Wednesday, March 21, 2012 12:05:12 PM

MAR 19, ’12 4:25 PM

Horace Dediu

Today Apple announced both a dividend and a share re-purchase plan which, when combined, will consume 45% of Apple’s current US cash reserves.

The dividend will be $2.65/share/quarter and the buyback will cost $10 billion over three years. The dividend will therefore cost about $2.5 billion per quarter (starting next quarter) and the re-purchase will cost about $833 million per quarter (starting next fiscal year).

However, note that Apple’s cash has been growing far more quickly. It increased by $16 billion last quarter or $37 billion over the last year. This rate of increase is itself increasing.

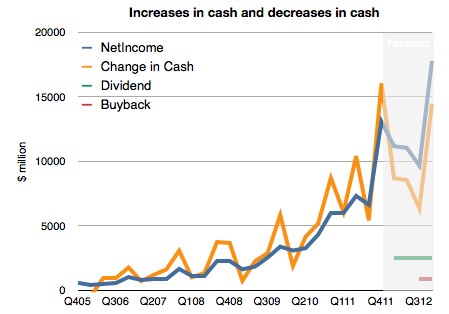

To illustrate, I prepared the following chart. It shows historic net income, change in cash and a forecast of the costs of the new uses of cash and future net income (based on my estimates).

I made an assumption that future cash growth will equal net earnings minus costs for the new dividend and share re-purchase. What we should see is that the previously tight coupling between increase in cash and earnings will remain but that there will be a negative offset by $3.333 billion each quarter. In other words, cash will increase but at a slower rate.

This means Apple’s total cash should still grow by more than $35 billion this year.

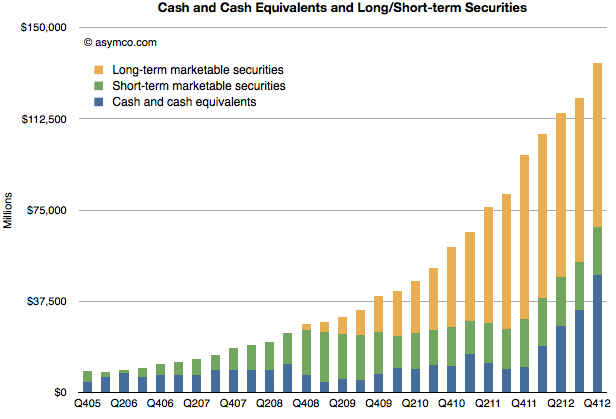

That would result in the following, more subdued, total cash trajectory (for simplicity, I assumed all added cash would be in cash and cash equivalent accounts)

http://www.asymco.com/2012/03/19/apples-dividend-and-share-re-purchase-plan-the-impact-on-cash-growth/

Recent AAPL News

- Apple Music celebrates the greatest records ever made with the launch of inaugural 100 Best Albums list • Business Wire • 05/13/2024 01:00:00 PM

- Arm Sets 2025 Target for AI Chip Development, Amazon and Microsoft Commit Billions to French Investments, and More • IH Market News • 05/13/2024 11:16:03 AM

- Weekly Surge for Render and Toncoin, US Bancorp Expands Bitcoin ETF Investments, and More in Crypto • IH Market News • 05/10/2024 07:32:06 PM

- Novavax Surges 57% Post $1.4 Billion Sanofi Deal; Apple Boosts Data Centers with AI and Internal Chips, and More News • IH Market News • 05/10/2024 12:02:56 PM

- Bain Capital in Talks to Acquire PowerSchool; Blackstone Emerges Victorious in Hipgnosis Bidding War, and More News • IH Market News • 05/09/2024 11:53:19 AM

- Meta Platforms Expands AI Ads, Apple Boosts iPhone Shipments, and More Highlights • IH Market News • 05/08/2024 12:27:48 PM

- Apple unveils stunning new iPad Pro with the world’s most advanced display, M4 chip, and Apple Pencil Pro • Business Wire • 05/07/2024 02:37:00 PM

- Apple unveils the redesigned 11-inch and all-new 13-inch iPad Air, supercharged by the M2 chip • Business Wire • 05/07/2024 02:37:00 PM

- Apple introduces M4 chip • Business Wire • 05/07/2024 02:37:00 PM

- Final Cut Pro transforms video creation with Live Multicam on iPad and new AI features on Mac • Business Wire • 05/07/2024 02:37:00 PM

- Logic Pro takes music-making to the next level with new AI features • Business Wire • 05/07/2024 02:37:00 PM

- Tesla’s April Sales Down 18% in China, Amazon’s Multi-Billion Dollar Cloud Expansion in Singapore, and More News • IH Market News • 05/07/2024 11:44:00 AM

- Index Futures Point to Strong Monday Opening, Building on Last Week’s Gains; Oil Prices Rise • IH Market News • 05/06/2024 12:09:15 PM

- Perficient Stock Soars 52.9% Post-Acquisition; Luminar Declines 10% Amid Workforce Cutbacks, and Other News • IH Market News • 05/06/2024 12:09:00 PM

- Jobs Data, Apple Earnings Contribute To Extended Rally On Wall Street • IH Market News • 05/03/2024 08:25:49 PM

- Jobs Data, Apple Earnings May Lead To Extended Rally On Wall Street • IH Market News • 05/03/2024 01:09:33 PM

- Apple reports second quarter results • Business Wire • 05/02/2024 08:30:00 PM

- U.S. Stocks Rally Amid Easing Worries About Possible Rate Hike • IH Market News • 05/02/2024 08:20:39 PM

- Alphabet CEO’s Billion-Dollar Wealth, Microsoft’s $1.7B Indonesia Investment, and More News • IH Market News • 04/30/2024 11:58:40 AM

- Philips Stocks Soar 47% Following US Deal, Tesla Bolsters Presence in China, and More News • IH Market News • 04/29/2024 11:11:24 AM

- BHP Bids $38.8 Billion for Anglo American; Biden Unveils Historic Micron Technology Deal, and More News • IH Market News • 04/25/2024 11:48:40 AM

- Coca-Cola and Microsoft Sign Billion-Dollar Agreement, Apple Event Set for May 7, and More News • IH Market News • 04/24/2024 11:28:02 AM

- AKT Token Skyrockets on Upbit Listing, IBIT Holds Strong in Top 10 ETFs, and More Crypto News • IH Market News • 04/23/2024 04:34:08 PM

- Apple Loses Market Share in China, GM Surges in Pre-Market Following Upward Revisions for 2024 Projections, and More News • IH Market News • 04/23/2024 11:25:34 AM

- Li Auto Stock Drops 7.3% Amid Tesla Price Cuts, Salesforce Retreats from Informatica Deal, and Other Market Updates • IH Market News • 04/22/2024 12:09:21 PM

Avant Technologies Equipping AI-Managed Data Center with High Performance Computing Systems • AVAI • May 10, 2024 8:00 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM