| Followers | 91 |

| Posts | 13604 |

| Boards Moderated | 1 |

| Alias Born | 07/09/2003 |

Sunday, May 06, 2012 4:38:25 PM

F6, one area we could agree where a Big Government's influence is sorely needed would be banking, especially after the Govs incapacity to enforce it's own laws has been so disasterous yet...

"Two years after President Barack Obama vowed to eliminate the danger of financial institutions becoming "too big to fail," the nation's largest banks are bigger than they were before the credit crisis.

Five banks - JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs Group - held $8.5 trillion in assets at the end of 2011, equal to 56% of the US economy, according to the Federal Reserve.

As weaker firms collapsed or were acquired, a handful of financial giants emerged from the crisis and have thrived. Since then, JPMorgan, Goldman Sachs and Wells Fargo have continued to swell, if less dramatically, thanks to internal growth and acquisitions from European banks shedding assets amid the euro crisis.

The industry's evolution defies the president's January 2010 call to "prevent the further consolidation of our financial system." Embracing new limits on banks' trading operations, Obama said then that taxpayers wouldn't be well "served by a financial system that comprises just a few massive firms."

http://articles.economictimes.indiatimes.com/2012-04-17/news/31355557_1_banking-system-financial-system-largest-banks

more alarming is the >>>>>

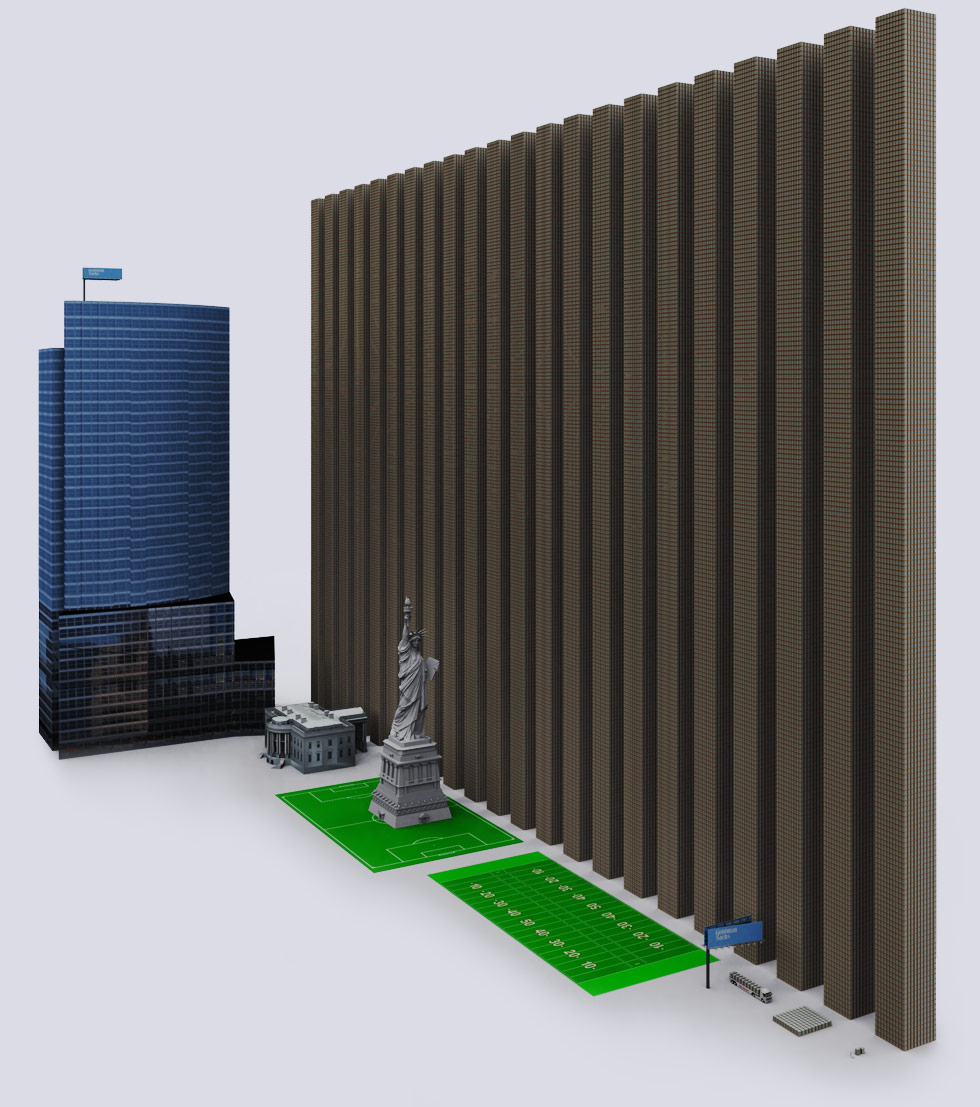

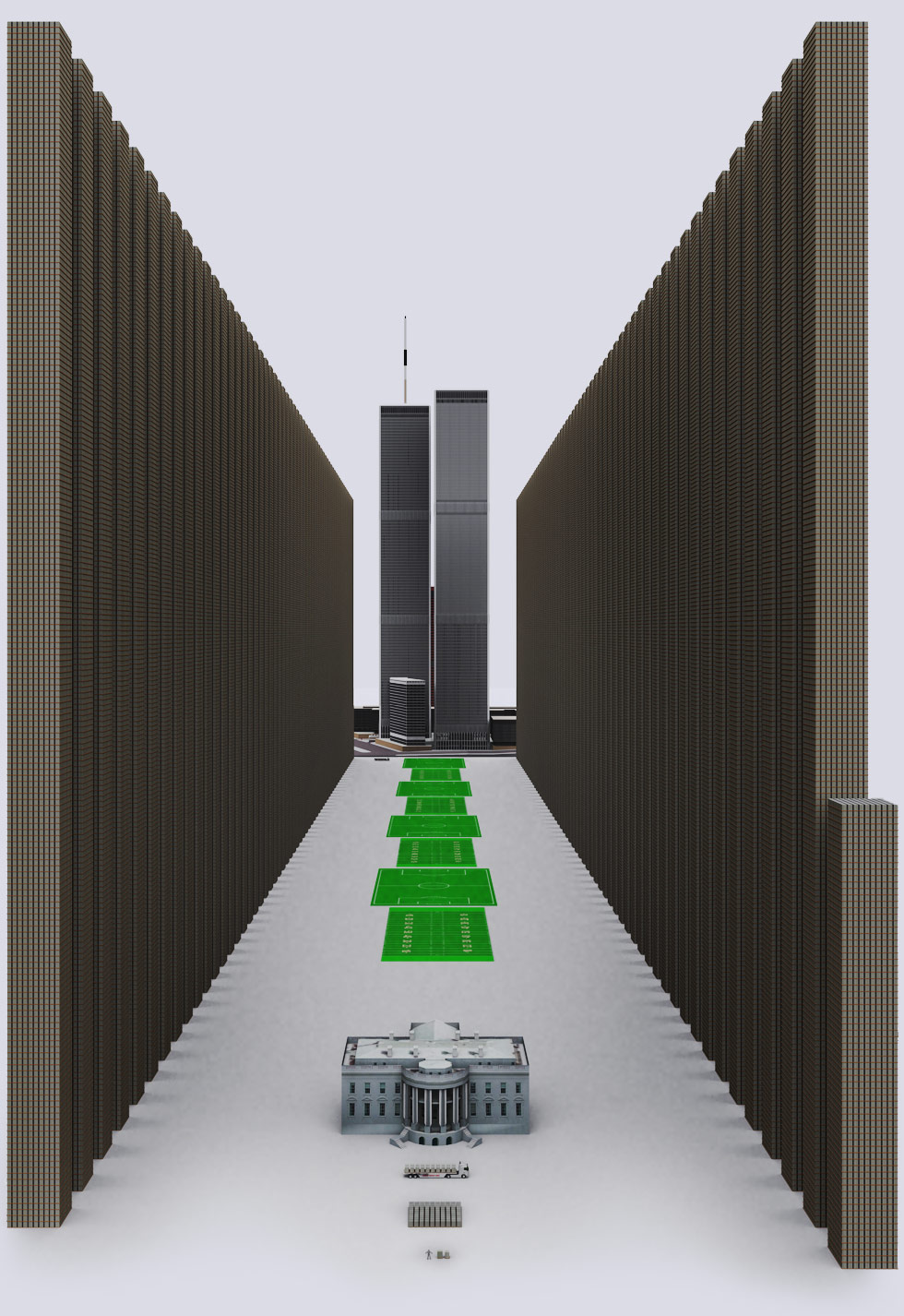

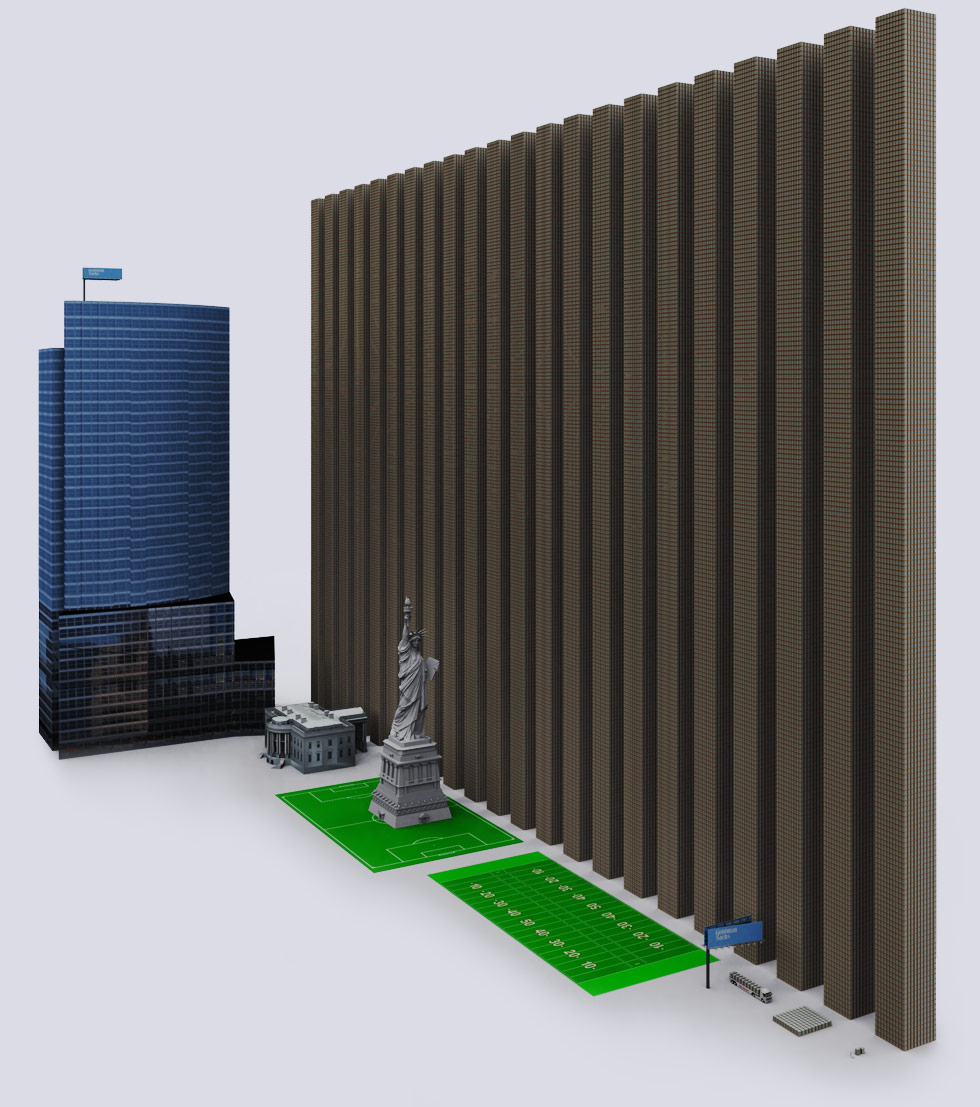

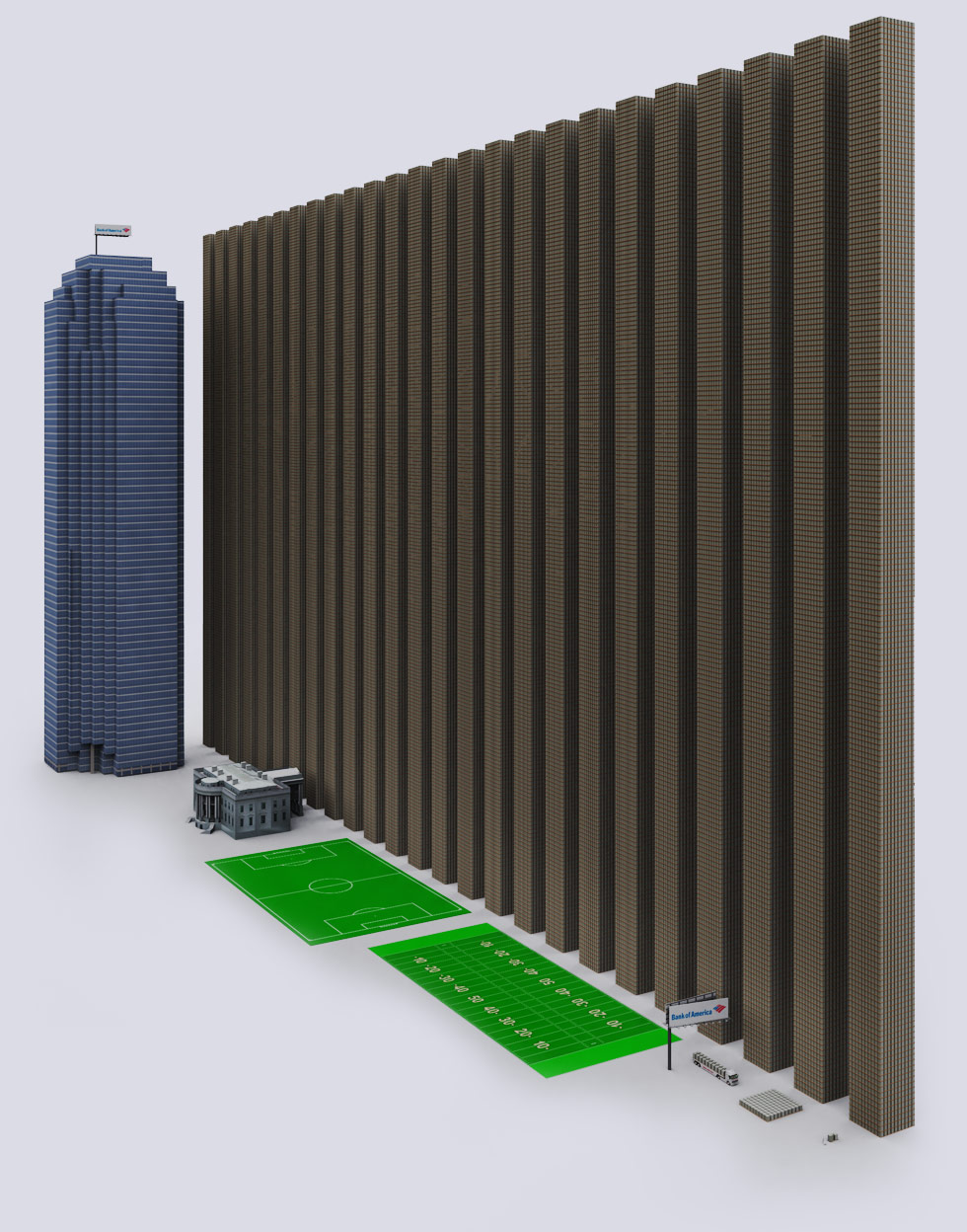

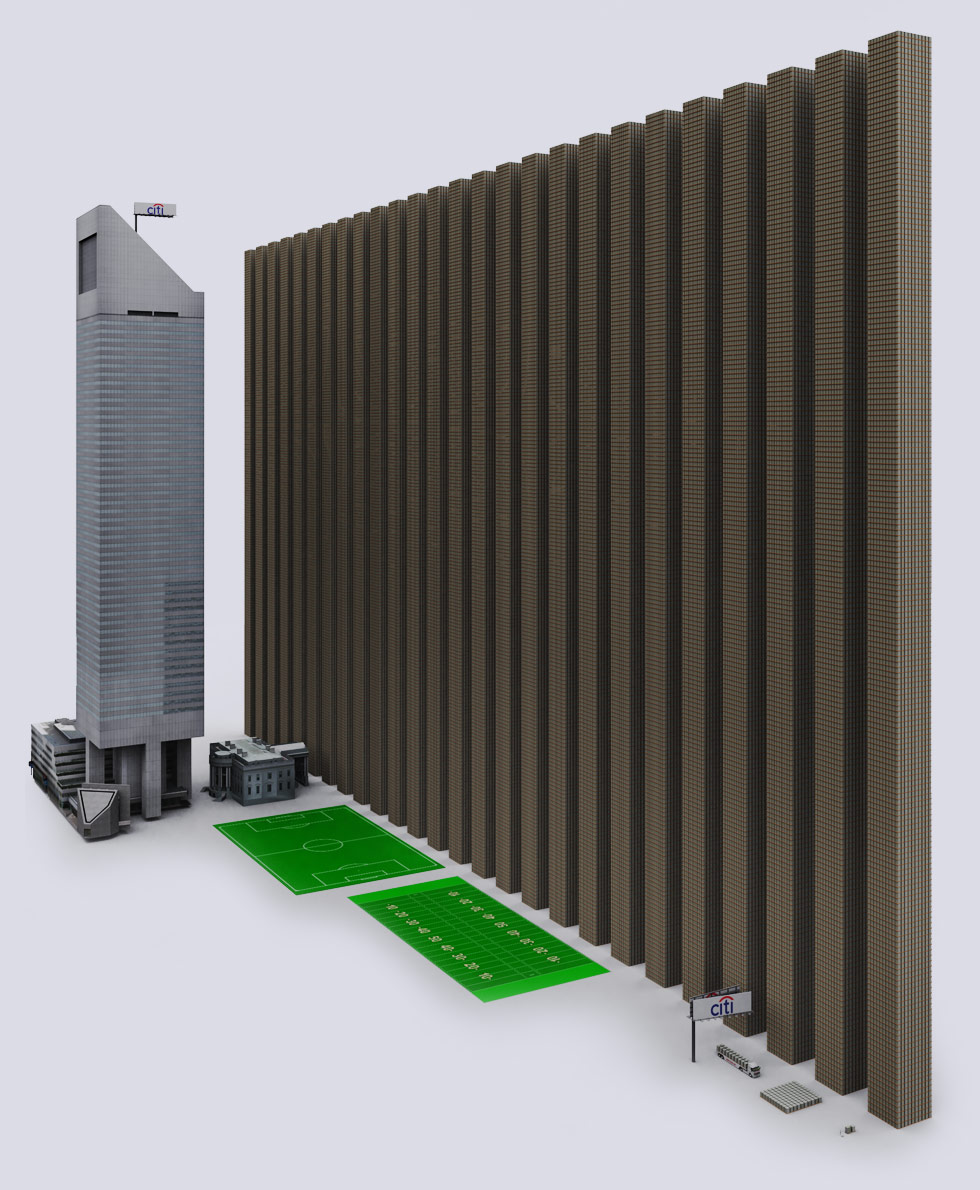

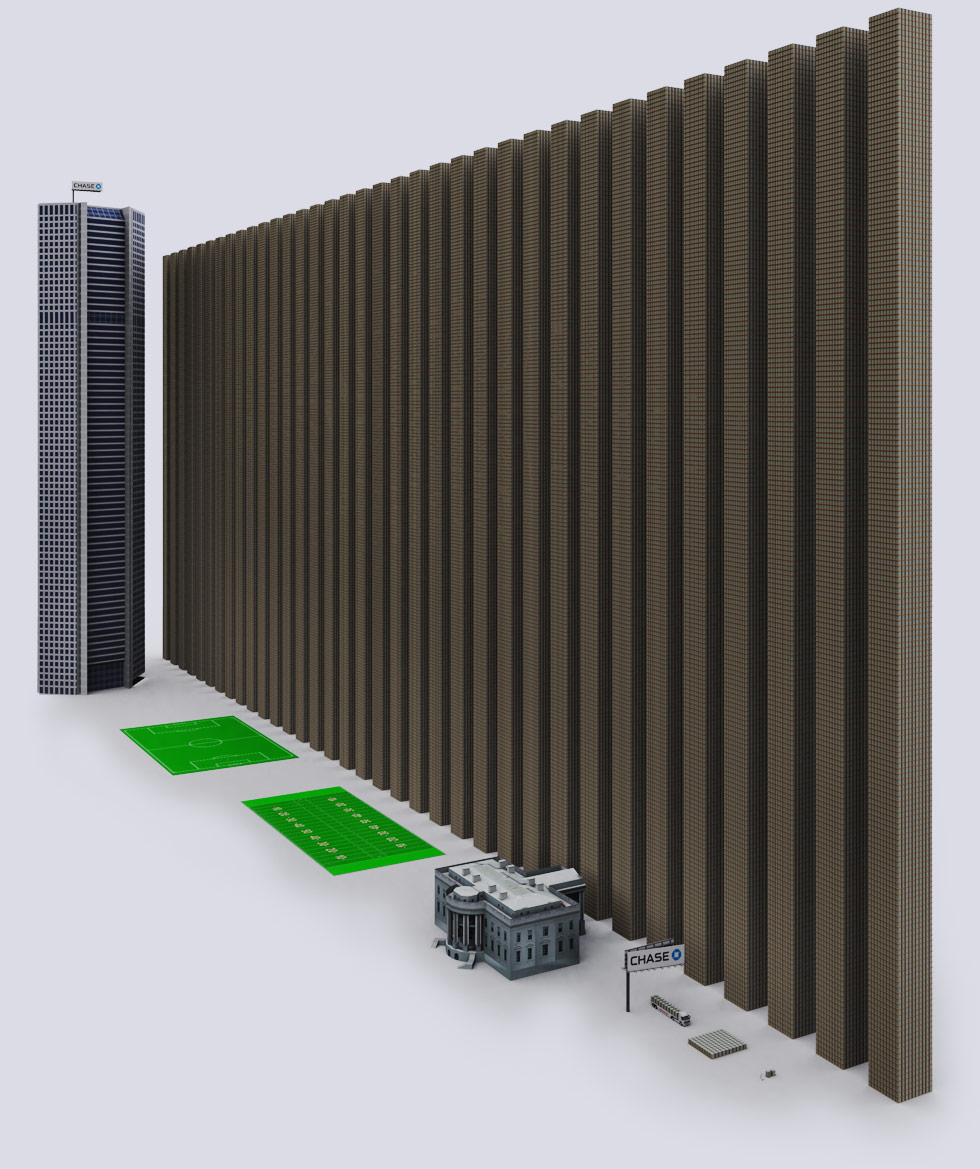

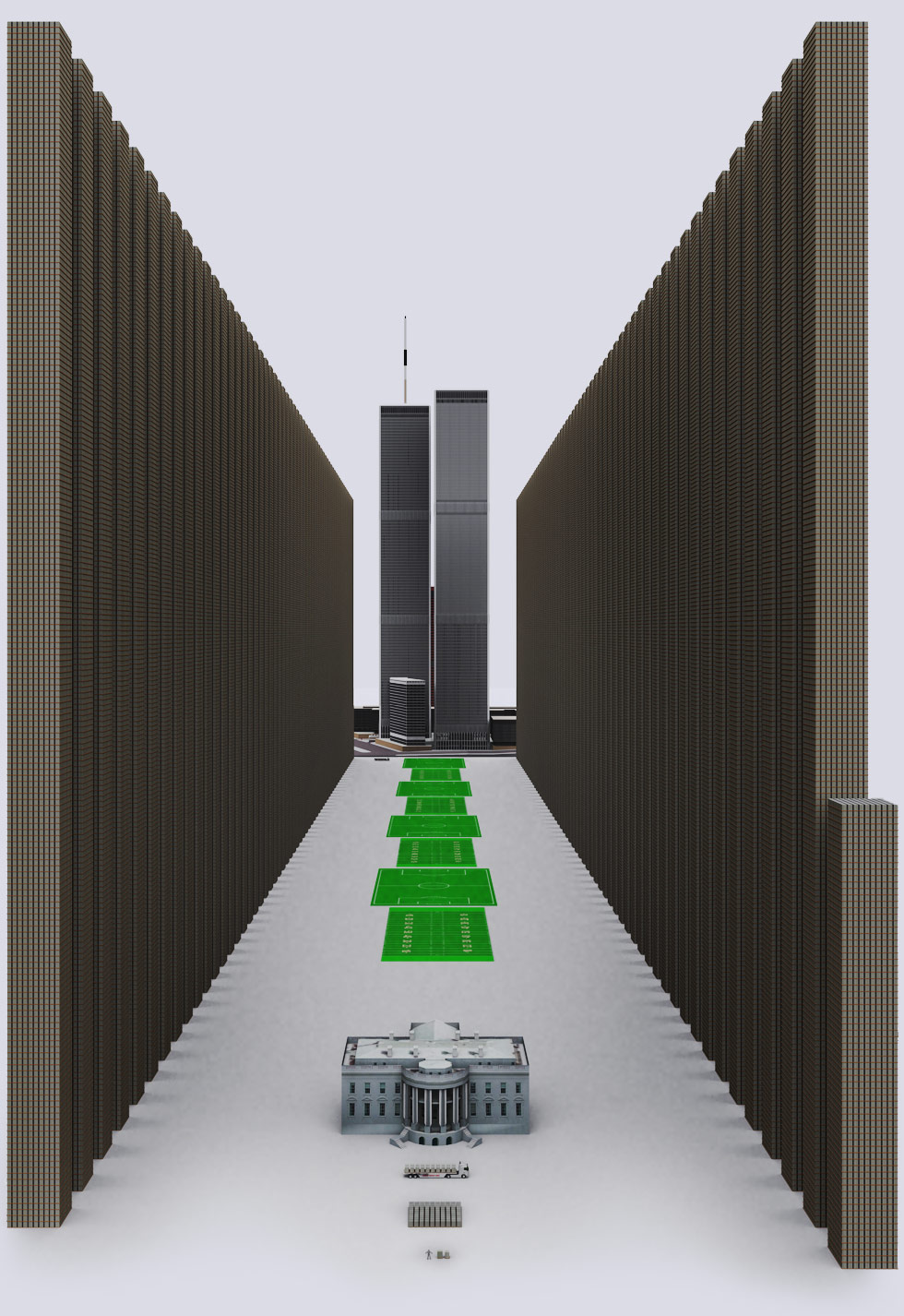

9 Biggest Banks’ Derivative Exposure - the still Unregulated Global Casino for Banks.... tall structures are stacks of cash representing a $Trillion....

Goldman Sachs has a derivative exposure of $44.192 Trillion dollars.

btw - Goldman Sachs got $10 billion of the 2008 TARP bailout, and in the same year paid $10.9 billion in employee compensation and “benefits”, while paying a tax rate of 1%. That means an average of $327,000 to each Goldman Sach’s employee.

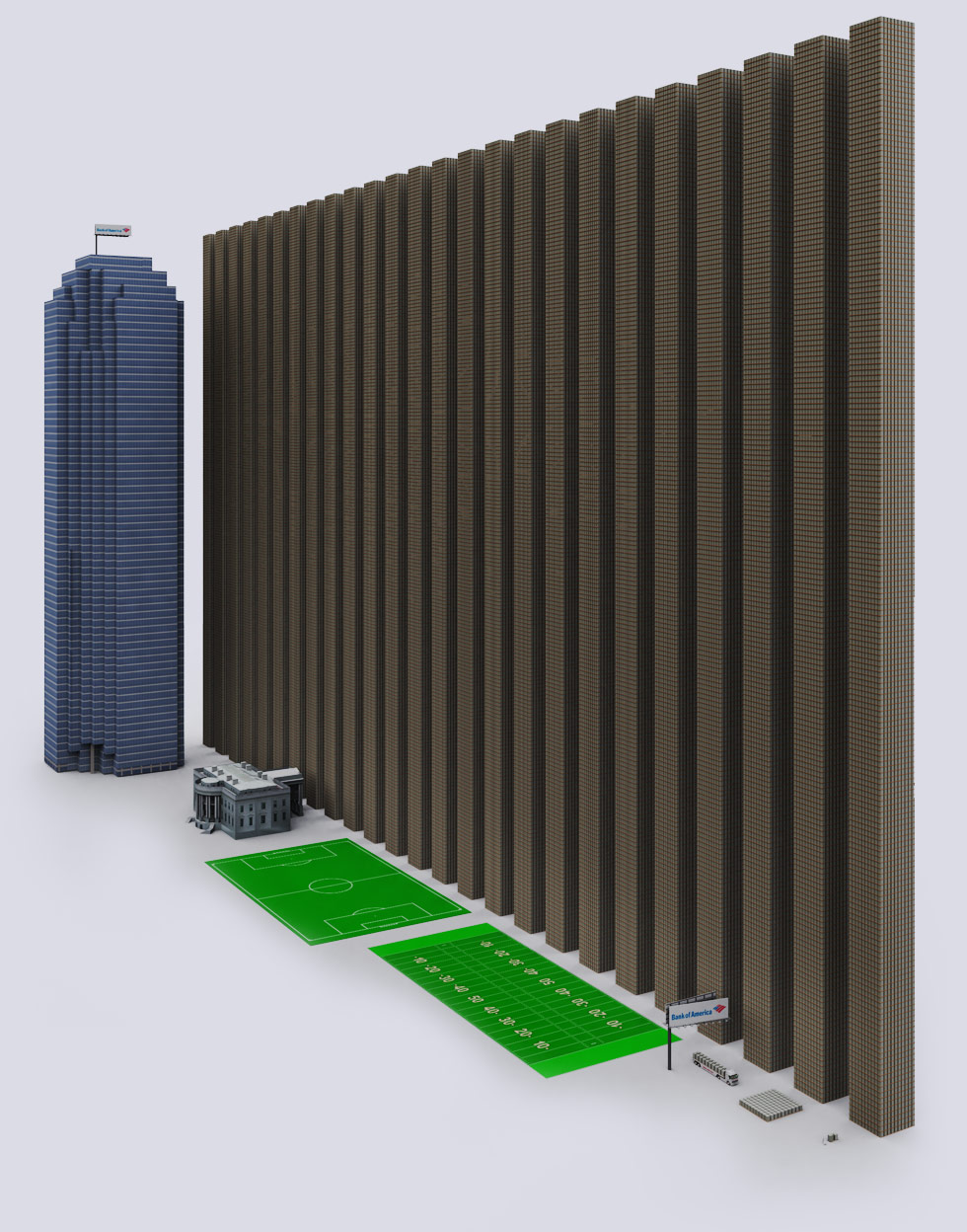

Bank of America

Bank of America has a derivative exposure of $50.135 Trillion dollars.

BofA is sticking the tax-payers with a MASSIVE bill, by moving derivatives to

accounts insured by the federal government @ total of $53.7 trillion as of 06/2011.

During 2011-12 BofA has been in need of cash, so Warren Buffett gave BofA $5 billion.

Same year BofA sold its stake in China Construction Bank to raise $1.8 billion in cash.

Bank of America paid $22 million to settle charges of improperly foreclosing on active-duty troops

BofA recruited 3 cyber attack firms to attack WikiLeaks. but the Anonymous hacker group hacked the security firms first.

BofA was sued for $31 billion in home-loan losses in 2011, the bank is involved in many lawsuits, too many to document.

BofA also received a SECRET $1.344 trillion dollar bailout from the Federal Reserve.

