful life-cycle."

Xstrata Zinc, one of the world's largest producers of zinc, describes it as a versatile material that plays a vital role in modern society. It is an essential nutrient in human health and very useful in crop yield improvement.

Aside from construction projects around the world, Zinc is coming to the forefront of the agriculture industry as its demand to increase crop yields has been hitting new heights. This is something that could be a catalyst for zinc in the years ahead and a factor many analysts and investors are not considering.

Zinc, in its traditional use of galvanizing, protects steel against corrosion for its use in automobiles, buildings and others. It is also used for the production of zinc die-casting alloys, brass and oxide, and in manufacturing batteries and other electrical and consumer goods.

Lundin Mining, known as a global leader in base metals, recently let the industry know it is on the prowl for advanced zinc assets. This is a management team who previously netted a $9.2 billion sale of Red Back Mining Inc. Whenever you have one of the best in the business focusing on a base metal such as zinc, one should take notice.

Paul Conibear, Lundin Mining's President and CEO, stated in respect to zinc acquisitions, "What we're looking at in a more substantial manner is things that could make a difference to our production profile and cash generation, either immediately or in a three-year term."

He went on to note that, "We're not desperate to do anything...We're looking at things right now, but we're doing so cautiously." This quote was from early 2012. Caution can quickly turn to aggressive movement, especially when some of the largest zinc mines are closing around the world.

MAJOR ZINC MINE CLOSURES

Lundin Mining's Galmoy Mine. The mine closure plan has been approved by regulatory authorities and remains on schedule to be completed prior to the end of 2012.

(image source: lundinmining.com)

Xstrata Zinc's Brunswick Mine - largest underground zinc mine in world. Scheduled for closure in 2013.

(image source: infomine.com)

Century Mine - Australia's largest open pit zinc mine. Current defined ore runs out in 2016.

(image source: mmg.com)

Lisheen Zinc Mine in Ireland has an approved closure plan in place.

(image source: lisheenmine.ie)

Another world leader, Teck Resources (TSX:TCK.A), the largest diversified mining company in Canada, is also becoming more bullish on zinc and its expanding uses.

In March of this year, Teck signed an agreement that promotes the use of zinc as a fertilizer with the Chinese Ministry of Agriculture. Don Lindsay, President and CEO of Teck, said of the agreement that "Working with NATESC (China's National Agricultural Technology Extension Service Center) we can increase the use of zinc fertilizers in China to significantly improve crop yields, reduce zinc deficiency and ultimately improve human health."

Zinc and Fertilizer Demand

When our team began researching the current market for zinc, it came as a surprise to us that its demand was growing exceptionally fast in the agriculture space. Strangely enough, scientists have admitted that they do not fully understand the specific role zinc plays in plant development; regardless, plant scientists have proven that the metal is an important component of plant growth.

It has been reported that, combined with macronutrients like potash, phosphate and nitrogen, zinc can support root growth and increase leaf size and resilience during stressful growing conditions.

Below is an excerpt from James Wellstead of Zinc Investing News:

The move to increase the amount of zinc in plants and foods is widespread and is supported by companies like Mosaic (NYSE:MOS) and K+S Group (FRA:SDF) company K+S KALI. Zinc fertilizers, most prominently zinc sulphate, are being used to reduce zinc deficiencies in both humans and plants.

The case for zinc fertilizers is often strongest in locations such as the US, Canada, Turkey and China. The relatively northern state of Minnesota, which ranks third in US soybean production and fourth in corn production, is one location where zinc fertilizer programs are being applied to large-scale industrial food crops like corn, sweet corn and soybean crops.

Read the entire article by clicking here.

Zinc Prices Expected to Rise

Andrew Michelmore, another CEO of an industry leading player, Minmetals Resources, stated, "While prices are not very good at the moment in zinc, that tightness of supply going forward will drive much better prices."

Zinc is a versatile metal that plays a vital role in modern society. Its uses are widespread and don't simply begin with galvanizing steel or iron and end with fertilizer growth. Zinc is also used for the production of zinc die-casting alloys, brass and oxide, batteries, health supplements and more electrical and consumer products than we could list in this report.

