Sunday, July 01, 2012 5:56:46 PM

Mammoth Energy Comprehensive Concession Overview Updated! 7/01

Lots of updates since June 3rd, and so much more going on now with the TTXP lot thrown in. I will wait until formal announcement before going into depth on this scenario.

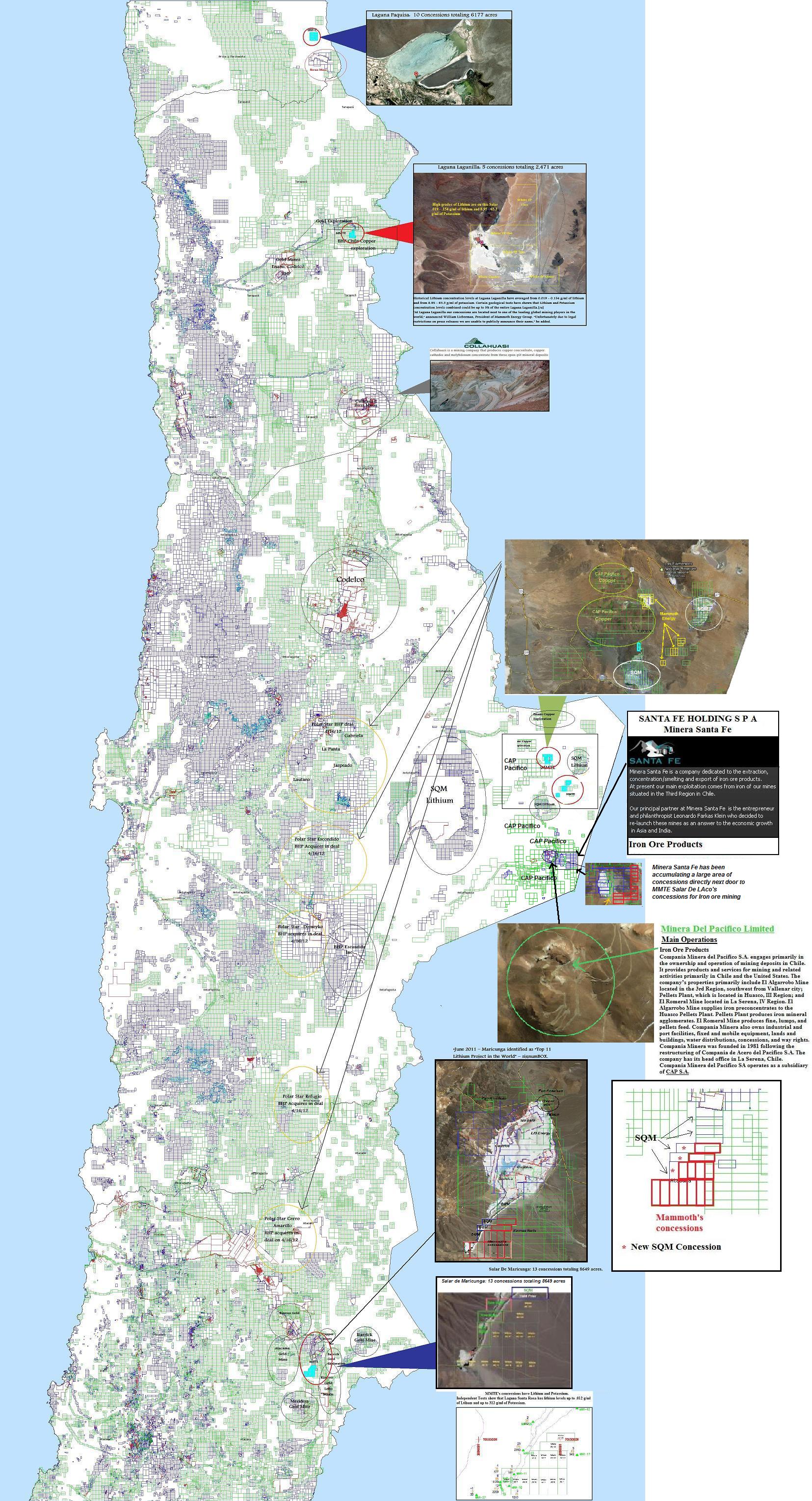

49 Concessions Totaling 31,462 acres across 5 regions

Three regions of the Five have had tests that show positive levels of lithium are present. Salar de Laco, Salar de Maricunga and Laguna Lagunilla.

Closer Look at lithium confirmations

Salar de Laco

"Past geological reports have been done on the Salar de laco and the company is currently studying the concentration levels, but in past testing lithium concentration levels have averaged between 9-20 mg/l of lithium.

Laguna Lagunilla

Historical Lithium concentration levels at Laguna Lagunilla have averaged from 0.019 - 0.154 g/ml of lithium and from 8.95 - 65.3 g/ml of potassium. Certain geological tests have shown that Lithium and Potassium concentration levels combined could be up to 5% of the entire Laguna Lagunilla.

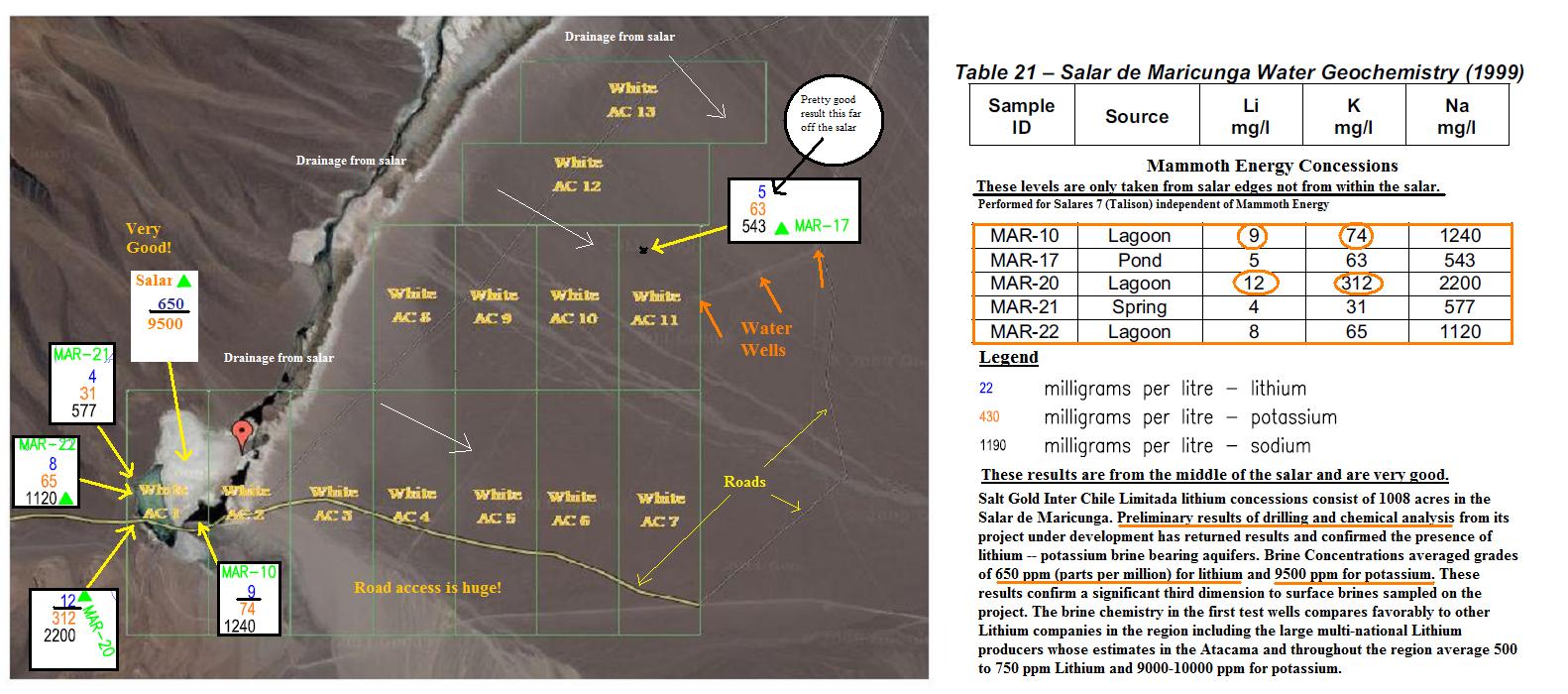

Salar de Maricunga

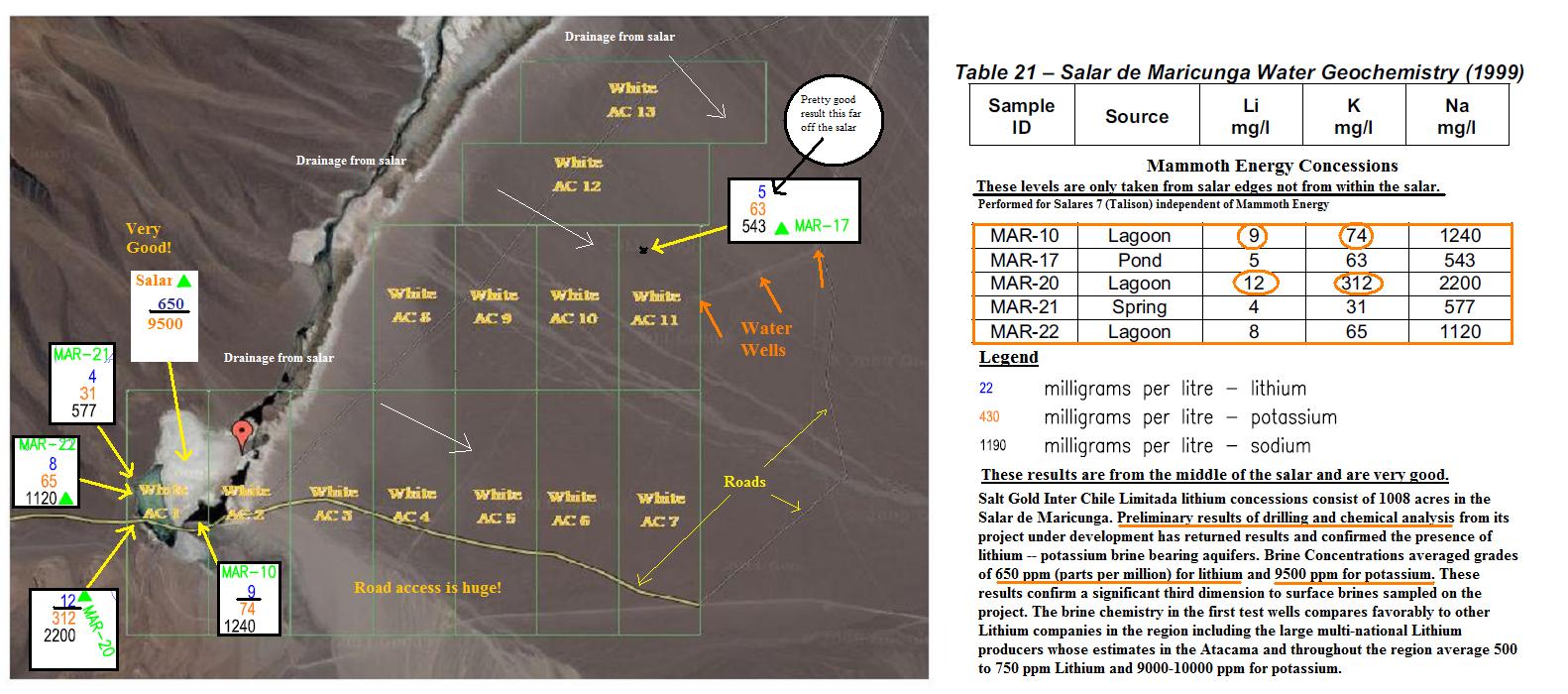

Independent tests show that Laguna Santa Rose where MMTE's concessions are contain lithium levels up to .012 g/ml and up to 312 g/ml of Potassium.

Salt Gold Inter Chile Limitada lithium concessions consist of 1008 acres in the Salar de Maricunga. Preliminary results of drilling and chemical analysis from its project under development has returned results and confirmed the presence of lithium -- potassium brine bearing aquifers. Brine Concentrations averaged grades of 650 ppm (parts per million) for lithium and 9500 ppm for potassium. These results confirm a significant third dimension to surface brines sampled on the project. The brine chemistry in the first test wells compares favorably to other Lithium companies in the region including the large multi-national Lithium producers whose estimates in the Atacama and throughout the region average 500 to 750 ppm Lithium and 9000-10000 ppm for potassium.

"Depths at the Salar de Maricunga average 100 Meters or 300 feet and currently acres are valued around $30,000 USD," said William Lieberman.

A closer look at the concessions, 43 Registered, 6 In Process

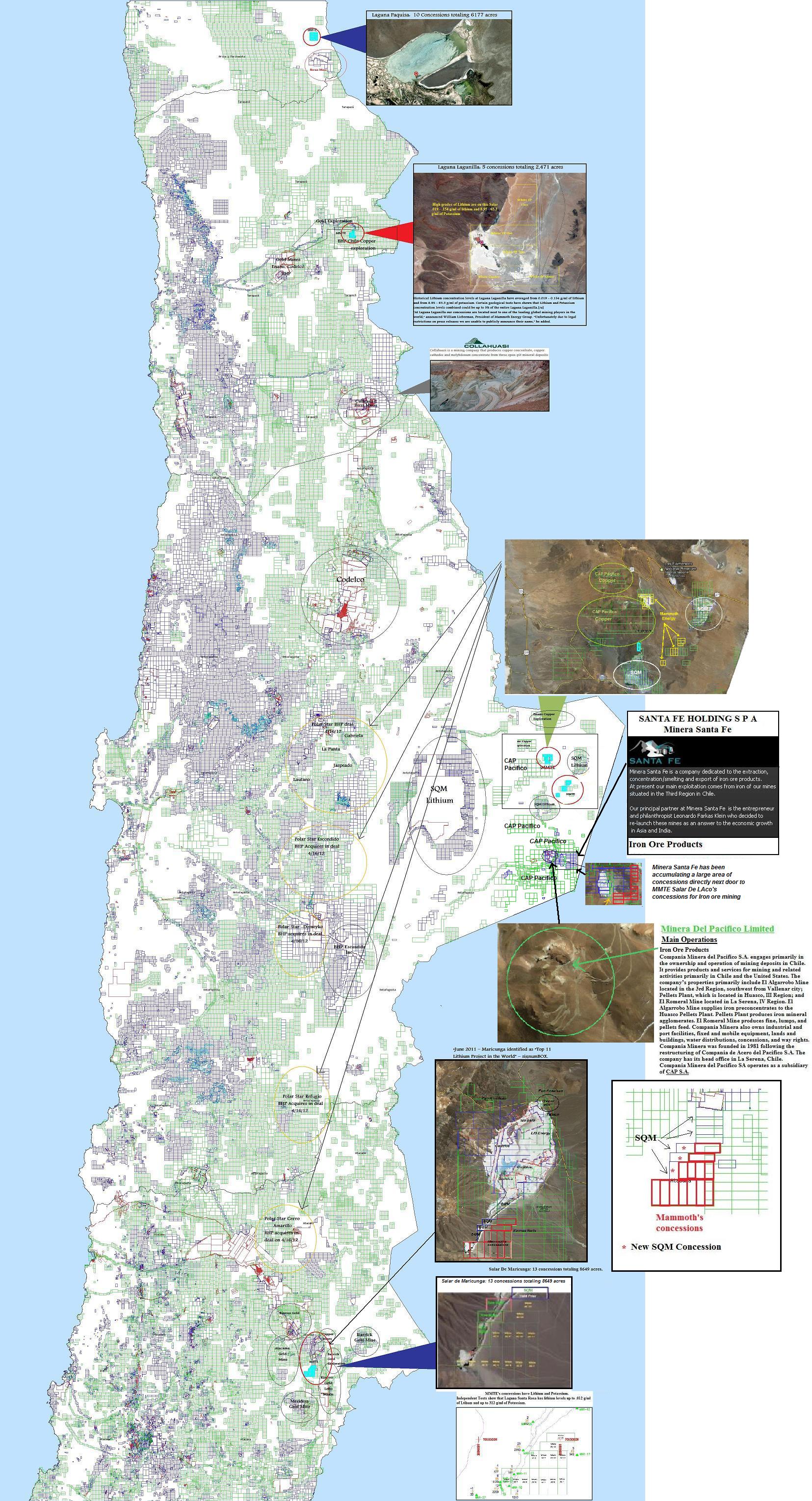

Laguna Lagunilla: 5 Concessions totaling 2,471 acres

Salar De Pujsa: 15 Concessions totaling 11,695 acres

Salar De Laco: 6 Concessions totaling 2471 acres

Salar De Maricunga: 13 Concessions totaling 8649 acres

Laguna Paquisa: 10 Concessions totaling 6177 acres

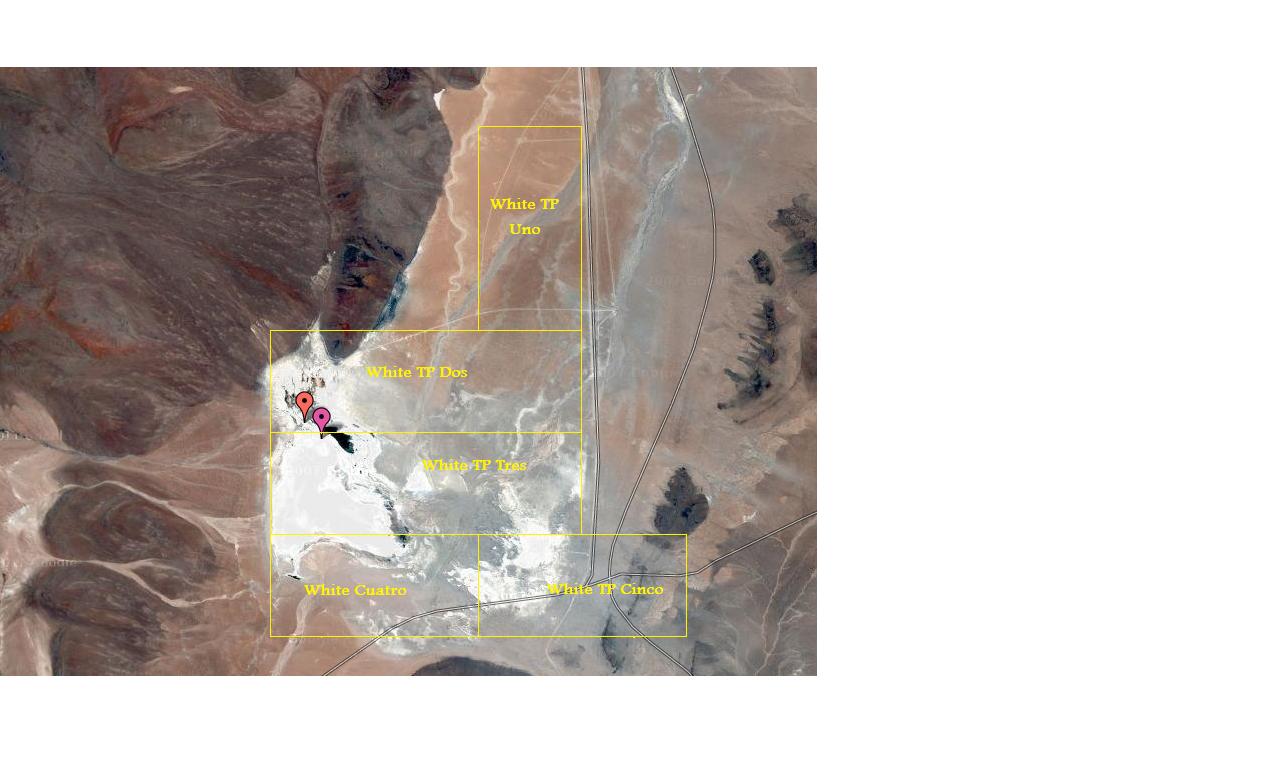

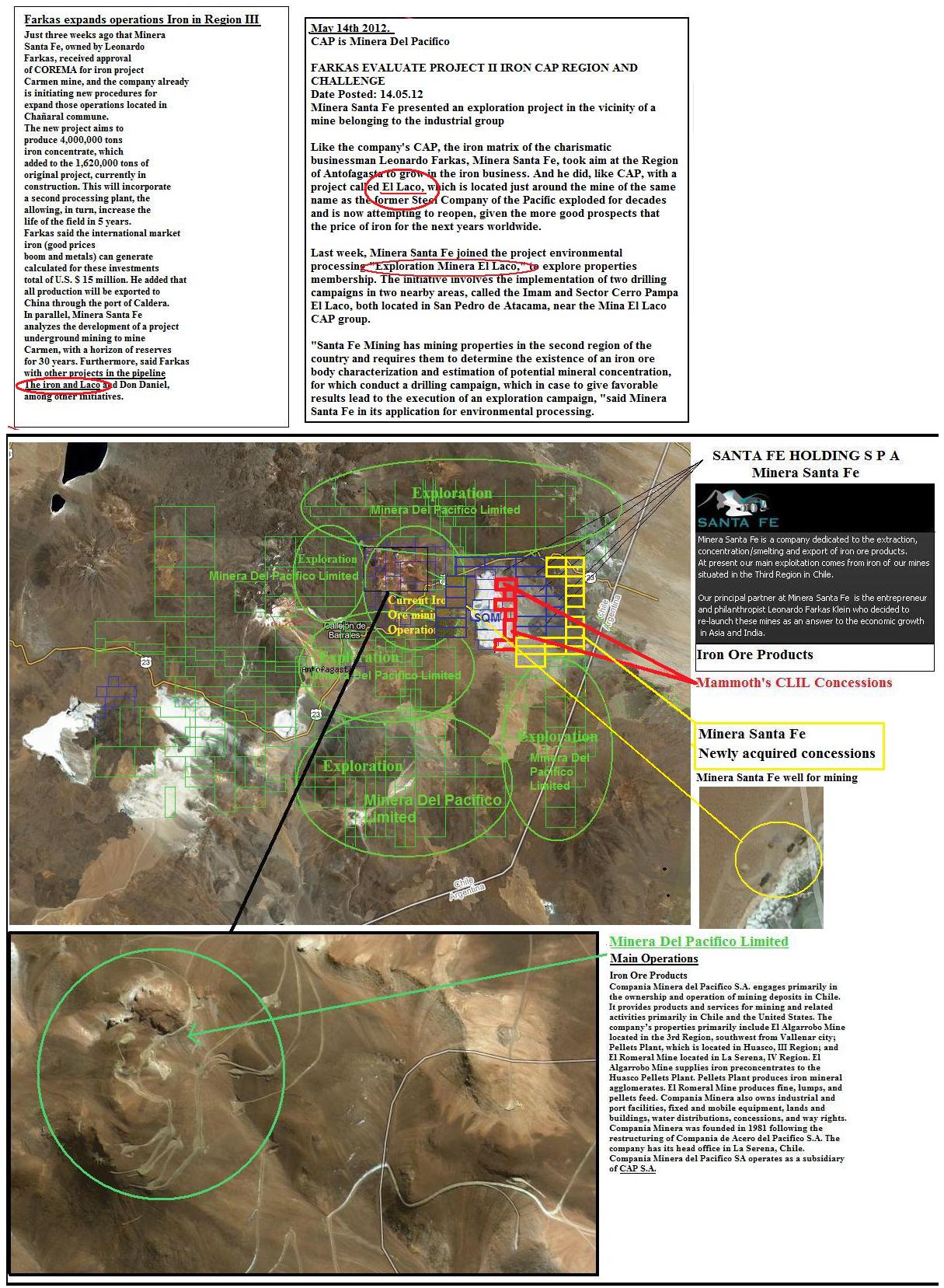

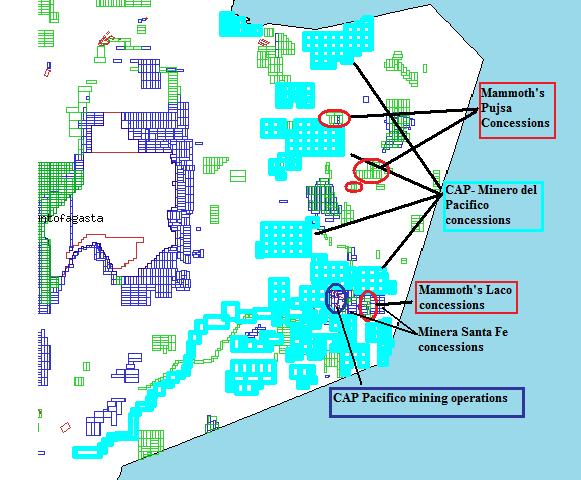

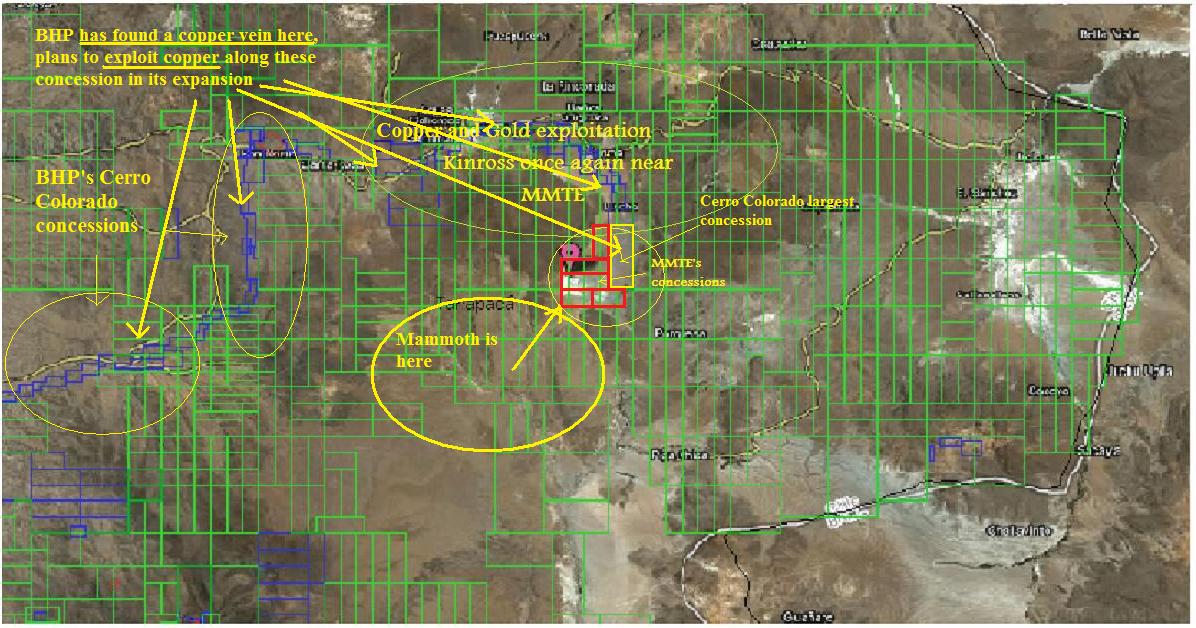

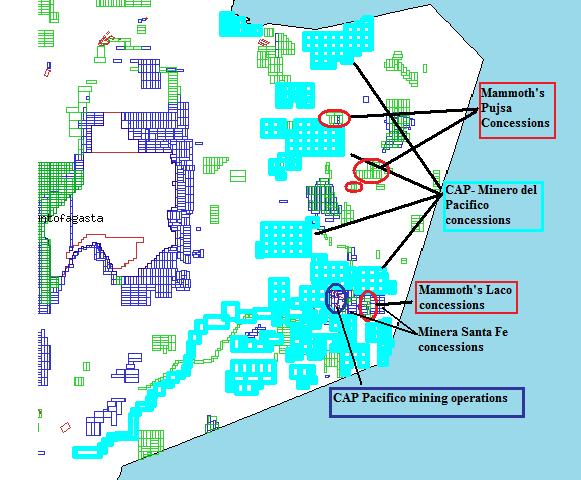

Here is a compehensive map showing mining concessions in Chile. Mammoths CLIL's concessions circled in Red. Updated!

Closer look at each region

Salar de Maricunga

Maricunga posts

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=74698018

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=74858997

Maricunga overview

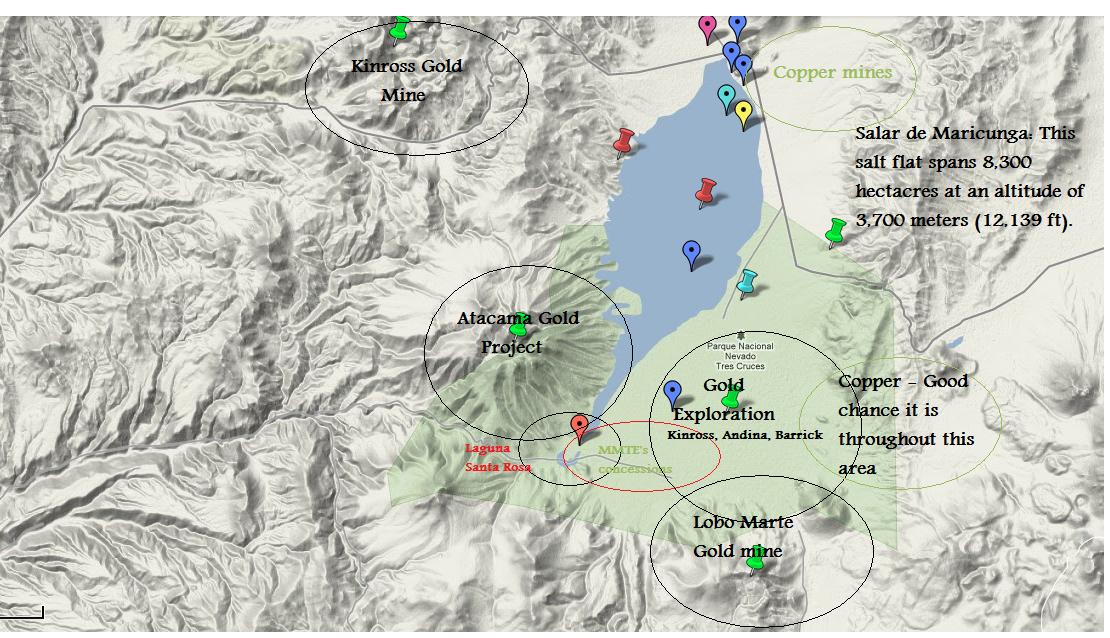

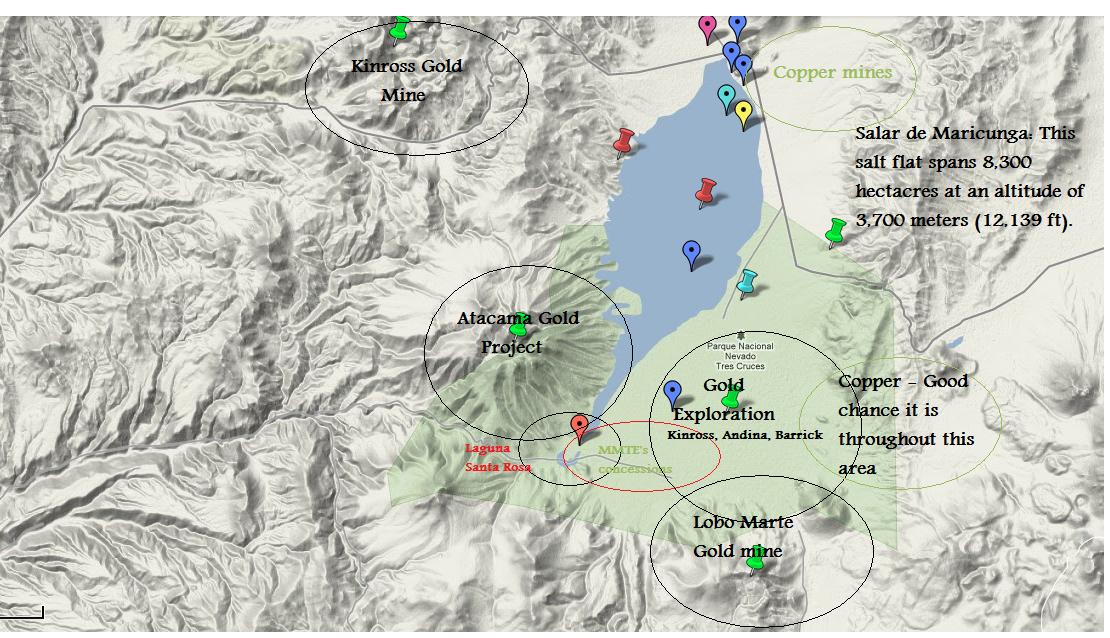

Salar de Maricunga: This salt flat spans 8,300 hectacres at an altitude of 3,700 meters (12,139 ft). The world's highest volcano, and the highest peak in Chile, Ojos del Salado, (6,893meters/22,615 ft.) is located in its vicinity. The salar is 180 km northeast of the city of Copiapó in the Andes mountains.

Topograhic map showing terrain and Copper and gold connections.

MMTE 3rd largest concession holder

Salar de Maricunga company lithium holdings by acreage

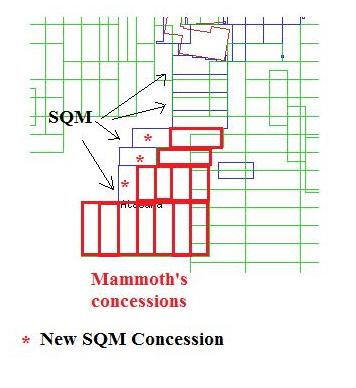

1. SQM - 16 concessions 2nd largest acreage, total unknown

2. Codelco - 13 concessions largest acreage, total unknown

3. Mammoth Energy - 13 concessions, 8649 acres (3rd largest concession holder

4. Lithium 3 Energy - 6 concessions, 3553 acres

5. Simbalik Group - 4 concessions, 3335 acres

6. Pan American Lithium - 5 concessions, 2965 acres

7. Talison - 1 concession - 257 acres

Mammoth acquired these concessions on 5/26/2011

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has acquired an initial thirteen lithium concessions for a total of 8649 acres (3500 Hectares) in the southern section of the Salar de Maricunga basin located in the province of Copiapo, Chile.

Of all of the Mammoth Energy projects, the one that seems to be positioned in a very hot zone, is the Salar de Maricunga concessions. Significant progress has been made in this region in the past 3 years and Mammoth has been in the thick of it, sometimes leading the way.

Lots of deals occurring in the Maricunga starting last year.

Li 3 Energy

Li3 Energy Announces Memorandum of Understanding with Strategic Partner

http://www.li3energy.com/news-media/news_pdfs/2012/Li3-POSCOCooperationAgreementMar2012Final.pdf

Important to note

The Maricunga properties represent the only Chilean properties in Li3 portfolio. Li3 was working on a lithium asset deal with New World Resources to acquire concessions in Argentina. That deal was terminated because the two sides could no come to terms.

Recent signum box studies result in this

Flagship Maricunga Project Maintains 2011 Year End Top Project Ranking

As of December 31st, 2011, according to the signumBOX Performance Index (SPI) ranking, upon achieving Chilean government permits, Li3’s Maricunga Project in its current state, is ranked amongst the top 5 undeveloped lithium projects in the world out of 52 other brine salars;

Pan American Lithium has struck its own deal with Posco.

Pan American has a larger portfolio of properties than LI3 spread throughout the Atacama.

Pan American Lithium Corp announces private placement with POSCAN

www.zorominingcorp.com/index.php?option=com_content&view=article&id=47&Itemid=53

On April 24th, Lithium 3 Energy released a report that shows significant lithium on the Maricunga project. Some of the details of that report are included in this post.

http://www.li3energy.com/projects/ni-43-101/2012NI_43-101Report_LI3_Energy.pdf

I believe that Mammoth Energy's subsidiary CLIL will be involved as it has been from the beginning in this region in the very near future. Things are moving very quickly as you will see in the timeline below. The Maricunga is one the best undeveloped lithium projects in the world. Mammoth is positioned with a large concession in the midst of this project. You will see in this post the significance of their existence and their ability to secure a position before many of its peers.