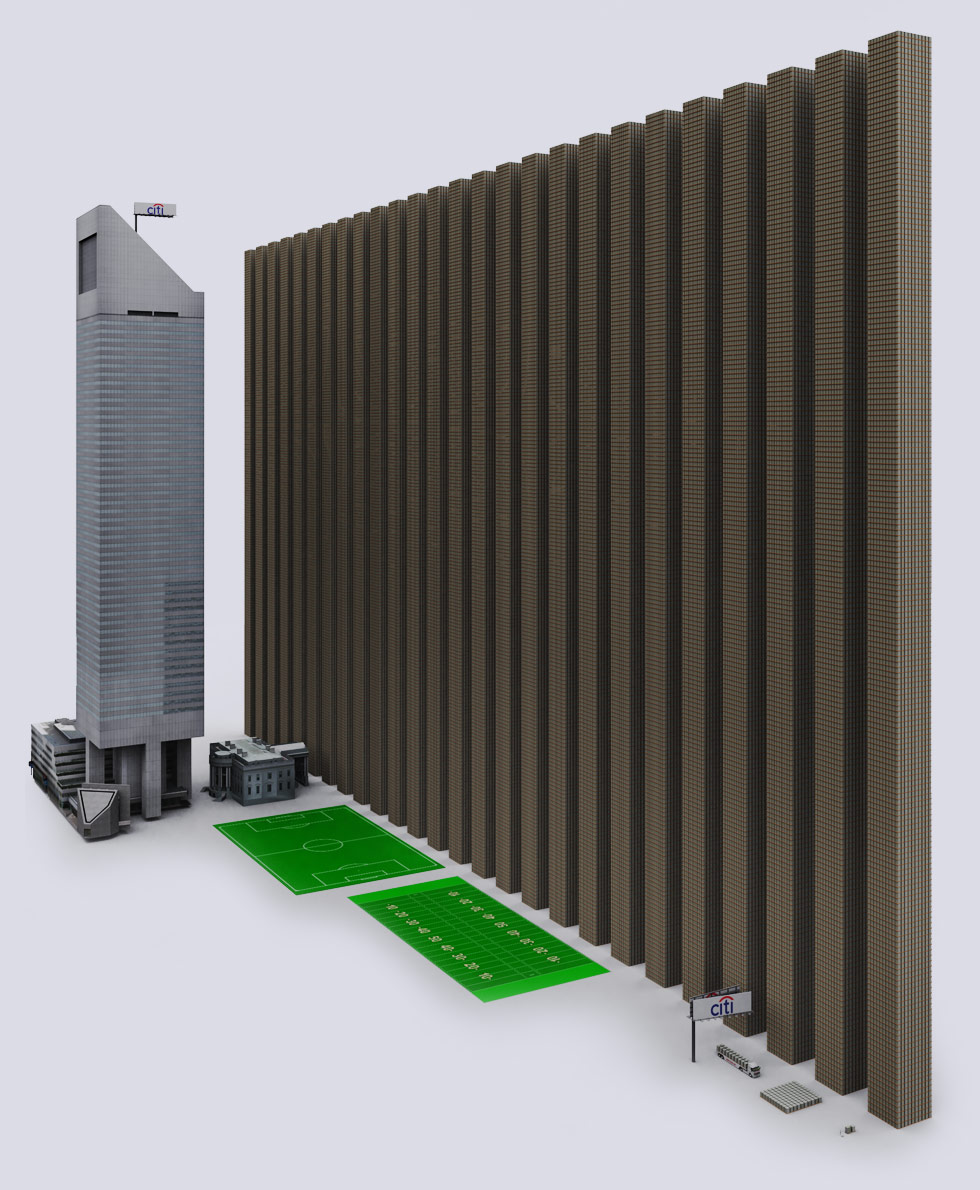

Citibank has a derivative exposure of $52.102 Trillion dollars.