The zinc sector today is one that has under-performed due to a marginal supply surplus. Prior to the surplus ending in the next 12-18 months, we expect a rush to secure assets as zinc's price is expected to rise significantly. Remember that the last time zinc fell into a deficit its price more than quadrupled. Zinc was trading in the $0.40 range when it began its ascent in the mid 2000s. With zinc trading at $0.84 per pound, a triple in its price is not out of the question and could usher in new all-time highs for the metal. This is likely what some of the leading base metal companies are anticipating.

When this zinc surplus ends abruptly in the coming year, we are expecting a widespread bullish reaction from the market.

As you know, we haven't introduced a new Featured Company in roughly four months. There's a reason for that. We have been actively searching for a specific type of company. And we have found what we were looking for. Our team meticulously evaluated a number of highly advanced zinc projects located within friendly, pro-mining jurisdictions. We've been searching for a company with several million dollars in its treasury and trading near its 52 week low. A significant amount of cash is extremely important for an advanced staged junior to have in this market as it can support the company through various economic environments. We want that safety net. When you learn about this company's management, you'll understand exactly why they have been selected as a Pinnacle Featured Company. They fit our criteria perfectly. Furthermore, there are large base metal mining companies with significant positions in this advanced junior.

There are five primary metrics that influence a junior mining stocks price action. Keep this in mind:

1. Fundamentals: Strength of its flagship asset (location, how much it owns, size, average grade, type of deposit).

2. Management: The most valuable asset a junior has. What is the track record of management? Have they taken assets to production stage, been bought out, etc.

3. Capital structure: Who is invested in the company (do they have strategic shareholders with a long-term view) and at what price? How much of the company do insiders own and how much does the public hold?

4. Price point: Where does it trade in comparison to where its financings have been completed? How many shares outstanding? How much cash is in its treasury in comparison to its market cap? Where is the line of support in the stock?

5. Market psychology: Are there reasons to believe the sector and/or stock will gain public market notoriety based on an influential component to its story or the sector it operates in?

We will be sending you our exclusive report on our new Featured Company as soon as it is completed. It will arrive in your inbox toward the latter half of the week. Stay tuned.

All the best with your investments,

PINNACLEDIGEST.COM

Dear member,

Contrary to what fair-weather commentators are saying now, the commodity markets remain firmly in a super cycle. This super cycle began following the tech and equity boom of the early 2000s. Historically, over the past hundred years, these cycles have lasted between 16 and 20 years. With interest rates across the world at or near record lows and multi-billion dollar infrastructure initiatives erupting from China to India to Turkey, and even in the United States, there is no end in sight for the current natural resource and commodity cycle. Recessions and short-term economic spasms can only slow down commodity demand momentarily. Population growth, urbanization of rural communities and currency devaluation continue to drive demand for commodities.

In every past commodity super cycle, this one being no different, there are 'tipping points'. Tipping points occur when supply can't keep up with demand. At various points during the commodity super cycle, nearly every major metal reaches its 'tipping point' and prices skyrocket. This happened with uranium in 2006, molybdenum in 2007, rare earths in 2009, silver in 2010 and graphite being the most recent and short-lived occurring in 2011. Our team strongly believes we are approaching a tipping point for zinc.

Zinc is a base metal which has been overlooked by the mainstream media for years. That's about to change.

With any trend there are early adopters and there are followers. Although we are not the first to pick up on the coming supply deficit for zinc, we believe that within the next 3-6 months there will be a rush to zinc assets and an increase in M&A activity within the sector. The following quote was taken from March of 2012, as the fundamentals surrounding zinc quietly surfaced.

"Zinc may represent the next big base metal play. Zinc will shift into 'deficit' (at latest by 2014) due to ongoing demand growth in the face of significant global mine depletion in mid-decade. In 2013, the closure of the Brunswick mine in Canada, Century in Australia and Vedanta's Lisheen mine in Ireland will shift sentiment towards zinc, with prices rallying in anticipation of tightening supplies. In the second half of this decade, zinc demand will be boosted by a recovery in G7 construction activity, particularly in the USA."

- Scotia Bank (Toronto, Canada; March 2012)

That statement was made over 6 months ago and although zinc is currently not in a supply deficit, it will be soon. Zinc prices will begin to rally in anticipation of tightening supply. The market is always looking 6 to 9 months ahead of the present and the institutions and large cap miners are preparing now.

Supply Deficit Looming

Source: www.crugroup.com

The last time the zinc market entered a supply deficit, its value more than quadrupled! Zinc's price went from less than $0.40 per pound in 2003 to over $2 per pound in 2006. Fortunes were made in the sector.

Zinc Price Action When Market Enters Deficit

(the above chart extends to October 19, 2012 when zinc closed at $0.84 per pound)

When the financial crisis of 2008 hit, zinc's price, along with every other commodity, collapsed. However, as mentioned above, even the worst recession cannot STOP continued demand for a base metal so critical to economic growth - it can only temporarily slow it down. This, coupled with extreme population growth and the urbanization of billions of people, resulted in zinc quickly recovering most of its gains from the mid 2000s. After recovering from the 2008 meltdown, zinc increased to more than $1 per pound and was back in its uptrend (up over 100% from early 2000 prices). Zinc has been consolidating since its rise to over $2 per pound back in 2005 and 2006.

What investors should be focused on is that the coming zinc deficits are predicted to be twice as severe as those which occurred in the mid 2000s. With no quick solution to the approaching supply deficit, given that many of the largest zinc mines have depleted their ore and are shutting down, prices are expected to rise. Demand for zinc is also expected to increase, which will put further pressure on supply and drive up prices.

Wood Mackenzie has been analyzing base metals for over 40 years. They released a statement on zinc in April of this year.

"Zinc has the most promising fundamental outlook among the metals... The zinc price is expected to be rangebound for the most part of this year before starting its ascent towards the end of 2012 in anticipation of a tight market. Brook Hunt expects the zinc price to average US$1.24/lb in 2014 and steadily climb thereafter, possibly challenging the previous high of US$2.08/lb that was reached in late 2006."

- Brook Hunt (Wood Mackenzie; April 2012)

Although zinc enjoyed a few years of record high prices in the mid 2000s, thanks to a significant supply shortage, the supply deficit approaching is anticipated to be much more severe. For this reason, we believe hitting its old high of US$2.08 per pound is very realistic.

The following graph should bridge the gap from a visual standpoint.

Source: www.crugroup.com

The mine closures listed above leave out a critical zinc mine also scheduled to be shut down: Lundin Mining's Galmoy Zinc Mine in Ireland, which is scheduled to close at the end of 2012. The result of these closures will see the market lose more than a million tonnes of annual production. Although zinc has enjoyed sufficient supply for many years, this surplus environment is coming to an end in a period where zinc demand is hitting all-time highs. New mines will be in high demand to aid in the deficit. The initial shock to the market should provide at least 18 to 24 months of catch up, where the industry will be hungry for zinc assets and M&A activity will be in full swing.

The reality that zinc is heading into a supply deficit within 12-18 months is the reason we are writing you this week. We are not going to miss out on this opportunity.

Once these zinc mines across the world, which are scheduled for shut-down, close their doors forever it will be too late to begin the search for viable zinc assets of the next generation. The big players move ahead of trends. They don't join them. The preparation for a shortfall won't begin in 2014, when the supply deficit is expected to hit, but long before that. In fact, it is happening right now. The best chance to make money is to get in front of these trends before they go mainstream.

Currently, global demand for refined zinc is expected to rise by 4.4% to 13.41 million tonnes in 2012. The US demand growth is seen at 5.1% for the year while countries like India, Brazil, Korea and Turkey are also projected to be strong.

On the production side, global zinc mine production is predicted to rise only 3.9%, to 13.45 million tonnes, while refined zinc production may rise 4.4% to 13.66 million tonnes. In 2013 the rise in production is expected to be minor; and by 2014, production is expected to be eclipsed by demand. This is bringing about new awareness to a metal that the developed and developing world can't grow without.

Zinc and Infrastructure

The wide usage of zinc goes relatively unnoticed. However, zinc is the fourth most widely consumed metal in the world after iron, aluminum and copper. Zinc has strong anti-corrosive properties and bonds well with other metals. For this reason, just over one-half of the zinc produced is used in zinc galvanizing, which is the process of adding thin layers of zinc to iron or steel to prevent rusting. Think of all the steel and iron being used around the world for infrastructure projects. All of these projects need zinc.

The OECD (the Organisation for Economic Co-operation and Development) has estimated yearly investment requirement for worldwide infrastructure projects to be roughly $600 billion for the next 20 years - only to guarantee the provision of water. That is annual infrastructure expenditures of more than half a trillion dollars each year, for 20 years straight. That's a staggering amount of money and new zinc mines are desperately needed to feed this demand. The OECD expects China to spend upwards of $2 trillion until 2030 for infrastructure to produce and distribute energy. In North America, the OECD believes the US and Canada must invest roughly $1.8 trillion in electricity facilities. Every country, including India and Russia, have massive infrastructure plans that will be extremely costly and require an exorbitant amount of zinc.

Zinc and its Many Uses

Zinc is a metal that sees its usage and demand increase almost every year. With an increasing global population there is more demand for zinc. It is this type of commodity you want to be holding before a deficit, as there is no substitute.

Brook Hunt commented that, "It is estimated that demand will grow 2-3% per year, especially in industries such as construction, automotive and transport due to zinc`s long useful life-cycle."

Xstrata Zinc, one of the world's largest producers of zinc, describes it as a versatile material that plays a vital role in modern society. It is an essential nutrient in human health and very useful in crop yield improvement.

Aside from construction projects around the world, Zinc is coming to the forefront of the agriculture industry as its demand to increase crop yields has been hitting new heights. This is something that could be a catalyst for zinc in the years ahead and a factor many analysts and investors are not considering.

Zinc, in its traditional use of galvanizing, protects steel against corrosion for its use in automobiles, buildings and others. It is also used for the production of zinc die-casting alloys, brass and oxide, and in manufacturing batteries and other electrical and consumer goods.

Lundin Mining, known as a global leader in base metals, recently let the industry know it is on the prowl for advanced zinc assets. This is a management team who previously netted a $9.2 billion sale of Red Back Mining Inc. Whenever you have one of the best in the business focusing on a base metal such as zinc, one should take notice.

Paul Conibear, Lundin Mining's President and CEO, stated in respect to zinc acquisitions, "What we're looking at in a more substantial manner is things that could make a difference to our production profile and cash generation, either immediately or in a three-year term."

He went on to note that, "We're not desperate to do anything...We're looking at things right now, but we're doing so cautiously." This quote was from early 2012. Caution can quickly turn to aggressive movement, especially when some of the largest zinc mines are closing around the world.

MAJOR ZINC MINE CLOSURES

Lundin Mining's Galmoy Mine. The mine closure plan has been approved by regulatory authorities and remains on schedule to be completed prior to the end of 2012.

(image source: lundinmining.com)

Xstrata Zinc's Brunswick Mine - largest underground zinc mine in world. Scheduled for closure in 2013.

(image source: infomine.com)

Century Mine - Australia's largest open pit zinc mine. Current defined ore runs out in 2016.

(image source: mmg.com)

Lisheen Zinc Mine in Ireland has an approved closure plan in place.

(image source: lisheenmine.ie)

Another world leader, Teck Resources (TSX:TCK.A), the largest diversified mining company in Canada, is also becoming more bullish on zinc and its expanding uses.

In March of this year, Teck signed an agreement that promotes the use of zinc as a fertilizer with the Chinese Ministry of Agriculture. Don Lindsay, President and CEO of Teck, said of the agreement that "Working with NATESC (China's National Agricultural Technology Extension Service Center) we can increase the use of zinc fertilizers in China to significantly improve crop yields, reduce zinc deficiency and ultimately improve human health."