Lithium 3 has recently (Dec. 2011) upped the ante on their Maricunga holdings, those concessions are detailed in yellow in this satelitte image. In this image you will see the main lithium players involved in the Maricunga project.

This image shows the results of Salres 7's technical report for the Maricunga salar. Notice the Li levels in the region. These results only show the edges of the salar. When Mammoth first expressed interest in the concessions from Salt Gold in 2010 they had their own results that show concentration levels from the middle of the salar.

The drainage basin also tested positive for lithium and could also be a source for brine tests if CLIL should move forward. I think they will move forward.

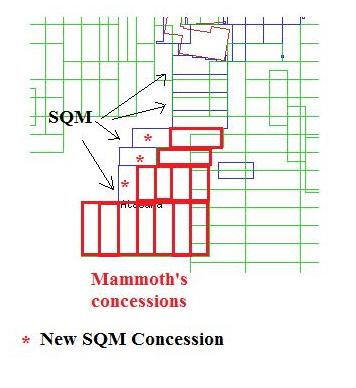

SQM increases its Maricunga holdings

Laguna Lagunillas

These concessions were acquired on 9/28/2011

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has signed a Letter of Intent to acquire five concessions for a total of 2471 acres (1000 hectares) of lithium concessions located at Laguna Lagunilla situated in the Pica commune.

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has acquired five additional concessions for a total of 2471 acres (1000 hectares) of lithium concessions located at Laguna Lagunilla situated in the Pica commune.

Claim Titles announced

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has announced it first five claim titles on its Laguna Lagunilla concessions for a total of 2471 acres (1000 hectares) of lithium concessions located at Laguna Lagunilla situated in the Pica commune.

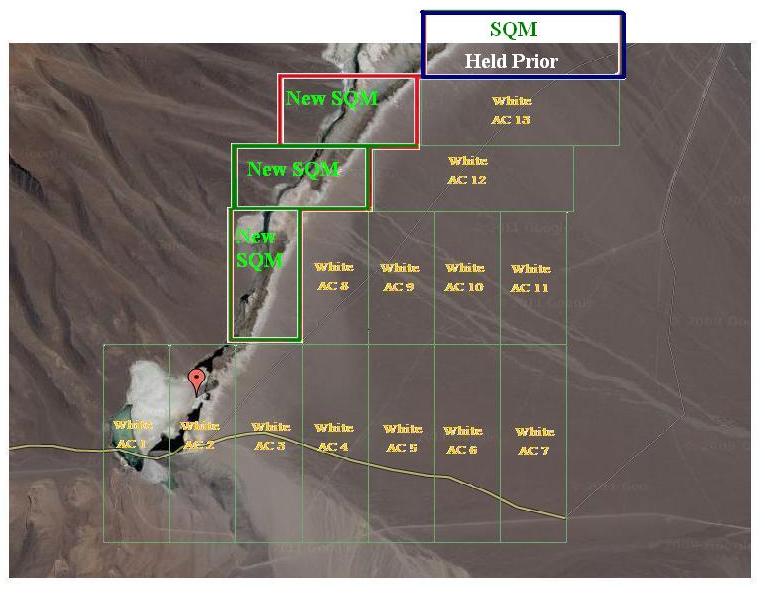

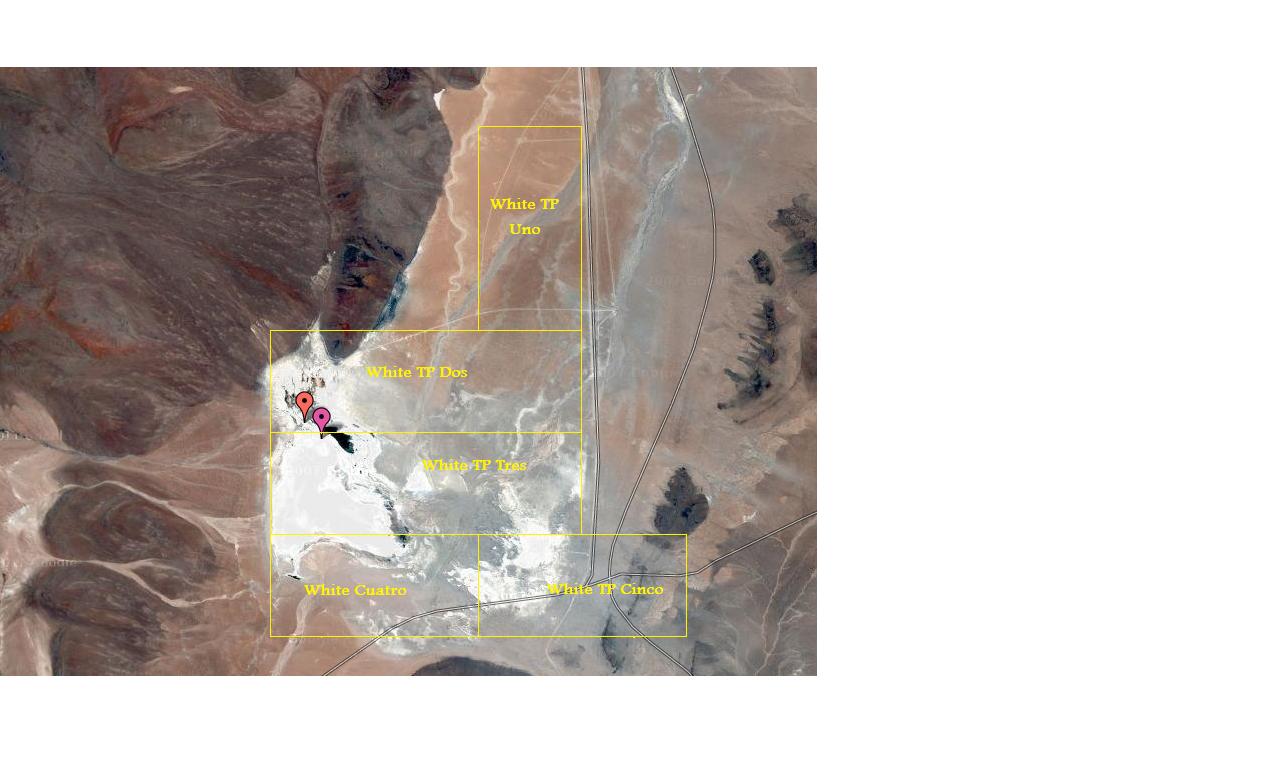

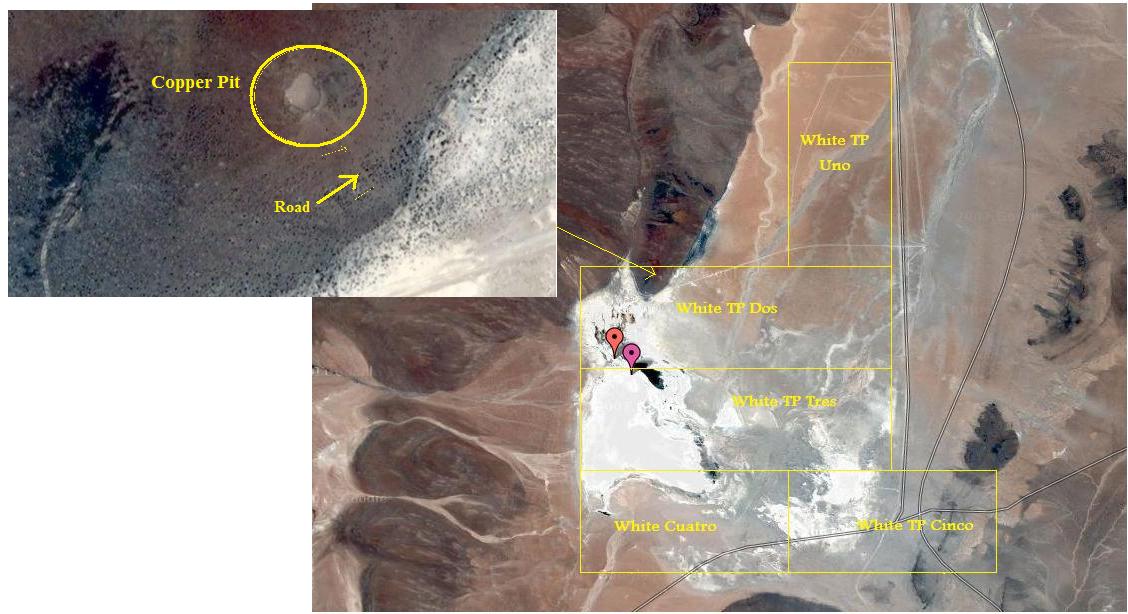

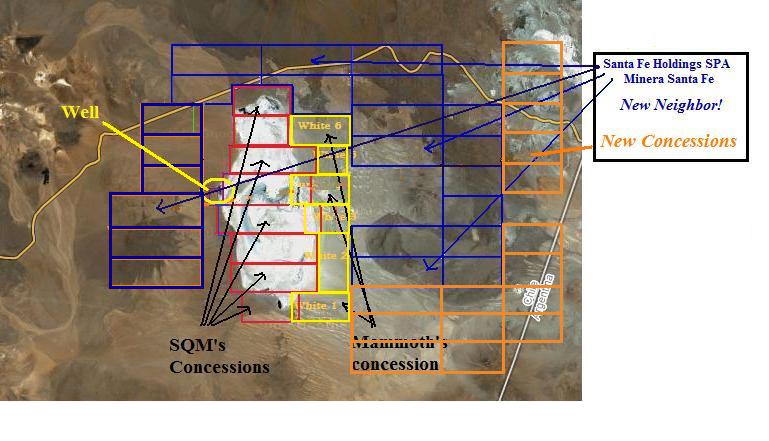

The claim titles are currently listed as White TP Uno, White TP Dos, White TP Tres, White TP Quatro, and White TP Cinqo. All concessions are currently constituted and are all rights to explore.

