| Followers | 27 |

| Posts | 1104 |

| Boards Moderated | 1 |

| Alias Born | 07/15/2009 |

Monday, June 18, 2012 8:59:13 PM

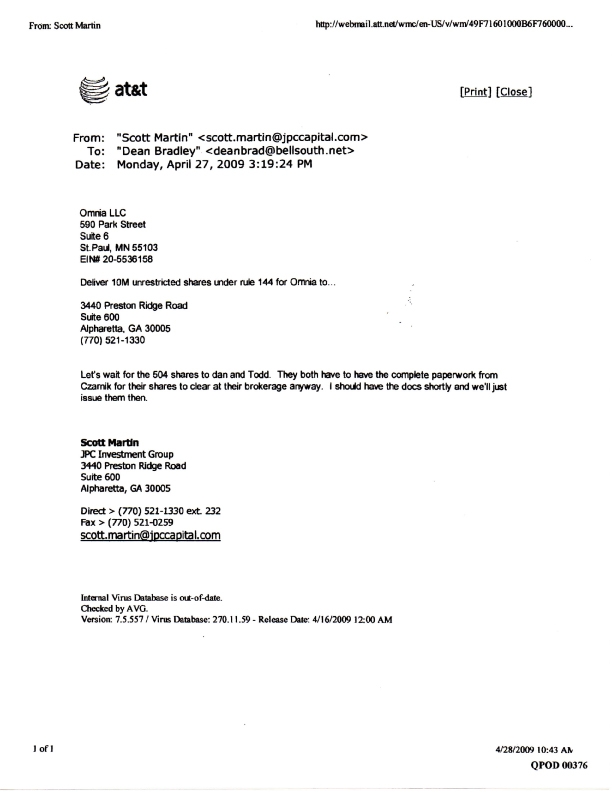

the particular person named in that one email was my attorney

Sounds about right Joe...does this sound alot like what went on at Quasar? Stephen Czarnik, a securities lawyer, for his role in multi-million dollar pump-and-dump stock schemes.

SECURITIES AND EXCHANGE COMMISSION

Litigation Release No. 21401 / February 2, 2010

Securities and Exchange Commission v. Stephen Czarnik, Case Number 10-CV-745 (S.D. New York)

SEC CHARGES NEW YORK SECURITIES LAWYER WITH FRAUD FOR ROLE IN PUMP-AND-DUMP SCHEME

On February 1, 2010, the United States Securities and Exchange Commission sued Stephen Czarnik, a securities lawyer, for his role in multi-million dollar pump-and-dump stock schemes. According to the complaint, the actions of Czarnik allowed three stock promoters — Ryan Reynolds, Jason Wynn and Carlton Fleming — to purchase millions of shares of stock in three penny stock companies for pennies per share, hype the companies through promotional mailers and other advertising, and illicitly sell their shares to the public for millions of dollars in profits. The Commission alleges that because the shares were not registered, Reynolds, Wynn and Fleming were able to deprive the investing public of important information about the actual financial condition and business operations of the companies.

According to the SEC, Czarnik purportedly served as counsel to the companies — My Vintage Baby, Inc., Alchemy Creative, Inc., and Beverage Creations, Inc. — and issued legal opinion letters and other documents proclaiming improper registration exemptions under Rule 504 of Regulation D. In these documents, Czarnik falsely represented that Reynolds, Wynn and Fleming intended to hold, rather than illegally distribute, shares of My Vintage Baby, Inc., Alchemy Creative, Inc. and Beverage Creations, Inc. in the public market. The SEC alleges that Czarnik knew or was reckless in not knowing that Reynolds, Wynn and Fleming intended to distribute the stock because he received emails describing the distribution plan and saw other indications of their promotional and trading activities.

The SEC alleges that by the above-mentioned conduct, Czarnik served as a necessary and substantial participant in unregistered offerings of stock, and as such, violated the registration provisions of the Securities laws, Sections 5(a) and (c) of the Securities Act of 1933. The SEC also alleges that by his fraudulent statements in the opinion letters and other associated documents, Czarnik violated Section 17(a) of the Securities Act and Section 10(b) of the Securities and Exchange Act of 1934 and Rule 10b-5 thereunder. The SEC is seeking against Czarnik a permanent injunction, a civil penalty, disgorgement of ill-gotten gains and a penny stock bar, among other relief.

The Commission acknowledges the assistance of the Financial Industry Regulatory Authority (FINRA) in the investigation of this matter.

FEATURED Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • May 17, 2024 11:00 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

VPR Brands (VPRB) Reports First Quarter 2024 Financial Results • VPRB • May 17, 2024 8:04 AM

ILUS Provides a First Quarter Filing Update • ILUS • May 16, 2024 11:26 AM

Cannabix Technologies and Omega Laboratories Inc. enter Strategic Partnership to Commercialize Marijuana Breathalyzer Technology • BLO • May 16, 2024 8:13 AM

Avant Technologies to Revolutionize Data Center Management with Proprietary AI Software Platform • AVAI • May 16, 2024 8:00 AM