Zinc and Fertilizer Demand

When our team began researching the current market for zinc, it came as a surprise to us that its demand was growing exceptionally fast in the agriculture space. Strangely enough, scientists have admitted that they do not fully understand the specific role zinc plays in plant development; regardless, plant scientists have proven that the metal is an important component of plant growth.

It has been reported that, combined with macronutrients like potash, phosphate and nitrogen, zinc can support root growth and increase leaf size and resilience during stressful growing conditions.

Below is an excerpt from James Wellstead of Zinc Investing News:

The move to increase the amount of zinc in plants and foods is widespread and is supported by companies like Mosaic (NYSE:MOS) and K+S Group (FRA:SDF) company K+S KALI. Zinc fertilizers, most prominently zinc sulphate, are being used to reduce zinc deficiencies in both humans and plants.

The case for zinc fertilizers is often strongest in locations such as the US, Canada, Turkey and China. The relatively northern state of Minnesota, which ranks third in US soybean production and fourth in corn production, is one location where zinc fertilizer programs are being applied to large-scale industrial food crops like corn, sweet corn and soybean crops.

Read the entire article by clicking here.

Zinc Prices Expected to Rise

Andrew Michelmore, another CEO of an industry leading player, Minmetals Resources, stated, "While prices are not very good at the moment in zinc, that tightness of supply going forward will drive much better prices."

Zinc is a versatile metal that plays a vital role in modern society. Its uses are widespread and don't simply begin with galvanizing steel or iron and end with fertilizer growth. Zinc is also used for the production of zinc die-casting alloys, brass and oxide, batteries, health supplements and more electrical and consumer products than we could list in this report.

The zinc sector today is one that has under-performed due to a marginal supply surplus. Prior to the surplus ending in the next 12-18 months, we expect a rush to secure assets as zinc's price is expected to rise significantly. Remember that the last time zinc fell into a deficit its price more than quadrupled. Zinc was trading in the $0.40 range when it began its ascent in the mid 2000s. With zinc trading at $0.84 per pound, a triple in its price is not out of the question and could usher in new all-time highs for the metal. This is likely what some of the leading base metal companies are anticipating.

When this zinc surplus ends abruptly in the coming year, we are expecting a widespread bullish reaction from the market.

As you know, we haven't introduced a new Featured Company in roughly four months. There's a reason for that. We have been actively searching for a specific type of company. And we have found what we were looking for. Our team meticulously evaluated a number of highly advanced zinc projects located within friendly, pro-mining jurisdictions. We've been searching for a company with several million dollars in its treasury and trading near its 52 week low. A significant amount of cash is extremely important for an advanced staged junior to have in this market as it can support the company through various economic environments. We want that safety net. When you learn about this company's management, you'll understand exactly why they have been selected as a Pinnacle Featured Company. They fit our criteria perfectly. Furthermore, there are large base metal mining companies with significant positions in this advanced junior.

There are five primary metrics that influence a junior mining stocks price action. Keep this in mind:

1. Fundamentals: Strength of its flagship asset (location, how much it owns, size, average grade, type of deposit).

2. Management: The most valuable asset a junior has. What is the track record of management? Have they taken assets to production stage, been bought out, etc.

3. Capital structure: Who is invested in the company (do they have strategic shareholders with a long-term view) and at what price? How much of the company do insiders own and how much does the public hold?

4. Price point: Where does it trade in comparison to where its financings have been completed? How many shares outstanding? How much cash is in its treasury in comparison to its market cap? Where is the line of support in the stock?

5. Market psychology: Are there reasons to believe the sector and/or stock will gain public market notoriety based on an influential component to its story or the sector it operates in?

We will be sending you our exclusive report on our new Featured Company as soon as it is completed. It will arrive in your inbox toward the latter half of the week. Stay tuned.

All the best with your investments,

PINNACLEDIGEST.COM

i-hub home base

http://investorshub.advfn.com/boards/board.aspx?board_id=3915

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.