Historical Lithium concentration levels at Laguna Lagunilla have averaged from 0.019 - 0.154 g/ml of lithium and from 8.95 - 65.3 g/ml of potassium. Certain geological tests have shown that Lithium and Potassium concentration levels combined could be up to 5% of the entire Laguna Lagunilla.

"At Laguna Lagunilla our concessions are located next to one of the leading global mining players in the world," announced William Lieberman, President of Mammoth Energy Group. "Unfortunately due to legal restrictions on press releases we are unable to publicly announce their name," he added.

BHP Chile

MMTE's concessions cover the entire salar. MMTE has access to the below Li levels.

BHP Chile owns these concessions primarily for Gold exploration. That leaves MMTE with Li and possibly Gold.

http://ih.advfn.com/p.php?pid=nmona&article=50112956

Look at what our concessions cover, the whole salar. Thats is 4695 acres of lithium. Someone will partner with us on this salar project.

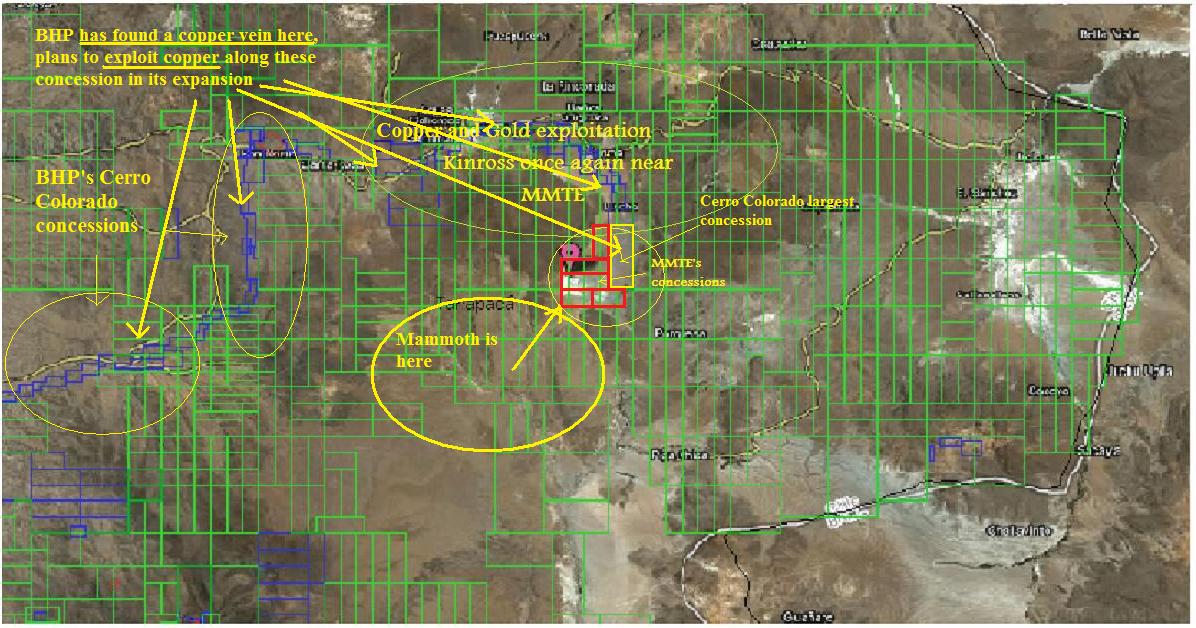

Satelite view of the salar

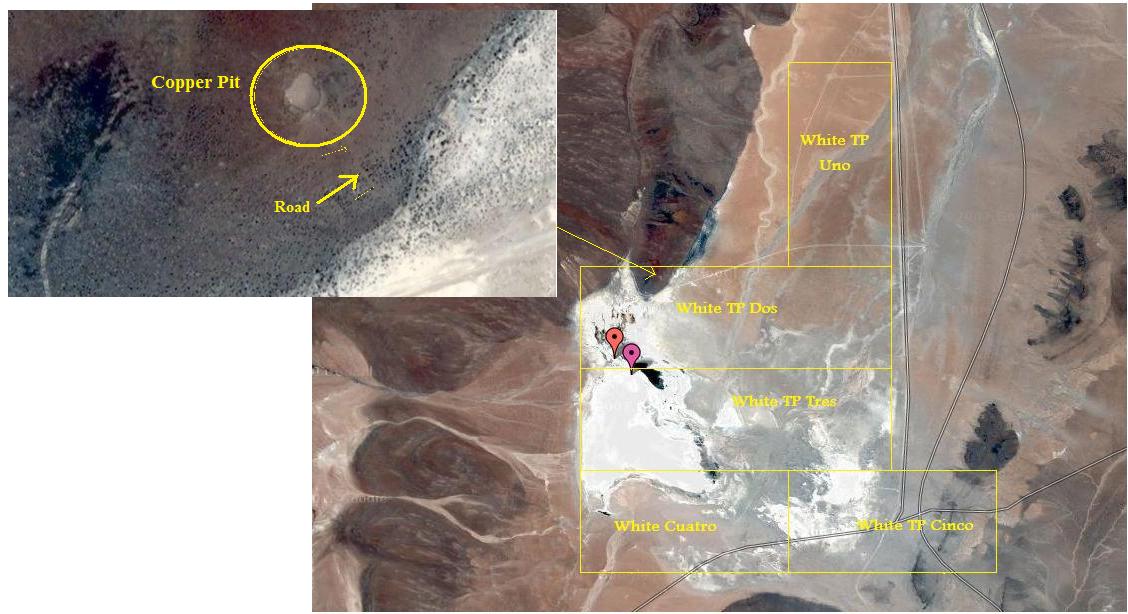

Laguna Lagunillas Copper There's that mineral again:)

On Mammoth's concession in the North part of Laguna Lagunilla, an exploratory copper pit was mined. You can see the roads leading up to the claim as well as some infrastructure. Copper was explored on these concessions and the copper vein seems to run straight into the Lagunillas concessions. Cerro Colorado's largest concession is directly ajacent to MMTE's.

Salar de Laco

These concessions were acquired on 6/03/2011

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has signed a Letter of Intent to acquire six concessions for a total of 2471 acres (1000 hectares) of lithium concessions located in the Salar de laco in northeast Chile.

"The Salar de laco is approximately 10 miles from the border of Argentina and approximately fifty miles away from the Salar de Atacama, Chile's largest mined lithium reserve," said William Lieberman, President of Mammoth Energy Group. He added, "With the Salar de laco and Salar de Pujsa LOI's currently in place, we are continuing our acquisition hunt to become one of the largest international holders of Lithium concessions in Chile."

The Salar de laco has similar geology to the Salar de Atacama where lithium concentrations average between 500 to 750 ppm lithium. The company intends to begin pursuing Canadian National Institute 43-101 compliant geographical reports on all of its announced acquisitions and current projects in negotiation.

Lieberman added, "Past geological reports have been done on the Salar de laco and the company is currently studying the concentration levels, but in past testing lithium concentration levels have averaged between 9-20 mg/l of lithium."

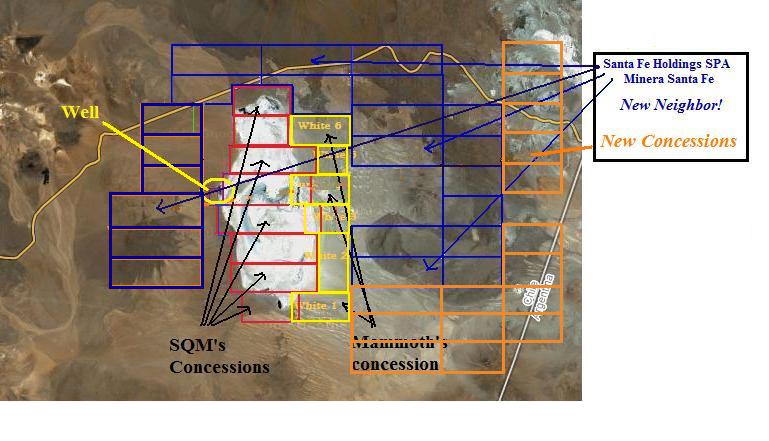

Huge changes in Salar de Laco!

Salar de Pujsa

These concessions were acquired on 6/28/2011

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary, Compania Lithium Investments Limitada of Chile, has signed a Letter of Intent to acquire seven concessions for a total of 4695 acres (1900 hectares) of lithium concessions located in the Salar de Pujsa.

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has acquired seven concessions for a total of 4695 acres (1900 hectares) of lithium concessions located in the Salar de Pujsa. With this additional acquisition Mammoth Energy Group has acquired more than thirteen thousand (13,000) acres of salar exploration rights in Chile.

"This acquisition solidifies our commitment to moving forward and we will be continuing our acquisition hunt and looking for the right strategic partners on additional lithium assets," said William Lieberman, President of Mammoth Energy Group.

Claim Titles Announced

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has announced its first seven claim titles on its Salar de Pujsa concessions for a total of 4965 acres (1900 hectares) of lithium concessions located at Salar de Pujsa situated in the San Pedro de Atacama commune.

The claim titles are currently listed as White LS Uno, White LS Dos, White LS Tres, White LS Cuatro, White LS Cinqo, White LS Seis, and White LS Siete. All concessions are currently constituted and are all rights to explore.

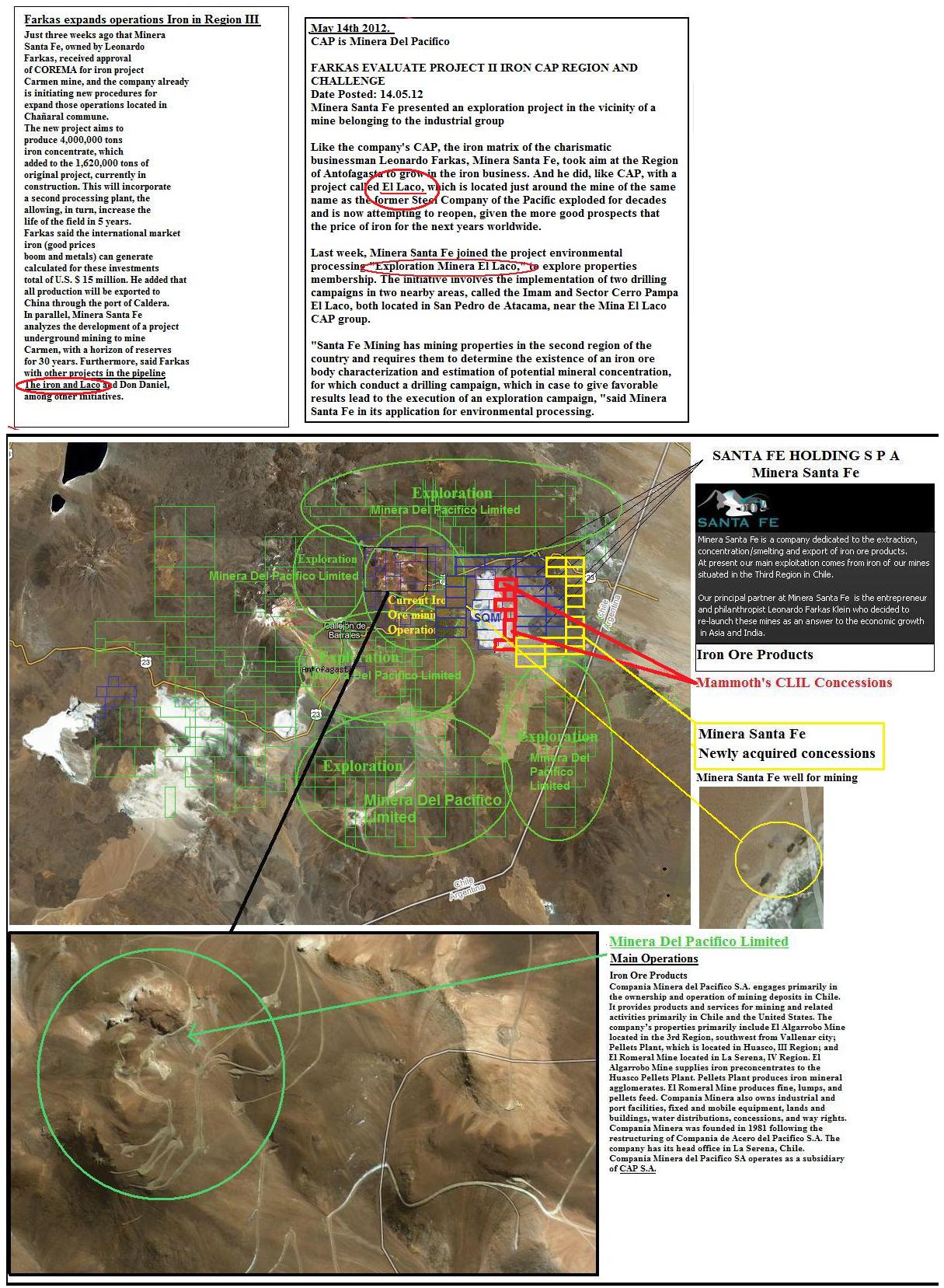

CAP Mineria del Pacifico - huge commitment in the Pujsa region.

Laguna Paquisa

These concessions were acquired on 11/14/2011

Mammoth Energy Group Inc. (PINKSHEETS: MMTE) a lithium and alternative energy mining company announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has acquired ten additional Lithium concessions for a total of 6177 acres (2500 hectares) in the Laguna Paquisa located in the Putre commune in Chile.

Conclusion

I firmly believe, that the current climate in Chile has a virtual lithium rush to acquire and develop lithium concessions. Mammoth Energy is in three prime target locations to work with a JV partner to begin working fesibility studies on Lithium extraction. With that MMTE is more than likely being sought out after its lithium concessions, specifically in the Maricunga, Laco and Lagunillas regions.

Recent findings show that Copper is now going to be a big part of our future. With the close relationship in mant regions with copper there is the definite possibility that we will see Mammoth Energy working with at minimum Lithium and associated minerals in its extraction (Potash) and Copper. Gold also could be in the mix.

MMTE has accomplished in the following in 1 year:

*They have built a portfolio of 49 concessions with 31,000+ acres

*They have formal registrations on 42 concessions

*They have claim titles in two regions

*They have the help of a mining expert in Maurice Colson

*They have hired an auditor to perform audits for uplist.

*We have a good idea now that we will merge with TTXP who is audited and uplisted.

* Copper and rare earth minerals are now in the mix with am erger with TTXP.

This all in one year. Not too bad for a Pink Sheet stock.

Next steps: complete audits, uplist, announce their partner(s),

move towards production.

More to come and I will update as we get confirmations and PR's.

Lots of updates since June 3rd, and so much more going on now with the TTXP lot thrown in. I will wait until formal announcement before going into depth on this scenario.

49 Concessions Totaling 31,462 acres across 5 regions

Three regions of the Five have had tests that show positive levels of lithium are present. Salar de Laco, Salar de Maricunga and Laguna Lagunilla.

Closer Look at lithium confirmations

Salar de Laco

"Past geological reports have been done on the Salar de laco and the company is currently studying the concentration levels, but in past testing lithium concentration levels have averaged between 9-20 mg/l of lithium.

Laguna Lagunilla

Historical Lithium concentration levels at Laguna Lagunilla have averaged from 0.019 - 0.154 g/ml of lithium and from 8.95 - 65.3 g/ml of potassium. Certain geological tests have shown that Lithium and Potassium concentration levels combined could be up to 5% of the entire Laguna Lagunilla.

Salar de Maricunga

Independent tests show that Laguna Santa Rose where MMTE's concessions are contain lithium levels up to .012 g/ml and up to 312 g/ml of Potassium.

Salt Gold Inter Chile Limitada lithium concessions consist of 1008 acres in the Salar de Maricunga. Preliminary results of drilling and chemical analysis from its project under development has returned results and confirmed the presence of lithium -- potassium brine bearing aquifers. Brine Concentrations averaged grades of 650 ppm (parts per million) for lithium and 9500 ppm for potassium. These results confirm a significant third dimension to surface brines sampled on the project. The brine chemistry in the first test wells compares favorably to other Lithium companies in the region including the large multi-national Lithium producers whose estimates in the Atacama and throughout the region average 500 to 750 ppm Lithium and 9000-10000 ppm for potassium.

"Depths at the Salar de Maricunga average 100 Meters or 300 feet and currently acres are valued around $30,000 USD," said William Lieberman.

A closer look at the concessions, 43 Registered, 6 In Process

Laguna Lagunilla: 5 Concessions totaling 2,471 acres

Salar De Pujsa: 15 Concessions totaling 11,695 acres

Salar De Laco: 6 Concessions totaling 2471 acres

Salar De Maricunga: 13 Concessions totaling 8649 acres

Laguna Paquisa: 10 Concessions totaling 6177 acres

Here is a compehensive map showing mining concessions in Chile. Mammoths CLIL's concessions circled in Red. Updated!

Closer look at each region

Salar de Maricunga

Maricunga posts

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=74698018

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=74858997

Maricunga overview

Salar de Maricunga: This salt flat spans 8,300 hectacres at an altitude of 3,700 meters (12,139 ft). The world's highest volcano, and the highest peak in Chile, Ojos del Salado, (6,893meters/22,615 ft.) is located in its vicinity. The salar is 180 km northeast of the city of Copiapó in the Andes mountains.

Topograhic map showing terrain and Copper and gold connections.

MMTE 3rd largest concession holder

Salar de Maricunga company lithium holdings by acreage

1. SQM - 16 concessions 2nd largest acreage, total unknown

2. Codelco - 13 concessions largest acreage, total unknown

3. Mammoth Energy - 13 concessions, 8649 acres (3rd largest concession holder

4. Lithium 3 Energy - 6 concessions, 3553 acres

5. Simbalik Group - 4 concessions, 3335 acres

6. Pan American Lithium - 5 concessions, 2965 acres

7. Talison - 1 concession - 257 acres

Mammoth acquired these concessions on 5/26/2011

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has acquired an initial thirteen lithium concessions for a total of 8649 acres (3500 Hectares) in the southern section of the Salar de Maricunga basin located in the province of Copiapo, Chile.

Of all of the Mammoth Energy projects, the one that seems to be positioned in a very hot zone, is the Salar de Maricunga concessions. Significant progress has been made in this region in the past 3 years and Mammoth has been in the thick of it, sometimes leading the way.

Lots of deals occurring in the Maricunga starting last year.

Li 3 Energy

Li3 Energy Announces Memorandum of Understanding with Strategic Partner

http://www.li3energy.com/news-media/news_pdfs/2012/Li3-POSCOCooperationAgreementMar2012Final.pdf

Important to note

The Maricunga properties represent the only Chilean properties in Li3 portfolio. Li3 was working on a lithium asset deal with New World Resources to acquire concessions in Argentina. That deal was terminated because the two sides could no come to terms.

Recent signum box studies result in this

Flagship Maricunga Project Maintains 2011 Year End Top Project Ranking

As of December 31st, 2011, according to the signumBOX Performance Index (SPI) ranking, upon achieving Chilean government permits, Li3’s Maricunga Project in its current state, is ranked amongst the top 5 undeveloped lithium projects in the world out of 52 other brine salars;

Pan American Lithium has struck its own deal with Posco.

Pan American has a larger portfolio of properties than LI3 spread throughout the Atacama.

Pan American Lithium Corp announces private placement with POSCAN

www.zorominingcorp.com/index.php?option=com_content&view=article&id=47&Itemid=53

On April 24th, Lithium 3 Energy released a report that shows significant lithium on the Maricunga project. Some of the details of that report are included in this post.

http://www.li3energy.com/projects/ni-43-101/2012NI_43-101Report_LI3_Energy.pdf

I believe that Mammoth Energy's subsidiary CLIL will be involved as it has been from the beginning in this region in the very near future. Things are moving very quickly as you will see in the timeline below. The Maricunga is one the best undeveloped lithium projects in the world. Mammoth is positioned with a large concession in the midst of this project. You will see in this post the significance of their existence and their ability to secure a position before many of its peers.

Lithium 3 has recently (Dec. 2011) upped the ante on their Maricunga holdings, those concessions are detailed in yellow in this satelitte image. In this image you will see the main lithium players involved in the Maricunga project.

This image shows the results of Salres 7's technical report for the Maricunga salar. Notice the Li levels in the region. These results only show the edges of the salar. When Mammoth first expressed interest in the concessions from Salt Gold in 2010 they had their own results that show concentration levels from the middle of the salar.

The drainage basin also tested positive for lithium and could also be a source for brine tests if CLIL should move forward. I think they will move forward.

SQM increases its Maricunga holdings

Laguna Lagunillas

These concessions were acquired on 9/28/2011

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has signed a Letter of Intent to acquire five concessions for a total of 2471 acres (1000 hectares) of lithium concessions located at Laguna Lagunilla situated in the Pica commune.

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has acquired five additional concessions for a total of 2471 acres (1000 hectares) of lithium concessions located at Laguna Lagunilla situated in the Pica commune.

Claim Titles announced

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has announced it first five claim titles on its Laguna Lagunilla concessions for a total of 2471 acres (1000 hectares) of lithium concessions located at Laguna Lagunilla situated in the Pica commune.

The claim titles are currently listed as White TP Uno, White TP Dos, White TP Tres, White TP Quatro, and White TP Cinqo. All concessions are currently constituted and are all rights to explore.

Historical Lithium concentration levels at Laguna Lagunilla have averaged from 0.019 - 0.154 g/ml of lithium and from 8.95 - 65.3 g/ml of potassium. Certain geological tests have shown that Lithium and Potassium concentration levels combined could be up to 5% of the entire Laguna Lagunilla.

"At Laguna Lagunilla our concessions are located next to one of the leading global mining players in the world," announced William Lieberman, President of Mammoth Energy Group. "Unfortunately due to legal restrictions on press releases we are unable to publicly announce their name," he added.

BHP Chile

MMTE's concessions cover the entire salar. MMTE has access to the below Li levels.

BHP Chile owns these concessions primarily for Gold exploration. That leaves MMTE with Li and possibly Gold.

http://ih.advfn.com/p.php?pid=nmona&article=50112956

Look at what our concessions cover, the whole salar. Thats is 4695 acres of lithium. Someone will partner with us on this salar project.

Satelite view of the salar

Laguna Lagunillas Copper There's that mineral again:)

On Mammoth's concession in the North part of Laguna Lagunilla, an exploratory copper pit was mined. You can see the roads leading up to the claim as well as some infrastructure. Copper was explored on these concessions and the copper vein seems to run straight into the Lagunillas concessions. Cerro Colorado's largest concession is directly ajacent to MMTE's.

Salar de Laco

These concessions were acquired on 6/03/2011

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has signed a Letter of Intent to acquire six concessions for a total of 2471 acres (1000 hectares) of lithium concessions located in the Salar de laco in northeast Chile.

"The Salar de laco is approximately 10 miles from the border of Argentina and approximately fifty miles away from the Salar de Atacama, Chile's largest mined lithium reserve," said William Lieberman, President of Mammoth Energy Group. He added, "With the Salar de laco and Salar de Pujsa LOI's currently in place, we are continuing our acquisition hunt to become one of the largest international holders of Lithium concessions in Chile."

The Salar de laco has similar geology to the Salar de Atacama where lithium concentrations average between 500 to 750 ppm lithium. The company intends to begin pursuing Canadian National Institute 43-101 compliant geographical reports on all of its announced acquisitions and current projects in negotiation.

Lieberman added, "Past geological reports have been done on the Salar de laco and the company is currently studying the concentration levels, but in past testing lithium concentration levels have averaged between 9-20 mg/l of lithium."

Huge changes in Salar de Laco!

Salar de Pujsa

These concessions were acquired on 6/28/2011

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary, Compania Lithium Investments Limitada of Chile, has signed a Letter of Intent to acquire seven concessions for a total of 4695 acres (1900 hectares) of lithium concessions located in the Salar de Pujsa.

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has acquired seven concessions for a total of 4695 acres (1900 hectares) of lithium concessions located in the Salar de Pujsa. With this additional acquisition Mammoth Energy Group has acquired more than thirteen thousand (13,000) acres of salar exploration rights in Chile.

"This acquisition solidifies our commitment to moving forward and we will be continuing our acquisition hunt and looking for the right strategic partners on additional lithium assets," said William Lieberman, President of Mammoth Energy Group.

Claim Titles Announced

Mammoth Energy Group Inc. (PINKSHEETS: MMTE), a lithium and alternative energy mining company, announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has announced its first seven claim titles on its Salar de Pujsa concessions for a total of 4965 acres (1900 hectares) of lithium concessions located at Salar de Pujsa situated in the San Pedro de Atacama commune.

The claim titles are currently listed as White LS Uno, White LS Dos, White LS Tres, White LS Cuatro, White LS Cinqo, White LS Seis, and White LS Siete. All concessions are currently constituted and are all rights to explore.

CAP Mineria del Pacifico - huge commitment in the Pujsa region.

Laguna Paquisa

These concessions were acquired on 11/14/2011

Mammoth Energy Group Inc. (PINKSHEETS: MMTE) a lithium and alternative energy mining company announced today that its wholly owned subsidiary Compania Lithium Investments Limitada of Chile has acquired ten additional Lithium concessions for a total of 6177 acres (2500 hectares) in the Laguna Paquisa located in the Putre commune in Chile.

Conclusion

I firmly believe, that the current climate in Chile has a virtual lithium rush to acquire and develop lithium concessions. Mammoth Energy is in three prime target locations to work with a JV partner to begin working fesibility studies on Lithium extraction. With that MMTE is more than likely being sought out after its lithium concessions, specifically in the Maricunga, Laco and Lagunillas regions.

Recent findings show that Copper is now going to be a big part of our future. With the close relationship in mant regions with copper there is the definite possibility that we will see Mammoth Energy working with at minimum Lithium and associated minerals in its extraction (Potash) and Copper. Gold also could be in the mix.

MMTE has accomplished in the following in 1 year:

*They have built a portfolio of 49 concessions with 31,000+ acres

*They have formal registrations on 42 concessions

*They have claim titles in two regions

*They have the help of a mining expert in Maurice Colson

*They have hired an auditor to perform audits for uplist.

*We have a good idea now that we will merge with TTXP who is audited and uplisted.

* Copper and rare earth minerals are now in the mix with am erger with TTXP.

This all in one year. Not too bad for a Pink Sheet stock.

Next steps: complete audits, uplist, announce their partner(s),

move towards production.

More to come and I will update as we get confirmations and PR's.

This is only my opinion, not an endorsement to buy or sell anything. Buying stocks is risky; you could lose all of your investment. Always do your DD.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.