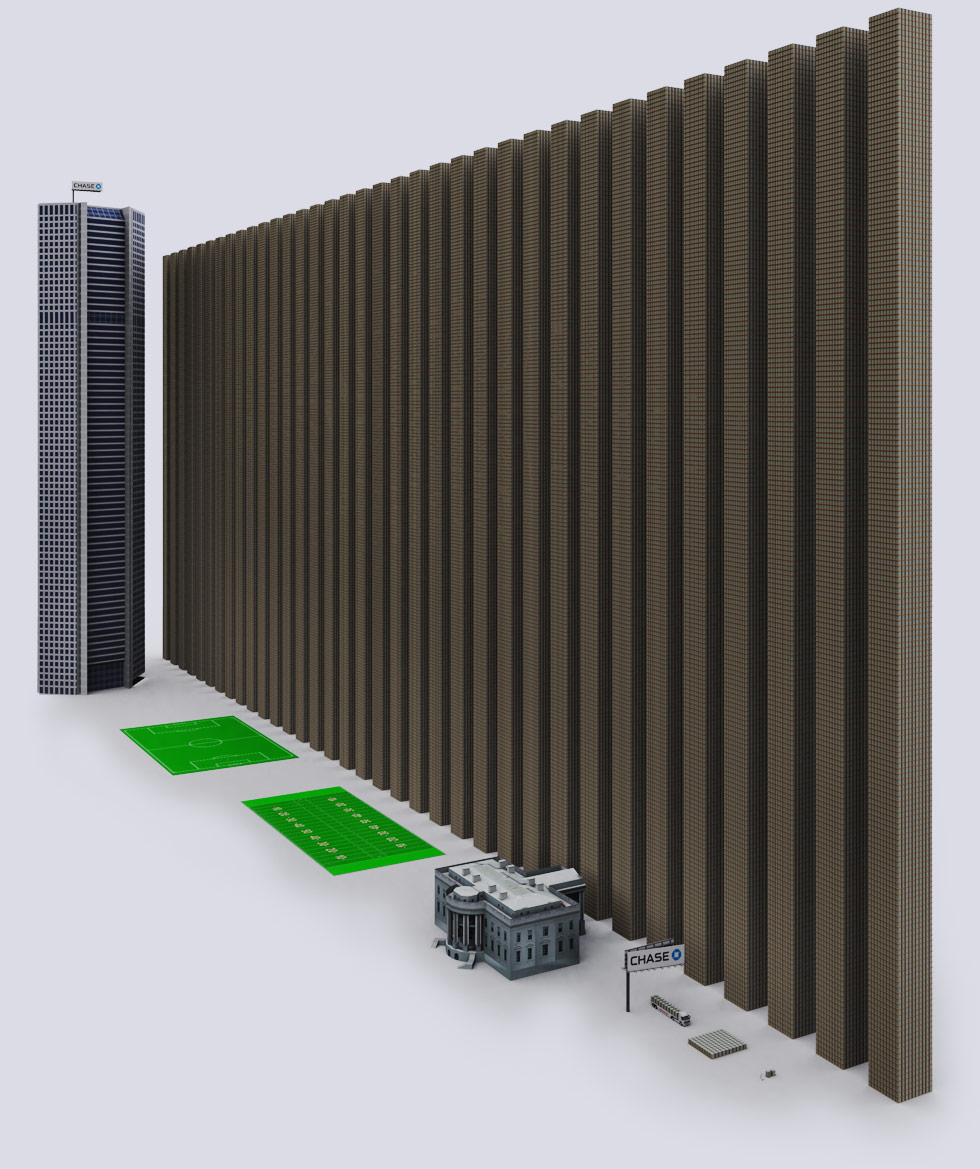

JP Morgan Chase has a derivative exposure of $70.151 Trillion dollars.

$70 Trillion is roughly the size of the entire world’s economy.

9 Biggest Banks’ Derivative Exposure – $228.72 Trillion

There is no government in the world that has this kind of money. This is roughly 3 times the entire world economy. The unregulated market presents a massive financial risk. The corruption and immorality of the banks makes the situation worse.

Keep an eye out in the news for “derivative crisis”, as the crisis is inevitable with current falling value of most real assets.

http://www.silverdoctors.com/infographic-9-biggest-banks-derivative-exposure/

"Two years after President Barack Obama vowed to eliminate the danger of financial institutions becoming "too big to fail," the nation's largest banks are bigger than they were before the credit crisis.

Five banks - JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs Group - held $8.5 trillion in assets at the end of 2011, equal to 56% of the US economy, according to the Federal Reserve.

As weaker firms collapsed or were acquired, a handful of financial giants emerged from the crisis and have thrived. Since then, JPMorgan, Goldman Sachs and Wells Fargo have continued to swell, if less dramatically, thanks to internal growth and acquisitions from European banks shedding assets amid the euro crisis.

The industry's evolution defies the president's January 2010 call to "prevent the further consolidation of our financial system." Embracing new limits on banks' trading operations, Obama said then that taxpayers wouldn't be well "served by a financial system that comprises just a few massive firms."

http://articles.economictimes.indiatimes.com/2012-04-17/news/31355557_1_banking-system-financial-system-largest-banks

more alarming is the >>>>>

9 Biggest Banks’ Derivative Exposure - the still Unregulated Global Casino for Banks.... tall structures are stacks of cash representing a $Trillion....

Goldman Sachs has a derivative exposure of $44.192 Trillion dollars.

btw - Goldman Sachs got $10 billion of the 2008 TARP bailout, and in the same year paid $10.9 billion in employee compensation and “benefits”, while paying a tax rate of 1%. That means an average of $327,000 to each Goldman Sach’s employee.

Bank of America

Bank of America has a derivative exposure of $50.135 Trillion dollars.

BofA is sticking the tax-payers with a MASSIVE bill, by moving derivatives to

accounts insured by the federal government @ total of $53.7 trillion as of 06/2011.

During 2011-12 BofA has been in need of cash, so Warren Buffett gave BofA $5 billion.

Same year BofA sold its stake in China Construction Bank to raise $1.8 billion in cash.

Bank of America paid $22 million to settle charges of improperly foreclosing on active-duty troops

BofA recruited 3 cyber attack firms to attack WikiLeaks. but the Anonymous hacker group hacked the security firms first.

BofA was sued for $31 billion in home-loan losses in 2011, the bank is involved in many lawsuits, too many to document.

BofA also received a SECRET $1.344 trillion dollar bailout from the Federal Reserve.

Citibank has a derivative exposure of $52.102 Trillion dollars.

JP Morgan Chase has a derivative exposure of $70.151 Trillion dollars.

$70 Trillion is roughly the size of the entire world’s economy.

9 Biggest Banks’ Derivative Exposure – $228.72 Trillion

There is no government in the world that has this kind of money. This is roughly 3 times the entire world economy. The unregulated market presents a massive financial risk. The corruption and immorality of the banks makes the situation worse.

Keep an eye out in the news for “derivative crisis”, as the crisis is inevitable with current falling value of most real assets.

http://www.silverdoctors.com/infographic-9-biggest-banks-derivative-exposure/

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.