Mayfair Mining & Minerals, Inc. is a publicly held, momentarily

unlisted mining and exploration company, operated from the U.K.

Its experienced management team, headed

by Mr. Clive de Larrabeiti,

has designed a business plan to build the company into a

successful exploration company with the focus on establishing

actual gold production in the foreseeable future.

To this effect, Mayfair recently acquired assets in Zimbabwe,

formerly held by

Conquest Resources (TSXV:CQR),

consisting of three former gold producing mines,

the Babs Gold Mine,

the Beehive Gold Mine,

the Piper Moss Mine and

the Eva exploration property.

The consideration for the acquisition was $2.0 million,

payable by 20 million fully paid common shares,

thus giving Conquest an approximate interest of

36.4% in the capital of Mayfair.

The Project

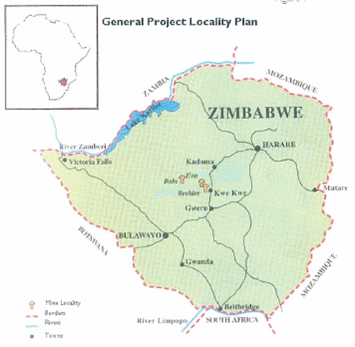

The three acquired mines are situated north and northeast of

Kwe Kwe within the Midlands Greenstone Belt on the highly

prospective Taba Mali Deformation Zone.

This major structural feature exceeds 100 km in length and

20 km in width and hosts some of the significant

gold producing operations in Zimbabwe.

The Beehive and Babs mines were developed between 1997 and 1998

at a cost of approximately $4.5 million and operated for 9 months

before being placed on care and maintenance in early 1999,

due to falling gold prices and increasing costs in Zimbabwean

currency.

In 1998, a 300 tpd processing plant was installed at

the Beehive mine site, equipped with a crushing circuit,

two parallel ball mills, C.I.P. tanks for leaching and

subsequent carbon recovery.

Unfortunately, the machinery attracted the attention of thieves

and was stolen in the idle and bad years.

The Beehive mine is reported to have produced 15,000 ounces

whilst the Babs produced 20,000 ounces.

The average grade of the ores from which this production

was derived were 6.8g/t and 9.6g/t.

The Eva prospect, located 4 km north of the Beehive,

has produced minor amounts of gold in the past.

The inferred mineral resources for the Beehive Mine are in

excess of 145,000 tonnes at an average grade of 6.8g/t gold,

whilst the Babs Mine may initially host 214,650 tonnes at

5g/t gold.

The Eva prospect may host 360,000 tonnes grading 2-3g/t.

The Piper Moss Mine

has an extensive history going back to the original claim staking

in 1912.

Old production records show that 163,190 ounces of gold

were produced from 518,376 tons of ore.

The mine is situated 3km north of the Globe and

Phoenix Mine which has produced over 3.2 million ounces of

gold from 3.6 million tons, which made it one of

the richest gold mines in the then British Commonwealth.

Prospects

The most recent availabe documentation on the acquired properties

are summary geological reports that date from respectively

October 2000 on the Beehive, Babs and Eva properties and October

1996 on the Piper Moss property.

According to these reports, the following observations can be

made:

all properties are situated in regions where various finds

of mineralization are known to be present,

all properties are fully documented and should be read and

studied with the general mining and exploration knowledge of

today;

none of the properties have been subjected to modern exploration

techniques;

the known reserves seem small but a great potential for further

resources has been recognized;

the Eva prospect has the potential to become a significant

low grade open pit mining operation;

all mining localities can be brought into production

relatively quickly;

it is believed that

the Beehive, Eva and Babs mines have the potential to become

significant medium-sized gold producing operations whereas

the Piper Moss mine has the additional feature of the Moss vein

that offers great potential, provided comprehensive and

meaningful exploration and development programs are carried out;

on all four properties, there are substantial quantities of

tailings readily available which should be sampled and

investigated for possibilities of early and economically

feasible recovery of the gold by vat and/or heap leaching;

all properties are easily accessible via main paved roads and

short distances on gravel roads and close to railroads and large

hydroelectric power lines;

within the territories of the company’s licensed areas, there are

several indications of mineral occurrences that should be

investigated.

First financing

Mayfair Mining & Minerals

is seeking an initial financing by Private Placement of Units

to a total amount of C$500,000.

The price of each Unit offered is C$0.10 and each Unit shall

consist of one share of the Company’s restricted Common Stock,

par value US$0.001 per share and one warrant to purchase an

additional common share for a period of two years from the date

of the issue at a subscription price of C$0.15 per Unit.

The proceeds of the issue will be used to enable the company

to design the first working program to inspect, organize and

evaluate theproperties, including a program for pre-exploration,

initial sampling and testing, and starting up the refurbishing of

the processing plant;

preparing and initiating a listing of the company’s shares

on a generally recognized stock exchange or automated

quotation system in Canada.

Management has already commenced having discussions with some

of the suitable choices for listing;

preparing and initiating negotiations to conduct a first major

financing in a range of US$5.0 million plus to enable the company

to start its first mature exploration and refurbishing program on

the acquired properties in Zimbabwe.

The challenge: An opportunity

Management of Mayfair Mining & Minerals

is determined to build a future in Zimbabwe, where it has

recognized good opportunities to participate in its emerging gold

industry.

The completed acquisition of the four above described mineral

properties should be a sound and prospective base for

accomplishing that.

The company is also in further advanced discussions on additional

mining project acquisitions or joint ventures in other highly

prospective gold regions of Zimbabwe.

Zimbabwe may not be the easiest operating environment in

the world but considering its history and the process of

change that is underway, Zimbabwe is widely and increasingly

becoming regarded as one of the more promising mining

destinations of Africa.

The rich greenstone belts that were the host of hundreds

of smaller gold mines were not left because they were depleted,

the mines stopped working due to adverse political and

economic circumstances.

Over the last few months, it has become apparent that several good

parties are coming to join the new interest in Zimbabwe gold

mining.

It is too early to speak of a gold rush but I am sure that we

will see a lot more of the same happening in the forthcoming

future.

On a longer term, it is likely to change the nature of the mining

industry as we know it from the past.

It will be a time that larger entities will come in and will

be created.

Consolidation should be the name of the new game, as may

be applying a new way of approaching exploration and mining.

The richness of Zimbabwe may not only to be found in deep

underground mining, there may be enough gold to be found

closer to surface.

New techniques should be used, unconventional thinking should

be given room.

The resources are there, in ample quantities and qualities.

Mayfair Mining & Minerals

has entered the Zimbabwe gold search at an early stage,

reflecting management’s vision of what is likely to develop

in the Zimbabwean gold mining scene over the next few years.

To make it happen and get the activities off to a good start,

the company is seeking a small group of sophisticated and

smart investors that are willing to share and support

that vision.

As I described it on the first page of this report,

I feel that Mayfair represents

”A NEW VENTURE ON HISTORICALLY KNOWN RESOURCES”,

offering a ”GROUND-FLOOR OPPORTUNITY”

that you don’t see coming by every day.

Henk J. Krasenberg

European Gold Centre

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990's led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000's and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Argonaut Gold – Initiating coverage new supporting company

Gold has started next move

Branding natural resources a primary asset

Africa: Strongest growth in gold mining

Gold ready for new uptrend

inShare

TAGS: EUROPEAN GOLD CENTRE, GOLD, HENK J KRASENBERG, MAYFAIR MINING & MINERALS, ZIMBABWE

« Platina har nått våra utpekade mål – vad händer nu?

Dokumentär om oljans historia »

http://ravarumarknaden.se/bringing-old-glory-to-a-new-shine/

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM